DPC Foundry, Detroit Shipbuilding Co., Wyandotte, Michigan 1915

Yay! Imagine yourself on a sleigh going down a steep slope.

• WTI, Brent Oil Sink Under $30 (FT)

At pixel time: WTI is at $29.67 per barrel, down 4.9% to a new 12-year low. Brent, meanwhile, is down 3.31% to $29.87. This is doing oily currencies no favours, on which more shortly. It’s unhelpful even to less oily currencies too; Barclays for example trimmed its inflation outlook for the UK based in part on the slide in oil. It also shoved out its expectation for the first UK rate rise to the fourth quarter of this year, from the second. Sterling trades at $1.4344 right now, a new five-and-a-half year low.

Last hour or so.

• China Stocks Enter Bear Market as State-Fueled Rally Evaporates (BBG)

Chinese stocks fell into a bear market for the second time in seven months, wiping out gains from an unprecedented state rescue campaign as investors lose confidence in government efforts to manage the country’s markets and economy. The Shanghai Composite Index sank 3.5% to 2,900.97 at the close, falling 21% from its December high and sinking below its nadir during a $5 trillion rout in August. Friday’s decline was attributed to persistent investor concerns over volatility in the yuan and a report that some banks in Shanghai have halted accepting shares of smaller listed companies as collateral for loans. “The market entered a disaster mode at the start of the year and it’s still in that pattern now,” said Wu Kan at JK Life Insurance in Shanghai.

“The market has completely no confidence and the basic reason is that stocks are expensive, particularly those small caps,” he said, adding that he plans to swap large-cap shares for small caps. The selloff is a setback for Chinese authorities, who have been intervening to support both stocks and the yuan after the worst start to a year for mainland markets in at least two decades. As policy makers in Beijing fight to prevent a vicious cycle of capital outflows and a weakening currency, the resulting financial-market volatility has undermined confidence in their ability to manage the deepest economic slowdown since 1990. [..] “The bottom has fallen out of the market in the last two weeks,” said Francis Lun at Geo Securities in Hong Kong “Investors have lost confidence after two weeks of meddling by government officials.”

Contagion.

• Asia Shares Hit 3-1/2-Year Lows As Oil Resumes Fall (Reuters)

Asian stocks surrendered earlier gains to hit 3-1/2-year lows on Friday as renewed pressure on oil prices and disappointing Chinese data kept investors on edge. MSCI’s broadest index of Asia-Pacific shares outside Japan declined 0.3% to the lowest level since June 2012, and was on track for a loss of 2.7% for the week. Japan’s Nikkei rose 0.7%, but was set for a weekly loss of 1.9%. Oil prices rebounded on Thursday, with international benchmark Brent futures rising 2.4% to $31.03 a barrel, recovering from its 12-year low of $29.73 hit earlier in the day. But that rally, largely driven by short-covering after a 20% fall since the start of year, proved to be shortlived. The collapse in oil prices has spooked financial markets as investors worried about the health of the global economy, with a slowdown in China and volatility in its markets making for a nervous start to the year.

“Market sentiment was cautious to begin with, as overnight gains in US equities were complicated by losses by European indices,” said Bernard Aw, market strategist at IG in Singapore. “Furthermore, oil prices were under pressure once again, constraining any relief rally in energy and material stocks.” Brent crude opened weaker on Friday and lost 0.6% to $30.69. U.S. crude fared even worse, slumping 1.8% to $30.63 as the prospect of additional Iranian supply looms over the market. It had posted the first significant gains for 2016 in the previous session. Stocks in China also returned to negative territory after a brief rebound in late trading on Thursday. The bounce – which saw the Shanghai Composite index reverse an earlier fall to a 4 1/2 month low to end 2% higher – raised suspicions among dealers that a “National Team” of investors, who participated in a rescue when markets plunged in August, had been behind the move again.

It only gets worse.

• A Towering Chinese Debt Mountain Looms Over Markets (BBG)

Lost in all the Chinese stock and currency market gyrations, policy missteps and mixed data is this economic reality: The government is constrained by a credit bubble that has ballooned to $28 trillion in an economy growing at its slowest pace in 25 years. Policy zig-zags have left investors divided over how wedded President Xi Jinping and Premier Li Keqiang are to financial sector reform and shifting their $10 trillion-plus economy from one powered by investment and exports to one more focused on consumption and services. China has appeared to backtrack on pledges to make its management of the yuan more market driven and there’s uncertainty over the government’s willingness to remove stock price supports imposed during a $5 trillion sell-off last summer.

Amid the confusion, the benchmark CSI 300 Index, down 14% in 2016, has revisited the lows of last year’s rout and pressure on the currency continues. Against that backdrop, Chinese officialdom faces the high-wire act of trying to keep the economy growing rapidly enough to repay past obligations, without resorting to a fresh pick-up in debt to fund more stimulus. It was China’s reliance on credit-fueled growth in the wake of the 2008 global financial crisis that resulted in one of the biggest debt expansions in recent history, and today’s hangover. “China is nowhere close to reining in its debt problems,” said Charlene Chu, the former Fitch analyst known for her warnings over China’s debt risks and now a partner of Autonomous Research Asia Ltd. “It is one of the key factors weighing on GDP growth and one of the reasons why foreign investors are so concerned about China’s trajectory.”

