Lewis Wickes Hine Gus Hodges, 11, instructs brother Julius 5. I found Gus selling as late as 9 pm, Norfolk VA 1911

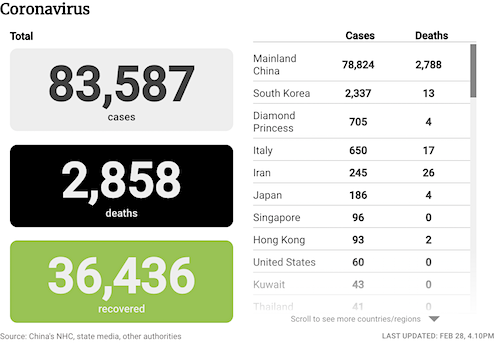

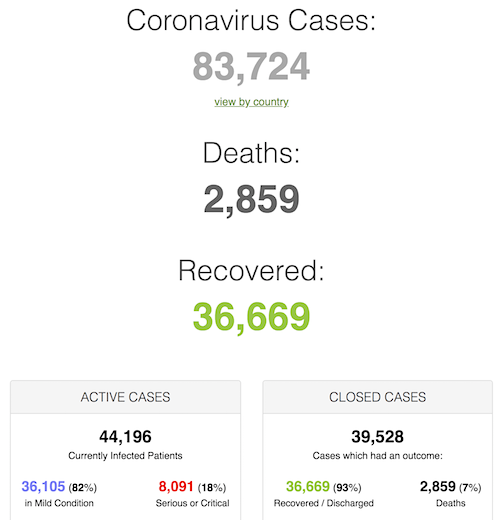

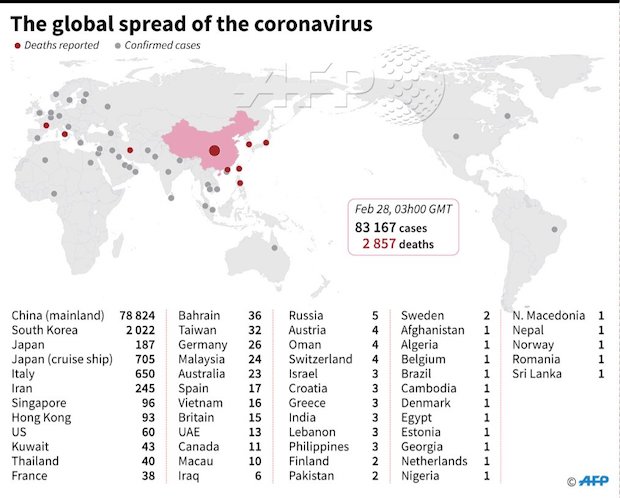

• Cases 83,733 (+ 1,314 from yesterday’s 82,419).

• Deaths 2,860 (+ 52 from yesterday’s 2,808)

• Holland (2), N-Ireland, New Zealand, Nigeria(!!), Lithuania first case

• Italy 653 cases, 17 deaths

• France 38 cases from 18 yesterday

• Germany 14 new cases, total 48

• Iran 245 confirmed cases, 26 deaths

• South Korea 256 new cases, total 2,337, over 1,000 new cases in 48 hours.

• China 327 new cases and 44 new deaths

– 180 million students homeschooled

• California 28 cases, monitoring 8400

• Greece 4 cases

• Starbucks says 85% of Chinese restaurants reopened

• Countries (Japan, UK) prepare to close down schools for months on end

From SCMP:

From Worldometer (Note: mortality rate down to 7%)

As I said yesterday: Coming to a town near you soon.

• England Only Has 15 Beds For Worst Respiratory Cases (G.)

England only has 15 available beds for adults to treat the most severe respiratory failure and will struggle to cope if there are more than 28 patients who need them if the number of coronavirus cases rises, according to the government and NHS documents. Ministers have revealed in parliamentary answers that there are 15 available beds for adult extracorporeal membrane oxygenation (ECMO) treatment at five centres across England. The government said this could be increased in an emergency. There were 30 such beds in total available during the 2018-19 winter flu season. But an NHS England document prepared in November 2017 reveals the system will struggle to cope if more than 28 patients need the treatment, describing that situation as black/critical.

