Yasuhiro Ishimoto Untitled, Chicago 1950

Losing half a trillion in 3 months should be no surprise now central banks have killed the negative feedback from a functioning market. It’ll be runaway wild swings till it is restored.

• Congratulations! Apple Loses Record $463 Billion in Market Cap in Three Months (Mish)

Apple set a record that will take a long time to beat. The first $ trillion company lost nearly half that in 3 months. On, August 2, Apple became the World’s First Trillion-Dollar Company at $207.05 per share. Hooray! On October 3, Apple had a peak market cap of about $1.138 trillion. Today, Apple’s market cap is about $675 billion. That’s a record market cap loss of $463 billion in three short months. Expect more stories similar to this, but this may be hard to top. Amazon has a chance but it needs a big disaster soon.

• more than double the size of Wells Fargo • more than three times the size of McDonald’s • more than five times the size of Costco • more than 10 times the size of Raytheon.

• Apple Just Lost A Facebook (CNBC)

In only three months, Apple has lost $452 billion in market capitalization, including tens of billions on Thursday as the tech giant’s stock sank further. Apple shares have fallen by 39.1 percent since Oct. 3, when the stock hit a 52-week high of $233.47 a share. With its market cap down to about $674 billion, those losses are larger than individual value of 496 members of the S&P 500 — including Facebook and J.P. Morgan. Microsoft, Amazon, Alphabet and Berkshire Hathaway are the only S&P 500 members with larger market caps than Apple’s loss since its recent high.

To put the Apple market value plunge in context, $446 billion is: • more than double the size of Wells Fargo • more than three times the size of McDonald’s • more than five times the size of Costco • more than 10 times the size of Raytheon. Apple gave a sudden warning to investors on Wednesday afternoon, lowering its fiscal first-quarter revenue guidance. Wall Street reacted, with one analyst saying this will represent Apple’s “biggest miss in years” and another saying the company’s announcement “raises more questions than answers.” Apple CEO Tim Cook’s letter to investors blamed a variety of factors for the guidance cut, including declining iPhone revenue and China’s weakening economy.

Only 6 years? That makes it sound cookie cutter.

• Apple Suffers Its Biggest Single-Day Loss In 6 Years (CNBC)

Apple stock cratered almost 10 percent Thursday, a day after slashing revenue guidance in a rare acknowledgement of waning sales. The stock ended trading at $142.19, its lowest price level since July 2017. The plunge makes for Apple’s worst day of trading since January 2013, and it extends a painful year-end trend for Apple into 2019. The stock, which once traded above $230 per share, shed 30 percent in the fourth quarter of 2018. Thursday’s losses push Apple’s market valuation below $700 billion and behind the market cap of Alphabet to become the fourth most valuable publicly traded U.S. company — down from the top spot just two months ago. The company has lost $450 billion in market value since its peak of about $1.1 trillion last year.

Hard not to think that people working in finance still can’t believe the industry doesn’t function. They keep trying to explain what happens, from inside their faulty models.

• Why This Time Is Different (MooTrades)

