Unknown Petersburg, Virginia. Group of Company B, U.S. Engineer Battalion 1864

Time to get nervous.

• Asian Markets Show Jitters as Polls Narrow Gap Between Trump and Clinton (G.)

Asian shares stumbled and the US dollar was on the defensive on Wednesday amid signs investors were becoming spooked by polls narrowing the gap between US presidential nominees Donald Trump and Hillary Clinton. Market anxiety has deepened over a possible Trump victory given uncertainty on the Republican candidate’s stance on issues including foreign policy, trade relations and immigration, while Clinton is viewed as a candidate of the status quo. Stocks across Asia Pacific saw a broad selloff on Wednesday with the Nikkei in Japan down by 1.8% at 4am GMT. There were also steep falls in Australia where the ASX/S&P 200 benchmark index was down almost 1.5%, with falls of 1.3% in South Korea and Hong Kong as markets took a lead from a sharp drop on Wall Street overnight.

The main European markets were also expected to begin the day in the red when they open later, according to futures trading. The tumultuous presidential race appeared to tighten after news that the FBI was reviewing more emails as part of a probe into Clinton’s use of a private email server. While Clinton held a five-percentage-point lead over Trump, according to a Reuters/Ipsos opinion poll released on Monday, other polls showed Trump ahead by 1-2 %age points. That pushed the US S&P500 Index down to a four-month closing low on Tuesday. The CBOE volatility index, often seen as an investors’ fear gauge, briefly rose to a two-month high, above 20%.

In the currency market, traders sold the dollar partly as they suspect Trump would prefer a weaker dollar given his protectionist stance on international trade. The euro rose to a three-week high of $1.1069, up about 2% from its seven-and-a-half-month low of $1.0851 hit just over a week ago. Against the yen, the dollar slipped to 104.03 yen from three-month high of 105.54 yen set on Friday. Koichi Yoshikawa at Standard Chartered Bank said: “If you had a long dollar position on the view that the dollar would gain because Clinton would win, you would surely close that position because her victory is less certain.”

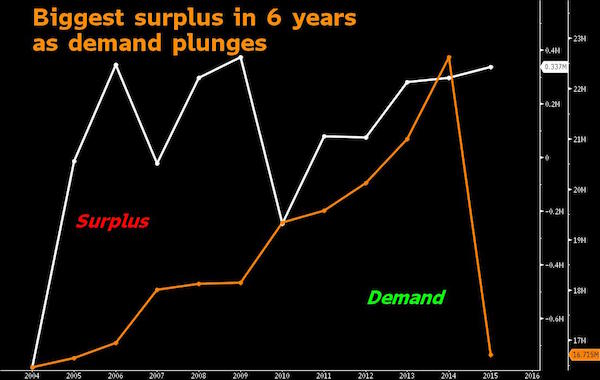

There’s that picture again of massive inventory in ports.

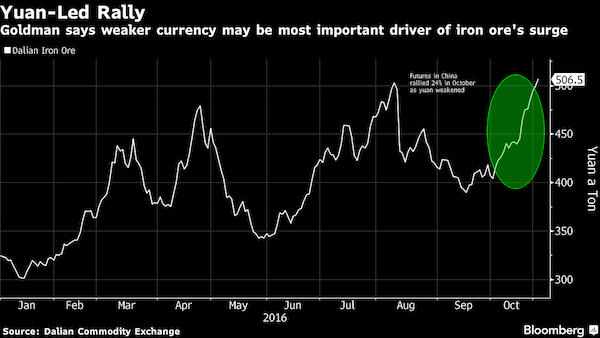

• Goldman Says Weakening Yuan Is Behind Iron Ore Rally (BBG)

Iron ore’s eye-catching rally to the highest since April is probably due to the weakening of the yuan, according to Goldman Sachs, which said that China’s currency may decline further against the dollar and help to sustain prices of the raw material. Prices surged last month as losses in the yuan prompted some local investors to move into dollar-linked assets, including iron ore, analysts Hui Shan, Amber Cai and Christian Lelong said in a report received Wednesday. Should the Federal Reserve raise interest rates by the end of the year, there’s scope for further yuan weakness, they wrote in the Nov. 1 note. Iron ore has rallied even as signs of robust supply multiply, including a buildup in stockpiles at ports in China.

