Daniel Garber The quarry 1917

Australians think they won.

• The World’s First Total Bubble (MB)

The regulators, yes, they’ll have to be reformed. But it doesn’t stop there. They were just the elite enablers. The corruption at the heart of the great Australian property bubble seeped into our entire economy and culture. It oozed under every door, entered every home and visited every BBQ. It bent every business. It ruined our media and distorted our politics. It infected our entire place in the world, disenfranchised from the Australian dream entire generations. It has choked our cities. And sold out the national interest to Chinese speculators, threatening our very freedom. There has never been a more comprehensive bubble in any nation. We have been engulfed by it. The world’s first total bubble.

Yet at its heart was not a miracle but prosaic bank corruption. Only the failure to assess expenditures and incomes, the failure to report accurately and honestly, the failure to advise with integrity and responsbility made any of it possible. Everything else flows outward from this black singularity. Your wealth. Your lifestyle. Your retirement plan. The roof over your head not being over someone else’s. All of it stems from the core corruption of a banking system that disgorged massive sub-prime mortgages across our firmament. I really have no idea what attempted snow job we will see next. But it is over. It is now only a matter of time before the Australian housing supernova collapses towards the banking black hole at its centre, sucked back into the void from whence it came. We’re all the royal commission now.

Brainard. Warning about what the Fed itself has built.

• Now Even a Fed Dove Homes in on the “Everything Bubble” (WS)

“If we have learned anything from the past, it is that we must be especially vigilant about the health of our financial system in good times, when potential vulnerabilities may be building,” explained Federal Reserve Board Governor Lael Brainard in a speech in Washington, D.C., this morning. This was a reference to a time-honored banker adage, now mostly forgotten after nearly nine years of easy money: Bad deals are made in good times. Brainard fills one of the seven slots on the Board of Governors. Two slots are filled by Chairman Jerome Powell and by Randal Quarles. Four slots remain vacant, waiting for Trump appointees to wend their way. She is a strong “dove” in the world of central banks, and she just pointed at why the Fed is tightening – and will continue to tighten: the Everything Bubble.

After rattling off a litany of indicators showing why and how the economy’s “cyclical conditions have been strengthening,” she added this gem, there being nothing like Fed-speak to make your day: “Currently, inflation appears to be well-anchored to the upside around our 2 percent target.” “Well-anchored to the upside” of the Fed’s target – and then she moved on to the “signs of financial imbalances.” “Financial imbalances,” in Fed speak, are asset bubbles, a phenomenon when prices are out of whack with economic reality. In a credit-based economy, assets are collateral for debt. And inflated asset prices put the financial system, meaning the lenders, at risk when those asset prices deflate. Since the Fed has to take care of the financial system, and since it blew up so wonderfully last time due to asset bubbles deflating, the Fed is right to be worried about it. At first the hawks, the rare ones; and now even the doves

“Risks will begin materializing in 3 years ‘at the latest..'”

• Recession Risks Are Increasing – Axel Weber (CNBC)

The world economy is set for one of its best years since the global financial crisis, with both developed and emerging countries growing while inflation is still subdued and monetary conditions remain largely accommodative. But such a good run could end in the next two to three years, according to UBS Chairman Axel Weber. “We’re at the end of a long recovery and, two to three years from now, at the latest, some of the risks could materialize. The recession risks are increasing,” Weber told CNBC’s Joumanna Bercetche this week at the Spring Meetings of the IMF and the World Bank. The IMF this week kept its forecast for 2018’s global growth at 3.9 percent which, if it materializes, would be the fastest expansion since 2011.

But the agency warned that global debt levels have hit a record, and governments should start reducing their indebtedness and build buffers for “challenges that will unavoidably come in the future.” Financial institutions should also brace for such risks, said Weber, adding that he thinks banks have become better prepared compared to before the last crisis. Like many in the industry, Weber said he doesn’t think a full-fledged trade war will happen as a result of the ongoing dispute between the U.S. and China. But, he added that it’s time to reassess Beijing’s role in the World Trade Organization, especially given projections that China will one day become the world’s largest economy. Weber added that companies from around the world should be allowed to do business in China more freely.

“..a “they will take over the world” and a “they will save the world” combination of hopes..”

