G.G. Bain New York, suffragettes on way to Boston 1913

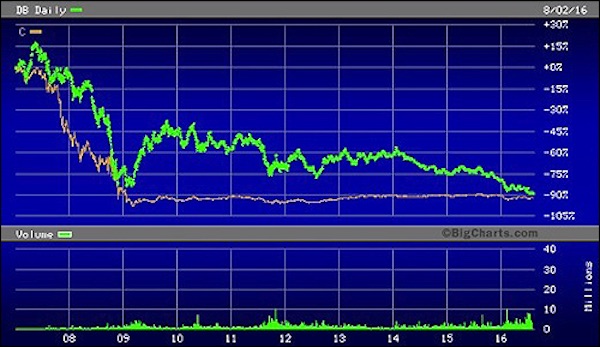

Martens and Martens. “..a year ago, Deutsche Bank’s stock closed at $34.88. Its share price at the open this morning was $12.56, a loss of 64% in one year’s time. But from June 1 of 2007, Deutsche Bank has lost a whopping 90% of its share value, right on par with Citigroup.”

• Is Deutsche as Dangerous to Financial Stability as Citigroup in 2008? (M2)

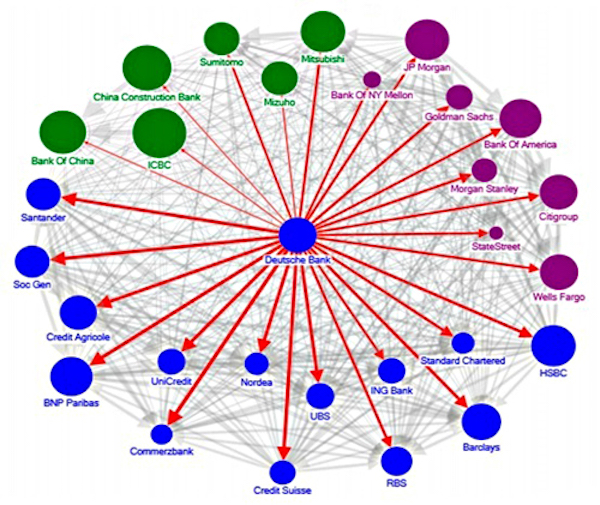

Deutsche Bank is starting to resemble the financial basket case that Citigroup became in 2008, leading to Citigroup’s partial ownership by the U.S. government for a time and the bank requiring the largest taxpayer bailout in U.S. financial history. Citigroup’s teetering condition and its interconnectedness to other mega banks played a critical role in the Wall Street crash and collapse of the U.S. economy. That Deutsche Bank (which is highly interconnected to other major Wall Street banks and locked and loaded with tens of trillions of dollars in derivatives) is now showing the same kind of stresses as Citigroup back in 2008, raises the obvious question about just how effectively the Obama administration has reined in systemic financial risk after six years of reassurances that Dodd-Frank financial reform was getting the job done.

On this date a year ago, Deutsche Bank’s stock closed at $34.88. Its share price at the open this morning on the New York Stock Exchange was $12.56, a loss of 64% in one year’s time. But from June 1 of 2007, prior to the onset of the financial crisis, Deutsche Bank has lost a whopping 90% of its share value, right on par with Citigroup. As of this morning’s open, Deutsche Bank has a measly $17.32 billion in equity capital versus a portfolio of derivatives amounting to just shy of $50 trillion notional (face amount) as of December 31, 2015.

Systemic Risk Among Deutsche Bank and Global Systemically Important Banks (Source: IMF: “The blue, purple and green nodes denote European, US and Asian banks, respectively. The thickness of the arrows capture total linkages (both inward and outward), and the arrow captures the direction of net spillover. The size of the nodes reflects asset size.”)

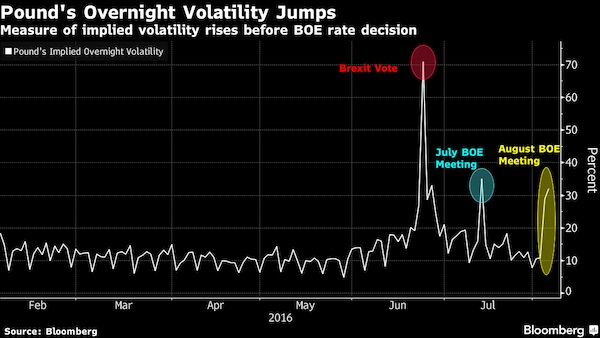

Carney’s expected to announce desperate measures today.