While some analysts have sought to explain the jump by pointing to higher coal prices as a driver, Goldman said that didn’t stack up as a reason, targeting the yuan’s drop instead. The Chinese currency has sagged as local policy makers signaled they are willing to allow greater currency flexibility amid a slump in exports and rise in the dollar. “By our estimates, about 60% of the iron ore price rally in October can be explained by the yuan depreciation,” the analysts said. Iron ore may be the first in line to benefit from onshore investment flows into commodities as the “futures curve is almost always backwardated, making long iron ore a positive-carry trade,” they said, referring to bets on gains.

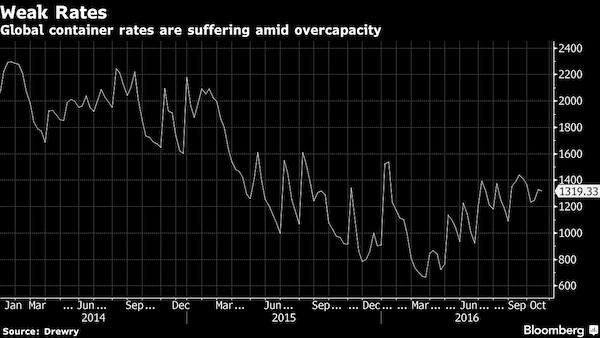

Global trade bites again.

• Maersk’s Profit Drops 43% On Overcapacity In Shipping Industry (BBG)

A.P. Moller-Maersk, owner of the world’s largest container line, reported a 43% decline in third-quarter profit as the shipping industry suffers from overcapacity. Net income fell to $429 million in the third quarter compared with $755 million in the same period a year earlier, the Copenhagen-based company said in a statement Wednesday. That missed the average estimate of $501 million in a Bloomberg survey of 15 analysts. “The result is unsatisfactory, but driven by low prices,” Chief Executive Officer Soren Skou said in the statement. “We generally perform strongly on cost and volume across businesses.” Maersk said its underlying profit for 2016 will be “below” $1 billion. Previously, the company had said the full-year result would be “significantly” below 2015’s $3.1 billion.

An excess of vessels and weak trade growth have driven container lines to try to under-bid each other on the rates they offer clients. The climate has proven lethal for some industry members, with South Korea’s biggest line Hanjin Shipping Co. filing for bankruptcy protection in August. Earlier this week, Japan’s three biggest container lines said they plan to merge their operations in an efforts to return to profit. Maersk’s response has been to cut costs. On Wednesday it said costs at Maersk Line declined 14% in the quarter, but that was outpaced by a 16% decline in freight rates. The shipping line reported a net operating loss after tax of $116 million compared with a profit by the same measure of $264 million a year earlier as freight rates fell 16%.

The destruction continues unabated and unopposed. “Construction of homes has collapsed, dropping by 95% from 2007 to 2016.”

• In Greece, Property Is Debt (NY Times)

At law courts throughout Greece, people are lining up to file papers renouncing their inheritance. Not necessarily because some feckless uncle left them with a pile of debt at the end of his revels; they are turning their backs on what used to be a pillar of Greece’s economy and society: real estate. Growing personal debt, declining incomes and ever higher taxes as Greece’s depression grinds on have turned property and the dream of easy money into dread of a catastrophic burden. The figures are clear. In 2013, two years after a property tax was introduced (previously, real estate tax revenue came mainly from transfers or conveyance taxes), 29,200 people declined to accept their inheritance, according to the Justice Ministry. In 2015, the number had climbed to 45,627, an increase of 56% in two years.

Reports from across the country suggest that this year, too, large numbers of people are refusing to inherit. “This can be very painful,” said Giorgos Voukelatos, a lawyer. “People may lose their family home. Because if the father or mother had debts, the child might be unemployed and unable to carry this weight as well.” The growing aversion to property is evident in the drop in business at notaries public. The national statistics service, Elstat, reported in July that in 2014 there were 23,221 deeds in which living parents transferred property to their children, down from 90,718 in 2008. The number of wills drawn up or notarized has been steady through the crisis, at around 30,000 annually, suggesting that many inheritances being rejected were not part of formal wills. (More than 120,000 people die each year.)

