Russell Lee Tracy, California. Tank truck delivering gasoline to a filling station 1942

‘Nice’ overview.

• The Warren Buffet Economy: Why Its Days Are Numbered-Part 1 (David Stockman)

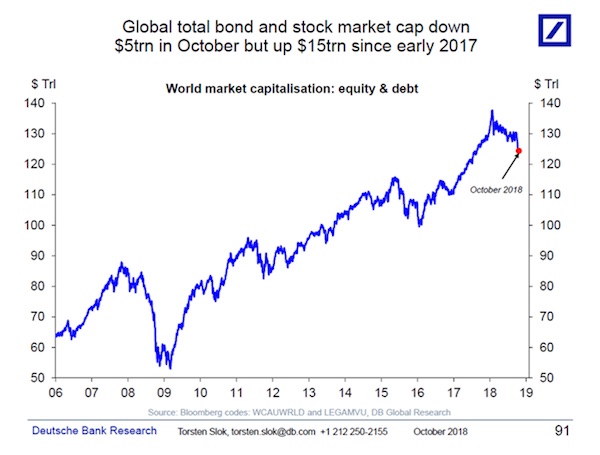

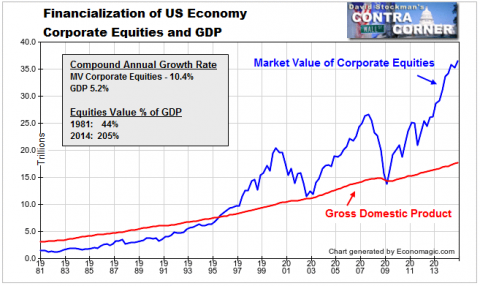

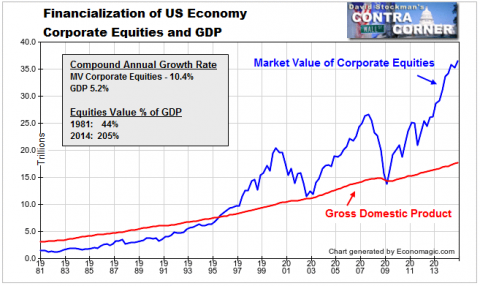

During the 27 years after Alan Greenspan became Fed chairman in August 1987, the balance sheet of the Fed exploded from $200 billion to $4.5 trillion. Call it 23X.

Let’s see what else happened over that 27 year span. Well, according to Forbes, Warren Buffet’s net worth was $2.1 billion back in 1987 and it is now $73 billion. Call that 35X.

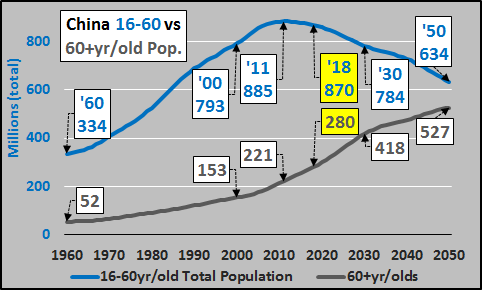

During those same years, the value of non-financial corporate equities rose from $2.6 trillion to $36.6 trillion. That’s on the hefty side, too—- about 14X.

Corporate Equities and GDP – Click to enlarge

When we move to the underlying economy that purportedly gave rise to these fabulous gains, the X-factor is not so generous. As shown above, nominal GDP rose from $5.0 trillion to $17.7 trillion during the same 27-year period. But that was only 3.5X

Next we have wage and salary compensation, which rose from $2.5 trillion to $7.5 trillion over the period. Make that 3.0X.

Then comes the median nominal income of US households. That measurement increased from $26K to $54K over the period. Call it 2.0X.

Digging deeper, we have the sum of aggregate labor hours supplied to the nonfarm economy. That metric of real work by real people rose from 185 billion to 235 billion during those same 27 years. Call it 1.27X.

Further down the Greenspan era rabbit hole, we have the average weekly wage of full-time workers in inflation adjusted dollars. That was $330 per week in 1987 and is currently $340 (1982=100). Call that 1.03X

Finally, we have real median family income. Call it a round trip to nowhere over nearly three decades!

Read more …

“..those looking to buy have already done so, leaving fewer buyers to step in if the market starts slipping.”

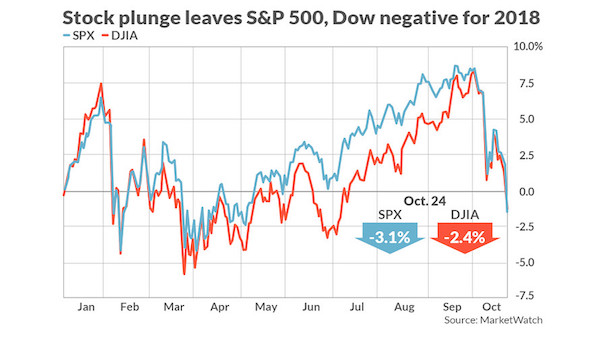

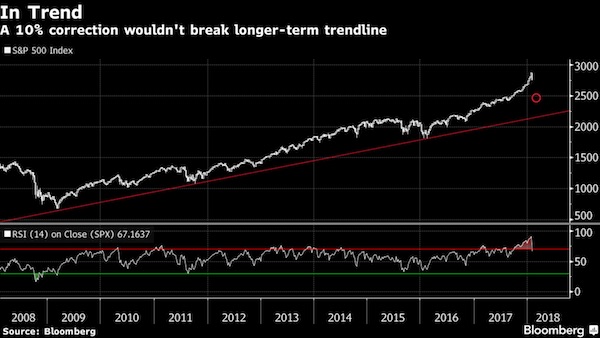

• Robert Prechter Is Warning Of A ‘Sharp Collapse’ In Stocks (MarketWatch)

