Raúl Ilargi Meijer

Forum Replies Created

-

AuthorPosts

-

Raúl Ilargi Meijer

KeymasterDiogenes,

Two years ago, when Nicole and I were lecture-touring Australia, the tour organizers set up a meeting for us in Melbourne with Michael Reynolds from New Mexico, the father of the earthship and a very interesting man, who was also doing lectures. Michael noted that often when he and his team are asked to build an earthship for someone, they want basement space of some kind. And when he asks them what for, the answer always has to do with guns. He thinks that’s the silliest idea: what are you going to do, shoot your neighbors? His solution is to build lots of earthships and establish a community that way, so your neighbors are your protection. I tend to agree, I’m not so sure guns are a great way to protect yourself.

As for bitcoins, they seem to me to be nice as an experiment, but I don’t see how in a world where everything is manipulated from people’s unconscious to stocks to gold markets, bitcoins would be the exception to the rule. You already have companies that claim million worth of them go missing without a trace. I’d want to see the safety aspect tested much more vigorously, and until then I won’t put my trust in bitcoins.

Raúl Ilargi Meijer

KeymasterI still don’t see why you say you are ‘horribly’ wrong. You got rid of the risk of ow(n)ing a long term mortgage on a home, and that risk is high. That has little to do with a few years left or right. Nothing that brings words like ‘horrible’ or horror’ to mind. And I’m not sure if this is you speaking or people around you, who you are obviously letting you put under a lot of pressure. You seem to seek for Nicole to take the blame for your ‘horror’ onto herself and away from you, in order to relieve that pressure, without recognizing that Nicole doesn’t see it as a horror. Taking choice bits from what we have said through the years without acknowledging the big picture is of course never either a good nor a fair approach. And perhaps Nicole could have been more careful, or more vague, in her choice of words, but in the big picture that makes no difference: you still got rid of a big risk. Unless perhaps people think the US is actually recovering and they’ll have the time to pay off another 15 years on their loans.

May 23, 2014 at 10:58 am in reply to: Debt Rattle May 21 2014: Drowning in the American Dream #13090Raúl Ilargi Meijer

KeymasterCory,

“Horribly wrong”? Isn’t that perhaps a bit much? Where is the horror?

Nicole directed several comments directly at you in the Atamai thread, still you say her answer was silence. I don’t quite follow that.

As for your continuing questions, I think I tried to respond to them at some length.

Raúl Ilargi Meijer

KeymasterCory,

Who is to say it cannot last that long?

And at the same time who is to say it can? It would seem to be a good idea to get the guessing part out of this as much as possible. Risk assessment.

All US asset markets are seriously bubbling right now due to QE, a situation that cannot last because public debt would get too high. It already is. That means either we will achieve escape velocity and a real recovery in the real economy, or asset prices must fall. Since all that seems to go up does so to a large extent on the back of QE, I have no idea where a real recovery could possibly come from. There’s simply nothing there.

The articles on the Zillow report that I referenced in my article above show that 20 million American mortgage holders can’t sell their homes, because they have too little or even negative equity. At 3 persons per household, that means 60 million, or 20% of the population, are stuck. They cannot move. Had they rented, they wouldn’t have had that problem. When asset prices begin to fall again, which I think is inevitable given that QE is the sole factor out there that has pushed them upward, the number of people stuck will rise, and not by a little bit.

Mortgages are already a noose around the necks of 60 million Americans, according to Zillow, and with new home sales and mortgage originations falling as much as they are, which means markets are shrinking because there are far fewer buyers, how can prices not fall and hang more nooses around more necks? There is no functioning real economy out there, in the sense that it exhibits a “healthy” growth rate, and without such a rate things can only get worse, there’s no such thing as a stable economy without growth in our system.

It all makes having a large mortgage debt, or any other kind of debt, a big risk. If you rent, you pay someone to take that risk for you. You don’t get the profit of rising home prices either, but how can prices rise when sales are plummeting (new homes -14.5%) and the economy is artificially kept alive through borrowing from our children?

Khiori

Buying a house if you can pay it off without getting into debt is fine, but a 30-year mortgage is a huge gamble. It’s not unlike getting into a casino betting you can beat the house. If people think this is really a recovering economy, it might make sense to them, but since Q1 GDP growth was negative, and that is with an ongoing QE, I wonder where they would see that recovery. China is struggling, Japan is worse, Europe is an increasingly divided experiment gone awry.

