Banksy

Funeral director

https://twitter.com/i/status/1649745506187239424

Beck

This is the most Powerful speech Glenn Beck has ever given… If you don’t feel this, we are NOT the same.. You are NOT a real American… pic.twitter.com/ua4QLe0vWd

— Matt Couch (@RealMattCouch) April 21, 2023

RFK jr

RFK Jr seems like a serious man. pic.twitter.com/2JPxWrQAE1

— Cernovich (@Cernovich) April 23, 2023

Makis

44 year old Canadian doctor Shannon Corbett (ObGyn & fertility specialist in Ontario) died suddenly of a heart attack while on vacation in Nassau, Bahamas.

She is the 150th Canadian doctor who "died suddenly" since Pfizer & Moderna mRNA rolled out#DiedSuddenly #cdnpoli #ableg pic.twitter.com/83MPVxNq6e

— William Makis MD (@MakisMD) April 22, 2023

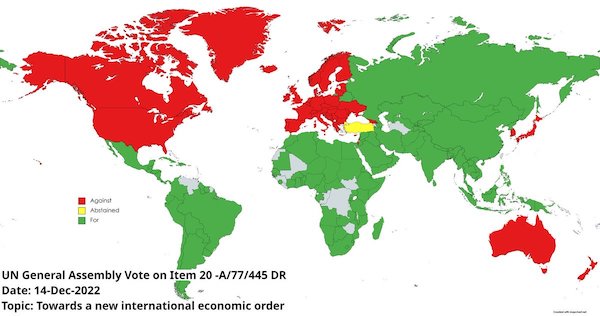

Very good from Kirill Strelnikov at RIA Novosti

“..a petrol station with matryoshka dolls couldn’t possibly stand up to the combined economic might of the enlightened West..”

It’s all about faulty modelling. A bunch of economists looking at nominal GDP only.

• Western ‘Experts’ Failed To Destroy Russia’s Economy (Strelnikov)

As is often the case in the Western media, the most embarrassing facts are only covered when they can no longer be hidden, but even then unpleasant admissions are made with numerous caveats and excuses. This week, the International Monetary Fund published a report, which drew the long overdue conclusion that the economic hegemony of the leading Western countries, represented by the G7, is shrinking as the BRICS (Brazil, Russia, India, China and South Africa) surge. Its conclusions were, of course, ‘polished’ by all the leading Western media outlets, but one thing became clear: Any triumphant Western predictions about the BRICS in general, and Russia in particular, can be safely tossed into the rubbish bin. In 2007, Western experts published a reassuring report stating that the total contribution of the BRICS to the world economy would not be comparable to that of the G7 until 2032.

But once again Western economic projections have failed, and the fact is that the BRICS countries caught up with the G7 in terms of their contribution to world economic growth as early as 2020, and at the moment the figures, even creatively manipulated by pundits, stubbornly show that by 2028 the BRICS will account for at least 35% (some sources say as much as 40%) of world GDP (compared with 27.8% for the G7). Western analysts, who are in fact echoing the wishes of the global deep state, have fallen into a similar trap in their assessment of Russia’s prospects and impact on the global economy. As we recall, since the beginning of last year, more sanctions have been imposed on Russia than on any other country in history, and the main talking heads in the West have reported with anticipation that the Russian economy will soon be reduced to dust.

Such was their confidence (after all, a petrol station with matryoshka dolls couldn’t possibly stand up to the combined economic might of the enlightened West) that analysts didn’t even bother with figures. The prediction was simple: Russia would be quickly and irrevocably destroyed – first its economy and then its social cohesion. A common trope for a number of years has been a comparison between the economies of Russia and Italy, with spurious claims that the economy of the world’s largest country is no bigger than that of the home of pizza and pasta, all based on simplistic measurements which fail to take into account currency differences, and overvalue the debt-fueled services sector. But something went wrong, and to the astonishment of the prognosticators, not only did Russia not kneel, it did not even bend to their will. The country’s position as a global energy superpower has been reaffirmed, and the title of global food superpower has been added. Other such titles will come in time. The forecasters began to compare their calculations and came to the conclusion that they had been counting wrongly.

As a result, a respected US publication, The National Interest, has published an ashen article whose main conclusion is that the comparison of the economies of Russia and Italy betrays the blatant incompetence of Western experts. In short, the roots of the comparison lie in the methodology of comparing economies by nominal GDP – the total value of all goods and services produced or sold in a country over a given period. Indeed, according to the World Bank, Russia’s nominal GDP in 2013 was about $2.29 trillion and Italy’s was about $2.14 trillion. But according to the authors of the article, the approach itself was fundamentally flawed: neither the exchange rate nor purchasing power parity (PPP) adjusted for living standards and labour productivity, per capita wealth and, most importantly, the availability of crucial material resources and goods, as opposed to nice “paper” assets like the value of global brands, copyrights and so on, were taken into account in the calculations.

