Amedeo Modigliani Elvira Resting at a Table 1919

Tucker CA

Ground forces have arrived to liberate Canada- armed with nothing but a $13 haircut and a message. pic.twitter.com/fLmfGEwTJ8

— Jason James (@jasonjamesbnn) January 24, 2024

https://twitter.com/i/status/1750271296716620250

https://twitter.com/i/status/1750307168971022359

Ep. 68 Whatever happened to the truckers who dared to protest Justin Trudeau? Some of them are still in jail, years later. Trucker Gord Magill explains how darkness has descended on Canada. pic.twitter.com/pmj6Quq4Sp

— Tucker Carlson (@TuckerCarlson) January 24, 2024

Kamala

A new book describes the tense and icy relationship between Kamala Harris and Joe Biden. Author of the book, Charlie Spiering, says Kamala’s just waiting it out until Biden finally admits he can’t finish another four years. Kamala thinks she should be president and she has no… pic.twitter.com/FEFdyc3HnY

— Jesse Watters (@JesseBWatters) January 25, 2024

Gorka

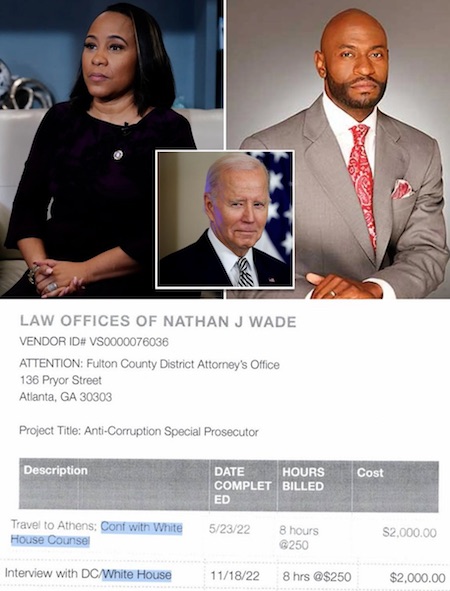

CORRUPTION: Fani Willis/Joe Biden/Pelosi conspiracy to target Trump. @SebGorka @JudicialWatch pic.twitter.com/PgLtTIqy4K

— Tom Fitton (@TomFitton) January 24, 2024

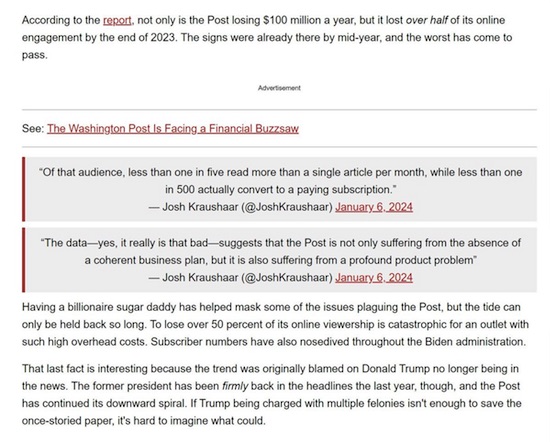

Elon BBC

Whenever you get annoyed by the media just remember this moment Elon roasted the BBC. pic.twitter.com/xNZetrPWR5

— Ian Miles Cheong (@stillgray) January 24, 2024

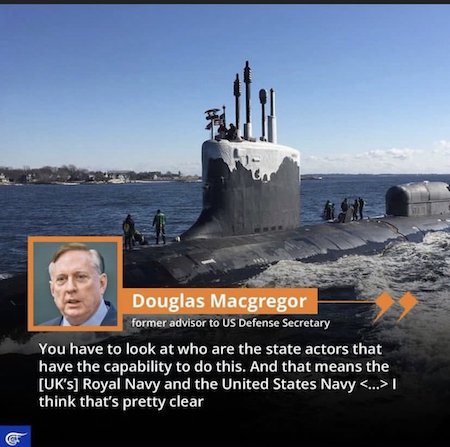

NATO

https://twitter.com/i/status/1749862196677333308

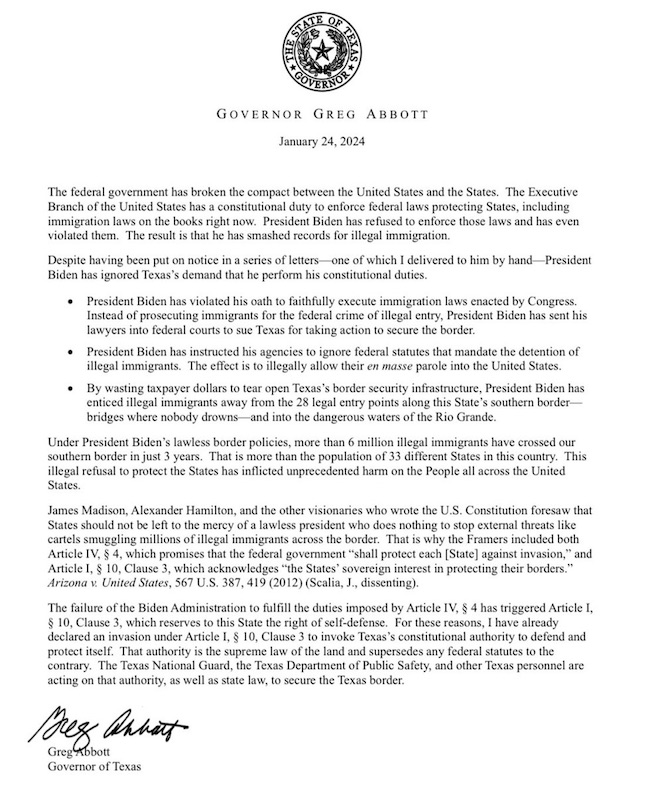

He appears to defy the Supreme Court as well.

