Yannis Behrakis Iranian immigrant at Greece-FYROM border 2015

101 revisited.

• Swiss To Vote On Private Banks’ License To Create -Electronic- Money (FT)

“Stop banks from creating money”? That sounds like killing the goose that lays the golden eggs. Aren’t private banks the reason why Switzerland has always been so rich? They don’t mean creating money in that sense. What do they mean then? They mean it literally. That’s not any clearer. Think about it this way. Do private banks have their own money printing presses so that they can mint coins and print banknotes at will? Of course not. That would be counterfeiting. Only the central bank can do that. Right. But you don’t have most of your money in physical cash, do you? No – are you crazy? It could get stolen, or I’d lose it, or my dog would eat it. Most of it is in the bank. Exactly. Most of what we think of as “money” is really a bank deposit, not cash. The UK has £70bn of notes and coins in existence – but more than £1.5tn sitting in deposits.

OK, so most money isn’t physical. Welcome to the modern world. Now are you going to explain what this Swiss initiative is about? It’s all related. As you say, of course banks don’t have their own printing presses. But what if they can create electronic money at will? That would be crazy. Just like physical counterfeiting, except they could forge much more money in much less time. And without getting ink on their fingers. Well, that’s what this Swiss referendum is about. Wait — you’re not trying to tell me banks are actually doing this, are you? That’s just what I’m telling you. Where do you think the deposits come from? Er, I never thought about it. I suppose when people go to the teller and deposit a cheque or a wad of cash, it all adds up over time. A bit hard to make £70bn add up to £1.5tn, even with a lot of time.

I see what you’re saying. So where do the deposits come from? Deposits are created from the loans banks make to customers. You’ve got that the wrong way round, no? Banks lend out the deposits they get. No. No? No. The bank decides whether it wants to make you a loan. If it does, then it simply adds the loan to its balance sheet as an asset and increases the balance in your deposit account by the same amount (that’s a liability for them). Voilà: new electronic money has been created. Just like that, at the stroke of a pen? These days, it’s more with a click of the mouse, but you have the right idea. Well, I never. I obviously realised that when I deposit money in the bank, they don’t store it in their vaults. I mean, I get how fractional reserve banking works — the banks hold deposits that are much larger than what they keep in reserve. But I assumed the amount of deposits customers put in determines how much the banks can lend out.

What do the campaigners want instead? To make electronic money issuance the prerogative of the state, like with physical cash. State e-money. People would keep deposits in the central bank, and private banks would only offer investment products or deposits backed fully by central bank reserves. It’s often called “narrow” or “limited-purpose” banking.

We’re finally waking up. Basic income gets spent into domestic economy, all stimulus all the way.

• Finland Plans To Give Every Citizen An €800 A Month Basic Income (Quartz)

The Finnish government is currently drawing up plans to introduce a national basic income. A final proposal won’t be presented until November 2016, but if all goes to schedule, Finland will scrap all existing benefits and instead hand out 800 euros per month—to everyone. It sounds far-fetched, but it’s looking likely that Finland will carry through with the idea. Whereas several Dutch cities will introduce basic income next year and Switzerland is holding a referendum on the subject, there is strongest political and public support for the idea in Finland. A poll commissioned by the government agency planning the proposal, the Finnish Social Insurance Institution or KELA, showed that 69% support (link in Finnish) a basic income plan.

Prime minister Juha Sipilä is in favor of the idea and he’s backed by most of the major political parties. “For me, a basic income means simplifying the social security system,” he says. But for those outside Finland, the plan raises two obvious questions: Why is this a good idea, and how will it work? It may sound counterintuitive, but the proposal is meant to tackle unemployment. Finland’s unemployment rate rose to 11.8% in May (though it was back down to 8.7% in October) and a basic income would allow people to take on low-paying jobs without personal cost. At the moment, a temporary job results in lower welfare benefits, which can lead to an overall drop in income. Previous experiments have shown that universal basic income can have a positive effect.