And the US has bad numbers everywhere but in stock markets and assets available only to the rich – who are getting richer -. This means your “if you have the income” is also an added risk factor. What is you lose – part of – it? If for instance a substantial drop in the S&P drains a few trillion out of the market, or China sells a good chunk of its US Treasuries, events that are not at all unlikely, volatility and risk will surge. Running an economy on borrowed virtual money is inherently unstable. But it’s all we got right now, and I can’t see myself recommending people dive into debt in that situation. There’s too much out there that is entirely fake, not grounded in people working with their hands so to speak, and too much that can go ‘poof’ in an instant. But if you think central banks will keep this up for years to come, or even if you think they’re able to, I guess your risk assessment might be different.

Raúl Ilargi Meijer

KeymasterBut Cory, what is really important in all this, in what you quote, in where we are, in where we think this will lead us? Do you yourself see a way available to our ‘leaders’ to lead ‘us’ out of the gutter? Assuming even that they would want to? And if you don’t, then what are the options? In what fashion can we, given that we don’t have a crystal ball, do anything else than to tell our readers to get out because the risk is so high? Do you feel that risk has gotten smaller, on anything but a temporary basis? I sure don’t.

Raúl Ilargi Meijer

KeymasterWell, both Nicole and I popped that dream lots of times here, and we”re to going to be found wrong: shale is a land speculation scheme. How can you be an energy source with depletion rates of 80%+ for the average well? It’s ridiculous. But of course you do get all these lofty predictions from the EIA, that’s their job, to make things look sunny and great and all.

Raúl Ilargi Meijer

Keymasterthat is brilliant, koso.

Raúl Ilargi Meijer

KeymasterCory,

Everything we said, including the timing, would have already come to fruition if not for the absolute insanity unleashed by the Fed and its peers, and the propaganda that accompanied it. We have said multiple times in the intervening years that we did not see that coming. But what could we be accused of in that regard, that we didn’t accurately predict insane behavior? I think unpredictability tends to be an inherent trait in that sort of behavior.

What counts now is being aware of what has lifted asset markets, including housing, over the past 5 years, and realizing that it will bring these markets down even further than they would have before every American man woman and child bought $25,000 or so worth of profit for the financial system courtesy of Ben Bernanke.

For us the prime take away from this is, as it was 5 years ago, that people need to cut their exposure to risk. And for us it’s not such a big deal that a few dollars here or there might have been theoretically lost at any given fixed point in time. We try to identify trends and the risks inherent in them, and both the trends and the risks have gotten a lot worse since 2009, even if the financial system and media have successfully fooled people into thinking otherwise.

That’s what I would tell your spouse. Not that I’m convinced he would listen. The insanity that worldwide totals $30-40 trillion is a giant bet that people will believe way too much debt can actually be fought with even more debt, and spend and borrow accordingly. As I wrote last week, if you present people with just the principle, they tend to understand. If you tell them this is what’s happening in their own lives today, not so much.

There are undoubtedly plenty people who feel certain we’re on our way back to normal ‘as it ever was’. They are the ones walking into the trap set with their own money.

Raúl Ilargi Meijer

Keymaster“…we prefer this propaganda illusion to the harsh reality.

Why? Because half of us are getting a direct check, benefit or payment from the state.

Eh, no. And honestly, not close.

Optimism bias is a deeply embedded part of the human mind, which has nothing to do with a government or what it hands out. It goes back way before there were governments.

The clinch is in defining reality as ‘harsh’. If we could convince people that the new reality is not as bad as they think, they would be much more likely to jump in. But people want what they have, not what they could have, and the longer they cling on to the illusion that what they have now can be maintained, the harder the new reality will be, both in perception and in reality.

Our brains are “organized” in such a way that they become self-defeating if not self-destroying. And maybe that’s an evolutionary thing. Maybe that’s the one trait that will keep our numbers in check. Still, though that has a whiff of optimism in it, it would be a huge threat too to those alive now, so it won’t wash. The best thing for the planet would be for you to leave, it’s not a popular theme.