“Florida Gov. Ron DeSantis, Virginia Gov. Glenn Youngkin, Oklahoma Gov. Kevin Stitt, South Dakota Gov. Kristi Noem, Georgia Gov. Brian Kemp, and Montana Gov. Greg Gianforte all announced that they stand with Texas and Gov. Greg Abbott.”

Note: immigration is now the no.1 issue for US voters.

• Texas Governor Defies Biden (RT)

Texas Governor Greg Abbott has refused to back down in his border-security row with US President Joe Biden’s administration, arguing that regardless of this week’s Supreme Court ruling in Washington’s favor, his duty to protect his constituents “supersedes” any federal laws. “The federal government has broken the compact between the United States and the states,” Abbott said on Wednesday in a statement. “The executive branch of the United States has a constitutional duty to enforce federal laws protecting states, including immigration laws on the books right now. President Biden has refused to enforce those laws and has even violated them.” As a result, Abbott claimed, more than 6 million illegal aliens have crossed into the US since Biden took office three years ago – exceeding the populations of all but 17 states – causing “unprecedented harm on the people all across the United States.”

The federal government’s failure to fulfill its constitutional duty has triggered a constitutional right of self-defense reserved to the state, he added. “I have already declared an invasion… to invoke Texas’s constitutional authority to defend and protect itself,” the Republican governor said. “That authority is the supreme law of the land and supersedes any federal statutes to the contrary.” Abbott issued the statement two days after the Supreme Court ruled that federal Border Patrol agents must be allowed to remove the concertina wire that the state had installed to prevent illegal aliens from crossing its border. The dispute escalated earlier this month when the Texas National Guard seized control of a park at a key border-crossing point and blocked federal officers from accessing the site.

The Texas National Guard and state troopers will continue working to secure the border, based on the state’s right to defend itself in lieu of the federal government doing its job, Abbott said. The Texas Military Department, which includes the state’s National Guard units, issued a statement on Tuesday pledging to “hold the line” to prevent illegal border crossings. “We remain resolute in our actions to secure our border, preserve the rule of law and protect the sovereignty of our state.” US Representative Chip Roy, a Texas Republican, applauded Abbott’s decision to fight Biden on the border crisis. “Washington is forcing our hand,” he said of Monday’s Supreme Court ruling. He added, “Consider that we are a nation so unserious and broken that we are paying Border Patrol to secure the border but will pay them instead to cut razor wire… to stop Texas from trying to do what Border Patrol’s core mission is.”

“..We often hear that the Supreme Court is a Republican court, but in actual fact it is a Tower of Babel Court committed to the total destruction of the United States as a nation..”

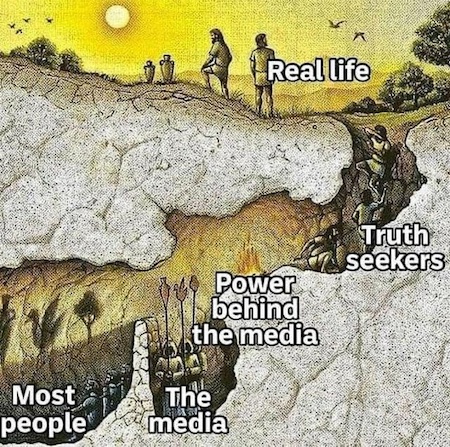

• The United States Has No Borders (Paul Craig Roberts)

I don’t know if Americans have any comprehension of what is happening to their country. I think not. I think most Americans are lost in their insouciance and in their comfortable myths about the greatness and freedom of their country. Flag waving patriots who can believe no evil of their country are the easiest to tyrannize. A plethora of July 4ths and Memorial Days have done the job. Americans are upset about foreign borders such as Ukraine’s and Israel’s, but even those few who try can do nothing about America’s own totally undefended borders. Texas tried to do something, but the US Supreme Court just ruled that Texas cannot protect its borders or the borders of the United States. The Supreme Court, ruling of course in line with the tyrant Abe Lincoln’s destruction of states rights, said the Biden Regime can destroy the fence Texas built to protect Texas’ and America’s borders.

There you have it. The so-called “civil war” did not only destroy the Confederate States of America. Lincoln’s war also destroyed the United States of America when it destroyed states’ rights. The 5-4 decision by the Supreme Court forbids Texas from protecting its borders, and thereby the borders of the United States, from being overrun by immigrant-invaders. We often hear that the Supreme Court is a Republican court, but in actual fact it is a Tower of Babel Court committed to the total destruction of the United States as a nation. What the Supreme Court, like the Biden Regime, the whore media, the anti-American Woke universities, The Rino Republicans, and the Democrat attorneys general and prosecutors are creating is a non-nation, a tower of babel that has no common interests, no common morals, no common religion, and no common agenda. This is the SATANIC CURSE of “diversity and multiculturalism.”

