Piet Mondriaan Place de la Concorde 1938-43

Jim Rickards @JamesGRickards: Russia just raised its growth forecast from -8% to -4%, cut interest rates from 9.5% to 8%, and raised its current account surplus forecast from $145 billion to $243 billion. Exports expected to reach a record $593 billion. How are those sanctions working out, Joe?

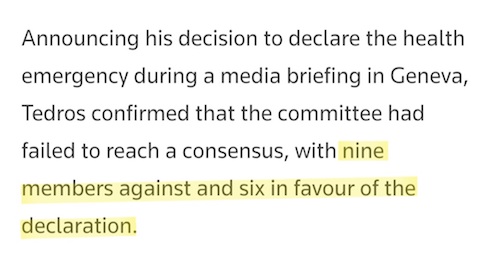

Tedros overruled his own experts. 98% of monkeypox infections are gay men. 5 people have died with/from it. How is that a global health emergency? Well, it could become one…

Bannon Alex Jones

https://twitter.com/i/status/1550863875473539074

Oligarchy or Patriarchy. Take your pick.

• Rule by the Few or Rule for the Many? (Batiushka)

Today the Ukraine is the battlefield where these two systems, Oligarchy and Patriarchy, are competing. The future of the whole world is being decided there. The Oligarchy has become embroiled ever more in its proxy war there because it intends to destroy Russia so that it can then destroy China. However, in order to do this, the USA must first finish off Russian-supplied Europe. The European elite has followed the Oligarchy’s dictates because its leaders are all only other ‘zelenskies’, whose strings are also pulled by the Oligarchy’s same puppeteers.

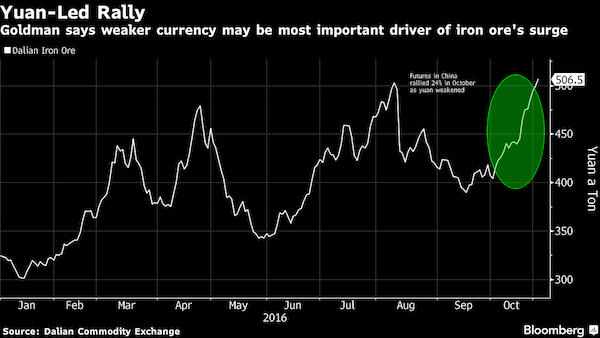

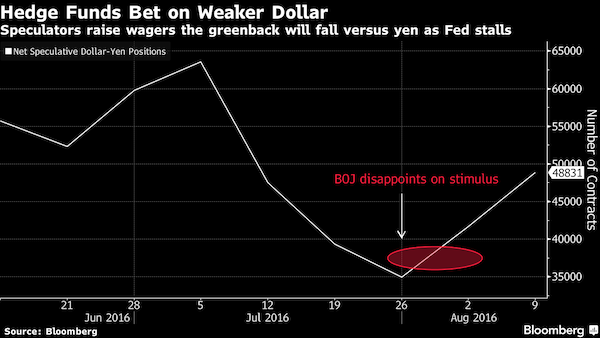

This is why the dollar has recently been rising against the pound sterling and the euro (and also the yen). However, seeing this, other countries are seeking alternatives and the USA is threatened with dedollarisation. There is no end game in the Ukraine for the Oligarchy. Meddling in Russia and Europe has meant heading towards economic meltdown. The Oligarchy is now pulling down an iron curtain on the Western world, not to protect it from some imagined foreign military attack, but to imprison the peoples of the USA, UK, EU, Japan, South Korea, Taiwan, Australia and New Zealand. As those peoples cotton on, this will end badly for the Oligarchy.

“Putin said that back in March, Moscow and Kiev had “actually reached an agreement, the only thing left to do was to sign it.”