May 15, 2014 at 9:07 am in reply to: Debt Rattle May 14 2014: China Will Drag Us Down With It #12905Raúl Ilargi Meijer

KeymasterDiogenes,

It’s not possible to have an actual conversation with someone who says even 10,000 ppm CO2 levels wouldn’t matter because the stuff is ‘clear and colorless’, or that the tides alone make sea levels shift more than CO2 ever could. What kind of argument is that anyway? Isn’t that like saying warming doesn’t matter because it’s hot in the Sahara? Climate scientists would need to use tarot cards to predict where sea levels might be in 86 years, but you can do without them and claim that if they rise, it will be because of the sun? Sorry buddy, but let’s get serious, shall we? And I’m still waiting for you to tell me who has been paying all those thousands of scientists to keep lying about their findings for all these years. And why.

Raúl Ilargi Meijer

KeymasterVariable

Phasing out of lecturing; is it that the results you’re getting from your lectures are starting to fall below expectations, or perhaps it has just “run its course” and now you are looking for something new?

Lectures are simply much less in demand. People have been sucked – back – into the great dream. This is very poignant in Europe, but evident all over.

Moving from Canada; I suppose you’re cashing out of the housing bubble while it is at its peak here, but curious what your longer-term view for Canada is at this point? Also, I believe you have family… does this transition across the Pacific impact them greatly?

No cashing out; The Automatic Earth really, I wasn’t lying, possesses nothing. Which is part, as I said, by design, we can’t very well do what we tell others they should not, but at this point it’s become a hindrance to doing something as basic as our work. The idea was to have just enough to do that work. Also, no family coming along, except for perhaps Nicole’s youngest daughter, who’s 18.

I’ll let Nicole provide other answers.

Raúl Ilargi Meijer

KeymasterI don’t know why or how people read into my “the work for Atamai also means that you see less of her here at The Automatic Earth” that she will be even less present here. That would be hard to do, if you ask me. What I meant is that she has been less present in the past while, but she’ll certainly be back and write more once the transition phase to NZ is done. Nicole is working on the final part of her food security piece, and preparing a video file on that topic at the same time. So no need to worry about Nicole at TAE.

May 10, 2014 at 7:18 pm in reply to: Debt Rattle May 10 2014: Just How Distorted are Those GDP Numbers? #12769Raúl Ilargi Meijer

KeymasterThe real people economy has been turning down for many years, a development creatively hidden behind a veil of massaged numbers. I haven’t read Pepe on Ukraine and been impressed by it. Same with Whitney and Paul Craig Roberts. Mostly scraping up some truth and blowing it out of proportion.

May 10, 2014 at 7:07 pm in reply to: Debt Rattle May 9 2014: We’re Not Doing Very Well, Are We? #12768Raúl Ilargi Meijer

KeymasterI’m as much Canadian as Dutch, that’s why, and the Dutch being all that great at languages is a gross exaggeration based on the fact that the rest are so poor. Great story about your nana, it’s all we need to know about what we lost, why that is important, and how the emptiness implicit in that makes us so destructive.

May 9, 2014 at 11:15 am in reply to: First Time In 800,000 Years: April CO2 Levels Above 400 ppm #12740Raúl Ilargi Meijer

KeymasterWell, that’s not an answer, is it? Not very convincing. I get the feeling the conspiracy is not where you think it is. Do all these scientists get paid to issue reports they know are not true, or do they get fed false information while training? Or maybe I should ask: who pays the deniers? Or: if there are no changes in the climate, why is Arctic ice vanishing (or is that all trick photography)?

May 8, 2014 at 6:17 am in reply to: First Time In 800,000 Years: April CO2 Levels Above 400 ppm #12727Raúl Ilargi Meijer

KeymasterDeadcat, the article deals not with the first time CO2 has reached 400 ppm, but with the first time it has remained over 400 ppm for an entire month.

Diogenes, that’s a lot of scam detection. Do they pay all the scientists, are they all part of the scam, or do they start teaching them false science in high school?

Raúl Ilargi Meijer

KeymasterDiogenes,

Treasuries will be less, not more, risky for the near future. Other than that, it’s increasingly what you expect a physical as opposed to a financial return from, i.e. a farm, arable land. I’m still not a gold or silver guy, other than at the other side of the crash, years from now. Gold is for those who can sit on it for 10-20 years, not for those who have to sell it in that timeframe just to survive. And that is 99% of people.

Raúl Ilargi Meijer

Keymaster“Do you (and I include Nicole here) honestly still think that preparing for a deflation with the same strategy you outlined since 2008 is still valid? Please be honest, because it is “only” a matter of survival.”