How did Americans fall for a program designed FOR THEIR OWN DESTRUCTION?! They fell for it because they are generous and weak-minded. The Daily Caller reports: “federal Border Patrol agents began cutting wire fences that, among other uses, helped channel individuals— unlawful migrants and U.S. citizens alike—to a lawful border crossing at a port of entry,” Texas Solicitor General Aaron Nielson wrote. “Border Patrol began this practice of destroying Texas’s property, according to the district court’s findings, in order to ‘facilitate the surge of migrants into Eagle Pass,’ using boats to ‘literally usher’ people across illegally.” In other words, the Biden Regime cut the fence in order to allow entry into the US that could not be monitored. The fence was in place to insure that immigrant-invaders had to pass through lawful border crossings, where their numbers are allegedly recorded.

But this is not enough for the Biden Regime which is intent on replacing America’s white population, which once constituted a nation, with a Tower of Babel. Why are the Biden Regime, the Democrats, the Rino Republicans, the universities, the media, the corporations, and alleged human rights organizations so determined to deprive Americans of a cohesive nation and to replace the American nation with a Tower of Babel in which there is no common culture and no common values? If white Americans are actually sufficiently braindead to have voted Biden Democrats into office, the dumbshits have committed self-suicide. People this stupid cannot expect to survive. Yesterday I got a message from the US Department of Health and Human Services. It was about Medicare. It was in 30 foreign languages.

“..widely spun myths of a “promised land,” a “land without a people,” the “only democracy in the Middle East,” and the “only secure place for Jews in the world.”

• Israel Loses Control Of Its Borders (Harb)

Israel once reigned supreme on the back of some immovable narratives: widely spun myths of a “promised land,” a “land without a people,” the “only democracy in the Middle East,” and the “only secure place for Jews in the world.” Today, those lofty soundbites lie in tatters, with the occupation state reeling from an unprecedented blow to its foundational ideas. This transformation has unfolded with unexpected intensity since the 7 October Al-Aqsa Flood resistance operation and Israel’s devastating, genocidal war on Gaza. But it is not just the challenge of narratives that has Israel on its back feet. For the first time in its 76-year history, Israel’s entire security calculations have been turned upside down: the occupation state is today grappling with buffer zones inside Israel. In past wars, it was Tel Aviv that established these “security zones” inside enemy territory — advancing Israel’s strategic geography, evacuating Arab populations near their state border areas, and fortifying its own borders.

This shift can be attributed to various factors, including vulnerabilities within the so-called “Arab Ring States” (Egypt, Jordan, Syria, and Lebanon). Throughout its history, Israel has consistently exerted military and political dominance, enforcing security measures on neighboring states, with the unconditional backing of allies like the US and Britain. But in this current war, Tel Aviv is slowly understanding that the equations and calculations of military confrontation have fundamentally changed — a process that began in 2000 when the Lebanese resistance, Hezbollah, forced Israel to withdraw from most occupied territories in southern Lebanon. Today, Israel is horrified to find itself retreating from direct confrontation lines with its arch-enemies in Gaza and Lebanon. The formidable capabilities of the resistance now include drones, rockets, targeted projectiles, tunnels, and spanking new shock tactics, casting doubt on the feasibility of Israeli settlers remaining safe in any of Israel’s border perimeters.

There is now one common refrain among settlers in the north and south of occupied Palestine: “We will not return unless security is restored on the border.” But prospects for their return appear elusive at present. The Israeli Defense Ministry, which pledged a swift and decisive war to safeguard its settlers over 100 days ago, is now actively devising plans to shelter approximately 100,000 people along the northern border, deeper inside its territory. This measure could involve evacuating settlements that may come under fire during any future military escalation with Hezbollah in Lebanon. This situation implies three critical outcomes: any immediate return of settlers remains unlikely, additional evacuations are anticipated, and numerous Israeli families – in the interim – may establish permanent settlements in other, more secure locations at a much further distance from the borders with southern Lebanon and the Gaza envelope.

Channel 13

An Israeli journalist from Channel 13 News, refuted claims made by the military regarding alleged crimes committed by Hamas, which were published around the world.

The journalist highlighted a particular incident involving the Kfir Brigade commander, who spoke to another channel… pic.twitter.com/8QuAmFpMv9

— Middle East Eye (@MiddleEastEye) January 24, 2024

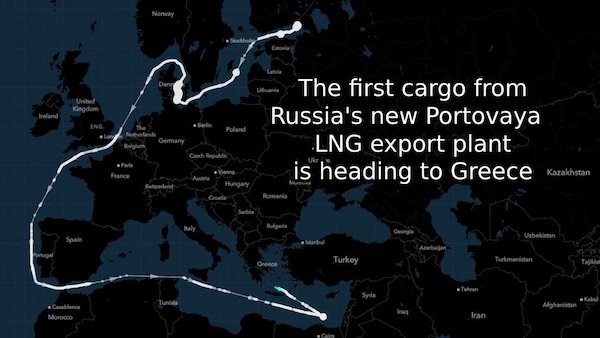

“..there had been another IL-76 carrying 80 more Ukrainian POWs in the sky at the time of the incident. This plane was turned around after the crash..”

