Odilon Redon Fallen angel 1872

Cheap money blows bubbles, but…

• A New US Oil Production Peak Looks Imminent (Robert Rapier)

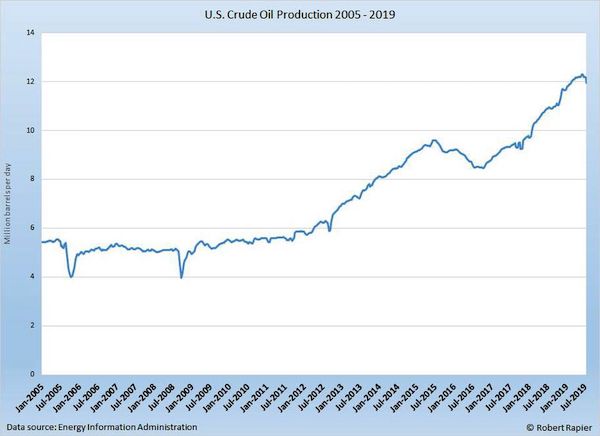

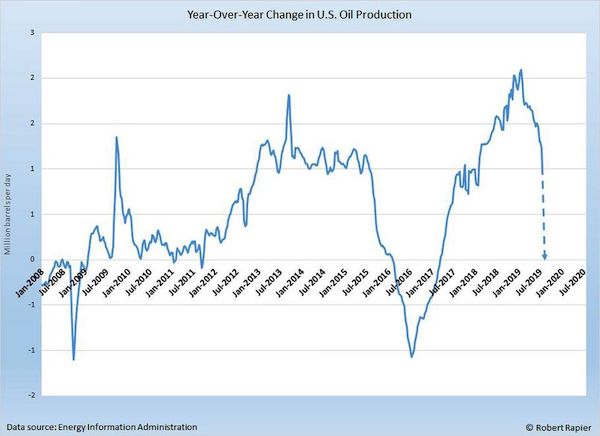

The resurgence of U.S. oil production over the past decade diminished OPEC’s control of the global oil markets. In less than eight years, U.S. oil production climbed from under 6 million barrels per day (BPD) to more than 12 million BPD. This surge is arguably the only reason oil prices today aren’t above $100/barrel (bbl). OPEC’s current strategy seems to be to wait for U.S. production to begin declining so they can begin to regain control of the oil markets. They may not have to wait all that long.

In last week’s article, I covered the slowdown in oil production growth in the Permian Basin. This is the most important oil-producing region in the U.S., but of course it isn’t the only one. And while most of the coverage of the resurgence of U.S. oil production has been primarily focused on shale oil and tight oil, U.S. offshore oil production has also made a big jump. Over the past decade, Gulf Coast oil production in the U.S. rose from about 1.2 million BPD to about 2.0 million BPD.

Thus, I thought today it might be instructive to look at the trends in total U.S. oil production. Note that in the previous graphic, it looks like production may be starting to turn down right at the end of the time frame. In fact, the Energy Information Administration (EIA) has reported a slight downward trend in U.S. oil production since May. The key question is whether this is an anomaly, or the beginning of a sustained trend. Applying the same analysis that I did last week to Permian Basin production – which looked at year-over-year production changes – it becomes clear that overall U.S. production growth is declining even faster than Permian Basin production growth.

“.. state-owned enterprises account for 80% of the revenue generated by Chinese companies..”

• China’s Wobbly Giants (Fortune)

In China, publication of the Fortune Global 500 has become a major media event. Companies advancing even a place or two rush out press releases. Those making the list for first time bask in the achievement; this year’s most notable Chinese debutant, smartphone maker Xiaomi, celebrated by doling out $24 million in stock to its 20,000 employees. The 2019 list gives Chinese firms something special to crow about: the number of Chinese firms rose to a record 129, including 10 from Taiwan, overtaking the 121 firms from the United States.

