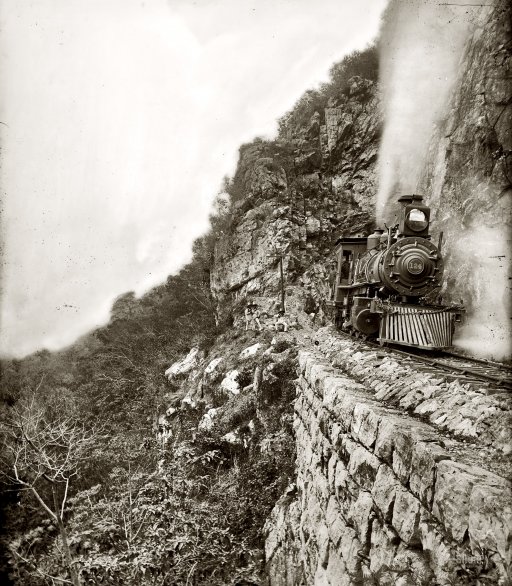

William Henry Jackson Tamasopo River Canyon, San Luis Potosi, Mexico 1890

The price we all will pay for this lousy piece of theater rises by the day.

• Yellen Is Worried About Global Growth – And Wall Street Loves It (MW)

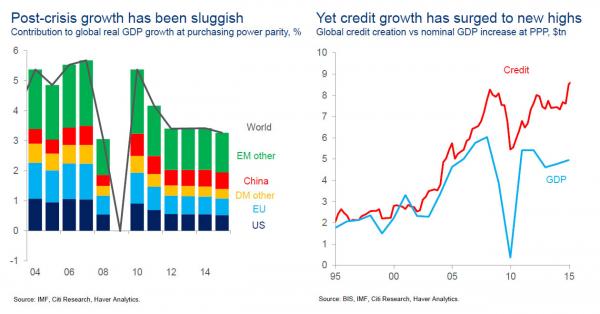

Janet Yellen offered up her best impression of a dove Tuesday. In other words, the Federal Reserve chairwoman stressed her intent to gradually lift benchmark interest rates off ultralow levels. Unsurprisingly, Wall Street cheered the prospect of an ever slower approach to raising interest rates as she spoke at a highly anticipated speech at the Economic Club of New York. The Dow Jones and the S&P 500 both posted their highest settlements of 2016. The dollar turned south and yields for rate-sensitive Treasurys touched one-month lows. What is worth taking note of is Yellen’s increased focus on forces outside of the U.S. as she outlines a plan to gingerly normalize interest rates, reiterating an updated March policy statement and the Fed’s reduced expectations for rate increases in 2016 (two versus an earlier projection for four).

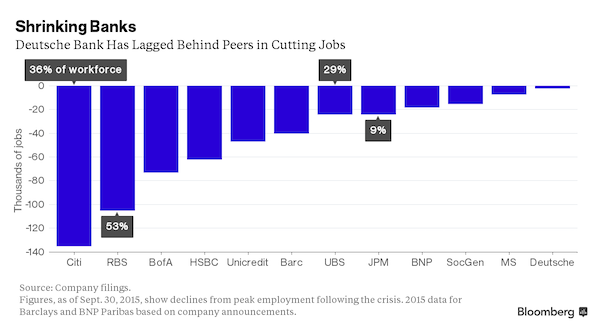

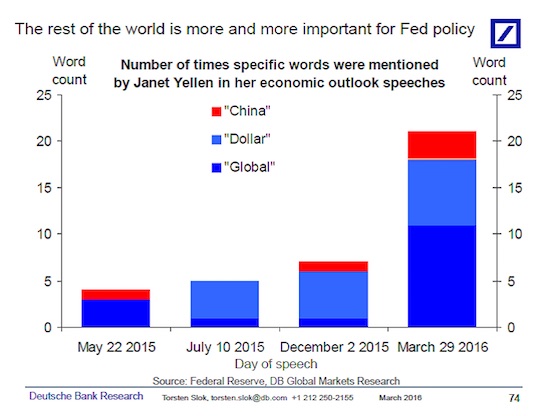

In a note, Deutsche Bank chief international economist Torsten Slok pointed out that Yellen & Co. have been more influenced by events in the rest of the world since late May. Mentions of China, the dollar and the term “global” have been more readily used by the Yellen as the emergence of negative interest rates in Japan and Europe have underscored consternation about the state of the world economy and. in particular, a slowdown by the world’s second-largest economy: China. Slok’s bar graph below illustrates the point. The Fed’s mandate, as Yellen reiterated Tuesday, is centered on the twin goals of maximum employment and stable prices, the latter of which the Fed defines as inflation at or near its 2% target level. But lately, fears that storms brewing abroad could wash ashore in the U.S. have come into greater focus, as the excerpt from Yellen’s Tuesday comments show:

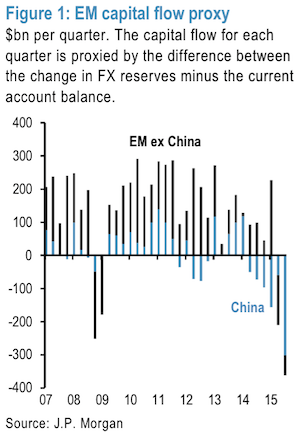

“One concern pertains to the pace of global growth, which is importantly influenced by developments in China. There is a consensus that China’s economy will slow in the coming years as it transitions away from investment toward consumption and from exports toward domestic sources of growth. There is much uncertainty, however, about how smoothly this transition will proceed and about the policy framework in place to manage any financial disruptions that might accompany it. These uncertainties were heightened by market confusion earlier this year over China’s exchange rate policy.”

How this is any different from interpreting the incoherent utterances of an oracle intoxicated by fumes, I don’t know.

