Raúl Ilargi Meijer

Forum Replies Created

-

AuthorPosts

-

February 19, 2014 at 1:30 pm in reply to: Debt Rattle Feb 18 2014: The Best And Brightest Among Us Are Not #11413

Raúl Ilargi Meijer

KeymasterHey caper, welcome. Thanks for your order. What I find hard at times is the continuing nonsense and illusions that reign the day. I think it would be much more helpful for us all to face up to our losses. Nicole won’t be in the maritimes in the near future, but perhaps later. And no, that”s not the worst part of the world to be when the whip comes down.

February 18, 2014 at 4:39 pm in reply to: Debt Rattle Feb 18 2014: The Best And Brightest Among Us Are Not #11398Raúl Ilargi Meijer

KeymasterFirst, apologies to ted and Professor L&L, whose IPs were both rejected by our spam detection systems. I have no idea why. It’s an aggressive bunch, and g-d knows we need that (43699 Cached Bad IPs. all good for maybe a thousand attempts), the attacks remain insane, but throwing out regular commenters seems weird. The system now says for both “Cached Bad IP”, but only after accepting registration and tons of comments from that same IP for months.

I whitelisted their IPs, it should be fine now. If this happens to anyone else, plaese notify me at contact •at• theautomaticearth •dot• com

February 15, 2014 at 2:22 pm in reply to: Debt Rattle Valentine’s 2014: Inequality Leads to War and Crisis #11319Raúl Ilargi Meijer

KeymasterQuite a few good observations. What I was going for is:

1) It’s not so much a matter of political or ethical leanings, low (income) tax rates are evidently disruptive to societies. They must be, because they coincide with unemployment, low pay for workers, misery. While higher rates are conducive to prosperity. It’s simply what history says. But in today’s discussion, it’s often perceived as counter-intuitive.

2) Current US income tax rates are terribly low from a historical point of view. It’s important that people keep themselves from accepting them as “normal”. They’re not. At all. They haven’t been this low in over 80 years, and times with higher rates have consistently been more prosperous.

Other than that, yes, capital gains taxes need to be raised in sync with income taxes, since they involve income.

And it’s undoubtedly true that virtual money sloshing around in a system sticks to the top more than the bottom. And it doesn’t stop there: while sloshing around, it moves money from the bottom to the top, by mixing real with virtual. I’ve clamored for restructuring of all bank debt a thousand times, precisely because of this. The virtual money doesn’t just come from what central banks issue as stimulus, it also includes all the – often years old – lost wagers that haven’t been settled because banks are exempt from “normal” accounting.

The entire picture, when viewed as a whole, is guaranteed to blow up societies.

February 14, 2014 at 7:55 pm in reply to: Debt Rattle Valentine’s 2014: Inequality Leads to War and Crisis #11306Raúl Ilargi Meijer

Keymaster“I would like to see what was happening in terms of monetary policy, interest rates and inflation/deflation at all of those times you’ve highlighted, Ilargi. “

There’s your homework for the weekend, Variable.

February 6, 2014 at 7:20 am in reply to: Nicole Foss Talks About David Holmgren’s Crash on Demand: Podcast #11097Raúl Ilargi Meijer

KeymasterIt appears on my Firefox, seems to like a mouse over before popping up. I used a simple cross platform player.

February 5, 2014 at 7:55 pm in reply to: Debt Rattle Feb 4 2014: The Shower Scene From Psycho #11092Raúl Ilargi Meijer

KeymasterNothing new in Dave’s part 3, resilience just cut it into pieces.It’s all in his original doc.

February 4, 2014 at 8:19 pm in reply to: Debt Rattle Feb 4 2014: The Shower Scene From Psycho #11070Raúl Ilargi Meijer

KeymasterWould we appoint multimillionaires Pelosi, Feinstein, Boehner and Rubio to oversee the redistribution of the debt (Because they have already squandered the wealth)?

Break up the banks in small enough pieces and all the usual suspects’ political cloud will evaporate. But yeah, Pelosi won’t do that, she would evaporate. It’ll mean people in the streets of America, and no Edward Bernays.