Xi finds out he can’t stop this.

• China’s Capital Flight (BBG)

Xi seems to realize that he paid a high price for the honor of having the Chinese yuan included, starting this October, in the International Monetary Fund’s basket of reserve currencies along with the dollar, the euro, the yen, and the British pound. To be included in the basket, China had to demonstrate that the yuan was “freely usable.” That forced it to lower some investment barriers—enabling the capital flight now bedeviling the leadership. The Institute of International Finance estimated in October that net capital flows out of China would reach $478 billion in 2015. New estimates due this month could show even larger outflows, the IIF says. It’s worth taking a close look at what “capital flight” really means for China. Capital flows out of the country aren’t necessarily bad; they’re simply the mirror image of its trade surplus.

Whenever China chooses to use a dollar, euro, pound, or ringgit earned from exports to buy a foreign asset, it’s sending capital abroad. Many foreign acquisitions strengthen the country, economically and politically. The problem now is that more money wants to get out of the country than wants to get in. Here’s the math: Last year, the IIF estimates, China had a little more than $250 billion coming in from the surplus on its current account, the broadest measure of trade. It got an additional $70 billion or so in net capital from nonresidents, including Chinese companies’ overseas affiliates. But those inflows were swamped by a record $550 billion in net outflows by individuals and companies inside China. Who stashed all that money abroad? The Bank for International Settlements attempted to answer that question in its Quarterly Review in September using the example of a hypothetical Chinese multinational.

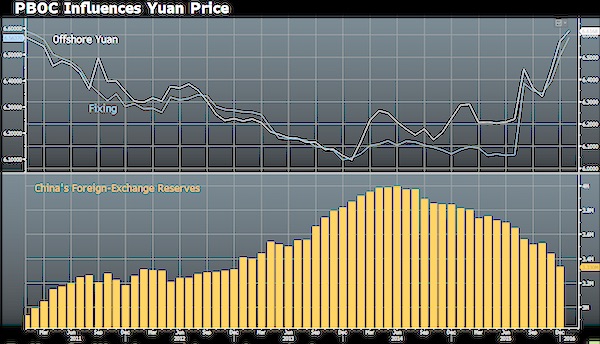

During the boom years, BIS economist Robert McCauley wrote, such a company made money by borrowing at near-zero rates in the U.S. and Europe, converting the money to yuan, and investing in China at higher yields. Now, he wrote, it was reversing course: borrowing more in yuan and holding more money in foreign currencies. That’s the dynamic the government is trying to overcome with its yuan-buying. The IIF projected in October that the government would need to sell off more than $220 billion of its reserves last year to meet the demand for foreign currency. The actual number was probably closer to half a trillion. The nation’s stockpile of foreign exchange reserves has dwindled to about $3.3 trillion. The cushion is shrinking. “Considering China’s foreign debt, trade, and exchange rate management, it needs around $3 trillion in foreign exchange reserves to be comfortable,” says Hao Hong at Bocom International.

What Xi is running up against is what international economists call the trilemma, or the impossible trinity. It says that a country can’t have all three of the following things at once: a flexible monetary policy, free flows of capital, and a fixed exchange rate. They fight one another. As soon as China started allowing free (or at least freer) flows of capital, it was inevitable that it would have to give up on one of the other two objectives. If it wanted to keep the yuan from falling, it would have to raise interest rates higher than is good for the domestic economy, essentially giving up on setting an appropriate monetary policy. Or, if it wanted to set interest rates as it pleased, it would have to allow the yuan to sink.

Do they really not get this?

• China Wants a Reserve Currency and Control, But Can’t Have Both (BBG)

This week’s unprecedented surge in the cost of borrowing yuan in Hong Kong is putting a spotlight on one of China’s biggest policy dilemmas: whether to create a real international reserve currency, or to keep control of its value. The cost of maintaining control came to the fore on Tuesday as interbank lending rates in the city jumped five-fold to a record 66.82%, a side effect of central bank intervention to combat the yuan’s slump to a five-year low. Such efforts to influence market pricing are untenable if China wants to develop active offshore markets for financing and trade in the currency, according to Rabobank Group and Royal Bank of Canada. “These measures are sustainable if China has no desire to internationalize the currency, but it wants to be a reserve currency,” said Michael Every at Rabobank in Hong Kong.

“It will have to accept that other holders of the offshore yuan can have a say in its value.” For Every, the most likely outcome is that China will give in to market forces and let the yuan weaken by another 13% this year, a view that puts him at the bearish end of strategist forecasts compiled by Bloomberg. Pressure to free up the exchange rate has increased after the IMF said the yuan will join its basket of reserve currencies in October and policy makers pledged to decrease capital controls by 2020 – a key step toward yuan internationalization. The PBOC’s actions in recent days suggest they’re not ready to loosen their grip. While the central bank has said its daily reference rate for the yuan is largely determined by market pricing, analysts say the fixing has differed from what the monetary authority’s methodology suggested it would be.

The PBOC has repeatedly bought the yuan in Hong Kong this week, soaking up supply of the currency, and China’s foreign-exchange regulator was said to verbally instruct some banks operating in the mainland to limit yuan outflows and reduce offshore liquidity. Those measures have succeeded, at least temporarily, in propping up the currency and converging the yuan’s onshore and offshore rates. But the intervention has also dented investor confidence.