I don’t at all like suggestions that I wouldn’t be honest. Who do you think you are? And apart from that, p, I posted that graph twice. Which part of it you don’t you understand?

April 20, 2014 at 5:41 pm in reply to: The United States’ Desperate Solutions For Not Sinking Alone #12426Raúl Ilargi Meijer

KeymasterLEAP2020 is not anti-American, it’s a European view. Tons of university degrees and all that, but as I said it works for and against them at the same time. The world will never have one government, so you can shove that notion aside and engage in more fruitful thinking. Or maybe I should say that as soon as there is a one world government, all hell’s going to break loose all over the globe; that we already effectively have such a government is a whole other issue. And it is the worst possible way, not the only, to address “the big problems”.

April 20, 2014 at 4:51 pm in reply to: The United States’ Desperate Solutions For Not Sinking Alone #12421Raúl Ilargi Meijer

KeymasterFair enough, chettt, but maybe the question is: what other “analysis” could be taken more seriously than this one? I can’t think of any, other than my own. And that”s not me tooting my own horn, I simply see all sorts of people jumping to all sorts of conclusions, likely because they’re all out of their league, while I only ask questions.

April 18, 2014 at 5:43 pm in reply to: Debt Rattle Apr 16 2014: Overpopulation Is Not A Problem For Us #12397Raúl Ilargi Meijer

KeymasterTabernac,

You made me wonder whether anyone has ever checked if all individual bacteria and yeast maintain their fertility rates throughout the tragic cycle of the consumption of surplus energy. I don’t know of any such research, but neither do I see any reason to assume falling fertility rates are not a ‘natural’ part of any such cycle in any organism, be it yeast, mice, or people.

The underlying question would be if any such falling rate in any of these cases could arrest the drive towards more consumption, for the group, not the individual, until the inevitable.

April 17, 2014 at 6:25 pm in reply to: Debt Rattle Apr 16 2014: Overpopulation Is Not A Problem For Us #12367Raúl Ilargi Meijer

KeymasterTAE Summary,

Good to see you back. Been far too long. As always.

You sure that God will get the credit, though? Why not the blame?

And doesn’t life beget energy, instead of vice versa? Or is that the chicken and the egg all over again for Easter?

April 16, 2014 at 6:02 pm in reply to: Debt Rattle Apr 16 2014: Overpopulation Is Not A Problem For Us #12346Raúl Ilargi Meijer

KeymasterCheck why, Terry?

April 16, 2014 at 6:01 pm in reply to: Debt Rattle Apr 16 2014: Overpopulation Is Not A Problem For Us #12345Raúl Ilargi Meijer

KeymasterHemingway! It’s been ages. How’s ma ville? Very true, what you picked out. We’ve gotten stuck in and fooled by planning 50-odd years ahead through pension plans and the like, but that’s such an aberration from anything and everything all our 1000s of generations of ancestors thought of, there was never any way that would work. It’s like some kind of delusionary time travel that don’t mean no-one no good. Living for today, and the fulfillment that day can bring, and making it so, is what we do best. So why did we stop?

April 16, 2014 at 3:23 pm in reply to: Debt Rattle Apr 15 2014: This Is Where We Say Good Night And Good Luck? #12339Raúl Ilargi Meijer

KeymasterGeolib

What you say about the narrative of collapse risks being true for your Single Tax religion: simply circling, re-quoting itself, harming itself. Why don’t you write a post on the topic for me, but not religious, I warn you, just explaining the cool calm collected and objective advantages that you think it would have for any given society. If you could add how or why you think present political systems would accept it, i.e. why it is not solely theoretical, that would be a bonus. And don’t make it too long, or force me to do too much editing.

April 16, 2014 at 12:26 pm in reply to: Debt Rattle Apr 15 2014: This Is Where We Say Good Night And Good Luck? #12325Raúl Ilargi Meijer

KeymasterKen

We can get to 500 million if the net loss of people is 100,000 per day for the next 178 years or so.

It might be good to add that at present there are some 350,000 births and 150,000 deaths in the world each day.

All we need to do is turn those two numbers around and we’ll be good in 89 years. That does mean, however, that we’re going to need lots of volunteers. So stop being so selfish, people, and sign up in large numbers to save the planet.

