John William Waterhouse Hylas and the Nymphs 1896

As I said yesterday: the divisions it causes are much bigger than the memo itself. It’s what happens in echo chambers.

• A Tale Of Two Americas (Axios)

On MSNBC, Rachel Maddow was literally laughing. Over on Fox News, Sean Hannity put up his dukes. At 9 last night, Axios points out that you could just flip between the two and see an encapsulation of our two Americas – total dismissal of the memo’s import, versus the assertion that it’s “only about 15 percent of what’s coming.”

So, Rachel, how was your day? “This thing?! This was two weeks of: This memo is going to end everything. This memo, have you heard about the memo? Hashtag: Release the memo! This memo will make Donald Trump innocent. This memo will put Robert Mueller in jail. It will abolish the FBI. The Justice Department will have to rename itself the Donald J. Trump & Family Private Security Task Force.” “I mean, I can’t believe this is it.” “I don’t really believe in the whole Cable News Wars idea. I know people who work across the street at the Fox News Channel. I’ve got friends that work there. I think we’re all doing our own thing in our own way best we can.”

“But, oh my God, right? … [T]his … hyping and huffing and puffing and working their audience up into a frenzy for two solid weeks.” “And apparently, despite all of that, … they either didn’t know or they didn’t notice that this thing they have been clamoring for and hyping for two solid weeks, … it actually disproves their whole point.” “They release this memo to prove that the dossier started everything. The memo says the dossier didn’t actually start anything.”

What’s up, Sean? “[W]hen you put all this information together, here’s what it all means. The FBI misled and purposely deceived a federal court while using an unverified, completely phony opposition research bought and paid for by Hillary Clinton.” “We have never, ever in history seen anything like this, and it was spearheaded not by rank-and-file members of the FBI intelligence community and Department of Justice. No. High-ranking officials: James Comey, Andrew McCabe, Rod Rosenstein, Peter Strzok, Lisa Page, likely Loretta Lynch.”

“But here’s the bottom line: Crimes have been committed. There is no way that they did not know that the FBI was lying to a FISA court in order to spy on an opposition campaign during an election year. They have aided and abetted what is a massive constitutional violation.” “Comey, McCabe, Rosenstein and others all need to be investigated and, in many cases, prosecuted to the fullest extent of the law.” “Now, of course, Comey is running scared. He’s out of his mind right now, now that he is exposed with this memo.” “[T]he special counsel must be disbanded immediately.” “And, by the way — nobody else will say this — all charges against Paul Manafort and General Michael Flynn need to be dropped. It’s that simple.” “This scandal is only in Phase 1. … Stay tuned! Tick tock! “

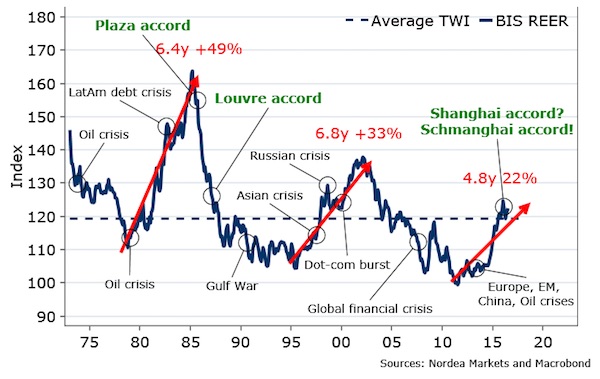

“..when something is not normal… it is just biding its time until it becomes normal again.”

• Today’s Market Is Biding Its Time Until It Becomes Normal Again (Bonner)

On Planet Earth, we can find our direction by reference to the Magnetic North. For investing, we use the most reliable force in finance – the relentless return to “normal” – to get our bearings. And searching for normal, we may have stumbled upon what could be the Trade of the Century. More on that later… As economists describe it, reversion to the mean is merely a recognition of the tendency for things to stay in a range that we recognize as “normal.” Trees do not grow 1,000 feet high. People don’t run 100 mph. You don’t get something for nothing. Normal exists because things tend to follow certain familiar patterns, shapes, and routines. When people go out in the morning, they know, generally, whether to wear a winter coat or a pair of shorts.