• The Faster Tesla Makes Model 3’s, The More Money They Will Lose (SM)

A few weeks ago, we shared a note about Tesla from the hedge fund Vilas Capital Management. The firm, which is short the shares, said “Tesla is going to crash in the next 3-6 months.” I received an update from Vilas this morning explaining why they’re even more bearish on Tesla today. The firm pared its short positions after the recent selloff. And Telsa now comprises about 98% of their short book. Clearly Vilas thinks Tesla’s reckoning is imminent. You can read the rest of Vilas’ thoughts on Tesla below:

We added meaningfully to our Tesla position in the first quarter at prices in the $340 range. We continue to believe that Tesla is extremely overvalued and that it will experience significant financial difficulties over time. All companies in a capitalistic system need to earn profits and those profits need to be attractive relative to the amount of shareholder capital employed. Tesla has never earned an annual profit. Along with digital currencies and Unicorns, Tesla appears to be caught up in a gold-rush-fever type of emotional response, both from a “they will take over the world” and a “they will save the world” combination of hopes, instead of their owners looking at the numbers.

Tesla bulls will argue that their production will rise to 5000 Model 3’s per week soon and, therefore, the stock will trade meaningfully higher. Given that the company lost $20,000 per Model S and X sold for roughly $100,000 each last year, due to the fact that it cost more to build, sell, service, charge and maintain these cars than they collected in revenue, as it is important to include all costs when evaluating a business, we predict it will impossible for Tesla to make a profit on a $35,000 to $50,000 car. As anyone with automotive experience knows, profit margins are far higher on bigger, more expensive cars. Therefore, the faster Tesla makes Model 3’s, the more money they will lose.

Das Kapital.

• Marx Predicted Our Present Crisis – And Points The Way Out (Varoufakis)

To see beyond the horizon is any manifesto’s ambition. But to succeed as Marx and Engels did in accurately describing an era that would arrive a century-and-a-half in the future, as well as to analyse the contradictions and choices we face today, is truly astounding. In the late 1840s, capitalism was foundering, local, fragmented and timid. And yet Marx and Engels took one long look at it and foresaw our globalised, financialised, iron-clad, all-singing-all-dancing capitalism. This was the creature that came into being after 1991, at the very same moment the establishment was proclaiming the death of Marxism and the end of history.

Of course, the predictive failure of The Communist Manifesto has long been exaggerated. I remember how even leftwing economists in the early 1970s challenged the pivotal manifesto prediction that capital would “nestle everywhere, settle everywhere, establish connexions everywhere”. Drawing upon the sad reality of what were then called third world countries, they argued that capital had lost its fizz well before expanding beyond its “metropolis” in Europe, America and Japan.

Empirically they were correct: European, US and Japanese multinational corporations operating in the “peripheries” of Africa, Asia and Latin America were confining themselves to the role of colonial resource extractors and failing to spread capitalism there. Instead of imbuing these countries with capitalist development (drawing “all, even the most barbarian, nations into civilisation”), they argued that foreign capital was reproducing the development of underdevelopment in the third world. It was as if the manifesto had placed too much faith in capital’s ability to spread into every nook and cranny. Most economists, including those sympathetic to Marx, doubted the manifesto’s prediction that “exploitation of the world-market” would give “a cosmopolitan character to production and consumption in every country”.

As it turned out, the manifesto was right, albeit belatedly. It would take the collapse of the Soviet Union and the insertion of two billion Chinese and Indian workers into the capitalist labour market for its prediction to be vindicated. Indeed, for capital to globalise fully, the regimes that pledged allegiance to the manifesto had first to be torn asunder. Has history ever procured a more delicious irony?

Yeah, sure.

• Market Power Wielded By US Tech Giants Concerns IMF Chief (G.)

The head of the International Monetary Fund, Christine Lagarde, has expressed concern about the market power wielded by the US technology giants and called for more competition to protect economies and individuals. Speaking at a press conference to mark the start of the IMF’s spring meeting in Washington, Lagarde said breaking up companies was not the solution, but added that her organisation was monitoring their impact on prosperity, financial stability and the workplace. “Competition is needed. From competition you get productivity growth and innovation. Too much concentration, too much market power in the hands of the few is not helpful to the economy or to the wellbeing of individuals.”

Pressure has been building in the US for antitrust laws to be used to break up some of the biggest companies, with Google, Facebook and Amazon all targeted by critics. Lagarde said: “I am not sure breaking up some of the tech titans in this country [the US] or in other countries will be the right answer. It used to be the right answer, but when most of the assets are intangible, how do you break them up? How do you facilitate access and allow market disruptors to operate? I think that is where a lot of new thinking has to be done.”