Raúl Ilargi Meijer

KeymasterCarb waster,

I have no new machine yet, running on two old ones for now, had the broken one repaired (new battery, HD and fans), but it’s all just temp. I need to relaunch Firefox 10 times day because Flash keeps loading up and slowing it to a crawl. There’s a 100+ tabs open, but I know no other way to work as much and as fast as I want to. I run 10.6.8, since any newer Mac OS invalidates my Photoshop, I can’t work without that, and a new version is more expensive than any computer I can think of. I’d like to be able to work faster, but I’m getting by for now.

February 1, 2014 at 6:20 pm in reply to: Debt Rattle Feb 1 2014: Meanwhile Back Home The Thumbscrews Are Tightened #10969Raúl Ilargi Meijer

Keymasterted,

Will the banks be bailed out again this time?

The major ones, yes, they’re in charge of the whole circus, not the Fed or the government. And they’ll gobble up a bunch of smaller banks in the process, certainly European ones, now the EU is about to start their next stress test. The centralization into ever bigger banks will simply continue until some country decides to have a Glass-Steagall-‘R-Us.

If the equity markets cease to be productive for banks will they start to lend out the money they have.

Lend it out to whom? Everyone will see lots of “assets” go poof in the night, what collateral will be left to secure loans with?

I can’t understand the language of the FED they say they will keep interest rates at zero but how can they do this?

The Fed’s control over interest rates is hot air entirely dependent on faith. Markets will let the illusion stand as long as the Fed feeds them for free, and as long as all parties confidently believe it will keep on doing it going forward. When it threatens to stop, real asset values must and will come into focus once more, and the markets will set interest rates.

Raúl Ilargi Meijer

KeymasterIan,

I may at times paint with a broad brush, but so is my poetic freedom. Labeling the use of the word “pretty” misogynist propaganda is something I’m happy to leave sitting on your conscience. Personally, I think you’re lightyears out of line, but perhaps you think such is your poetic freedom. Rest assured, I would never throw such accusatory terms around as casually as you do. Still, since there is nothing even resembling misogynist propaganda, I can’t remove it.

January 30, 2014 at 11:58 am in reply to: Debt Rattle Jan 28 2014: Squandered Blood and Angry Birds #10908Raúl Ilargi Meijer

KeymasterKoso,

A coin with many sides. The US is still a net importer, but the trade deficit may be narrowing more due to the temp bubble in domestic energy production than the – in relative terms – strong USD.

For one thing, a high dollar makes Obama’s dream of doubling exports in a 5 year timeframe a silly mirage, and exports are absolutely key in times of high debt levels.

Without artificial interest rates, the USD might be even higher, a “natural” course of things between stronger and weaker economies. Moreover, the dollar is not high at all vs the Euro, which is at $1.37 today, while it might be better off at par.

The US knows China will push to keep the renmimbi low, so it doesn’t have to do much there. As long as it doesn’t rise vs the Euro, Fed and Treasury probably think they have the best they can get – without extreme measures-.

One more thing: since the USD is the reserve currency, and most commodities plus a lot of debt are denominated in dollars, Washington can in theory simply print to pay for increasing costs. Note: unlike QE, that would risk devaluing the dollar, because it would mean money/credit actually entering the real economy.

Raúl Ilargi Meijer

KeymasterThanks for the kind words TRJ.

I post Ambrose stuff because I like the data he has, and hope people will know who he is: not us. And you’re right: all that “capital” he talks about is a leveraged illusion, and fodder for the taperworm. Poof!

January 24, 2014 at 4:06 pm in reply to: Debt Rattle Jan 24 2014: Argentina Returns to Villa Miseria #10760Raúl Ilargi Meijer

KeymasterWell, Greenpa, I have used the word ‘mob’ alongside ‘shadow banking system’, for obvious reasons, and I think they’re a huge threat to politburo control. But since we can’t keep track of the mob, just filing it under shadow banking is maybe the smart thing to do. They’re of course part of Beijing as well, and probably taking over as we speak. I see no reason to keep the apparatchik model going, though.