• Zelensky Refuses Peace Talks (RT)

Ukrainian President Vladimir Zelensky, explaining the reasons behind his country’s refusal to negotiate with Moscow, compared Russia to an insatiable “cachalot” who would not understand the language of diplomacy. In a Friday interview with the Wall Street Journal, Zelensky responded to the recent remarks of his Russian counterpart, Vladimir Putin, who said earlier this week that Russia and Ukraine could have ended their conflict in March if Kiev had not withdrawn from negotiations. Calling this statement “total delirium,” the Ukrainian leader said that, prior to Moscow’s offensive, he had been trying to talk to Putin for a long time but he couldn’t be bothered to take a phone call.

“He came here without talking, killed people, displaced 12 million, and now says Ukraine doesn’t want to negotiate. They just murder people, destroy cities, enter them, and then say: ‘Let’s negotiate’. With whom can they talk? With rocks? They are covered in blood, and this blood is impossible to wash off. We will not let them wash it off,” Zelensky said. Now, five months into the military conflict, Ukrainians believe that all of the country’s territories must be “liberated” before any negotiations can resume, according to him. Zelensky stressed that he would prefer to conduct ‘de-occupation’ in a non-military manner but, in his opinion, Russia would not understand anything until it got “smashed in the face.”

Moreover, he believes there is another reason conducting talks no longer makes sense. Russia will never stop seizing Ukrainian territories, he claimed. “It is a cachalot that has swallowed two regions and now says: Freeze the conflict. Then it will rest and, in two or three years, it will seize two more regions and say again: Freeze the conflict. And it will keep going further and further. One hundred percent,” the Ukrainian leader said. Meanwhile, Putin said that back in March, Moscow and Kiev had “actually reached an agreement, the only thing left to do was to sign it.” “In order to create these conditions, our troops withdrew from central Ukraine, from Kiev, but the Kiev authorities refused to implement these agreements” and have no desire to do so even now, the Russian president added.

If Russia wanted Zelensky dead, he would be.

• US Concerned About Zelensky’s Safety (RT)

US National Security Advisor Jake Sullivan said on Friday that Washington is worried about the personal safety of Ukrainian President Vladimir Zelensky. The US is assisting Zelensky with his security, Sullivan added. “President Zelensky’s personal safety is something that concerns us,” Sullivan told the Aspen Security Forum in Colorado. “This is a leader in wartime, dealing with an enemy in Russia that is ruthless, brutal and capable of just about anything.” “President Zelensky takes the precautions you would expect to protect himself,” Sullivan continued, adding that the US is helping to “facilitate” the Ukrainian leader’s security, without elaborating. The US offered to evacuate Zelensky from Kiev when Russia launched its military operation in Ukraine in February. Zelensky did not take up the offer.

This week, Ukraine’s parliament approved the firing of Ivan Bakanov, the top official at the state security service (the SBU). Zelensky also removed the heads of SBU departments in five of the country’s regions. Bakanov was a close associate of Zelensky, and the pair had worked together since the latter’s days in comedy. Ukraine’s president has claimed on several occasions that assassins have threatened his life, and his officials said numerous times that Russia intends to have the president killed. Moscow denies these allegations, with Kremlin spokesman Dmitry Peskov stating in April that Zelensky “is the president of Ukraine,” and Russia wants him to sit down and agree to its terms for peace. Asked whether he worries about declining public support for Ukraine at home, Sullivan said that he worries “about literally everything,”except the arms pipeline to Kiev.

The $40 billion military and economic aid bill signed by US President Joe Biden in May allocates “enough resources to keep weapons flowing for some time,” Sullivan stated, adding that even though public support for Ukraine may be dipping, there is a “reservoir” of “deep and sustainable support” in the White House and Congress. Should the tens of billions of dollars run out, Sullivan said that “there will be bipartisan support in the Congress to re-up those resources should it become necessary.” As Sullivan spoke in Aspen, National Security Council spokesman John Kirby announced that the Biden administration would send a fresh tranche of weapons worth $270 million to Ukraine, including four HIMARS rocket artillery systems. The US has given Ukraine a dozen of these truck-mounted weapons platforms already, although Russia claims to have destroyed four during the last three weeks.

Zelensky Is About To Be Assassinated By The Americans

“Russia had nothing to do with the targeting of a grain facility in the port city of Odesa..”

