Jean-Michel Basquiat In this case 1983

Andrew Korybko:

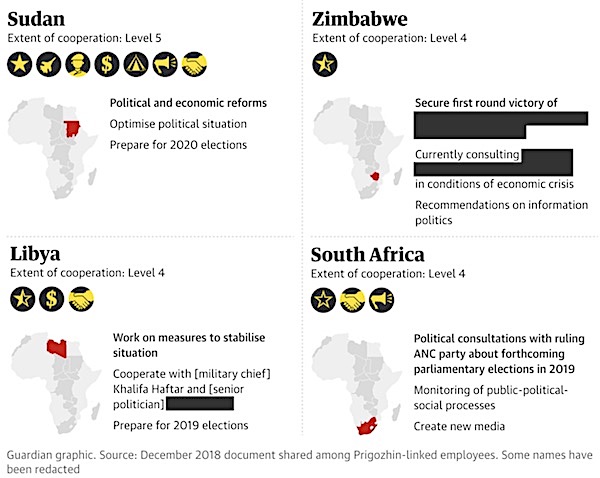

Politico published a very detailed piece on Sunday about how “To counter Russia in Africa, Biden deploys a favored strategy”, which cites four unnamed US officials with knowledge of their country’s plan for waging Hybrid War against Wagner in Africa. Just like the French one that was reported by Axios last October, which was analyzed at the time here, the US’ also focuses a lot on information warfare. Taken together, they prove that the West intends to turn Africa into a major battleground in the New Cold War.

According to Politico’s sources, “The aim (of the latest effort) is to highlight for African officials how working with Wagner is likely to sow chaos in the long term despite its promises to bring peace and security to countries facing political turmoil and violence…it underscores the degree to which the Biden administration believes Wagner — and the Kremlin — pose a long term threat to U.S. interests on the continent.”

In other words, it builds upon the French’s fearmongering about Wagner’s “Democratic Security” services (counter-Hybrid War tactics and strategies that were earlier elaborated upon here), but openly acknowledges that these narratives are being spread in pursuit of the US’ own interests. This candid admission inadvertently discredits one official’s claim that “they create more terrorists than they actually eliminate”, which the Central African Republic (CAR) and Mali know for a fact isn’t true.

The only terrorists “created” in those countries after their cooperation with Wagner are the ones clandestinely armed by America and France on the pretext of them supposedly being ‘freedom fighters’, but who in reality function as the West’s anti-Russian proxies there. Once again, the CAR authorities know this for a fact, which makes one wonder why the US would waste its time spewing this information warfare narrative to them like Politico reported that they’ve already attempted to do.

This curious question is answered when it’s later revealed in the article that “The idea is that if Wagner is seen as disrupting the flow of trade and investment, it could drive a wedge between Beijing, a long-time investor in Africa, and Moscow — an alliance that has only strengthened in recent months and continues to concern Washington.” Of relevance, the West ridiculously claimed in late March that Wagner allegedly slaughtered Chinese miners in the CAR, which was analyzed here right after it started circulating.

This adds crucial context to the US’ Hybrid War on Wagner in Africa since it shows that disinformation is being relied upon in a desperate attempt to divide the Sino-Russo Entente. That’s a wishful thinking fantasy if there ever was one since these two’s efforts on the continent complement one another: China’s game-changing Belt & Road Initiative investments can actually be protected from Western-connected Hybrid War threats via Russia’s “Democratic Security” services provided by Wagner.

The other countries that have been on the receiving end of this propaganda campaign are Burkina Faso, Chad, the Democratic Republic of the Congo (DRC), and Rwanda, each of which is unlikely to bite the West’s bait. Regarding the first, its interim leader declared last week that his country is in a “strategic alliance” with Russia, while the second expelled the German Ambassador for meddling instead of the Russian one early last month after the US falsely claimed that Wagner was plotting a coup there.

As for the DRC and Rwanda, those two are presently engaged in their own Hybrid War with one another over the former’s resource-rich eastern region whose rebels are allegedly backed by the latter, with the case compellingly being made here that France is exploiting their conflict for divide-and-rule purposes. Furthermore, Russian-Congolese ties have only strengthened in recent months despite the US’ reported sharing of anti-Wagner disinformation, while Russia and Rwanda defended the CAR’s capital in late 2020.

Although Politico didn’t report that related falsehoods were shared with Sudan, they nevertheless devoted part of their article to discussing Wagner’s alleged activities there, which aims to advance America’s latest fake news campaign attempting to pin the blame for its ongoing conflict on Russia. The motivations behind them doing so were recently explained here, which touched on the intent to have Sudan cut Russia/Wagner off from the CAR together with assembling a regional coalition against it.

The abovementioned assessment of the US’ motivations was just confirmed in Politico’s piece after they admitted that “American officials have shared intelligence specifically related to Wagner’s business operations in the [CAR] and shared it not only with local officials but also officials from neighboring countries with an interest in removing Wagner from the region.” Considering the military context and prior disinformation provocation, it’s likely that Chad is the primary target of this influence operation.

Its envisaged role as the vanguard of the West’s Hybrid War on Wagner in Africa was analyzed in the hyperlink that was shared a few paragraphs above regarding that country’s expulsion of the German Ambassador instead of the Russian one after the US falsely claimed that Wagner was plotting a coup there. Intrepid readers should review it if they’re interested since repeating the pertinent points in this piece would be redundant, but it’s enough for casual readers to simply know that this is the US’ goal.

All told, while America is ramping up its operations to counter Wagner’s growing popularity across Africa, it lacks the credibility to advance its goal through information warfare alone as proven by its cited failures in Burkina Faso, the CAR, Chad, the DRC, Rwanda, and Sudan. This observation strongly suggests that it’ll therefore increasingly resort to kinetic measures like arming terrorist groups under the pretext of them supposedly being ‘freedom fighters’, which could even result in a false flag attack against Chad.

This regional power is the primary target of the US’ efforts since it urgently requires someone on the continent to serve as the vanguard of its campaign. Chad’s expulsion of the German Ambassador instead of the Russian one after the US claimed that Wagner was plotting a coup there, however, shows that N’Djamena doesn’t believe a word that Washington says about Russia. In a desperate last-ditch attempt to trick Chad into playing this proxy role, it might thus launch a false flag attack against it from the CAR.

That wouldn’t be too difficult to do either since large parts of this country still remain outside the control of the Russian-backed authorities, with those lawless regions being the realm of jointly supported American-French terrorists who masquerade as rebels. Having already preconditioned the public to expect a supposedly Wagner-driven coup against Chad from the CAR via the false report that the US previously shared and just reminded everyone of in Politico’s piece, this scenario cannot be discounted.

To be clear, this doesn’t mean that it will definitely happen, nor that Chad would fall for this provocation. Even so, there’s still a chance that this sequence of events unfolds, in which case this regional military power would be manipulated into serving as the US’ vanguard in its Hybrid War on Wagner in Africa. This could take the form of Chad intervening in CAR and/or against the allegedly Wagner-aligned Rapid Security Forces in Sudan’s “deep state” war, both possibilities of which would be very destabilizing.

Observers should therefore closely monitor this latest front of the New Cold War for any signs that events are moving in this direction, while Russian and Chadian military-security officials should immediately enter into close contact in order to preemptively avert the US’ divide-and-rule plot against them. It would be mutually detrimental if America’s potential provocation succeeds, which could plunge this part of Africa into a protracted conflict that risks reversing its multipolar progress of the past year.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.