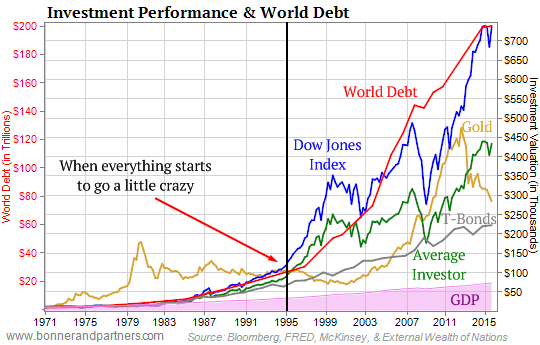

The temperature is not 100 degrees one day and zero the next. Occasionally, of course, odd things happen. And sometimes, things change in a fundamental way. But usually, when people say “this time is different”… it’s time to bet on normal. This phenomenon – reversion to the mean – has been thoroughly tested and studied in the investment world. It seems to apply to just about everything – stocks, bonds, strategies, markets, sectors… you name it. But let’s push on. What is unusual in the chart below? What is so abnormal that the mean is likely to revert against it? You will note that global debt was only $30 trillion in 1994. Now it is $230 trillion. That $200 trillion in extra credit is probably the whirlwind that sent equities spinning up to the top right.

Those gusts blew stock and other asset prices up to heights never seen before. The Dow reached over 26,000. Houses went on the market for more than $100 million. Gold rose above $1,900. But while stocks and bonds may have the wind at their backs, it seems to blow in the economy’s face… making forward progress almost impossible. The real economy – as depicted by GDP at the bottom of the chart – has grown in a rather normal way, but at a slower and slower rate. Its steady, plodding increase gives no hint of the chaos going on above it. The real economy and the financial world are as different as the eye of a hurricane and the swirling clouds and storms around it. Another thing you notice is that until the mid-’90s… and again between 2008 and 2012… the average investor got essentially no benefit in exchange for the added risk of putting his money into equities (the chart above includes dividends). He might just as well have left his money in U.S. Treasury bonds.

[..] there is a time to be in stocks… and a time to be out of them. Without knowing the future, you can still know when something is not normal. And when something is not normal… it is just biding its time until it becomes normal again.

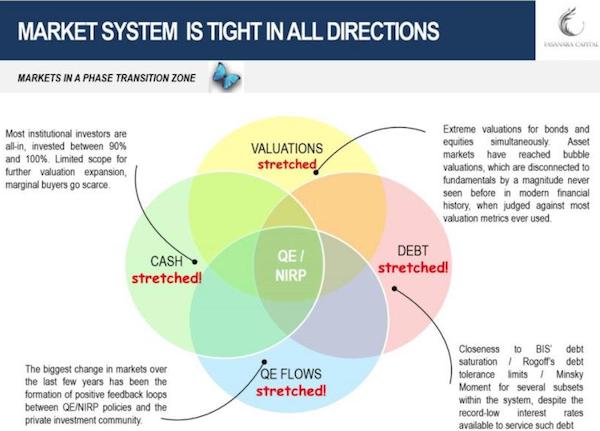

Who or what can restore flexibility when everything’s maxed out to the point of bursting?

• The Market System Is Tight In All Directions (Fas.)

The Four Pillars Holding Markets Up Are Strained, All At The Same Time. Viewed as a combination of intertwined components, each component is showing growing signs of pressure and seem to be running out of road for further advancing. The synchronicity of them, more than any single component taken independently, is what should draw attention, as it compounds systemic risk. Here are the four components, characterizing the basin of chaotic attraction for markets nowadays:

What happens when the system is tight in its key possible directions of expansion? That it expands no more. Stochastically, on one of the components a tipping point is reached, which jumpstarts the autolytic effect, spreading back through the vectors of the complex system, and snapping the unstable equilibrium into an alternative stable state. That is our thesis. In [a] recent interview, we discuss the impending tipping points for markets due to a synchronicity of excess valuations, excess indebtedness, excessively low cash balances and a drawback in excessive public flows. Let’s give a cursory look across the four components. Again, the list is by no means exhaustive, but rather a work-in-progress (seemingly endless) collecting of data points, following on to our previous work of ‘a long list of anomalies’

In a country so divided it doesn’t take much to let things get out of hand.

