Pablo Picasso Circus � 1918

Another crazy story. less than 2 weeks before the midterms some loonie allegedly sent crude explosive devices to Democrats and CNN. Obviously, doesn’t appear to help Trump. Who they all fall over each other to blame, absolving themselves from all responsibility in the process. Some details:

Bombs had ISIS-like logo’s on them

At least some contained shards of glass

They were sent to people who don’t open their own mail

None of the bombs went off

Powder in package to CNN was harmless

Seen a lot more like that on Twitter, many people saying the ‘bombs’ are a joke.

• Donald Trump Attacks Media ‘Hostility’ After Attempted Pipe Bombings (G.)

Donald Trump has attacked what he called media “hostility” in a speech to a campaign rally following a wave of pipe bombs sent to senior Democrats, prominent critics and the broadcaster CNN. The US president, who earlier said at the White House he condemned the attempted bombings and that a “major federal investigation” was under way, followed this with a plea for unity during a midterms campaign rally in Mosinee, Wisconsin, later on Wednesday. “Any acts or threats of political violence are an attack on our democracy itself,” he told the crowd. “We want all sides to come together in peace and harmony. We can do it … Those engaged in the political arena must stop treating political opponents as morally defective.” But he soon reverted to a familiar scapegoat. The media, he said, has “a responsibility to set a civil tone and to stop the endless hostility and constant negative and oftentimes false attacks and stories”.

[..] Trump, who still assails Clinton at rallies while supporters chant “lock her up” two years after he defeated her, took a softer tone in Wisconsin. “Let’s get along,” he told supporters. “By the way, do you see how nice I’m behaving tonight? Have you ever seen this? We’re all behaving very well and hopefully we can keep it that way, right?” He did not mention the intended recipients of the devices by name but spoke more generally, including in language which could be taken to refer to protests against himself and allies. “No one should carelessly compare political opponents to historical villains, which is done often, it’s done all the time, got to stop. We should not mob people in public places or destroy public property. There is one way to settle our disagreements. It’s called peacefully, at the ballot box.”

Zucker doesn’t take any responsibility for the political climate. Nor do any of the others. 24/7 blasting Trump for two years has had no influence, apparently. Someone should make a database with all Trump articles at MSM that contain positive things about Trump vs those that are negative.

• CNN President Jeff Zucker Blasts Trump White House After Bomb Threat (THR)

CNN president Jeff Zucker, who has long sparred with President Donald Trump throughout their decades of knowing each other, lashed out at him in a statement on Wednesday, hours after his network’s New York office was forced to evacuate due to a bomb threat. “There is a total and complete lack of understanding at the White House about the seriousness of their continued attacks on the media,” Zucker said. “The president, and especially the White House press secretary, should understand their words matter. Thus far, they have shown no comprehension of that.”

The president has been criticized for his slow response to the bomb threat on Wednesday, initially responding only by echoing Vice President Mike Pence’s tweet condemning it. On Wednesday afternoon, Trump spoke directly at a White House event, pledging to take action. “The full weight of our government is being deployed to conduct this investigation and bring those responsible for these despicable acts to justice,” he said. “We will spare no resources or expense in this effort. In these times, we have to unify. We have to come together, and send one clear, strong unmistakable message that acts or threats of political violence of any kind have no place in the United States of America.”

All over the world.

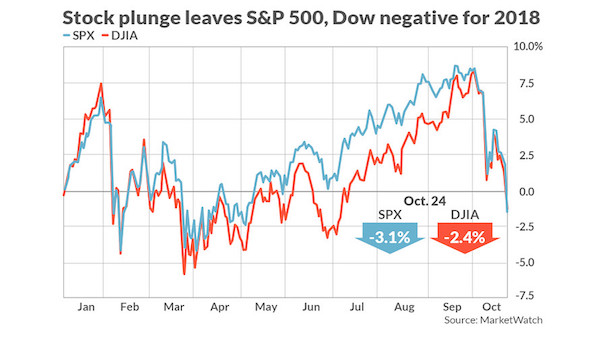

• Dow Falls 600 Points And Wipes Out 2018 Gains (MW)

Stocks ended sharply lower Wednesday, as losses accelerated into the close and put both the Dow and the S&P 500 into the red for the year, and the Nasdaq into correction territory. Upbeat results from Boeing were credited with briefly pushing the Dow higher in early morning trading, before investors took an increasingly defensive stance, fleeing for the relative safety of utilities and consumer nondurable shares. The Dow Jones Industrial Average fell 606.11 points, or 2.4%, to 24,583.42, while The S&P 500 dropped 84.59 points, or 3.1%, to 2,656.10, it’s sixth straight losing session.