The desire to inherit used to be so great that some took it upon themselves to give fortune a hand. Greeks were stunned in 1987 when the police uncovered a gang that had killed at least eight rich elderly people after forging their wills. The plot’s leader was a lawyer and former mayor of an Athens suburb; accomplices included a notary public and a gravedigger. Murder Inc., as the news media called it, was seared into popular consciousness as an instance in which criminals acted out a common desire. Today, people are more likely to run away from real estate than be tempted to kill for it.

The collapse of the real estate market shows why. The total number of transactions dropped by 74% from 2004 to 2014. People once hoped that if they came into property they could sell it and live easier; now they fear that they will be unable to sell it and the taxes will drag them down. If they did find a buyer, they would be unlikely to gain much, as prices of apartments have fallen by 41% since 2008, according to the Bank of Greece. Construction of homes has collapsed, dropping by 95% from 2007 to 2016. With no end to the crisis in sight, people will continue to dread coming into property.

An entire campaign blinded by hubris.

• Hillary Clinton Is Irreparably Damaged, Even If She Wins (MW)

We don’t know whether the reopening of the FBI probe of Hillary Clinton’s emails will cost her the election. It may be that she will still emerge the winner after next Tuesday’s vote, or that Donald Trump’s momentum from the Wikileaks emails, Obamacare’s failures, and Clinton’s flawed candidacy were going to carry him to victory in any case. What we do know is that whoever wins, we are in for a fiasco in politics that will make even this fiasco of a campaign pale by comparison. There is hardly any scenario that is too far-fetched. Even if the polls are right and Clinton’s lead translates into an electoral victory, she will be so damaged going into office that her chances of getting anything done will be virtually nil. In this sense alone, Trump’s claim that this scandal is “worse than Watergate” could prove to be true.

As an incumbent, Richard Nixon at least had an administration in place when he won re-election in 1972, though it took nearly another two years before he was forced to resign under threat of impeachment. Clinton is likely to be stymied from the start, especially if the ongoing investigations into her email practices and the Clinton Foundation lead to further damaging disclosures. For one thing, we now have the precedence of Watergate, and Republicans, who are sure to retain the House and now probably the Senate, will not let go. There is hardly a chance that it will all end well for Clinton and that she will be exonerated because what is already known has many Republicans convinced that she is guilty at the very least of mishandling classified documents and perhaps obstruction of justice.

While the immediate attention in the wake of last week’s disclosure about reopening the email investigation has focused on FBI Director James Comey, the real conundrum in all this concerns his boss, Attorney General Loretta Lynch. Lynch fatally compromised her position by meeting with former President Bill Clinton just days before the original investigation was closed without a grand jury ever considering the evidence. And now her failure to block Comey’s disclosure — while leaking that she wanted to — is another ethical lapse. Other reports indicate that she attempted to quash the investigation into the Clinton Foundation. It is hard to see how she can remain in office even if Clinton wins and wants to keep her. Her resignation — or even impeachment — seems inevitable with Republicans out for blood.

The damage done to the whole Clinton entourage through the machinations exposed in the Wikileaks emails means that many of them – Huma Abedin, Cheryl Mills, John Podesta, Neera Tanden – will be virtually untenable in any position of responsibility in a new Clinton administration. And this is the best-case scenario for Clinton. We all know what the worst-case scenario is.

Hilarious. 370 economists making Trump’s case for him: “The economists object to Mr. Trump for questioning the legitimacy of economic data produced by institutions such as the Bureau of Labor Statistics.” Everybody questions the BLS. Except for 370 economists?!

• 370 Economists, Including 8 Nobel Laureates: ‘Do Not Vote for Trump’ (WSJ)

A group of 370 economists, including eight Nobel laureates in economics, have signed a letter warning against the election of Republican nominee Donald Trump, calling him a “dangerous, destructive choice” for the country. Signatories include economists Angus Deaton of Princeton University, who won the economics Nobel last year, and Oliver Hart of Harvard University, who was one of the two Nobel winners this year. The letter is notable because it is less partisan or ideological than such quadrennial exercises, and instead takes issue with Mr. Trump’s history of promoting debunked falsehoods.