Not pretty.

• Layoffs and Unrest Loom in China as Growth Slows (BBG)

While most of the world has fixated on the plunging Shanghai and Shenzhen stock exchanges and Beijing’s missteps managing the currency, China’s labor market has become increasingly fragile. As wage arrears and layoffs grow, unrest in factories and on construction sites is spreading. Worker protests and demonstrations doubled last year, to 2,774, with December’s total of more than 400 such incidents, setting a monthly record. The protests come as China’s slower growth crimps profits and concerns about poor policymaking sap investor confidence.

“The increase in strikes and protests began last August around the time of the yuan devaluation and subsequent stock market crash and continued to build during the final quarter of the year, as the economy has showed little sign of improvement,” says Geoffrey Crothall at Hong Kong-based workers’ advocacy organization China Labour Bulletin. That’s worrisome for China’s Communist Party, which came to power in 1949 claiming to represent the working masses. In a sign of its nervousness, Beijing on Jan. 8 formally arrested four labor organizers in Guangdong, amid a broad crackdown on rights activists. “The situation is not so good these days,” Zhang Zhiru, a Shenzhen-based labor campaigner, said in a text message. “It is not convenient to accept interviews from the foreign media.”

The government’s official unemployment rate for urban workers is fiction: It’s remained largely unchanged at around 4% even when China’s economy has dipped significantly in the past, as during the global financial crisis. Still, most outside observers estimate the real figure may be a couple of%age points higher (the Conference Board’s China Center for Economics and Business puts it at about 6%). Wage growth has been outpacing gross domestic product growth in recent years, and 10.7 million urban jobs were created in the first nine months of last year, surpassing the official full-year target of 10 million, according to the Ministry of Human Resources and Social Security.

“Announcing last call to a bar full of drinkers tends not to encourage moderation, either..”

• The Simple Truth About China’s Market (BBG)

“This is insane,” said Chen Gang, chief investment officer for Shanghai Heqi Tongyi Asset Management, on Jan. 7, the day stock trading in China lasted only 29 wild minutes before market circuit breakers shut it down. Unlike some would-be sellers that day, he says he unloaded all his firm’s equity holdings by the time the exit door closed. The circuit breakers, put in place just a few days before, called for an all-day trading halt if shares dropped 7%. Those rules have taken much of the blame for China’s latest market chaos. The China Securities Regulatory Commission said they had a “magnet effect”—as shares fell, people may have rushed to get sell orders in while they still could, pulling prices down to the trigger point even faster. (Announcing last call to a bar full of drinkers tends not to encourage moderation, either.) The focus on poorly designed trading curbs may, however, distract from a less exotic source of risk: speculation.

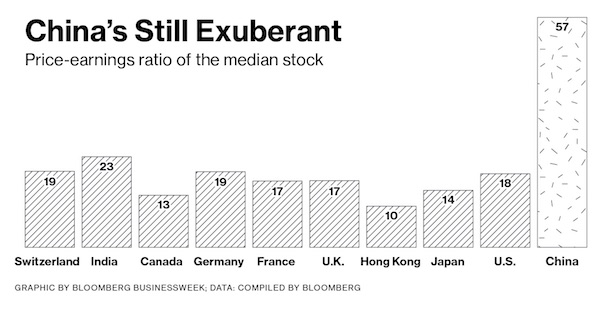

The median stock on mainland exchanges still trades at about 57 times earnings—at least twice as expensive as any other major market. (Leading China stock indexes don’t look nearly so pricey but are weighted to financial companies, which tend to carry lower valuations.) In spite of currency instability and concerns about slowing economic growth, investors are treating the typical Chinese company as if its potential is somewhere between that of Google and Facebook. A boom in initial public offerings made parts of the stock market look more like a lottery. Shares of Beijing Baofeng Technology, a developer of online video players, soared 4,200% in 55 trading days after going public on the Shenzhen stock exchange in March. (The stock then dropped 31% before suspending trading in October.)

With the market crowded with novice retail investors, other companies simply renamed themselves to look like tech stocks, recalling the 1960s “tronics” and 1990s dot-com booms in the U.S. “There are stocks that are basically junk, but they’re trading at outrageous valuations because there’s a lot of market manipulation,” says Jian Shi Cortesi at GAM in Zurich. “The way down is always very volatile.” China’s stock market didn’t used to be so exciting. Under President Xi Jinping’s administration, articles in state-run media encouraged people to invest, fostering a belief that the government would make sure everyone profited. The benchmark CSI 300 index climbed 150% in the 12 months before the market slide that began in June, and it’s still up 53% from the start of that run.

The nation has more than 90 million individual investors, compared with 87.8 million members of the Communist Party. Now retail investors are having doubts. Hua Jie, a 56-year-old retiree in Sichuan province, says she hasn’t been this downbeat on the nation’s stock market since she began investing more than a decade ago. “I no longer want to play this game,” says Hua, a former saleswoman at a consumer electronics store in Chengdu. “I’ve lost faith in the regulators.” Many institutional investors, too, have been quick to bail as markets turn south. Hedge funds often have agreements with investors requiring liquidation if their holdings drop below a certain value. That may have helped accelerate the early January rout.

