Salvador Dali� The burning giraffe �1937

Dali: “The only difference between immortal Greece and our era is Sigmund Freud who discovered that the human body, which in Greek times was merely neoplatonical, is now filled with secret drawers only to be opened through psychoanalysis.”

James Baldwin mural by Rico Gatson at the 167th Street subway station, New York.

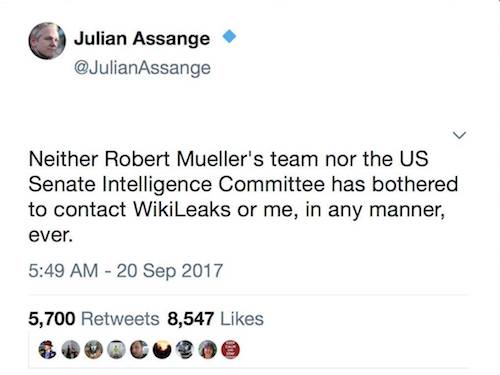

https://twitter.com/i/status/1824168925040681066

Dennis Quaid plays Reagan in new movie

It turns out Facebook is censoring content about the new biopic movie “Reagan” because they think it can “sway the election”

That’s what Dennis Quaid told @joerogan

Even though Reagan hasn’t been on the ballot in 40 years

Guarantee FB wouldn’t block promos for an Obama movie! https://t.co/IBlLZLules pic.twitter.com/TeuR6MtDg2

— DC_Draino (@DC_Draino) August 16, 2024

https://twitter.com/i/status/1824497201294270481

https://twitter.com/i/status/1824505575994007689

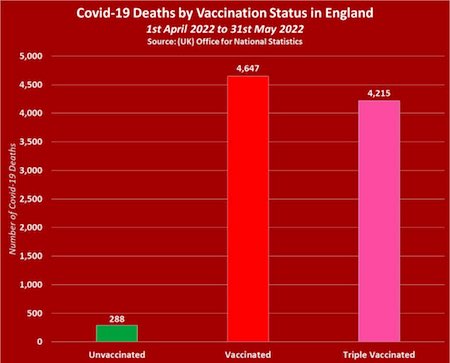

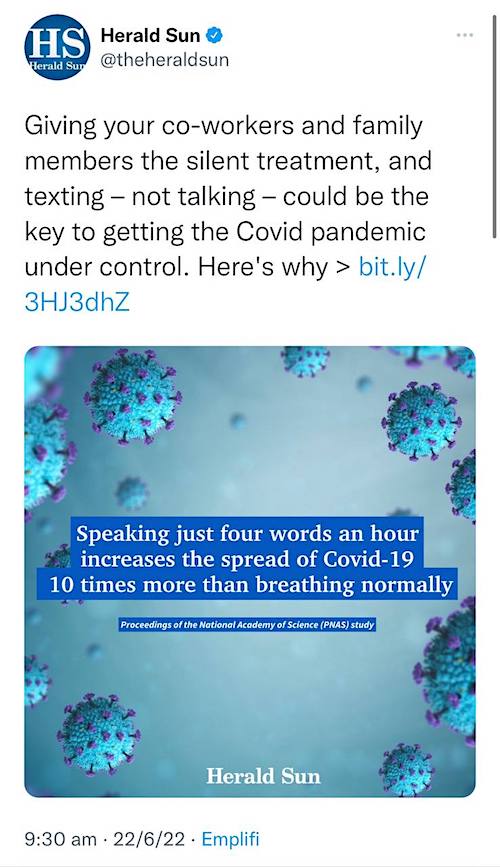

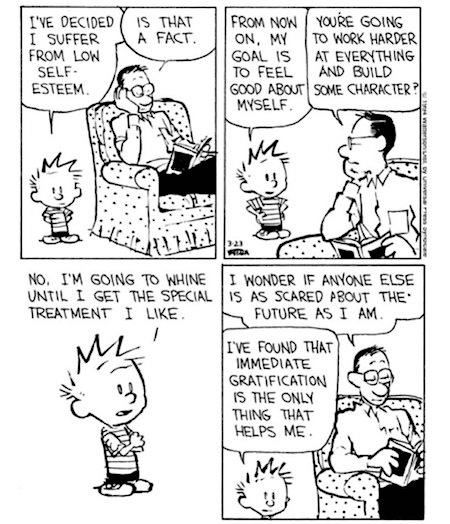

Gouging

Harris set to propose a ban on price gouging.https://t.co/UhBLb0RHPx

Sad her 1st big policy announcement is economically illiterate.

"Gouging" didn't cause inflation, Biden's spending did.

Her naive staff could learn from these @EductionSITC students why “gouging” is good. pic.twitter.com/8cYSl8KfWK

— John Stossel (@JohnStossel) August 15, 2024

270

Biden: I served in the senate for 270 years. I know I only look 40, but I'm a little bit older. For the longest time I was too damn young because I was only 29 when I got elected, now I'm too damn old. pic.twitter.com/IVPD3qc1HZ

— Acyn (@Acyn) August 15, 2024

Benz

https://twitter.com/i/status/1824271248265822586

Tucker

Casey Means was a Stanford-educated surgeon. Her brother Calley was a lobbyist for pharma and the food industry. Both quit their jobs in horror when they realized how many people were being killed by the systems they participated in. This is an amazing story.

(0:54) Who Are… pic.twitter.com/1oIVLvPlAv

— Tucker Carlson (@TuckerCarlson) August 16, 2024

“The Ghost of Hubert Humphrey Is Stalking Kamala Harris”

• The Politics of Joy (Solomon)

Like Hubert Humphrey six decades ago, Kamala Harris has remained in step with the man responsible for changing her title from senator to vice president. She has toed President Biden’s war line, while at times voicing sympathy for the victims of the Gaza war that’s made possible by policies that she supports. Her words of compassion have yet to translate into opposing the pipeline of weapons and ammunition to the Israeli military as it keeps slaughtering Palestinian civilians. As the Democratic standard-bearer during carnage in Gaza, Harris has been trying to square a circle of mass murder, expressing empathy for victims while staying within bounds of U.S. government policies. Last week, Harris had her national security adviser declare that “she does not support an arms embargo on Israel.”

If maintained, that stance will continue to be a moral catastrophe — while increasing the chances that Harris will lose to Donald Trump. In effect, so far, Harris has opted to stay aligned with power brokers, big donors and conventional political wisdom instead of aligning with most voters. A CBS News / YouGov poll in June found that Americans opposed sending “weapons and supplies to Israel” by 61 to 39 percent. Last week, Harris described herself and running-mate Tim Walz as “joyful warriors.” Many outlets have heralded their joyride along the campaign trail. The Associated Press reported that “Harris is pushing joy.” A New York Times headline proclaimed that “joy is fueling her campaign.” The brand of the Harris campaign is fast becoming “the politics of joy.”

Such branding will be a sharp contrast to the outcries from thousands of protesters in Chicago outside the Democratic National Convention next week, as they denounce U.S. complicity with the methodical killing of so many children, women and other civilians in Gaza. Campaigning for joy while supporting horrendous warfare is nothing new. Fifty-six years before Vice President Harris called herself a “joyful warrior,” Vice President Humphrey declared that he stood for the “politics of joy” when announcing his run for the 1968 Democratic presidential nomination.