“He misinforms the electorate, degrades trust in public institutions with conspiracy theories and promotes willful delusion over engagement with reality,” said the signatories, which also include Paul Romer, the new chief economist at the World Bank, and Kenneth Arrow, the 1972 Nobel winner. The economists object to Mr. Trump for questioning the legitimacy of economic data produced by institutions such as the Bureau of Labor Statistics. They say he hasn’t proposed credible solutions to reduce budget deficits and that he has promoted misleading claims about trade and tax policy. They also chide Mr. Trump for failing to “listen to credible experts” and for promoting “magical thinking and conspiracy theories over sober assessments of feasible economic policy options.”

[..] Peter Navarro, a Trump adviser and professor at the University of California, Irvine, said the economics profession has been so wrong about the impact of trade deals, including both the North American Free Trade Agreement in 1994 and the accession of China to the World Trade Organization in 2001, that it has little standing to criticize Mr. Trump’s position on those pacts. Tuesday’s letter “is a headline, whatever, and then they wind up being just so horribly wrong,” Mr. Navarro said. “You shouldn’t believe economists or Nobel Prize winners on trade.”

“You don’t need a Ph.D. in economics to know Trump’s plan to cut taxes, reduce regulation, increase oil, gas, and clean coal production, and eliminate our trade deficit by increasing exports and reducing imports will significantly increase growth, boost wages and generate trillions in new tax revenues,” he said. “This new letter is an embarrassment to an economics profession which continues to insist bad trade deals are good for America—a classic case of reality running roughshod over textbook trade theory.”

“Not only was Bill Clinton’s wife under an FBI investigation at the time [..] but his own charitable foundation was also under investigation, a fact that was unknown at the time to the public and the media.

• Clintons Are Under Multiple FBI Investigations as Agents Are Stymied (Martens)

Current and former FBI officials have launched a media counter-offensive to engage head to head with the Clinton media machine and to throw off the shackles the Loretta Lynch Justice Department has used to stymie their multiple investigations into the Clinton pay-to-play network. Over the past weekend, former FBI Assistant Director and current CNN Senior Law Enforcement Analyst Tom Fuentes told viewers that “the FBI has an intensive investigation ongoing into the Clinton Foundation.” He said he had received this information from “senior officials” at the FBI, “several of them, in and out of the Bureau.” That information was further supported by an in-depth article in the Wall Street Journal by Devlin Barrett. According to Barrett, the “probe of the foundation began more than a year ago to determine whether financial crimes or influence peddling occurred related to the charity.”

Barrett’s article suggests that the Justice Department, which oversees the FBI, has attempted to circumvent the investigation. The new revelations lead to the appearance of wrongdoing on the part of U.S. Attorney General Loretta Lynch for secretly meeting with Bill Clinton on her plane on the tarmac of Phoenix Sky Harbor International Airport on the evening of June 28 of this year. Not only was Bill Clinton’s wife under an FBI investigation at the time over her use of a private email server in the basement of her New York home over which Top Secret material was transmitted while she was Secretary of State but his own charitable foundation was also under investigation, a fact that was unknown at the time to the public and the media.

The reports leaking out of the FBI over the weekend came on the heels of FBI Director James Comey sending a letter to members of Congress on Friday acknowledging that the investigation into the Hillary Clinton email server was not closed as he had previously testified to Congress, but had been reopened as a result of “pertinent” emails turning up.

The Daily Mail reoprts on ‘persons of interest’: Huma Abedin, Terry McAuliffe, Cheryl Mills, Phillipe Reines, John Podesta, Tony Podesta, Doug Band, Justin Cooper, Anthony Weiner

• Five Separate FBI Cases Are Probing Clinton’s Inner Circle (DM)

The extent to which Hillary Clinton’s key advisers are now the focus of major FBI investigations is becoming clear. The Clintons’ long-term inner-circle – some of whom stretch back in service to the very first days of Bill’s White House – are being examined in at least five separate investigations. The scale of the FBI’s interest in some of America’s most powerful political fixers – one of them a sitting governor – underlines just how difficult it will be for Clinton to shake off the taint of scandal if she enters the White House. There are, in fact, not one but five separate FBI investigations which involve members of Clinton’s inner circle or their closest relatives – the people at the center of what has come to be known as Clintonworld.