• Yellen Says Caution in Raising Rates Is ‘Especially Warranted’ (BBG)

Federal Reserve Chair Janet Yellen said it is appropriate for U.S. central bankers to “proceed cautiously” in raising interest rates because the global economy presents heightened risks. The speech to the Economic Club of New York made a strong case for running the economy hot to push away from the zero boundary for the Federal Open Market Committee’s target rate. “I consider it appropriate for the committee to proceed cautiously in adjusting policy,” Yellen said Tuesday. “This caution is especially warranted because, with the federal funds rate so low, the FOMC’s ability to use conventional monetary policy to respond to economic disturbances is asymmetric.” Fed officials left their benchmark lending rate target unchanged this month at 0.25% to 0.5% while revising down their median estimate for the number of rate increases that will be warranted this year to two hikes, from four projected in December.

U.S. Treasuries advanced following her remarks, while the dollar weakened and U.S. stocks erased earlier losses. The Standard & Poor’s 500 Index was up 0.5% to 2,046.90 at 1:52 p.m. in New York, after falling as much as 0.4%. “Yellen has doubled down on the dovishness from the March statement and press conference,” said Neil Dutta at Renaissance Macro Research. “Global economic developments are cited very prominently.” Yellen said the FOMC “would still have considerable scope” to ease policy if rates hit zero again, pointing to forward guidance on interest rates and increases in the “size or duration of our holdings of long-term securities.”

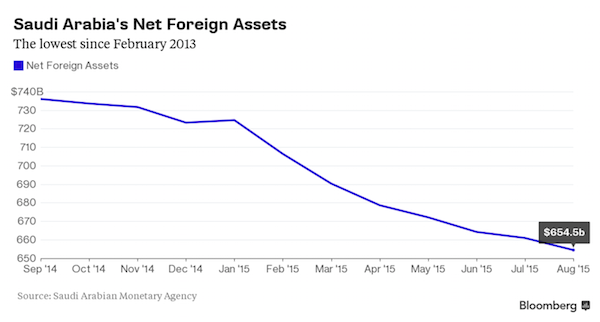

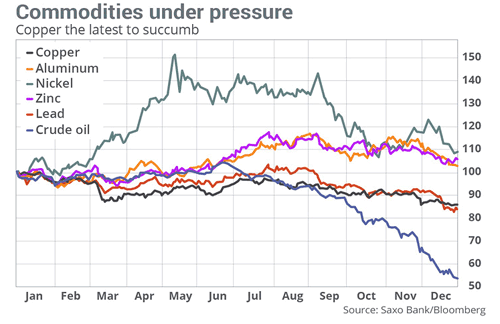

“While these tools may entail some risks and costs that do not apply to the federal funds rate, we used them effectively to strengthen the recovery from the Great Recession, and we would do so again if needed,” she said. Fed officials’ quarterly economic forecasts for the U.S. didn’t change much in March, while Yellen stressed in a post-FOMC meeting press conference on March 16 that their sense of risks from global economic and financial developments had mounted. Yellen mentioned two risks in her New York speech. Growth in China is slowing, she noted, and there is some uncertainty about how the nation will handle the transition from exports to domestic sources of growth. A second risk is the outlook for commodity prices, and oil in particular. Further declines in oil prices could have “adverse” effects on the global economy, she said.

“The politics are more polarized than even the Depression and more like the Civil War – and we have over 300 million guns in this country.”

• The US Is in for Much Greater Civil Unrest Ahead (Dent)

I made a confession to our Boom & Bust subscribers last month. While I generally advise against owning most real estate, I have a secluded property in the Caribbean. It’s the only property I own (I rent my home in Tampa) and I know for a fact that its value will likely depreciate in the great real estate shakeout I see ahead, although likely by half as much as a high-end property in Florida. The reason I own this property is because I see rising chances for civil unrest in the inevitable downturn ahead, especially in the U.S. I want a place to go if things get really bad, and it looks increasingly likely that they will. The evidence for that is piling up in this year’s presidential race… What we have now, surprising to most political analysts, is a genuine voter revolt against the rich and the establishment.

Trump is taking over the Republican Party, and Sanders is threatening Clinton beyond what almost anyone would have forecast a year ago, even if he can’t quite seem to win. And it doesn’t matter if Trump can back up most of his statements with facts, or if Sanders’ policies have any chance of being viable economically. They understand what the pundits don’t. The people are angry and they want change. When the U.S. came out of World War II, it emerged with the strongest and most successful middle class in the decades that followed. Never before had there been such a middle class emerge in all of history. We had a vibrant workforce with higher wages… a baby boom… startling innovation… But now we have led the decline of that middle class, with wage competition from Asia, Mexico and other emerging countries, and the rapid rise of the professional and speculative classes.

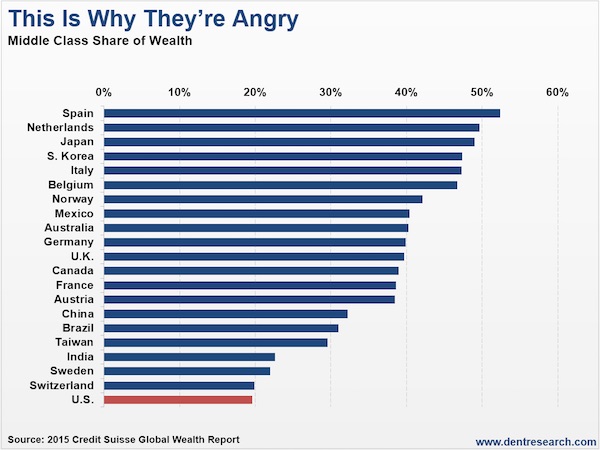

Meanwhile, many higher-paid manufacturing jobs have moved overseas, and even service jobs like call centers have moved to places like India. More immigrants have come in and competed as well. That’s why a silent “near” majority of Americans are anti-immigrant and free trade… Duh! But here’s the real rub. Higher incomes help you survive at a better standard of living, and real wages have only been declining since 2000. They’ve barely risen even back to 1970s levels. That’s enough to be mad about. The ability to live as you want, to retire longer term, and to have power in society comes more from wealth – and that is way more skewed towards the upper class. And that’s where the middle class in America has lost the most ground. Look at this chart from a recent study by Credit Suisse of the share of wealth held by the middle class. Look at how we compare to the rest of the top countries.