The IMF is carefully monitoring new digital currencies such as Bitcoin, which it says are prone to fraud and can be used for money laundering. “We have seen a flourishing of cryptocurrencies. There are now more than 100. That has stability implications eventually. We do not think it is systemic at this point in time but regulators and supervisors have to be watchful.” Lagarde expressed concern at the growing threat of a trade war between the US and China, saying that protectionism posed a threat to the upswing in the global economy and to an international system that had served countries well.

Facebook is peanuts.

• Bill Gates Backs Plan to Surveil the Entire Planet From Space (Gizmodo)

EarthNow is a new company looking to provide satellite imagery and live video in virtually real-time. Its unsettling pitch describes a network of satellites that can see any corner of the globe and provide live video with a latency of about a second. And a look at the startup’s top investors gives a lot of confidence that this thing is happening. On Wednesday, EarthNow announced that it will emerge from the Intellectual Ventures ISF Incubator to become a full-scale commercial business. Its first round of investors is comprised of a small group of complimentary powerhouses: AirBus, the SoftBank Group, Bill Gates, and satellite-industry vet Greg Wyler.

The amount of the initial investment hasn’t been disclosed, but the announcement says the funding “focuses primarily on maturing the overall system design to deliver innovative and unique real-time Earth observation services.” That makes it sound like the company is in its very early stages, but don’t be so sure. Wyler’s OneWeb has already deployed highly advanced satellites with a blazing fast 130ms latency and its goal is to have a constellation of hundreds of satellites beaming broadband around the globe by 2020.

EarthNow will use an upgraded version of OneWeb’s technology with a lot of hardware power packed into a 500-pound unit. “Each satellite is equipped with an unprecedented amount of onboard processing power, including more CPU cores than all other commercial satellites combined,” the announcement says. The satellites will also do an onboard analysis of the live imagery using machine learning, but the company doesn’t go into detail about what it will analyze or why it would be necessary to dedicate that processing onboard.

“Wall Street meets Apocalypse Now,..”

• Palantir Knows Everything About You (BW)

High above the Hudson River in downtown Jersey City, a former U.S. Secret Service agent named Peter Cavicchia III ran special ops for JPMorgan Chase & Co. His insider threat group—most large financial institutions have one—used computer algorithms to monitor the bank’s employees, ostensibly to protect against perfidious traders and other miscreants. Aided by as many as 120 “forward-deployed engineers” from the data mining company Palantir, which JPMorgan engaged in 2009, Cavicchia’s group vacuumed up emails and browser histories, GPS locations from company-issued smartphones, printer and download activity, and transcripts of digitally recorded phone conversations.

Palantir’s software aggregated, searched, sorted, and analyzed these records, surfacing keywords and patterns of behavior that Cavicchia’s team had flagged for potential abuse of corporate assets. Palantir’s algorithm, for example, alerted the insider threat team when an employee started badging into work later than usual, a sign of potential disgruntlement. That would trigger further scrutiny and possibly physical surveillance after hours by bank security personnel. Over time, however, Cavicchia himself went rogue. Former JPMorgan colleagues describe the environment as Wall Street meets Apocalypse Now, with Cavicchia as Colonel Kurtz, ensconced upriver in his office suite eight floors above the rest of the bank’s security team.

People in the department were shocked that no one from the bank or Palantir set any real limits. They darkly joked that Cavicchia was listening to their calls, reading their emails, watching them come and go. Some planted fake information in their communications to see if Cavicchia would mention it at meetings, which he did. It all ended when the bank’s senior executives learned that they, too, were being watched, and what began as a promising marriage of masters of big data and global finance descended into a spying scandal. The misadventure, which has never been reported, also marked an ominous turn for Palantir, one of the most richly valued startups in Silicon Valley. An intelligence platform designed for the global War on Terror was weaponized against ordinary Americans at home.

It took less than an hour.

• Comey Memos Already Leaked To AP (ZH)

Update 3: President Trump is up late tonight, we suspect reading through former FBI Director Comey’s leaked memos as he exclaims: “James Comey Memos just out and show clearly that there was NO COLLUSION and NO OBSTRUCTION.” Trump is also quick to remind Americans of one of the reasons he fired him: “Also, he leaked classified information,” and ended with a jab at the endless farce: “WOW! Will the Witch Hunt continue?”

Update 2: Less than an hour after Comey’s memos were released by DOJ to Congress, the 15 pages have miraculously “become available” to The Associated Press. Given that no source is provided, we assume they were leaked with the intent to embarrass President Trump. Comey’s memos detail private dinner conversations with the President in January 2017, during which Trump asked him to pledge his loyalty. Another conversation about former White House national security adviser Michael Flynn is also detailed in the memos. In a memo dated Jan. 28, 2017, Comey recounted a dinner he had with Trump at the White House shortly after the president’s inauguration.