• Mysterious Missiles Strike Grain Facility at Odessa Port (CTH)

Let me say from the outset, with a degree of specific assurance we generally reserve for other matters, Russia had nothing to do with the targeting of a grain facility in the port city of Odesa. Geopolitically and strategically, such an action would be against their interests. These events have the smell of the U.S. State Dept and CIA all over them. Start by first reviewing the agreement between Russia and Ukraine that was announced yesterday. July 22 (Reuters) – Russia and Ukraine signed a landmark deal on Friday to reopen Ukrainian Black Sea ports for grain exports, raising hopes that an international food crisis … can be eased.” NATO country Turkey, specifically Recep Erdogan, brokered the deal between Russia and Ukraine. Ignore the narrative engineering and WATCH:

Russia was particularly a geopolitical beneficiary from the agreement itself. No longer could NATO and the western alliance blame Russia for the void in gobal food markets associated with the conflict in Ukraine. From the perspective of Russian President Putin, the grain movement through the port city of Odesa was a net benefit. “Russia has taken on the obligations that are clearly spelled out in this document. We will not take advantage of the fact that the ports will be cleared and opened. We have made this commitment,” said Russian Defense Minister Sergei Shoigu. However, from the perspective of the Western alliance, the agreement mooted one of their biggest justifications for the upcoming global food shortage. If Ukraine and Russia are exporting food, and yet food costs are still rising…. well, the food shortage impact from western energy disruption, the Build Back Better agenda, starts to become increasingly visible.

Suddenly, within hours of the trade agreement, the grain transportation system and the port city of Odesa come under fire from mysterious cruise missiles. “Europe – Missiles struck a key Ukrainian port Saturday, just one day after Kyiv and Moscow signed a breakthrough deal to unblock shipments of grain. Pointing the finger at Russia, Ukraine’s air force chief said the port — a key site for exporting Ukrainian grain — had been deliberately targeted. “The port of Odesa, where grain is processed for shipment, was shelled. We shot down two missiles, and two more missiles hit the port territory, where, obviously, there is grain,” Ukrainian air force spokesman Yuri Ignat told reporters. Russia has denied any involvement in the strikes, says Turkey’s defence minister.”

The origin of the mysterious missile attack becomes clear when you overlay the question of ‘who has motive’? It wasn’t Russia. We can be almost certain it was the U.S. State Department, and covert CIA operators, who used their operational control within Ukraine to target the exports. Stopping the export of Ukrainian grain is in the interests of the western alliance. After all, it was the United States who previously claimed, “Vladimir Putin is weaponizing food.”… pparently, Russian President Vladimir Putin has the ability to drive up U.S. inflation, explode U.S. energy costs, increase gasoline prices, influence global agriculture, weaken U.S. oil refining capability, disrupt availability of diesel fuel, impede the transportation of U.S. goods, force municipal energy companies to raise prices, cancel airline flights, stop the manufacturing of infant formula and now block the production -and increase the cost- of food in North America.

That’s their collective story, and they’re sticking to it.

“..if Russia were to aggressively deploy its best-in-class air defense systems into the battle zone, two squadrons of actively flying F-16s would be destroyed in less than a month – if not sooner..”

• Flying Coffins (Will Schryver)

[..] we are now hearing apparently serious talk of sending some of our otherwise destined-for-retirement F-16s and A-10s to Ukraine – ostensibly to become the latest “game-changer” able to “turn the tide” against a seemingly inexorable Russian victory. Indeed, since the news first broke earlier this week, in the form of comments by Secretary of the Air Force Frank Kendall at the Aspen Security Forum, thousands of “Slava Ukraini!”-chanting supporters of Ukraine have erupted with shouts of “Hallelujah!” on Twitter and elsewhere – convinced that THIS is – finally! – the wunderwaffe they’ve been waiting for. So … let me be perfectly clear: The notion that the US (and/or its NATO allies) can ship F-16s and A-10s to Ukraine in order to save the Ukrainians from an otherwise absolutely certain defeat is an unqualified delusion; a ridiculous fantasy of the highest order.