The U.S. is the worst! No wonder the middle class here feels the most dis-empowered! It explains why America’s electorate either wants to nominate a political outsider who talks tough and promises to restore our power in the world… or an avowed socialist to combat income and wealth inequality by attacking Wall Street and the top 1%. I have said for a long time that the two countries I most expect to have the worst potential for civil unrest are China… and the U.S. China because it created the greatest over-expansion and urbanization bubble in modern history. Now, it has 250 million unregistered migrant urban workers from rural areas that will be stuck without jobs (and nowhere to go) after they can’t keep building infrastructures for no one. But the U.S. has the most polarized politics of any major country, and the greatest income and wealth inequality in the developed world. The politics are more polarized than even the Depression and more like the Civil War – and we have over 300 million guns in this country.

A minister mentioned temp government ownership of the steel industry this morning. Like China, I guess?!

• Steel Industry Dealt Hammer Blow As Tata Withdraws From UK (Tel.)

The steel industry was dealt a hammer blow on Tuesday as it emerged that Tata plans to completely withdraw from its British operation, putting thousands of jobs at risk. The Indian conglomerate’s board decided to pull out of the UK after rejecting a turnaround plan for Port Talbot, the nation’s biggest steelworks. The South Wales plant employs around 4,000 who face an uncertain future as Tata now seeks a buyer for its British steel assets. Steelworks in South Yorkshire, Northamptonshire and County Durham are also set to be put up for sale. A Tata spokesman said: “The Tata Steel Board came to a unanimous conclusion that the [turnaround] plan is unaffordable… the assumptions behind it are inherently very risky, and its likelihood of delivery is highly uncertain.”

Tata said it had ordered its European steel subsidiary to “explore all options for portfolio restructuring including the potential divestment of Tata Steel UK, in whole or in parts”. The decision by Tata placed the Government under pressure to step in to save Britain’s steel industry. Anna Soubry, the industry minister, has said that “in the words of the Prime Minister, we are unequivocal in saying that steel is a vital industry”. As Tata’s decision emerged from Mumbai, officials were looking at options to secure the survival of British steel making under new owners. It is understood they could include similar measures to those taken by the Scottish government to facilitate the acquisition of two former Tata mills by the commodities investor Liberty House. Taxpayers footed the bill to keep workers on standby and the plants were even temporarily nationalised while the deal was finalised.

“For energy companies, the price-book ratio is about 31% below its 10-year average, while the discount for miners is 44%.”

• Bonfire of the Commodities Writedowns is Just Starting (BBG)

What does $13 billion of burning money smell like? Commodity investors are getting a nose for it. Japanese trading houses Mitsui, Mitsubishi, and Sumitomo have announced 767 billion yen ($6.8 billion) of writedowns on assets this year, including copper, nickel, iron-ore and natural-gas projects. PetroChina wrote 25 billion yuan ($3.8 billion) off the value of oil and gas fields that have “no hope” of making a profit at current prices, President Wang Dongjin said last week, while Citic posted a HK$12.5 billion ($1.6 billion) impairment on an Australian iron-ore mine. Cnooc’s annual results last Thursday count as a good news story against that backdrop, with impairments of 2.75 billion yuan that were lower than the previous year’s.

Investors might hope after all this that we’d be reaching the level where mining and energy assets have been written back to normal levels, allowing companies to start the hard work of rebuilding. It doesn’t look that way. There’s certainly been a reality check of late. The balance sheets of major mining and energy companies have shrunk by $856 billion over the past 12 months, putting the value of their total assets at their lowest level since 2011, according to data compiled by Bloomberg. That looks dramatic until you compare it to the performance of the Bloomberg Commodities index. Companies are still more asset-rich than they were in 2011, which was the peak of a once-in-a-generation commodities boom. This delayed response to lower prices isn’t surprising.

Non-financial companies should have a high bar for reassessing their asset values to prevent manipulation of earnings (revaluations upward count as income, just as writedowns count against profit). That means a degree of inertia: after the 2008 financial crisis, the value of assets in the S&P 500 index didn’t bottom out until June 2010. Even if you blame weak-kneed accountants for that delay, an analogous pattern can be seen in the real economy. Default rates in the U.S. tend to peak well after economic slowdowns begin. To some extent, equity investors are already taking this in their stride. Price-to-book ratios of the Bloomberg World Energy Index and the Bloomberg World Mining Index are at their lowest levels since at least 2003, suggesting the market doesn’t believe companies’ balance sheets are worth as much as they appear on paper. For energy companies, the price-book ratio is about 31% below its 10-year average, while the discount for miners is 44%.

And projections for elections indicate Abe could get a 2/3 majority. How weird is that?