With this correction alone, Russia’s real GDP is quite comparable to that of Germany (one of the ten most economically developed countries in the world): $4.81 trillion for Russia versus $4.85 trillion for Germany in 2021. But even such sophisticated calculations do not reflect the real situation. In times of crisis, the production of physical goods comes first, and here the Russian economy is not only stronger than the German economy, but more than twice as strong as France. Add to this Russia’s key role in supplying the world with energy, vital natural resources and food (not to mention its impact on global security) and we don’t need the conclusions of the world’s smartest analysts to understand our country’s real place in the world. Not so long ago, the IMF forecast 0.3% economic growth for Russia in 2023. Perhaps we should thank the “experts” and send this forecast to the same place as the others. Meanwhile, it’s better that we win in the real world, not on paper.

Trying to sink Europe…

• G7 Allies Consider Outright Ban Of All Trade With Russia (ZH)

Washington is in discussion with several Western partners about outright ending trade with Russia. The debate is occurring as the US-led economic war on Russia has failed to stop Moscow’s war machine in Ukraine. According to Bloomberg News, members of the Group of 7 (G7) are considering banning exports to Russia. The debate is occurring among member states – the US, Britain, Canada, France, Germany, Italy, Japan and the European Union – ahead of an international summit in May. Members of the G7 have maintained significant exports to Russia since Washington declared it would isolate Moscow using sanctions. According to Trade Data Monitor, $66 billion in goods have flowed to Russia from member states. The proposed ban will essentially switch the way Washington outlaws trade with Russia.

Currently, the US and its allies are blacklisting Russian products, companies and individuals. If adopted, the export ban will prohibit all trade with Moscow that is not explicitly exempted from Western sanctions. The Miami Herald reports that food and medicine will likely be on the exemption list. However, international aid organizations argue that exemptions are ineffective and sanctions largely stomp out the trade of civilian goods. The proposed export ban faces serious obstacles to overcome before the May G7 summit. All EU member states will have to agree to the ban for the bloc to sign on. Additionally, the export ban could threaten the grain export deal that Turkey and the UN brokered with Russia and Ukraine last year. According to the EU, since the agreement was implemented, 23 million tonnes of food products have left Kiev’s Black Sea ports.

After Russia invaded Ukraine 14 months ago, the White House unleashed a series of sanctions targeting Moscow that it believed was acting as an economic nuclear weapon. While the Joe Biden administration hoped that the entire globe would join in on the Kremlin’s isolation, after a year, only close Western partners have followed Washington’s lead. This has allowed Moscow to weather the West’s sanctions by turning to other trading partners – including China and India.

More disaster modelling. Canada commits $200 billion to an empty model.

• Feds Have No Data on How Regulations Reduce Emissions: Audit (ET)

The federal government does not know the extent that regulations are reducing greenhouse gas (GHG) emissions, despite committing $200 billion towards the issue. An April 20 report released by the Commissioner of the Environment and Sustainable Development, Jerry DeMarco, indicates that Environment and Climate Change Canada does not attribute emission results to specific regulations. The federal department does not measure, or report on, the contributions of each regulation toward meeting the set target for 2030. An audit by the commissioner concluded that Environment Canada “used modelling approaches to estimate greenhouse gas emission reductions.” The federal government does not know if regulations to limit methane emissions are achieving their target, said the report. The audit found that large sources of methane emissions were unaccounted for in inventories and not covered by any existing regulations.

The audit considered five regulations with the stated intent to reduce emissions from vehicles on the road, power plants, and oil and gas production. DeMarco concluded, “Without comprehensive impact information, the federal government does not know whether it is using the right tools to sufficiently reduce emissions to meet its target.” The audit suggested some regulations, targeted at reducing emissions from power generation, achieved the targeted level, while regulations intended to reduce vehicle emissions failed to meet their target. “Although greenhouse gas emissions from passenger cars decreased, this was offset by even larger increases in emissions for light trucks and heavy-duty vehicles, such as school and transit buses and freight, delivery, garbage, and dump trucks,” said the report.

The audit also said the government took “too long to develop regulations given the urgency of the climate crisis.” The report was critical that it took more than five years to develop the Clean Fuel Regulations, which was double the initial plan. The Liberals first promised to plant 2 billion trees by 2031 on the campaign trail in 2019, and said the country would cut emissions from 42 to 45 percent lower than 2005 levels. The country only cut 8.4 percent of emissions between 2005 and 2021, according to the most recent national greenhouse gas inventory report.

The audit found the country isn’t on track to plant even one-tenth of the promised trees by the deadline, despite a $3.2 billion allocation in the 2020 fall economic statement. “There is no solution to climate change and terrestrial biodiversity loss that does not include forests,” DeMarco’s report said. “It is unlikely that the two billion trees program will meet its objectives unless significant changes are made.” On the emissions front, the audit indicates the federal government committed to eliminating 2 million tonnes of greenhouse-gas emissions yearly, by 2030. Now the Liberal government said it will not start reducing emissions until 2031, at the earliest.

