Pablo Picasso Bathers with ball 3 1928

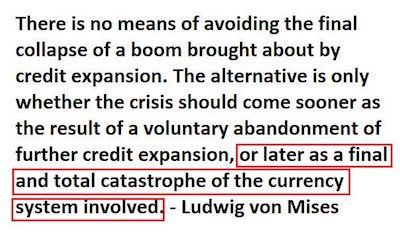

Yeah, no, more Fed crap and comments about markets and I’ve had enough. A market should be recognized as an action, a process, not as a thing or an object. And the action is price discovery. If that is not taking place you don’t have a market. Anything the Fed props up is not a market. One necessary aspect of price discovery is honesty, people must believe they’re not being tricked. With the way people talk about this now, the language they use risks losing all meaning. Enough already, and that goes for Jesse Colombo too. Who also posted this one on Twitter, which is a lot more relevant than his article. But that’s just me.

• Why The Fed Keeps Propping Up The Market (Colombo)

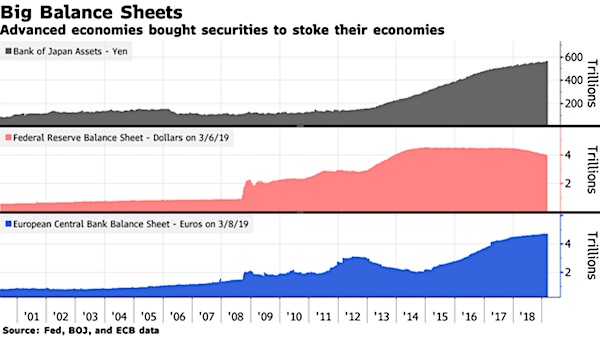

The bull market of the past decade since the Great Recession has been an unusual one: despite all of the economic damage that occurred during the global financial crisis and rising risks (including global debt rising by $75 trillion), it has been the longest bull market in history. The explanation for this paradox is simple: it’s not an organic bull market because the Fed and other central banks keep stepping in to prop up the market every time it stumbles. Though the Fed has two official mandates (maintaining stable consumer prices and maximizing employment), it has taken on the unofficial third mandate of supporting and boosting the stock market since the Great Recession.

The chart below, which was inspired by market strategist Sven Henrich, shows how the Fed or other central banks have stepped in with more monetary stimulus (quantitative easing, promises to keep interest rates low, etc.) every time the S&P 500 has stumbled over the past decade:

An economy that is growing at 2%, inflation near zero, and Central banks globally required to continue dumping trillions of dollars into the financial system just to keep it afloat is not an economy we should be aspiring to. But despite commentary the financial system has been ‘put back together again,’ then why are Central Banks acting?

Get rid of them or they’ll blow up America.

• Fed’s New Balance Sheet Plan: Get Rid of MBS (WS)

The Fed has a new plan for what to do with its balance sheet and today announced several major components of it:

• Begin tapering the “runoff” of Treasury securities in May. • End the runoff of Treasury securities on September 30. • Continue shedding mortgage-backed securities (MBS) at the current maximum of $20 billion a month, essentially until their gone. • After September, reinvest MBS principal payments into Treasury securities. • Chair Jerome Powell said during the press conference that the balance sheet will by then be “a bit above $3.5 trillion.” • The balance sheet will remain at this level even as the economy grows, thus slowly shrinking in relationship to GDP. • The Fed may sell MBS outright to speed up the process of getting rid of them. • No decision has been made on the delicate issue of the maturity composition of the balance sheet – which would require buying short-term bills for the first time in years to replace longer-term notes and bonds.

The stated balance-sheet doctrine now is that the Fed wants to have sufficient reserves (money that banks deposit at the Fed) to conduct monetary policy efficiently. The interest it pays the banks on those reserves is one of its major tools to manage short-term interest rates.

It’s not even the main trump card the EU has.

• EU Will Only Back Short Brexit Delay If May’s Deal Passes First (G.)