At that point, the Pentagon was several years into its massive killing spree in Vietnam, as Humphrey kicked off his campaign by saying: “here we are the spirit of dedication, here we are the way politics ought to be in America, the politics of happiness, politics of purpose, politics of joy; and that’s the way it’s going to be, all the way, too, from here on out.” If Kamala Harris loses to Trump after sticking with her support for arming the slaughter in Gaza, historians will likely echo words from biographer Offner, who wrote that after the 1968 election Humphrey “asked himself repeatedly whether he should have distanced himself sooner from President Johnson on the war. The answer was all too obvious.”

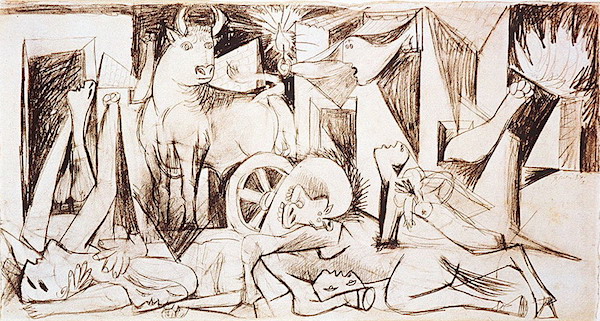

Getting closer… don’t like this one bit.

“..there is reliable reporting that the enemy infantry is made up of NATO special forces from the United States, Britain, France, and Poland alongside the NeoNazis of Ukraine..”

“This is as close to World War Three taking place as it can get..”

• Biden’s Incriminating Admission Of US Involvement In Offensive On Russia (SCF)

It is breathtaking what is going on with the offensive into the Kursk and Belgorod regions of the Russian Federation. This is as close to World War Three taking place as it can get, if not already happening. This week American President Joe Biden admitted deep U.S. involvement in the invasion of Russia by Ukrainian forces. The complacent, casual admission is shocking. Biden told media that his officials were in “constant contact” with the Kiev regime on the offensive that began on August 6. Biden added with undisguised pleasure that the incursion had created a “real dilemma” for Russian leader Vladimir Putin. It seems likely that the summer offensive will go the same ill-fated way as last year’s offensive by Ukraine that took place in the main war zone area of Donbass, the region which was formerly eastern Ukraine but is now legally part of the Russian Federation.

The offensive last summer turned out to be a disaster for Ukrainian forces as superior Russian defenses decimated them. As with this summer’s offensive, there has been much Western media hyping of the initial gains. But the optimism is giving way to the reality that Russian forces are containing the cross-border foray and will eventually expel Ukrainian troops. There are indications that the Ukrainian side has lost over 2,000 casualties over the past 10 days and incurred heavy losses of destroyed NATO military equipment. Nevertheless, it is alarming what has been embarked on by the NATO-backed regime. This is the first time that Russia has been invaded by a foreign enemy since the Great Patriotic War when Nazi Germany waged its genocidal war. Ironically, a turning point in that war was in the Kursk region when the Red Army defeated the Wehrmacht.

The symbolism of today’s events in Kursk and Belgorod is horrifying. Here we have Ukrainian militants who glorify the Third Reich wearing Nazi helmets while they terrorize Russian civilians. Video footage shows deliberate shelling of civilian homes and apartment blocks in what can only be described as a scorched earth campaign. Up to 200,000 civilians have been evacuated from the Kursk and Belgorod regions. The invasion force is equipped with NATO tanks and armored vehicles. This is an incredible echo of history whereby German, British, and American tanks are marauding on Russian soil and terrorizing towns and villages. Furthermore, there is reliable reporting that the enemy infantry is made up of NATO special forces from the United States, Britain, France, and Poland alongside the NeoNazis of Ukraine. In short and shocking terms: NATO has invaded Russia with a terror campaign replicating Nazi Germany.

[..] Even Western media reports are conceding that the initial Ukrainian-NATO gains are slowing down. There are also Western reports expressing concern that the futile foray will only weaken the already overstretched Ukrainian lines in the main battle region of Donbass which will accelerate Russia’s advances in Ukraine. Moscow is indicating that it will push on without stopping to defeat the Kiev regime. As with Nazi Germany’s Kursk offensive, the NATO-backed regime will be seen to have recklessly overplayed its hand. The last reserves of its best battalions are taking severe losses in Kursk. From Russia’s perspective, the NATO invasion per se is not a serious threat. It is a barbaric violation of Russian territory and its citizens. But the assault in itself does not in any way constitute a national security threat. It will be dealt with harshly.

“Ukraine is going to lose another 30 percent or more of its territory when this is done because Russia has basically determined that Ukraine can’t be trusted, the West can’t be trusted, that Russia can never believe in the notion of a Ukraine willing to live in peace with its Russian neighbor,” Ritter claimed. “So Russia is going to destroy Ukraine..”

• Scott Ritter: Russia Obliterates NATO Fighters, Weaponry (Sp.)

Kiev’s incursion has given Moscow the opportunity to destroy strategic reserves of troops and weapons. Ukraine was forced to expend some of their most well-trained soldiers and advanced technology in a failed effort to capture the Kursk nuclear power plant, highlighted former US Marine intelligence officer Scott Ritter. Such was the former UN chief weapons inspector’s analysis on Sputnik’s The Critical Hour program Thursday, where Ritter discussed the latest desperate maneuver of the failing Western proxy war. “A NATO-created, trained, equipped and directed force of not just Ukrainians, but Polish, French, Americans [and] British has invaded Russia,” said the American dissident, who faced persecution in Washington after challenging the George W. Bush administration’s claims of Iraqi weapons of mass destruction during the runup to the United States’ disastrous war on the Middle Eastern country.

“This force could be up to 20,000-strong,” Ritter noted. “It looks like the Ukrainians are seeking to reinforce it as we speak with thousands of more people drawn from the Zaporozhye front. It’s an invasion of Russia. And that should scare the heck out of everybody who just heard that statement.” “This is how you trigger nuclear war. Now, fortunately, the Russians aren’t panicking… the incursion has been contained. Not only that, it’s been blunted.”Ritter noted that Moscow quickly responded to the attack, taking the opportunity to destroy Ukrainian supply lines running from the Sumy region. Russia has also neutralized some of the regime’s most well-trained troops and high-tech NATO weaponry, such as a British Challenger tank, US M1 Abrams tanks and Bradley infantry fighting vehicles. The ongoing conflict against the Western client state has served as a showcase for Russian defense technology, which has fared well against Ukraine’s dwindling supplies of expensive NATO weaponry.

“They gave it to us. They handed it to us,” said Ritter of Kiev’s strategic reserves of troops and armaments. “The Russians are winning. The Ukrainians are dying. And there’s nothing Ukraine will have to replace these troops.” “These troops have been trained and prepared for well over a year and a half. These are NATO equivalent troops. Many of them are NATO troops, sheep-dipped Polish troops, sheep-dipped French troops, American mercenaries recruited as soon as they leave the active duty of the United States Armed Forces… This is a NATO unit, literally a NATO unit that was sent into Ukraine and the Russians are destroying it. That’s the reality of what’s going on in Kursk right now.” Ritter claimed Moscow had uncovered Ukrainian troops’ plans to seize a nuclear power plant in the Kursk region, essentially holding it hostage in exchange for the return of territory in Crimea, Kherson or Zaporozhye.