The president of Elliott Wave International, Rovert Prechter may not be a household name on Main Street, but he’s widely known on Wall Street as the foremost authority on the Elliott Wave principle, a forecasting methodology used by generations of technical analysts that is based on the belief that financial markets trend in five waves, and retrace in three waves. Prechter is also the executive director of the Socionomics Institute, founded to study how those same wave patterns define changes in social mood and govern social events. “If the cycle is still operating, the stock market is at high risk of a sharp collapse. Near term, we’re prepared to see the Dow make one more high. But it doesn’t have to happen.”

Elliott Wave analysis, which was devised by Ralph Nelson Elliott in the 1930s, is much more than a bunch of numbers and letters placed on a chart to denote which wave, or degree of waves, the market is traversing. Those who fully embrace it say it is the only form of technical analysis that can incorporate and explain all the other techniques used by chart watchers. Walter Zimmerman at energy research firm United-ICAP, calls it the “grand unified field theory of chart pattern analysis.” Head-and-shoulders reversals, technical divergences, candlestick charts—they can all be explained within the framework of the Elliott Wave principle, Zimmerman said.

Based on Prechter’s analysis of where the stock market is positioned within its wave structure, he believes the bull market is in a “precarious position.” For one, he said the sentiment indicators he follows have reflected extreme optimism for over two years. That is often viewed as a contrarian signal, because it suggests those looking to buy have already done so, leaving fewer buyers to step in if the market starts slipping. In addition, Prechter said a number of momentum indicators have been revealing a “dramatic lessening” in the number of stocks and indexes that have participated in the rally in recent months.

Read more …

A daring plan indeed.

• Iceland Warns Hedge Funds Not to Sue as it Seeks Billions in Taxes (Bloomberg)

The prime minister of Iceland said any hedge fund planning to challenge the legal basis of a planned tax on failed bank assets should think again. “If they wanted to make some kind of an example out of Iceland, to threaten people, then this wouldn’t be a good case for them,” Prime Minister Sigmundur David Gunnlaugsson said in an interview in Reykjavik on Monday. “This is founded on solid legal ground.” Iceland has tried to ensure its treatment of creditors caught in an $85 billion banking default won’t drag the island through an Argentine-like period of litigation. The island’s 2008 financial meltdown wiped out its three biggest banks after the government said the $15 billion economy didn’t have the means to save them.

The economic collapse that followed forced Iceland to impose capital controls to stop investors from fleeing its markets. The island’s approach to addressing the crisis won praise from Nobel laureates including Paul Krugman and institutions led by the International Monetary Fund. Iceland’s central bank estimates gross domestic product will grow 4.5% this year, well above the 1.5% the European Commission sees the euro zone expanding. Gunnlaugsson’s administration on Monday unveiled an historic piece of legislation to unwind capital controls in place for almost seven years. But to make sure the measures don’t result in a capital exodus led by hedge funds, the island also imposed a one-time so-called stability tax of 39%.

Only winding-up committees that are able to reach a composition agreement approved by the central bank and finance ministry will be exempt. They have until the end of the year to do so, under the new legislation. Whether hedge funds end up paying the tax or see their claims whittled down through a composition process may end up being largely moot. The government has indicated it expects to get as much as $5.1 billion from creditors in the failed banks before they exit the island. Efforts to defend Iceland’s financial stability mean bank creditors probably need to leave at least 500 billion kronur ($3.8 billion) in the economy, Finance Minister Bjarni Benediktsson said in a separate interview on Monday. He says it’s likely that “the actual stability payment will be lower than the levied stability tax.”

Read more …

An easy way out?

• Greece, Creditors Discuss Extending Bailout in Bid to Break Deadlock (WSJ)

Greece and its creditors are discussing an extension of the country’s bailout program through March 2016, people familiar with the talks said, an offer aimed at breaking a protracted standoff over the terms for fresh aid and averting a Greek default. The proposal, first presented last week, is part of European officials’ efforts to prod the government in Athens to agree to painful concessions in exchange for rescue funds. But continued disagreements over the economic overhauls and austerity measures demanded by Greece’s lenders risk undermining the plan, people familiar with the plans say. The eurozone’s portion of Greece’s €245 billion rescue program runs out at the end of June, raising questions over how Athens will pay off its debt beyond this month and remain in Europe’s currency union.

With a debt load close to 180% of its gross domestic product and an economy back in recession, Greece is unable to raise money from international bond markets and has been depending on rescue loans from the eurozone and IMF for more than five years. A nine-month extension would help carry Athens over its current funding gap. It would also give both Prime Minister Alexis Tsipras and his country’s creditors—the eurozone and the International Monetary Fund—more time to chart a new path for Greece’s economy. But it leaves open questions over whether the government would, indeed, be able to finance itself beyond March, or need even more support.

To help keep Greece solvent over the proposed bailout extension, Greece would receive financing from some €10.9 billion in aid money that had originally been set aside to prop up Greek banks, three people familiar with the negotiations said. The measures, they said, were discussed at a meeting between Mr. Tsipras and Jean-Claude Juncker, the president of the European Commission, on Wednesday. “What we offered would mean that Greece is fully financed until March 2016,” one of the people said.