It suggests that if no beds are available “within the designated and surge capacity” in the UK, they might have to be sourced from other countries, for example, from the Karolinska Institute in Sweden. ECMO treatment is used in only the most severe cases of respiratory failure when other treatments are not working. It uses an artificial lung located outside the body to put oxygen into a patient’s blood and continuously pump this blood into and around their body. It has been used to treat Covid-19 cases in China, which is ordering more machines from Germany, according to state media.

In answer to a Labour MP’s question on Thursday about coronavirus preparedness, Jo Churchill, a health minister, said: “Since April 2013, NHS England has commissioned a total of 15 adult respiratory extra corporeal membrane oxygenation beds from five providers in England, with further provision in Scotland. In periods of high demand, capacity can be increased.” Jon Ashworth, the shadow health secretary, questioned the readiness of the NHS to deal with a sharp escalation of coronavirus cases after years of cutbacks. “After years of Tory austerity, we know we’ve lost well over 15,000 beds since 2010,” he said. “We know that last week critical care bed occupancy was running at over 80%…”

https://twitter.com/TVRav/status/1232985651831812096

Curious: “..in some labs, the third step of that, they were having trouble with getting a quality control validation on that, so it led to inconclusive results,” Azar said. “We now, as of yesterday afternoon, the FDA authorized the use of those tests by using just the first and second step.”

• Diagnosis Of Coronavirus Patient In California Was Delayed For Days (NPR)

The first suspected U.S. case of a patient getting the new coronavirus through “community spread” — with no history of travel to affected areas or exposure to someone known to have the COVID-19 illness — was left undiagnosed for days because a request for testing wasn’t initially granted, according to officials at UC Davis Medical Center in Sacramento, Calif. The patient in Northern California is now the 60th confirmed case of the coronavirus in the United States. The Centers for Disease Control and Prevention disclosed the latest case Wednesday evening, as President Trump assigned Vice President Pence to lead the administration’s response to the disease.

“This case was detected through the U.S. public health system — picked up by astute clinicians,” the CDC said in a brief statement about the new patient. UC Davis included more details about the case in its own statement, drawing on an email sent to staff at its medical center. It said the CDC initially ruled out a test for the coronavirus because the patient’s case didn’t match its criteria. “UC Davis Health does not control the testing process,” the hospital noted. The new patient, who lives in Solano County and has not been identified, was transferred to UC Davis Medical in Sacramento County from another hospital this month.

Staff at UC Davis then suspected the patient might be infected with the coronavirus that has caused more than 2,800 deaths. “Upon admission, our team asked public health officials if this case could be COVID-19,” the hospital said. “We requested COVID-19 testing by the CDC, since neither Sacramento County nor CDPH [California Department of Public Health] is doing testing for coronavirus at this time. Since the patient did not fit the existing CDC criteria for COVID-19, a test was not immediately administered. UC Davis Health does not control the testing process.”

[..] The CDC has completed more than 3,600 coronavirus tests, Azar said during a congressional budget hearing on Thursday. While he said it hasn’t had a testing “backlog,” he added that the agency’s test has three steps — and that the last step has posed some problems. “What we found was that in some labs, the third step of that, they were having trouble with getting a quality control validation on that, so it led to inconclusive results,” Azar said. “We now, as of yesterday afternoon, the FDA authorized the use of those tests by using just the first and second step.”

The cost to get tested for #Coronavirus with no insurance being $3,270 is the most USA thing that could ever USA.

