Jean-Léon Gérôme Truth Coming Out of Her Well to Shame Mankind 1896

An entire library of articles about Big Tech is coming out these days, and I find that much of it is written so well, and the ideas in them so well expressed, that I have little to add. Except, I think I may have the solution to the problems many people see. But I also have a concern that I don’t see addressed, and that may well prevent that solution from being adopted. If so, we’re very far away from any solution at all. And that’s seriously bad news.

Let’s start with a general -even ‘light’- critique of social media by Claire Wardle and Hossein Derakhshan for the Guardian:

How Did The News Go ‘Fake’? When The Media Went Social

Social media force us to live our lives in public, positioned centre-stage in our very own daily performances. Erving Goffman, the American sociologist, articulated the idea of “life as theatre” in his 1956 book The Presentation of Self in Everyday Life, and while the book was published more than half a century ago, the concept is even more relevant today. It is increasingly difficult to live a private life, in terms not just of keeping our personal data away from governments or corporations, but also of keeping our movements, interests and, most worryingly, information consumption habits from the wider world.

The social networks are engineered so that we are constantly assessing others – and being assessed ourselves. In fact our “selves” are scattered across different platforms, and our decisions, which are public or semi-public performances, are driven by our desire to make a good impression on our audiences, imagined and actual. We grudgingly accept these public performances when it comes to our travels, shopping, dating, and dining. We know the deal. The online tools that we use are free in return for us giving up our data, and we understand that they need us to publicly share our lifestyle decisions to encourage people in our network to join, connect and purchase.

But, critically, the same forces have impacted the way we consume news and information. Before our media became “social”, only our closest family or friends knew what we read or watched, and if we wanted to keep our guilty pleasures secret, we could. Now, for those of us who consume news via the social networks, what we “like” and what we follow is visible to many [..] Consumption of the news has become a performance that can’t be solely about seeking information or even entertainment. What we choose to “like” or follow is part of our identity, an indication of our social class and status, and most frequently our political persuasion.

That sets the scene. People sell their lives, their souls, to join a network that then sells these lives -and souls- to the highest bidder, for a profit the people themselves get nothing of. This is not some far-fetched idea. As noted further down, in terms of scale, Facebook is a present day Christianity. And these concerns are not only coming from ‘concerned citizens’, some of the early participants are speaking out as well. Like Facebook co-founder Sean Parker:

Facebook: God Only Knows What It’s Doing To Our Children’s Brains

Sean Parker, the founding president of Facebook, gave me a candid insider’s look at how social networks purposely hook and potentially hurt our brains. Be smart: Parker’s I-was-there account provides priceless perspective in the rising debate about the power and effects of the social networks, which now have scale and reach unknown in human history. [..]

“When Facebook was getting going, I had these people who would come up to me and they would say, ‘I’m not on social media.’ And I would say, ‘OK. You know, you will be.’ And then they would say, ‘No, no, no. I value my real-life interactions. I value the moment. I value presence. I value intimacy.’ And I would say, … ‘We’ll get you eventually.'”

“I don’t know if I really understood the consequences of what I was saying, because [of] the unintended consequences of a network when it grows to a billion or 2 billion people and … it literally changes your relationship with society, with each other … It probably interferes with productivity in weird ways. God only knows what it’s doing to our children’s brains.”

“The thought process that went into building these applications, Facebook being the first of them, … was all about: ‘How do we consume as much of your time and conscious attention as possible?'” “And that means that we need to sort of give you a little dopamine hit every once in a while, because someone liked or commented on a photo or a post or whatever. And that’s going to get you to contribute more content, and that’s going to get you … more likes and comments.”

“It’s a social-validation feedback loop … exactly the kind of thing that a hacker like myself would come up with, because you’re exploiting a vulnerability in human psychology.” “The inventors, creators — it’s me, it’s Mark [Zuckerberg], it’s Kevin Systrom on Instagram, it’s all of these people — understood this consciously. And we did it anyway.”

Early stage investor in Facebook, Roger McNamee, also has some words to add along the same lines as Parker. They make it sound like they’re Frankenstein and Facebook is their monster.