The five known investigations are into: Anthony Weiner, Huma Abedin’s estranged husband sexting a 15-year-old; the handling of classified material by Clinton and her staff on her private email server; questions over whether the Clinton Foundation was used as a front for influence-peddling; whether the Virginia governor broke laws about foreign donations; and whether Hillary’s campaign chairman’s brother did the same. The progress of the Clinton Foundation investigation and that into McAuliffe was first reported by the Wall Street Journal. The FBI does not generally comment on investigations, so it is entirely possible there are more under way. Here are the advisers and consiglieri – and how the FBI is looking at them:

Rep. Gowdy has said he thinks Kadzik will do his job properly.

• Top DOJ Official In Clinton Probe ‘Kept Podesta Out Of Jail’ in 1998 (F.)

The Justice Department official in charge of informing Congress about the newly reactivated Hillary Clinton email probe is a political appointee and former private-practice lawyer who kept Clinton Campaign Chairman John Podesta “out of jail,” lobbied for a tax cheat later pardoned by President Bill Clinton and led the effort to confirm Attorney General Loretta Lynch. Peter Kadzik, who was confirmed as assistant attorney general for legislative affairs in June 2014, represented Podesta in 1998 when independent counsel Kenneth Starr was investigating Podesta for his possible role in helping ex-Bill Clinton intern and mistress Monica Lewinsky land a job at the United Nations.

“Fantastic lawyer. Kept me out of jail,” Podesta wrote on Sept. 8, 2008 to Obama aide Cassandra Butts, according to emails hacked from Podesta’s Gmail account and posted by WikiLeaks. Kadzik’s name has surfaced multiple times in regard to the FBI’s investigation of Democratic presidential nominee Hillary Clinton for using a private, homebrewed server. After FBI Director James Comey informed Congress on Thursday the FBI was reviving its inquiry when new evidence linked to a separate investigation was discovered, congressional leaders wrote to the Department of Justice seeking more information. Kadzik replied. “We assure you that the Department will continue to work closely with the FBI and together, dedicate all necessary resources and take appropriate steps as expeditiously as possible,” Kadzik wrote on Oct. 31.

Can’t keep your enemies any closer than this.

• Hillary Clinton: Wall Street’s Favorite Enemy (R.)

Hillary Clinton began her presidential campaign by promising to do what it takes to rein in Wall Street. Boosted by Wall Street’s toughest critics, U.S. senators Bernie Sanders and Elizabeth Warren, the Democratic candidate has declared “the deck is still stacked in favor of those at the top” and said she would raise bank fees and tighten banking regulations. She has encouraged regulators to break up too-risky banks. And yet, Wall Street appears unperturbed by the prospect of a Clinton presidency. In fact, the banking industry has supported Clinton with buckets of cash and stocks have sold off on days when the Clinton campaign stumbles. Privately, bankers say that they trust her to remain a pragmatist who will keep the current regulatory regime laid down by the Dodd-Frank Wall Street reform legislation passed in 2010.

“I don’t think Clinton wakes up thinking about Wall Street,” one senior banking industry lobbyist said. There are hints in apparently leaked email discussions among Clinton’s campaign staff that bankers are not far off the mark when they count on her to tread lightly. Pressed during the campaign by progressive Democrats to call for a revival of the Glass-Steagall Act that would require separation of commercial and investment banking, Clinton ultimately refused. She also weighed another progressive favorite – a tax on financial transactions- but instead recommended a far narrower plan to tax only canceled orders by high speed traders. Ultimately, what bankers most like about Clinton is that she is not Donald Trump.

Many financiers fear her unorthodox Republican rival could disrupt global trade, damage geopolitical relationships and rattle markets, industry analysts and participants say. “Those are the kind of things that corner offices think about,” said Karen Shaw Petrou of Federal Financial Analytics, whose firm advises financial firms about U.S. regulatory policy. “The overriding concern about Trump has dominated people’s thinking.” [..] People who work for hedge funds and private equity firms have contributed more than $56 million to Clinton’s presidential campaign and the supporting groups that face no legal cap on donations. Trump’s campaign and related groups received just $243,000 from donors in the same sector, according to data from the Center for Responsive Politics.

“During an election it is OK to announce that a candidate for president is cleared but it is not OK to say that a candidate is under investigation.”