• Pound Volatility Gauge Climbs as Traders Brace for BOE Rate Cut (BBG)

A measure of overnight potential price swings for the pound against the dollar approached the highest closing level since Britain voted to leave the European Union in June as traders braced for the Bank of England’s policy decision Thursday, which most economists forecast will bring the first interest-rate cut in seven years. Sterling fell versus all but one of its 16 major peers as swaps pricing showed a 100% chance of a rate cut. While all except two of 52 analysts in a Bloomberg survey forecast a reduction, there are a suite of other measures, including an expansion of its bond-purchase program, which the BOE may adopt to tackle a Brexit-induced fallout which are more difficult to predict.

Some economists said they would not rule out the possibility that the BOE will keep its powder dry at this meeting, as it did in July, while awaiting a clearer economic picture. “There is quite a lot of speculation regarding what the BOE might do today, so the short-term volatility is to be expected,” said Mark Dowding, a London-based partner and money manager at BlueBay Asset Management. “We doubt the BOE would be opposed to the idea of the pound falling further as it would support the growth outlook, which is deteriorating markedly. We see the pound falling to $1.20 or lower by the end of the year.”

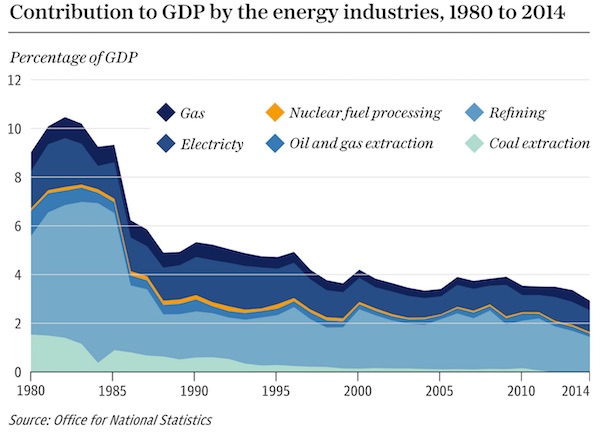

Yes, Britain’s in for a bind. But energy is not Ambrose’s strong suit.

• Britain Faces A Nasty Shock When The Global Energy Cycle Turns (AEP)

Britain’s energy industry is dying. While the US is striving for self-sufficiency in fuel and power as a primary goal of strategic security in a dangerous world, this country has acted with strange insouciance. We have let matters drift for so long that half of our nuclear reactors will be phased out over the next nine years with nothing ready to replace them. North Sea oil and gas is a spent reserve. Britain’s dependency on imported fuels and electricity has jumped from 17pc to 46pc since 2000. Energy is becoming a corrosive element in Britain’s current account deficit, now 6.9pc of GDP, and the scale of vulnerability has been masked by the slump in world energy prices. When the global fossil cycle turns – inevitable, given the $400 investment freeze in oil and gas projects over the last two years – Britain will face a national energy ‘margin call’.

The confluence of Brexit, a new government, and the review of the Hinkley Point nuclear plant have suddenly thrown open the debate on how the UK should power its economy. It is a dangerous moment, but also giddily fluid. As a summer exercise, I will float a few thoughts on how to seize this chance, open to suggestions from Telegraph readers for better ideas. My heterodox mix will satisfy nobody: it includes fracking a l’outrance, micro-nuclear and molten-salt reactors, more off-shore wind, a Norwegian-style push for electric vehicles by 2030, and a grand plan for carbon capture and storage to take advantage of Britain’s unique competitive advantage in this field and revitalize Northern industries.

There is no shortage of funds. Britain can borrow at 1.47pc for half a century, and it should do so without compunction as an investment stimulus to carry the country through the post-Brexit storm. Oil and gas fracking does not require public money anyway. Britain’s shale industry is already poised to drill, so that is where I will begin today.