The Kiev regime would “threaten Russia and the world with a nuclear catastrophe if Russia wouldn’t come to the negotiating table,” the analyst claimed, calling the gambit “an insane plan.” The former intelligence officer compared Ukraine’s plan to the Battle of the Bulge, during which a weakened Nazi regime desperately attempted to cut British and American troops off from a supply base at the port of Antwerp. “I think most people, when the Kursk battle is evaluated, would say that the capture of the Kursk nuclear power plant was always a bridge too far,” Ritter claimed. “It wasn’t going to happen. But that appears to be the actual operational battle plan and goal and objective of the Ukrainian forces.”

The analyst claimed Ukraine’s repeated intransigence would force Moscow to capture more territory, noting Russia’s repeated attempts to reach a diplomatic solution with Kiev both before and after it launched its special military operation in early 2022. “Ukraine is going to lose another 30 percent or more of its territory when this is done because Russia has basically determined that Ukraine can’t be trusted, the West can’t be trusted, that Russia can never believe in the notion of a Ukraine willing to live in peace with its Russian neighbor,” Ritter claimed. “So Russia is going to destroy Ukraine. And, sadly, that is probably the way this war is going to end.”

“President Putin’s reaction to the Kursk invasion was visible in his body language. He was furious: for the flagrant military/intel failure; for the obvious loss of face; and for the fact that this buries any possibility of rational dialogue about ending the war. Yet he managed to turn the upset around in no time…”

• So What Really Happened In Kursk? (Pepe Escobar)

An extremely serious debate is already raging among selected circles of power/intelligence in Moscow – and the heart of the matter could not be more incandescent. To cut to the chase: what really happened in Kursk? Was the Russian Ministry of Defense caught napping? Or did they see it coming and profited to set up a deadly trap for Kiev? Well-informed players willing to share a few nuggets on condition of anonymity all stress the extreme sensitivity of it all. An intel pro though has offered what may be interpreted as a precious clue: “It is rather surprising to see such a concentration of force was unnoticed by satellite and drone surveillance at Kursk, but I would not exaggerate its importance.” Another intel pro prefers to stress that “the foreign intel section is weak as it was very badly run.” This is a direct reference to the state of affairs after former security overseer Nikolai “Yoda” Patrushev, during Putin’s post-inauguration reshuffle, was transferred from his post as secretary of the Security Council to serve as a special presidential aide.

The sources, cautiously, seem to converge on a very serious possibility: “There seems to have been a breakdown in intel; they do not seem to have noticed the accumulation of troops at the Kursk border”. Another analyst though has offered a way more specific scenario, according to which a hawkish military faction, spread across the Ministry of Defense and the intel apparatus – and antagonistic to the new Minister of Defense Belousov, an economist – let the Ukrainian invasion proceed with two objectives in mind: set a trap for Kiev’s top enemy commanders and troops, who were diverted from the – collapsing – Donbass front; and put extra pressure on Putin to finally go for the head of the snake and finish off the war. This hawkish faction, incidentally, regards Chief of the General Staff Gerasimov as “totally incompetent”, in the words of one intel pro. There’s no smoking gun, but Gerasimov allegedly ignored several warnings about a Ukrainian buildup near the Kursk border.

A retired intel pro is even more controversial. He complains that “traitors of Russia” actually “stripped three regions from troops to surrender them to the Ukrainians.” Now, these “traitors of Russia” will be able “to ‘exchange’ the city of Suzha for leaving the fake country of Ukraine and promote it as an inevitable solution.” Incidentally, only this Thursday Belousov started chairing a series of meetings to improve security in the “three regions” – Kursk, Belgorod and Bryansk. Hawks in the siloviki apparatus don’t make it a secret that Gerasimov should be fired – and replaced by fabled General Sergey “Armageddon” Surovikin. They also enthusiastically support the FSB’s Alexander Bortnikov – who de facto solved the extremely murky Prigozhin affair – as the man now really supervising The Big Picture in Kursk.

Well, it’s complicated. President Putin’s reaction to the Kursk invasion was visible in his body language. He was furious: for the flagrant military/intel failure; for the obvious loss of face; and for the fact that this buries any possibility of rational dialogue about ending the war. Yet he managed to turn the upset around in no time, by designating Kursk as a counter-terrorist operation (CTO); supervised by the FSB’s Bortnikov; and with an inbuilt “take no prisoners” rationale. Every Ukrainian in Kursk not willing to surrender is a potential target – set for elimination. Now or later, no matter how long it takes.

“..Herr Hitler, the petty Bohemian corporal with the same psycho-sexual neuroses we see in Kiev’s cross-dressing, coke-sniffing Zelensky..”

• Prussian Field Marshals Do Not Mutiny. But Ukrainians Generals Must (Hayes)

Kursk, Kharkov and Belgorod, Russian cities that are back in the news, just as they were this time 80 years ago when Manstein, Model, Hauser and Guderian, the cream of the Wehrmacht’s High Command, slugged it out with their Red Army equivalents, before seeing their forces battered there and, shortly afterwards, mauled beyond hope of redemption in Western Ukraine as well. Manstein, the architect of the Wehrmacht’s victory in the Third Battle of Kharkov, was, like Napoleon at Austerlitz, the master of the counter-attack but, also like Napoleon at Austerlitz, he had the tools at hand to get the job done. In his case, those tools consisted of SS divisions Das Reich and Leibstandarte SS Adolf Hitler, which crashed into the Red Army’s flank and put them on the ropes.

Whereas Manstein was an operational genius, who had the men at hand to do what was required of him, the same cannot be said of Ukraine’s High Command, who recently sent their best soldiers to their doom in Kursk for no hope of a strategic, operational or even tactical advantage. Because those Ukrainians and the Russian prisoners they took are stuck in Kursk with no hope of escape or reinforcements, the rank stupidity of those Ukrainians generals, who placed their men’s necks into a Russian noose, knows few precedents. Having allowed the Ukrainians have their day in the Kursk sun, the Russian Army will hunt them down, just as their great grandfathers hunted down the 7,000 or so SS stragglers, who did not surrender alongside Paulus at Stalingrad.

Although that is a particularly high price for Zelensky to pay for a few meaningless headlines in NATO’s press, there is one very important analogy to the trials Manstein faced, when he subsequently tried to establish a defensive line in Western Ukraine for the Red Army juggernaut heading his way. Instead of being let to his own considerable devices to stem the Red Army tide, Manstein and his fellow Prussian field marshals had to waste valuable time and resources dealing with the non-stop interference of Herr Hitler, the petty Bohemian corporal with the same psycho-sexual neuroses we see in Kiev’s cross-dressing, coke-sniffing Zelensky, who has personally claimed credit for the Kursk debacle.