How Facebook and Google Threaten Public Health – and Democracy

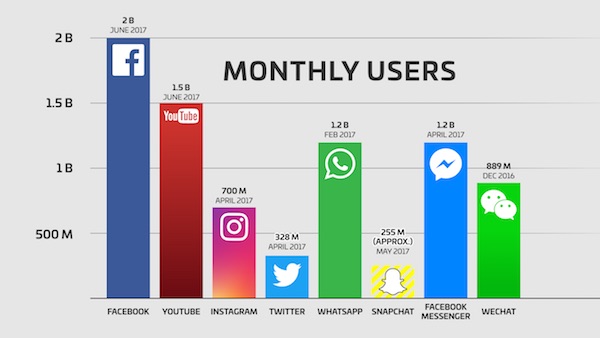

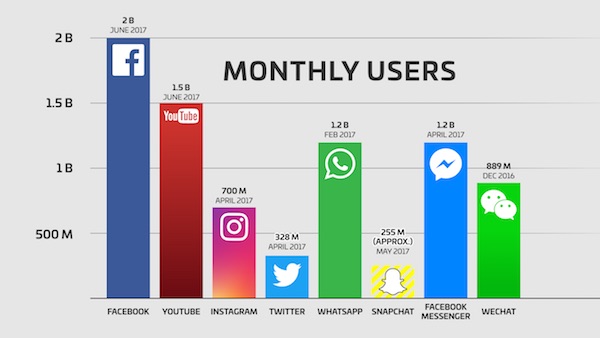

The term “addiction” is no exaggeration. The average consumer checks his or her smartphone 150 times a day, making more than 2,000 swipes and touches. The applications they use most frequently are owned by Facebook and Alphabet, and the usage of those products is still increasing. In terms of scale, Facebook and YouTube are similar to Christianity and Islam respectively. More than 2 billion people use Facebook every month, 1.3 billion check in every day. More than 1.5 billion people use YouTube. Other services owned by these companies also have user populations of 1 billion or more.

Facebook and Alphabet are huge because users are willing to trade privacy and openness for “convenient and free.” Content creators resisted at first, but user demand forced them to surrender control and profits to Facebook and Alphabet. The sad truth is that Facebook and Alphabet have behaved irresponsibly in the pursuit of massive profits. They have consciously combined persuasive techniques developed by propagandists and the gambling industry with technology in ways that threaten public health and democracy.

The issue, however, is not social networking or search. It is advertising business models. Let me explain. From the earliest days of tabloid newspapers, publishers realized the power of exploiting human emotions. To win a battle for attention, publishers must give users “what they want,” content that appeals to emotions, rather than intellect. Substance cannot compete with sensation, which must be amplified constantly, lest consumers get distracted and move on. “If it bleeds, it leads” has guided editorial choices for more than 150 years, but has only become a threat to society in the past decade, since the introduction of smartphones.

Media delivery platforms like newspapers, television, books, and even computers are persuasive, but people only engage with them for a few hours each day and every person receives the same content. Today’s battle for attention is not a fair fight. Every competitor exploits the same techniques, but Facebook and Alphabet have prohibitive advantages: personalization and smartphones. Unlike older media, Facebook and Alphabet know essentially everything about their users, tracking them everywhere they go on the web and often beyond.

By making every experience free and easy, Facebook and Alphabet became gatekeepers on the internet, giving them levels of control and profitability previously unknown in media. They exploit data to customize each user’s experience and siphon profits from content creators. Thanks to smartphones, the battle for attention now takes place on a single platform that is available every waking moment. Competitors to Facebook and Alphabet do not have a prayer.

Facebook and Alphabet monetize content through advertising that is targeted more precisely than has ever been possible before. The platforms create “filter bubbles” around each user, confirming pre-existing beliefs and often creating the illusion that everyone shares the same views. Platforms do this because it is profitable. The downside of filter bubbles is that beliefs become more rigid and extreme. Users are less open to new ideas and even to facts.

Of the millions of pieces of content that Facebook can show each user at a given time, they choose the handful most likely to maximize profits. If it were not for the advertising business model, Facebook might choose content that informs, inspires, or enriches users. Instead, the user experience on Facebook is dominated by appeals to fear and anger. This would be bad enough, but reality is worse.