April 16, 2014 at 12:13 pm in reply to: Debt Rattle Apr 15 2014: This Is Where We Say Good Night And Good Luck? #12324Raúl Ilargi Meijer

KeymasterOh, that’s certainly true, p01; I just meant you don’t have to do those calculations in order to prevent the collapse because it will come anyway.

April 16, 2014 at 9:29 am in reply to: Debt Rattle Apr 15 2014: This Is Where We Say Good Night And Good Luck? #12321Raúl Ilargi Meijer

KeymasterRaleigh,

Mankind may have invented mythological/religious stories of a deity that made us in his own image, stories that serve to make us feel elevated above all other life, and the crowning achievement of creation/evolution, but the reality is that we are no different from the yeast in the wine vat or bacteria in a petri dish, or any and all other organisms for that matter: when confronted with an energy surplus in a given environment, all species will multiply and proliferate until either they run out of space or the energy surplus runs out, and then there is a die-off.

To be exact: the die-off comes before a species can run out of space or energy, because the use of energy produces waste, and no organism can survive in a medium of its own waste (the corollary to the 2nd law of thermodynamics as defined by Herman Daly and Kenneth Townsend in their 1993 book “Valuing the Earth”). Thus, there will always be more space and more energy left even after the population has collapsed. And that collapse is inevitable. No need to worry about how many people need to disappear for any given amount of time.

I‘ve often called us the most tragic species, because we have an awareness, we can see ourselves do it, but that doesn’t mean we can stop ourselves from doing it. Perhaps we need to contemplate the limits of our awareness, perhaps if we were fully aware of what we do, we wouldn’t to the damage we do. Or perhaps our awareness simply is no match for the drive to consume all energy available to us, a drive we inherited from more primitive lifeforms. However it may be, what we call our awareness, and our power of reasoning, seem to be applied in the race to consume energy as fast as we can, not to slow down the rate of consumption, even if our survival might hinge on it. What’s ironic is that the drive to consume is very close, if not identical, to the drive to survive that all life possesses.

Note that this describes us as a species, not as individuals. And while individual humans can make “decisions” that may seem very commendable, what happens is that when an individual organism “decides” to lower his/her/its consumption rate, other individuals in the group jump in and take over, so overall consumption for the group keeps rising. This difference between group behavior and -possible- individual behavior is often misinterpreted, I think, to mean that we can make the group do what the individual can do.

April 16, 2014 at 6:08 am in reply to: Debt Rattle Apr 15 2014: This Is Where We Say Good Night And Good Luck? #12318Raúl Ilargi Meijer

KeymasterKen,

You’re undoubtedly right that stock markets are a major factor. It’s probably also that our forced move away from Blogger that plays a part, plus the fact that especially Nicole’s ‘extra curricular’ activities, even though they’re TAE activities, have taken time away from posting on the actual site.

I think it should be pretty obvious that we are now in a far worse position than we were when the markets were deep red, precisely because of what was used to lift those markets. It may yet take a while for that to play out, though I’m sure the plug will be pulled when mom and pop least expect it. In that light, it’s a good idea for everyone to wonder for a second who mom and pop are in 2014.

April 16, 2014 at 5:59 am in reply to: Debt Rattle Apr 15 2014: This Is Where We Say Good Night And Good Luck? #12317Raúl Ilargi Meijer

KeymasterJust lowering the birth rate doesn’t work, or at least not well. A healthy population is dependent on a healthy age balance. I don’t know how to solve the overpopulation issue, but I do know this is not the way to go. Then again, I also can’t see older people -boomers, the most numerous generation- go voluntarily in large numbers, though I’ve been suggesting it to them here at TAE.

I’ve written earlier that we may have to concede that we can’t solve this one, we’ll have to leave it to nature to do it for us.

Detail: China has 1.3 billion people, not 1.6. Still a difference of about the entire US population.

April 15, 2014 at 6:28 pm in reply to: Debt Rattle Apr 15 2014: This Is Where We Say Good Night And Good Luck? #12310Raúl Ilargi Meijer

KeymasterNot a clue, Indus. When we were still at Blogger, we had a vibrant comments section. Perhaps people find the WordPress one harder to find? Or maybe Nicole and I should post more comments? But still, a good thing that you like TAE so much. We’ll figure out all the rest in time.