The situation, as I write, is that the Russian Army continues not only to grind down their Ukrainian counter-parts but to undermine their key defensive lines at Pokrovsk and Niu-York. When the Ukrainian lines collapse there, as they will later this month, the Ukrainians, deprived of their strategic reserves wantonly sacrificed in Kursk, will be in headlong retreat, but with no Manstein or Model to stem the Russian advances. This is not to deny Ukraine the right to a counter attack but it is to say that such decisions should be the preserve of their competent generals, not of cross-dressing Zelensky or the desk generals he answers to in NATO’s Ramstein air base who, like him, have no real skin in the game.

Although Kursk will not be the end of this grizzly show, the end result of a Russian victory has already been determined, just as it was with Kursk in 1943. Only days prior to Herr Hitler blowing his brains out, Marshal Ferdinand Schörner‘s 12th Wehrmacht Army were able to inflict catastrophic casualties on the Poles at the Battle of Bautzen and it was that same month of April 1945 that the Americans suffered their highest fatalities of the European war at the hands of the Wehrmacht, who felt they still had to fight on. Also in April 1945, de Gaulle, not wanting to be upstaged in the division of spoils which would follow Germany’s surrender, launched a mini-D-Day attack on the isolated Royan pocket, which by any yardstick was a horrendous war crime not only because of the 1,500 French citizens the Yanks wantonly incinerated there but because Germany’s unconditional surrender was known to be only days away.

“..the only hope for a prosperous future is through reintegration into Russia..”

• Ordinary Serbians Understand What The Ukrainian Farmers Still Do Not (SCF)

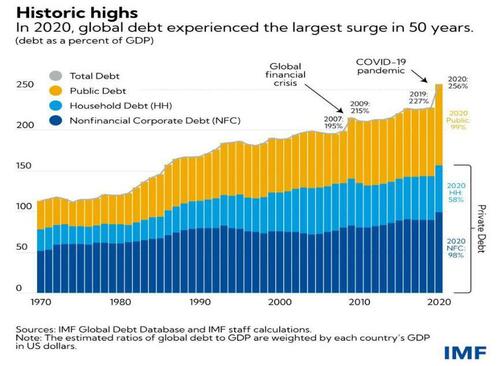

In Serbia, people took to the streets to protest against an agreement between the Serbian government and investment “giants” Blackrock and Rio Tinto. Pressure from large investment funds against state sovereignty is raising concerns among ordinary Serbian citizens, who are protesting to prevent their country from becoming a hostage of global financial predators. It is curious to observe the situation in Serbia and compare it with the terrible Ukrainian reality. One of the most serious and ignored issues regarding the current conflict is the active participation of private investment funds in military aid contracts between Western countries and Ukraine. Contrary to what the pro-Kiev media claims in their lying propaganda, Ukraine is not receiving anything “for free”. Kiev will have to pay for every dollar received in weapons from the US and Europe.

Obviously, Ukraine will not be able to actually pay all these debts. What remains of the country in the post-war period will be an economically devastated nation, unable to maintain its own basic living expenses. It would be naive to think that Western financial predators would not think of this when drafting their abusive contracts with Ukraine. So, to solve this problem, there are several clauses in Western contracts literally establishing the concession of Ukrainian territories and natural resources to international investment funds as a condition of guaranteeing payment.In other words, if Ukraine is unable to pay its billion-dollar military debts – and obviously it won’t be able to – Kiev will have to hand over land and resources to investment companies like Blackrock. This is already happening. Several hectares of fertile Ukrainian territories were transferred to Blackrock and other companies.

Financial predators especially prefer areas of the so-called “black earth” – a Eurasian region where the most fertile soil in the world is located. Millions of tons of black earth have already been exported from Ukraine as part of the process of “paying off” the regime’s exorbitant debts. This tends to get worse and worse, as the Ukrainian regime continues to receive successive military “aid” packages, further increasing its international debt. It is curious to think what global investment funds will do with productive Ukrainian territories. It is known that many of these properties are already being handed over to agricultural giants such as Monsanto. It is possible that Western companies will invest in these regions to receive profits from food production.

However, unfortunately, amid the advancement of the agendas of organizations like the WEF, the possibility of Western elites trying to foment a global food crisis cannot be ruled out. It is very likely that these fertile lands will stagnate and become unproductive to drive Ukraine out of the world market and create a food crisis situation. There are several recent actions that make it clear that the West, for some reason, wants to cause hunger in the world. European countries illegally blocked Russian ships carrying grain and fertilizers to poor states in Africa and Asia. In the same sense, sanctions on Russian and Belarusian fertilizers have harmed several emerging countries dependent on this technology to produce food. For the West, the more hunger, the more dependence and, therefore, the easier it is to impose ideological agendas and political hegemony. In other words, hunger in poor countries is a strategic weapon for Western elites.

It remains to be seen when Ukrainian farmers will discover the malign plan behind all the foreign support for Kiev. Perhaps the Ukrainian agrarian elite has not yet understood that they will be one of the biggest losers of the regime’s actions in this conflict. While the media talks about Russia “annexing” regions in the east, all the remaining territory of Ukraine is being quickly annexed by Blackrock and other investment funds. It seems clear that for Ukrainian farmers and rural workers, the only hope for a prosperous future is through reintegration into Russia. In everything that is left for Ukraine, there will be no more space for rural production and work in the fields. When farmers finally understand this reality, perhaps a wave of protests similar to what is happening in Serbia will begin in Ukraine. Or, in a more extreme case, perhaps farmers and rural workers will form popular militias and begin a partisan war against the neo-Nazi regime.

“..this is not only not true, this cannot be true.”

• Western Governments Sell Farfetched Nord Stream Tale to Wary Public (Sp.)

Two-thirds of European Union citizens remain concerned over the lack of clarity surrounding the 2022 Nord Stream pipeline explosion, recent opinion polling reveals. A survey conducted in May found large numbers of Europeans were troubled by the lack of results from recent investigations into the matter, including 75% of Greeks, 74% of Hungarians, and 72% of Portuguese people who were still worried over the state of affairs. In Germany, perhaps Ukraine’s most important European backer, a full 71% of people said they were concerned over the lack of an explanation for the incident. It was in this context that German officials revealed a surprising break in the case this week, claiming a Ukrainian diving instructor known as Volodymyr Zhuravlev was responsible for the pipeline’s sabotage.

“My feeling is that this is a cover for something, whether for Kursk or something else that they’re planning,” said Serbian-American journalist Nebojsa Malic on Sputnik’s The Final Countdown program Thursday.[..] “They’re trying to wrap up the Nord Stream stuff because maybe the Germans arrested this guy on suspicion of something,” Malic speculated. “Maybe the story is unraveling. Nobody’s really yet offered a rebuttal to Seymour Hersh’s allegations from last year that pretty much conclusively point a finger to either the British or the Americans.” “He says Americans. Other people have put his information together and pointed a finger to the British. But it definitely wasn’t the Russians blowing up their own pipeline.” Host Ted Rall doubted German officials’ claim that an amateur diver could have been responsible for the sabotage, noting the difficulty of the operation.

“The Nord Stream 2 pipeline explosion took place at a depth of 260 feet”, Rall said, noting the pipeline was twice as deep as the 130-foot depth limit for recreational divers. “We’re being told that these are not professional [divers]… You think about the logistical challenge. You have to go to 260 feet. It’s pitch dark. It’s freezing cold. It’s freezing cold in the Caribbean at 260 feet. But this is the Baltic Sea, so it’s bitter.” Then, you have to locate this thing. You have to break through the external casing of the thing. You have to plant the bomb. And you have to get away from it, you know, before it blows up and kills you and the rented pleasure craft that you got from Poland or wherever… this is not only not true, this cannot be true.