— Luke Barnett (@LukeBarnett) February 26, 2020

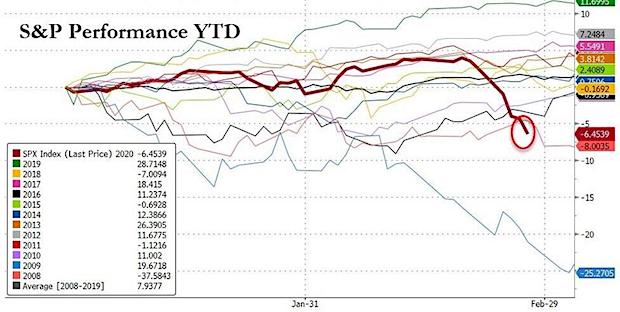

The “markets” woke up 5-6 weeks late, but now they’re clued in

• The Last Time This Happened Was Days Before The Great Depression (ZH)

The US equity market is suffering its worst start to a year since 2009…

In the space of just six days, we went from record high to a ‘correction’ (over 3,000 Dow points and down over 10.5%)…

What is most ominous is the fact that, as NatAlliance Securities reports, “This would be only the second time in history that this has happened. The other? 1928.”

In other words, the only other time the Dow Jones entered a correction this fast from an all time high was months before the start of the Great Depression.

“..the coronavirus response [is] officially an election issue now…”

• Whistleblower Claims ‘Corrupt Cover-Up’ Of Dangerous Coronavirus Quarantines (ZH)

A complaint filed with Health and Human Services (HHS) and promptly leaked to the New York Times alleges that federal health employees interacted with Americans quarantined for possible coronavirus exposure without proper medical training or protective gear, and that health agency leaders engaged in a ‘corrupt cover-up’ when staff members complained, according to the Times. Filed with the Office of the Special Counsel, a whistleblower described as a ‘senior leader’ at HHS said the team was “improperly deployed” to two California military bases to assist with processing American evacuees from coronavirus hot zones in China and elsewhere.

The staff members were sent to Travis Air Force Base and March Air Reserve Base and were ordered to enter quarantined areas, including a hangar where coronavirus evacuees were being received. They were not provided training in safety protocols until five days later, the person said. Without proper training or equipment, some of the exposed staff members moved freely around and off the bases, with at least one person staying in a nearby hotel and leaving California on a commercial flight. Many were unaware of the need to test their temperature three times a day. -New York Times

[..] The Times notes that the complaint comes right after President Trump began to downplay the risks of coronavirus on US soil “amid bipartisan concern about a sluggish and disjointed response by the administration to an illness that public health officials have said is likely to spread through the United States.” In other words, the coronavirus response officially an election issue now.

“The whistle-blower’s account raised questions about whether the Trump administration has taken adequate precautions in its handling of the virus to date, and whether Mr. Trump’s minimization of the risks has been mirrored by other top officials when confronted with potentially disturbing developments.” -New York Times

Update just in from Reuters:

“Greek woman who recently returned home from northern Italy became Greece’s fourth coronavirus case and is being closely monitored, health authorities said on Friday. The 36-year-old woman has been admitted to a coronavirus isolation unit of the capital’s Attikon Hospital.”

• Greece Reports 4 Coronavirus Cases, Cancels Carnival (K.)

Greece reported two new cases of coronavirus in the past 24 hours, bringing the total number of confirmed cases to three, and said it would suspend all carnival celebrations in the country. The health ministry said one of the cases involved a relative of a 38-year-old woman in the northern town of Thessaloniki who became the first confirmed case in Greece. The woman had recently returned from Milan in northern Italy, epicentre of the coronavirus outbreak in Europe. The third reported case, in Athens, was a female who had also visited northern Italy. Among events to be canceled is a carnival parade in the coastal city of Patra slated for March 1, authorities said.

But the Olympics are on. When you close schools, hospitals close too, because that’s where the mothers work.

• Abe Urges Japan March School Shutdown To Stem Coronavirus (R.)

Angry Japanese parents joined bewildered teachers and businesses on Friday in a rush to find new ways to live and work for a month after Prime Minister Shinzo Abe’s shock call for all schools to close in a bid to stop coronavirus spreading. Abe’s unprecedented move late on Thursday to ask local authorities to shut down their schools means students will be out of school from Monday at least until the new academic year starts in early April. Earlier this week the government urged that big gatherings and sports events be scrapped or curtailed for two weeks to contain the virus while pledging that the 2020 Summer Olympics will go ahead in Tokyo.