Most of these tanks will never be in action.

• German Tanks Pose Logistical Problems For Ukraine – Foreign Policy (RT)

Ukraine will likely have to procure a range of different munitions, rather than a single type, for German-made Leopard tanks, Foreign Policy has reported. In a report on Thursday, the media outlet stated that the vehicles provided to Kiev by eight countries are not uniform in terms of the shells they fire. The article also highlights the supposed inadequacy of air defences that have already been supplied. Foreign Policy wrote that the “Leopard tanks arriving from eight different countries fire different rounds, meaning that Ukrainians can’t buy munitions for their newly tricked-out ground forces in bulk.” As for Abrams tanks which the US has pledged to donate, these will likely take months to actually arrive on the battlefield, the outlet noted.

According to the article, Ukraine is also facing severe shortages of modern air defense systems. The country reportedly has enough to cover just a few cities. To make matters worse, the Hawk missile systems provided by Washington have been shipped without radars, Foreign Policy claimed. The setbacks are supposedly holding up Kiev’s planned spring counteroffensive, and causing discontent among the Ukrainian leadership. The media outlet cited President Vladimir Zelensky’s calls on the West to step up its military support for Ukraine late last month. Echoing that sentiment, Aleksey Danilov, the secretary of Ukraine’s National Security and Defense Council, lamented to the Associated Press earlier this week that some of Ukraine’s backers “promise one thing and do a completely different one.” The official also made it clear that “nobody will start unprepared,” referring to the planned counteroffensive.

A Ukrainian MP quoted by Foreign Policy claimed that the push had originally been planned for April, but had to be postponed indefinitely due to the lack of weapons necessary to pull it off. On Friday, the New York Times published a report saying that as of late February Kiev had only 200 of the 253 tanks that US military officials deemed sufficient for a successful counteroffensive. The paper, citing leaked Pentagon documents, noted that the majority of hardware was of Soviet design. The NYT also claimed that the US and its allies were having difficulty keeping up with Ukraine’s demand for artillery shells.

Yeah, don’t let’s talk.

• Berlin To Expel Russian Diplomats En Masse, Moscow To Mirror That Decision (TASS)

The German authorities have decided to massively expel Russian diplomats, thus Berlin is pursuing a course to destroy the entire range of Russia-Germany relations, the Russian Foreign Ministry told TASS on Saturday. “The authorities of the Federal Republic of Germany have decided on another mass expulsion of members of the Russian diplomatic missions in Germany. We strongly condemn these actions of Berlin, which continues to demonstratively destroy the entire range of Russia-Germany relations, including in their diplomatic dimension,” the ministry pointed out. The diplomats promised to give a mirror response to Berlin’s decision.

“As a response to Berlin’s hostile actions, the Russian side has decided to mirror the decision and expel German diplomats from Russia, as well as to significantly limit the maximum number of employees of German diplomatic missions in our country. On April 5, 2023, the Russian Foreign Ministry officially notified German Ambassador to Russia Geza Andreas von Geyr of this decision,” the diplomats said. They also pointed out that Berlin, in violation of its assurances, has put the media on notice of another mass expulsion of Russian diplomatic staff. “It is indicative that the German side, despite its repeated assurances of unwillingness to make the story public, violated them by making representatives of the media regularly used to organize ‘controlled leaks and information’ issues aware of its plot,” the ministry said.

On March 25, the Focus media outlet said, citing sources in the foreign ministry, that German Foreign Minister Annalena Baerbock planned to declare more than 30 accredited Russian diplomats personae non gratae. According to the Focus, German security agencies claim that these diplomats use their diplomatic status to illegally obtain political, economic, military, and scientific information for subsequent use in acts of sabotage and dissemination of disinformation. Commenting on these reports, a source in the Russian Foreign Ministry said that Russia would give a tough response to such steps.

Conveniently hiding behind papal secrecy.

• Vatican Refuses To Commit ‘Grave Sin’ – Media (RT)

A representative of the Vatican has said in a court filing that it would be a “grave sin” for the church to be forced to disclose communications between an archbishop and a cardinal in a UK trial related to a disputed real estate deal, according to a report by Bloomberg. “The violation of the pontifical secret is deemed a grave sin,”Carlos Ferando Diaz Paniagua, a Roman Catholic priest and lawyer, declared in documents filed with a London court in March. The pontifical secret, also referred to as papal secrecy, refers to an oath taken by members of the church designed to protect the distribution of sensitive information. It stands, Diaz Paniagua added to the court, “regardless of any grave or urgent considerations or the need to protect the common good.”