Raúl Ilargi Meijer

KeymasterThe Chinese people had been allowed a taste of money and freedom. From there on in, it’s just a matter of time. As one my daily links said yesterday: complex systems need freedom of action. Now they’ve let it come this far, for Beijing clamping down would mean killing off the economy, if not all out warfare with the underground systems, shadow banking, mob. Going to war with Japan? Kills the economy. Smaller prey? Would not be accepted. Total state control doesn’t rhyme with an economy based on profits. A 1000% rise in money supply is nothing something you easily reverse. And then there’s voices calling for more of the same, because the Chinese don’t spend their money fast enough. Half the politburo is already in bed with with the shadows, and for the other half reinstating full force is not an option anymore. Hard to predict how it will turn, but back to same old same old looks undoable.

Raúl Ilargi Meijer

KeymasterAbsolutely, Rebecca. I got a mail from a friend earlier who said that in India, Brazil, Kenya this is the normal: stock markets do great while the masses starve. It’s just that in America, this is at least 50 years ago, the middle class rose with the markets, and are still heavily invested through market funds and pension funds. It’s an order of magnitude different than in the poorer countries, but now it’s returning there.

Raúl Ilargi Meijer

Keymasterg-minor, that will be true for a lot of things. The worse the situation, the bigger the illusions, in fact. There’s something in there that depicts the beauty of the downfall, as some kind of theme throughout history, like societies collapsing just when they engage in their most exuberant building projects.

Raúl Ilargi Meijer

KeymasterAsh is fine.

Raúl Ilargi Meijer

KeymasterALL the blog posts? You’re a brave man!

In the late 1990’s, I decided, after having read a few of its articles, to take a full month off and read ALL 242 articles on Jay Hanson’s dieoff.org. Best education anyone could ever wish for, still would be today, and which at the same time made even clearer to me how useless universities are when it comes to real knowledge.

About my metaphors, I think we’re both as on as we are off: it seems to depend on what timeline you’re thinking off, or in. In that regard, it’s amusing to see the deflation theme take center stage now, even if it’s only so the media and politicians can deny it’s even possible. As I’ve often said, it’s not so much the willingness of politicians to spend public funds to keep the illusion going that surprises me, but people’s willingness to accept that they do. People don’t know what’s coming, because they choose not to, day to day life is much easier that way.

But huge debts can only possibly lead to deflation, and if they’re based on insane leverage levels to boot, it’s scorched earth time. It’s a fair guess that in reality there are no real assets underpinning even 0.1% of all debt anymore.

But please tell: why did you move back to Kosovo? I’ don’t think I’ve ever been.

Raúl Ilargi Meijer

Keymaster.. could it be the “D” scare has already been exercised?

First of all, it’s not ”the “D” SCARE”, it’s simply called deflation. But pray tell, what signs are there that D has been around yet at all, let alone “already exercised”?

.. If shocked enough, it will fill the well to the point money is running back up through the holes in the bucket

It hasn’t given any indication at all of any intent to do that, while deflation has now settled in and picked her favorite chair, it’s only been busy handing your money to the primary dealers. The Fed has not been”printing” anything whatsoever, it’s only been taking money away from people, who will therefore have less to spend, which will sink the velocity of that money.

What was the question again?

Raúl Ilargi Meijer

KeymasterGreat! I’m looking forward to it.

Raúl Ilargi Meijer

KeymasterAutoMan,

You have an absolutely great point. Would you consider writing a guest post about the topic?

Raúl Ilargi Meijer

KeymasterGuys, first of all of course thanks for your kind donations, do keep them coming, cause we’re not there yet by a long shot, and as per the Mac vs PC thing, I’ve only ever worked with Mac, and converted many who would never ever go back, and the best price for your buck discussion is up for grabs and by no means decided. Macs tend to last longer, and all of TAE’s history is Mac, and transferring all of it to PC would be a nightmare, so all in all, I don’t see Mac as elitist or anything at all, they’re simply a tool, and a tool that so far has given me no reason to doubt it’s up for the job. The Mac that died went all over the world, and I should have replaced it sooner, but our present financial situation makes that hard, so I waited. Until I no longer could….

Raúl Ilargi Meijer

KeymasterIt’s funny, in light of the thread above, that Nicole addresses the same topic today in her “Crash on Demand?” article:

It is our view at TAE that for a time energy limits are not likely to manifest, as lack of money will be the limiting factor in a major financial crisis. At the present time, with modestly increasing energy supply, the delusion of far greater increases to come, and falling demand, energy is already ceasing to be a pressing concern. As liquidity dries up, and demand falls much further as a result of both lack of purchasing power and plummeting economic activity, this will be even more the case.