• Can The American People Defeat The Oligarchy That Rules Them? (PCR)

Aren’t you surprised that Hillary and the presstitutes haven’t blamed Putin for FBI director Comey’s reopening of the Hillary email case? But the presstitutes have done the next best thing for Hillary. They have made Comey the issue, not Hillary. According to US Senator Harry Reid and the presstitutes, we don’t need to worry about Hillary’s crimes. After all, she is only a political woman feathering her nest, just as political men have done for ages. Why all this misogynist talk about Hillary? The presstitutes’ cry is that Comey’s alleged crime is far more important. This woman-hating Republican violated the Hatch Act by telling Congress that the investigation he said was closed is now reopened. A very strange interpretation of the Hatch Act. During an election it is OK to announce that a candidate for president is cleared but it is not OK to say that a candidate is under investigation.

In July 2016 Comey violated the Hatch Act when he, on orders from the corrupt Obama Attorney General, announced Hillary clean. In so doing, Comey used the prestige of federal clearance of Hillary’s violation of national security protocols to boost her standing in the election polls. Actually, Hillary’s standing in the polls is based on the pollsters over-weighting Hillary supporters in the polls. It is easy to produce a favorite if you overweight their supporters in the poll questions. If you look at the crowds attending the two candidate’s public appearances, it is clear that the American people prefer Donald Trump, who is opposed to war with Russia and China. War with nuclear powers is the big issue of the election.

Hillary’s problem has the ruling American Oligarcy, for which Hillary is the total servant, concerned. What are they going to do about Trump if he wins? Will his fate be the same as John F. Kennedy, Robert Kennedy, Martin Luther King, George Wallace? Time will tell. Or will a hotel maid appear at the last minute in the way that the Oligarchy got rid of Dominique Strauss-Kahn? All of the American and Western feminists, progressives, and left-wing remnant fell for the obvious frame-up of Strauss-Kahn. After Strauss-Kahn was blocked from the presidency of France and resigned as Director of the IMF, the New York authorities had to drop all charges against Strauss-Kahn. But Washington succeeded in removing Strauss-Kahn as a challenge to its French vassal, Sarkozy.

Because it seems cheap and easy.

• Why Is MI5 Making Such A Fuss About Russia? (G.)

If I had cornflakes for breakfast (which I don’t), I would have choked on them, reading Andrew Parker’s view of the threat posed by Russia, not just to the world at large – that is a commonplace of the “new cold war” discourse – but to the stability of the UK. With the majority vote for Brexit against the strong preference of Scotland and Northern Ireland for remain, we have shown ourselves quite capable of inflicting potentially fatal harm to our national stability all by ourselves. Why would we need Russia to do it for us? That was a knee-jerk reaction to the main thrust of the MI5 chief’s first national newspaper interview in the agency’s history. But a second, more substantial, response chased behind it in the form of a rather basic, and recurrent, question.

Why is the UK establishment in general, and UK intelligence in particular, so fixated on a supposed threat from Russia? The cold war is a quarter-century behind us. The Warsaw Pact was dissolved; the Soviet Union collapsed. Today’s Russia has three quarters of the territory but only half the population of the old Soviet Union. Its GDP, whether overall or per capita, is far below that of the US, or ours. Its 2015 military budget took 5% of that – $70bn in actual money – less than an eighth of the nearly $600bn spent by the US. “Tsar” Vladimir Putin may have played a weak hand magnificently, as judged by admirers and detractors alike, but a weak hand is still a weak hand.

If Russia really harbours ambitions to reconstitute an empire, its only success to date is the expensive (in every respect) reacquisition of Crimea, a contested no-man’s land of ragtag rebels in the rust belt of eastern Ukraine, and two miniature enclaves inside independent Georgia. That recent “show of force”, when the might of the Russian navy made its stately progress through the English Channel, demonstrated only the obsolescence of the erstwhile superpower’s fleet. In the same interview, Parker disclosed that there were around 3,000 “violent Islamic extremists in the UK, mostly British”, and that cyber, not just in Russia’s hands, was the threat of the future. So let me repeat the question: why does Russia remain bogeyman-in-chief?

Here are a few ideas. The first is that blaming Russia carries little cost. Russia is not China. Investment is not a big consideration. For all sorts of reasons, political relations have long been dire. Applying the same virulent rhetoric to terrorism conducted in the name of Islam, on the other hand, risks fomenting social and cultural strife here at home. A second reason, now as in the past, is that blaming Russia aligns us comfortably with the US, where stalwarts in Congress and at the Pentagon have never emerged from their old thinking about the threat. The Russia card has been played to exhaustion during this presidential campaign, to the point where it could swing the election – and I don’t mean in Donald Trump’s favour. A third factor is the consensus about a strong and malevolent Russia that still rules the “expert” community, and will probably do so for a few years yet – helped along by the hatchet-faced Putin.