Meanwhile, the Nasdaq shed 329.14 points, or 4.4%, to 7108.4, a performance that put the index more than 10% below its Aug. 29 all-time high, meeting the widely used definition of a market correction. The loss also marked the worst day for the Nasdaq since Aug. 18, 2011. October is shaping up to be a brutal month for equities, as expected, with the S&P falling 8.9% month-to-date, the Dow down 7.1%, and the Nasdaq falling 11.7% since the start of the month. Wednesday’s session also sent the Dow into losing territory for the year, with the index down 0.6% in 2018. The blue-chip index is also down for five straight weeks, it’s longest string of weekly losses since July, 11 2008, when the market fell for six straight weeks. The S&P 500 also ended the trading day in the red, down 0.7% year-to-date.

Broad pessimism.

• Asia Pacific Shares In Freefall Amid Fears Over Global Economy (G.)

Shares in Asia Pacific have plunged into bear market territory and wiped billions off the values of companies as one analyst warned that the losses could be a harbinger of a wholesale “capitulation”. After the worst day for tech stocks on Wall Street for seven years, markets were in retreat from Sydney to Shanghai as concerns about the global economy and rising borrowing costs were compounded by local factors. In Australia the benchmark ASX200 closed down 164 points or 2.8% as it suffered its fifth straight day of losses. In Japan the Nikkei was off 3.2% and has now dropped around 13% from a 27-year peak of 24,448.07 touched in early October.

A broad indicator of shares in the region – the MSCI Asia Pacific index – has now fallen 20.3% from the year-to-date high set on 29 January, representing an official bear market. The Vix “fear” index, which measures volatility across the market, has spiked sharply this week and was up 21% overnight. “We haven’t thought that selling would be this steep. This sell-off makes us think the market may be set for capitulation,” said Shoji Hirakawa, chief global strategist at Tokai Tokyo Research Center. The contagion looked set to continue into the European trading session with the FTSE100 expected to fall 0.65% at the open.

Italians, Deutsche. Draghi doing a speech soon.

• Value of Euro Zone Banks Drops by a Third From 2018 Peak (R.)

The value of euro zone banks have collapsed by a third since markets touched their peak at the end of January, data showed on Wednesday, as another quarter of disappointing profits at Deutsche Bank dragged the region’s sector down. European banks shares, which have never reclaimed their pre-financial crisis prices, have been the worst performing sector so far in the monetary block this year, down 26.5 percent as investors shed assets seen as most vulnerable to political upheaval. “The fall is not justified by a similar drop in earnings,” commented Farhad Moshiri, an analyst covering European banks at Alphavalue, arguing that political risk had a stronger negative impact than sector results.

Still, Deutsche’s bleak results and revenue forecast on Wednesday, which sent shares down 5 percent for their worst day since end-May, deepened the sector-wide rout. The Spring political crisis in Italy and the following on-going row with the European Commission about the country’s populist government’s budget took a heavy toll, particularly on Italian banks. The latters are heavily exposed to Italian sovereign debt, which has shed value since the country decided to raise spending and put an end to years of fiscal prudence. Slowing economic growth on the continent and elusive monetary normalization, with a first interest rate hike by the European Central Bank (ECB) still far away, also weighed on stock prices.

A legal issue about taxes on mortgages only makes things worse.

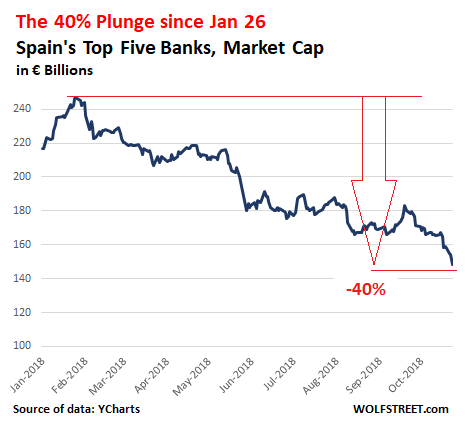

• Spain’s Mortgage Market Seizes Up, Bank Stocks Sink, Legal Uncertainty Reigns

In the last five trading days, the shares of Spain’s five largest listed banks have re-energized their plunge that had started at the end of January and now amounts to 40%. The cause for the recent drop? A shock ruling by Spain’s Supreme Court that lenders, rather than mortgage borrowers, should pay the contractual tax on mortgage loans, on the grounds that the lender is the only party with an interest in getting the loan certified by a notary, since this is what enables the bank to begin foreclosure proceedings if the borrower defaults on payments. Even the Supreme Court’s desperate decision last Friday to suspend its own ruling a day after it had announced the ruling, a historic flip-flop that left everything in limbo and its reputation in tatters, failed to stop the rout (data via YCharts):