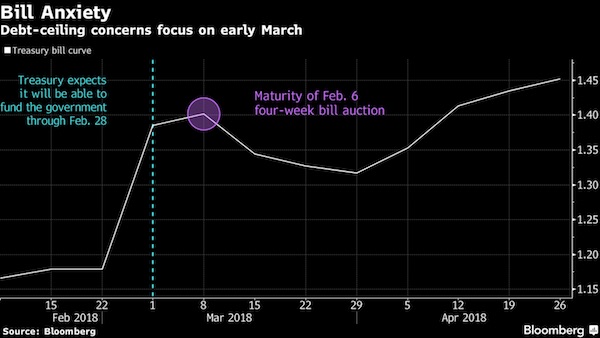

• Bond Market’s Debt-Ceiling Alarm Bell Is Ringing Loud and Clear (BBG)

In the $2 trillion Treasury-bill market, where the U.S. government turns for short-term funding, investors are showing they’re plenty nervous about the approaching deadline to raise the nation’s debt ceiling. With Treasury expected to exhaust its borrowing authority as early as the first half of March, a four-week bill sale on Tuesday will serve as the latest gauge of investor anxiety. There’s growing concern that the impasse over the debt limit will become entangled with efforts to keep the government open. Current federal funding expires Feb. 8, and the Republican-led Congress has been working on a stopgap measure to extend that into late March.

Treasury has deployed extraordinary measures to stay under the debt cap since it was reinstated in early December, but investors are wary. The new securities mature March 8, around when the Congressional Budget Office expects Treasury to run out of room. Traders are asking for higher yields to own previously issued bills maturing March 8. What’s more, an auction last week of bills due March 1 drew the weakest demand since May. “People are kind of getting skeptical of March 8 bills,” said Joseph Abate at Barclays Capital in New York. “You might argue that the March 1 bill isn’t necessarily vulnerable to payment delay because the Treasury probably has sufficient resources to meet outflows and thus might be able to last until” March 5.

Treasury has placed the drop-dead date around the end of February. But investors are leaning toward the projection from the nonpartisan CBO, which said last week that the U.S. may run the risk of default without a debt-ceiling increase in the first half of March. After the Jan. 30 auction of bills maturing March 1, the rate on those securities was higher than debt due a week later. Since then, the rate on debt expiring March 8 has climbed to 1.40%, exceeding that on bills due a week later.

In a country where 70% of people live paycheck to paycheck, the best the central bank president can muster is “they should diversify their investments..” And people are praising her for doing such a good job.

• Yellen: “I Don’t Want To Label What We’re Seeing As A Bubble” (ZH)

While her term ended – for all practical purposes – with the conclusion of this week’s January FOMC meeting, former Fed Chairwoman Janet Yellen’s last official day at the helm of the world’s most important central bank was marked by an explosion of volatility in the Dow, with the blue chips recording their worst single-day selloff since the collapse of Lehman brothers. And even though it’s tempting to suspect Friday’s selloff might foreshadow what’s to come during the Powell era, Yellen admitted during an interview with PBS Newshour that she was disappointed to not be reappointed for a second term by President Trump – and that, if she had her druthers, she would’ve opted to stay. “I would have liked to serve an additional term and I did make that clear, so I will say I was disappointed not to be reappointed,” Yellen said Friday. “I think things are looking very strong.”

Despite the volatility of the past week and the first nascent signs of wage growth in years – which should worry a central bank whose primary responsibility is to put a floor under plunging markets – Yellen says she expects interest rate hikes to proceed as planned. “The Federal Reserve has been on a path of gradual rate increases and if conditions continue as they have been, that process is likely to continue,” she said. “And as it happens we would expect long rates to move up.” Unlike fellow former Fed chairman Alan Greenspan – who this week declared that both stocks and bond valuations are in bubble territory – Yellen was careful not to use such strident language. “I don’t want to label what we’re seeing as a bubble.”

“But I would say that asset valuations are generally elevated…for the stock market, the ratio of price to earnings…is near the high end of its historical range. If we look at for example commercial real estate and other assets, we’re seeing high valuations.” But should Americans be worried about the markets? “They should be careful and I would say diversified in their investments. What we look at is the likely resilience of the economy and the financial system… In that regard, we have a banking system that is much stronger and better capitalized and better able to withstand a shock than prior to the financial crisis.” Stlll, Yellen is refusing to rule out another selloff. “Asset valuations could change I’m not predicting that that would happen and I wouldn’t rule that out,” she said.

Powelll will be cleaning up Bernanke and Yellen’s shit.