Everyone in the Canadian town of Dauphin was given a stipend from 1974 to 1979, and though there was a drop in working hours, this was mainly because men spent more time in school and women took longer maternity leaves. Meanwhile, when thousands of unemployed people in Uganda were given unsupervised grants of twice their monthly income, working hours increased by 17% and earnings increased by 38%. One of the major downsides, of course, is the cost of handing out money to every single citizen. Liisa Hyssälä, director general of Kela, has said that the plan will save the government millions. But, as Bloomberg calculated, giving €800 of basic income to the population of 5.4 million every month would cost €52.2 billion a year. The government expects to have 49.1 billion euros revenue in 2016.

Another serious consideration is that some people may be worse off under the plan. As the proposal hasn’t been published yet, it’s not yet known exactly who will lose out. But those who currently receive housing support or disability benefits could conceivably end up with less under national basic income, since the plan calls for scrapping existing benefits. And as national basic income would only give a monthly allowance to adults, a single mother of three could struggle to support herself compared to, for example, a neighbor with the same government support but no children and a part-time job.

Excellent graphs from Stockman.

• These Ain’t Your Grandfather’s “Jobs” (David Stockman)

This “Jobs Friday” ritual is getting truly absurd. So it can’t be repeated often enough: These artifacts of the BLS’ seasonally maladjusted, trend-cycle modeled, heavily imputed, endlessly crafted and five times revised “jobs” numbers have precious little to do with the real health of the main street economy. Indeed, the six-year run of job gains since early 2010 primarily represents “born-again jobs” and part-time gigs. In economic terms, they do not remotely resemble your grandfather’s industrial era economy when a “job” lasted 40 to 50 hours per week all year round; and most of what the BLS survey counted as “jobs” paid a living wage. Not now. Not even close.

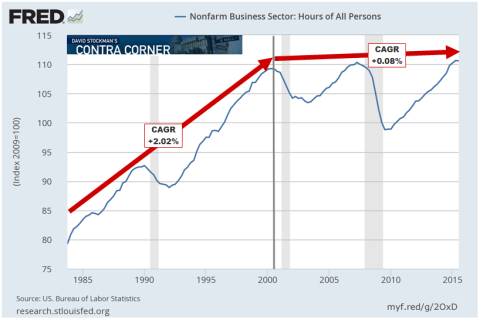

The Wall Street fools who bought the dip still another time on Friday do not have the slightest clue that the US jobs market is actually quite dead. The chart below is also generated by the BLS but it measures actual labor hours employed, not job slots. It self-evidently puts the lie to the establishment survey fiction upon which the robo-machines and day traders are so slavishly focussed.

The fact is, labor hour inputs utilized by the US nonfarm business economy have “grown” at the microscopic annualized rate of 0.08% since the turn of the century. That’s as close as you can get to zero even by the standards of sell-side hair splitters, and it compares to a 2.02% CAGR during the 17 years period to Q3 2000. So let’s see. Prior to the era of full frontal money printing, labor utilization grew 25X faster than it has since the turn of the century. Yet the casino gamblers bought Friday’s more of the same jobs report hand-over-fist—-apparently on the premise that this giant monetary fraud is actually working. Not a chance. The contrast between the two periods shown in the chart could not be more dramatic. Nor do these contrasting trends encompass a mere short-term aberration.

The death of the US jobs market has been underway for a decade and one-half! Even in the establishment survey itself, the evidence of a failing jobs market is there if you separate the gigs and the low-end service jobs from the categories which represent more traditional full-pay, full-time employment. The latter includes energy and mining, construction, manufacturing, the white collar professions like architects, accountants and lawyers and the finance, insurance and real estate sectors. It also includes designers and engineers, information technology, transportation and warehousing and about 11 million full-time government employees outside of the education sector.

We have labeled this as the “breadwinner economy” because the work week averages just under 40 hours in these categories and annualized pay rates average just under $50k. These kinds of family supporting jobs were what the Labor Department bureaucrats had in mind back in the 1930s and 1940s when the current employment surveys and reports were originally fashioned.

Germany 1 – Italy 0.

• ECB Lowered Stimulus Ambitions After Hitting Opposition (Reuters)

Hints by Mario Draghi ahead of last Thursday’s ECB rate meeting that the euro zone may need another big injection of money backfired, stiffening the resolve of more conservative central bankers who criticized him for raising expectations too high, sources familiar with the discussions said. The ECB President and his chief economist Peter Praet stoked expectations with dovish speeches in the weeks before the meeting but the ECB’s Governing Council concluded that markets needed to be disappointed this time because the economic outlook has improved and new inflation forecasts were not as bad as feared, the sources said.