Raúl Ilargi Meijer

KeymasterD,

I may be useful to note than Nicole and I don’t define inflation as rising prices, but as the money and credit supply multiplied by the velocity of money. Rising (or falling) prices are merely an effect of this. There are tons of articles in our archives that explain this.

This means that you can’t have inflation in one part of an economy and deflation in another, It also means that central bank control over the process is limited, since no-one can force people to spend.

Raúl Ilargi Meijer

KeymasterIndus, I’m not sure why you would think Nicole wrote this piece or other recent ones, but she didn’t. My name is at the top of them all.

As for the competence issue, our leaders are quite competent in serving their own issues, just not ours. But then, they – were – never meant to do the latter, so maybe I shouldn’t have used the word incompetent to begin with. And if I do, then in the sense of our political system not having the competence to select leaders that do act in our interest.

March 24, 2014 at 12:48 pm in reply to: Debt Rattle Mar 20 2014: An Unprecedented Opportunity #11932Raúl Ilargi Meijer

Keymaster20% renewables would mean 80% non-renewables, i.e. status quo.

If you mean 20% of current energy is enough to live on, that’s partly right. If you want to get 100% of that from renewables, you will no longer have a central grid. Are we ready for that? You don’t solve that issue with a local grid here and there. You would have to reset the entire structures of our societies.

Taking down energy use to 20% of present levels also means general economic collapse; our economies need mass energy throughput to be viable concerns. Do we want economic collapse, and are we ready for it? I don’t think so. It would mean a lot of misery and fighting etc. Be careful what you wish for.

I don’t balk at renewable energy, but at the rosy stories being bandied around about it. Our societies are very much complex systems, and most well-intended measures will have unintended consequences. Which is why we need to ask questions, not just follow the circus.

I think we need to leave behind the idea that we can change entire countries, let alone the world. It’ll be hard enough to get things right at the local level.

Raúl Ilargi Meijer

KeymasterThorium has been a promise just around the corner for many decades. Yet there’s still not a single active (scaled up) thorium facility in the world. Which is not for lack of trying, or investment. India did a lot of work, China does some now. It’s still just a promise just around the corner, but don’t forget there’s a lot of money in promising.

March 20, 2014 at 2:38 pm in reply to: The Bank of England Lights A Fuse Under the Field of Economics #11866Raúl Ilargi Meijer

KeymasterOnly vote for a party that vows to eliminate private banks under the current economic model of central banks. Am I missing something?

Yeah, there are no such parties anywhere. Beppe Grillo probably comes closest.

Also, banks don’t only not contribute much, they suck away a very substantial part of the value of real production in an economy.

March 18, 2014 at 7:18 pm in reply to: Debt Rattle Mar 18 2014: The Deep Dark Forest And The Crippled Trees #11841Raúl Ilargi Meijer

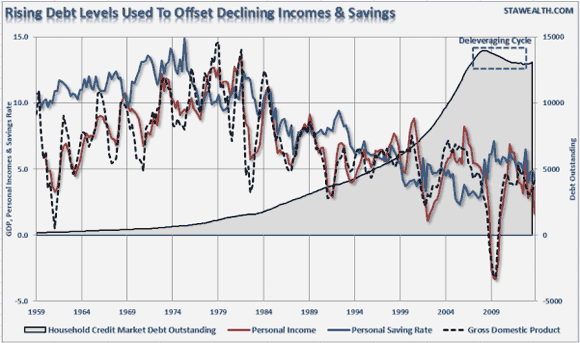

KeymasterYeah, exactly, Ken, this graph from a while back depicts that quite well:

Raúl Ilargi Meijer

KeymasterOr is it: One petagram means 10 to the fifteenth power, i.e. 6 petagrams is equal to 6 billion tons.

Raúl Ilargi Meijer

KeymasterThat’s hilarious, carb.

Edited it: [ Ed: The current global carbon export flux caused by sinking particles in oceans stands at 6 petagrams per year. A petagram is a quadrillion grams, or about 1.1 billion US tons. Annual global carbon emissions from fossil fuels stands at about 9 petagrams. ]

March 13, 2014 at 4:49 pm in reply to: Debt Rattle Mar13 2014: The Demise Of The Ponzi Democracy #11773Raúl Ilargi Meijer

KeymasterJal

Not a dime of stimulus has gone towards the people so far. But you think central banks and cabinets would do a 180?! I think maybe if they’d had any such intentions, they would have acted that way long before.

-

AuthorPosts