The legal request for various emails and text messages stems from a 2018 claim by the Vatican that it was defrauded by financier Raffaele Mincione and his companies in the $383 million sale of a former Harrods warehouse in London’s high-end Chelsea district. Ten people – including an Italian cardinal – have been accused by Vatican prosecutors in relation to various fraud and embezzlement charges amid allegations that the property had been sold at an inflated price. The Vatican has claimed it could lose as much as $186 million in its purchase of the site, which was intended to be developed into luxury apartments, and that it was improperly advised throughout the proceedings. Mincione, who is a defendant in the Vatican case, has in turn sued the church in the aforementioned London civil trial. He claims that his reputation has been damaged by the Vatican’s accusations against him.

In 2020, he petitioned the London court for a declaration that he had acted in good faith throughout his role in the real estate deal – a ruling his legal team believes would assist him in the separate trial brought by the Vatican. As part of the civil case, Mincione’s lawyers sought a trove of digital communications between high-ranking church officials Cardinal Pietro Parolin and Archbishop Edgar Pena Parra. Diaz Paniagua claimed in response that emails and text messages between the pair are irrelevant to the case, while the Vatican has said messages protected by pontifical secret are akin to state secrets Lawyers representing Mincione have declined to comment. The Vatican has until April 28 to decide if it intends to maintain pontifical secret as its reason for refusal to comply with a court request.

“..you don’t need bullets, you don’t need tanks, you don’t need weapons of any kind, you just need some common sense.”

• Trump Lays Out Timeline To End Ukraine Conflict (RT)

Former US president Donald Trump has promised to put a swift end to the bloodshed in Ukraine should he be elected again in 2024. The Republican also trashed the incumbent Joe Biden’s foreign policy, claiming it has made the world a more dangerous place. Speaking to his supporters in Fort Myers, Florida, on Friday, Trump said: “Before I even arrive at the Oval Office, shortly after we win the presidency, I will have the horrible war between Russia and Ukraine settled. I’ll get it settled very quickly.” He explained that he “know[s] both” Russian President Vladimir Putin and Ukrainian leader Vladimir Zelensky. Trump, who served as president from 2017 until 2021, claimed that he “got along” with the Russian head of state, and that Putin would not have launched his military campaign against Ukraine had Trump been in office.

“It’s still pretty easy for me to do,” the Republican insisted, referring to ending the conflict that has gone on for more than a year. He went on to allege that other countries’ leaders have lost respect for the US under Biden’s leadership because of his allegedly poor handling of America’s foreign policy. To regain it, Trump argued, “you don’t need bullets, you don’t need tanks, you don’t need weapons of any kind, you just need some common sense.” The former US president described himself as the “only candidate” who could promise to prevent the US from getting involved in World War III. If “these incompetent people” remain in office, however, there “will be a war like no other” with belligerent parties using nuclear weapons, Trump warned.

Last month, the Republican hopeful publicly asserted on at least two occasions that it would take him 24 hours to get Russia and Ukraine to end the fighting and negotiate if he were to be reelected. Talks between Kiev and Moscow were suspended last April by the Ukrainian leadership. Kiev accused the retreating Russian military of committing atrocities in several Kiev suburbs, a claim Moscow has denied.In October of last year, President Zelensky signed a decree, ruling out talks with his Russian counterpart. That order was given after Russia absorbed four Ukrainian regions following referendums. The Kremlin maintains that it is open to peace negotiations in principle as long as Kiev relinquishes its claim to the territories and agrees to Russia’s terms. Ukraine, in turn, says it is determined to resolve the issue by winning the conflict on the battlefield.

“I cannot imagine how the Justice Department allowed this to go on, if not for corruption at the highest level. And they are in some serious trouble right now. I think they know it..”

A Republican member of the House Oversight Committee thinks a flurry of recent corruption scandals could lead to the impeachment of President Joe Biden. Between the revelation that the ‘Hunter laptop letter hoax’ signed by 51 current and former intelligence officials was created at the best of Antony Blinken during the 2020 US election, the obvious implications of CCP leverage over the Biden family, and information presented by an IRS whistleblower regarding the Hunter Biden probe, things may get interesting according to Rep. Tim Burchett (R-TN). When asked about China’s influence over the Biden family, Burchett told Fox News’ Maria Bartiromo on Friday: “We know of at least eight Biden family members who have profited from dealings overseas,” adding “I think if you delve into it deep enough, there’s prostitution rings involved in this, human trafficking has been rumored to be part of some of this. These so-called companies that have allowed the Biden family to profit. It is gross, and it is disgusting.”