[..] the most striking characteristic of China’s presence on the Global 500 remains the overwhelming—and growing—dominance of state-owned firms. A calculation by Hong Kong’s South China Morning Post found that, if firms from Hong Kong and Taiwan are excluded, state-owned enterprises account for 80% of the revenue generated by Chinese companies on the 2019 list, up from 76% last year. Derek Scissors, resident scholar at the American Enterprise Institute, argues the prevalence of state-owned behemoths among Chinese firms “reveals more weakness than strength.”

He questions whether firms like Ping An Insurance Group (No. 29) and Huawei Technologies (No. 61) are truly private; doubts the veracity of financial results reported by China’s state-owned firms; and notes that Chinese SOEs are mostly sleepy monopolies. The vast revenue of state-owned Chinese companies on the Fortune 500, he concludes, “primarily represents waste.” Former Financial Times China correspondent Richard McGregor offers a more nuanced explanation for the ascendance of China’s state-owned giants in his new book Xi Jinping: The Backlash. For China watchers, the entire book is a must-read, but this excerpt published recently in The Guardian, summarizes Richard’s account of how and why Xi sought to bolster state-owned enterprises at the expense of private enterprise.

What is it, 100 days until Halloween?!

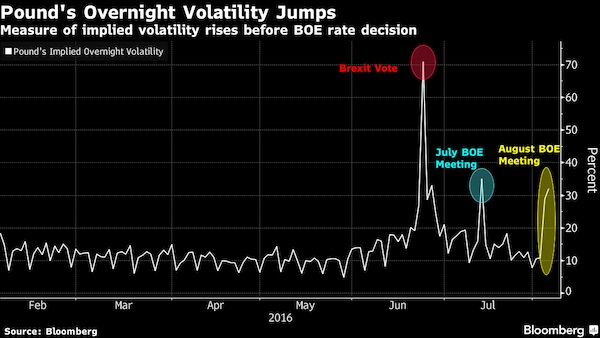

• Business Lobby Group CBI Says UK, EU Not Ready For No-Deal Brexit (BBC)

The Confederation of British Industry (CBI) has warned the government that neither the UK nor the EU is ready for a no-deal Brexit on 31 October. “While the UK’s preparations to date are welcome, the unprecedented nature of Brexit means some aspects cannot be mitigated,” said the CBI. It has published practical steps it says the UK, EU and firms can take. A government spokesman said the UK has increased the pace of planning for no-deal. The CBI had previously said leaving the EU with a deal was essential to protect the economy and jobs. New Prime Minister Boris Johnson has made Michael Gove responsible for planning a no-deal Brexit. Mr Gove has said the UK government is currently “working on the assumption” of a no-deal Brexit.

He said his team still aimed to come to an agreement with Brussels but, writing in the Sunday Times, he added: “No deal is now a very real prospect.” The CBI’s report What Comes Next? The Business Analysis Of No Deal Preparations advises what measures businesses can take to reduce the worst effects. The advice is based on a study of existing plans laid out by the UK government, European Commission, member states and firms. “And although businesses have already spent billions on contingency planning for no deal, they remain hampered by unclear advice, timelines, cost and complexity,” the CBI says. “Larger companies, particularly those in regulated areas such as financial services, have well-thought-through contingency plans in place, though smaller firms are less well prepared.”

They’re stuck on the backstop: “Johnson may well find that having left one political union, he spends an increasing proportion of his time trying to keep another together..”

• Johnson Told No-Deal Brexit Will Crush Domestic Policy Plans (G.)

Boris Johnson’s ambitious domestic agenda would be crushed by the pressing needs of the emergency that would follow a no-deal Brexit, a new report by a Whitehall thinktank has concluded. The Institute for Government (IfG) warned there is “no such thing as a managed no deal” and the hard Brexiters predictions of a “clean break” from the EU will not materialise. Johnson will begin his first full week in Downing Street by ramping up planning for the possibility of a no-deal Brexit on 31 October, with more than £1bn to be announced within days for preparations by Sajid Javid, the chancellor. He sent out a raft of cabinet ministers over the weekend to talk about “turbo-charging” preparations as part of a publicity blitz, making clear that the UK will be heading for no deal unless EU leaders agree to replace the Irish backstop.