At least not using the laws of physics as they exist on our planet. So, why on earth are they so lame at their cover story?” “They’re counting that most people are idiots,” said Malic. “When you’ve been deceiving the public for so long, you don’t have to bother to try very hard. And this is what these Western media have become basically, victims of their own success. They don’t have to be very creative with their deceptions because they rarely get challenged.” Malic speculated that pinning the blame on a Ukrainian diver could serve as a way to further discredit Volodymyr Zelensky, “whose legitimacy has expired in May” after his previous mandate as president ended, he noted.

Like the firemen set homes ablaze and then offer to put the fire out.

• Harris Unveils Plan To Fix Last 4 Years Of Economic Destruction (ZH)

With the election right around the corner and the average American choking on inflation, Vice President Kamala Harris has unveiled several galaxy brain policies aimed at “lowering costs for American families,” which she and her teleprompter will present at a Friday speech in North Carolina – just days before the Democratic National Convention in Chicago. While we know about Harris stealing Donald Trump’s plan to eliminate taxes on tips (after she was the tie-breaking vote on legislation to supercharge IRS enforcement), the proposals also include; Communist price controls to crack down on ‘corporate price-gouging in the food and grocery industries.’ (Except…)

Here's your "price gouging" narrative: average costs paid by businesses have risen just as much as costs charged to consumers – if businesses are being "greedy," they're doing it all wrong… pic.twitter.com/ALiw72MXSf

— E.J. Antoni, Ph.D. (@RealEJAntoni) August 14, 2024

• A $25,000 subsidy for first-time home buyers, under which those who have a two-year history of on-time rent payments would be eligible for “down-payment support.”

• A cap on prescription drug costs and the elimination of medical debt for millions of Americans

• Child tax credit that would provide $6,000 per child to families for the first year of a baby’s life (after JD Vance suggested an increase from $2,000 per child to $5,000)Other items include efforts aimed at lowering the cost of rent and helping renters who are struggling financially, according to NBC News. She will also propose plans to stop data firms from driving up lease rates, as well as stopping Wall Street firms from buying and flipping homes in bulk. As part of the rollout, Harris will call on Congress to pass the Preventing the Algorithmic Facilitation of Rental Housing Cartels Act, a bill introduced by Sens. Ron Wyden, D-Ore., and Peter Welch, D-Vt., that they said would prevent corporate landlords from using private equity-backed price-setting tools to raise rents dramatically in communities across the country.

Harris will also call on Congress to pass the Stop Predatory Investing Act, a bill introduced by Sen. Sherrod Brown, D-Ohio, and several other Democratic senators. The bill is designed to stop communities from being taken advantage of by Wall Street investors and distant landlords. The bill would curtail those practices by removing key tax benefits for major investors who acquire large numbers of single-family rental homes. Harris will also call for the construction of three million new housing units via construction tax incentives – as well as a $40 billion proposal for local governments to build or preserve affordable housing units. We’re sure that won’t be a giant cash grab.

As even the Washington Post notes – “Harris has thus far surrounded herself with many former aides to Biden, and her team had made some overtures to business leaders that they hoped reflected a more centrist approach. But the policy positions she embraced Friday suggest she will continue, if not deepen, the party’s transformation under Biden, who pushed for more aggressive government intervention in the economy on industrial, labor and antitrust policies.” Meanwhile, according to a Gallup survey taken earlier this year, just 21% of Americans say it’s a good time to buy a house – while just days ago, July’s inflation reading showed that shelter prices jumped 0.4% from the previous month. According to Fed Chairman Jerome Powell, it might take ‘several years’ for the pandemic-era rent increases to abate.

“..it is about the mainstream media working in close coordination with the US government to deceive the American people about a war..”

• Scott Ritter: Biden Administration Declaring War on Journalism (Sp.)

Recent FBI raids on properties belonging to Russian-American political scientist Dimitri K. Simes and Scott Ritter, who both challenge the mainstream US political propaganda, are meant to squash dissent on Ukraine, former UN weapons inspector Ritter told Sputnik. The conflict in Ukraine – in which the US has become deeply involved by providing the Kiev regime with billions of dollars – reportedly has people questioning Washington’s hawkish policy that the government seeks to suppress. “What is our crime? Our crime is to have an opinion that is opposite of that of the United States government when it comes to Ukraine,” Ritter emphasized. It is not just about the government deceiving the American people, it is about the mainstream media working in close coordination with the US government to deceive the American people about a war, Ritter noted.

‘This is a very dangerous time for all Americans’: Scott Ritter

“Understand that the US government doesn't trust you. Doesn't believe you're capable of thinking. The US government is actively trying to deceive you and manipulate you,” Ritter told Sputnik, commenting on the… pic.twitter.com/HCqa2kXdkq

— Sputnik (@SputnikInt) August 16, 2024

“That’s where independent journalists come in. That’s where a genuinely free press [comes in], a press that isn’t subordinated to the US government, that doesn’t serve as a stenographer of US government policy, a free press that questions the official narrative,” he pointed out. Ritter concluded that the US government does not trust common people, irrespective of their political leanings, and is actively trying to deceive and manipulate the public. Earlier, Simes, a Channel One presenter in Russia and the founder and ex-president of the Center for the National Interest (USA), told Sputnik that he had not been to the United States since 2022, and had not been notified ahead of time that FBI agents would be conducting a search of his property in Rappahannock County, Virginia, this week.

“..employ Bobby for, at least, cleaning up the public health and pharma sectors of the blob — an epic task he’s ideally suited for.”

• The No Prisoners, End of the Road Election (Kunstler)

It’s fun to muse on the torrent of panicked, deranged texting between Democratic Convention delegates as a runaway train of malignant fates, bad choices, insane policies, delusional ideas, and feral emotion drives them to nominate a moron for president. The confusion and self-doubt must be epic. Are we really gonna do this? Is this really happening? You must imagine this is the same state of mind as, say, a car-full of drunken bridesmaids fishtailing down the highway at 70mph toward a telephone pole. The mis-plays and subterfuges that brought them to this pass cannot be undone: the insult of letting “Joe Biden” front for a criminal blob government, the many hoaxes and the exorbitant lawfare lawlessness, the gross mismanagement of public affairs, wreckage of institutions, ruined economy, devalued dollar, destruction of households and communities, sexual lunacy and programmed mental illness — this is the party’s legacy.

Are none among them even a little bit ashamed of the damage they’ve done to this nation? And maybe wondering about it between one another? Perhaps even anxious to make it stop? And so, the delegates head to Chicago, a city in civic freefall, to either pretend to celebrate the capricious selection of utterly dubious leaders imposed on them by unseen hands, or, just maybe, to revolt against the evil cabal affecting to “defend our democracy” by squashing it. Of course that’s inside the convention. Lord knows what hijinks are being concocted for outside the United Center arena by the various tribes that run on hot yellow bile these dog days of summer — the Hamas mob, the sex freaks, Antifas, BLMs, assorted Bolsheviks, anarchists, utopians, climate change sob-sisters, Gramscian culture stompers, Spartacists, Trotskyites, Jacobins, Fabians, and plain old riffraff out for fun and loot. The gigantic parking wasteland surrounding the United Center on West Madison Street has the look of a perfect battlefield.