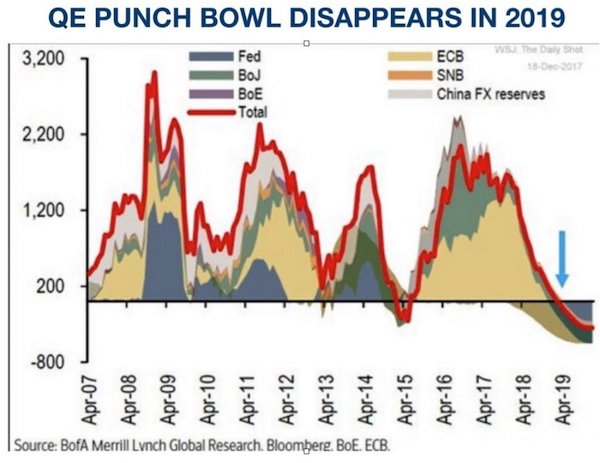

We have seen the last three bull markets catalyzed largely by loosening liquidity conditions during the bear markets that preceded them by central banks — in more and more of a globally coordinated fashion. This has led me to believe that the expansion of liquidity is the primary driver for consistent risk asset upward price revisions (aka bull markets). More than economic developments, earnings or political discourse. As a result it is crucial to realize that the ‘punch bowl’ of quantitative easing, the veritable liquidity spigot that juiced markets higher over the last 9.5 years, is not only running dry, but going in reverse (taking liquidity from markets). The impact of this reversal cannot overstated. It will be the primary catalyst that drives this bear market in equities lower. Only a reversal of tightening liquidity conditions will drive risk assets higher again.

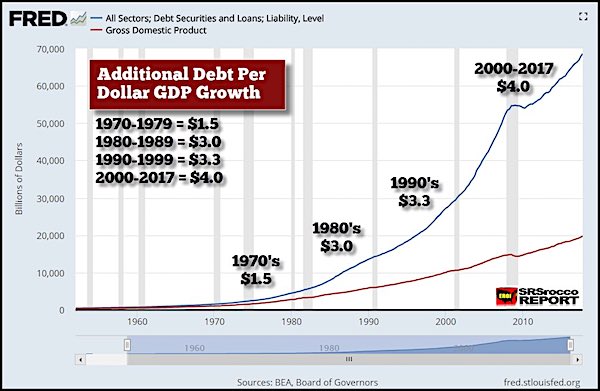

Macro: • $1 of US GDP growth now costs $4 of debt, and is only growing as we push on the string of debt to borrow forward demand to today. • US now has $200 trillion of unfunded liabilities over the next 10 year period. • Debt monetization isn’t just important, it will become a necessity. Otherwise rates normalize and the party ends in a very bad way (insolvency and/or extreme austerity measures).

Everybody is getting ready for a fight. Just not one that would benefit their voters.

• Democrats Introduce Impeachment Articles On 1st Day In The House (RT)

Democrats are flexing their muscles as the incoming majority in the US House of Representatives, introducing articles of impeachment and even quixotic constitutional amendments even though they have no hope of passing. Rep. Brad Sherman (D-CA) introduced articles of impeachment on the first day of the 2019 Congress, starting with a resolution demanding President Donald Trump be impeached for “threatening, and then terminating” then-FBI Director James Comey in 2017. Reserving the option to introduce more articles later, Sherman told CNN he wanted to be able to “force the conversation on impeachment” when (if?) the Mueller report is released, “challenging” his Democratic colleagues who haven’t yet chosen to support Trump’s impeachment.

Sherman filed the exact same impeachment resolution in 2017 but could only muster one supporter, Rep. Al Green (D-TX), who later filed his own articles of impeachment. Rep. Rashida Tlaib (D-MI) didn’t even wait until she was seated as a congresswoman to go after the president’s job, publishing an op-ed on Thursday entitled “Now is the time to begin impeachment proceedings against President Trump.” “We already have overwhelming evidence that the president has committed impeachable offenses,” she wrote, accusing Trump of “abuse of power and abuse of the public trust” along with a laundry list of crimes. In person, she was even more direct, reportedly telling a MoveOn.org reception, “We’re gonna impeach that mother**ker.”

Speaker of the House Nancy Pelosi has been noticeably reticent on impeachment, telling NBC on Thursday that Democrats should wait for the Mueller report before making any moves. “We shouldn’t be impeaching for a political reason, and we shouldn’t avoid impeachment for a political reason,” she said. Many rank-and-file Democrats ran on pro-impeachment platforms, but with polls indicating only a third of Americans support the idea and a two-thirds majority in the Republican-controlled Senate required to remove the president, they are unlikely to make any sudden moves.

“..there are almost 900 Canadians in a similar situation in the United States..”

• Canada Says 13 Citizens Detained In China Since Huawei CFO’s Arrest (R.)