And in a Daily Mail article, McNamee’s ideas are taken a mile or so further. Goebbels, Bernays, fear, anger, personalization, civility.

Early Facebook Investor Compares The Social Network To Nazi Propaganda

Facebook officials have been compared to the Nazi propaganda chief Joseph Goebbels by a former investor. Roger McNamee also likened the company’s methods to those of Edward Bernays, the ‘father of public’ relations who promoted smoking for women. Mr McNamee, who made a fortune backing the social network in its infancy, has spoken out about his concern about the techniques the tech giants use to engage users and advertisers. [..] the former investor said everyone was now ‘in one degree or another addicted’ to the site while he feared the platform was causing people to swap real relationships for phoney ones.

And he likened the techniques of the company to Mr Bernays and Hitler’s public relations minister. ‘In order to maintain your attention they have taken all the techniques of Edward Bernays and Joseph Goebbels, and all of the other people from the world of persuasion, and all the big ad agencies, and they’ve mapped it onto an all day product with highly personalised information in order to addict you,’ Mr McNamee told The Telegraph. Mr McNamee said Facebook was creating a culture of ‘fear and anger’. ‘We have lowered the civil discourse, people have become less civil to each other..’

He said the tech giant had ‘weaponised’ the First Amendment to ‘essentially absolve themselves of responsibility’. He added: ‘I say this as somebody who was there at the beginning.’ Mr McNamee’s comments come as a further blow to Facebook as just last month former employee Justin Rosenstein spoke out about his concerns. Mr Rosenstein, the Facebook engineer who built a prototype of the network’s ‘like’ button, called the creation the ‘bright dings of pseudo-pleasure’. He said he was forced to limit his own use of the social network because he was worried about the impact it had on him.

As for the economic, not the societal or personal, effects of social media, Yanis Varoufakis had this to say a few weeks ago:

Capitalism Is Ending Because It Has Made Itself Obsolete – Varoufakis

Former Greek finance minister Yanis Varoufakis has claimed capitalism is coming to an end because it is making itself obsolete. The former economics professor told an audience at University College London that the rise of giant technology corporations and artificial intelligence will cause the current economic system to undermine itself. Mr Varoufakis said companies such as Google and Facebook, for the first time ever, are having their capital bought and produced by consumers.

“Firstly the technologies were funded by some government grant; secondly every time you search for something on Google, you contribute to Google’s capital,” he said. “And who gets the returns from capital? Google, not you. “So now there is no doubt capital is being socially produced, and the returns are being privatised. This with artificial intelligence is going to be the end of capitalism.”

Ergo, as people sell their lives and their souls to Facebook and Alphabet, they sell their economies along with them. That’s what that means. And you were just checking what your friends were doing. Or, that’s what you thought you were doing.

The solution to all these pains is, likely unintentionally, provided by Umair Haque’s critique of economics. It’s interesting to see how the topics ‘blend’, ‘intertwine’.

How Economics Failed the Economy

When, in the 1930s, the great economist Simon Kuznets created GDP, he deliberately left two industries out of this then novel, revolutionary idea of a national income : finance and advertising. [..] Kuznets logic was simple, and it was not mere opinion, but analytical fact: finance and advertising don’t create new value, they only allocate, or distribute existing value in the same way that a loan to buy a television isn’t the television, or an ad for healthcare isn’t healthcare. They are only means to goods, not goods themselves. Now we come to two tragedies of history.

What happened next is that Congress laughed, as Congresses do, ignored Kuznets, and included advertising and finance anyways for political reasons -after all, bigger, to the politicians mind, has always been better, and therefore, a bigger national income must have been better. Right? Let’s think about it. Today, something very curious has taken place.