• Ukraine A ‘Terrorist State’ – Senior Russian MP (RT)

Ukraine should be designated as a terrorist state, and the government in Kiev should be branded a terrorist cell, the head of the State Duma Defense Committee Andrey Kartapolov has said, following the crash of an IL-76 military aircraft in Russia’s Belgorod Region. Earlier on Wednesday, the Russian military transport plane crashed near the village of Yablonovo, around 90km from the Ukrainian border. It was carrying 65 captured Ukrainian military personnel for a prisoner swap, as well as six crew members and three people accompanying the POWs. It is believed that there were no survivors.

According to Kartapolov, Kiev was well aware of who this plane was transporting and accused the Ukrainian forces of shooting down the aircraft using what he claimed were “three Patriot or Iris-T air defense missiles.” He also noted that there had been another IL-76 carrying 80 more Ukrainian POWs in the sky at the time of the incident. This plane was turned around after the crash, the MP said. Regarding the exact details of the incident, Kartapolov said “specialists will figure this out later,” but noted that Kiev had demonstrated an unbelievable degree of cynicism by destroying its own soldiers.

“There can be no negotiations with these ‘people,’” he said, calling on the international community to open its eyes and realize who it is trying to help. Ukrainian media have also reported that the country’s military destroyed the plane, citing government sources. Ukrainskaya Pravda, however, claimed that the aircraft had been transporting S-300 air defense missiles rather than prisoners. Some time after its initial report, the newspaper removed the reference to Kiev’s role in the incident, stating only that its military sources had confirmed the crash.

The Ukrainskaya Pravda newspaper first said the plane was filled with missiles. That piece was swiftly deleted.

• Time For West To Realize It Is Helping Nazis – Top Russian MP (RT)

US and German lawmakers must finally realize that by sending weapons to Kiev, they are helping a “Nazi regime” that has stooped to knowingly killing dozens of its own prisoners of war, Russian State Duma Chairman Vyacheslav Volodin said on Wednesday. The lawmaker’s comments came shortly after the Russian Defense Ministry reported the crash of an IL-76 cargo aircraft carrying 65 captured Ukrainian service members, as well as several crew and accompanying personnel, in Belgorod Region bordering Ukraine. The soldiers were being transported to the area to be exchanged, officials said. Russian MP Andrey Kartapolov claimed that Kiev knew about the impending exchange and the flight route, but attacked the plane anyway.

“So that they can finally see who they are funding.”

After the Il-76 crash, State Duma Chairman Vyacheslav Volodin said that members of foreign parliaments must finally realize their responsibility and understand that they are helping the N@zi regime. Thanks for sharing:… pic.twitter.com/hjQb2VJBBT

— Zlatti71 (@djuric_zlatko) January 24, 2024

He stated that the IL-76 had been downed by three missiles fired from either a US-made Patriot or German-made IRIS-T air defense system, and suggested that further prisoner exchanges were out of the question for the time being. Commenting on the tragedy, Volodin advised the Russian parliament to draft an appeal to the US Congress and German Bundestag, so that those lawmakers could “finally understand who they are funding.” “This is a Nazi regime, nurtured by [US President Joe] Biden, [French President Emmanuel] Macron, [German Chancellor Olaf] Scholz… they must understand their responsibility,” he added, urging Western legislators to impeach the aforementioned leaders.

Volodin claimed that Kiev had shot down its own troops in mid-flight: “Their mothers, wives, and children were waiting for them. They also killed our pilots… defenseless, who were on a humanitarian mission, using American and German missiles.” Russia has repeatedly condemned Western arms deliveries to Ukraine, arguing that they only prolong the conflict. Officials in Moscow have also said that Kiev is actively using Western-supplied munitions to target civilian infrastructure both in Donbass and elsewhere.

“..these non-Ukrainian citizens are not protected by international humanitarian law and that Moscow has already made it clear that, if captured, they will be judged as neo-Nazi mercenaries..”

• French Mercenaries Dying in Ukraine (SCF)

Recently, Russian forces bombed military facilities in Kharkov, killing more than sixty foreign mercenaries, most of them French. The case gained great attention in the media for showing the high participation of foreign troops in hostilities against Russia, which makes it clear that NATO countries are participating in the conflict in an intense way, not only with the mere sending of money and weapons.The incident in Kharkov resumed discussions on the topic of the presence of foreign mercenaries on Ukrainian soil. Since the beginning of the special military operation, non-Ukrainian citizens have often died on the battlefield when fighting on Kiev’s side. Russia has already made it clear that eliminating enemy mercenary troops is one of its top priorities, which is why attacks like this recent one will continue to happen until foreigners stop arriving in Ukraine.