• The Fed’s Dilemma Isn’t Going Away Under Powell (Shilling)

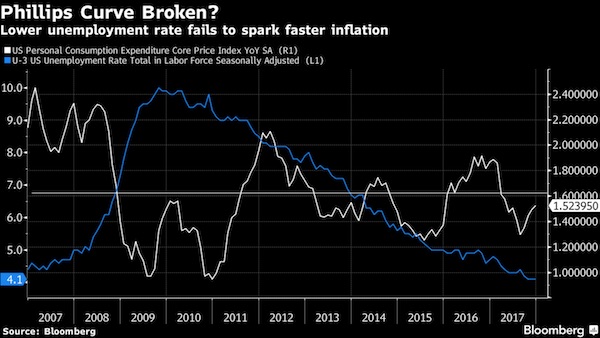

[..] the Fed is confronted with a serious dilemma: Inflation and wage increases continue to undershoot its expectations at the same time the central bank confronts forces pressuring it toward credit tightening. The new chairman, Jerome Powell, who isn’t a trained economist, may change the central bank’s tone, but his soon-to-be predecessor Janet Yellen and the other academic economists who have dominated monetary policy, believe fervently in the theoretical Phillips Curve. It posits that a declining unemployment rate should spur inflation, despite evidence to the contrary. Rather than increase as the unemployment rate declined since the recession, the rate of inflation has largely stayed the same.

Nevertheless, the Fed wants to tighten credit slowly due to chronic low inflation and memories of the May 2013 “taper tantrum,” when a mere mention by then-Chairman Ben Bernanke of reducing the Fed’s rate of asset purchases sent financial markets into tailspins as interest rates leaped. Another reason for the Fed to tighten is to keep commercial banks from lending out the more than $2 trillion in excess reserves the Fed has given them through quantitative easing. These are simply an asset of the banks and a liability on the Fed balance sheet with little financial or economic consequences. But as economic growth picks up as a result of the tax cuts followed by likely massive fiscal stimulus, creditworthy borrowers will want to borrow, banks will be happy to lend, and these excess reserves could turn into tons of money that would threaten major inflation.

Fat chance.

• Theresa May Says Brexit Transition Deal Will Be Agreed In Seven Weeks (R.)

British Prime Minister Theresa May said on Friday that a Brexit transition period will be agreed with the European Union in seven weeks as she tries to ease concerns that a deal may take longer to reach. The EU has offered Britain a status quo transition until the end of 2020 after Brexit. Both sides are aiming to reach a transition agreement by the end of March that will form part of the final withdrawal treaty to be agreed later this year. But there is disagreement inside May’s Conservative Party over some details such as the status of EU citizens during the transition and the scope of European Court of Justice jurisdiction. Many businesses and banks are concerned a battle over the terms of a transition could delay or even sink an agreement just months before Britain exits the EU on March 29, 2019.

“In seven weeks time, we will have an agreement with the European Union, that is the timetable they have said on an implementation period,” May told the BBC in an interview in China. “What the British people voted for is for us to take back control of our money, our borders and our laws and that’s exactly what we are going to do,” May said of Brexit. The EU and Britain hope to hammer out a deal on Britain’s exit and the outline of a trade package by October 2018. But some EU officials have begun to voice concern that a plan to have the leaders endorse negotiating guidelines for a new phase of talks to begin in April on a future trade agreement may be in danger of slipping if May does not spell out what Britain’s demands are for that trade pact.

Britain is as divided as the US is.

• Tory Former Attorney General Says “Time is Now” To Reverse Brexit (Ind.)

Dominic Grieve has warned the public it is running out of time to change its mind on Brexit, saying the next few months are “decision time”.The former Attorney General told The Independent it would soon be too late to reverse the decision to leave the EU, and urged people to make their minds up in the next six months.“The six months we have between now and the autumn are so important,” he said. “It is going to be decision time. And decision time in the sense of what happens in the next six months being a final decision.“If people do want to change their mind, and they could if they wanted to, the time is now. It cannot be after 29 March 2019, and frankly it cannot be after the end of the autumn of this year.”

While he did not endorse calls for a second EU referendum, Mr Grieve said it was important to give people the chance to change their minds on Brexit. “I’m not calling for a second referendum,” he said. “But we should not exclude the possibility that people’s opinion may change. And to start from an opinion on an issue that was expressed 18 months ago, where people are bound to have had their opinion influenced since, we must be very careful to listen about what it is they want.”He continued: “It the most extraordinary conundrum. We have an instruction from the electorate, by a small but significant majority, to do something that many of us [in Parliament] think is going to be very hard to achieve without serious damage to the wellbeing of every citizen in this country. It is an ethical conundrum and it is a practical conundrum.”

And here is why the country is so divided.

• Anger Over Glut Of ‘Posh Ghost Towers’ Planned For London (G.)