Deleverage my behind.

• China Credit Growth Surged In December Amid Fresh Stimulus (BBG)

China’s broadest measure of new credit surged the most since June as companies increase borrowing on the corporate bond market, underscoring a shift away from reliance on state-backed banks for funding. Aggregate financing rose to 1.82 trillion yuan ($276 billion) in December, according to a report from the People’s Bank of China on Friday, compared with the median forecast of 1.15 trillion yuan in a Bloomberg survey. The data shows companies are turning to alternative sources for credit given banks’ reluctance to lend. It also adds to signs the economy is stabilizing, not slumping as its falling currency and plunging stock market seem to suggest. “The real economy is relatively strong,” said Wang Tao at UBS in Hong Kong. “The credit supply offers strong support and that’s related to the central government’s call for financial institutions to bolster the economy.”

The rising bond issuance is due to lower barriers for companies to enter the market and falling interest rates, Wang said. “This helps cut the financing costs for companies,” Wang said. The PBOC’s monetary easing has been driving down borrowing costs and spurring bond sales. Chinese corporations sold 8.1 trillion yuan of notes last year, the highest in history and a jump of 34% from 2014. Yield spread between five-year top rated corporate bonds and government securities plunged 69 basis points last year, according to ChinaBond, the biggest annual drop in its data going back to 2007. Chinese property developers, which had been frequent overseas borrowers, are switching to local bonds to avoid rising debt costs as the yuan weakens. The builders sold the equivalent of $72 billion of domestic debentures in 2015 compared with just $11 billion of dollar notes, the first time local sales have overtaken foreign ones, according to Bloomberg Intelligence.

Has the word pipedream ever been more fitting?

• Glimmers Of Hope For Oil As Russia Poised To Slash Output – But.. (AEP)

The first signs of a thaw are emerging for the battered oil market after Russia signalled a sharp fall in exports this year, a move that may offset the long-feared surge of supply from Iran. The oil-pipeline monopoly Transneft said Russian companies are likely to cut crude shipments by 6.4pc over the course of 2016, based on applications submitted so far by Lukoil, Rosneft, Gazprom and other producers. This amounts to a drop of 460,000 barrels a day (b/d), enough to eliminate a third of the excess supply flooding the world and potentially mark the bottom of the market. Russia is the world’s biggest producer of oil, and has been exporting 7.3m b/d over recent months. Transneft told journalists in Moscow that tax changes account for some of the fall but economic sanctions are also beginning to inflict serious damage.

External credit is frozen and drillers cannot easily import equipment and supplies. New projects have been frozen and output from the Soviet-era fields in western Siberia is depleting at an average rate of 8pc to 11pc each year. Russia’s deputy finance minister, Maxim Oreshkin, told news agency TASS that the oil price crash could lead to “hard and fast closures in coming months”. What is unclear is whether the production cuts are purely driven by markets or whether it is in part a political move to pave the way for a deal with Saudi Arabia. Opec stated in December that it is too small to act alone and will not cut production unless non-OPEC states join the effort to stabilize the market, a plea clearly directed at Russia. Kremlin officials insist publicly that they cannot tell listed Russian companies what to do, and claim that Siberian weather makes it harder to switch supply on and off. Oil veterans say there are ways to cut quietly if president Vladimir Putin gives the order.

Helima Croft, from RBC Capital Markets, said the expected cuts could be the first steps towards an accord. “As the economic reality of lower oil prices begins to bite, perhaps Putin will push for a course correction and reach a deal with the Saudis. It would certainly upend the current conventional wisdom that Opec is down for the count,” she said. Russia has a strong incentive to strike a deal. Anton Siluanov, the finance minister, said the Kremlin is drawing up drastic plans to slash spending by 10pc, warning that the country’s reserve fund may run dry by the end of the year. “We have decided not to touch defence spending for now,” he said. The budget deficit is running near 5pc of GDP at current oil prices, yet the country lacks an internal bond market and cannot borrow abroad.

Nice theory.

• The ‘Real’ Price Of Oil Is Below $17 (ZH)

“You see a big destruction in the income of the oil and commodity producers,” exclaims an analyst but, as Bloomberg notes, while oil prices flashing across traders’ terminals are at the lowest in a decade, in real terms the collapse is considerably deeper. Adjusted for inflation, WTI is its lowest since 2002 and worse still Saudi Light Crude is trading at below $17 (in 1998 dollar terms) – the lowest since the 1980s… Slumping prices are a critical signal that the boom in lending in China is “unwinding,” according to Adair Turner, chairman of the Institute for New Economic Thinking.

In fact, while sub-$30 per barrel oil sounds very scary, Saudi prices would be less than $17 a barrel when converted into dollar levels for 1998, the year oil sank to its lowest since the 1980s. Slowing investment and construction in China, the world’s biggest energy user, is “sending an enormous deflationary impetus through to the world, and that is a significant part of what’s happening in this oil-price collapse,” Turner, former chairman of the U.K. Financial Services Authority, said.

Unrest looms large.