To be even more precise, it’s batshit crazy silly talk. Indeed, the only possible interpretation of Kendall’s broaching of the subject at this juncture is that there is now a profound recognition, at the highest levels of the Pentagon, that the inevitable outcome of this war is set in stone. But, because political considerations preclude them being able to acknowledge this reality, they must somehow stall for time, during which they can better prepare the American people to receive the bad news that the Mother of All Proxy Armies – which the US spent eight long years and countless billions building – has been comprehensively wrecked in a matter of months by the supposedly inept armed forces of the Russian Federation.

As expected and predicted by a great many intelligent and insightful military analysts, the 120+ M-777 tow-behind howitzers (of which 80+ have now been destroyed) and a dozen M-142 HIMARS multiple-launch rocket systems (of which at least 4 have already been “eliminated” from the battlefield) have produced negligible results. Each, in its turn, generated a hopeful sense of euphoria among those rooting for the team in blue and yellow. Each produced a few early successes which were celebrated far beyond their actual military significance by western commentators. And, once Russian countermeasures were formulated and executed, each has proven to be nothing more than what sober military analysts always knew them to be: run-of-the-mill artillery systems which are at best equivalent to their Russian counterparts, and arguably inferior in several key respects.

As far as providing F-16s and A-10s to Ukraine is concerned, I am strongly persuaded that it is nothing but empty propaganda. I don’t believe there is any serious actionable intent behind the words. But even if there is, there are several realities that render the entire proposition futile: – Ukrainian pilots are not trained on these platforms, and they cannot possibly be adequately trained in any less than at least a year. It is utterly ludicrous to believe otherwise. – Even if US/NATO pilots and ground crew were provided to field, say, two squadrons of F-16s and another two squadrons of A-10s, they would prove to be, against Russian air defenses and fighter aircraft, the obsolescent air frames they are already known to be. The A-10s, in particular, would not survive more than a handful of sorties – at most – in Ukrainian airspace. And, if Russia were to aggressively deploy its best-in-class air defense systems into the battle zone, two squadrons of actively flying F-16s would be destroyed in less than a month – if not sooner. In short, it would be an absolute slaughter.

Sitting ducks.

• Russia Claims It Destroyed HIMARS (RT)

Four of the US-supplied HIMARS rocket artillery launchers and one of their support vehicles have been destroyed over the past three weeks of fighting in Ukraine, the Russian Ministry of Defense said on Friday. The US sent 12 launchers earlier this month, and said on Friday it would provide Kiev with four more. “High-precision strikes with land- and air-based missiles destroyed four HIMARS multiple rocket launch systems and one ammunition and reloading vehicle between July 5 and July 20,”General Igor Konashenkov said in a daily briefing. Two of the launchers were destroyed near the settlement of Malotaranovka, south of Kramatorsk. Another, alongside the support vehicle, was destroyed near Krasnoarmeysk – known in Ukraine as Pokrovsk.

The final one was destroyed on the eastern outskirts of Konstantinovka, the Defense Ministry specified. All three locations are on territory claimed by the Donetsk People’s Republic but under the control of Ukrainian troops. The US provided Kiev with eight High Mobility Artillery Rocket Systems (HIMARS) last month, to replace rocket artillery lost in the conflict with Russia. The Malotaranovka strike was widely publicized on July 5, but the subsequent two strikes had not been previously mentioned. Earlier on Friday, the White House confirmed that four additional HIMARS launchers, 580 suicide drones and thousands of rounds of artillery ammunition would be sent to Ukraine as part of the $270 million “security assistance”package.

One US official, who spoke to Reuters on the condition of anonymity, insisted that no HIMARS launchers sent to Ukraine had been destroyed. Meanwhile, the government in Kiev has accused Moscow of spreading “misinformation” calculated to dissuade the West from sending Ukraine more weapons. “Russia is trying to stop the supply of weapons from the West and intimidate Ukraine’s allies with the fictional power of Russia’s armed forces,” Sergey Leshchenko, an aide to President Vladimir Zelensky’s chief of staff, Andrei Yermak, told reporters.