London councils have granted property developers planning permission to build more than 26,000 luxury flats priced at more than £1m each, despite fears that there are already too many half-empty “posh ghost towers” in the capital. Builders are currently constructing towers containing 7,749 homes priced between £1m and £10m, and have planning rights to build another 18,712 high-end apartments and townhouses, the Observer can reveal. Politicians and housing campaigners said the figures show councils are prioritising the needs of the super-rich over those of hardworking young Londoners. The boom in developments of luxury flats, which often include private cinemas, gyms, swimming pools and concierge facilities, comes as the capital faces a growing crisis in the availability of affordable housing, with nurses, police officers and other essential workers struggling to get on to the housing ladder.

Research shows that a fifth of aspiring first-time buyers have moved in with their parents to save money, and a quarter of them will need to stay there for at least five years to amass enough for a deposit. The proportion of English first-time buyers who rely on help from families and friends for their deposit has increased from 22% in 1996 to 29% in 2016, according to the government’s English Housing Survey. Anne Baxendale of Shelter said: “The UK is in the grip of a housing crisis and nowhere is this more apparent than in the capital – and these luxury developments are certainly not the types of homes most Londoners need. The government must close loopholes which make it easy for developers to build high-priced homes that are way out of reach of ordinary families, rather than the affordable ones most people actually need and can afford.”

David Lammy, the Labour MP for Tottenham, said the figures “reveal a travesty being played against the working class and young Londoners”. “The public keep being told we are building more affordable housing, and people can see cranes up all over London,” he said. “But this shows that councils are prioritising the fancies of overseas millionaires and billionaires before the needs of hardworking young Londoners.” Just 6,423 affordable homes were built in London during the 2016-2017 financial year (the latest figures available), a 5% decline on the previous year and a big drop from the 19,622 built in 2014-15.

Plus, of course, Britain suffers from what brought Trump to power. Where globalization goes to die.

• ‘We Made The Finest Steel In The World – Now We Make Lattes’ (G.)

Wearing a T-shirt with the slogan “Fighting for the community” underneath an image of Redcar’s mothballed steelworks, Frankie Wales is preparing to take a training session at the town’s boxing club. Young men are sparring in the rings; others are hitting punchbags. “Nothing gets you fit like boxing,” says one, exhausted from the ring. Wales, who set up the club 20 years ago and funds it on a shoestring with various small grants, is proud to be doing his bit for Redcar’s young people. He is a livewire in a community struggling to get off the floor after a series of near knockout blows. The local steelworks ceased production in 2015 with the loss of 3,000 jobs. Someone, he insists, has to help them. “It is incredibly sad,” he says. “Not long ago they would go and work in the steelworks after school.

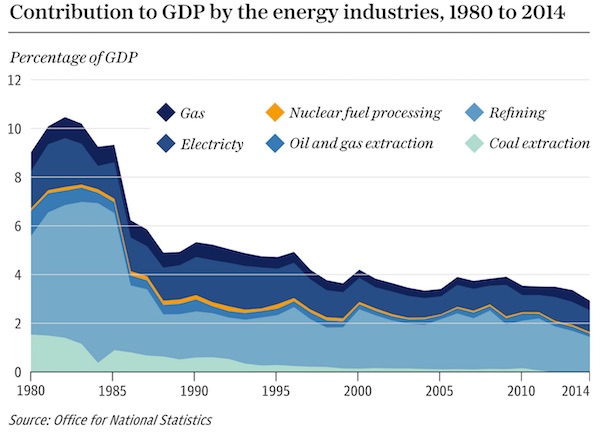

Men round here made the finest steel in the world. Now they are making lattes and sandwiches on zero-hours contracts. We have lots of entrepreneurial kids, but the only entrepreneurial activity going on around here is selling fags and drugs.” Few young people care what those who are supposed to run their country – politicians and civic and business leaders – say any more because they feel so let down. “We have lost the steel industry, lost the local shipbuilding, lost the coal. What’s the point? There is nothing left,” says Wales. “We just have to make the best of what we have got and get on with it ourselves.” Like many communities in England’s north-east, the people of this North Yorkshire town, which bears the scars of industrial decline, and has a youth unemployment rate more than double the national average, made their unhappiness known in June 2016.