As of Friday, confirmed cases in Japan topped 200, with four deaths, excluding more than 700 cases and four more deaths from the quarantined cruise liner Diamond Princess. While the virus has hit China hardest so far, causing nearly 80,000 infections and almost 2,800 deaths, according to official Chinese figures, its rapid spread to a number of other countries around in the world in the past week has stoked fresh alarm. Abe’s move – issued as a formal request rather than an order – drew scathing criticism, with health officials left scratching their heads and analysts said the plan was politically motivated and made little sense.

“We’ll just have to get our revenge at the next elections,” @Ayu49Sweetfish tweeted, as working parents with young children were left wondering what to do for the duration. In the northern Hokkaido prefecture, which has seen the largest number of coronavirus cases in Japan, the governor had already announced a closure of all schools until March 4. That left one hospital closing doors to patients without reservations on Friday because about a fifth of its nurses were unable to work while their children were out of school.

They’ll close their borders to refugees and migrants but not virus carriers. Wonder what happens when Turkey is forced to report corona cases.

• EU Experts: Closing Borders ‘Ineffective’ For Coronavirus (EUO)

EU experts said on Thursday (27 February) that refusing entry to an EU country of people with coronavirus symptoms would be counter-productive and “ineffective” to prevent the spread of the virus. “Refusal of entry is not considered an appropriate preventive measure as the virus would spread further” since those potential patients would keep moving in the region without being treated, EU sources said. Instead, the experts advised having “systematic” checks for all those arriving, ensuring a coordinated approach between border guards and national authorities, as well as a real-time exchange of information. The principle of free movement of people in the EU was already in danger in 2015 when some member states introduced border check due to the migration crisis.

Today, six EU countries – Germany, France, Austria, Denmark, Sweden and Norway – still have temporary border controls to prevent irregular migrant flows. However, any member state can notify the EU authorities of the intention of closing borders temporary due to the coronavirus outbreak – a decision that can only be made by member states and that cannot be vetoed by the European Commission. None have yet done so. If national authorities decide to introduce this exceptional measure, it must be justified passing a “test of proportionality”. Additionally, the commission is working on a joint procurement to ensure there is enough protective and medical equipment for health-care workers – and other authorities like the army – over fears that the outbreak of the coronavirus could lead to a supply shortage in some member states. However, this joint initiative has not been launched yet but there is an “increasing interest” among member states to be part of it, EU sources told reporters in Brussels.

Twitter: “Turkish coastguard not patrolling as before. They just approached a boat heading to Northern #Lesbos and then they left without intercepting” a local from Skala village just told me. It seems that #Turkey‘s government meant what they said.”

• Turkey Says Can’t Contain Europe-Bound Syrian Refugees Amid Idlib Battle (RT)

Turkey is no longer able to contain millions of displaced Syrians and has reached “full capacity,” Ankara’s ruling AK party said in a fresh threat to open the floodgates into Europe as tensions over Idlib reach boiling point. With Ankara vowing to go “all in” to halt a Syrian Army offensive to retake Idlib province from rebel militias, AKP spokesman Omer Celik suggested Turkey would soon allow hundreds of thousands of Syrian refugees to pour into Europe, a threat repeatedly made by President Recep Tayyip Erdogan in the past. “Turkey can not bear the pressure of the new refugees, we now say that Turkey is at full capacity,” Celik told CNNTurk early on Friday.

While the spokesman noted Turkey’s refugee policy remains “the same,” he said “We are no longer in a position to hold refugees” amid an expected influx of newly displaced Syrians. An earlier report at Reuters cited an unnamed Turkish official who said much the same, although the official went further in stating that police, coast guard and border security officers had been ordered to “stand down” and allow the refugees to cross into Europe. Turkey and the European Union (EU) struck an agreement in 2016 in hopes of stemming the flow of refugees passing into Europe, with the EU providing some €6 billion ($6.6 billion) to help resettle the displaced people.

Erdogan, however, has slammed the multinational body time and again, insisting it has yet to hand over all of the promised aid. With at least 33 Turkish troops killed in the effort to stop Damascus’ offensive on Idlib – the last remaining militant stronghold, some of which are backed by Ankara – tensions between the two countries have reached new heights. Still engaged in intense skirmishes with militants in Idlib, the Syrian Army has signaled no intention of halting its advance, putting Damascus and Ankara on a collision course as the former fights to reclaim its territory.