All that commences on Monday. In the meantime, much misdirection zings around the Trumpian opposition and the outlier Robert F Kennedy, Jr., as the intel blob that runs mainstream media attempts to seed dissension and confusion amongst them. It includes rumors that Mr. Trump made “a deal” with the blob to go all flabby in exchange for getting let off the hook on his many blob-contrived lawfare problems. The chance of that being true must be zero, even though New York Judge Juan Merchan has an opportunity to send the former president to jail on September 18. I would like to see him try that. It will surely prompt the most momentous and memorable tableau of symbolic resistance in US history since John Paul Jones yelled to the British ship Serapis requesting his surrender, “I have not yet begun to fight.”

As for RFK, Jr., stories circulate that Mr. Trump tried (and failed) to make a deal that would have got Bobby on-board as veep, or some other juicy assignment, if he would drop out of the race. But it’s hard to see exactly how that discredits either of them, since just about everybody expects Mr. Trump, if elected, to employ Bobby for, at least, cleaning up the public health and pharma sectors of the blob — an epic task he’s ideally suited for.

“..Chinese Foreign Minister Wang Yi took a crucial phone call from Iranian Acting Foreign Minister Ali Bagheri Kani, during which he adamantly supported all of Tehran’s efforts to ensure regional peace and stability..”

• A BRICS Trio Is Staring Down Israel (Pepe Escobar)

The Global Majority is fully aware that the genocidals in Tel Aviv are trying as hard as they can to provoke an apocalyptic war – with full US military support, of course. Contrast that combative mindset with 2,500 years of Persian diplomacy. Iran’s acting Foreign Minister, Ali Bagheri Kani, has recently remarked how Tehran is trying hard to prevent “the Israeli regime’s ‘dream’ of triggering an all-out regional war.” But one should never interrupt the enemy when he is in total panic. Sun Tzu would have approved this maxim. Iran certainly won’t interfere as the US and G7 members pull out all stops to come up with some semblance of a Gaza ceasefire deal between Hamas and Israel to prevent a serious military retaliation by Iran and the Axis of Resistance. Earlier this week, that warning bore fruit: Hamas representative in Lebanon, Ahmed Abdel Hadi, reported yesterday that Hamas will not show up at the tentative negotiation round on Thursday – today. The reason?

The clear climate is full of deceit and procrastination from Netanyahu, playing for time while the Axis prepares a response to the assassination of martyrs [Hamas Politburo Chief Ismail] Haniyeh and [Hezbollah Military Commander Fuad] Shukr… [Hamas] will not enter into negotiations that provide cover for Netanyahu and his extremist government. So the waiting game, actually a masterclass of strategic ambiguity to rattle Israel’s nerves, will persist. Beneath all the cheap drama of the collective west begging Iran to not respond, there is a void. Nothing is offered in return. Worse. Washington’s European vassals – the UK, France, and Germany – issued a statement straight out of Desperation Row, where they “call on Iran and its allies to refrain from attacks that would further escalate regional tensions and jeopardize the opportunity to agree a ceasefire and the release of hostages. They will bear responsibility for actions that jeopardize this opportunity for peace and stability. No country or nation stands to gain from a further escalation in the Middle East.”

Predictably, not a single word about Israel. In this neo-Orwellian formulation, it’s as if the recorded history of the planet started when Iran announced it would retaliate for the assassinations of Haniyeh in Tehran. Iranian diplomacy swiftly replied to the vassals, stressing its “recognized right” to defend national sovereignty and create deterrence against Israel, the real source of terrorism in West Asia. And crucially, emphasizing they “do not seek permission from anyone” to exercise it. The heart of the matter predictably escapes western logic: If Washington had forced a Gaza ceasefire last year, the risk of an apocalyptic war convulsing West Asia would have been avoided. Instead, the US on Wednesday approved a further $20 billion weapons package to Tel Aviv, showing exactly how committed the Americans are to securing a permanent ceasefire. The Israeli provocations, especially the assassination of Haniyeh, were a direct affront to three top BRICS members: Iran, Russia, and China.

So, the response to Israel implies a concerted articulation of the trio, deriving from its interlocked comprehensive strategic partnerships. Earlier on Monday, Chinese Foreign Minister Wang Yi took a crucial phone call from Iranian Acting Foreign Minister Ali Bagheri Kani, during which he adamantly supported all of Tehran’s efforts to ensure regional peace and stability. It also signals Chinese support for an Iranian reaction to Israel. Especially considering that the assassination of Haniyeh was seen in Beijing as an unforgivable slap to its considerable diplomatic efforts, taking place only a few days after the Hamas chief, alongside other Palestinian political representatives, signed the Beijing Declaration. Then, on Tuesday, Palestinian Authority (PA) President Mahmoud Abbas met with his Russian counterpart Vladimir Putin at his Novo-Ogaryovo residence in Moscow. What Putin told Abbas is a gem of an understatement:

“It is well known that Russia today, unfortunately, must defend its interests, defend its people with weapons in its hands, but what is happening in the Middle East [West Asia], what is happening in Palestine – certainly does not go unnoticed.” Yet there is a serious problem. The US- and Israeli-backed Abbas is like some sort of broken reed, enjoying scarce credibility in Palestine, with the latest polls revealing that 94 percent of West Bankers and 83 percent of Gazans demand his resignation. Meanwhile, less than 8 percent of Palestinians blame Hamas as responsible for their current, horrible plight. Overwhelming trust is placed in the new Hamas leader, Yahya Sinwar.

Moscow is in a complex position – trying to boost a new political process in Palestine with its instrumental tools of statesmanship, in a much more forceful way than the Chinese. Yet Abbas is resisting it. There are some auspicious angles, though. In Moscow, Abbas said that they had discussed BRICS: “We have reached a verbal agreement that Palestine would be invited in the ‘outreach’ format,” and expressed hope that: A particular format of a meeting could be organized and it will be devoted exclusively to Palestine, so that all countries would voice their views on the developments that are taking place … It will all be as relevant as possible, considering the fact that the countries of this association [BRICS] are all friendly to Palestine.

“It’s a miracle and God had something to do with it and maybe it’s – we want to save the world.”

• Trump To Be Surrounded By Bulletproof Glass At Outdoor Events (MN)

The Secret Service is to implement a raft of new security measures for upcoming outdoor rallies featuring President Trump, including surrounding him with bulletproof glass, according to a source. The Washington Post reports that the USSS has begun storing the glass in locations around the country in order to prepare for Trump campaign events. The source stated “Former presidents and candidates don’t normally get bulletproof glass or support from DoD [Department of Defense],” adding “This glass needs to be brought in on trucks and vans.” The report further notes that acting USSS head Ronald Rowe has overseen the plans after convening with Trump’s team.The report claims that Trump aides said he wants to do more outdoor rallies again, including a return to Butler PA where he was almost assassinated.