Trump asked Comey who he thought he should be in contact with in the administration, and Comey mentioned the national security adviser. The president said Flynn had “serious judgment issues,” Comey wrote in his memo. Trump then explained to Comey that when the president had complimented British Prime Minister Theresa May on being the first to congratulate him on his election, Flynn interjected that another leader had called first. That was the first time Trump learned of the other leader’s call, Comey wrote.

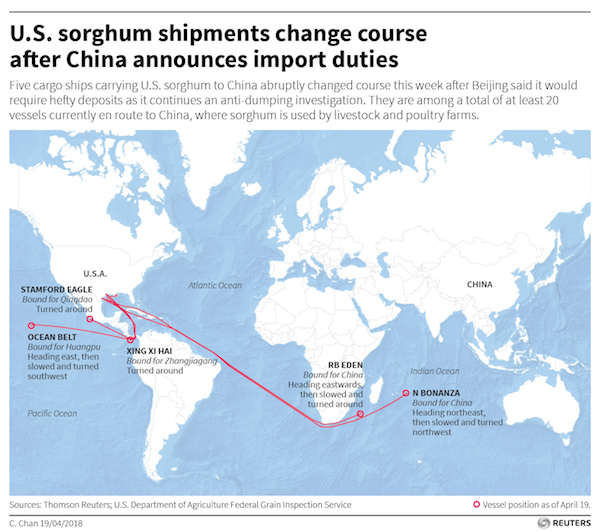

Why is US farmland used to provide Chinese animal feed? Isn’t that perhaps what’s wrong with global trade?

• US Sorghum Armada U-Turns At Sea After China Tariffs (R.)

Several ships carrying cargoes of sorghum from the United States to China have changed course since Beijing slapped hefty anti-dumping deposits on U.S. imports of the grain, trade sources and a Reuters analysis of export and shipping data showed. Sorghum is a niche animal feed and a tiny slice of the billions of dollars in exports at stake in the trade dispute between the world’s two largest economies, which threatens to disrupt the flow of everything from steel to electronics. The supply-chain pain felt by sorghum suppliers on the Pacific, Atlantic and Indian oceans underscores how quickly the mounting trade tensions between the U.S. and China can impact the global agricultural sector, which has been reeling from low commodity prices amid a global grains glut.

Twenty ships carrying over 1.2 million tonnes of U.S. sorghum are on the water, according to export inspections data from the USDA’s Federal Grain Inspection Service. Of the armada, valued at more than $216 million, at least five changed course within hours of China’s announcing tariffs on U.S. sorghum imports on Tuesday, Reuters shipping data showed. The five shipments, all headed for China when they were loaded at Texas Gulf Coast export terminals owned by grain merchants Cargill or Archer Daniels Midland would be liable for a hefty deposit to be paid on their value, which could make the loads unprofitable to deliver. Beijing, which is probing U.S. imports for damage to its domestic industry, announced Tuesday that grains handlers would have to put up a deposit of 178.6% of the value of the shipments.

Thie red lines are far apart. Hard to see how they will resolve this.

• EU to Reject UK Brexit Plan for the Irish Border (BBG)

European Union officials are set to reject a potential U.K. solution to the crucial issue of what happens to the Irish border after Brexit, deepening the stalemate in negotiations. While the U.K. hasn’t made a formal proposal, it has indicated that the bloc’s “backstop” solution for maintaining an invisible border should apply to the whole of the U.K., according to three people familiar with the EU position. It would mean the whole U.K. stays in parts of the single market and customs union as a last resort to avoid a border on the island of Ireland. But the European Commission opposes it and only wants to offer that special status to Northern Ireland, according to the people, who declined to be named.

Finding a way to avoid customs checks on the border between Northern Ireland and Ireland after Brexit is proving the biggest obstacle for U.K. and EU negotiators trying to get a deal on Britain’s divorce from the bloc. While both sides agree that withdrawal treaty must include a “backstop” on Ireland in case a better option doesn’t emerge from the final trade deal, they can’t agree on what it should look like. As talks fail to yield solutions, pressure is mounting on Prime Minister Theresa May at home to backtrack on one her main Brexit pledges and keep the U.K. in the EU’s customs union after Brexit.

That would go a long way to solve the Irish border issue and would also please businesses that are keen on keeping cross-border trade easy. The Commission’s proposal would effectively cut Northern Ireland off from mainland Britain and May has said no British prime minister could accept that. In December, the two sides agreed on a backstop that would have applied to the whole of the U.K., rather than just Northern Ireland. The U.K. stands by that agreement, which also pledged that “no regulatory barriers develop between Northern Ireland and the rest of the United Kingdom.”