No respect for Nicole, either, then, Frank?!

But it’s even funnier that our old young friend VK disagrees from the other side of the spectrum:

You can’t write the same things you did in 2008!

“It is our view at TAE that for a time energy limits are not likely to manifest, as lack of money will be the limiting factor in a major financial crisis”

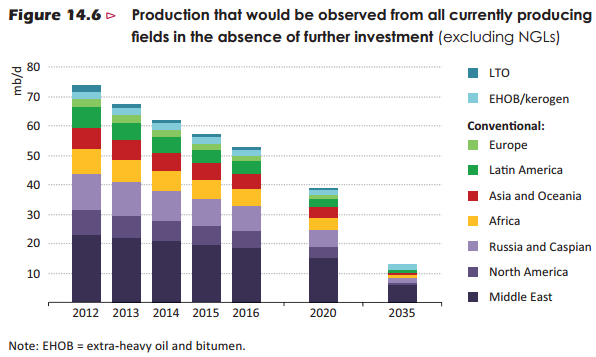

In 6 years we lose 35 Mn bpd without new investments. TAE has to shift from the 2007-2008 mindset.

And to be realistic you have to talk about self defence & guns.

Raúl Ilargi Meijer

KeymasterAs for that crunch, being skeptical of a crunch is what we do, all the time, day after day after day. But all I see is a crunch that grows in size day by day, because people let themselves get fooled into thinking that not only can debt be paid off with more debt, but that they will actually profit from this being executed in their name, and with their money. Look, the S&P breaks another record! Well, you certainly earned that look, because you’re paying for it.

If people still think we were wrong, and are wrong, about that crunch, let’s talk, but they need something better to bring to the table than S&P records or home prices. Because we can’t have that conversation without looking at debt levels. And I think that’s where the turning point still is, whether in conversations or in real life. You think things are looking up? Okidoke, so what happened to the debt that caused the 2007/8 crisis? Well, personal debt went down a tad (foreclosures), though plastic is all the rage again, bank debt (by far the largest) has been hidden behind a too big to fail wall, and federal debt is on its way out of the ballpark, going going but by no means gone.

But hey, everything seems normal right? Well, unless you’re in Greece, or Italy, or Spain, or Detroit, or you’re in that fast growing American army that just lost your foodstamps and your unemployment benefits. So maybe things seem normal for you because they no longer do for other people? If it looks like what it was before, that must be real, right?, that couldn’t be an temporary illusion bought with debt, like getting a new credit card and use it to pay the mortgage and the kids’ school fees and dentist bills till it’s maxed out after a few weeks or months? How many people do you think went routes just like that? And where are they now?

Does anyone think that the debt pays off itself? And even if you do, please note that it hasn’t so far: it’s only grown. How do you think that will end? How could it possibly end?

Raúl Ilargi Meijer

KeymasterHonestly, I lost serious respect for Ilargi when he claimed that Peak Oil has not happened because we have reached a non-catastrophic equilibrium based on demand destruction rather than supply increase.

Really, I said that? In those exact words, or is it paraphrased? Non-catastrophic equilibrium? I wonder. What year was that?

December 29, 2013 at 8:54 pm in reply to: The Taper And The China Credit Power Struggle Squeeze #10085Raúl Ilargi Meijer

KeymasterI doubt the same power relationship exists between the PBoC and Chinese banks as the ones in (formerly) rich nations. It will eventually, but for now the PBoC looks like a tool for the government, not the banks.

Raúl Ilargi Meijer

KeymasterThe fight between governments and corporations was decided long ago. The outcome became inevitable the money corporate money was allowed to enter politics.

But inflation there is not. If you can’t figure out how prices can rise without inflation, you’re not going to understand what happens. No chance.

Merry Christmas to you all, in Grace and in Light.

Raúl Ilargi Meijer

Keymasterrheba,

And all you say about Mauldin is why The Automatic Earth is here, and needs to be, and deserves everyone’ support. Just about every single finance site has something to peddle, especially gold. If Nicole and I held gold, or stocks, or you name it, our views and writings about it would be influenced by that, and we don’t see that as a positive thing. And of course we realize that we limit our potential audience that way, and risk the very existence of TAE, something that’s very obvious to us right now, but we’re simply not interested in helping people make money, we want to help who have little, not lose it. And that’s a huge difference from John Mauldin, who in order to make you money dares not speak the truth.