Read more …

“Europe and international institutions must recognize that austerity has failed..”

• Grexit Would Be “Start Of The End For The Eurozone,” Says Tsipras (DW)

In the interview in the Tuesday edition of Italy’s Corriere della Sera, Tsipras said that if Greece were forced out of the eurozone after failing to make a deal on managing its debt, Spain or Italy could soon follow, precipitating the collapse of the currency bloc. “It would be the start of the end for the eurozone,” Tsipras said. “If Europe’s political leadership cannot handle a problem like Greece, which represents 2 percent of its economy, how will the markets react to countries that are facing much bigger problems, like Spain or Italy that has a 2 billion euro public debt?” he said. “If Greece goes bankrupt, the markets will immediately look for the next victim.

If negotiations fail, the cost for European taxpayers will be enormous,” he warned. Tsipras also reiterated comments made in the past few days in which he rejected demands by Greece’s international creditors to cut pensions and other social spending in return for access to the last tranche of a multi-billion-euro bailout. Tsipras feels Greece is being unfairly targeted with harsh austerity measures. But he said Greece could reach a deal if these demands for austerity were dropped. “Europe and international institutions must recognize that austerity has failed,” he said.

Read more …

But that is the one point the troika won’t let go of.

• Greek PM Tsipras Says Accord Possible If Pensions Are Not Cut (Reuters)

Greece could reach a deal with its international creditors if they dropped demands including cuts to pensions, PM Alexis Tsipras said in an interview with Italian daily Corriere della Sera on Tuesday. Reflecting the more conciliatory tone Athens has adopted in recent days, he said the two sides could find a compromise on key elements in any deal, including the size of a primary budget surplus. But he showed no signs of accepting creditor demands for cuts to pensions or other social spending, repeating comments he has made over recent days. “I think we’re very close to an agreement on the primary surplus for the next few years,” he told the newspaper. “There just needs to be a positive attitude on alternative proposals to cuts to pensions or the imposition of recessionary measures.”

The comments came as Greece’s international partners, including German Chancellor Angela Merkel and European Central Bank officials, have warned that time is rapidly running out. Tsipras is due to meet Merkel and French President Francois Hollande on Wednesday to try to break the impasse that has raised fears Greece could be forced out of the euro zone, with unforeseeable consequences for the single currency and the wider world economy. After dismissing the latest proposal from the EU and IMF as “absurd” last week, the leftwing government in Athens has signaled it is willing to compromise but continues to reject what it sees as unfairly punishing austerity measures. “We cannot continue with a program that has clearly failed,” Tsipras said.

Read more …

Varoufakis: “We need to avert an accident that won’t be an accident..”

• Greece Lashes Out at Creditor Demands (Bloomberg)

The EU’s frustration with Greece is mounting. While Prime Minister Alexis Tsipras is looking to nail down when Greece is going to receive more financial aid, the country’s creditors are still focused on the policy measures required to qualify for support. German Chancellor Angela Merkel demanded urgent action from the Greek government on Monday after U.S. President Barack Obama voiced his concerns about the standoff at a summit of Group of Seven leaders. EC President Jean-Claude Juncker said Greece is not doing enough to overcome differences with the euro area. “I am still waiting for the Greek part of the bridge,” Juncker said in an interview with Bayerischer Rundfunk. “One can’t endlessly lengthen the EU or Eurogroup part of the bridge.”

Creditors are growing increasingly exasperated with Tsipras’s negotiating tactics after he rejected the terms of an aid package again last week. Tsipras’s government then used a technicality to postpone a payment of about €300 million to the IMF. Tsipras will travel to Brussels on Wednesday for an European Union summit with South American leaders which Merkel and French President Francois Hollande will also attend. “Europe and institutions must understand that austerity has failed,” Tsipras said in an interview with Italy’s Corriere della Sera on Tuesday. “Tomorrow we will enter into a discussion on the merits of progress made so far. We will define a clear timeframe for the deal.”

Greek Minister of State Nikos Pappas and Deputy Foreign Minister Euclid Tsakalotos will hold meetings with creditors in Brussels on Tuesday after sitting down with EU Economic Affairs Commissioner Pierre Moscovici on Monday. A solution to the negotiations could be reached before June 14 but further high-level meetings will only happen if there is a chance of a deal, a French government official told reporters on the condition of anonymity. Relations between Greece and its creditors have soured since last week’s talks between Tsipras and Juncker spurred optimism that a deal might be within reach. The aftermath of that meeting has been marked by mutual recriminations, with Tsipras calling the creditors’ proposal absurd, and Juncker saying the Greek leader had misrepresented the creditors’ position.

In response to the entreaties from Merkel and Juncker, Greek Finance Minister Yanis Varoufakis questioned the good faith of his country’s creditors. Varoufakis said in Berlin late Monday that aid could be released overnight if euro-area officials took the negotiations seriously. “We need to avert an accident that won’t be an accident,” he said at an event that followed a meeting German Finance Minister Wolfgang Schaeuble. “We have a historic duty not to allow this to happen.”

Read more …

Mason is learning.