Washington has sent Kiev a total of 16 wheeled HIMARS launchers, with London providing another three or so tracked rocket artillery vehicles capable of launching the same munitions. The HIMARS came with medium-range, satellite-guided GLMRS projectiles, which Ukraine claims to have used to great effect against ammunition storage facilities and infrastructure objects. According to the Russian Defense Ministry, Ukraine has lost over 760 multiple launch rocket systems (MLRS) and more than 3,100 artillery pieces since the beginning of hostilities in February.

“This NAM 2.0 drive – of which China is a key player – stands in stark opposition to how the Empire of Chaos – and Lies – wove its toxic net..”

• For Those About To Rock, NAM 2.0 Salutes You (Escobar)

Those were the days, in 1955, at the legendary Bandung conference in Indonesia, when the newly emancipated Global South started dreaming of building a new world, via what became configured later in 1961 in Belgrade as the Non-Aligned Movement (NAM). The Empire of Chaos – and Lies – would never allow a starring role for NAM. So it played dirty: everything from hardcore subversion and bribing to military coups and proto-color revolutions. Yet now, the Spirit of Bandung lives again, via a sort of NAM 2.0 on steroids: a Newly Aligned Movement, with the leaders of Eurasian integration at the vanguard. We just had a taste of which way the geopolitical wind is blowing at the gathering of a new power troika in Tehran. Unlike Stalin, Roosevelt and Churchill in 1943, Putin, Raisi and Erdogan did not meet to carve up the world.

They met essentially to discuss how another world is possible – through bilaterals, trilaterals, multilaterals and an enhanced role for an array of relatively new geopolitical and geoeconomic institutions. Russia – and China – have been on the forefront of all recent key decisions. Their diplomacy has brought Iran to join the SCO as a full member. Their pull is attracting key Global South players to join BRICS+. Russia has all but convinced Turkey to join BRICS+, the SCO and the EAEU, and facilitated the re-approximation of Tehran and Ankara as well as Tehran and Riyadh. Russia has largely influenced the remake/remodel process across West Asia. This NAM 2.0 drive – of which China is a key player – stands in stark opposition to how the Empire of Chaos – and Lies – wove its toxic net, via the war on terror, since the start of the millennium.

The Empire tried to subdue what it described as MENA (Middle East-Northern Africa) on the basis of two invasions/occupations (Afghanistan-Iraq); a total devastation (Libya); and a protracted proxy war (Syria). All eventually failed. And that brings us to the stunning contrast between these two foreign policy approaches, graphically illustrated by the spectacular failure of the teleprompter-reading “leader of the free world” in his visit to Jeddah – he was not even allowed to go to Riyadh – compared to Putin’s performance in Tehran. Not only we are witnessing the lineaments of a Russia/Iran/Turkey informal alliance; we are witnessing the alliance reading a soft riot act to the Empire: leave Syria, before you suffer yet another humiliation. And with a Kurd-directed corollary: keep away from the Americans and recognize the authority of Damascus before it’s too late.

Ankara could never admit it in public, but the fact is Sultan Erdogan – as much against US troops in Syria as Putin and Raisi – even seems to have swiftly calibrated his previous designs on Syrian sovereign territory. The much-debated Turkish military operation in northern Syria in the end may be restricted to taming the YPG Kurds. The heart of the action will in fact revolve around how the Russia/Iran/Turkey/Syria alliance will make like impossible for Americans stealing Syrian oil.

Not many freedoms left there.

• Ukraine To Make Seeking Russian Passport A Crime (RT)

Trying to obtain Russian citizenship as a Ukrainian could soon become a criminal offense, the country’s Deputy Prime Minister and Minister for Reintegration of the Temporarily Occupied Territories Irina Vereschuk warned on Friday. In a Telegram post, Vereschuk said that the matter had previously been discussed during a closed interdepartmental meeting. “Work on the draft law continues, there will be discussions, but the direction has been determined,” the deputy prime minister said. She admitted that there could be “a long and difficult discussion” about the legal aspects of obtaining a Russian passport, about human rights, and “the need to survive under occupation.”