Including Steve Keen, David Graeber.

• Cash Handouts Are Best Way To Boost Growth, Say Economists (G.)

Direct cash handouts to households would be a better way of boosting Britain’s flagging economy than the interest-rate cuts expected from the Bank of England on Thursday, according to a group of progressive economists. In a letter to the chancellor, 35 economists have urged Philip Hammond to ditch the approach that has been followed by the government since the recession of 2008-09 and give the Bank the right to try more radical options. The letter, to be printed in Thursday’s Guardian, suggests that the Bank should be allowed to create money to fund key infrastructure projects. Alternatively, the group says the Bank could pay for tax cuts or direct payments to households.

The letter states: “A fiscal stimulus financed by central bank money creation could be used to fund essential investment in infrastructure projects – boosting the incomes of businesses and households, and increasing the public sector’s productive assets in the process. Alternatively, the money could be used to fund either a tax cut or direct cash transfers to households, resulting in an immediate increase of household disposable incomes.” Threadneedle Street would need approval from the Treasury to adopt what the US economist Milton Friedman once described as “helicopter drops” of money on to the economy as a means of removing the threat of deflation. The nine members of the Bank’s monetary policy committee (MPC) will announce at midday how they plan to respond to the economic shock caused by the decision to leave the EU in the 23 June referendum.

The rape of Greece continues.

• Shock At The ATM: 1000s Of Supplementary Greek Pensions Cut By 21%-46% (KTG)

It was certainly a shock for thousands of Greek pensioners: beginning of August they saw their supplementary pensions to have undergone cuts from 21% up to 46%. Affected are 311,680 pensioners receiving pensions from 11 pension funds. The 3. bailout and the Pensions Reforms provided that if the sum of main and supplementary pension exceeds €1,300 gross, the supplementary pension has to be cut. The second wave of cuts to be implemented as of September will affect another 924,345 pensioners belonging to other pension funds.

The Pension Reforms ended up in throwing all pensioners in one bag and have them ‘share’ the available pension funds, although this is –first of all- “unfair” for the pensioners of the private sector. They have been loyally paying their social security contributions all through their work life, while the pensioners of the public sector have been paying much less and thus receiving disproportionately much more. Public servants who massively left service with early retirement of 25 years in 2010, they ended up receiving a pension amount equal to their salary – although it should have been much lower. Yes, it is unfair. And this is what I hear from more and more people form the private sector.

100,000 TTiP protesters in Germany yesterday?!

• EU Trade Policy ‘Close To Death’ If Canada Deal Fails (Politico)

One of the EU’s most senior officials has warned that the bloc’s trade policy will be “close to death” if it cannot ratify a landmark agreement with Canada. The alarm sounded by Jean-Luc Demarty, director-general for trade, is a sign of growing concern in Brussels that the European Commission is losing control over one of its core competencies in the face of surging public opposition to free trade. In a frustrating blow to the Commission, the member countries last month wrested the approval process for the trade deal with Canada away from Brussels. The accord will now require approval in Europe’s 38 national and regional parliaments, raising the specter of delays and even vetoes in assemblies ranging from Wallonia to Romania.

Demarty delivered his stark warning at the EU’s trade policy committee ahead of the summer break, according to people present at the confidential meeting. Most diplomats expect the Canadian deal to win the qualified majority required for provisional application at the Council. Notes from the July 15 meeting, seen by POLITICO on Monday, showed that Demarty warned that EU trade policy would have a “big credibility problem” if it could not ratify the deal. He then added that it would be “close to death.” Two other diplomats confirmed the remarks and added that this was now typical of Demarty’s tone on the subject. One observed that Demarty seemed “helpless.”

Traditionally, trade has been the blue-riband portfolio in Brussels, with national governments surrendering all of their powers to negotiate trade deals and impose tariffs to the Commission. But Brussels suffered a significant setback on July 5 when France and Germany unexpectedly insisted that a trade deal with Canada would have to be ratified by the EU’s 38 national and regional assemblies. That has left the Commission scrambling to rescue the deal and preserve its status as the biggest force in global trade.

It’s healthy when bubbles burst. But painful too for some.