Raúl Ilargi Meijer

KeymasterSo fair to say we’re in a “no-win” solution?

First item on the list: define “win”. You want to change things around here, might as well start off in the right direction.

So: what do you mean when you say “win”? Same old same old and then some? And “no-win” is the opposite of that? Is it possible that the first step towards winning is to stop defining it in a way you never gave much thought to begin with?

Nothing personal, don’t get me wrong, more like something everyone should stop and think about. Along the same lines as why we equate “successful” with making lots of money. Why do we do that? Where’s the success in it?

Raúl Ilargi Meijer

Keymasterstill happening, oh lord?

It’s great for me now. I did clear the cache. since we moved host two days ago, that might have an effect. and we’re on a real fast server now, performance has gone up a lot

sorry, no going back

Raúl Ilargi Meijer

Keymasterjal, I don’t know what that is, no-one else has complained today

I changed the settings for your order, it should be good now

BTW, the email I have on file for you bounces, if you send me a good mail address at TheAutomaticEarth • gmail • com, we can have these talks off the comments section

Raúl Ilargi Meijer

Keymasterjal,

@ ilargi

I went to the purchase of the download and the price is coming up as $39.95 US, with paypal. Is that correct?Yes, that’s correct. My big red numbers are not big enough yet? 😉

Raúl Ilargi Meijer

KeymasterDoes Nicole show us her Ontario compound?

No. That was made impossible years ago by the attacks on TAE.

Raúl Ilargi Meijer

KeymasterHey zander, good to see you. Got a URL for that?

December 8, 2013 at 9:24 am in reply to: How To Stop Jeff Bezos From Filling Our Skies With Drones #9626Raúl Ilargi Meijer

KeymasterLord B, we left Blogger because we had to, spammer and idiot attacks were insane and Google wouldn’t do anything about that. Our comment moderation box became inaccessible to ourselves, and comments got stuck in it. Joomla was never ideal, and WP will take a bit of work apparently. We simply have no money to pay people to do this stuff for us.

Raúl Ilargi Meijer

KeymasterApologies for the mishaps in publishing an earlier version of this article. We’re working hard to correct a number of errors that occurred during the conversion from Joomla to WordPress.

December 3, 2013 at 4:19 pm in reply to: How To Stop Jeff Bezos From Filling Our Skies With Drones #9534Raúl Ilargi Meijer

KeymasterWon’t disturb stork baby deliveries, cuz most babes are over 5 lbs.

Bit of a shame, that, it would have been nice to have the Humane Society on our side too.

December 2, 2013 at 6:53 pm in reply to: How To Stop Jeff Bezos From Filling Our Skies With Drones #9524Raúl Ilargi Meijer

Keymasterlet’s see

Hmm, definitely will go on the to do list. 1 pic didn’t work, 2 pics did. Then I got to choose between detach and delete, picked detach, and the 2nd pic is gone. Thanks for pointing this out, jal.

BTW, pipefit, you back among the chosen few? 😉

Attachments:

You must be logged in to view attached files.December 2, 2013 at 7:26 am in reply to: Nicole Foss : Where the Rubber Meets the Road in America #9505Raúl Ilargi Meijer

KeymasterTed, I’m not Nicole, and I wasn’t name calling. Just trying to say that the government doesn’t give money away to people, and hence there’s not inflationary impulses coming from that direction.

pipefit, the spam system bounced you, not us. I cleared your IP, you should be good to go now. The system has 11,600 bad IPs cached and stopped 14.500 spammers in 10 days. Both numbers doubled over night Sunday morning. Of those 14,500, many are good for over 1000 attempts each (system stops counting at 1000), so we’re talking millions of attempts. Pretty crazy.

December 1, 2013 at 5:00 pm in reply to: Nicole Foss : Where the Rubber Meets the Road in America #9499Raúl Ilargi Meijer

KeymasterTed, the government takes money away from people, that’s what it does. It doesn’t give it to them, you commie.

-

AuthorPosts