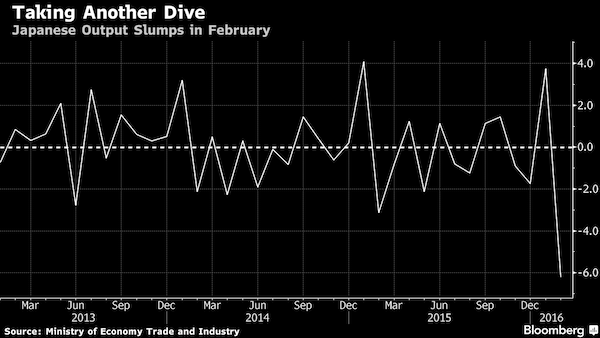

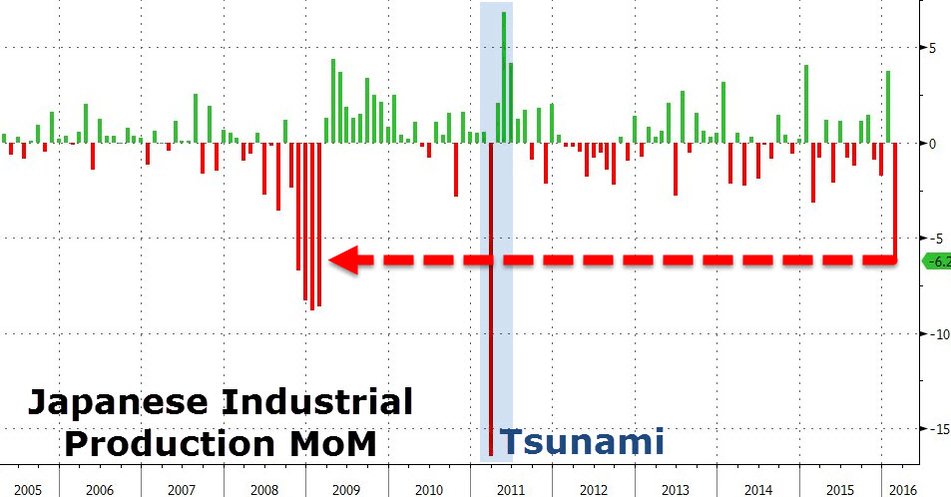

• Japan Industrial Output Drops 6.2% In February, Most Since 2011 (BBG)

Japan’s industrial production dropped the most since the March 2011 earthquake as falling exports sapped demand and a steel-mill explosion halted domestic car production at Toyota. Output slumped 6.2% in February after rising in January, the trade ministry said on Wednesday. Economists surveyed by Bloomberg had forecast a 5.9% drop. The government projects output will expand 3.9% this month. The data underscores the weakness of Japan’s recovery from last quarter’s contraction, with overseas shipments dropping for the last five months and sluggish domestic demand. With pressure building on policy makers to bolster growth, Prime Minister Shinzo Abe said Tuesday that the government would front load spending after parliament passed a record budget for the 12 months starting April 1. He resisted calls for a supplementary fiscal package.

“The slump in industrial output in February suggests that manufacturing activity will contract this quarter,” Marcel Thieliant, senior Japan economist at Capital Economics, wrote in a note. This means there is a growing risk that the economy won’t expand this quarter after the contraction in the final three months of last year, Thieliant wrote. Junichi Makino, chief economist at SMBC Nikko Securities, was more upbeat about the outlook. Production plans for March and April are strong, and there are signs of stronger demand for cars, electrical equipment and machinery, he said in a note. The size of the drop in February was due to both the fall in production at Toyota and the lunar new year, according to Makino.

“For years, traders on the mainland have used copper as collateral to finance trades in which they borrowed foreign currencies and invested the proceeds in higher-yielding assets denominated in renminbi.”

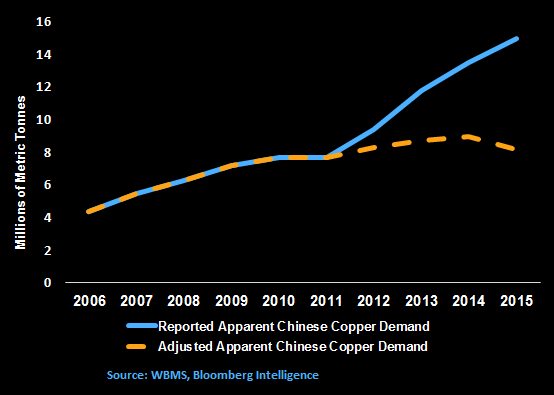

• China’s True Demand For Copper Is Only Half as Much as You Think (BBG)

Virtually every aspect of the commodities bust has a China angle. Forecasts for China’s consumption of raw materials have proved wildly optimistic, while domestic production of certain resources have resulted in particularly severe gluts in commodities such as steel and coal. But in one respect, China has been putting an artificial degree of upward pressure on a select resource—copper—sparing it from the worst of the rout in commodities. For years, traders on the mainland have used copper as collateral to finance trades in which they borrowed foreign currencies and invested the proceeds in higher-yielding assets denominated in renminbi. This carry trade with Chinese characteristics allowed them to net a tidy profit.

(As an aside, however, the devaluation of yuan in August prompted analysts to wonder whether this trade has reached its best-before date—something that would have implications for the future global demand for copper, if true. Meanwhile, there have been persistent rumors of regulators cracking down on such trades.) This practice of warehousing copper to help engage in financial arbitrage “inflated demand, kept prices higher, and led miners to raise output,” according to Bloomberg Intelligence Analysts Kenneth Hoffman and Sean Gilmartin, who sought to identify the extent to which demand for copper has been buoyed by its use as collateral for such trades. The decline in Chinese copper demand for household appliances and electronics since 2011 doesn’t jibe with the headline demand statistics, the analysts note, which show the country’s total copper demand increased of 45% from 2011 to 2015.