There are several reasons why mercenary soldiers enlist to fight in Ukraine. There are those militants who are ideologically committed to the ultranationalist ideology of the Kiev regime, who join the Ukrainian forces in “solidarity” with the neo-Nazi dictatorship. There are those ordinary citizens, mainly from emerging countries, who are attracted by the opportunity of a job in the military field, being induced to enlist. And there are also professionals from the private military sector who are hired by the Ukrainian state or Western countries to conduct operations in Ukraine. All these foreign troops play a vital role in the Western-Ukrainian war efforts. Foreigners help compensate Kiev for its losses, as they replace native fighters who perish in combat. At the same time, these soldiers, especially those from NATO countries, help the Western bloc acquire real direct combat experience with Russian forces – preparing the alliance for a possible future scenario of total war.

Currently, the Atlantic military alliance cannot send official troops to Ukraine, as this would represent the start of a direct war with Moscow. The real meaning of the conflict in Ukraine is precisely the use of Kiev as a proxy to wage war against Russia, however this could change in the future. As Ukraine rapidly loses and anti-Russian paranoia in the West continues to grow, it is possible that the situation will become out of control at some point. In this sense, one way for Western countries to prepare is by sending unofficial troops to the Ukrainian battlefield, where frictions with the Russians are already occurring. These soldiers tend to pass on field experience and data to officers in their countries, which is why they must be considered especially dangerous, with their elimination being a priority for Moscow.

However, one detail that draws attention in the recent case of Kharkov is the strong presence of French citizens among the mercenaries. In fact, there are undoubtedly many French nationals fighting for the Ukrainian regime. Last year, Paris’ intelligence admitted that at least 400 French fighters were on the Ukrainian front – around thirty of them being known neo-Nazi criminals. Considering that these are public data exposed by the French government itself, it is possible to say that the real number may be much higher. Paris is believed to be secretly encouraging large numbers of mercenaries to join Kiev’s forces, especially after political events in the African Sahel. With the recent wave of pro-Russian revolutions in African countries, the French sphere of influence on that continent has been severely diminished.

Paris appears to be trying to “compensate” for its frustration in Africa with massive support for Kiev, sending large numbers of mercenaries to defend the regime. This is also the opinion of Stevan Gajic, an analyst at the Institute of European Studies in Belgrade, who recently said in an interview that Macron is “hysterical” about Russia. Gajic believes that the French president’s recent speeches in Paris and Davos, calling for a “victory” against Russia, show how fanaticized he is in his anti-Russian hatred. Gajic stated that Paris is “especially frustrated” after the wave of revolutions in Africa and that he thinks “that’s another motive for such feverish support of the Ukrainian cause, and NATO’s cause against Russia”.

However, any kind of support for the Ukrainian regime is becoming embarrassing for the West itself. Just as NATO’s weapons are destroyed every day on the battlefield, foreign mercenaries are frequently targeted and neutralized. Instead of “wearing down” Russia or training its citizens for direct war in the future, the West is only losing influence and being demoralized. Furthermore, with massive deaths on the front lines, the tendency is for fewer and fewer mercenaries to accept fighting for Kiev. It is also important to remember that these non-Ukrainian citizens are not protected by international humanitarian law and that Moscow has already made it clear that, if captured, they will be judged as neo-Nazi mercenaries – in the same way that has happened with militants from fascist organizations such as the Azov Battalion.

“..the sources are considering importing North Koreans to fill the manpower gap..”

• The Plan For Reviving Donetsk (Helmer)

There is no lack of confidence in Donetsk that the war will be won, but no conviction when exactly that will be. A Ukrainian heavy artillery salvo hit the Kirovsky district market, on the western outskirts of Donetsk city on Sunday, killing at least 27 people, and wounding about as many. The New York Times reported falsely “it was not possible to independently confirm which side launched the strike.” The reaction in Donetsk, and also in Moscow, is that the incident triggers serious questioning of how the Russian military operations can be failing still to drive long-range Ukrainian artillery, rockets and missiles far enough westwards to protect the civilians of Donetsk region; and also the three other accession regions of expanded Donbass; as well as the Russian border regions to the north of Belgorod, Bryansk, and Kursk.

The daily operations briefing and bulletin from the Ministry of Defense in Moscow are reporting exceptionally high casualty rates for the Ukrainian side – 860 last Thursday; 1,005 on Monday; 700 on Tuesday. The bulletin, which is blocked on the internet in many of the NATO allied states, also reveals a rising toll on the US and NATO-supplied long-range guns, and a changing ratio for Russian army operations each day from defence to offence. Still, sources in Donetsk and Moscow acknowledge that although the pace and impact of Russian operations along the line of contact have been growing in recent days, the east-to-west depth of the demilitarized zone required for long-term security remains a hope and military ambition — not yet the reality on the ground, or in the economy of Donetsk.

Donetsk business sources say they are actively planning for the reconstruction of the region’s mining and metals fabrication industries, and they are negotiating terms of financial assistance for both with the federal authorities, as well as the regional administration. The sources said this week they are sure that in the plans now being discussed there will be no return of the Ukrainian oligarchs who controlled Donetsk’s economy in the past, especially Rinat Akhmetov, Igor Kolomoisky, and Victor Pinchuk. The Donetsk sources said the most pressing problem at the moment is the lack of manpower to return from the fighting to work; the sources are considering importing North Koreans to fill the manpower gap. For the longer term, the conviction in Donetsk is that there will also be no return of the criminal gangs who had dominated the local economy in parallel with, and accommodated by the oligarchs. “From the Russian side,” said a business figure in the steel industry, “I am sure the recovery and reconstruction will be done with a heavy hand. No mafia.”