Donald Tusk has put a no-deal Brexit back on the table by saying EU leaders will only agree to a short delay if MPs back Theresa May’s deal next week, on a day of high drama in Brussels and London. After belatedly receiving the prime minister’s formal letter requesting a three-month extension of article 50, and taking a late afternoon phone call with her, the European council president admitted that success appeared “frail, even illusory” on the eve of Thursday’s summit. The German foreign minister, Heiko Maas, tweeted: “The letter from Theresa May has not solved any problem yet. If the European council [summit of leaders] is to decide on an extension of the deadline for Britain, we would like to know what is the concrete purpose.”

But Tusk said the EU would seek until the very last moment to avoid the UK crashing out without a deal and show “patience and goodwill” despite the “Brexit fatigue” in the capitals. The EU27’s heads of state or government would be likely to agree in principle at the summit on Thursday to an extension up to 23 May or 30 June, and sign it off without needing to meet next week should May be able to find a majority in the Commons at the third time of asking, he said. The European commission is insisting that an extension beyond the date of the European elections on 23 May would require British MEPs to be elected, although others believe there is little risk as long as the UK has left by 1 July when the parliament formally convenes.

“In the light of the consultations that I have conducted over the past days I believe that a short extension will be possible but to be conditional on a positive vote on the withdrawal agreement in the House of Commons,” Tusk said. “A question remains open as to the duration of such an extension. Prime Minister May’s proposal of the 30 June, which has its merits, creates a series of questions of a legal and political nature. Leaders will discuss this tomorrow.”

The frustration and “tension”, as one senior EU diplomat described it, was made clear by the French foreign minister, Jean-Yves Le Drian, who told the French parliament on Wednesday afternoon that Paris was willing to block an extension. He said there were only two ways to leave the EU: ratify the withdrawal agreement or a no-deal exit. If parliament did not ratify the withdrawal agreement “the central scenario is a no-deal exit”, he said, adding: “We’re ready.” He stated that if May could not present “sufficient guarantees of the credibility of her strategy” that would lead to the extension being refused and a no-deal exit.

But it would be undemocratic?!

• Remain Would Win Second Brexit Referendum Clearly, Poll Indicates (Ind.)

Nearly two-thirds of people would vote to remain in the EU rather than for Theresa May’s deal if a referendum offering those options were called, a snap poll by YouGov has found. Sixty-one per cent of the population would vote to remain while 39 per cent would opt for the existing deal, However, if people were asked in a public vote whether they would prefer to remain in the EU or leave with no deal in place, Remain would still win, though by the smaller margin of 57-43 per cent. It shows a 22-point lead for Remain over Ms May’s deal, or a 14-point lead for Remain over no deal at all.

The poll, carried out on behalf of the Put it to the People campaign, comes as second referendum expectations have risen. [..] A march in support of a Final Say second referendum takes place on in central London on Saturday and is expected to attract hundreds of thousands of protesters. Meanwhile a “Leave means Leave” protest, also known as the “Brexit betrayal march”, is underway with Brexit supporters walking for two weeks from Sunderland to London demanding the UK leaves the EU on 29 March.

Carefully crafted utter panic.

• Theresa May: Don’t Blame Me For Brexit Crisis, Blame MPs (G.)

Theresa May is facing a furious backlash from her own backbenchers and calls for her resignation after she blamed squabbling MPs for delaying Brexit. In a defiant statement on Wednesday night she told the British public: “I am on your side,” and now hopes to force her deal through parliament next week at the third time of asking. Less than an hour earlier, she had been warned in a private meeting with Conservative MPs that her bid to delay leaving could end up losing her even more votes from her own party.

“She is going into an ever narrower cul-de-sac,” said one former minister. Speaking in Downing Street in a televised address, May said the three-month Brexit delay she had earlier in the day formally requested from EU27 leaders was “a matter of great personal regret for me” – and she would not countenance a longer extension of article 50. With just nine days to go before Britain is due to leave the EU, she laid the blame for the crisis squarely at the door of parliament.

“Of this I am absolutely sure: you the public have had enough.”