Moreover, when benchmarked against cement—another material widely used for construction purposes—copper’s rapid rise in China looks particularly suspicious. While cement intensity, or percentage used per square meter, rose 11% in the time period, copper intensity surged an astounding 117%. Putting all this together, Hoffman and Gilmartin conclude that “real Chinese demand may be 54% lower than anticipated” after stripping out the demand for copper tied to the carry trade. That amounts to nearly 7 million metric tonnes of copper procured for use as collateral in 2015 alone, according to the pair’s calculations—equal to the mass of more than 30,000 Statues of Liberty.

The banks will be stuck with the smelly bits. Lots of them.

• China’s Large Banks Wary on Beijing’s Plan for Bad Debt to Equity Swaps (BBG)

China’s proposal to deal with a potential bad-loan crisis by having banks convert their soured debt into equity is meeting with unexpected resistance from some of the biggest potential beneficiaries of the plan – the country’s large banks. Asked about the plan at the Boao Forum last week, China Construction Bank Chairman Wang Hongzhang said he needs to think of his shareholders and wouldn’t want to see a plan that simply converted “bad debt into bad equity.” China Citic Bank’s Vice President Sun Deshun said at a press conference last week that any compulsory conversion of debt into equity would have to be capped. And Bank of China Chairman Tian Guoli said in Boao that it’s “hard to evaluate” how effective debt-equity swaps will be, as so much has changed in China since the tool was used to bail out the banking system during a previous crisis in the late 1990s.

Behind the caution is a lack of clarity about how exactly the government will proceed with the conversion of up to 1.27 trillion yuan ($195 billion) of bad debt owed to the banks mostly by the country’s lumbering state-owned enterprises, and – crucially – about the level of support that will be available from the state. Bank of Communications, the first of China’s large banks to report 2015 earnings, said Tuesday it nearly doubled its bad-debt provisions in the fourth quarter of last year to 7.5 billion yuan. Without backing from the government, in the form of cash injections or easier capital rules for the banks, any debt-equity swaps would simply shift the bad-loan problem from the SOEs to the banks, with potentially disastrous consequences for the stability of the nation’s lenders. On the other hand it will be politically impossible to repeat the approach used in 1999 and again in 2004, when Chinese taxpayers effectively underwrote the bailouts, leaving the banks unscathed.

“You can’t kill three birds with one stone,” said Mu Hua at Guangfa Securities, referring to the need to balance the need to fix bank and SOE bad loans while protecting the interests of Chinese taxpayers. “Voluntary swaps won’t scale up unless the government offers enough incentive, such as lowering the risk weighting or setting up a platform for banks to dump the stakes.” The discussion of debt-equity swaps comes as China’s policymakers scramble for ways to cut corporate leverage that has climbed to a record high, and to clean up the mounting tally of bad loans on the banks’ books. Premier Li Keqiang said at the National People’s Congress earlier this month that the country may use the swaps to cut the leverage ratio of Chinese companies and to mitigate financial risks.

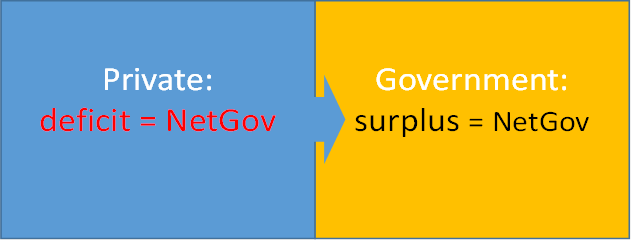

Growth comes from household debt.

• Eurozone ‘Flying On One Engine’: S&P (CNBC)

The euro zone economy is “flying on one engine,” according to the chief European economist at ratings agency Standard and Poor’s, which trimmed its growth and inflation forecasts for the euro zone. In his latest report on Wednesday, S&P’s Chief European Economist Jean-Michel Six likened the 19-country euro zone to a plane “flying on one engine” and “fighting for altitude” and said that while there are reasons to hope that the economy will pick up altitude, a “pre-crisis flight path” of robust growth is not likely. Since the start of the year, Six noted that global market turmoil had caused a “nosedive in financial conditions…(which) had taken some wind out of the euro zone economy” and although regional conditions had since improved – particularly due to what he called a “well-received” set of more accommodative measures from the ECB – the eurozone relied too much on domestic consumption for growth.

While the euro zone had seen its recovery “gathering momentum” over the last two years, Six warned that the “the current upswing in the euro zone has been a one-engine, consumer recovery.” To illustrate his point, Six noted that consumption represents 55% of the region’s GDP and has accounted for a “whopping” 72% of economic growth since 2014. That dependence on consumption entailed risks, he said, although the euro zone might well get away with it. “A recovery that mainly relies on one cylinder is by definition suspicious: It could quickly grind to a halt, as it did in the previous cycle in 2010-2011. Or, it could be a flash in the pan, caused simply by a one-off drop in household energy bills.”

ECB leaves nothing for others to invest in.

• Europe’s Bond Shortage Means Draghi Is About to Shock the Market (BBG)

As ECB Governor Mario Draghi prepares to increase and broaden his bond-buying program, the shrunken market might be in for a shock. While policy makers will expand their asset-purchase plan by €20 billion a month at the start of April, corporate debt won’t be included until later in the quarter. That’s leaving investors to face even higher demand for government bonds with supply unable to keep up and some of Europe’s biggest banks are predicting yields are headed for even more record lows. “All of that is going to be in covered bonds, in govvies, in agencies,” Vincent Chaigneau at Societe Generale in London said in an interview. “That’s going to create a shock on supply-demand in Europe.”