The new prime minister is also heading to Scotland, Wales and Northern Ireland in the coming days to promise to “strengthen the union”, but he faces a difficult meeting with Ruth Davidson, the Scottish Conservative leader, on Monday as she warned over the weekend that she cannot sign up to his no-deal Brexit strategy. In its report on no deal, the IfG predicted that the union of the United Kingdom would come under “unprecedented pressure” in the event of a no-deal Brexit, with Northern Ireland “most acutely affected”. It said that legislation to introduce direct rule in Northern Ireland with immediate effect would be needed to get through a no-deal Brexit if the devolved government is not restored by the end of October. “Johnson may well find that having left one political union, he spends an increasing proportion of his time trying to keep another together,” it said.

[..] In another sign of the uncertainty Johnson faces, the owner of Vauxhall warned on Sunday that it will close its Ellesmere Port plant with the loss of 1,000 jobs if Brexit renders it unprofitable. “No deal is a step into the unknown: the prime minister’s second 100 days will be even more unpredictable than his first,” the report says, adding that the EU is unlikely to agree to negotiate any “side deals” to soften the impact. “Rather than ‘turbo-charging’ the economy, as Johnson has suggested, the government is more likely to be occupied with providing money and support to businesses and industries that have not prepared or are worst affected by a no-deal Brexit – as well as dealing with UK citizens in the EU, and EU citizens here, who have been similarly caught out,” it says.

[..] Dominic Cummings, the mastermind behind Vote Leave, who has been hired as Johnson’s special adviser, has been tasked with delivering Brexit “by any means necessary”. In a meeting with fellow special advisers, he made it clear that he believes No 10 can outmanoeuvre parliamentary critics of no deal and force Brexit to happen by 31 October. However, leading former cabinet ministers – Philip Hammond, David Gauke and Rory Stewart – are all preparing to join the cross-party battle to make sure parliament has a say on the form of the UK’s departure. One source close to the group said Cummings’s confidence of being able to proceed with a no deal if necessary was “misplaced”, while another former cabinet minister described the senior No 10 adviser as a “master of disinformation and spin”.

While all attention and funding goes towards Brexit…

• More Than 4 Million In UK Are Trapped In Deep Poverty (G.)

More than 4 million people in the UK are trapped in deep poverty, meaning their income is at least 50% below the official breadline, locking them into a weekly struggle to afford the most basic living essentials, an independent study has shown. The Social Metrics Commission also said 7 million people, including 2.3 million children, were affected by what it termed persistent poverty, meaning that they were not only in poverty but had been for at least two of the previous three years. Highlighting evidence of rising levels of hardship in recent years among children, larger families, lone parent households and pensioners, the commission urged the new prime minister, Boris Johnson, to take urgent action to tackle growing poverty.

The commission’s chair, Philippa Stroud, a Conservative peer, said there was a pressing need for a concerted approach to the problem. “It is time to look again at our approach to children, and to invest in our children as the future of our nation,” she said. Campaigners said the commission showed austerity had undermined two decades of anti-poverty policy. “By cutting £40bn a year from our work and pensions budget through cuts and freezes to tax credits and benefits, the government has put progress into reverse,” said Alison Garnham, the chief executive of Child Poverty Action Group.

He was strong in the Mueller hearing.

• Ratcliffe Tapped To Replace Coats As US Spy Chief (R.)

U.S. President Donald Trump said on Sunday he would nominate Representative John Ratcliffe, a Texas Republican who strongly defended him at a recent congressional hearing, to replace Dan Coats as the U.S. spy chief. Coats, the current U.S. director of national intelligence who has clashed with Trump over assessments involving Russia, Iran and North Korea, will step down on Aug. 15, the president said as he announced his decision on Twitter. “John will lead and inspire greatness for the Country he loves,” Trump said, thanking Coats “for his great service to our Country” and saying an acting director will be named shortly. The post of director of national intelligence, created after the Sept. 11, 2001 attacks on the United States, oversees the 17 U.S. civilian and military intelligence agencies, including the CIA.