• Saudi Life With $30 Oil (BBG)

Times are getting tougher in the Hathut household, so father Mohammad is looking for extra work and the three kids are being told to switch off the lights to cut his electricity bill. This is Saudi Arabia in 2016. It may be a familiar story to austerity-hit Europeans and Americans, but in a nation synonymous with conspicuous consumption, the belt-tightening has been unsettling. Unprecedented cuts to fuel and energy subsidies are forcing the kind of rigor never seen during the era of petrodollar-fueled wealth that quadrupled per-capita income since the late 1980s. “A lot of things will change,” said Hathut, 30, who plans to supplement his income as a business-administration teacher at a Riyadh university with private training sessions. “But many youths are still in a state of shock. They haven’t processed the news and what to do.”

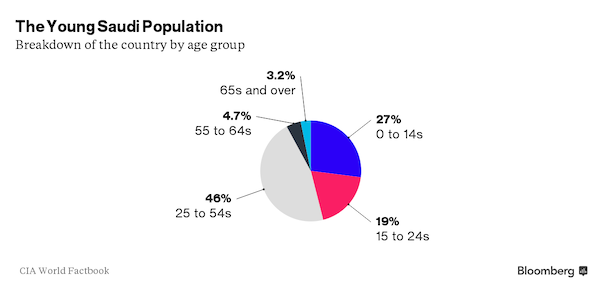

With oil having plunged to about $30 a barrel, signs of the tectonic shift taking place in the ultra-conservative Islamic kingdom are everywhere: from the royal palace where the nation’s founding family is contemplating the sale of its monopoly oil producer to the homes and businesses adjusting to the new economy.Those aged 15 to 34, who make up more than 40% of the 21 million Saudis, are at the forefront of the upheaval. No longer can they take for granted free health care, gasoline at 20 cents a liter and routine pay increases. Even the power of the religious police, which upholds the strict brand of Islam that defines Saudi Arabia, may no longer go unchecked by the government. The Consultative Council, an advisory body, last month urged the Commission for the Promotion of Virtue and Prevention of Vice to compile a list of banned behaviors to prevent abuse by officers.

They can arrest unmarried couples found together in a car or people caught with flowers on Valentine’s Day. More women are entering the workplace and were able to run in local elections for the first time last month, though they’re still banned from driving. It’s “night and day” from 20 years ago when investment banker Khlood Aldukheil, 42, would get into the elevator to go up to her office only to be told no women worked in the building. People used to hang up on her because they thought they were calling the wrong department, she said. Young, social media-savvy Saudis now expect to have more of a say in running and modernizing the country, changing Saudi Arabia as we know it, said Ghanem Nuseibeh, at Cornerstone Global Associates. “Saudi youth won’t be content with what the previous generations were content with,” said Nuseibeh. “Whatever the state is going to take away from them because of dwindling financial resources they would expect to receive it by some other means.”

That should solve everything..

• Saudi Arabia Plans New Sovereign Wealth Fund (Reuters)

Saudi Arabia plans to create a new sovereign fund to manage part of its oil wealth and diversify its investments, and has asked investment banks and consultancies to submit proposals for the project, according to people familiar with the matter. Plunging oil prices have strained Saudi Arabia’s finances. The kingdom’s state budget deficit is at a record high and net foreign assets dived more than $100 billion in 15 months. The new fund could change the way tens of billions of dollars are invested and affect some of the world’s leading asset managers, particularly in the United States, where the bulk of Saudi Arabia’s foreign assets are managed. “Keeping the foreign reserves at a good level is necessary to maintain a solid financial position and support the riyal,” said one of the sources.

Another source said the Saudi government sent out a “request for proposal” to banks and consultants late last year, seeking ideas on how to structure a new fund. The sources asked not to be identified because the plans are confidential. They said the Saudi government did not tell them the size of the planned new fund. One source said the fund would focus on investing in businesses outside the energy industry, such industrials, chemicals, maritime and transportation. The sources stressed that no final decisions had been made, and a range of options were being studied. The sources said managers of the planned fund may be able to invest directly in companies rather than channelling investments through foreign asset managers. This could maximize returns. The second source said he understood the new fund would ideally be up and running within 12 to 24 months, with an office in New York.

Commodities prices will restart their epic decline.

• Iron Ore Risks Tumbling Into $20s on Demand Fall: Citi (BBG)

After oil sank into the $20s this week, will iron ore follow suit? “There’s a strong possibility that iron ore falls below $30 in 2016,” Citigroup’s Ivan Szpakowski said on Thursday after the bank cut price forecasts through to 2018 in a report. In the first half, “the biggest pressure is actually from the demand side. It’s actually going to come from weak steel demand in China,” said Szpakowski. The raw material is seen at $36 this year, 12% lower than previously forecast, and $35 in 2017 and 2018, down from $39 and $40, analysts including Szpakowski wrote in the Jan. 14 report. The base-case forecast over a three-year horizon was cut to $35 from $40, while the bear-case was put at $28.

Iron ore has been routed as the world’s largest miners including Rio Tinto and BHP Billiton in Australia and Brazil’s Vale expanded low-cost output while demand growth stalled in China. Lower costs including freight and energy and weakening currencies in producer nations are enabling suppliers to reduce their break-even rates and withstand lower prices. Costs had fallen more than expected, the bank said. “Given the market’s need for further curtailments, we see the evolution of costs as one of the two most important factors for the iron ore market, alongside Chinese policy decisions affecting steel demand,” the bank said in the report. “We see challenges for iron ore ahead.” Ore with 62% content delivered to Qingdao rose 1.8% to $40.22 a dry ton on Thursday after slumping 4.1% to $39.51 a day earlier.