• Greece Is Not Ireland – And It’s Not Just About The Economics (Mason)

Why did Greece collapse and Ireland survive? It’s a question that perplexes international policymakers, and the answers are not to be found solely in economics. First, because the Irish crisis was a banking crisis: its banks were bust, the state bailed them out and took on debts it could not sustain. Austerity was harsh – but the economy was globalised. Even as Irish banks went bust, the Irish banking sector – an unofficial conduit of money from London to the tax havens, and full of US investment banks – was still recruiting. Then there’s agribusiness. Irish agriculture, from a country of 3 million people, produces enough to feed 50m worldwide and growing. If you look at the the profile of imports and exports from Ireland to Britain, it’s much the same via mix and per-capita GDP as the trade between the north and south of Britain.

In other words – hugely controversial to say politically – Britain and Ireland are close to being a single economy with two currencies. Ireland, in short, had the English language, an established role to play with the City of London and Frankfurt, and a modern, high-scale agriculture business. That is not to say austerity was popular: even now the water protests are boosting the same kind of radical left party we see ruling Greece, and boosting Sinn Fein, which has aligned itself internationally with Syriza. But in Ireland the kind of austerity enacted did not tank production by 25% and family incomes by 40%. It did not cause ordinary middle class people to vote for a party whose flags are red and methodology Marxist. And there was no mass fascist movement in Ireland.

The difference is: Greece is an unmodernised capitalism where you can’t impose austerity at this level and hope to modernise at the same time. I’ve become an unwilling expert, for example, on its pharmacy regulations. Sure, the law saying pharmacies can’t open within a certain short distance of each other has been repealed, but there is still a rule that says one pharmacy per 1,000 people, one owner for each pharmacy, one pharmacy for each pharmacist. Walgreens, Superdrug and Boots, in other words, are locked out of this sector, whose opening hours are not generous. There is even a massive fight over whether newsagents are allowed to sell aspirin in Greece. To somebody who needs aspirin during pharmacy closing hours this can appear a no brainer: liberalise everything.

It is exactly what the IMF has been arguing for in the Brussels Group talks, even this month: liberalise the pharmacies and bakeries or we withhold 7bn of aid and your country goes bankrupt. The problem is, the deep structures of Greek capitalism mean you can only modernise by unpicking things carefully and with consent. A population used to being seen personally by a pharmacist, to getting their drugs on informal credit when they can’t pay, just will not transform itself overnight into a midwest American consumer group. It’s the same with taxes. Hiking VAT sounds like a no-brainer in a country that needs to raise taxes. When Varoufakis proposed instead to set a low 16% top rate of VAT, on the grounds that it would undermine the culture of evasion, the IMF’s economists reportedly said yes. Somewhere along the line it got hiked to 23%. If the IMF’s negotiators wanted to give the impression their aim is to destroy most of the small businesses that keep Greek capitalism alive, and with it, consent for democracy, they are doing a brilliant job.

Read more …

She would do well to throw him out. But his right wing support is strong. How strong does Angela feel?

• Merkel-Schaeuble Differences Over Greece Approach Said to Widen (Bloomberg)

A split between German Chancellor Angela Merkel and Finance Minister Wolfgang Schaeuble is widening over Greece as the funding standoff goes down to the wire, said people familiar with the matter. Merkel is ready to make concessions to keep Greece in the euro because of geopolitical concerns, while Schaeuble is willing to let the country exit the euro unless its government takes measures to ensure the country’s long-term survival in the monetary union, said the people, who asked not be identified speaking about internal party discussions. That divide is also reflected in Merkel’s parliamentary caucus, which is increasingly uneasy with letting the 41-member budget committee decide on disbursing any aid to Greece and is looking instead at a vote of the lower house of parliament on a deal that includes changes to previous agreements, they said.

Greece is deadlocked with creditors over the conclusion of a multi-year bailout program expiring at the end of the month, with Prime Minister Alexis Tsipras calling the latest offer “a bad negotiating trick” in talks that place “clearly unrealistic” demands on the euro region’s most indebted member. While Merkel has repeatedly said she’ll keep working to allow Greece to stay in the euro area, Schaeuble has emphasized that the contagion risk from the country possibly exiting the bloc is “marginal.” Many lawmakers in Merkel’s 311-strong caucus made up of the Christian Democratic Union and Bavarian Christian Social Union are finding it difficult to support the chancellor’s position and would side with Schaeuble if forced to choose, the people said.

Some within her caucus are discussing whether Merkel would need to tie any decision on the bailout program to a confidence vote to rally lawmakers behind her, one of the people said. Any agreement that doesn’t spell out binding reform obligations wouldn’t be accepted even among those siding with Merkel, the people said. Lawmakers from all coalition parties, which also includes the Social Democrats, object to a possible last-minute vote in Germany’s lower house of parliament at the end of the month, the last week the Bundestag is in session before the summer break, one person said. Lawmakers want time to scrutinize any proposal put before them and not be pressured to make a hasty decision, the person said.

Read more …

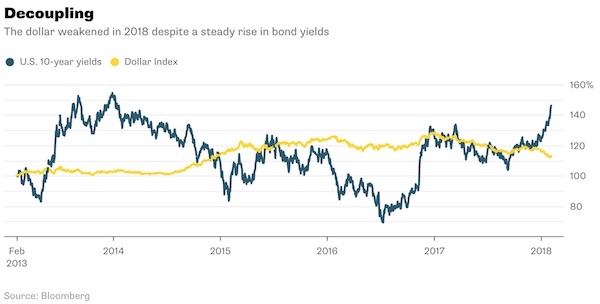

“..emerging markets have accumulated debts in U.S. currency totaling almost $6 trillion.”