Western media are reluctant to mention Russia, they want the blame to be on Assad. Russia has said that Turkey is supporting terrorists in Syria.

• Idlib Attack That Killed 33 Turkish Soldiers Was ‘Also Against NATO’ (RT)

The spokesman for Turkey’s ruling AK party has labelled the Syrian airstrike that allegedly claimed the lives of dozens of Turkish soldiers in rebel-held Idlib an attack on NATO, calling for the US-led alliance to intervene. “We call on NATO to [start] consultations. This is not [an attack] on Turkey only, it is an attack on the international community. A common reaction is needed. The attack was also against NATO,” AKP spokesman Omer Celik told Turkish media on Thursday. At least 33 Turkish soldiers are said to have been killed in Idlib, the last militant stronghold in Syria, in an airstrike Ankara blamed on Damascus. In the wake of initial reports that dozens of Turkish servicemen perished in the raid, Turkish President Receep Erdogan held a 6-hour marathon meeting that concluded early Friday.

The military bloc itself, while pledging support to its “ally Turkey,” has been wary of making any promises. Apparently shocked by reports of the Turkish casualties, US envoy to NATO Kay Bailey Hutchinson reportedly exclaimed “Oh my gosh” in response to the news when speaking to media late Thursday, but dodged the question of whether the US-led alliance would consider invoking Article 5 – which would pave the way for a collective military response to an armed attack on one of its members. However, she did not miss out on a chance to call on Turkey to tear up its deal to buy the Russian-made S-400 missile defense system, while also taking a jab at Moscow: “They see what Russia is, they see what they are doing now” – despite the fact that Ankara has not blamed Moscow for the attack.

And Pakistan. Now add a coronavirus outbreak.

• East Africa Faces New Locust Threat (R.)

Countries in East Africa are racing against time to prevent new swarms of locusts wreaking havoc with crops and livelihoods after the worst infestation in generations. A lack of expertise in controlling the pests is not their only problem: Kenya temporarily ran out of pesticides, Ethiopia needs more planes and Somalia and Yemen, torn by civil war, can’t guarantee exterminators’ safety. Locust swarms have been recorded in the region since biblical times, but unusual weather patterns exacerbated by climate change have created ideal conditions for insect numbers to surge, scientists say. Warmer seas are creating more rain, wakening dormant eggs, and cyclones that disperse the swarms are getting stronger and more frequent.

In Ethiopia the locusts have reached the fertile Rift Valley farmland and stripped grazing grounds in Kenya and Somalia. Swarms can travel up to 150 km (93 miles) a day and contain between 40-80 million locusts per square kilometer. If left unchecked, the number of locusts in East Africa could explode 400-fold by June. That would devastate harvests in a region with more than 19 million hungry people, the U.N. Food and Agriculture Organization (FAO) has warned. Uganda has deployed the military. Kenya has trained hundreds of youth cadets to spray. Lacking pesticides, some security forces in Somalia have shot anti-aircraft guns at swarms darkening the skies. Everyone is racing the rains expected in March: the next generation of larvae is already wriggling from the ground, just as farmers plant their seeds.

Popular story though.

• Not Quack-Checked! MSM Dives For ‘Chinese Duck Army’ Story (RT)

Western media have fallen hard for an apparently fake if adorable story about a 100,000-strong “duck army” China has supposedly marched to fight the billions of locusts currently laying waste to Pakistan’s food supply. Initially published by local Chinese outlet Ningbo Evening News, the clickbait-tastic story, complete with a video showing a herd of ducks supposedly marching in formation, proved impossible to resist – or to factcheck – and spread around the world by the time people started asking questions. Supposedly reputable outlets including the BBC, Bloomberg, and Time unquestioningly parroted the story about “special Chinese ducks” that would be “more effective than pesticide” – not to mention better for the environment – in taking on the ravenous swarms.