A pending U.S. Federal Reserve rate hike also factored into the decision, though to a lesser extent, as policymakers were concerned that a big move by the ECB would weaken the euro further and possibly force the Fed to delay its own action on rates to prevent a too rapid divergence of policy between the world’s top two central banks. The ECB cut its deposit rate on Thursday and extended its monthly asset buys by six months to boost stubbornly low inflation and lift growth. But the moves were considered by markets to be the bare minimum in the light of the bank’s previous signals.

One source with direct knowledge of the situation interpreted Draghi’s public stance ahead of the meeting as trying to pressure the Governing Council to take bigger action. “Draghi raised expectations too high, on purpose, and attempted to paint the Governing Council into a corner,” the source said. “This was problematic and he was criticized for this by several governors in private.” Unlike last year, when opponents of quantitative easing made their stance public before the decision, the hawks mostly worked behind the scenes.

You first! Nobody can afford to cut production. It’s what happens in deflation.

• Paralysed OPEC Pleads For Allies As Oil Price Crumbles (AEP)

The Opec cartel is to continue flooding the world with crude oil despite a chronic glut and the desperate plight of its own members, demanding that Russia, Kazakhstan and other producers join forces before there can be output cuts. Brent prices tumbled almost $2 a barrel to $42.90 as traders tried to make sense of the fractious Opec gathering in Vienna, which ended with no production target and no guidance on policy. It reeked of paralysis. Prices are poised to test lows last seen at the depths of the financial crisis in early 2009. The shares of oil companies plummeted in London, and US shale drillers went into freefall on Wall Street. “Lots of people said Opec was dead. Opec itself has just confirmed it,” said Jamie Webster, head of HIS Energy.

Venezuela’s oil minister, Eulogio del Pino, pushed for a cut in output of 1.5m barrels a day (b/d) to clear the market, describing the failure to act as calamitous. “We are really worried,” he said. Abdallah Salem el-Badri, Opec’s chief, conceded that the cartel’s strategy has been reduced to an impotent waiting game, hoping that the pain of low prices will lure Russia and other global producers to the table. “We are looking for negotiations with non-Opec, and trying to reach a collective effort,” he said. Mr el-Badri said there have been “positive” noises from some but none is yet ready to lock arms and create a sort of super-Opec, able to dictate prices. “Everybody is trying to digest how they can do it,” he said.

The cartel’s 12 members postponed a decision on their next step until next year, once they know how much oil Iran will sell after sanctions are lifted. “The picture is not really clear at this time, and we are going to look one more time in June,” he said. “Everybody is worried about prices. Nobody is happy,” said Iraq’s envoy, Adel Abdul Mahdi. His country has lost 42pc of its fiscal revenues and is effectively bankrupt. Foreign companies are owed billions and have begun to freeze projects. The government cannot afford to pay its own security forces and is cutting vital funding for anti-ISIS militias, raising fears that the political crisis could spin out of control. Helima Croft, from RBC Capital Markets, said four of the frontline states in the fight against ISIS are now being destabilized by the crash in oil prices, including Algeria and Libya.

Opec leaders will now have to grit their teeth and prepare for a long siege, testing their social welfare models to the point of destruction. Even Saudi Arabia is pushing through drastic austerity measures. Deutsche Bank said the fiscal break-even cost needed to balance the budget is roughly $120 for Bahrain, $100 for Saudi Arabia, $90 for Nigeria and Venezuela, and $80 for Russia, based on current exchange rate effects. “It is going to be 12 to 18 months before they see any relief,” David Fyfe, from the oil trading group Gunvor, said. “We think oil stocks will continue to build in the first half of next year and we don’t think they will draw down to normal levels until well into 2017.”