The steel-making commodity bottomed at $38.30 on Dec. 11, a record in daily prices dating back to May 2009. Steel output in China will probably shrink 2.6% this year as local consumption weakens and mills encounter stiffer opposition to exports, Szpakowski estimated. Supply fell 2.2% to 738.38 million tons in the first 11 months of last year, according to official data. China, which makes about half the world’s steel, is set to report full-year output on Jan. 19. “Under our bear case, we believe medium-term prices would need to fall to around $28 a ton, primarily due to assumptions of weaker oil and export-country currencies,” Citigroup said in the report, with the bull case for iron ore at $45.

By drinking Kool-Aid.

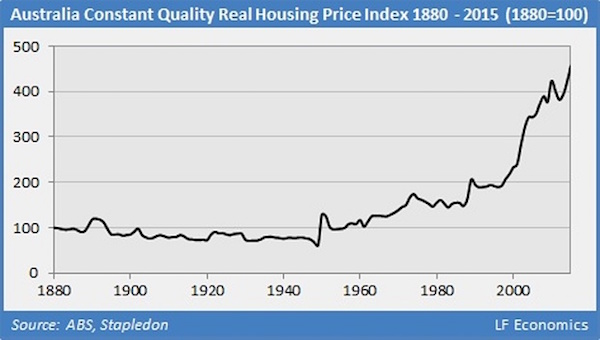

• How Australian Households Became The Most Indebted In The World (Guardian)

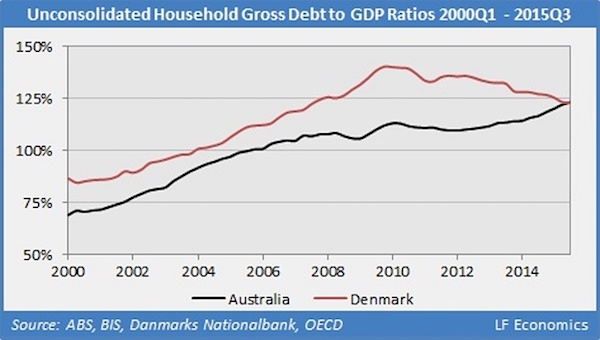

The results are in: Australian households have more debt compared to the size of the country’s economy than any other in the world. Research by the Federal Reserve has shown the consolidated household debt to GDP ratio increased the most for Australia between 1960 and 2010 out of a select group of OECD nations. Australia’s household sector has accumulated massive unconsolidated debt compared with other countries. As of the third quarter of 2015, it now has the world’s most indebted household sector relative to GDP, according to LF Economics’ analysis of national statistics. Denmark long held this unholy accomplishment, but has been slowly deleveraging over the last several years as its housing bubble peaked and burst during the GFC.

The latest debt-financed boom in Sydney and Melbourne has resulted in Australia now overtaking Denmark, a comparison of official figures from Australia and Denmark has shown. Australia has around $2 trillion in unconsolidated household debt relative to $1.6 trillion in GDP. Australia’s ratio is 123.08%, while Denmark’s fell slightly to 122.99% in the third quarter of 2015, a marginal difference of 9 basis points. Although Denmark holds the record in terms of peak debt of 140.14% in the last quarter of 2009, as Australia continues to leverage and Denmark deleverages the current gap between the two will widen. Apart from Switzerland (which alongside Denmark has a negative interest rate), no other country is close in terms of having such extreme household sector debts.

The UK ratio is 85.9% while in the US it is 79.1%. Due to Switzerland’s opaque financial accounts, it is impossible to calculate a figure for this quarter. Its ratio for the second quarter of 2015 is 121.3%, and household debt is rising very slowly, so it would take an extraordinary increase over the quarter to potentially beat Australia. [..] Australian property investors and homeowners are burdened with massive mortgages, especially new and marginal entrants. Unlike winning a gold medal at the Olympics, having the world’s most indebted household sector is not an achievement the nation should be proud of. This is where Australia’s real debt and deficit problem lies, not in the public sector.

“Miracles do happen, but are not customarily invoked for economic projections..” (Hold on, mainstream economics is all about miracles. Like the perennial growth miracle.)

• A 3-Year Austerity Freeze Will Allow Resumption Of Growth in Greece (Mody)

From 2009 to 2015, the Greek government s primary deficit (deficit not counting interest payments) declined from 10% of GDP to nearly zero. Greece ran a 10% of GDP current account deficit with the rest of the world; now the balance shows a surplus. Compare the numbers with Ireland, Portugal, and Spain, or compare them with the historical record of reducing deficits: Greece has delivered as much, or more.But the austerity was much harsher for Greece. Public spending was pushed down by about 25%, an order of magnitude more than in the other countries. This caused GDP and tax revenues to collapse. The perverse consequence was a soaring public debt ratio, which rose from 145% of GDP in 2009 to 200% of GDP. Simply put, Greece was pushed to run much harder and fell further behind.