Ratcliffe, a member of the House of Representatives intelligence and judiciary committees, defended Trump during former Special Counsel Robert Mueller’s testimony on Wednesday about his two-year investigation of Russian interference in the 2016 presidential election and possible obstruction of justice. Ratcliffe also accused Mueller of exceeding his authority in the report’s extensive discussion of potential obstruction of justice by Trump after the special counsel decided not to draw a conclusion on whether Trump committed a crime. The congressman agreed that Trump was not above the law, but said the president should not be “below the law” either.

“My family won’t fly on a 737 Max.”

• Work On Production Line Of Boeing 737 MAX ‘Not Adequately Funded’ (BBC)

A former Boeing engineer has told the BBC’s Panorama programme that work on the production line of the 737 Max plane was not adequately funded. The aircraft is currently grounded after two crashes which killed 346 people. The 737 Max is the company’s fastest selling plane and has earned the company billions of dollars in sales. Boeing denies the claims and says it’s committed to making the 737 Max one of the safest aircraft ever to fly. Adam Dickson worked at Boeing for 30 years and led a team of engineers who worked on the 737 Max. He said they were under constant pressure to keep costs down. “Certainly what I saw was a lack of sufficient resources to do the job in its entirety,” he says. “The culture was very cost centred, incredibly pressurised. Engineers were given targets to get certain amount of cost out of the aeroplane.”

Mr Dickson said engineers were under pressure to downplay new features on the 737 Max. He said by classifying them as minor rather than major changes, Boeing would face less scrutiny from the US regulator, the Federal Aviation Administration. “The goal was to show that those differences were so similar to the previous design that it would not require a major design classification in the certification process. There was a lot of interest and pressure on the certification and analysis engineers in particular, to look at any changes to the Max as minor changes.” He said that downplaying the changes reduced scrutiny in a way that could impact safety. Now even his own family have fears about the plane’s safety. “My family won’t fly on a 737 Max. It’s frightening to see such a major incident because of a system that didn’t function properly or accurately.”

“How does it happen 10 minutes away from the American border in Michigan, people here are paying one-10th of the price for the vitally important drug they need to stay alive?”

• Insulin Is Our Oxygen: Bernie Sanders Rides Another Campaign Bus To Canada (G.)

When Hunter Sego realized the insulin he needed to manage his Type 1 diabetes cost more than $1,400, he called his mother in a panic. His family had insurance. He did not believe it was possible a one-month supply of “life saving” medication could cost so much. The price tag was correct. Then a student and football player at DePauw University, he began to ration his insulin, using a quarter of what had been prescribed. He lost weight. His grades dropped. He struggled on the field. Fortunately, his mother found out and stopped him from rationing his insulin – a practice that is increasingly common and potentially deadly.

On Sunday, Sego and his mother, Kathy, drove seven hours from Indiana to join a caravan of roughly a dozen patients with Type 1 diabetes on a bus to Canada with Vermont senator and presidential candidate Bernie Sanders. The Americans – wearing glucose monitors on their arms and shirts that said “diabetic” – set out to buy insulin for a fraction of its cost at home. Sanders’ northern sojourn, a trip his campaign sponsored, was designed to highlight the rising cost of prescription drugs in the US, which the senator said was the result of “incredible corruption and greed” on the part of the US pharmaceutical industry.

“How does it happen 10 minutes away from the American border in Michigan, people here are paying one-10th of the price for the vitally important drug they need to stay alive?” Sanders asked, calling the disparity a “national embarrassment”. In his remarks outside of the Olde Walkerville Pharmacy in Windsor, Sanders vowed that as president he would appoint an attorney general to investigate the pharmaceutical industry for what he described as “collusion” between the major drug companies. “Prices go up and up and up at the same level for the same companies,” he said. “So what you do is you throw these people in jail if they engage in price-fixing.”