On Monday, the Supreme Court announced that it won’t decide who has to pay the tax on mortgages — the banks or the borrowers — until November 5. In other words, there will be two more weeks of acute legal uncertainty. This has plunged Spain’s mortgage market into chaos. For years Spanish banks and builders have been desperately trying to breath new life into the market — including, in some cases, by resurrecting 100% mortgages, a high-risk instrument that helped fuel Spain’s madcap property boom. But now, thanks to the pervading legal uncertainty, the market has all but seized up. On Tuesday, sources from a number of large banks told the financial daily Cinco Dias that the only mortgages being signed are with clients who had already arranged to sign the contract before last week’s furor and who don’t mind paying the mortgage tax. “We’re not signing any new ones,” the sources said.

Italy must insist France gets the same treatment.

• It’s Not Just Italy – France’s 2019 Budget Also A Concern For Brussels (CNBC)

Markets have been on the edge regarding Italy’s future spending, but there are other countries challenging European fiscal rules. France, the second-largest economy in Europe, received a letter from Brussels last week, warning that its planned debt reduction in 2019 does not respect the proposals that Paris had agreed previously with the EU. Spain, Belgium, Portugal and Slovenia were also effectively told off by the EU. In the case of France, the 2019 budget plan sees its structural deficit (the difference between spending and revenues, excluding one-off items) falling 0.1 percent this year and 0.3 percent in 2019. Paris had agreed in April to an annual reduction of 0.6 percent of GDP for its structural deficit.

Though the tone of the warning from Brussels to Paris was softer than the tone towards Rome, the two countries have perhaps more similarities than differences. The French 2019 budget “shows that the government relies heavily on very optimistic revenues to achieve fiscal consolidation and that spending is out of control again,” Daniel Lacalle, chief economist and investment officer at Tressis Gestion, told CNBC via email. “In the case of France, it is a very difficult budget to accept by the European Commission because France has not had a balanced budget since 1974 and has missed its own deficit targets more than eleven times,” Lacalle added.

A curious turnaround. To be continued.

• Tesla Shares Soar On Surprise Third-Quarter Profit (CNBC)

Tesla shares soared by more than 12 percent after the company reported a surprise profit for the third quarter as CEO Elon Musk made good on his promise to start turning regular profits in the last half of the year. The company’s earnings report, released after the markets closed Wednesday, also showed better-than expected car sales and a faster timeline on its Model 3 production. The electric car maker said its midsize Model 3 sedan, which it hopes to produce on mass scale, was the best-selling car in the U.S. when measured by revenue and the fifth best-selling car in terms of volume. Musk told analysts on a call it was an “incredibly historic quarter” for the young car company. It was welcome news for investors following an otherwise a tumultuous few months.

It does. Somone better get serious about this.

• Airbnb Can’t Go On Unregulated – It Does Too Much Damage To Cities (G.)

Remember the “sharing economy”? That rhetoric looks more comically disingenuous than ever in light of the news that a single Airbnb user in Barcelona is managing a portfolio of properties that brings in an eye-watering £33,000 a day in high season. Old neighbourhoods are being overrun with short-term tourists and shops selling souvenir tat. Rents for residents are being driven up, in Barcelona as well as Berlin, New York and elsewhere. Airbnb is a parasitic monster that squats over cities and hoovers up vast sums of money through its slimy proboscis. So what can be done?

Airbnb, short for “airbed and breakfast”, originally sold itself as a way for travellers to stay in people’s spare rooms and get an authentic feel of a foreign culture. This friendly idea is still present in the company’s vocabulary – “hosts”, not landlords, and “hospitality” in place of “business” – even though the vast majority of its listings are now for self-contained apartments or houses. In Barcelona, it used to cost €250 (£221) for a short-term rental permit. Now that such permits are no longer being issued, they change hands for up to €80,000. It’s “sharing” for the rich, maybe, but not for the rest of us.

During their early rapid growth, sharing economy companies started operations around the world without regard to local laws on the basis that existing regulations had not envisaged the radical and disruptive new ideas they embodied. But the tide slowly turned as the whizzy tech rhetoric wore off and it became clear that Uber was in fact a taxi company and Airbnb was in effect a hotel business.