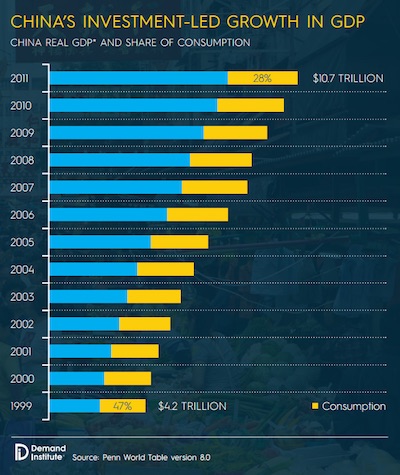

Not a great article. But the underlying idea is important: China will not be saved by consumers. “According to the World Bank, Chinese household consumption added up to $3.4 trillion in 2013, compared with $11.5 trillion in the U.S. and $10.3 trillion in the European Union.”

• China’s Consumers Have a Long Way to Go (BBG)

The Chinese growth miracle of the past few decades has been driven by investing and exporting, not consumer spending. Lately, though, we’re hearing a lot about a “great rebalancing” in which domestic buyers of cars, phones, clothes, health-care and other consumer goods and services come to play a much bigger role in China’s economy. This would be swell – both for China and for a global economy that’s also in need of some balance. Before we all get excited about it, though, it’s important to remember just how unbalanced China’s economy is. In 2011, the latest year for which comparative data is available, [consumption] represented 28% of real GDP, compared with 76% in the United States, 67% in Brazil, 60% in Japan, 59% in Germany, and 52% in India. That’s from “Sold in China: Transitioning to a Consumer Led Economy,” a report released this summer by the Demand Institute, a joint venture of the Conference Board and Nielsen. So is this:

The shrinking of consumption’s share of China’s economy started well before 1999 – in 1952, consumption made up 76% of economic activity. It can’t keep going down forever, and all signs are that its decline has halted since 2011. But the likeliest path forward, again according the Demand Institute, will be one in which consumption stays stuck at a relatively low %age of GDP. That’s based on an examination of economic development in 167 countries from 1950 to 2011, which found that: Countries whose underlying economic characteristics were similar to China’s generally saw consumption remain flat relative to GDP for a considerable period after it stopped falling.

What that translates to, according to yet another Demand Institute report released last month, is a forecast of aggregate consumer spending growth in China of 5.2% a year for the next 10 years. That’s much faster than the growth in consumer demand we’re likely to see in any other major economy during that period – so multinational corporations with stuff to sell will continue to be very interested in the place. But that growth will remain concentrated in a relatively small number of cities, a lot of the money will be spent on domestically produced services and the growth probably won’t be enough for China to serve as a major engine of global consumer demand just yet.

It certainly hasn’t taken on that role this year. Reports Bloomberg News: “China’s trade imbalance with the rest of the world is rising, with the nation’s current-account surplus swelling as a share of the global economy. Much of that has been driven by a rising merchandise trade excess – which is set for a record this year – thanks to sliding imports due in part to commodity-price declines that have walloped natural-resource providers.” Commodity prices will eventually stop declining. Chinese consumers will, barring an economic meltdown, keep increasing their spending. The rebalancing will continue. It just has a long, long way to go before the Chinese economy or the global economy is actually balanced.

PwC? Really?

• Pursuing Transparency, Pope Orders External Audit Of Vatican Assets (Reuters)

The Vatican said on Saturday it had ordered the first external audit of its assets as part of a drive by Pope Francis to bring transparency to its finances where millions of euros have gone unrecorded without any central oversight. Papal spokesman Federico Lombardi said auditors PricewaterhouseCoopers would start work immediately. The pope has promised to overhaul the Vatican’s murky financial management, which have been hit by repeated scandals in recent years, however he has met resistance from Church officials who want to maintain tight control over operations. Lombardi told reporters that the Vatican’s Secretariat for the Economy had called on PwC, the world’s second-largest audit firm by revenue, to review the Vatican’s consolidated financial statements, which includes assets, income and expenses.

The decision to work with one of the world’s top four auditors continued “the implementation of new financial management policies and practices in line with international standards,” he said. A Vatican financial statement this year revealed that Vatican departments had stashed away €1.1 billion of assets that were not declared on any balance sheet. The head of the economy secretariat, Cardinal George Pell, said last year that departments had “tucked away” millions of euros and followed “long-established patterns” in jealously managing their affairs without reporting to any central accounting office. Pope Francis picked Pell, an outsider from the English-speaking world, to oversee the Vatican’s often muddled finances after decades of control by Italian clergy. Since the pope’s election in March, 2013, the Vatican has enacted major reforms to adhere to international financial standards and prevent money laundering.