What she missed is that it’s her they’re tired of.

• MPs Furious After May Blames Them For Crisis (Ind.)

MPs have called Theresa May “irresponsible”, “disgraceful” and “toxic” after she blamed them for for the UK’s impending failure to leave the EU on 29 March. Labour’s Wes Streeting accused the prime minister of putting MPs’ lives in danger with an “incendiary” address. Ms May used a Downing Street speech to criticise the very people she needs to get her Brexit deal through the Commons at the third time of asking, telling voters that she was “sure” that “you, the public, have had enough” of political games. She said: “You’re tired of the infighting, you’re tired of the political games and the arcane procedural rows, tired of MPs talking about nothing else but Brexit when you have real concerns about our children’s schools, our National Health Service, knife crime. “You want this stage of the Brexit process to be over and done with. I agree. I am on your side.”

It can be done. Just not in the US, too many guns there already.

• New Zealand Bans All Assault Weapons Immediately (AP)

Prime Minister Jacinda Ardern says New Zealand is immediately banning sales of military style semi-automatic rifles and high-capacity magazines like the weapons used in last Friday’s attacks on two Christchurch mosques. Ardern announced the ban Thursday and said it would be followed by legislation to be introduced next month. She said the man arrested in the attacks had purchased his weapons legally and enhanced their capacity by using 30-round magazines “done easily through a simple online purchase.” [..] The New Zealand government is asking all owners of assault weapons or now-banned attachments to report them to the government in the next two days before turning them in.

I think manipulation by central banks is a much bigger problem than stagnation.

• Stagnant Capitalism (Varoufakis)

When the Great Depression followed the 1929 stock-market crash, almost everyone acknowledged that capitalism was unstable, unreliable, and prone to stagnation. In the decades that followed, however, that perception changed. Capitalism’s postwar revival, and especially the post-Cold War rush to financialized globalization, resurrected faith in markets’ self-regulating abilities. Today, a long decade after the 2008 global financial crisis, this touching faith once again lies in tatters as capitalism’s natural tendency toward stagnation reasserts itself. The rise of the racist right, the fragmentation of the political center, and mounting geopolitical tensions are mere symptoms of capitalism’s miasma.

A balanced capitalist economy requires a magic number, in the form of the prevailing real (inflation-adjusted) interest rate. It is magic because it must kill two very different birds, flying in two very different skies, with a single stone. First, it must balance employers’ demand for waged labor with the available labor supply. Second, it must equalize savings and investment. If the prevailing real interest rate fails to balance the labor market, we end up with unemployment, precariousness, wasted human potential, and poverty. If it fails to bring investment up to the level of savings, deflation sets in and feeds back into even lower investment.

It takes a heroic disposition to assume that this magic number exists or that, even if it does, our collective endeavors will result in an actual real interest rate close to it. How do free marketeers convince themselves that there exists a single real interest rate (say, 2%) that would inspire investors to funnel all existing savings into productive investments and spur employers to hire everyone who wishes to work at the prevailing wage?

I’ve kept my distance from the discussion, but this is nice.

• Exposing the Myth of MMT (Rickards)

When critics hear that a Green New Deal could potentially cost something like $97 trillion, or proposals for Medicare for all, free tuition, free child care or guaranteed basic income, they say, “That all sounds nice, but we just can’t afford it.” That’s their main argument — that no matter how desirable these programs might be in theory, we just can’t afford them. Most criticism of MMT falls along those lines. Even the Keynesians like those I mentioned earlier, who generally favor large amounts of government spending to stimulate the economy, have come out against MMT. Besides that claim that we can’t afford it, even the Keynesians say MMT would be highly inflationary. If you printed that much money and start handing it out to people, demand would outstrip the output capacity of the economy and you’d get high inflation.