Canada has said 13 of its citizens have been detained in China since the Huawei executive Meng Wanzhou was arrested in December in Vancouver at the request of the US. “At least” eight of those 13 have since been released, a Canadian government statement said, without disclosing what charges if any had been laid. Prior to Thursday’s statement, detention of only three Canadian citizens had been publicly disclosed. Diplomatic tensions between Canada and China have escalated since Meng’s arrest on 1 December. The Canadian government has said several times it sees no explicit link between the arrest of Meng, the daughter of Huawei’s founder, and the detentions of Canadian citizens. But Beijing-based western diplomats and former Canadian diplomats have said they believe the detentions were a “tit-for-tat” reprisal by China.

Meng was released on a C$10m ($7.4m) bail on 11 December and is living in one of her two Vancouver homes as she fights extradition to the US. The 46-year-old executive must wear an ankle monitor and stay at home from 11pm to 6am. The 13 Canadians detained included Michael Kovrig, Michael Spavor and Sarah McIver, a Canadian government official said on Thursday. McIver, a teacher, has been released and returned to Canada. Kovrig and Spavor remain in custody. Canadian consular officials saw them once each in mid-December. Overall there are about 200 Canadians who have been detained in China for a variety of alleged infractions and continue to face on-going legal proceedings. “This number has remained relatively stable,” the official said. In comparison there are almost 900 Canadians in a similar situation in the United States, the official said.

Who’s going to save Deutsche? It’s far too big not to be saved. But it would drag down any other bank with it. Let the German government do it.

• UBS Chairman Pours Cold Water On Deutsche Bank Merger Talk (R.)

Swiss bank UBS is not looking to merge with any other bank, Chairman Axel Weber told the Tages-Anzeiger newspaper, dismissing speculation that UBS could join forces with Deutsche Bank. “There is a lot of talk in Europe and the United States about mergers but nothing happens. These are all simulation games,” he said in an interview published on Thursday. Asked specifically about whether UBS, the world’s largest wealth manager, was running simulations about Germany’s biggest lender, Weber said: “Every company has to think things over, but it makes little sense to consider mergers at group level now. These paralyze companies for years.

“UBS is much stronger today than before the financial crisis, but combining with another bank — no matter which — would be premature at this moment. We want to grow primarily organically and we surely have to be able to walk before we want to run.” Weber, a former Bundesbank chief who joined UBS in 2012, said he could imagine remaining in his post until 2022. Asked how long Chief Executive Sergio Ermotti might stay, he said UBS wanted an orderly leadership transition and was under no pressure to act while it ensured the right talent was in place.

The Dutch finance minister published a list of tax havens a few days ago. Holland wasn’t on it. These people don’t give a sh*t about their credibility.

• Google Shifted $23 Billion To Tax Haven Bermuda In 2017 (R.)

Google moved 19.9 billion euros ($22.7 billion) through a Dutch shell company to Bermuda in 2017, as part of an arrangement that allows it to reduce its foreign tax bill, according to documents filed at the Dutch Chamber of Commerce. The amount channeled through Google Netherlands Holdings BV was around 4 billion euros more than in 2016, the documents, filed on Dec. 21, showed. “We pay all of the taxes due and comply with the tax laws in every country we operate in around the world,” Google said in a statement. “Google, like other multinational companies, pays the vast majority of its corporate income tax in its home country, and we have paid a global effective tax rate of 26 percent over the last ten years.”

For more than a decade the arrangement has allowed Google owner Alphabet to enjoy an effective tax rate in the single digits on its non-U.S. profits, around a quarter the average tax rate in its overseas markets. The subsidiary in the Netherlands is used to shift revenue from royalties earned outside the United States to Google Ireland Holdings, an affiliate based in Bermuda, where companies pay no income tax. The tax strategy, known as the “Double Irish, Dutch Sandwich”, is legal and allows Google to avoid triggering U.S. income taxes or European withholding taxes on the funds, which represent the bulk of its overseas profits.