Sunday feel good story.

• Where Uruguay Leads, The Rest Of The World Struggles To Keep Up (Guardian)

As the world’s most powerful nations squabbled in Paris over the cost of small cuts to their fossil fuel use, Uruguay grabbed international headlines by announcing that 95% of its electricity already came from renewable energy resources. It had taken less than a decade to make the shift, and prices had fallen in real terms, said the head of climate change policy – a job that doesn’t even exist in many countries. This announcement came on top of a string of other transformations. In 2012 a landmark abortion law made it only the second country in Latin America, after Cuba, to give women access to safe abortions. The following year, gay marriage was approved, and then-president José Mujica shepherded a bill to legalise marijuana through parliament, insisting it was the only way to limit the influence of drug cartels.

What’s more, the country cracked down so strongly on cigarette advertising, in a successful bid to cut smoking rates, that it is now being sued by tobacco giant Philip Morris. Mujica himself became internationally famous for refusing to enjoy the trappings of presidential power – staying in his tiny house rather than moving into the official mansion – and giving away 90% of his salary. To those who have never taken much interest in South America’s second smallest country, Uruguay seems to be quietly reinventing itself as a beacon of innovation and progress. In fact, the changes fit into a long progressive tradition, stretching back over a century and a half, celebrated by Peruvian literary giant Mario Vargas Llosa in a recent tribute to Mujica’s initiatives on gay marriage and marijuana.

In the 1870s, Uruguay pioneered universal, free, secular education, the first Latin American country to make it compulsory for every child to attend school. That focus on education has its echoes in a modern-day policy to give every student a laptop. It was also one of the first countries in the region to give women the right to vote, and legalised divorce in 1907. That was decades ahead of other South American countries, and nearly a century ahead of nearby Chile, which only passed a similar law in 2004. “We must remember that Uruguay, in contrast with most Latin American countries, has a long and solid democratic tradition, to the extent that when it was a young nation it was known as ‘the Switzerland of America’ for the strength of its civil society, deep-rooted rule of law, and for armed forces which are respectful of the constitutional government,” said Vargas Llosa.

He traced many of those traditions back to the rule of early-20th-century president José Batlle y Ordóñez, who fought for workers’ rights and universal suffrage, abolished the death penalty and laid the foundations of the welfare state. The country’s level of education, cultural life and civic mindedness had made it “the envy of all the continent”, he added. Not all of Batlle’s successors were interested in his progressive legacy. The country came under the rule of a military dictatorship from 1973 to 1985, when generals jailed huge numbers of political prisoners and earned Uruguay the nickname “the torture chamber of Latin America”. But this century it has been returning to its political roots, to become a model not just for the region, but for the world.

Lunacy for Washington to support Erdogan in fighting Kurds. They’re the ones most effective vs ISIS.

• US Puts Request For Bigger Turkish Air Role On Hold (Reuters)

Since Turkey shot down a Russian fighter jet last week, the United States has quietly put on hold a long-standing request for its NATO ally to play a more active role in the U.S.-led air war against Islamic State. The move, disclosed to Reuters by a U.S. official, is aimed at allowing just enough time for heightened Turkey-Russia tensions to ease. Turkey has not flown any coalition air missions in Syria against Islamic State since the Nov. 24 incident, two U.S. officials said. The pause is the latest complication over Turkey’s role to have tested the patience of U.S. war planners, who want a more assertive Turkish contribution – particularly in securing a section of border with Syria that is seen as a crucial supply route for Islamic State.

As Britain starts strikes in Syria and France ramps up its role in the wake of last month’s attacks on Paris by the extremist group, U.S. Defense Secretary Ash Carter publicly appealed this week for a greater Turkish military role. The top U.S. priority is for Turkey to secure its southern border with Syria, the first official said. U.S. concern is focused on a roughly 60-mile stretch used by Islamic State to shuttle foreign fighters and illicit trade back and forth. But the United States also wants to see more Turkish air strikes devoted to Islamic State, even as Washington firmly supports Ankara’s strikes against Turkey’s Kurdistan Workers Party (PKK), viewed by both countries as a terrorist group. Carter told a congressional hearing this week that most Turkish air operations have been targeted at the PKK rather than at Islamic State, but U.S. officials acknowledge some promising signs from Turkey, including moves to secure key border crossings.