Citing Lu Lizhi, said to be a senior researcher with the Zhejiang Academy of Agricultural Sciences, the stories called the ducks a “biological weapon” and predicted they’d be unleashed against the hungry insects “as early as the second half of this year” following a test-run in China’s Xinjiang province. Alas, the story of locust-eating ducks fighting the devastating biblical plague has proved to be largely quackery, media that had covered it began realizing on Thursday. Unfortunately for Pakistan, which declared a national emergency earlier this month over the devastating infestation, an avian army is not waddling to their rescue, and even if they were, they wouldn’t do much good.

The Food and Agriculture Organization did the math and found an army of 100,000 ducks could only eat 20 million locusts in a day, while just one square kilometer of swarming locusts contains anywhere from 40 to 80 million of the insects. Also, swarms may stretch over hundreds of square kilometers, as they have in some locust-stricken areas of Africa.

Markets are falling off a cliff, and gold hardly moves. That’s what manipulation looks like.

• How Gold Is Manipulated (Rickards)

Currently the price of gold is set in two places. One is the London spot market, controlled by six big banks including Goldman Sachs and JPMorgan. The other is the New York gold futures market controlled by COMEX, which is governed by its big clearing members, also including major western banks. In effect, the big western banks have a monopoly on gold prices even if they do not have a monopoly on physical gold. The easiest way to perform paper manipulation is through COMEX futures. Rigging futures markets is child’s play. You just wait until a little bit before the close and put in a massive sell order. By doing this you scare the other side of the market into lowering their bid price; they back away.

That lower price then gets trumpeted around the world as the “price” of gold, discouraging investors and hurting sentiment. The price decline spooks hedge funds into dumping more gold as they hit “stop-loss” limits on their positions. A self-fulfilling momentum is established where selling begets more selling and the price spirals down for no particular reason except that someone wanted it that way. Eventually a bottom is established and buyers step in, but by then the damage is done. Futures have a huge amount of leverage that can easily reach 20 to 1. For $10 million of cash margin, I can sell $200 million of paper gold.

[..] Another way to manipulate the price is through gold leasing and “unallocated forwards.” “Unallocated” is one of those buzzwords in the gold market. When most large gold buyers want to buy physical gold, they’ll call JPMorgan Chase, HSBC, Citibank, or one of the large gold dealers. They’ll put in an order for, say, $5 million worth of gold. The bank will say fine, send us your money for the gold and we’ll offer you a written contract in a standard form. Yet if you read the contract, it says you own gold on an “unallocated” basis. That means you don’t have designated bars.

There’s no group of gold bars that have your name on them or specific gold bar serial numbers that are registered to you. In practice, unallocated gold allows the bank to sell the same physical gold ten times over to ten different buyers. It’s no different from any other kind of fractional reserve banking. Banks never have as much cash on hand as they do deposits. Every depositor in a bank thinks he can walk in and get cash whenever he wants, but every banker knows the bank doesn’t have that much cash. The bank puts the money out on loan or buys securities; banks are highly leveraged institutions.

How long can Biden keep this documentary under wraps?

• Biden Treated Ukraine ‘As His Private Property’ – Ex-Prosecutor Shokin (RT)

Former top Ukrainian prosecutor Viktor Shokin says he was pushed out under pressure from US Vice President Joe Biden, after he seized the assets of the oligarch behind Burisma, the gas company that employed Biden’s son. President Donald Trump’s efforts to investigate Biden’s role in getting Shokin fired served as a pretext for his impeachment in the House of Representatives back in December. However, after Trump was acquitted by the Senate, the US media forgot about Burisma — and Ukraine. French investigative journalist Olivier Berruyer, founder of popular anti-corruption and economics blog Les Crises, did not.

In the fourth installment of his documentary series ‘UkraineGate: Inconvenient facts,’ Shokin reveals why and how he was ousted and what role the US has played in Ukraine. Shokin tells Berruyer that Biden and the US government had approved his appointment as prosecutor-general — as, indeed, they did all major appointments in Ukraine since the 2014 Maidan upheaval? — and worked with him well until he started getting too close to Burisma. He rejected reports that described his probe as “dormant.” “Biden was acting on behalf of his own interests, and those of his family, and not in the interest of the American people,” Shokin said, adding that Barack Obama’s VP “believed that Ukraine was his private property, his fiefdom and that he could do whatever he wanted here.”