But the MMT advocates have an answer to these objections. They’re not the least bit intimidated by critics who say we can’t afford it. They say, “Yes, we can, and Modern Monetary Theory proves it. Just print the money and monetize the debt. Japanese debt is 2.5 times the United States’ debt, and China’s is higher than ours.” They haven’t collapsed, so we can take on far more debt than we have today. Furthermore, QE did not create much inflation. In fact, the Fed would like to see more inflation than it has. It still can’t produce a sustained 2% inflation rate after all these years. You might think the argument is ridiculous. After all, do we really want to become Japan? But in important ways, the MMT crowd has the upper hand in the debate.

After 27 years, Australia is finally hitting a recession.

• Australia Construction Slowdown A Major Threat To The Economy (ABC.au)

The property market upheaval brings billionaire investor Warren Buffett’s oft-quoted piece of wisdom to mind: “Only when the tide goes out do you discover who’s been swimming naked.” We are witnessing more naked developers as half-finished projects dot the landscape of our major cities. As the year progresses, many more operators who’ve pushed the boundaries will join them. “Areas of oversupply will see a bit more chaos in the next six to twelve months,” Scott Gray-Spencer, local head of capital markets at the global real estate firm CBRE, told ABC’s The Business. Mr Gray-Spencer sees areas more than 10 kilometres from the city centres of Sydney and Melbourne, and parts of Queensland, as the most vulnerable.

Property investors, who were major targets of the crackdown, accounted for almost 50 per cent of mortgages two to three years ago. They have largely left the market and political uncertainty may keep them on the sidelines for longer as they await the outcome of the looming federal election. Should Labor win, it’s likely investors will wait to see how its plans to curb the negative gearing and capital gains tax concessions pan out. Even though Labor’s proposed negative gearing changes will not affect new housing, investors may still be worried about price growth because the next buyer is unable to negatively gear. So it could be some time before developers see an important group of buyers return in force. If the banks don’t stop them, the less generous tax laws might.

A half-finished apartment block in Cronulla sits idle while it waits for a buyer. (ABC News: John Gunn)

At first sight it looked like a parody.

• As Russia Collusion Fades, Ukrainian Plot To Help Clinton Emerges (Solomon)

After nearly three years and millions of tax dollars, the Trump-Russia collusion probe is about to be resolved. Emerging in its place is newly unearthed evidence suggesting another foreign effort to influence the 2016 election — this time, in favor of the Democrats. Ukraine’s top prosecutor divulged in an interview aired Wednesday on Hill.TV that he has opened an investigation into whether his country’s law enforcement apparatus intentionally leaked financial records during the 2016 U.S. presidential campaign about then-Trump campaign chairman Paul Manafort in an effort to sway the election in favor of Hillary Clinton.

The leak of the so-called “black ledger” files to U.S. media prompted Manafort’s resignation from the Trump campaign and gave rise to one of the key allegations in the Russia collusion probe that has dogged Trump for the last two and a half years. Ukraine Prosecutor General Yurii Lutsenko’s probe was prompted by a Ukrainian parliamentarian’s release of a tape recording purporting to quote a top law enforcement official as saying his agency leaked the Manafort financial records to help Clinton’s campaign. The parliamentarian also secured a court ruling that the leak amounted to “an illegal intrusion into the American election campaign,” Lutsenko told me.

Lutsenko said the tape recording is a serious enough allegation to warrant opening a probe, and one of his concerns is that the Ukrainian law enforcement agency involved had frequent contact with the Obama administration’s U.S. embassy in Kiev at the time. “Today we will launch a criminal investigation about this and we will give legal assessment of this information,” Lutsenko told me.

A memorial service was held on Sunday in Washington for William Blum, a former State Department official whose disillusionment with the Vietnam War turned him into a fierce critic of U.S. foreign policy. Blum educated a generation of Americans about the rapacious aims of the U.S. abroad, debunking the myth of Washington’s good intentions for the peoples of the world. Blum died on December 9, 2018.