Turkey bombs NATO allies. Well, I’ll be darned…

• Germany ‘Plans To Prevent Sharing Intelligence’ With NATO Ally Turkey (Telegraph)

Germany has reportedly drawn up plans to prevent sharing intelligence with its Nato ally Turkey as it prepares to support international air strikes against Islamic State of Iraq and the Levant (Isil). German Tornado aircraft are to commence reconnaissance flights over Syria and Iraq after the country’s parliament on Friday voted to deploy up to 1,200 military personnel. Highly unsual measures have been ordered to prevent Turkey getting access to intelligence from the flights, according to Spiegel magazine. The aircaft are expected to operate from Incirlik airbase in southern Turkey, and as Nato allies, the two countries would normally expect to share intelligence. But German commanders are concerned Turkey may use surveillance information from the flights to direct attacks against Kurdish forces allied to the West.

Ankara has been carrying out its own air strikes against the Kurdistan Workers’ Party (PKK) in south-east Turkey and Iraq as well as People’s Defence Units (YPG) in Syria. Two German officers have been given the sole task of ensuring no intelligence is shared with Turkey that could be used to target these groups, according to Spiegel. They will seek to ensure that German Tornados are not used for reconnaissance missions near the Turkish border. If the aircaft accidentally stray into the area, they will prevent the data from the flights being passed to Turkey. The German parliament on Friday approved plans to deploy up to 1,200 military personnel in support of the air strikes by 445 votes to 146. Six Tornados will be sent to the region together with a refuelling aircraft and a naval frigate.

The German forces will not take part in combat missions directly but will provide reconnaissance flights and force protection. The frigate is being deployed to support the French aircraft carrier Charles de Gaulle, which is already in the region. The deployment is a break with Germany’s traditional reluctance to get involved in overseas wars because of its Nazi past. “It’s a question of responsibility for us to take action. We’ve watched for long enough,” Norbert Röttgen of Angela Merkel’s Christian Democrat party told fellow MPs in the debate before the vote. “Anyone who votes in favour is leading Germany into a war with completely unclear risks of escalation. Instead of combating Isil, you’re strengthening it,” Sahra Wagenknecht, of the opposition Left Party, said.

Frontex will be the boss.

• Greek Government Unveils Plan To Set Up Five Refugee Hotspots (Kath.)

Only days after requesting European Union help in tackling the ongoing migrant and refugee crisis, the Greek government has unveiled plans to set up five so-called hotspots to register and identify arrivals. The decision, which was published early Saturday in the Government Gazette, foresees the creation of screening centers on the eastern Aegean islands of Chios, Kos, Leros, Samos and Lesvos. Their operation will fall under the responsibility of the Southern and Northern Aegean regional authorities and will rely on Defense Ministry technical infrastructure and personnel.

The decision designates the areas which will host the registration centers on Lesvos, Leros and Kos. Details on the Samos and Chios facilities are to be announced in the coming days. Local authorities reacted to the news, saying they had been caught unawares by the government’s decision. In a statement on Saturday, [opposition party] New Democracy’s local organization on Kos said it opposed the creation of a hotspot on the island, describing it as a “catastrophic move for Greece’s fourth biggest tourism destination.”

All it takes is 15 votes, and you’re occupied: “One option could be not to seek the member-state’s approval for deploying Frontex but activating it by a majority vote among all 28 members..”

• EU Welcomes Greek Request For Border Aid (Kath.)

The European Commission on Friday welcomed a decision by the Greek government to request help from European Union-flagged patrols and emergency workers in monitoring its borders and screening asylum seekers fleeing conflict in the Middle East, amid reports that Brussels is mulling the formation of a special force to beef up the Schengen Area. Speaking in Brussels on Friday, Commission spokesman Margaritis Schinas said that Greece’s decisions to activate the bloc’s Civil Protection Mechanism, to allow EU agency Frontex to help with the registration of migrants on the border with the Former Yugoslav Republic of Macedonia (FYROM), and to trigger the Rapid Border Intervention Teams mechanism (RABIT) for extra patrols in the Aegean were “in the right direction.”