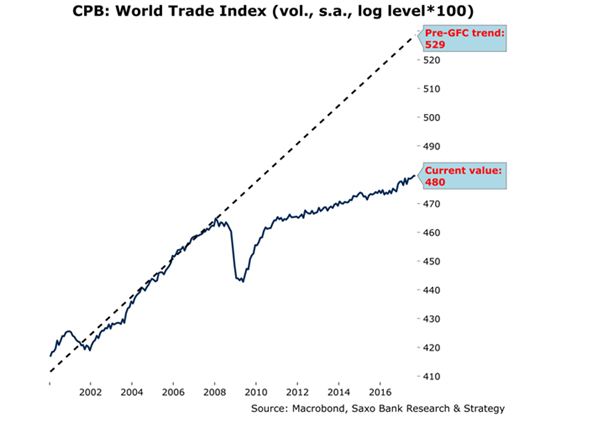

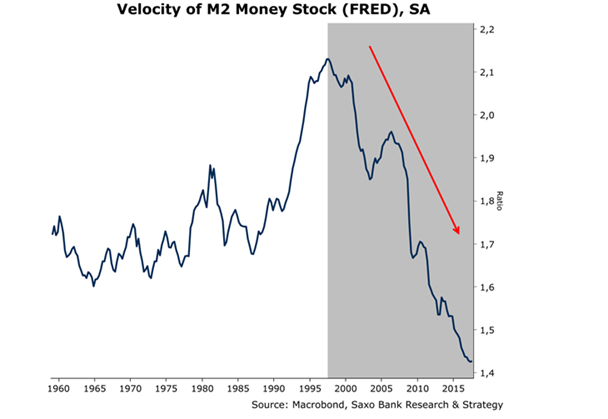

If we do what Kuznets originally suggested, and subtract finance and advertising from GDP, what does that picture -a picture of the economy as it actually is reveal? Well, since the lion’s share of growth, more than 50% every year, comes from finance and advertising -whether via Facebook or Google or Wall St and hedge funds and so on- we would immediately see that the economic growth that the US has chased so desperately, so furiously, never actually existed at all.

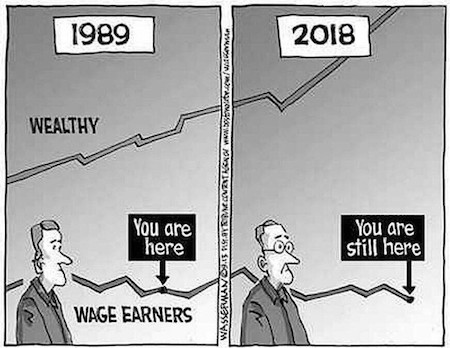

Growth itself has only been an illusion, a trick of numbers, generated by including what should have been left out in the first place. If we subtracted allocative industries from GDP, we’d see that economic growth is in fact below population growth, and has been for a very long time now, probably since the 1980s and in that way, the US economy has been stagnant, which is (surprise) what everyday life feels like. Feels like.

Economic indicators do not anymore tell us a realistic, worthwhile, and accurate story about the truth of the economy, and they never did -only, for a while, the trick convinced us that reality wasn’t. Today, that trick is over, and economies grow , but people’s lives, their well-being, incomes, and wealth, do not, and that, of course, is why extremism is sweeping the globe. Perhaps now you begin to see why the two have grown divorced from one another: economics failed the economy.

Now let us go one step, then two steps, further. Finance and advertising are no longer merely allocative industries today. They are now extractive industries. That is, they internalize value from society, and shift costs onto society, all the while creating no value themselves.

The story is easiest to understand via Facebook’s example: it makes its users sadder, lonelier, and unhappier, and also corrodes democracy in spectacular and catastrophic ways. There is not a single upside of any kind that is discernible -and yet, all the above is counted as a benefit, not a cost, in national income, so the economy can thus grow, even while a society of miserable people are being manipulated by foreign actors into destroying their own democracy. Pretty neat, huh?

It was BECAUSE finance and advertising were counted as creative, productive, when they were only allocative, distributive that they soon became extractive. After all, if we had said from the beginning that these industries do not count, perhaps they would not have needed to maximize profits (or for VCs to pour money into them, and so on) endlessly to count more. But we didn’t.

And so soon, they had no choice but to become extractive: chasing more and more profits, to juice up the illusion of growth, and soon enough, these industries began to eat the economy whole, because of course, as Kuznets observed, they allocate everything else in the economy, and therefore, they control it.

Thus, the truly creative, productive, life-giving parts of the economy shrank in relative, and even in absolute terms, as they were taken apart, strip-mined, and consumed in order to feed the predatory parts of the economy, which do not expand human potential. The economy did eat itself, just as Marx had supposed – only the reason was not something inherent in it, but a choice, a mistake, a tragedy.