Within a few days of Shokin seizing the assets of Mykola Zlochevsky, the oligarch owner of Burisma, President Petro Poroshenko summoned him and told him to back off. “Don’t you understand what Biden wants from you? Why are you getting into this Burisma stuff again?” Shokin quoted Poroshenko as saying. Within a few weeks, he was replaced by someone Biden called “more solid” – Yuriy Lutsenko, who had no training in law, and whom Shokin describes as a traitor to Ukraine.

Absolutely non-partisan.

• Ethics Complaint Questions How Devin Nunes Pays For Lawsuits (Hill)

A nonpartisan watchdog group in an ethics complaint Wednesday asked Congress to investigate how Rep. Devin Nunes (R-Calif.) is paying for several ongoing lawsuits against critics. In its complaint to the Office of Congressional Ethics, the Campaign Legal Center notes Nunes’s annual congressional salary of $174,000 would likely not cover the costs of the various suits, indicating that he is either receiving free or discounted legal services or working on contingency with an attorney, all of which would require him to disclose the assistance. Nunes has yet to file a legal expense fund with the Office of Congressional Ethics. “Representative Nunes’s overt involvement with the highly-publicized lawsuits threatens to establish a precedent that the Legal Expense Fund regulations no longer apply to Members,” the complaint states. “Although Representative Nunes is entitled to legal representation and he may pursue any legal action to protect and defend his interests, he must comply with House rules,” it continued.

“An [Office of Congressional Ethics] investigation will preserve Representative Nunes’s legal right to counsel while upholding well-established House rules and precedent.” Defendants in Nunes’s lawsuits include Twitter, CNN, McClatchy and two anonymous Twitter accounts that have mocked him. The complaint also claims that even if Nunes was paying Virginia attorney Steven Biss based on contingency — meaning that should Nunes win his cases, Biss would get paid by taking a percentage the resulting award — Biss has also sent two letters demanding apologies for criticisms from Rep. Ted Lieu (D-Calif.) and Nunes’s 2017 opponent Andrew Janz. “Mr. Biss sent a letter to Representative Lieu threatening to bring an ethics complaint against him,” the complaint reads. “An ethics complaint will not result in a monetary award that could support payment under a contingency fee agreement.”

“..the arrow that flies in the night..”

• UK Mainstream Media Participate In Assange Crucifixion (Galloway)

The vast majority of the Fourth Estate in Britain either care nothing for the plight of Julian Assange, or are actively participating in his crucifixion. On the face of it, that makes no sense. If it were the intention of these journalists to actually be worthy of that name, then the proceedings in Belmarsh would be the biggest story in their world. The law being tested in the Woolwich Crown Fort would be a mortal danger to them, a dagger at their throat, a sword of Damocles hanging over their head. The prosecution made perfectly clear that the mere possession by a newspaper or a broadcaster of the foreign state secrets published by Assange would itself be a crime under the US Espionage Act, and thus they themselves open to an extradition request from a foreign state.

Though this statement was made in “open court,” virtually no msm journalist even reported it, never mind condemned it. How has this situation come about? Whatever happened to Woodward and Bernstein, to the Sunday Times devastating campaign against the Thalidomide scandal, the New York Times revelations of the Pentagon Papers? Where is the reporting about My Lai? The answer lies in the words of Francis Bacon four centuries ago, when he foretold of the impact of self-censorship: “the arrow that flies in the night” he called it. You don’t see it but it kills its quarry just the same. If Julian Assange is sent into the dungeons of America, free journalism, free speech and even democracy itself will have been murdered in plain sight. On the British mainstream media watch.

“Fitzgerald responded that Assange didn’t only seek to change US government policy, but that he succeeded.”

• Julian Assange Leaked US Files For Political Ends – Lawyers (G.)