“If I was those 51 people, I’d be lawyering up right now because they’re going to be asked in public at some point what they knew and if they knew that all this other stuff was going on, because it is very damning Maria. This is just the very tip of the iceberg,” he continued. “This very brave IRS agent coming forward, I think, will just start it,” Burchett said, referring to the senior agent in charge of the Hunter Biden investigation who came forward earlier this week in a letter to lawmakers, accusing the DOJ of ‘mishandling’ the Hunter Biden case, and that his client had information that would contradict sworn testimony from a senior political appointee. When asked if that might lead to an impeachment, Burchett said: “If this coverup shows what’s going on, what we assume is going on, and that the 51 folks were basically lied to and showed false documentation, how can you not…”

“The lawyer for the whistleblower joined “Special Report with Bret Baier” Thursday night claiming his client is “not a political person” and does not have a “political agenda,” but does have documents to support his allegations that he hopes to bring to both congressional Democrats and Republicans. “If you delve into it deep enough, there’s prostitution rings involved in this. Human trafficking has been rumored to be a part of some of these so-called companies that have allowed the Biden family to profit. It is gross and it is disgusting about what has been allowed to go on,” Burchett said.” -Fox News “I cannot imagine how the Justice Department allowed this to go on, if not for corruption at the highest level. And they are in some serious trouble right now. I think they know it,” Burchett continued.

“..failure to file taxes, felony tax evasion and falsely stating on a federal form for a gun purchase..”

That is all.

• Hunter Biden’s Lawyers To Meet With Feds – CNN (RT)

Lawyers representing Hunter Biden have reportedly set up a meeting with US Department of Justice (DOJ) officials to discuss the status of a criminal investigation into President Joe Biden’s son. The meeting will take place next week and include a senior DOJ official, as well as US Attorney David Weiss, the Delaware prosecutor who has led the probe on Hunter Biden since 2018, CNN reported on Friday, citing unidentified sources familiar with the matter. Fox News, which confirmed the report, said Biden’s lawyers requested the meeting weeks ago, and it’s unrelated to allegations made this week about the investigation by an Internal Revenue Service (IRS) whistleblower.

CNN said prosecutors have narrowed the scope of the probe to include possible charges for failure to file taxes, felony tax evasion and falsely stating on a federal form for a gun purchase that he had not used illegal drugs. Weiss is reportedly also considering related charges involving money laundering and unregistered foreign lobbying. The tax case relates at least partly to Biden’s income from ventures in Ukraine and China. The IRS whistleblower, who has not been identified and has sought permission to give testimony to Congress, supervised the agency’s investigation into the younger Biden’s alleged tax violations. The whistleblower reportedly claims that the probe has been undermined by “political considerations” and that Attorney General Merrick Garland misled Congress about how the case is being handled.

There is no indication that the scheduling of next week’s DOJ meeting with Biden’s lawyer suggests that prosecutors are prepared to make a decision soon on whether to file charges, Fox said, citing a source. There is “growing frustration” in the FBI because the bulk of the investigative work concerning the Biden allegations was completed last year, NBC News reported on Thursday. The IRS finished its part of the investigation more than a year ago, the report adds. A bombshell New York Post report on alleged foreign influence-peddling by the Biden family surfaced in October 2020, just three weeks before the presidential election. The report was based on correspondence contained on a laptop computer that Hunter Biden had abandoned at a Delaware repair shop.

Former CIA Director Mike Morell recently admitted in congressional testimony that Joe Biden’s presidential campaign played a role in the creation of an open letter – signed by 51 former intelligence officials – claiming that the Hunter Biden allegations had “the classic earmarks of a Russian information operation.” Morell, who acknowledged that he wanted to help Joe Biden get elected, said the letter was prompted by Biden campaign staffer Antony Blinken, now US secretary of state. Media outlets and the Biden campaign used the letter to discredit the Post report, which was censored by Facebook based on an FBI misinformation warning.

“..Mr. Pomerantz’s deposition will go forward on May 12, and we look forward to his appearance,”

• Bragg Caved. Jim Jordan Won (ET)

Manhattan District Attorney Alvin Bragg has dropped his effort to quash a congressional subpoena to a former prosecutor who worked in his office, a congressional aide told The Epoch Times in a statement on Friday. “This evening, the Manhattan District Attorney’s Office withdrew its appeal in Bragg v. Jordan. Mr. Pomerantz’s deposition will go forward on May 12, and we look forward to his appearance,” Russel Dye, spokesperson for Rep. Jim Jordan (R-Ohio), chair of the House Judiciary Committee, wrote to The Epoch Times in a statement. “Bragg caved. Jim Jordan won,” the House Judiciary Committee wrote in a statement on Twitter Friday.

The development wrapped up a legal clash between Bragg and House Judiciary Republicans, whereby Bragg had attempted to stop the lawmakers from requesting testimony from Mark Pomerantz, a former prosecutor who investigated former President Donald Trump’s finances. Pomerantz left Bragg’s office in February 2022 in protest of Bragg’s initial unwillingness to bring an indictment against Trump. A grand jury, encouraged by Bragg, brought an indictment against Trump in late March, prompting Jordan to initiate a probe into what he calls a “politically motivated” prosecution against a former president. Jordan subpoenaed Pomerantz to seek his testimony as a part of that probe.