• BRICs Hit a Wall, Drag Down Rest of the World (Pesek)

Fourteen years ago, Goldman Sachs presented a thesis that quickly gained traction among investors and policy makers: Brazil, Russia, India and China, the bank claimed, would increasingly drive global growth, filling a void left by the West. Today, the opposite case seems far more plausible. The so-called BRIC nations are now threatening to drag down the rest of the world. China’s exports declined in May for the third straight month, while imports slumped for the seventh month in a row. Asia’s biggest economy, in other words, is being hit in two directions: weak demand abroad and a sluggish economy at home. Not to mention the epic stock bubble that is sucking oxygen from its financial system. It’s not just China, though, as Gabriel Stein of Oxford Economics recently told me in Tokyo.

A new report from Oxford’s research team points out that imports are currently declining in Brazil, India and especially Russia. The BRICs are responsible for a drop in annual world trade by about 1.3%age points, the most pronounced deceleration since the 2008-2009 global financial crisis. And these trends extend far beyond the four emerging giants. For the 13 non-BRIC developing economies that Oxford tracks, imports of goods grew by only about 1.5% in the first quarter year-over-year (the long-term average for these countries has been about 8%). And what’s most worrying is that this slowdown is taking place even before the Federal Reserve begins its announced interest rate hikes. (Emerging-market stocks fell for an 11th straight day yesterday, the longest such streak in 24 years, amid concerns about Fed policy.)

Emerging nations have certainly hit a wall before, including Southeast Asia in 1997, Russia a year later and Argentina more times than we can count. But there are good reasons to believe today’s threat could be far more severe and lasting, including emerging markets’ higher debt levels and relatively modest growth in advanced economies. Even with the recent pickup in job creation, today’s 2.7% U.S. growth is about half the pace of the late 1990s, while the euro zone’s 1% pace is only a third of its output back then. And while Japan’s economy expanded 3.9% in the first quarter, the 30% devaluation of the yen is dampening growth prospects across Asia.

The stakes are also higher now than ever before, because emerging economies are more central to the global economy. In 1999, they accounted for roughly 23% of world gross domestic product and 38% on a purchasing-power-parity basis. Today, those shares are 35% and over 50%, respectively. The BRICs alone account for about 20% of world GDP, not much different than America’s 24% in 2007, just before the global crisis. Meanwhile, developed nations are more financially exposed to emerging markets than ever before. In December, the Bank for International Settlements said emerging markets have accumulated debts in U.S. currency totaling almost $6 trillion.

Read more …

“We’re in for a huge change in society,” he said Monday. “Get used to it. And be prepared.”

• Billionaire Cartier Owner Sees Wealth Gap Fueling Social Warfare (Bloomberg)

Johann Rupert, the South African who has made billions peddling Cartier jewelry and Chloe fashion, said tension between the rich and poor is set to escalate as robots and artificial intelligence fuel mass unemployment. “We cannot have 0.1% of 0.1% taking all the spoils,” said Rupert, who has a fortune worth $7.5 billion, according to data compiled by Bloomberg. “It’s unfair and it is not sustainable.” The founder and chairman of Richemont, whose 20 brands also include Vacheron Constantin and Montblanc, said he expects advances in technology to lead to job losses after having read books on the subject recently. Conflicts between social classes will make selling luxury goods more tricky as the rich will want to conceal their wealth, Rupert said in a speech Monday at the Financial Times Business of Luxury Summit in Monaco.

“How is society going to cope with structural unemployment and the envy, hatred and the social warfare?” he said. “We are destroying the middle classes at this stage and it will affect us. It’s unfair. So that’s what keeps me awake at night.” Rupert, a university dropout whose father made a fortune setting up Rembrandt Tobacco Corp. and selling it off, has in the past made other social critiques. Nicknamed ‘Rupert the Bear’ for his pessimistic views on the economy, the 65-year-old refers to himself as a “reformed prostitute,” having spent a decade as an investment banker. He said in 2008 that the collateral damage from the financial crisis was yet to come. “We’re in for a huge change in society,” he said Monday. “Get used to it. And be prepared.”

Read more …

“What they want to do is get you into a loan where you just keep paying, paying, paying, and at the end of the day, they take your car.”

• Auto Title Lenders Are Snagging Unwary Borrowers In Cycle Of Debt (LA Times)

Cash-strapped consumers are being shown a new place to find money: their driveways. Short-term lenders, seeking a detour around newly toughened restrictions on payday and other small loans, are pushing Americans to borrow more money than they often need by using their debt-free autos as collateral. So-called auto title loans — the motor vehicle version of a home equity loan — are growing rapidly in California and 24 other states where lax regulations have allowed them to flourish in recent years. Their hefty principal and high interest rates are creating another avenue that traps unwary consumers in a cycle of debt. For about 1 out of 9 borrowers, the loan ends with their vehicles being repossessed.

“I look at title lending as legalized car thievery,” said Rosemary Shahan, president of Consumers for Auto Reliability and Safety, a Sacramento advocacy group. “What they want to do is get you into a loan where you just keep paying, paying, paying, and at the end of the day, they take your car.” Jennifer Jordan in the Central Valley town of Lemoore, Calif., lived that financial nightmare, though a legal glitch later rescued her. Jordan, 58, said she needed about $400 to help her pay bills for cable TV and other expenses that had been piling up after her mother died. She turned to one of a proliferating number of storefront title lenders, Allied Cash Advance, which promises to help “get the cash you need now.” But Jordan said it wouldn’t make a loan that small.