• Reality of BC’s Foreign Buyers Tax Begins To Bite, Deals Collapsing (FP)

Realtors and lawyers desperate to get in under the deadline filed a record-setting 15,000 property transfer applications on Thursday and Friday, the last business days before B.C.’s punishing new 15-per-cent tax on foreign property buyers went into effect. More than 9,200 transactions were filed on Friday, breaking the 2007-2008 record of more than 8,400 in a single day, according to the B.C. Land Title and Survey Authority. It also reported over 5,800 transactions on Thursday, representing nearly as many deals registered at month’s end in April. The demand was so heavy that it crashed the land titles office’s electronic filing service on both days, the authority said.

Now, as a new dawn breaks in Metro Vancouver’s real estate market, realty companies and real estate boards are reporting the first anecdotes of deals falling through as foreign buyers forfeited deposits on binding deals rather than pay the new tax. And they report evidence of local buyers withdrawing offers in expectation that the market will soften. Elton Ash, executive vice-president of Re/Max Western Region, said it is too early to accurately quantify how many deals fell apart, but he’s heard from realtors in some of the company’s 30 Metro Vancouver offices of cases where foreign buyers who couldn’t rearrange previously negotiated closing dates have already walked away.

[..] Jonathan Cooper, vice-president of operations at MacDonald Realty, expects many cases to go to court because deposits are held in trust by realtors and usually can’t be released without a court order. “I think the next chapters in this story are going to be written by lawyers,” Cooper said. “There are going to be cases for sellers trying to get the deposit out of trust and maybe suing the buyer for specific performance trying to get them to complete, and/or for damages if they are not able to find a buyer at a similar price point.”

“Across Italy, cities faced with shrinking income and rising expenses bought swaps from U.S. firms to cut short-term interest costs..”

• Morgan Stanley Discloses $3.21 Billion Italian Swaps Claim (BBG)

Morgan Stanley said an Italian prosecutor may seek as much as €2.88 billion ($3.21 billion) over allegations that derivatives the investment bank sold more than a decade ago were improper and unfairly unwound. Italy’s Court of Accounts, the country’s state auditor, sent Morgan Stanley the proposed claim over derivatives created from 1999 through 2005 and terminated by 2012, the New York-based bank said Wednesday in a quarterly regulatory filing. Italy had paid Morgan Stanley $3.4 billion to unwind interest-rate swaps and options that had backfired, as it was cheaper than renewing the contracts, Bloomberg reported in 2012.

Mark Lake, a Morgan Stanley spokesman, said the proposed claim is groundless and that the bank will defend itself vigorously. Wall Street has been accused of duping municipalities with sophisticated and complex instruments. Some banks pitched the derivatives transactions as a way to save on borrowing expenses, but many ended up being costly for their government customers. Across Italy, cities faced with shrinking income and rising expenses bought swaps from U.S. firms to cut short-term interest costs, putting them at risk of paying more in the long run.

Wonder when this bubble will burst. Tesla rides ‘green waves’ in more than one way.

• Tesla Loses $293 Million as Deliveries Fall Short, Expenses Rise (WSJ)

Tesla Motors’s loss widened in the second quarter amid higher costs, but the company stuck to an ambitious plan that calls for building nearly 80,000 cars in 2016 and pulling forward a cheaper sedan aimed at the mass market. The Silicon Valley electric car maker’s report follows a tumultuous period capped by a traffic fatality related to the company’s semiautonomous Autopilot system. Regulators also dinged the company’s practice of having certain buyers sign nondisclosure agreements and the company faced continued questions about the quality of its Model X sport-utility vehicle.

Tesla, long known as a company that moves faster than traditional auto makers, plowed forward during the quarter. It announced its intention to combine with SolarCity Corp., which shares with Tesla Elon Musk as chairman. On Monday, the Tesla announced a firm deal with SolarCity valued at $2.6 billion.

“..the next leg down in oil prices could be far more disruptive than most investors expect and it may not take much to trigger a major financial event.”