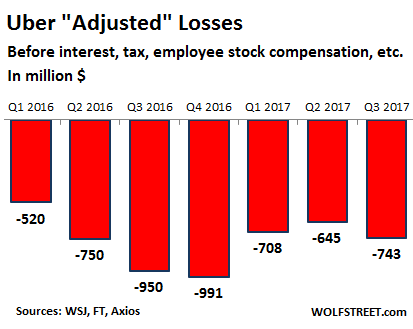

[..] Life is not flourishing, growing, or developing in a single way that I or even you can readily identify or name. And yet, the economy appears to be growing, because purely allocative and distributive enterprises like Uber, Facebook, credit rating agencies, endless nameless hedge funds, shady personal info brokers, and so on, which fail to contribute positively to human life in any discernible way whatsoever, are all counted as beneficial. Do you see the absurdity of it?

[..] It’s not a coincidence that the good has failed to grow, nor is it an act of the gods. It was a choice. A simple cause-effect relationship, of a society tricking itself into desperately pretending it was growing, versus truly growing. Remember not subtracting finance and advertising from GDP, to create the illusion of growth? Had America not done that, then perhaps it might have had to work hard to find ways to genuinely, authentically, meaningfully grow, instead of taken the easy way out, only to end up stagnating today, and unable to really even figure out why yet.

Industries that are not productive, but instead only extract money from society, need to be taxed so heavily they have trouble surviving. If that doesn’t happen, your economy will never thrive, or even survive. The whole service economy fata morgana must be thrown as far away as we can throw it. Economies must produce real, tangible things, or they die.

For the finance industry this means: tax the sh*t out of any transactions they engage in. Want to make money on complex derivatives? We’ll take 75+%. Upfront. And no, you can’t take your company overseas. Don’t even try.

For Uber and Airbnb it means pay taxes up the wazoo, either as a company or as individual home slash car owners. Uber and Airbnb take huge amounts of money out of local economies, societies, communities, which is nonsense, unnecessary and detrimental. Every city can set up its own local car- or home rental schemes. Their profits should stay within the community, and be invested in it.

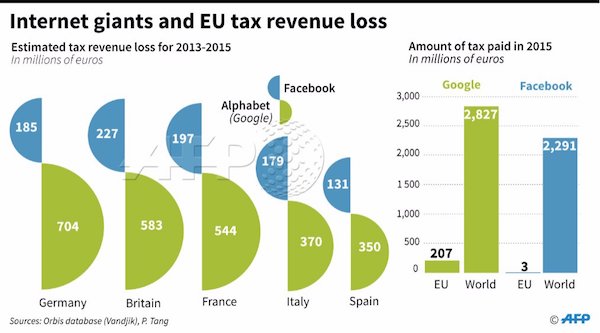

For Google and Facebook as the world’s new major -only?!- ad agencies: Tax the heebies out of them or forbid them from running any ads at all. Why? Because they extract enormous amounts of productive capital from society. Capital they, as Varoufakis says, do not even themselves create.

YOU are creating the capital, and YOU then must pay for access to the capital created. Yeah, it feels like you can just hook up and look at what your friends are doing, but the price extracted from you, your friends, and your community is so high you would never volunteer to pay for it if you had any idea.

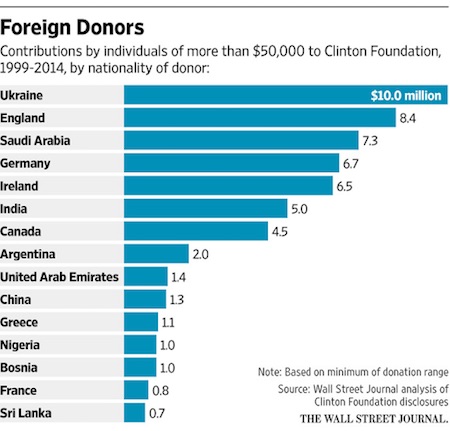

The one thing that I don’t see anyone address, and that might prevent these pretty straightforward ”tax-them-til they-bleed!” answers to the threat of New Big Tech, is that Facebook, Alphabet et al have built a very strong relationship with various intelligence communities. And then you have Goebbels and Bernays in the service of the CIA.