How many agents are going to be on his tail?

• Papadopoulos To Head To Greece To Retrieve $10,000 Payment (Fox)

Former Trump adviser George Papadopoulos told Fox News’ Maria Bartiromo in an exclusive interview that he is heading back to Greece to retrieve $10,000 that he suspects was dropped in his lap as part of an entrapment scheme by the CIA or FBI — and federal investigators want to see the marked bills, which he said are now stored in a safe. Papadopoulos said on “Sunday Morning Futures” he was “very happy” to see Devin Nunes, R-Calif., grill former Special Counsel Robert Mueller about the summer 2017 payment during last week’s hearings — even though Mueller maintained, without explanation, that the matter was outside the scope of his investigation.

“I was very happy to see that Devin Nunes brought that up,” Papadopoulos said. “A man named Charles Tawil gave me this money [in Israel] under very suspicious circumstances. A simple Google search about this individual will reveal he was a CIA or State Department asset in South Africa during the ’90s and 2000s. I think around the time when Bob Mueller was the director of the FBI. “So, I have my theory of what that was all about,” Papadopoulos added. “The money, I gave it to my attorney in Greece because I felt it was given to me under very suspicious circumstances. And upon coming back to the United States I had about seven or eight FBI agents rummaging through my luggage looking for money.”

According to Papadopoulos, “the whole setup” by the “FBI likely, or even the special counsel’s office,” was intended to “bring a FARA [Foreign Agents Registration Act] violation against me.” The FARA statute played a key role in the prosecutions of former Trump aides, including Michael Flynn and Paul Manafort. Papadopoulos previously told Bartiromo in May that he wanted authorities to take a look at the money trail. “I actually want Congress, [Bill] Barr, [DOJ Inspector General Michael] Horowitz, and [U.S. Attorney John] Huber to review the bills because I still have the bills and I think they are marked,” Papadopoulos said. “These bills that are still in Athens right now must be examined by the investigators because I think they are marked and they’re going to go all the way back to DOJ, under the previous FBI under [James] Comey, and even the Mueller team.”

But the torture just continues…

• US Wants To ‘Make An Example’ Of Assange In Jail, UN Expert Claims (SMH)

The United States government has promised that Julian Assange will get a fair trial on espionage charges, rejecting the accusation of a United Nations expert that the administration “intends to make an example of him” with excessive charges and jail time. It has challenged the assessment of the expert, the UN’s Special Rapporteur on Torture Nils Melzer, that Assange would “be exposed to a real risk of torture or other cruel, inhuman or degrading treatment or punishment” if he ended up in a US jail. But Melzer has warned that extradition to the US would severely and dangerously worsen Assange’s already fragile psychological state.

The WikiLeaks founder is in a London jail awaiting a legal fight against extradition to the US, where he has been charged with conspiracy to receive and disclose top secret documents allegedly obtained from army whistleblower Chelsea Manning in 2010. Assange’s team are expected to argue he will not receive a fair trial if the extradition takes place, and that extradition would be dangerous to his health – arguments bolstered by the damning independent report from Melzer. In May, after visiting Assange in Belmarsh Prison for an interview and psychological examination, Melzer concluded that the US, Britain, Sweden and Ecuador shared responsibility for the “psychological torture” of Assange.

On Sunday new details emerged of Melzer’s conclusions, after the publication of letters that Melzer sent to the respective governments of those countries. The UN Human Rights Commissioner also published two responses received from the US and Sweden which strongly rejected Melzer’s claims and arguments. In his letters, Melzer gave new details of Assange’s prison regimen. At the time of his visit Assange was shut in his cell for about 20 hours a day, eating all his meals in the 2 metre by 3 metre space with “a bed, a cupboard, a note-board, basic sanitary installations, a plastic chair and a medium sized window”. Melzer called for Assange to be given access to the prison library and gym, and expressed concern that his situation “severely hampers his ability to adequately prepare” for his legal fight.