Schinas said that Greece, which is in the front line of Europe’s migration and refugee crisis, has pledged to set up another four so-called hot spots on an equal number of Aegean islands. A first hot spot is already in operation on Lesvos. “We hope to have concrete, tangible progress on the ground” before an EU summit on December 17 where migration will be on the agenda, he added. Greece’s decision came amid reported threats from several EU governments that the country risked being kicked out of the Schengen zone of passport-free travel because of its leaky frontier. The SYRIZA-led government on Friday sought to fend off criticism of foot-dragging, saying it was the EU that failed to meet repeated Greek calls for aid.

“Since May, Greece has persistently been asking for technical, technological and staffing help, and what it has received from Europe is far less than what was asked for,” Alternate Minister for European Affairs Nikos Xydakis told The Associated Press, adding that Greece needed 750 but initially received only 350 staff from Frontex. Xydakis said that about 100 more border guards had arrived in recent days. In comments Friday, European Migration and Home Affairs Commissioner Dimitris Avramopoulos sought to take some of the pressure off Athens, saying that Schengen should be made “part of the solution.” “It is precisely by applying the rules, by using the system, that we ensure the safety of our citizens. We should focus on strengthening and improving Schengen, not breaking it down.”

Meanwhile, reports on Friday said the EU is mulling a measure that would grant a special EU border force powers to step in and guard a member-state’s external frontier to protect Schengen. The EU’s executive is expected to propose the establishment of the unit on December 15. It is unclear if operations would require prior invitation from the member-state in question. “One option could be not to seek the member-state’s approval for deploying Frontex but activating it by a majority vote among all 28 members,” an unidentified EU official told Reuters. But such a move is not expected to sit well among member-states wary of potential sovereignty loss.

Lovely pictures.

• Witnessing The Migration Crisis (Yannis Behrakis)

I have been covering refugees and migrants for over 25 years. The difference this time was that migrants were arriving in my homeland. A couple of boats arrived every night. Everybody aboard was scared as they didn’t know how the police and locals would react. Small dinghies kept on arriving, even when the weather was rough. The Turkish coast was just 4-5 km away. To start with the migrants were scared, unsure. They arrived overnight because they were hiding. Each time they saw a photographer or a local they thought it was the police about to arrest them. Sometimes they got frightened and even “surrendered” occasionally, lifting their arms. I shouted welcome to reassure them. Once on land they started laughing and giving “high fives”. The atmosphere was charged with emotion.

Nobody expected there would be so many of them. The local community wasn’t prepared but most Greeks have some refugee blood and locals realised that these people only wanted to use Greece as a stepping-stone to move north. There were families including children and old women. So people thought, “We need to help them”. At the beginning of a situation like this there is always some mistrust among both migrants and locals. Soon migrants came to realise that people were friendly on the island of Kos and the police wouldn’t arrest them. Gradually they were more open and less fearful.

It was very quiet on the island before the tourist season started. I waited for two or three boats a night. I could hear the engines from the beaches. Moonlit nights can help a little to figure out where the boats are. In the mornings I went to the abandoned Captain Elias Hotel, where most of the migrants and refugees were put up, to take more pictures. The weather was good, so the migrants would camp on the beach, around the port or the town centre. The U.N. refugee agency UNHCR and Medecins Sans Frontieres, or Doctors without Borders, also arrived on the island to help. The migrants queued outside the police station to get temporary documents. Once they had those papers they could then buy a ticket to Athens and continue north.

One day I was photographing a raft in Lesbos. I noticed a movement and thought somebody had jumped overboard. I focused using a long lens and saw the fin of a dolphin. The dolphin jumped almost in front of the raft. It was a truly magic moment. It was as if the dolphin was showing the way and welcoming the people on the raft. [..] The least challenging part of the assignment was taking pictures. The difficulty was the emotional involvement in the story. It was disappointing to see the same thing happening again and again.