• Sucking Liberals into a New Cold War (William Blum)

Cold War Number One: 70 years of daily national stupidity. Cold War Number Two: Still in its youth, but just as stupid. “He said he absolutely did not meddle in our election. He did not do what they are saying he did.” – President Trump re Russian President Vladimir Putin after their meeting in Vietnam. [Washington Post, Nov.e 12, 2017] Putin later added that he knew “absolutely nothing” about Russian contacts with Trump campaign officials. “They can do what they want, looking for some sensation. But there are no sensations.” Numerous U.S. intelligence agencies have said otherwise. Former Director of National Intelligence, James Clapper, responded to Trump’s remarks by declaring: “The president was given clear and indisputable evidence that Russia interfered in the election.”

As we’ll see below, there isn’t too much of the “clear and indisputable” stuff. And this of course is the same James Clapper who made an admittedly false statement to Congress in March 2013, when he responded, “No, sir” and “not wittingly” to a question about whether the National Security Agency was collecting “any type of data at all” on millions of Americans. Lies don’t usually come in any size larger than that. Virtually every member of Congress who has publicly stated a position on the issue has criticized Russia for interfering in the 2016 American presidential election. And it would be very difficult to find a member of the mainstream media who has questioned this thesis. What is the poor consumer of news to make of these gross contradictions?

Time to rephrase ‘social media’. Man evolved living in groups, it’s simple.

• Loneliness Estimated To Shorten A Person’s Life By 15 Years (SciAm)

Thanks to remarkable new technologies and the widespread use of social media, we are more “connected” than ever before. Yet as a nation, we are also more lonely. In fact, a recent study found that a staggering 47 percent of Americans often feel alone, left out and lacking meaningful connection with others. This is true for all ages, from teenagers to older adults. The number of people who perceive themselves to be alone, isolated or distant from others has reached epidemic levels both in the United States and in other parts of the world. Indeed, almost two decades ago, the book Bowling Alone pointed to the increasing isolation of Americans and our consequent loss of “social capital.” In Japan, for example, an estimated half million (known as hikikomori) shut themselves away for months on end.

In the United Kingdom, four in 10 citizens report feelings of chronic, profound loneliness, prompting the creation of a new cabinet-level position (the Minister for Loneliness) to combat the problem. While this “epidemic” of loneliness is increasingly recognized as a social issue, what’s less well recognized is the role loneliness plays as a critical determinant of health. Loneliness can be deadly: this according to former Surgeon General Vivek Murthy, among others, who has stressed the significant health threat. Loneliness has been estimated to shorten a person’s life by 15 years, equivalent in impact to being obese or smoking 15 cigarettes per day. A recent study revealed a surprising association between loneliness and cancer mortality risk, pointing to the role loneliness plays in cancer’s course, including responsiveness to treatments.

Wasn’t kale supposed to not need any?

• Kale Is Now One Of The Most Pesticide-Contaminated Vegetables (CNBC)

Often touted for being highly nutritious, kale has joined the list of 11 other fruits and vegetables known to be “dirty,” according to an analysis by the Environmental Working Group. The watchdog group publishes its “Dirty Dozen” list annually, in which it ranks the 12 produce items that contain the highest amount of pesticide residues. The group analyzes data from the Department of Agriculture’s regular produce testing to determine the list. Ranked alongside kale on the list are strawberries, spinach, nectarines, apples, grapes, peaches, cherries, pears, tomatoes, celery and potatoes.

The last time kale was included in the USDA’s produce tests was 2009 and it ranked eighth on the Dirty Dozen list. “We were surprised kale had so many pesticides on it, but the test results were unequivocal,” said EWG Toxicologist Alexis Temkin in a release. More than 92 percent of kale had residue from at least two pesticides after washing and peeling the appropriate vegetables, according to the report. Some had up to 18. Almost 60 percent of the kale samples showed residual Dacthal, a pesticide that is known as a possible human carcinogen. The group releases its “Clean Fifteen” list as well, highlighting the 15 produce items with the least amount of pesticide residue detected. It includes avocados, sweet corn, pineapples, frozen sweet peas, onions, papayas, eggplants, asparagus, kiwis, cabbages, cauliflower, cantaloupes, broccoli, mushrooms and honeydew melons.

Home › Forums › Debt Rattle March 21 2019