“76% of Tory members said that warnings about no deal Brexit — like those on food & medicine — are “exaggerated or invented, and in reality leaving without a deal would not cause serious disruption.”

• Over Half Of Tory Members Consider Quitting Party Over May’s Brexit Deal (BI)

Conservative party members overwhelmingly want MPs to vote down Theresa May’s Brexit deal, with more than half saying they have even considered ripping up their membership over it, according to a new poll. A survey of 1,215 Tory party members published on Friday found that 59% of Conservative party members oppose the Withdrawal Agreement May has negotiated with the European Union, while just 38% support it. Among all Conservative party members, more than half (56%) said they had considered quitting the party over May’s deal, according to YouGov polling for leading academics at the ESRC-funded Party Members Project.

The findings will spook figures in Downing Street who had hoped that Conservative MPs would return from their constituencies over Christmas having been urged by party members to get behind May and her deal. The prime minister was forced to postpone a parliamentary vote on her deal after more than 100 of her MPs announced that they planned to oppose it. [..] The Tory party membership is particularly supportive of leaving the EU without a deal, despite the myriad warnings from ministers about the disruption it would cause across multiple aspects of life in the UK, including food and medicine. A whopping 76% of Tory members said that warnings about a no deal Brexit are “exaggerated or invented, and in reality leaving without a deal would not cause serious disruption.” Just 18% said the warnings were realistic.

The -legal- power of Monsanto should never be underestimated.

• US Judge Limits Evidence In Trial Over Roundup Cancer Claims (R.)

A federal judge overseeing lawsuits alleging Bayer’s glyphosate-based weed killer causes cancer has issued a ruling that could severely restrict evidence that the plaintiffs consider crucial to their cases. U.S. District Judge Vince Chhabria in San Francisco in an order on Thursday granted Bayer unit Monsanto’s request to split an upcoming trial into two phases. The order initially bars lawyers for plaintiff Edwin Hardeman from introducing evidence that the company allegedly attempted to influence regulators and manipulate public opinion.

Thursday’s order applies to Hardeman’s case, which is scheduled to go to trial on Feb. 25, and two other so-called bellwether trials which will help determine the range of damages and define settlement options for the rest of the 620 Roundup cases before Chhabria. But Hardeman’s lawyers contended that such evidence, including internal Monsanto documents, showed the company’s misconduct and were critical to California state court jury’s August 2018 decision to award $289 million in a similar case. The verdict sent Bayer shares tumbling though the award was later reduced to $78 million and is under appeal. Under Chhabria’s order, evidence of Monsanto’s alleged misconduct would be allowed only if glyphosate was found to have caused Hardeman’s cancer and the trial proceeded to a second phase to determine Bayer’s liability.

Time to cut all ties with Brazil.

• New Brazil President Bolsonaro Launches Assault On Amazon Rainforest (G.)

Hours after taking office, Brazil’s new president, Jair Bolsonaro, has launched an assault on environmental and Amazon protections with an executive order transferring the regulation and creation of new indigenous reserves to the agriculture ministry – which is controlled by the powerful agribusiness lobby. The move sparked outcry from indigenous leaders, who said it threatened their reserves, which make up about 13% of Brazilian territory, and marked a symbolic concession to farming interests at a time when deforestation is rising again. “There will be an increase in deforestation and violence against indigenous people,” said Dinaman Tuxá, the executive coordinator of the Articulation of Indigenous People of Brazil (Apib).

“Indigenous people are defenders and protectors of the environment.” Sonia Guajajara, an indigenous leader who stood as vice-presidential candidate for the Socialism and Freedom party (PSOL) tweeted her opposition. “The dismantling has already begun,” she posted on Tuesday. Previously, demarcation of indigenous reserves was controlled by the indigenous agency Funai, which has been moved from the justice ministry to a new ministry of women, family and human rights controlled by an evangelical pastor. The decision was included in an executive order which also gave Bolsonaro’s government secretary potentially far-reaching powers over non-governmental organizations working in Brazil.

Home › Forums › Debt Rattle January 4 2019