In response, Bragg sued the House Judiciary Committee and Pomerantz to prevent Pomerantz from testifying. That lawsuit led to a hearing on Wednesday in the Southern District Court of New York, and a subsequent decision by District Judge Mary Kay Vyskocil, a Trump appointee, ordered that the congressional panel has the authority to become involved in the investigation of Trump and declined Bragg’s request for a court injunction on the congressional subpoena.

Went on for well over a year…

• Airman’s Leaks Started Just 48 Hours After Russia Invaded Ukraine (ZH)

The Pentagon’s humiliation just grew deeper, as it turns out National Guard Airman Jack Teixeira’s leaks of classified documents started far earlier than has previously been reported. Tipped off about a second, 600-member Discord chat group where Teixeira also posted, the New York Times found the Massachusetts Air National Guard information technology specialist started sharing information about the war in Ukraine within 48 hours of Russia’s February 2022 invasion. In contrast to the previously reported chat group, this one was far larger and was publicly listed on a YouTube channel. This development makes the intelligence community’s failure to discover the posts all the more embarrassing: The document used to criminally charge Teixeira says he started posting in December 2022, but it turns out his stream of leaks spanned 13 months.

The Times matched Teixeira to the account in the newly-publicized chat room by a variety of means, including the user name, photos he posted that match known photos of his family home’s interior, a reference to his birthday, and, not least, the user’s declaration that he worked in an Air Force intelligence unit. The posts reviewed by the Times were detailed descriptions of classified documents, with the user believed to have also posted photos of documents that have since been deleted. Teixeira jumped into leak mode just two days after the Russian invasion, posting, “Saw a pentagon report saying that 1/3rd of the force is being used to invade.” When others in the chat room questioned his information, he wrote, “I have a little more than open source info. Perks of being in a USAF intel unit.”

In a March 27, 2022 post in which he said he was citing “an NSA site,” Teixeira told the group Russian forces were about to pull back from Kiev: “Some ‘big’ news. There may be a planned withdrawal of the troops west of Kiev, as in all of them.” Two days later, Russia announced it was doing just that. “The job I have lets me get privilege’s above most intel guys,” he boasted with imperfect punctuation. When another chat participant cautioned him not to abuse those privileges, Teixeira fittingly replied, “Too late.”

“There are enduring problems, aren’t there, about their conflict, their problem? It’s so easy to say in one word. If you have any problems, you can talk about it together.”

• China Questions Sovereignty Of Ex-Soviet States (RT)

China’s ambassador to France has called into question the sovereignty of Ukraine and other former Soviet republics, suggesting that their hazy status under international law makes it difficult to resolve conflicts over disputed territories such as Crimea. “Even these countries of the former Soviet Union don’t have effective status in international law because there is no international agreement to make their status as a sovereign country concrete,” Ambassador Lu Shaye said on Saturday in an interview with French broadcaster LCI. Asked by Swiss journalist Darius Rochebin whether Crimea is Ukrainian territory, Lu said, “It depends on how you perceive the problem . . . . It’s not that simple.” Rochebin tried to correct his guest, saying, “Sorry, according to international law, you know it’s Ukraine. Under international law, you can argue it, you can dispute it, but this is Ukraine.”

Lu replied, “Crimea was originally part of Russia, wasn’t it? It was [Soviet leader Nikita] Khrushchev who gave Crimea to Ukraine in the Soviet Union.” Pressed again on the peninsula’s status, the Chinese diplomat said, “Now, we must not quarrel about this kind of problem again. Now, the most urgent thing is to stop, to cease fire, to stop.” Chinese officials have tried to maintain a neutral stance on the Russia-Ukraine conflict, resisting pressure from the US and other Western powers to join in condemning Moscow and imposing sanctions. Beijing, which proposed a 12-point peace plan in February, has emphasized the need to stop the bloodshed in Ukraine and work toward a diplomatic solution that accounts for the security concerns of all parties involved.

Ukrainian President Vladimir Zelensky has vowed to recapture all of his country’s territory, including Crimea – a goal that most of Kiev’s Western backers don’t see as realistic. Residents of the peninsula voted overwhelmingly for Crimea to become part of Russia in 2014, following a US-backed overthrow of Ukraine’s elected government. Asked about the importance of territorial integrity from Kiev’s point of view, Lu again pointed to the historical complexity of the issue, saying, “There are enduring problems, aren’t there, about their conflict, their problem? It’s so easy to say in one word. If you have any problems, you can talk about it together.”

“France’s next presidential election is scheduled for 2027, when Macron won’t be able to run again because of term limits.”

• Macron Is ‘Bunkered,’ Le Pen Says (RT)

Emmanuel Macron’s decision to push through pension reforms – in defiance of public opinion on the issue – has created a “total rupture” between the French president and his country’s people, opposition party leader Marine Le Pen has claimed. “The problem is that Emmanuel Macron is completely bunkered,” Le Pen said on Saturday in an interview with France’s BFM TV. “He can no longer leave the Elysée [presidential palace] without arousing the ire of a people he refuses to listen to and whose will he refuses to respect.” Macron was booed by crowds in eastern France on Wednesday, when he made his first public appearances since he signed into law an unpopular pension law earlier this month. Union workers claimed credit for cutting off the electricity at a woodworking factory in Muttersholtz just before the president arrived, leaving him partially in the dark during his visit.