Instead, it would lend her $2,600 at what she later would learn was the equivalent of 153% annual interest — as long as she put up her 2005 Buick Rendezvous sport utility vehicle as collateral. Why would the company want to lend her much more money than she needed? The key reason is that California has no limit on interest rates for consumer loans of more than $2,500, and it otherwise doesn’t regulate auto title loans. “She never said anything about the interest or nothing,” Jordan said of the employee who made the loan in 2012. Six months later, unable to keep up with the loan payments, Jordan said, she was awakened at 5 a.m. “My neighbor came pounding on my door and said, ‘They’re taking your car!'” she recalled.

Read more …

Coming to a town near you soon.

• At Least Two More Illinois Cities Poised for Bankruptcy (Mish)

On May 29, citing a report mentioned in Bond Buyer, I noted ‘Five Chicago Suburbs Headed for Bankruptcy (More Illinois Cities Will Follow)’. The cities are Maywood, Sauk Village, Blue Island, Country Clubs Hills, and Dolton. The village of Dolton strongly disagrees with the report. The others did not comment. The Bond Buyer report was based on an analysis of state comptroller’s local government Finance Warehouse by Marc Joffe at CivicPartner, a municipal finance research firm. I have since been in contact with Joffe and asked for an opinion of several cities I believe to be seriously troubled. My top two choices were Harvey and Robbins. Joffe responded …

“Hello Mish. Your intuition was correct about both. Harvey and Robbins are at least as bad as the five I listed in the original report. The last publicly available audited Financial Report for the City of Harvey covers the year ended April 30, 2009. In that year, the City reported an unrestricted net position of -$17.6 million and a general fund balance of -$10.4 million. The negative fund balance was equivalent to over half the city’s annual revenue. The city has provided incomplete, unaudited reports for subsequent years. The latest available report, for the year ended April 30, 2013, shows a further deterioration in the general fund balance to -$19.3 million – about 85% of annual revenues.

According to the Chicago Tribune, the city’s 2014 budget also included a deficit, suggesting that Harvey’s fiscal imbalance is even worse today. Harvey’s late reporting and accumulated general fund deficit led Fitch to downgrade the city from BBB- to B in February 2010 and then to withdraw its ratings entirely in November of that year. The city has now been unrated for more than four years.

Read more …

“.. if it is illegal to take more than $US50,000 out of China, why are so many Chinese nationals capable of splurging millions of dollars on individual properties?”

• Who’s The Real Culprit Behind Australia’s Housing Bubble? (ABC.au)

No one, it seems, has had any interest in reining in the runaway housing market, a point hammered home by Prime Minister Tony Abbott last week when he expressed a desire for prices to keep on rising, despite a blunt warning from new Treasury head John Fraser. The following day, as he ramped up the notion into a political fight – Bill Shorten wants your house to decrease in value – Hockey attempted to argue that soaring house prices and affordability were separate issues. What seems to have eluded our political masters is that market adage – the bigger the boom, the more painful the bust. Then of course there is the constant moan from the business lobby; Australia is too costly, wages are too high. There is a reason for that. It’s called real estate.

For the past 15 years, rents have dictated wages. Not the other way around. No matter how you measure it, Sydney and Melbourne real estate is in dangerous territory, fuelled by a heady mixture of cheap cash from foreign and domestic investors. When it unravels, the pain will reverberate through the banking system, causing enormous damage to the real economy. A major reason for the official inaction is that this is a bubble that has been deliberately contrived. In 2012, when the Reserve Bank began its easing bias, it was determined to create a housing boom – so residential construction could fill the gap created by the decline in resource project construction. But as investors, rather than owner occupiers, plunged in almost from day one, APRA and the RBA should have taken action.

Instead, they were happy to watch the bubble inflate and now, rather than admit a mistake, reluctantly are playing catch-up. A large portion of the investor action emanated from self-funded retirees, taking advantage of changes to superannuation rules that allowed them to gear up their super funds. While as a nation we boast about the extent of our national savings pool, little attention has been devoted to the fact that a significant amount of that pool is now exposed. As the Storm Financial collapse graphically illustrated, the capital losses on a property market bust will be magnified by debt. That could wipe out a significant number of super balances and put more pressure on the federal budget.

Read more …

Impressive exposé.

• Washington’s Great Game and Why It’s Failing (Alfred McCoy)

For even the greatest of empires, geography is often destiny. You wouldn’t know it in Washington, though. America’s political, national security, and foreign policy elites continue to ignore the basics of geopolitics that have shaped the fate of world empires for the past 500 years. Consequently, they have missed the significance of the rapid global changes in Eurasia that are in the process of undermining the grand strategy for world dominion that Washington has pursued these past seven decades. A glance at what passes for insider “wisdom” in Washington these days reveals a worldview of stunning insularity. Take Harvard political scientist Joseph Nye, Jr., known for his concept of “soft power,” as an example. Offering a simple list of ways in which he believes U.S. military, economic, and cultural power remains singular and superior, he recently argued that there was no force, internal or global, capable of eclipsing America’s future as the world’s premier power.

For those pointing to Beijing’s surging economy and proclaiming this “the Chinese century,” Nye offered up a roster of negatives: China’s per capita income “will take decades to catch up (if ever)” with America’s; it has myopically “focused its policies primarily on its region”; and it has “not developed any significant capabilities for global force projection.” Above all, Nye claimed, China suffers “geopolitical disadvantages in the internal Asian balance of power, compared to America.” Or put it this way (and in this Nye is typical of a whole world of Washington thinking): with more allies, ships, fighters, missiles, money, patents, and blockbuster movies than any other power, Washington wins hands down.