• We’re Not Out of the Woods Yet (STA)

The risk of a global shock appears to be rising once again as (1) oil prices fall back into the $30s and (2) modestly improving US economic growth strengthens the case for a rising dollar. In addition to a likely revival in US rate hike expectations, growing foreign demand for US cash flows, or the prospect for more central bank easing abroad (both of which could drive the dollar higher), the world economy may already be nearing another breaking point as foreign central bank assets held at the Federal Reserve continue to fall on a year-over-year basis. Every time this measure has fallen below zero in the last fifty years, it has coincided with a major global event.

My suspicion is that oil producing countries (who officially flipped from current account surplus into current account deficit in 2015) are liquidating their US dollar assets to manage government budget shortfalls. With that in mind, the next leg down in oil prices could be far more disruptive than most investors expect and it may not take much to trigger a major financial event. We’re not aggressively betting on a crisis, but my colleagues and I on the STA Investment Committee continue to run conservative portfolios with an underweight to equities, and a focus on yield-oriented assets (like corporate bonds and preferred stocks) and defensive assets (like cash, gold, managed futures, and long-dated US Treasuries) while we wait for quality assets to go on sale.

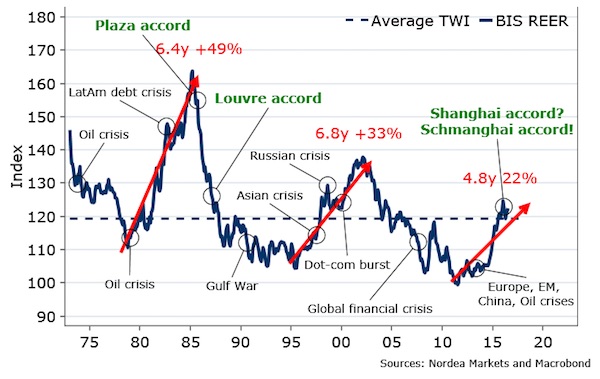

If you’ve been paying attention to global markets this year, you are probably still scratching your head as to what fundamentally changed in early February. What pulled us back from the edge of a global crisis and set the stage for one of the most powerful reflations (ex earnings) in recent memory? What caused corporate credit spreads to collapse, crude oil to bottom, and the S&P 500 to scream higher? And, most importantly, is this a sustainable new trend? Or an epic bear trap? As regular FWIW readers may remember, I offered a hypothesis in mid-March – arguing that major central banks had begun to quietly intervene in foreign exchange markets – and I laid out a vision for 2016 as long as policy elites were able to keep the trade-weighted US dollar in a “goldilocks” trading range.

Ronald Reagan Returns.

• Justice Department Officials Objected to US Cash Payment to Iran (WSJ)

Senior Justice Department officials objected to sending a plane loaded with cash to Tehran at the same time that Iran released four imprisoned Americans, but their objections were overruled by the State Department, according to people familiar with the discussions. After announcing the release of the Americans in January, President Barack Obama also said the U.S. would pay $1.7 billion to Iran to settle a failed arms deal dating back to 1979. What wasn’t disclosed then was that the first payment would be $400 million in cash, flown in at the same time, as The Wall Street Journal reported Tuesday.

The timing and manner of the payment raised alarms at the Justice Department, according to those familiar with the discussions. “People knew what it was going to look like, and there was concern the Iranians probably did consider it a ransom payment,’’ said one of the people. The disclosures reignited a political furor over the Iran deal in Washington that could complicate White House efforts to fortify it before Mr. Obama’s term ends. Three top Republicans who have been feuding in recent weeks—presidential candidate Donald Trump, Sen. John McCain and House Speaker Paul Ryan—were united Wednesday in blasting the Obama administration.

Excellent expose by John Pilger.

• Julian Assange: The Untold Story Of An Epic Struggle For Justice (Pilger)

The siege of Knightsbridge is both an emblem of gross injustice and a gruelling farce. For three years, a police cordon around the Ecuadorean embassy in London has served no purpose other than to flaunt the power of the state. It has cost £12 million. The quarry is an Australian charged with no crime, a refugee whose only security is the room given him by a brave South American country. His “crime” is to have initiated a wave of truth-telling in an era of lies, cynicism and war. The persecution of Julian Assange is about to flare again as it enters a dangerous stage. From August 20, three quarters of the Swedish prosecutor’s case against Assange regarding sexual misconduct in 2010 will disappear as the statute of limitations expires.