The pension reforms, which included raising France’s retirement age to 64 from 62, sparked mass protests and civil unrest across the country. “He generated anger, and it is he who is at the origin of the disorder, the chaos,” Le Pen said. “I believe that today, there is a total rupture between Emmanuel Macron and the French people.” Le Pen accused the president of refusing to listen to public outcry on the pension law, reflecting a “failing democracy.” She added, “When the people say no, it’s no. We will have to tell him that democracy is doing what we said we were going to do. Democracy is respecting the will of the people.”

An Ifop Group poll released on Wednesday showed that Le Pen has overtaken Macron in public popularity. Asked which of the two personalities they prefer, respondents favored Le Pen over the president by a 47%-42% margin. Macron defeated Le Pen in last year’s presidential election by more than 17 percentage points. He beat her even more handily in 2017, winning 66.1% of the votes. France’s next presidential election is scheduled for 2027, when Macron won’t be able to run again because of term limits. Le Pen, leader of France’s National Rally party, plans to run for president for the fourth time. Even before Macron signed the pension bill last week, a poll showed that he would lose to Le Pen by a 55%-45% margin if they were to face off again.

Other words for pots and pans… “..a regulation banning “portable sound devices”.. “..the brand-new edict forbidding “entertainment devices.“.. “any sound device that is portable or emanating from a vehicle that has not been duly authorized..”

• French Cops Confiscate Cookware (RT)

French police in the village of Ganges confiscated saucepans and other metallic cookware from protesters on Thursday after hurriedly adopting a regulation banning “portable sound devices” ahead of a visit from President Emmanuel Macron. The French leader is currently touring the nation to defend his unpopular pension reforms. Video posted to social media shows police officers opening backpacks and ordering protesters to ditch their cookware. When one complains such restrictions are illegal, the officer retrieves a piece of paper from his car, presumably bearing the brand-new edict forbidding “entertainment devices.” Demonstrators were also reportedly forbidden from bringing small flutes anywhere near the school where Macron was to speak.

The Herault prefecture rushed to impose the ban on “any sound device that is portable or emanating from a vehicle that has not been duly authorized” within the security perimeter of the areas to be visited by Macron just hours before his visit on Thursday, hoping to protect the head of state from the chorus of metallic banging he faced during his first event in Alsace. While authorities insisted the snap edict was a “common police measure” meant to target amplifiers and speakers, experts questioned the legality of confiscating pots and pans, noting that the hastily adopted decree banned the use of the devices, not their possession. Macron’s political opponents seized on the pan ban’s overreach. “Is it possible to get out of a democratic crisis by banning saucepans?” Green Party MP Sandrine Rousseau asked. Communist Party spokesman Ian Brossat said he was “impatiently awaiting the bill which will prohibit the sale of saucepans.”

Asked whether he would face the demonstrators, Macron responded that he would do so only “if people are ready to talk.” “Where I’m from, eggs and pans, these are for cooking,” the president quipped. Macron later attempted to further marginalize the protesters, declaring, “it is not saucepans that will move France forward.” “The person who is preventing France from moving forward is [Macron],” Chloe Bourguignon, the secretary general of regional union UNSA Grand-Est, told FranceInfo. “It shows great contempt to say such a thing, particularly after all the messages of provocation that he has sent in the last few weeks.” After the pension reform package became law this week, Macron ordered his government to “restore peace” over the next 100 days, vowing not to back down on raising the retirement age by two years even though the legislation is opposed by more than two-thirds of the French population.

https://twitter.com/i/status/1649824727542779987

Get their pots and pans and bring out the high tech…

• French Police Cleared To Use Drones For Crowd Monitoring (R.)

French police is allowed from Friday to use drones equipped with cameras for a wide range of tasks including crowd monitoring and border control, following the publication of a decree in the Official Journal on Thursday.

This comes just over a year before the Paris 2024 Olympics and at a time when opposition to President Emmanuel Macron’s pension reform has triggered huge protests that at times turned violent. The decree allows police, customs or military to use drones to prevent attacks on people or property, ensure the security of gatherings in public places as well as maintain or restore public order when these gatherings are likely to severely disrupt public order.

The drones can also be used for the prevention of terrorist acts, the regulation of transport flows, border surveillance, and rescuing people, the decree said. The decree details and implements in practice a security law voted by parliament last year. France’s CNIL data privacy watchdog had in March demanded that a detailed policy of use be published, including on the information of the public concerned by the use of drones.