If Professor Nye paints power by the numbers, former Secretary of State Henry Kissinger’s latest tome, modestly titled World Order and hailed in reviews as nothing less than a revelation, adopts a Nietzschean perspective. The ageless Kissinger portrays global politics as plastic and so highly susceptible to shaping by great leaders with a will to power. By this measure, in the tradition of master European diplomats Charles de Talleyrand and Prince Metternich, President Theodore Roosevelt was a bold visionary who launched “an American role in managing the Asia-Pacific equilibrium.” On the other hand, Woodrow Wilson’s idealistic dream of national self-determination rendered him geopolitically inept and Franklin Roosevelt was blind to Soviet dictator Joseph Stalin’s steely “global strategy.” Harry Truman, in contrast, overcame national ambivalence to commit “America to the shaping of a new international order,” a policy wisely followed by the next 12 presidents.

Read more …

A topic that warrants much more scrutiny. You don’t need a master plan for things to go horribly awry.

• The New World Order – A Faustian Bargain (Jeff Thomas)

The push-and-pull of sociopathic leaders is unending. Their very makeup dictates that each one individually will always be vying for more. In order to achieve that, they will form subversive subgroups that will agree on a separate direction from what has been agreed by the primary group, and along the way, each one, in his lack of conscience and loyalty, might betray both the primary group and the subgroup. In the end, there’s no question that there are those who consider themselves to be part of a New World Order, as so many have publicly stated so themselves, for generations. Also, there can be little doubt that each member expects to come out of the deal as a ruler, not as one of the ruled. Further, the effort is ongoing and growing, and will result in great damage for the average person who, in most cases, simply wishes to be left alone to run his own life.

It has been postulated by many that those who see themselves as an Elite are nearing the completion of what they perceive as world dominance. However, should they succeed, they will betray their partners the very next day, as it’s their nature to do so. Their behaviour would likely be that of a group of cats with their tails tied together. So, what might we take away from this discussion? First, that there most assuredly are extremely domineering forces (regardless of how closely associated they might be), which, in the near future, will do immense damage to the cause of freedom in the world, particularly in those countries where they are most dominant, or will become most dominant. Second, the situation does appear to be reaching a head.

The two greatest uncertainties will be how much damage will be done before the dust has settled, and how protracted the period of destruction and struggle for dominance might be. Ultimately, for the reasons stated above, I don’t believe the New World Order concept can fully prevail, but it can and will do damage of unprecedented proportions in the attempt to implement it. Those involved will not be swayed from their individual or collective objectives (consider Adolf Hitler or Josef Stalin). The best that can be done is to work at placing ourselves as far outside of their sphere of influence as possible.

Read more …

This has been obvious for a while.

• Pentagon Report Proves US Complicity In ISIS (Nafeez Ahmed)

According to leading American and British intelligence experts, a declassified Pentagon report confirms that the West accelerated support to extremist rebels in Syria, despite knowing full well the strategy would pave the way for the emergence of the ‘Islamic State’ (ISIS). The experts who have spoken out include renowned government whistleblowers such as the Pentagon’s Daniel Ellsberg, the NSA’s Thomas Drake, and the FBI’s Coleen Rowley, among others. Their remarks demonstrate the fraudulent nature of claims by two other former officials, the CIA s Michael Morell and the NSA s John Schindler, both of whom attempt to absolve the Obama administration of responsibility for the policy failures exposed by the DIA documents.

As I reported on May 22nd, the US Defense Intelligence Agency (DIA) document obtained by Judicial Watch under Freedom of Information confirms that the US intelligence community foresaw the rise of ISIS three years ago, as a direct consequence of the support to extremist rebels in Syria. The August 2012′ Information Intelligence Report’ (IIR) reveals that the overwhelming core of the Syrian insurgency at that time was dominated by a range of Islamist militant groups, including al-Qaeda in Iraq (AQI). It warned that the supporting powers to the insurgency – identified in the document as the West, Gulf states, and Turkey – wanted to see the emergence of a Salafist Principality in eastern Syria to isolate the Assad regime.

The document also provided an extraordinarily prescient prediction that such an Islamist quasi-statelet, backed by the region s Sunni states, would amplify the risk of the declaration of an Islamic State across Iraq and Syria. The DIA report even anticipated the fall of Mosul and Ramadi. Last week, legendary whistleblower Daniel Ellsberg, the former career Pentagon officer and US military analyst who leaked Pentagon papers exposing White House lies about the Vietnam War, described my Insurge report on the DIA document as a very important story.

Read more …

How to make a bad thing worse.

• Richard Branson Peddles Technohappy ‘Remedies’ For Climate Change (Bloomberg)

As talks aimed at slowing global warming drag on, researchers are pushing new ideas that some are calling last-ditch attempts to avert the worst effects of climate change. Some proposals are uncontroversial, such as using charcoal to lock carbon dioxide into soil or scattering carbon-absorbing gemstones. Richard Branson, the billionaire chairman of Virgin, has offered a $25 million prize for the best solution in the field known as geoengineering. Other ideas to cool the planet have scientists worried about unintended consequences. There are proposals, untested at scale and with uncertain costs, to block the sun’s rays with airborne particles or seed the oceans with carbon-absorbing iron. That they’re even being considered reveals both frustration over government inaction and skepticism that policy alone will solve the problem.