When their unwarranted powers are finally taken away from them it will be too late.

• Central Banks and the Revenge of Politics (Issing)

The reputation of central banks has always had its ups and downs. For years, central banks’ prestige has been almost unprecedentedly high. But a correction now seems inevitable, with central-bank independence becoming a key casualty. Central banks’ reputation reached a peak before and at the turn of the century, thanks to the so-called Great Moderation. Low and stable inflation, sustained growth, and high employment led many to view central banks as a kind of master of the universe, able – and expected – to manage the economy for the benefit of all. The depiction of US Federal Reserve Chair Alan Greenspan as “Maestro” exemplified this perception. The 2008 global financial crisis initially bolstered central banks’ reputation further.

With resolute action, monetary authorities made a major contribution to preventing a repeat of the Great Depression. They were, yet again, lauded as saviors of the world economy. But central banks’ successes fueled excessively high expectations, which encouraged most policymakers to leave their monetary counterparts largely responsible for macroeconomic management. Such “expectational” and, in turn, “operational” overburdening has exposed monetary policy’s true limitations. In other words, central banks’ good reputation now seems to be backfiring. And “personality overburdening” – when trust in the success of monetary policy is concentrated on the person at the helm of the institution – means that individual leaders’ reputations are likely to suffer as well.

Yet central banks cannot simply abandon their new operational burdens, particularly with regard to financial stability, which, as the 2008 crisis starkly demonstrated, cannot be maintained by price stability alone. On the contrary, a period of low and stable interest rates may even foster financial fragility, leading to a “Minsky moment,” when asset values suddenly collapse, bringing down the whole system. The limits of inflation targeting are now clear, and the strategy should be discarded. Central banks now have to reconcile the need to maintain price stability with the responsibility – regardless of whether it is legally mandated – to reduce financial vulnerability. This will not be easy, not least because of another new operational burden that has been placed on many central banks: macro-prudential and micro-prudential supervision.

They’re already completely lost by the looks of it.

• Brexit Complexity Set to Overwhelm Politicians (G.)

Managing Britain’s exit from the EU is such a formidable and complex challenge that it could overwhelm politicians and civil servants for years, senior academics have warned. Theresa May has announced she will trigger article 50 – the two-year process of negotiating a separation from the EU – by the end of March next year. The government will also publish a great repeal bill, which will transfer all EU-originated laws into British law, so that MPs can decide how much they want to discard. A report from The UK in a Changing Europe, an independent group of academics led by Prof Anand Menon of King’s College London, warns that this will only be the start of the process of extricating Britain from the EU and establishing new relationships with other member states.

“Brexit has the potential to test the UK’s constitutional settlement, legal framework, political process and bureaucratic capacities to their limits – and possibly beyond,” Menon said. The group of experts, commissioned by the Political Studies Association, found that identifying and transposing the legislation to be included in the great repeal bill – and then deciding what to keep and what to ditch – will be a daunting task for civil servants. They also warn that while article 50, as set out in the Lisbon treaty, concerns the terms of a divorce with the rest of the EU – including what share of EU liabilities the UK should take on, for example – it is unclear whether the process can allow for parallel negotiations on Britain’s future status. And they suggest the repatriation of decision-making in key policy areas including agriculture, the environment and higher education to Britain from Brussels could affect the balance of power between Westminster and the devolved parliaments – another major constitutional headache for politicians.

Wonder how far this kind of research will lead.

• Oil Drilling Thought To Have Caused 1933 Killer Earthquake In California (R.)

Several damaging Los Angeles-area earthquakes of the 1920s and 1930s, including the deadliest ever in southern California, may have been brought on by oil production during the region’s drilling boom of that era, US government scientists have reported. The findings of a possible link between oil extraction and seismic events in the LA basin do not apply to modern industry practices but suggest the natural rate of quake occurrences in the region may be lower than previously calculated, the scientists said. The study’s authors, Susan Hough and Morgan Page of the US Geological Survey, stressed a distinction between their results and separate research attributing a growing frequency of quakes in Oklahoma and elsewhere to underground wastewater injection associated with fossil fuel production.