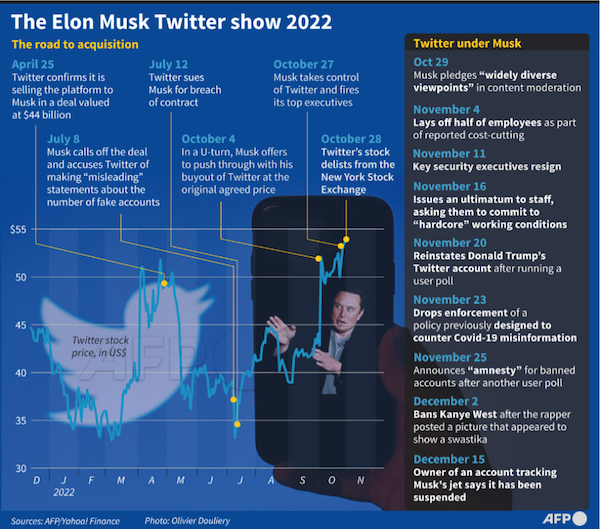

Taibbi and Elon Musk have had some sort of falling-out I see.

Taibbi: “You people are shockingly dishonest. This is referencing my refusal to leave Substack and move to Twitter subscriptions. The full quote is: “This whole business of me maybe moving to Twitter or using this new subscription service – I was trying to protect Elon in this situation… I was trying to communicate this to him: the Twitter Files wouldn’t be taken seriously if there was even a theoretical financial relationship between the two of us.”

• US Democrats Threaten Matt Taibbi With Arrest (RT)

Democratic congresswoman Stacey Plaskett has threatened Twitter Files journalist Matt Taibbi with prosecution for perjury, journalist Lee Fang revealed on Thursday. Plaskett reportedly accused the independent journalist of deliberately misrepresenting the partnership between the social media giant and various US government agencies during his testimony before Congress last month. Fang, who obtained and published a copy of the letter from the Virgin Islands representative, pointed out that Plaskett based her allegations largely on claims made by MSNBC host Mehdi Hassan during a recent confrontational interview between Hassan and Taibbi – accusations Fang had already debunked in a recent piece published on his Substack blog.

https://twitter.com/i/status/1649833430228631553

Plaskett’s claim that Taibbi had deliberately mixed up CISA (the Homeland Security subsidiary, the Cybersecurity and Infrastructure Security Agency) and CIS (the Center for Internet Security) in order to falsely depict an unconstitutionally cozy relationship between the Department of Homeland Security and Twitter was based on a single tweet, which Taibbi had deleted upon realizing his error and which was unrelated to his March 9 testimony before the House Subcommittee on the Weaponization of the Federal Government. As Taibbi pointed out to GrayZone journalist Aaron Maté on Friday, that comment referred to just one of many well-documented connections between DHS, its contractors (like CIS and the Election Integrity Partnership), and Twitter, and the Twitter Files ultimately revealed the platform was working with both CIS and CISA in the same manner.

Plaskett, who denounced Taibbi as a “so-called journalist” during the subcommittee hearing and accused him of posing a threat to people who disagreed with him, rounded out her letter with seven questions, demanding answers by this past Friday on the penalty of prosecution for perjury, which carries a five-year prison sentence. However, Taibbi claimed he did not even receive the message until the deadline had already arrived. Analyzing the document, Fang revealed it was co-written by staffers for House Minority Leader Hakeem Jeffries and former House Judiciary Committee chair Jerry Nadler. Taibbi was the first journalist hand-picked by Twitter CEO Elon Musk to report on internal communications confirming the depth of the collusion between a dozen US government agencies and the major social media platforms to squelch dissent and promote narratives desirable to Washington. While he was in Washington testifying before Congress, a tax agent visited his home, leaving a note in what Republican lawmakers have denounced as an intimidation tactic from their political foes.

Macleod

Is TikTok a US Deep State Front?

"We really have the best of both worlds for the U.S. government. They get to keep these private companies at arm's length, all the while filling their ranks with former State Department officials, former officials who worked at the White House or… pic.twitter.com/gEcXC44Ws5

— ScheerPost.com (@scheer_post) April 22, 2023

Daly

“The global north is now a minority in a new world order which won’t be based on the dollar but will be based on a new system of multilateralism.”

Irish MEP Clare Daly with a message for NATO. pic.twitter.com/fTlCCfqGiQ

— MintPress News (@MintPressNews) April 22, 2023

Plans for an EU "Rapid Deployment Capacity" should be read in the context of Irish governments' constant promises that "there are no plans for an EU army."

What's a "Rapid Deployment Capacity"?

Read about it here: https://t.co/OtnvBANaxr pic.twitter.com/WUdOyZHS16

— Clare Daly (@ClareDalyMEP) April 22, 2023

Photographer Axel Bocker took a glorious damselfly close-up in Germany and earned a spot as a finalist in the 2021 Comedy Wildlife Photography Awards

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.