However, he stated that he did not want to go on a stage outside again without the protective glass.Previous presidents, including Trump himself have utilised the glass before. Trump spoke about the assassination attempt again during a press conference at his Bedminster, New Jersey golf club on Thursday afternoon. A reporter asked him “You’ve spoken about God saving your life and I’m wondering, have you put much thought into why God saved your life? As in for what purpose has he been shielding and protecting you?” “That was a miracle,” Trump responded, adding “It’s a miracle and God had something to do with it and maybe it’s – we want to save the world.”

BREAKING: A real reporter just asked Trump the greatest question EVER

Reporter: "You've spoken about God saving your life… have you put much thought into why God saved your life?"

And Trump says God saved him to help "Save The World"

WOW! pic.twitter.com/zrEkJetGGW

— George (@BehizyTweets) August 15, 2024

“..they “released the crime scene” after just three days and cleaned up the blood and other “biological evidence..”

• ‘Disturbing Fact’ Emerges In Trump Assassination Probe (RT)

The remains of Thomas Matthew Crooks, who tried to kill Republican presidential candidate Donald Trump last month, were released to his family for cremation in what appeared to be a cover-up, Congressman Clay Higgins has said. Crooks was killed by the US Secret Service on July 13 after he opened fire on Trump during his rally in Butler, Pennsylvania. He managed to injure Trump and two rally-goers, while killing a third. Higgins is a Louisiana Republican with background in law enforcement, and a member of the congressional Task Force established to investigate the attempted assassination. He traveled to Butler earlier this month to examine the crime scene. His report on the trip was made public on Thursday. “My effort to examine Crooks’ body on Monday, August 5, caused quite a stir and revealed a disturbing fact,” Higgins wrote in the report. “The FBI released the body for cremation 10 days after J13. On J23, Crooks was gone. Nobody knew this until Monday, August 5, including the County Coroner, law enforcement, Sheriff, etc.”

Higgins noted that the county coroner “would have never released Crooks’ body to the family for cremation or burial without specific permission from the FBI.” The coroner’s report and the autopsy report were not ready as of August 5, and without the body there was no way to verify their accuracy, Higgins noted. Such actions by the FBI “can only be described by any reasonable man as an obstruction to any following investigative effort,” he wrote. Higgins was in Butler for three days and spent about 20 hours investigating the crime scene. According to his findings, Crooks fired eight shots from the roof of a building overlooking the fairgrounds where Trump spoke. The ninth shot came from a Butler SWAT operator and struck Crooks’ rifle, while the tenth shot from a Secret Service sniper killed him.

The FBI reportedly has the casings from the roof, but they “released the crime scene” after just three days and cleaned up the blood and other “biological evidence,” according to the report.Crooks did not use a ladder to climb the roof, but an air conditioning unit. He somehow knew to take a position that minimized his exposure to Secret Service snipers, Higgins wrote, noting that it is not usual practice to assign counter-snipers to former presidents. “I have not yet investigated Crooks’ origins, how he came to be a shooter, how he manufactured a remote trigger bomb, etc. I have not reviewed the harvested evidence, nor have I examined his home, his vehicle, spoken with his family, his neighbors, his classmates, examined his computer, his emails, or his closet,” Higgins wrote, vowing that he intends to do so.

Paul Craig Roberts has no internet service. He doesn’t like that.

• The Digital Revolution Is Satan’s Master Weapon (Paul Craig Roberts)

For the last three days I have been experiencing digital Hell. The Internet has been down for three days and there is no information. The company provides such minimum customer service that it has been difficult even to reach a robot. You have to leave a number for a call back as “all our representatives are busy helping other customers.” When the call comes you learn that there is an outage in a large area and given an estimated repair time. They put you on a message list for cell phone texts. The repair time estimates lengthened four times from August 13 into August 14 and have now ceased. The morning of the 14th a text informed me that my service was restored. It wasn’t. I called the service provider who, after a call back, eventually was able to confirm that the service was not restored.

What has happened, I believe, is that in order to boost the company’s profits and thus the “performance bonuses” of the executives and board, the company spends minimal money on maintenance and has replaced its own repair servicemen with outside contractors, reporting the cost savings as profits. In other words, the company is being sucked dry by its executives. Moreover, maintenance and improvements might have been deferred so long that parts for the existing equipment are no longer available or are hard to come by. This is America today. I drove several miles to a county library to check emails and found one saying my service was restored. Of course, it wasn’t. I tried to check foreign news sources to see what was going on, as US media is useless. The library’s firewall wouldn’t let me connect to some sites. Researchers have told me that Trump’s few accomplishments during his first term can no longer be found online except for a few branded disinformation by “fact checkers.” To spell it out for you, a fictional world of false narratives is being created for us while we sit there, insouciant as always, scrolling our cell phones.

In the old analog world this was impossible. Every newspaper had a morgue. Every library had printed evidence as did everyone who had books, newspapers, magazines. Today the information is in a cloud subject to denial of access and erasure. Google is putting our actual history in the Memory Hole and creating a new fictional history consistent with the official narratives. This is the price we pay for the ability to scroll cell phones. In the midst of my Internet frustration, BMW’s software engineers added another. My 6-year old BMW’s screen flashed “danger, tire inflation problem.” I am informed I can drive 80 mph, ten miles above Interstate speed limit, but must attend to the problem. I suppose there might be some danger on a German autobahn at 150 mph on under inflated tires, but on track weekends we always let air out of our tires for better grip. I never had any problem on under inflated tires at the 135-140 mph I could reach on the short straightaways.

To fix the problem, you have to attend to all four tires. But you are far from finished. The software can tell when inflation falls below the specified number, but it cannot tell when you inflate to the specified number. In other words, you can’t turn the warning off. The software doesn’t believe you. You have to prove it to the software by driving the car a distance so the system can recalibrate its tire inflation readings to confirm you are not taking an easy way out by turning off the warning. It wasn’t possible for the wonderful analog cars I had to waste a person’s time like this any more than it was possible for a corporation’s “customer service” department to waste hours of a customer’s time with what was in analog days accomplished in a three-minute (answered by the third ring) landline telephone call that always connected. Moreover the person who answered the phone was not a robot and was capable of handling whatever your problem was, and you didn’t have to wait another 20 minutes to reach the person in the department that handled only the one problem.

Try it yourself, call your bank, your Internet service. This is what you will get: do you want office hours, billing, to open an account, to close an account, to change an appointment, technical help or repair? You also have to indicate whether you speak English or Spanish, another indication of how far we are advanced in losing our country. Clearly, if there is any assimilation, it is white Americans assimilating to Immigrant-invaders. I am not just ranting. I am pointing out important and critical facts. The digital revolution has permitted corporations to shift the cost of customer relations to the customer. The customer pays for it in hours of wasted time and the stress of frustration. Even when you finally get a live person, it is someone in Asia you can barely understand and whose responses are automated and often difficult to realign to your problem.

The digital revolution has totally destroyed our privacy and our security. I have a notice in front of me from a financial corporation that reads: “The types of personal information we collect and share . . . can include: name, phone number, home and email addresses, marital status, family member information, Social Security number, driver’s license number, and driving records, healthcare information, credit information, and credit scores.” In other words, they put your entire identification on the Internet where any hacker can steal your identity, open accounts and credit cards in your name, and hack into your bank and investment accounts. I am told that I can “limit some but not all sharing.” Despite the privacy protection of the US Constitution, the digital revolution allows the NSA, the FBI, any foreign intelligence service, the State Department, Homeland Security, and just about anyone else to spy on us without a warrant and to compile a file on each of us containing our contacts, reading interests, purchases, travel, political orientation, affairs, and so forth.