Don’t like Verhofstadt, but it’s time for honesty.

• Brexit Deal ‘Progress Is At 0%’ Until Irish Border Solved – Verhofstadt (Ind.)

The European Parliament’s Brexit coordinator has rejected Theresa May’s suggestion that a deal is “95 per cent done”, as Brussels warned it will not be bounced into an agreement. Guy Verhofstadt said the withdrawal agreement needed to prevent no deal was “0 per cent done” as far as MEPs were concerned, because of the lack of a solution to the Irish border issue. “Progress on the Brexit negotiations can be 90 per cent, 95 per cent or even 99 per cent,” Mr Verhofstadt said. “But as long as there is no solution for the Irish border, as long as the Good Friday agreement is not fully secured, for us in our parliament progress is 0 per cent.”

The European Parliament has a veto on the final Brexit deal and has said it would kill any agreement that does not prevent a hard border between Ireland and Northern Ireland. Speaking in a debate at the parliament’s Strasbourg seat on Wednesday morning, the second in command of the European Commission Frans Timmermans also warned that the block would not “rush a deal through at the expense of our principles”. “As was clear after the European Council the bottom line is that we do not have the decisive progress that we need,” Jean-Claude Juncker’s deputy said. “The good will and the determination to find a deal as soon as possible are there. But it is also clear that we will not rush a deal through at the expense of our principles or our agreed commitments, most notably on the Irish border question.

Watch the pound when she makes it official.

• May Sets November Date To Trigger No-Deal Brexit Preparations (G.)

Theresa May has set a date for Whitehall to trigger a series of no-deal Brexit preparations as her government faces up to the possibility that there will be no agreement with the EU about Britain’s departure. With less than six months to go before the UK leaves the bloc, the cabinet has agreed that a flurry of activity will be triggered in the second week of November as the government prepares to crash out of the EU, informed sources said. Civil servants have also accelerated plans to lay down new laws and secondary legislation so that UK businesses and both British and EU citizens can prepare. The move follows concerns across government that preparations for how the UK might cope with crashing out the EU are still uncertain.

The Brexit secretary, Dominic Raab, told cabinet colleagues on Tuesday that Whitehall departments needed to step up their efforts next month and move “from warning businesses to telling them to act”. Whitehall has until now concentrated on the publication of more than 100 technical notices detailing the potential impact on particular industries but not on individual businesses and people. A source said that there would be an acceleration of preparations after MPs return from a short break on 12 November. “We have to get on with no-deal legislation. At the moment, we’re looking at the same legislation for a deal as no deal. In the case of no deal it would need royal assent before we leave. “There will be an awful lot to discuss. It will concentrate minds. Obviously we don’t want to upset the negotiations, but the clock is ticking and it will get harder and harder the later we leave it,” the source said.

This is Theresa May’s country, her accomplishment.

• Disadvantaged Groups Trapped In Poverty And Excluded From UK Society (Ind.)

Britain is a divided nation as the poor are increasingly trapped in poverty and excluded from mainstream society because of their social status, the human rights watchdog has warned. A major report from the Equality and Human Rights Commission (EHRC) found a continued decline in prospects for disadvantaged groups has cemented a “two-speed society” in the UK which leaves many behind. The watchdog found that in just three years “alarming backward steps” have left disabled people, ethnic minorities and children from poorer backgrounds struggling to make headway in a society where “significant barriers still remain”.

Charities accused Theresa May of breaking the promise she made in her first speech as prime minister to tackle “burning injustices” in British society. It comes just days before Philip Hammond, the chancellor, is to set out a budget with critics waiting for spending commitments that will deliver on the prime minister’s conference promise that austerity is finally coming to an end. In a speech on Thursday, shadow chancellor John McDonnell will say that schools, councils and the UK’s social care system are “crying out for investment” and called on the government to “stump up the cash”. David Isaac, chair of the EHRC, said Britain was facing a “defining moment in the pursuit of equality”.

Stop using pesticides altogether.

• Ban Entire Pesticide Class To Protect Children’s Health – Experts (G.)

Evidence that an entire class of pesticides threatens the health of children and pregnant women is now so arresting that the substances should be banned, an expert panel of toxicologists has said. Exposure to organophosphates (OPs) increases the risk of reduced IQs, memory and attention deficits, and autism for prenatal children, according to the paper, published in Plos Medicine. More than 10,000 tonnes of OP pesticides are sprayed in 24 European countries each year and usage is higher in the US, where the Trump administration is appealing against a federal court ban on chlorpyrifos, one of the most popular agricultural insecticides.