Greece’s creditors now want more austerity. Because, once again, growth projections are absurdly optimistic, the debt burden could escalate uncontrollably, leading to calls for more austerity in a never-ending cycle.Twice in the last year when they voted Syriza to power in December 2014 and in July 2015 when they rejected the creditors deal the Greek people pleaded that this calamity be stopped. But with the threat of blowing Greece up, the creditors powered on. From 1981, when it joined the European Union, the Greek economy grew by expanding the Greek state. Europe was supposed to anchor democracy and foster prosperity. Instead, corruption and entitlement became entrenched. With the incentives so deeply embedded, each change in government only reshuffled the individuals enjoying state patronage. Both Europe and Greece failed.

The creditors now wish to convey that they are pushing to redeem themselves and Greece. But real change to create a new growth model for Greece and unravel the corrupt networks will take years. In the meanwhile, asking Greece for further fiscal consolidation of 3.5% of GDP over the next three years is stunning economic illiteracy, more so because one of the creditors the IMF has intellectually discredited this policy. By itself, such austerity could cause GDP to contract by 7%. Plus, prices will decline, making household and business debt harder to repay, further undermining growth and public finances. The creditors projections show a miraculous resumption of growth. Miracles do happen, but are not customarily invoked for economic projections.The creditors obsession with Greek pensions as too high even if true is somewhat beside the point.

Pensions are important in sustaining the livelihoods of vulnerable families. And it is not just a warm and fuzzy regard for social equity and justice that is at stake. The scale of reduction proposed, along with all the other austerity measures, will have immediate macroeconomic consequences. As consumption declines, so will growth and prices. Greece s debt-deflation cycle will continue. Higher private and public debt burdens will further undermine the banking system. Make no mistake, deeper economic distress cannot cure long-term economic pathologies, just as heavy-lifting is not recommended to revive a patient from cardiac arrest. The long-term damage will be far-reaching. For a start, the most talented are leaving in droves. Greece’s weak growth prospects will only become worse.

[..] Greece has a nearly balanced primary budget. A three-year freeze on austerity will allow resumption of growth. An agenda to lower and rationalize pensions then would make more sense. But Greece also needs deep debt relief. The coy promises of driblets of relief are intended as a clever tactic for dragging Greek authorities down the road of needed reform. But if such reform undermines growth, the needed debt relief will increase with time. Greece will become a permanent ward of the creditors. The Greeks will suffer more pain and the creditors will see less of their money.

Much as it pains me to say it, but he’s right on the EU.

• Dutch Populist Wilders Says EU Finished, Netherlands Must Leave (BBG)

The European Union is teetering, and Dutch Freedom Party leader Geert Wilders wants to tip it over the edge. Wilders, 52, whose party leads opinion polls with calls to close Dutch borders to refugees, pledged to immediately pull the Netherlands out of the 28-nation EU should he become prime minister in elections due in March next year. The EU is unraveling and that’s to be encouraged, he said, urging the U.K. to quit the bloc in its forthcoming referendum. “We are not sovereign any more; we are not even allowed to form our own immigration policy or even close our borders and I would do that,” Wilders said Thursday in an interview in the Dutch parliament building in The Hague. “I would wish the Dutch to be more like Switzerland. In the heart of Europe, but not in the EU.”

A household name in the Netherlands since 2004, when he split from the mainstream Liberal party to form his own on an anti-Islam platform, the bouffant-haired blond has enjoyed a swell of support as voters have grown increasingly alarmed at the arrival in Europe of more than a million refugees from Syria and elsewhere. The latest poll showed him winning the most parliamentary seats – as many as Prime Minister Mark Rutte’s Liberals won in 2012 – if elections were held now. After years of turbulence surrounding Greek membership of the euro, the focus of uncertainty in the EU has shifted to Britain, where Prime Minister David Cameron is set to call a referendum as early as June on whether the U.K. should stay in or leave.

Wilders said he “hopes” Britons will opt to quit, with a knock-on effect on the Netherlands. In the event of a so-called Brexit, “you will see that it will be easier for other countries to make the same decision,” Wilders said. “The beginning of the end of the European Union has already started. And it can be an enormous incentive for other countries if the United Kingdom would leave.”

I covered the topic of legality of EU border controls a while back (and better, I would argue), see for instance: Greece Is A Nation Under Occupation. This is exactly why people like Wilders and Le Pen are right on Europe: no country’s leader has the legal right to squander its sovereignty.

• Europe Doesn’t Need Stronger Borders (Legrain)

Before World War I, people could travel around the world without a passport, as Austrian writer Stefan Zweig famously did. Since then, passports, border checks, and bureaucratic and physical barriers to freedom of movement have become the norm. That’s what made the Schengen Area so special: From 1995 onward, 26 European countries (22 of the 28 EU countries, plus four others) abolished their border controls and adopted a common travel-visa policy. People and goods were able to travel unimpeded from Lisbon to Lithuania, Budapest to Brittany. As well as providing practical advantages, it was a powerful symbol of how Europe was coming together. But the refugee crisis and the Paris terrorist attacks on Nov. 13, 2015, have strained Schengen to the breaking point.