Remember: Jim Rickards predicted Turkish default recently. Erdogan may see it too.

• Turkey Snap Election All About Power And A ‘Deteriorating’ Economy (CNBC)

Turkey’s president surprised markets Wednesday by announcing that he would hold snap presidential and parliamentary elections in June with experts saying the move is a sign of both panic and genius. Recep Tayyip Erdogan said elections will be held on June 24, far earlier than previously expected, saying uncertainty over Turkey’s neighbor Syria, and macroeconomic imbalances, were a reason not to delay the vote originally scheduled for November 2019. He also said the country urgently needed to make the switch to an executive presidency, implementing changes to the Turkish constitution which give the president more power.

Fadi Hakura, Turkey analyst at Chatham House, told CNBC Thursday that the move was a sign of panic amid a deteriorating economy. “Erdogan’s calling of the election is a sign of panic and despair. Erdogan has previously viewed early elections as weakness and dishonorable to democracy, but now he’s panicking over the state of the Turkish economy,” Hakura said. “The very fact he’s called brought them forward by almost a year and a half should mitigate the fallout of a worsening economy on his popularity,” he said. [..] If Erdogan wins the election, as widely expected, he will be able to consolidate power following changes to the constitution which have changed Turkey from a parliamentary to a presidential republic, concentrating power in the hands of the president.

It will not be plain sailing for the president, however, with Turkey’s economy dealing with high inflation (at 10.2 percent) fueled by fiscal and monetary policies that have promoted rampant growth — the economy expanding 7.3 percent in the fourth quarter of 2017, according to the last reading available. The Turkish lira has been on a rollercoaster ride in recent months, reflecting wider fears on the prioritization of growth over inflation control, but the announcement of a snap election — and the likelihood that Erdogan will win – has calmed the currency somewhat.

WIth Brazil as corrupt as it is, how long will this hold?

• Brazil Prosecutor Recommends Denying Total Oil License Near Amazon (AFP)

A Brazilian prosecutor warned of “ecocide” in recommending against a drilling license for French oil major Total close to a huge coral reef near the mouth of the Amazon River. The prosecutor’s office for Amapa state said “the only way to guarantee avoiding environmental damage to the area is to deny the license.” “Authorizing oil drilling activity without adequate studies violates the international obligations that Brazil has signed,” the prosecutor’s office said late Wednesday, warning of “large-scale environmental destruction that would amount to ecocide and a crime against humanity.”

The recommendation was sent to the government environmental agency Ibama, which has 10 days to respond. On Tuesday, environmental campaigners Greenpeace said that a previously discovered coral reef had been found to extend right into where Total plans to drill. The enormous reef was found in 2016, but is only now said to overlap directly with Total’s blocks, 75 miles (120 km) off the Brazilian coast, the group said. The finding, made during a research expedition, invalidates Total’s environmental impact assessment, which is based on the reefs being located at least five miles (eight kilometers) from drilling, Greenpeace said.

People say it won’t be that bad, because elephants do well in protected parks. But isn’t that the problem? That the best we can do is build big zoos?

• Cow Could Soon Be Largest Land Mammal Left Due To Human Activity (R.)

The cow could be left as the biggest land mammal on Earth in a few centuries, according to a new study that examines the extinction of large mammals as humans spread around the world. The spread of hominims – early humans and related species such as Neanderthals – from Africa thousands of years ago coincided with the extinction of megafauna such as the mammoth, the sabre-toothed tiger and the glyptodon, an armadillo-like creature the size of a car. “There is a very clear pattern of size-biased extinction that follows the migration of hominims out of Africa,” the study’s lead author, Felisa Smith, of the University of New Mexico, said of the study published in the journal Science on Thursday..

Humans apparently targeted big species for meat, while smaller creatures such as rodents escaped, according the report, which examined trends over 125,000 years. In North America, for instance, the mean body mass of land-based mammals has shrunk to 7.6kg (17lb) from 98kg after humans arrived. If the trend continues “the largest mammal on Earth in a few hundred years may well be a domestic cow at about 900kg”, the researchers wrote. That would mean the loss of elephants, giraffes and hippos. In March, the world’s last male northern white rhino died in Kenya. [..] Smith said “my optimist hat would like to say that it’s not going to happen because we love elephants”. But she said populations of large land mammals were falling and “declining population is the trajectory to extinction”.

Home › Forums › Debt Rattle April 20 2018