Irva Hertz-Picciotto, the paper’s lead author and director of the UC Davis environmental health sciences centre, said: “We have compelling evidence from dozens of human studies that exposures of pregnant women to very low levels of organophosphate pesticides put children and foetuses at risk for developmental problems that may last a lifetime. By law, the EPA cannot ignore such clear findings: It’s time for a ban not just on chlorpyrifos, but all organophosphate pesticides.” The meta-review of data and literature on OPs analysed and cross-referenced scores of reviews and epidemiological studies with a UN database that covers 71 countries, and other research material.

In the process, the scientists discovered that US regulators had already quietly banned 26 out of 40 OP pesticides considered hazardous to human health. In Europe, the figure was 33 out of 39. However, 200,000 people still die each year from pesticide poisonings, according to UN estimates, about 99% of them in the developing world. A further 110,000 suicides using pesticides take place each year.

Not bad, but too late.

• European Parliament Votes To Ban Single-Use Plastics (Ind.)

Fragments of plastic have been found everywhere from Arctic sea ice to fertilisers being applied to farmland. Animals as small as plankton and as large as whales are known to eat plastic, and as tiny shards enter the human food chain they seem to be ending up inside humans as well. While much still remains unknown about the impact plastic is having on the environment and human health, environmentalists have called for urgent measures from industry and governments to curb the flow of plastic. “We have adopted the most ambitious legislation against single-use plastics. It is up to us now to stay the course in the upcoming negotiations with the council, due to start as early as November,” said Belgian liberal Frederique Ries, who was responsible for the bill.

Under the new rules, member states would have to ensure that tobacco companies cover the cost of cigarette butt collection and processing in a bid to reduce the number entering the environment by 80 per cent in the next 12 years. Similar measures would apply to producers of fishing gear, who would have to help ensure at least 50 per cent of lost or abandoned fishing gear containing plastic is collected per year. Fishing gear accounts for over a quarter of waste found on Europe’s beaches, and “ghost fishing” is thought to be responsible for thousands of whales, seals and birds dying every year. EU states would also be obliged to recycle 90 per cent of plastic bottles by 2025, and producers would have to help cover costs of waste management.

But they don’t mean sailing ships.

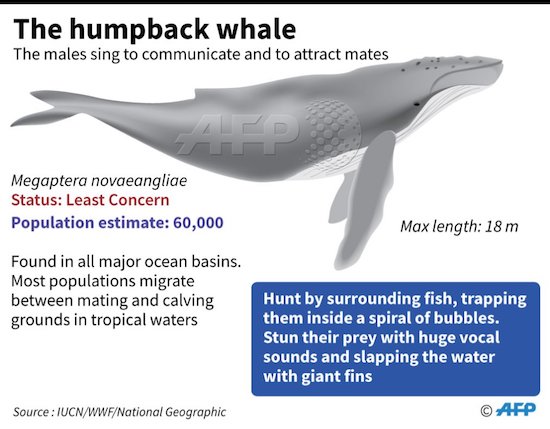

• Humpback Whales Stop Singing When Ships Are Near (AFP)

Humpback whales are famous for their eerie, underwater songs. But researchers in Japan said Wednesday these massive marine creatures stop singing, at least temporarily, when human-driven ships are nearby. Researchers focused on the remote Ogasawara Islands in Japan, some 620 miles (1,000 kilometers) south of Tokyo, where a single passenger-cargo liner passed through the area once per day. Male humpback whales sing as a way to communicate and attract mates. But by plunging a pair of hydrophones into the water to listen to the whales’ reaction — about 26 of whom were detected in the study area — researchers found that the approach of a ship silenced them.

“The main reaction of humpback whales was to stop singing either when the ship approached or after it passed by,” said the study in the journal PLOS ONE, led by Koki Tsujii from Ogasawara Whale Watching Association and Hokkaido University. Fewer male humpbacks sang in the area within 500 yards (meters) of the shipping lane than elsewhere. “After the ship passed by, whales within around 1,200 meters tended to temporarily reduce singing or stop singing altogether,” said the study. Many whales did not start to sing again until a half hour after the ship was gone from the area. Since ocean noise has been on the rise in recent decades, some experts said the findings raise new questions about what other whale behaviors might be changing due to mounting human presence on the high seas.