The prospect of increased largess from the ECB has pushed government bonds higher, with the yield on German 10-year bunds headed for their biggest quarterly slide in almost five years. They dropped to 0.15% on Tuesday, half where they were when the ECB announced an increase to its quantitative-easing program on March 10. French bank Societe Generale predicts the bund yield will slide not only to the record low of 0.049% posted in April 2015, but to negative 0.05% by the end of the next quarter. The ECB cut its main interest rates, announced the increase to QE and revealed a new targeted-loan program earlier this month as it ramped up efforts to boost inflation in the 19-member currency bloc. A report on Thursday will show consumer prices in the currency zone probably fell for a second month in March, according to economists surveyed by Bloomberg.

The rate hasn’t touched policy makers’ near-2% goal since 2013.The ECB has said it’s confident it has an “adequate” universe of assets to buy. But even when corporate debt purchases start, some investors are skeptical the ECB will be able to purchase sufficient quantities to alleviate pressure on government securities. Peter Schaffrik at Royal Bank of Canada in London said the consensus is that officials will be able to buy about €5 billion of company bonds, leaving an additional €15 billion of government and agency securities to be acquired each month.

The defaults are delayed not because of energy firms, but because of their lenders.

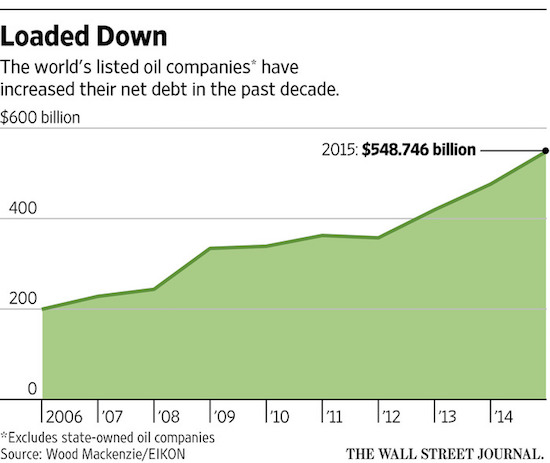

• Oil Explorers Face Challenge to Secure Financing as Oil Prices Fall (WSJ)

Just a few years ago, when oil sold for about $100 a barrel, banks [in London] were lining up to give international oil explorers access to billions of dollars to finance new drilling and projects. But as oil prices stay mired in a funk, the money is drying up. Senior executives from companies such as Tullow Oil and Cairn Energy have been meeting with their bankers for a biannual review of the loans that allow them to keep drilling and building out projects. For many European companies, it has been a nail-biting experience, as banks worry about the growing pile of debt taken on by oil companies with little or no profits. Several companies said they expect their ability to tap credit lines to be diminished after the reviews. Some lenders have brought in teams that specialize in corporate restructuring to scrutinize companies’ balance sheets, spending and assets, though not at Tullow or Cairn.

In the past, the reviews were generally conducted solely by banks’ energy specialists. The new scrutiny in Europe comes as oil-company debt emerges as an issue across the world with prices for crude near $40 a barrel—down more than 60% from June 2014. Globally, the net debt of publicly listed oil and gas companies has nearly tripled over the past decade to $549 billion in 2015, excluding state-owned oil companies, according to Wood Mackenzie, the energy consultancy. Reviews of these loans have high stakes. If a bank decides a company has already borrowed more than it can afford, the reviews could trigger a repayment, more cost cuts or even a fire sale of assets to raise cash. “There isn’t anyone in the oil independent sector that will be very relaxed at the moment,” said Thomas Bethel at Herbert Smith Freehills.

Oil companies are facing a similar set of biannual reviews in the U.S., where many small and midsize companies borrowed heavily to expand during the shale boom. The number of energy loans deemed in danger of default is on course to breach 50% at several major U.S. banks, The WSJ reported last week. But some American firms have been able to raise cash by issuing new stock or selling new debt, while in recent years Europe-based explorers have come to rely more on bank lending as investors that once pumped up the industry are fleeing in droves. In Europe, the focus is on a specialized type of borrowing known as reserves-based lending that has mushroomed in recent years. Europe’s top 10 non-state-owned oil companies have taken on over $12 billion in such loans, which are particularly exposed to energy prices as they are secured against the value of a company’s petroleum reserves and future production.

What happens when you plant Goldman’s MO in fertile ground.

• The Rise and Fall of Goldman’s Big Man in Malaysia (BBG)

The prime minister of Malaysia had a message for the crowd at the Grand Hyatt San Francisco in September 2013. “We cannot have an egalitarian society – it’s impossible to have an egalitarian society,” Najib Razak said. “But certainly we can achieve a more equitable society.” Tim Leissner, one of Goldman Sachs’s star bankers, enjoyed the festivities that night with model Kimora Lee Simmons, who’s now his wife. In snapshots she posted to Twitter, she’s sitting next to Najib’s wife, and then standing between him and Leissner. Everyone smiled. The good times didn’t last. At least $681 million landed in the prime minister’s personal bank accounts that year, money his government has said was a gift from the Saudi royal family. The windfall triggered turmoil for him, investigations into the state fund he oversees and trouble for Goldman Sachs, which helped it raise $6.5 billion.

Leissner, the firm’s Southeast Asia chairman, left last month after questions about the fund, his work on an Indonesian mining deal and an allegedly inaccurate reference letter. Few corporations have mastered the mix of money and power like New York-based Goldman Sachs, whose alumni have become U.S. lawmakers, Treasury secretaries and central bankers. Leissner’s rise and fall shows how lucrative and fraught it can be when the bank exports that recipe worldwide. In 2002, when the firm made him head of investment banking in Singapore, it had just cleaned up a mess there after offending powerful families. It took only a few years before the networking maestro was helping the bank soar in Southeast Asia – culminating in billion-dollar deals with state fund 1Malaysia Development Bhd., also known as 1MDB. But if his links to the rich and powerful fueled his Goldman career, they also helped end it.

How to kill an entire education system in a few easy steps.