Dumbshit nerds at Stanford University have actually created the ability to create a video of a person speaking in his own voice with lips matching the words speaking whatever offense authorities want to arrest him for. Imagine a defense attorney trying to convince a normal American jury that what they are seeing with their own eyes is a fabrication. Among Americans there doesn’t appear to be any awareness of what is off limits if freedom is to survive. I am convinced that whatever its advocates intend, the consequence of Artificial Intelligence is to displace humans from human functions and to commit us all to rule by tyrants. The few, tiny benefits of AI are not worth the destruction of human independence and freedom. Yet there is no way off this road to pure Hell and the destruction of mankind.

This is just about labeling. Big deal… But let’s see the Supreme Court throw out 58,000 claims…

• Bayer Shares Soar After Roundup Weedkiller Victory In Philadelphia Court (ZH)

Shares of Bayer AG have been pressured over the years after a tidal wave of litigation over its Roundup weedkiller. The company settled much of the Roundup litigation but still faces tens of thousands of lawsuits. Bloomberg reported on Thursday that the 3rd US Circuit Court of Appeals in Philadelphia ruled in favor of Bayer’s Monsanto, shielding the German company from a lawsuit brought by a Pennsylvania groundskeeper. This decision could open the door for a crucial review by the US Supreme Court, potentially paving the way to finally resolve the ongoing litigation nightmare. Chief Judge Michael Chagares, writing for a unanimous three-judge panel, stated that the Federal Insecticide, Fungicide, and Rodenticide Act mandates nationwide uniformity in pesticide warning labels, blocking any attempt from Pennsylvania to add the warning label to the Roundup weedkiller bottle.

Bayer pointed out that the decision conflicts with rulings from federal appeals courts in Atlanta and San Francisco. This ruling sets the stage for the case to be reviewed by the US Supreme Court. A Bayer spokesman told Bloomberg via an emailed statement that the ruling “creates a split among the federal appellate courts and necessitates a review by the US Supreme Court.” Years of litigation have weighed on shares of Bayer trading in Germany, which have been down nearly 80% since peaking at around $120 in 2017. Shares are up 10% to end the week at around the 29 euro handle. “On the single stock level, Bayer’s shares are rallying after the company won an appeal in Roundup litigation, driving the Pharma space higher,” Goldman’s Ananya Prakash wrote in a note this AM.

Bloomberg, citing a note from Holly Froum, an analyst at Bloomberg Intelligence, highlights what might be next for Bayer… The next step could entail a more comprehensive review from the Philadelphia appeals court, which may take months and could push back trials scheduled in Pennsylvania, Holly Froum, an analyst at Bloomberg Intelligence, said in a note. That could reduce Bayer’s ultimate exposure in the overall litigation, potentially keeping settlement costs within the company’s $16 billion outlay, Froum said. So far, Bayer has settled most of Roundup litigation for $10.9 billion but faces almost 58,000 claims. Another 114,000 claims have been settled or deemed ineligible.

When that photo was taken, JFK was still alive..

• James Baldwin at 100 (Patrick Lawrence)

Great writers, and I count Baldwin among these, are not to be put on shelves where they begin to gather dust — pigeon-holed, this is to say, by way of a few stock adjectives that save people the trouble of thinking very hard about them. Writer, civil-rights activist, gay advocate, witness, prophet: Yes, well. There is the elephant’s trunk, the elephant’s tail, and the elephant. It was Baldwin’s wholeness that made him James Baldwin, the man who lives among us by way of the best work. Many readers know Baldwin by his immensely powerful essays. In Notes of a Native Son, The Fire Next Time, No Name in the Street, The Devil Finds Work, The Evidence of Things Not Seen, and so on you find many sides of Baldwin: The pulpit sermonizer he trained early on to be, the man of letters, the journalist, the political philosopher, the media critic. There is enduring greatness in the best of these pieces. His sentences can come at you with the force of a controlled eruption. His diction is always masterful.

Along with this went the civil rights work, speaking and writing, the extended travels in the South, the fruitful friendships: King, Harry Belafonte, Brando, Medgar Evers, lots of others — altogether the unflinching solidarity. But Baldwin always wanted to be understood first as a novelist, David Leeming, a longtime friend, wrote in James Baldwin: A Biography (Knopf, 1994). It is debatable whether posterity will let Baldwin have his way, or whether he should. But I am struck — maybe a piece of evidence here — by how little the novels figure in the various remembrances marking his 100th. Go Tell It on the Mountain, 1953, was Baldwin’s first book and also his first published novel. Already he is in search of something more than what history handed him and the realities with which black life in mid-century America faced him.

Baldwin, right of center, with Hollywood actors Charlton Heston, left, and Marlon Brando, right, at the 1963 March on Washington for Jobs and Freedom. Sidney Poitier, rear, and Harry Belafonte, right of Brando, can also be seen in the crowd.

He looked over the fence of protest literature and the political novel to infuse his writing with complexities of black experience hitherto unexplored in fiction. Baldwin was after, in a word I hope not too reductive, interiority. Go Tell It is the story of John Grimes, a teenager whose family was part of the prewar and immediate postwar Great Migration. He is eager to escape the fates of those around him: the confinements, the learned inferiority, the self-contempt, the domestic turmoil — all the consequences of an inherited black identity. Grimes’ project, as Leeming puts it, is “salvation from the chains and fetters.” Giovanni’s Room, 1956, continues Baldwin’s quest in a way that may not be immediately evident. David, the American protagonist, is in Paris and draws close to an Italian bartender named Giovanni even though he, David, is engaged.

The novel is in essence the story of David’s inner turmoil as he discovers and explores his love for another man, along with his own subliminal homophobia. Giovanni’s Room was well-received, despite Baldwin’s anxieties as he published a novel featuring the theme of homosexuality. And here is one of the most interesting things about this book. There are no black characters in it. David, Giovanni, Hella (David’s fiancée) are white. You can call Giovanni’s Room “a gay novel” if you like, but the phrase implies things about Baldwin that were not so, while missing a big part of his aspiration. Baldwin was openly gay but also a private man. In Giovanni’s Room he wanted to write a novel declaring that he was a writer, as against a black writer.

Job

The job is to know the technique. pic.twitter.com/L4ZPvLFr0g

— Learn Something (@cooltechtipz) August 16, 2024

Queen

This flower is called "Queen of the Night." It blossoms only at night and only one night a year. pic.twitter.com/zxQTZ7OwMK

— Nature is Amazing ☘️ (@AMAZlNGNATURE) August 16, 2024

Duckling

Duckling is able to play dead long enough to escape Leopard pic.twitter.com/Iw1VwZ3XAr

— Nature is Amazing ☘️ (@AMAZlNGNATURE) August 16, 2024

Swimming

https://twitter.com/i/status/1824446436018184463

King

https://twitter.com/i/status/1824280140383150380

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.