At the same time Washington’s obsession with Assange and WikiLeaks has intensified. Indeed, it is vindictive American power that offers the greatest threat – as Chelsea Manning and those still held in Guantanamo can attest. The Americans are pursuing Assange because WikiLeaks exposed their epic crimes in Afghanistan and Iraq: the wholesale killing of tens of thousands of civilians, which they covered up, and their contempt for sovereignty and international law, as demonstrated vividly in their leaked diplomatic cables. WikiLeaks continues to expose criminal activity by the US, having just published top secret US intercepts – US spies’ reports detailing private phone calls of the presidents of France and Germany, and other senior officials, relating to internal European political and economic affairs.

None of this is illegal under the US Constitution. As a presidential candidate in 2008, Barack Obama, a professor of constitutional law, lauded whistleblowers as “part of a healthy democracy [and they]must be protected from reprisal”. In 2012, the campaign to re-elect President Barack Obama boasted on its website that he had prosecuted more whistleblowers in his first term than all other US presidents combined.

The details are stunning, but at the same time familiar.

• Court Throws Out Terrorism Conviction In Canada, Cites Police Entrapment (I’Cept)

Sting operations — in which an undercover agent or informant provides the means and opportunity to lure otherwise incapable people into committing a crime — have represented the default tactic for counterterrorism prosecutions since the 9/11 attacks. Critics believe these stings amount to entrapment. Human Rights Watch, for instance, argues that law enforcement authorities in the U.S. have overstepped their role by “effectively participating in developing terrorism plots.” Nonetheless, U.S. courts have rejected entrapment defenses, no matter how hapless the defendants. In Canada, however, the legal standing of counterterrorism stings has suddenly shifted.

Last week, a high-ranking judge in British Columbia stayed the convictions of two alleged terrorists, ruling that they had been “skillfully manipulated” and entrapped by an elaborate sting operation organized by the Royal Canadian Mounted Police. “The specter of the defendants serving a life sentence for a crime that the police manufactured by exploiting their vulnerabilities, by instilling fear that they would be killed if they backed out, and by quashing all doubts they had in the religious justifications for the crime, is offensive to our concept of fundamental justice,” the judge wrote. “Simply put, the world has enough terrorists. We do not need the police to create more out of marginalized people who have neither the capacity nor sufficient motivation to do it themselves.”

This is the first time that a counterterrorism sting — whose tactics were developed by the FBI through modifying those of undercover drug stings — has been thrown out of court whole cloth in Canada or the U.S. Supreme Court Justice Catherine J. Bruce was ruling in the case of John Nuttall and his common-law wife, Amanda Korody, two drug addicts who lived on the streets in British Columbia. As part of sting operation in which the RCMP paid at least 200 officers a total of more than $900,000 Canadian in overtime, law-enforcement agents encouraged the couple to place pressure-cooker bombs at the British Columbia parliament building on Canada Day 2013. As in FBI counterterrorism stings, RCMP provided Nuttall and Korody with everything they needed to become terrorists.

Can we adopt this throughout the world please?

• Italy Adopts ‘Beautiful’ New Law To Slash Food Waste (BBC)

Italy has passed into law a raft of new measures to try to reduce the mountain of food wasted in the country each year. The bill – backed by 181 Senators, with two against and 16 abstaining – aims to cut waste one million tonnes from the estimated five million it wastes each year. It has been heralded as “one of the most beautiful and practical legacies” of the Expo Milano 2015 international exhibition – which focused on tackling hunger and food waste worldwide – by Agriculture Minister Maurizio Martina. According to ministers, food waste costs Italy’s business and households more than €12bn per year. Studies suggest it could amount to more than 1% of GDP.

The problem is by no means confined to Italy. The UN Food and Agricultural Organisation (FAO) estimates that some one third of food may be wasted worldwide – a figure which rises to some 40% in Europe. “The food currently wasted in Europe could feed 200 million people,” the FAO says. It’s not the first time Italy has acted decisively over issues of hunger and food. Three months ago, its highest court ruled that stealing small amounts of food to stave off hunger was not a crime.