Julian Assange’s legal team has rejected a suggestion by lawyers for US authorities that his actions were not “political offences”, arguing that the WikiLeaks founder had published classified documents to highlight human rights abuses. On the fourth day of Assange’s extradition hearing in London, before proceedings were adjourned until May, his barrister, Edward Fitzgerald QC, said the motives for publishing confidential information about Guantánamo Bay and the actions of the US military in Iraq and Afghanistan were political. Assange faces 18 charges in the US of attempted hacking and breaches of the Espionage Act over the publication of classified US cables a decade ago.

His defence argues that he should be protected from extradition because the US-UK treaty rules it out for political offences. James Lewis QC, a barrister for the US authorities, argued earlier on Thursday that Assange’s actions were not inherently political as they did not have the direct purpose of overthrowing the US government or changing US government policy. “Any bare assertion that WikiLeaks was engaged in a struggle with the US government … needs to be examined far more,” he told Woolwich crown court. Fitzgerald responded that Assange didn’t only seek to change US government policy, but that he succeeded. “WikiLeaks didn’t just seek to induce change, it did induce change,” he said, referring to the withdrawal of US troops from Iraq.

“What other purpose can there be publishing the Apache helicopter strike [video, showing the killing of 12 people] and [US] rules of engagement than to show that the war was being waged in a way that conflicted with fundamental human rights? “What other point can there be to releasing the Guantánamo Bay files than to induce a government change of policy? And the same for revealing civilian deaths in the Iraq war – [it] was to induce a change in government policy.’’

“Nearly every war that has started in the past 50 years has been a result of media lies.” ~ Julian Assange

They lied about Vietnam

They lied about Afghanistan

They lied about Iraq (twice)

They lied about Libya

They lied about #Syria

They lied about Yemenpic.twitter.com/v11ltYBzRX— Sarah Abdallah (@sahouraxo) February 27, 2020

Murray in court.

• Your Man in the Public Gallery – The Assange Hearing Day 3 (Craig Murray)

Edward Fitzgerald made a formal application for Julian to be allowed to sit beside his lawyers in the court. Julian was “a gentle, intellectual man” and not a terrorist. Baraitser replied that releasing Assange from the dock into the body of the court would mean he was released from custody. To achieve that would require an application for bail. Again, the prosecution counsel James Lewis intervened on the side of the defence to try to make Julian’s treatment less extreme. He was not, he suggested diffidently, quite sure that it was correct that it required bail for Julian to be in the body of the court, or that being in the body of the court accompanied by security officers meant that a prisoner was no longer in custody.

Prisoners, even the most dangerous of terrorists, gave evidence from the witness box in the body of the court nest to the lawyers and magistrate. In the High Court prisoners frequently sat with their lawyers in extradition hearings, in extreme cases of violent criminals handcuffed to a security officer. Baraitser replied that Assange might pose a danger to the public. It was a question of health and safety. How did Fitzgerald and Lewis think that she had the ability to carry out the necessary risk assessment? It would have to be up to Group 4 to decide if this was possible. Yes, she really did say that. Group 4 would have to decide.

Baraitser started to throw out jargon like a Dalek when it spins out of control. “Risk assessment” and “health and safety” featured a lot. She started to resemble something worse than a Dalek, a particularly stupid local government officer of a very low grade. “No jurisdiction” – “Up to Group 4”. Recovering slightly, she stated firmly that delivery to custody can only mean delivery to the dock of the court, nowhere else in the room. If the defence wanted him in the courtroom where he could hear proceedings better, they could only apply for bail and his release from custody in general. She then peered at both barristers in the hope this would have sat them down, but both were still on their feet.

In his diffident manner (which I confess is growing on me) Lewis said “the prosecution is neutral on this request, of course but, err, I really don’t think that’s right”. He looked at her like a kindly uncle whose favourite niece has just started drinking tequila from the bottle at a family party. Baraitser concluded the matter by stating that the Defence should submit written arguments by 10am tomorrow on this point, and she would then hold a separate hearing into the question of Julian’s position in the court.

From Greece.

If you read us, please support us. It’s the only way the Automatic Earth can survive. Donate on Paypal and Patreon.