“..That is like using a howitzer to shoot a duck..”

• US Has Lost Race for Hypersonic, Directed Energy Weapons – Senator (Sp.)

The United States has already lost the race to develop hypersonic and directed energy weapons to its rivals, Independent Senator Angus King said during a hearing of the US Senate Armed Services Committee on Tuesday. “We are woefully behind on the issue of directed energy,” King said. “On hypersonics and directed energy, we have lost the race or we are badly losing the race. We have a lot of catching up to do. This should be a hair on fire catching up priority.” In the Red Sea, the US Navy was currently forced to use multi-million dollar missiles to shoot down inexpensive drones fired by the Houthi rebels in Yemen that cost less than 1% of the price of the US systems, King said.

“The missiles we are using are costing $2 million to $4 million each. That is like using a howitzer to shoot a duck,” King added. Earlier on Tuesday, the National Defense Industrial Association and the Emerging Technologies Institute said in a new report that the Biden administration and the Defense Department had failed to give US business and industry the clear direction and leadership it needs to develop directed energy weapons systems and as a result it will not be able to produce such weapons for a long time to come.

“Moscow bears no responsibility for US-Russia relations reaching an all-time low, Russian Foreign Minister Sergey Lavrov has said..”

• Moscow Won’t Beg ‘Uncle Sam’ For Forgiveness – Lavrov (RT)

Moscow bears no responsibility for US-Russia relations reaching an all-time low, Russian Foreign Minister Sergey Lavrov has said, insisting that the burden of restoring them lies solely with Washington. Relations between the US and Russia went into a tailspin after the start of the Ukraine conflict in February 2022, with Moscow condemning Washington and other Western countries for introducing unprecedented sanctions and sending weapons to Kiev. The Kremlin argues the deliveries will only prolong the conflict but not change its outcome. Another major issue in bilateral relations has been NATO’s creeping expansion toward Russia’s borders, which Moscow views as an existential threat. Russia has said that Ukraine’s desire to join the US-led military bloc was one of the main reasons for the current conflict.

In an interview with CBS News on Monday, when asked about the potential for improving relations between Moscow and Washington amid the stand-off over Ukraine, Lavrov stressed that Russia would not take the initiative to repair them because it was not his country that spoiled them in the first place. We are not going to… run to Washington: ‘Uncle Sam, please forgive us. We were bad boys.’ We have nothing to complain about. The minister stressed that the ties between the two powers were shattered by “those who invented the Russian threat” and “those who ignored huge amount of goodwill shown by President Vladimir Putin during his first two terms.” According to Lavrov, Western policymakers decided that the Russian leader was “so nice,” and tried to “keep him in [their] pocket,” which was a mistake.

Lavrov went on to regret that the current generation of politicians in Washington had seemingly drawn no lessons from what he described as “unacceptable policies which the United States started to promote” in the early 1990s. The minister’s comments come after Putin admitted last month that he was a “naive” person early in his political career because he believed that there was no fundamental reason for Russia and the West to be at odds after the collapse of the Soviet Union. However, he said that he later realized that Western countries were seeking to bring about the partition of Russia into several entities in order to gain more global influence.

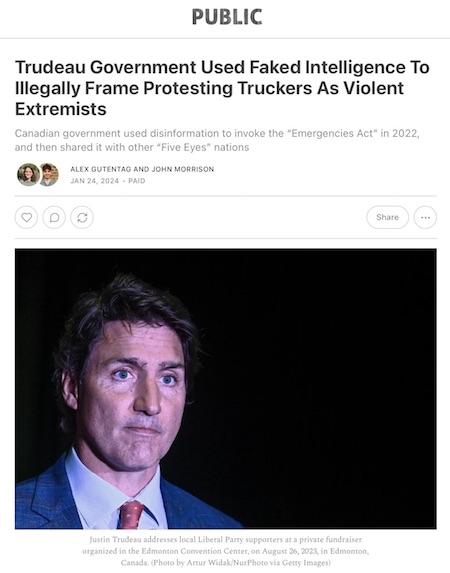

“The characterization of political critics as terrorists has long been a signature of authoritarian governments..”

• Court Declares Trudeau’s Crackdown on the Truckers to be Unlawful (Turley)

Two years ago, I wrote a column denouncing Canadian Prime Minister Justin Trudeau’s use of a counter-terrorism law to shut down the Freedom Convoy trucker protests as an authoritarian attack on free speech. Now, a Canadian court has agreed and ruled that the use of the Emergencies Act was unlawful and “unreasonable.” Despite Trudeau’s attacks on civil liberties, he remains a favorite of the media as an iconic figure on the left. Various civil liberties groups have opposed the iron-handed measures of Trudeau, including The Canadian Civil Liberties Association and the the Canadian Constitution Foundation. The characterization of political critics as terrorists has long been a signature of authoritarian governments. The Canadian Parliament actually extended those powers, dismissing civil liberties concerns. Fortunately, despite the actions of Trudeau and the Parliament, there is an independent court system in Canada.