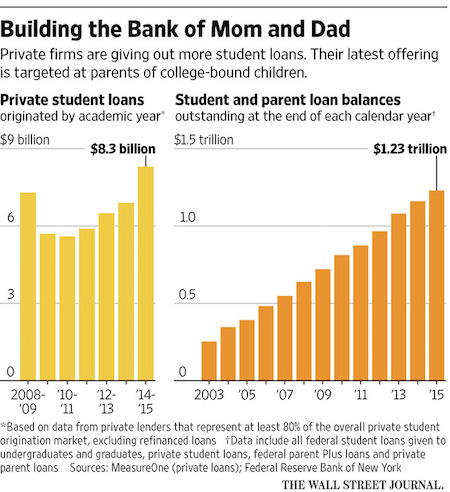

• New Student Loans Targeted Straight at Mom and Dad (WSJ)

As rising tuition costs pile ever-higher debts on students, lenders and colleges are pushing for an alternative: Heap more on their parents. An increasing number of private student lenders are rolling out parent loans, which allow borrowers to get funds to pay for their children’s education without putting the students on the hook. The loans mimic a similar federal program but don’t charge the hefty upfront fee levied by the government, which could make them cheaper and encourage more use. SLM Corp., the largest U.S. private student lender by loan originations and better known as Sallie Mae, will introduce its version of the loan next month. Parents will be able to borrow at interest rates ranging from about 3.75% to 13%, with 10 years to pay it off.

“There’s an opportunity to expand our reach,” said Charles Rocha, chief marketing officer at Sallie Mae. The lender joins banks like Citizens Financial Group, which started offering a similar loan last year. Online lender Social Finance, or SoFi, first rolled one out in 2014 at the request of Stanford University. Stanford spokesman Brad Hayward said the university initiated discussions about the loan to help parents who were looking for more financing options. Colleges including Stanford, Boston College and Carnegie Mellon University are referring parents to the loans through emails or by putting them on lists of preferred loan options. An official at Boston College also said the school approached lenders to create the loans.

Lenders see the new products as an area of growth in an otherwise sluggish lending environment. Colleges are helping push them in part because of a quirk in federal calculations. Unlike ordinary federal student loans, the parent loans don’t count on a scorecard in which the U.S. Education Department discloses universities’ median student debt at graduation. That can ease the pressure to keep tuition increases in check at a time when heavy student debt has become a political issue.

“..basic income could remove the need for a welfare state that is patronising and humiliating..”

• Free Lunch: Basic Welfare Policy (Sandhu)

There are ideas that refuse to die no matter how many times they are rejected. One such idea is Universal Basic Income. Basic income is the proposal to pay all citizens an unconditional regular amount sufficient for basic needs, and then leave them to seek their fortune as best they can in the market. Few trials have been held and those have not led to large-scale adoption, but the proposal keeps recurring in social policy debates. That is largely because it is an excellent idea. In the past century the attraction for thinkers on the left and the right has been that basic income could remove the need for a welfare state that is patronising and humiliating, creates perverse incentives against working, and whose complexity means it often fails to reach those truly in need of help while subsidising the middle class.

Today, with deepening anxiety that we will all be put out of work (or, alternatively, be enslaved) by robots, the appeal of basic income has returned to its roots. More than 200 years ago, Thomas Paine advocated it as a way to fairly distribute the “ground rent” generated by concentrated landholdings to the landless — the idea being that the earth was humanity’s common property. If technological change today means markets tilt the distribution of income towards capital owners and away from workers, a similar argument can be made for the redistribution of “rent” due to humanity’s technological ingenuity equally among every citizen.

“The reason to want to make problems worse is that problems are profitable..”

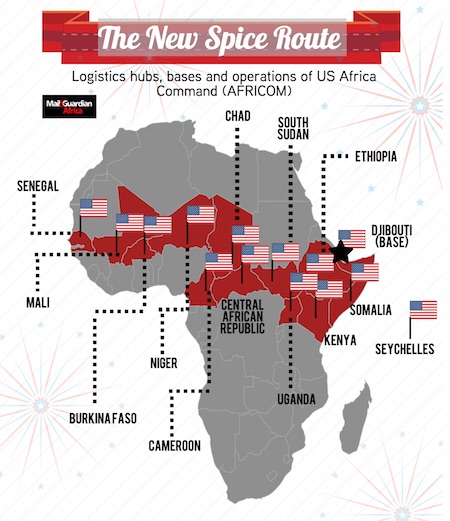

• Always Attack the Wrong Country (Dmitry Orlov)

There are numerous tactics available to those who aim to make problems worse while pretending to solve them, but misdirection is always a favorite. The reason to want to make problems worse is that problems are profitable—for someone. And the reason to pretend to be solving them is that causing problems, then making them worse, makes those who profit from them look bad. In the international arena, this type of misdirection tends to take on a farcical aspect. The ones profiting from the world’s problems are the members of the US foreign policy and military establishments, the defense contractors and the politicians around the world, and especially in the EU, who have been bought off by them. Their tactic of misdirection is conditioned by a certain quirk of the American public, which is that it doesn’t concern itself too much with the rest of the world.