Germany (to limit refugee inflows) and France (to keep out potential terrorists) are now demanding the creation of a powerful EU border guard to police the Schengen Area’s external border. The European Commission has duly proposed the establishment of a beefed-up “European Border and Coast Guard” with a bigger budget and staff than its feeble current incarnation, Frontex. Controversially, the new force would have the power to intervene to plug leaky borders – even against the wishes of the government of the country concerned. But such a huge surrender of national sovereignty to an EU agency of dubious competence and limited accountability is undesirable, unnecessary, and potentially illegal. The EU ought to be able to handle the arrival of the roughly million refugees and other desperate migrants who entered without permission last year.

They account for only 0.2% of the EU population of 508 million – and are outnumbered by the 1.25 million Syrian refugees in tiny Lebanon (population 4.5 million). They are also far fewer than the 2 million or so other migrants who arrive in EU countries each year through standard channels. But regrettably, the predominantly poor and Muslim newcomers tend to be seen as a burden and a threat. And in the absence of a generous, orderly, and fair system for welcoming refugees and processing asylum claims, most governments try to pass the unwanted newcomers on to others through a variety of means, from waving them on their way (Greece and Italy) to keeping them out with razor-wire fences (Hungary). Now that the two countries that had maintained an open door, Germany and Sweden, are closing it, the EU is trying to stop refugees from reaching Europe altogether.

[..] EU officials already control Greece’s budget. Do they really think it’s a good idea to march into Greece and take control of its borders too? Indeed, Steve Peers, a professor of EU law at the University of Essex who edits the EU Law Analysis blog, argues that the EU border guard’s proposed powers would contravene the EU treaties: “[W]hile the EU can establish rules on border controls and regulate how Member States’ authorities implement them, it cannot itself replace Member States’ powers of coercion or control, or require Member States to carry out a particular operation.”

A few refugees and Europe loses all decency. Deplorable.

• Switzerland Joins Denmark In Seizing Assets From Refugees (Guardian)

Refugees arriving in Switzerland have to turn over to the state any assets worth more than 1,000 Swiss francs (£690) to help pay for their upkeep, broadcaster SRF reported on Thursday, revealing a practice that has drawn sharp rebukes for Denmark. SRF’s 10 vor 10 news programme showed a receipt a refugee from Syria said he received from authorities when he had to turn over more than half of the cash his family had left after paying traffickers to help them get to the neutral Alpine country. It also showed an information sheet for refugees that stated: “If you have property worth more than 1,000 Swiss francs when you arrive at a reception centre you are required to give up these financial assets in return for a receipt.”

Stefan Frey, from refugee aid group Schweizerische Fluechtlingshilfe, was quoted as saying: “This is undignified … This has to change.” SRF cited the state migration authority SEM as justifying the measure, noting the law called for asylum seekers and refugees to contribute where possible to the cost of processing their applications and providing social assistance. An SEM spokeswoman told SRF: “If someone leaves voluntarily within seven months this person can get the money back and take it with them. Otherwise the money covers costs they generate.” In addition, refugees who win the right to stay and work in Switzerland have to surrender 10% of their pay for up to 10 years until they repay 15,000 Swiss francs in costs, according to the report.

Denmark is amending a proposal to confiscate refugees’ possessions to pay for their stay. It plans to raise the amount they will be allowed to keep after coming under fire from the United Nations refugee agency. Several organisations, including the Office of the UN High Commissioner for Refugees, have censured the Nordic country for the proposal, as well as for others that would delay family reunification and make acquiring refugee and residence status more difficult.

But of course, nothing condemns the EU like the drowning children.

• Nine Bodies Of Refugees, Migrants Found Off Turkish Coast (Reuters)

The bodies of nine migrants, some of whom may have drowned up to 10 days earlier while trying to reach Europe by sea, were found on Turkey’s coast in recent days, as neither cold winter waters nor government efforts seemed to stem the flow of migrants. The bodies of five men and one woman were found washed up on the shores of Seferihisar near Izmir on Tuesday, district governor Resul Celik told Reuters, adding doctors believe they drowned 5 to 10 days ago. The coast guard said separately in a statement that it had found the bodies of a girl and two women near Ayvalik further north after a boat partially capsized. It rescued 13 people, but a search continued for two men and a boy.

In a deal struck at the end of November, Turkey promised to help stem the flow of migrants to Europe in return for cash, visas and renewed talks on joining the European Union. But European officials have repeatedly said Turkey’s efforts to curb migrant arrivals were falling short. The International Organization for Migration (IOM) said on Tuesday 18,872 migrants had arrived in Europe by sea in the first 11 days of the year, almost all of them to Greece. 47 people died trying to make this route. Turkish officials have said dozens of suspected ring-leaders of human trafficking networks have been arrested and the Turkish government has said it is trying to reduce illegal immigration by giving Syrians, who represent the biggest portion of arrivals to Europe, work permits.

Tsipras needs to man up and lead Greece out of the EU. The difference in moral values is an insult.

• Three Children Drown Off The Coast Of Greece’s Agathonisi Island (Kath.)

Three children drowned off the coast of the southeast Aegean island of Agathonisi early on Friday, as the boat they were traveling in from Turkey to Greece capsized. A rescue boat belonging to a nongovernmental organization managed to save the other 20 passengers who were on board a boat. The rescue team was alerted by a military base on the small island, after the boat was seen capsizing and sinking by an officer. The rescued passengers, whose nationality was not immediately known, were to be transferred to the nearby island of Samos so they could receive medical attention.