The use of the Emergencies Act allowed the government to arrest the leaders of the Freedom Convoy, freeze bank accounts of protesters, and seize donations of other citizens. Trudeau simply declared that the protesters were “threats to the security of Canada that are so serious as to be a national emergency.” In his ruling, Justice Richard Mosley wrote: “I have concluded that the decision to issue the Proclamation does not bear the hallmarks of reasonableness – justification, transparency and intelligibility – and was not justified in relation to the relevant factual and legal constraints that were required to be taken into consideration.” Trudeau merely cited the potential for violence without any compelling support for an imminent risk of violence. The court declared: “The potential for serious violence, or being unable to say that there was no potential for serious violence was, of course, a valid reason for concern. But in my view, it did not satisfy the test required to invoke the Act particularly as there was no evidence of a similar “hardened cell” elsewhere in the country, only speculation.”

In many ways, the court stated the obvious, but this was an obvious point that other courts and a majority in Parliament ignored: “I agree with the Applicants that the scope of the Regulations was overbroad in so far as it captured people who simply wanted to join in the protest by standing on Parliament Hill carrying a placard. It is not suggested that they would have been the focus of enforcement efforts by the police. However, under the terms of the Regulations, they could have been subject to enforcement actions as much as someone who had parked their truck on Wellington Street and otherwise behaved in a manner that could reasonably be expected to lead to a breach of the peace. [309] One aspect of free expression is the right to express oneself in certain public spaces. By tradition, such places become places of protected expression…To the extent that peaceful protestors did not participate in the actions of those disrupting the peace, their freedom of expression was infringed.”

Bravo.

https://twitter.com/i/status/1750227176773841104

https://twitter.com/i/status/1750299455532798201

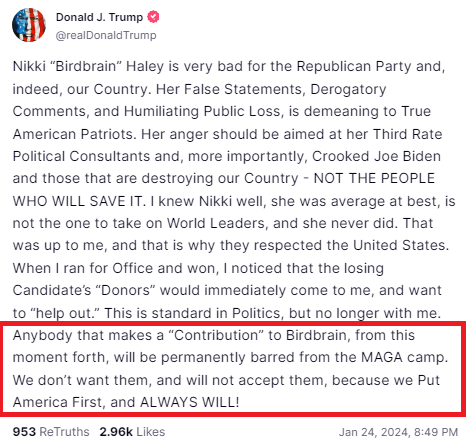

“..about 7 in 10 said they were registered as undeclared prior to Tuesday.”

• 70% of Nikki Haley Voters Not Registered Republicans (BB)

Nikki Haley relied heavily on the support of Independents and Democrats in the New Hampshire primary yet still lost by wide margins. Of Haley voters in the Granite State, CNN said, “about 7 in 10 said they were registered as undeclared prior to Tuesday.” CNN relied on an exit poll to make its shocking statement. New Hampshire’s loose requirements allow for voters to cross over, while future Republican caucuses and primaries will consist overwhelmingly of registered Republicans. Trump crushed Haley in the New Hampshire primary by double digits with results still outstanding. The Associated Press called the New Hampshire results within three minutes. In Iowa, where Trump won by a historic thirty percent, it took the Associated Press 31 minutes to call the race. Trump’s path to the nomination seems all but inevitable after his crushing victory. Sens. John Cornyn (R-TX) and Debbie Fischer (R-NE) endorsed Trump within minutes of his victory.

How to save Boeing this time? Who still feels safe in a 737 MAX? Also, a few days ago a wheel came off a 757 on a runway just seconds before take off.

• Alaska Airlines Finds Loose Bolts On “Many” Boeing Jets (RT)

Alaska Airlines, the US air carrier whose Boeing 737 MAX 9 jet suffered a midair blowout earlier this month, triggering a nationwide grounding of the model for safety inspections, has confirmed that it has found loose bolts on “many” of the planes in its fleet. ”It makes you mad that we’re finding issues like that on brand new airplanes,” Alaska Airlines CEO Ben Minicucci said on Tuesday in an NBC News interview. He added, “I’m more than frustrated and disappointed. I’m angry. This happened to Alaska Airlines. It happened to our guests and happened to our people.” Minicucci was referring to a January 5 flight bound for California from Portland, Oregon, that had to turn back after a door plug blew off at 16,000 feet, injuring several of the 171 passengers aboard.

The outcome could have been far worse, he said, had the seat next to the door plug not been vacant – one of just seven empty seats on the flight. “We had a guardian angel, honestly, on that airplane.” The US Federal Aviation Administration (FAA) responded to the near-catastrophe by grounding all Boeing 737 MAX 9 jets in the country for safety checks. The latest incident follows the temporary banning of the 737 MAX, Boeing’s top-selling airliner, by aviation regulators around the world in March 2019, after crashes in Ethiopia and Indonesia killed a combined 346 people. The planes were cleared to go back into service around two years later, following repairs to their flight control systems. Minicucci said Alaska Airlines will send auditors to scrutinize the quality-control systems at Boeing to ensure that all of the jets it has ordered from the company are safe to fly. He added that the carrier will reconsider plans to buy a newer version of the 737, the long-delayed MAX 10, from Boeing.