As Google, Facebook and the CIA are ever more entwined, these companies become so important to what ‘the spooks’ consider the interests of the nation that they will become mutually protective. And once CIA headquarters in Langley, VA, aka the aptly named “George Bush Center for Intelligence”, openly as well as secretly protects you, you’re pretty much set for life. A long life.

Next up: they’ll be taking over entire economies, societies. This is happening as we speak. I know, you were thinking it was ‘the Russians’ with a few as yet unproven bucks in Facebook ads that were threatening US and European democracies. Well, you’re really going to have to think again.

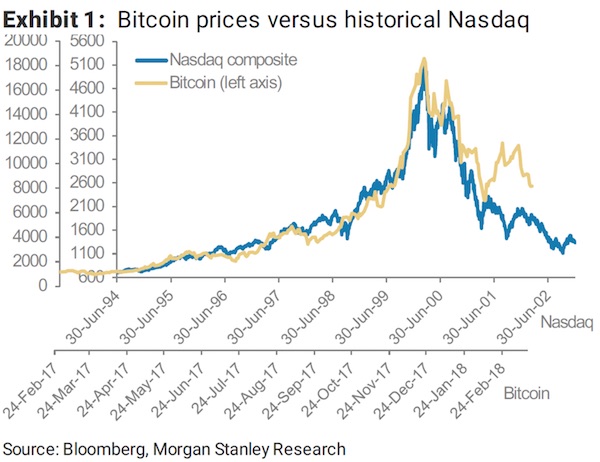

The world has never seen such technologies. It has never seen such intensity, depth of, or such dependence on, information. We are simply not prepared for any of this. But we need to learn fast, or become patsies and slaves in a full blown 1984 style piece of absurd theater. Our politicians are AWOL and MIA for all of it, they have no idea what to say or think, they don’t understand what Google or bitcoin or Uber really mean.

In the meantime, we know one thing we can do, and we can justify doing it through the concept of non-productive and extractive industries. That is, tax them till they bleed. That we would hit the finance industry with that as well is a welcome bonus. Long overdue. We need productive economies or we’re done. And Facebook and Alphabet -and Goldman Sachs- don’t produce d*ck all.

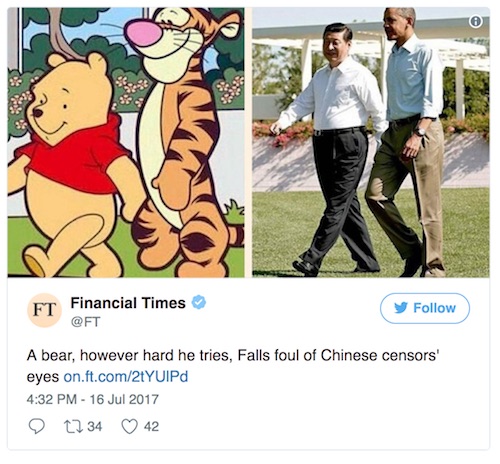

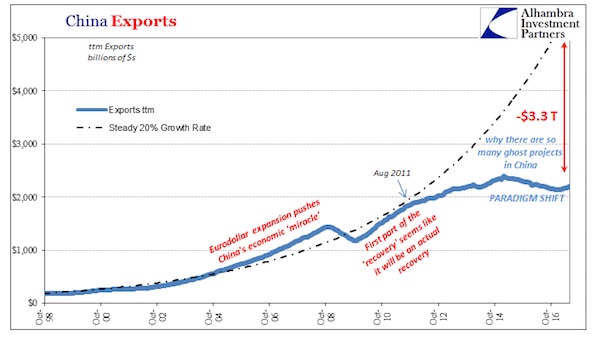

When you think about it, the only growth that’s left in the US economy is that of companies spying on American citizens. Well, that and Europeans. China has banned Facebook and Google. Why do you think they have? Because Google and Facebook ARE 1984, that’s why. And if there’s going to be a Big Brother in the Middle Kingdom, it’s not going to be Silicon Valley.