“For the last 20 to 30 years, governments, at the back of their minds, have assumed that mitigation is the main way forward,” said Mark Maslin, a fellow at the U.K.’s Royal Geographical Society. Researchers now realize that the planet needs “other urgent ways of dealing with CO2.” Interest in geoengineering comes after two decades of United Nations talks that have yet to produce a global climate-change agreement. Envoys from about 200 nations will meet December in Paris, where they’re expected to finalize a pact to curb carbon emissions. There is a sense of urgency. Researchers are seeking to limit warming to 2 degrees Celsius (3.6 degrees Fahrenheit) from pre-industrial times. “To achieve that we will have to actually do some sort of geoengineering,” Maslin said.

Global surface temperatures have already risen about 0.85 degrees Celsius since 1880, according to a 2014 UN report. The researchers found that while the unintended consequences of manipulating the climate may be significant, “some basic inquiry does seem appropriate.” A National Academy of Sciences panel echoed those concerns. In a February report, it found little evidence that researchers will be able to deploy geoengineering anytime soon. It also concluded that the U.S. should study the technologies as a “last-ditch” tool. Tinkering with the planet’s climate may carry more risk than efforts to reduce carbon emissions, said David Titley, a professor in Pennsylvania State University’s department of meteorology. “Climate intervention involves techniques that are of high and unknown risk,” he said. “The risks for mitigation and adaptation are understood and manageable.”

Read more …

Which is of course flatly denied.

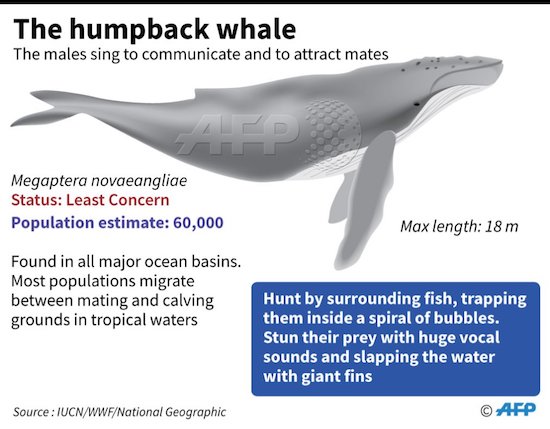

• Shell’s Arctic Drilling Will Harass Thousands Of Whales And Seals (Guardian)

Royal Dutch Shell’s plans for exploratory drilling in the US Arctic this summer will involve the harassment of whales and seals by the thousands, an application document filed by Shell to the National Marine Fisheries Service (NMFS) reveals. Most notably, Shell estimates its Arctic activities will expose more than 2,500 bowhead whales, more than 2,500 gray whales and more than 50,000 ringed seals to continuous sounds and pulsed sounds, deemed damaging enough to constitute harassment. The bowhead whale is listed under the US Endangered Species Act. By Shell’s own estimate, 13% of the overall population of bowhead whales still alive are potentially harassed .

The number of gray whales potentially harassed also constitutes 13% of the overall population, while the number of ringed seals potentially harassed amounts to 16%. Under the ESA, the ringed seal is classified as threatened. Under the Marine Mammal Protection Act, the government may allow for the “taking” or “harassment” of marine mammals, so long as the number taken is small and the impact on the species negligible. But environmental groups argue the numbers affected by the Shell plans are not small, nor will the impact on species be negligible. “The authorisation that they [Shell] are seeking is a request to be able to harass that amount of animals. Shell has asked the government to authorize the taking of that amount of animals,” said Christopher Krenz, a scientist and Arctic campaign manager with Oceana.

Read more …

Turning into a tsunami.

• Influx Of Migrants To Greek Islands From Turkey Up Sixfold (Kathimerini)

The influx of undocumented immigrants into Greece from neighboring Turkey has increased dramatically, growing sixfold in the first five months of the year compared to the same period in 2014, according to new figures released by the coast guard on Monday. A total of 40,297 immigrants and refugees were intercepted in the Aegean, particularly on the islands of the eastern Aegean, between January 1 and May 31 as compared to 6,500 in the same period last year, according to coast guard figures. The influx is continuing, and is expected to intensify as the weather improves. Coast guard officers detained 4,046 migrants over the weekend (including Friday). The problem is more intense on some islands, such as Lesvos, which received 18,371 immigrants in the first five months of the year.

On Monday alone two boatloads carrying a total of 78 would-be migrants arrived on the island’s shores. The situation on Chios, Kalymnos and Kos is said to be just as bad. A total of 7,317 migrants arrived on Chios from January to June. The island’s mayor, Manolis Vournous, said authorities have set up a makeshift camp outside the main police precinct as temporary accommodation for hundreds of migrants. Similar stopgap solutions have been sought on other islands. On Lesvos, a drivers’ education center has been transformed into a temporary settlement for migrants. The islands of Samos and Kos, which are popular summer tourist destinations, have also been struggling, having received 4,658 and 4,625 immigrants respectively in the first five months of the year.

Works are under way to repair an abandoned hotel on Kos that suffered serious damage in a recent fire. It will be able to accommodate around 400 migrants once works are complete, local authorities said. A spokesman for the Citizens’ Protection Ministry told Kathimerini that 80% of the incoming migrants are refugees from Syria, adding that Greek Police has boosted personnel and equipment to accelerate the identification process. Last Friday, the United Nations refugee agency said it is boosting its staff presence on several islands in the Aegean.

Read more …