The average member of the American public has no idea where various countries are, can’t tell Sweden from Switzerland, thinks that Iran is full of Arabs and can’t distinguish any of the countries that end in -stan. And so a handy trick has evolved, which amounts to the following dictum: “Always attack the wrong country.” Need some examples? After 9/11, which, according to the official story (which is probably nonsense) was carried out by “suicide bombers” (some of them, amusingly, still alive today) who were mostly from Saudi Arabia, the US chose to retaliate by attacking

Saudi ArabiaAfghanistan and Iraq. When Arab Spring erupted (because a heat wave in Russia drove up wheat prices) the obvious place to concentrate efforts, to avoid a seriously bad outcome for the region, was Egypt—the most populous Arab country and an anchor for the entire region. And so the US and NATO decided to attackEgyptLibya.When things went south in the Ukraine, whose vacillating government couldn’t make up its mind whether it wanted to remain within the Customs Union with Russia, its traditional trading partner, or to gamble on signing an agreement with the EU based on vague (and since then broken) promises of economic cooperation, the obvious place to go and try to fix things was the Ukraine. And so the US and the EU decided fix

the UkraineRussia, even though Russia is not particularly broken. Russia was not amused; nor is it a country to be trifled with, and so in response the Russians inflicted some serious pain on theWashington establishmentfarmers within the EU.Who was at fault exceedingly [became] clear once the Ukrainians that managed to get into power (including some very nasty neo-Nazis) started to violate the rights of Ukraine’s Russian-speaking majority, including staging some massacres, in turn causing a large chunk of it to hold referendums and vote to secede. (Perhaps you didn’t know this, but the majority of the people in the Ukraine are Russian-speakers, and there is just one city of any size—Lvov—that is mostly Ukrainian-speaking. Mind you, I find Ukrainian to be very cute and it makes me smile whenever I hear it. I don’t bother speaking it, though, because any Ukrainian with an IQ above bathwater temperature understands Russian.) And so the US and the EU decided to fix things by continuing to put pressure on

the UkraineRussia.

The exact opposite of what they -pretend to- want.

• European Border Crackdown Kickstarts Migrant-Smuggling Business (WSJ)

ATHENS—The leaders of 15 human-smuggling networks gathered behind the closed curtains of an Afghan restaurant here in late February, the air fragrant from grilled lamb and hookahs. It was time to celebrate a boost to their business, people present recall. Police in Macedonia had just stopped letting Afghans cross the border from Greece. Today, the entire human highway to Europe’s north, traveled by nearly a million refugees and other migrants last year, has been closed. The crackdown, complete with razor-wire fences guarded by riot police, has stranded about 50,000 migrants in Greece. Many are desperate to get out but too afraid to turn back. For those with cash left, smugglers are now the best hope.

The combination of closed borders and unrestrained migration has turned Athens’s Victoria Square and the nearby port city of Piraeus into the center of a barely disguised human-trafficking business. In grimy cafes, cheap hotels and dark alleys, business is booming for smugglers who arrange transit around closed borders and into relative safety. They say they even offer a money-back guarantee—most of the time. “If you stay here even for five minutes, you will see it. A human bazaar is taking place,” said Orestis Papadopoulos, owner of a kiosk on Victoria Square that sells cigarettes and magazines. “And when the police clear the square, they just go around the corner and come back minutes later.” One recent afternoon, Ali, who wouldn’t provide his last name, walked into the restaurant that hosted the February celebration. He said he is 33 years old, was born in Afghanistan and lives in Athens. He specializes in smuggling Afghans and Iraqis.

Followed by three associates, Ali grinned broadly, exposing a missing tooth. Then he hugged other men in the restaurant, including a passport forger. Thirty Afghan clients had just reached Germany, meaning Ali’s smuggling syndicate would get about €54,000 ($60,280). “I’m very happy today,” he said. Ali’s smartphone rang as he ate lamb with rice. A prospective customer wanted to reach Germany by plane, using a false passport. “It costs €4,700,” Ali said. He left the noisy restaurant to haggle. When Europe’s refugee crisis exploded last year, demand for smugglers fizzled once migrants had successfully crossed the Aegean Sea from Turkey. German Chancellor Angela Merkel ’s open-door policy for refugees largely made Ali and his rivals obsolete.

Since then, the Balkans and the EUhave clamped down on migration from Greece into the rest of the continent, threatening to turn the country into a giant, open-air refugee camp. The problem will likely be exacerbated by last week’s terrorist attacks in Brussels, which immediately led to toughened security at airports, train stations and borders. Europe is now even less likely to reopen its borders to legal transit for refugees and migrants. For smugglers, the job could get harder, but they can always push the prices they charge higher.

“If Europe were to welcome the same percentage of refugees as Lebanon in comparison to its population, it would have to take in 100 million refugees.”

• UN Chief Urges All Countries To Resettle Syrian Refugees (Reuters)

U.N. Secretary-General Ban Ki-moon called on all countries on Wednesday to show solidarity and accept nearly half a million Syrian refugees for resettlement over the next three years. Ban, kicking off a ministerial conference hosted by the U.N. refugee agency UNHCR in Geneva, said: “This demands an exponential increase in global solidarity.” The United Nations is aiming to re-settle some 480,000 refugees, about 10% of those now in neighboring countries, by the end of 2018, but has conceded it needs to overcome widespread fear and political manipulation. Ban urged countries to pledge new and additional pathways for admitting Syrian refugees, adding: “These pathways can include resettlement or humanitarian admission, family reunions, as well as labor or study opportunities.”

Filippo Grandi, U.N. High Commissioner for Refugees, said the refugees were facing increasing obstacles to find safety. “We must find a way to manage this crisis in a more humane, equitable and organized manner. It is only possible if the international community is united and in agreement on how to move forward,” Grandi said. The five-year conflict has killed at least 250,000 and driven nearly 5 million refugees abroad, mostly to neighboring Turkey, Lebanon, Jordan and Iraq. Grandi said: “If Europe were to welcome the same percentage of refugees as Lebanon in comparison to its population, it would have to take in 100 million refugees.” Ban, referring to U.N.-led efforts to end the war, said: “We have a cessation of hostilities, by and large holding for over a month, but the parties must consolidate and expand it into a ceasefire, and ultimately to a political solution through dialogue.”