They fought back. In Redcar, there was a hefty 66% vote for Brexit, similar to that in areas further north up the coast, from Teesside to Tyneside. “We have to get our country back to where it needs to be,” says Geoff Holding, a caretaker at a government office in the town who voted Leave and whose brother lost his job at the steelworks. He wants an end to cheap imports of foreign goods, like the Chinese steel that did for the local plant. There is a still a thriving chemicals sector in Redcar, but not enough manufacturing. “We need to bring things back in-house, get industry back on its own feet, make things ourselves.”

“Staggering volumes of dirty cash, including hundreds of thousands of dollars worth of $20-dollar bills stuffed in hockey bags..”

• Illicit Foreign Casino Cash Often Goes Straight Into Vancouver Housing (VSun)

It’s almost hard to believe the dismaying stories that Postmedia investigative reporter Sam Cooper has been producing about the laundering of hundreds of millions of dollars of East Asian cash through Metro Vancouver casinos and the funnelling of much of it into the city’s pricey real estate. Yet Cooper continues to clearly map out, using impeccable high-level sources, the trans-national connections between Chinese drug traffickers, B.C. casinos and the city’s housing market. He has been so effective that NDP Attorney General David Eby ended years of B.C. Liberal inaction on casino fraud to launch an investigation by money-laundering specialist Peter German. Global intelligence agents have come to call the Asian-Pacific network of corruption, drugs, tax avoidance and real estate that Cooper is exposing “The Vancouver Model.”

Metro’s casinos have become infamous for the way B.C.’s former Liberal government allowed them to be exploited to help make possibly billions of dollars in “dirty” money appear “clean” – particularly by injecting it into residential housing and condo development. Cooper says his sources “took a lot of risks” to unveil how high-stakes Chinese gamblers, called “whales,” have been funnelling illicit cash into gambling chips, especially at Richmond’s River Rock Casino. Using freedom-of-information law, Cooper obtained reports in which an official with the B.C. Lottery Commission noted that 97 of its 100 top rollers were East Asian. Cooper also dug up reports suggesting one out of four of China’s major 100 alleged financial fugitives were living in Canada, with many of them believed to be in B.C.

One Metro Vancouver gambler was accused Lai Changxing, alleged mastermind of a billion-dollar drug-smuggling operation in China, who owned property in Richmond. An audit of 800 “VIP” gamblers at River Rock Casino found their most common profession was “real estate.” Almost half their $53 million worth of transactions in one year were flagged as “suspicious.” The second and third most common professions among the biggest gamblers were “business owner” and “construction.” Many high-stakes gamblers at River Rock also declared themselves as “housewife” or “student” – with one youth forking over $819,000 in cash to buy casino chips. Investigators believe housewives and offspring are often used as fake “nominees” to hide the true source of wealth in money-laundering and real-estate schemes. Staggering volumes of dirty cash, including hundreds of thousands of dollars worth of $20-dollar bills stuffed in hockey bags, have been flowing through Metro casinos and then been shifted into real-estate.

A major and undoubtedly heated protest today. Topic: A former Yugoslav province wants to call itself Macedonia. But there already is a Greek province called macedonia. So Greece has refused to accept that name for a foreign country, and has for years halted access for that country to international organizations. The legacy of Alexander the Great plays a big role too. There are negotiations ongoing, but 70% of Greeks want no referral to Macedonia in the country’s eventual name. So no New Macedonia etc. Just call it the Republic of Skopje.

• Greece On Edge For ‘Macedonia’ Protest In Athens (K.)

With United Nations-mediated negotiations aimed at resolving a dispute between Greece and the Former Yugoslav Republic of Macedonia (FYROM) over the latter’s name at a sensitive juncture, the government is bracing for Sunday’s Athens rally protesting the use of the term “Macedonia” in a solution amid signs that the turnout will be significant. Around 1,500 buses have been chartered to bring demonstrators from the provinces to the capital where the rally is to begin at Syntagma Square at 2 p.m. Most conservative New Democracy MPs are expected to attend. ND leader Kyriakos Mitsotakis said the party respects both those who do choose to attend and those who do not.

“We respect all choices,” he said. Former conservative premier Antonis Samaras endorsed the demo, saying Sunday will be “a great day for the country.” The main speaker will be veteran Greek composer Mikis Theodorakis, who is to address the crowd in person rather than sending a video message as originally planned. Speeches will also be delivered by three clerics representing the Church of Greece, which has backed the rally following initial reservations by Archbishop Ieronymos. The Greek Police plans to erect barriers to keep demonstrators at Syntagma apart from anarchists who are to stage their own counter-rally, starting at noon outside Athens University.