The new study, published in the Bulletin of the Seismological Society of America, also noted that early 20th-century industry techniques differed greatly from today, so the findings “do not necessarily imply a high likelihood of induced earthquakes at the present time”. The report suggested four major Los Angeles-area quakes in 1920, 1929, 1930 and 1933 were triggered by early drilling methods in which oil was extracted without water being pumped into the ground to replace it, causing the ground to subside. This could have artificially placed more pressure on seismic faults near oilfields. The most devastating event was the so-called Long Beach earthquake of 10 March 1933, a 6.4-magnitude quake that ruptured the Newport-Inglewood fault along the coast, toppling scores of buildings and killing 115 to 120 people – the highest death toll on record from a southern California earthquake.

“..seeking to precipitate the coup through “subliminal messages” in their columns before it happened..”

• Turkey Rejects Europe’s ‘Red Line’ On Press Freedom After Detentions (R.)

Turkey’s prime minister said he had no regard for Europe’s “red line” on press freedom on Tuesday and warned Ankara would not be brought to heel with threats, rejecting criticism of the detention of senior journalists at an opposition newspaper. Police detained the editor and top staff of Cumhuriyet, a pillar of the country’s secularist establishment, on Monday, on accusations that the newspaper’s coverage had helped precipitate a failed military coup in July. The United States and European Union both voiced concern about the move in Turkey, a NATO ally which aspires to EU membership. European Parliament President Martin Schulz wrote on Twitter that the detentions marked the crossing of ‘yet another red-line’ against freedom of expression in the country.

“Brother, we don’t care about your red line. It’s the people who draw the red line. What importance does your line have,” Prime Minister Binali Yildirim told members of his ruling AK Party in a speech in parliament. “Turkey is not a country to be brought in line with salvoes and threats. Turkey gets its power from the people and would be held accountable by the people.” Prosecutors accuse staff at Cumhuriyet, one of few media outlets still critical of President Tayyip Erdogan, of committing crimes on behalf of Kurdish militants and the network of Fethullah Gulen, a U.S.-based cleric blamed for orchestrating the July coup attempt. Journalists at the paper were suspected of seeking to precipitate the coup through “subliminal messages” in their columns before it happened, the state-run Anadolu agency said.

Good to know, right? You don’t really own your car. Or anything else that has software in it.

• It’s Now -Temporarily- Legal to Hack Your Own Car (IEEE)

You may own your car, but you don’t own the software that makes it work— that still belongs to your car’s manufacturer. You’re allowed to use the software, but in the past, trying to alter it in any way (including fixing it by yourself when it breaks or patching security holes) was a form of copyright infringement. iFixit, Repair.org, the Electronic Frontier Foundation (EFF), and many others think this is ridiculous, and they’ve been lobbying the government to try to change things. A year ago, the U.S. Copyright Office agreed that people should be able to modify the software that runs cars that they own, and as of last Friday, that ruling came into effect. It’s good for only two years, though, so get hacking. The legal and technical distinction between physical ownership and digital ownership is perhaps most familiar in the context of DVD movies.

You can go to the store and buy a DVD, and when you do, you own that DVD. You don’t, however, own the movie that comes on it: Instead, it’s more like you own limited rights to watch the movie, which is a very different thing. If the DVD is protected by Digital Rights Management (DRM) software, the Digital Millennium Copyright Act (DMCA) says that you are not allowed to circumvent that software, even if you’re just trying to watch the movie on a different device, change the region restriction so that you can watch it in a different country, or do any number of other things that it really seems like you should be able to do with a piece of media that you paid 20 bucks for.

Cars work in a similar way. You own the car as a physical object, but you only have limited rights to the software that controls it, because the car’s manufacturer holds the copyright on that software. This prevents you from making changes to the software, even if those changes are to fix problems or counter obsolescence, as well as preventing you from investigating the security of the software, which can have very serious and direct consequences for you as the owner and driver. It’s also worth pointing out that (especially in older vehicles like the 1995 Volvo 940 Turbo belonging to a certain anonymous journalist) relatively simple computerized parts can cost a ridiculous amount of money to replace because there is no legal alternative besides buying a new one from the manufacturer, who hasn’t made them in 20 years and would much rather you just bought an entirely new car anyway.