Boeing issued a statement to NBC acknowledging that “we have let down our airline customers and are deeply sorry for the significant disruption to them, their employees and their passengers.” The massive defense contractor added that it’s taking steps to get the 737 MAX 9s back into service and improve its quality performance. Like Minicucci, United Airlines CEO Scott Kirby is rethinking plans to buy more Boeing jets following the latest safety scare. United also detected loose bolts when it performed safety inspections of its grounded 737s. “I think the MAX 9 grounding is probably the straw that broke the camel’s back for us,” Kirby said on Tuesday in a CNBC interview. He added that Boeing needs “real action” to restore its reputation for quality.

“..Russia, China, and Iran view the WEF as an ally in the destruction of the West. This is a mistake..”

• Satan’s Agent: The World Economic Forum (Paul Craig Roberts)

The World Economic Forum is the worst source of disinformation in the world. Even the name is disinformation as it is not a world forum representing the world. It is a group of stupid American and European corporate executives who have been conned by Klaus Schwab, the world’s worst ego-manic, into believing that you don’t count until you are a member and devote of the WEF. Schwab has sold the executive class the line that WEF attendees are members of the most prestigious country club and are members of a privileged caste that exists so far above “useless eaters” that the goal of culling the world population by 7.5 billion people is not shameful. At the recent WEF meeting in Davos, Switzerland, Schwab and his devotees took a hit broadside from Jaier Milei, the newly elected president of Argentina.

Milei told them that the Western world is in danger because the West’s leaders had abandoned freedom and adopted collectivism. Milei was talking about the WEF. Either he is a very brave man or he did not realize to whom he was speaking. I expect that he will have an “airplane accident” or be pushed out of office by some concocted charges from Washington. Washington’s diminishing influence and power has encouraged other long silent voices in Latin America to speak up. The distinguished Peruvian, Dr. Victor Andres Belaunde Gutierrez, took up Milei’s theme and unloaded on the WEA groupies as disgraceful and shameful: “The demonstrations of frivolity and intellectual mediocrity that the famous forum emits are increasingly scandalous. For example, the impression that the prostitute traffickers make during these meetings – why not some orgies while we save the world with 2100 euro-a-night women?”

“The pitiful spectacle of a supposed witch, sorceress, or God knows what, emitting sounds and spitting on the faces of some panelists, is decidedly pathetic. I cannot conceive how a person who has any notion of self-respect, would tolerate being a part of pranks of that caliber. Can people who willingly participate and applaud such farces be recognized as serious?” “Have they no shame? Is it that their need to belong to the cool people of the planet is so powerful? – Is it that the cool and sophisticated is now inevitably ridiculous and shameful?” The WEA is an anti-human cult devoted to the destruction of freedom and human life. In my opinion, it would be wondrous if the next time the collection of stupid and evil beings assemble, Russia, China, or Iran would launch a missile attack that completely destroys the WEF.

They won’t because Russia, China, and Iran view the WEF as an ally in the destruction of the West. This is a mistake, because the Russian, Chinese, and Iranian populations are also fated to be culled. Judging by the effort of the World Health Organization, the WEF’s ally, to centralize in its hands the health protocols of the entire world and its forecast of a doomsday pandemic, the culling device will be a biowarfare pathogen released on the world. No Western legislature is doing anything to shut down the illegal labs. As Russia knows where many of the illegal biowarfare laboratories are located, Russia should take them out with missile strikes. Evil has to be confronted and overcome or evil will prevail. Evil has already recruited the corporate and political leadership of the Western world. How much more advantage shall we permit Evil before we are overcome?

Newman

"I think the dam is finally cracking."

Award-winning journalist, Alex Newman, explains why the "human-induced climate change" narrative is finally crumbling.

"Three new peer-reviewed papers, published in major prestigious scientific journals… completely undermine the alleged… pic.twitter.com/tgGxwM4be6

— Wide Awake Media (@wideawake_media) January 24, 2024

Dead vax

— healthbot (@thehealthb0t) January 24, 2024

Assange Stone

Day X is here: the last chance in the British courts to stop Julian Assange’s extradition

Protest to defend a free press.

Tuesday 20 February and Wednesday 21 February

Time: 8.30am

Place: Royal Courts of Justice, the Strand, London WC2A 2LL (nearest tubes Holborn and Temple)… pic.twitter.com/vSNtCiBql3— Free Assange – #FreeAssange (@FreeAssangeNews) January 24, 2024

Love cats

https://twitter.com/i/status/1750145213509578961

Love

https://twitter.com/i/status/1750170343036088672

TigerIce

https://twitter.com/i/status/1750196777662230833

King in the mist

The King in the mist pic.twitter.com/swdEHUumU0

— Nature is Amazing ☘️ (@AMAZlNGNATURE) January 25, 2024

The Karakoram Highway, connecting Pakistan to China, is one of the highest paved roads in the world, at maximum elevation of 4,714 m. It is often referred to as the Eighth Wonder of the World.

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.