“But let’s not forget: There is a lot of Ukrainian blood on the red Russian passport – military and civilian, women’s and children’s,” Vereschuk said. Two days ago, she wrote on Facebook that passports and referendums were being used by Moscow as “weapons, more dangerous than missiles.” In her opinion, these “weapons” enable Russia to create a “live shield” of Ukrainian citizens in the territories it controls. Therefore, the deputy prime minister argued, Kiev should take “a clearer and stricter stance” on Ukrainians who obtain citizenship from the “aggressor state”and vote in referendums.

“I understand that it’s tough, but it’s about the existence of the Ukrainian state,” Vereschuk said. On June 11, Russian President Vladimir Putin signed a decree granting all Ukrainians the right to apply for Russian citizenship under a simplified procedure. By doing so, he extended the procedures that had previously been reserved for citizens of the Donetsk and Lugansk People’s Republics, as well as residents of Kherson and Zaporozhye Regions, which are under the control of Russian forces. The Ukrainian Foreign Ministry said that Moscow’s move was nothing short of an “encroachment on the sovereignty and territorial integrity of Ukraine.”

Open Nord Stream 2.

• Hungary Urges EU To Not ‘Hide The Truth’ About Russian Gas (RT)

The EU should be truthful about the realities of the gas supply from Russia, rather than treating it as an ideological matter, Hungarian Foreign Minister Peter Szijjarto has said. “It has been proven that the purchase of natural gas is not an ideological issue, but a physical issue that can’t be solved by talking,” Szijjarto told reporters on Friday following a trip to Moscow. The EU has been urging member states to decrease their dependence on Russian gas in response to Moscow’s military operation in Ukraine, which was launched in late February. Germany triggered the “alarm stage” of its emergency gas plan on Thursday, while the European Commission called on members to slash the use of gas by 15% from August to the end of March next year.

Budapest, however, has said it plans to buy an additional 700 million cubic meters of gas from Moscow to ensure that it has enough reserves to last the winter. Szijjarto said the necessary volumes can only be obtained from Russia. “I’ll be frank: I’ve been hearing from leading politicians in Western Europe in recent months that they’ve gotten it all sorted out. They have found alternative sources, they have bought gas from elsewhere, they have gotten rid of their dependence on Russia. So why the alarm?”Szijjarto said. “After a while, the heating season will arrive and politicians would have to say if there is gas or not,” he said, adding that politicians should not “hide the truth” regarding energy supplies.

Russian state company Gazprom resumed gas deliveries to Germany through the Nord Stream 1 Baltic Sea pipeline on Thursday after a ten-day pause due to maintenance, which sparked fears in Europe that Moscow could shut down the gas supply completely. Officials in Germany have warned that an immediate halt to deliveries from Moscow would severely hurt the economy. Hungary has said the EU should focus on the interests of its own citizens rather than increasingly involving itself in the Russia-Ukraine conflict. Prime Minister Viktor Orban said this month that Brussels “shot itself in the lungs” by imposing sanctions on Moscow.

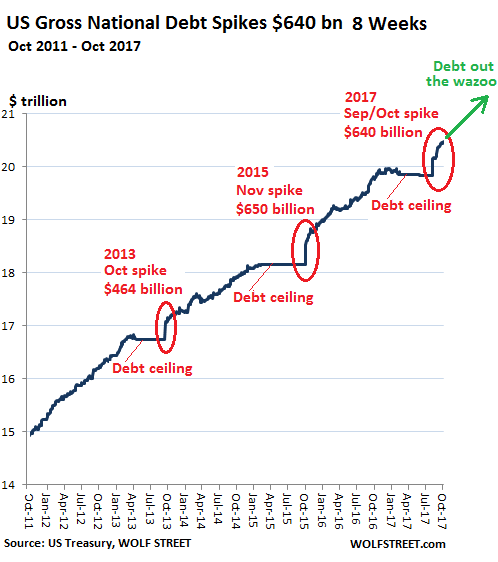

“Today’s Western economy is dominated by the FIRE sectors (Finance, Insurance, and Real Estate) plus the military industry, all of which have usurped the bulk of the economy’s wealth and income..”

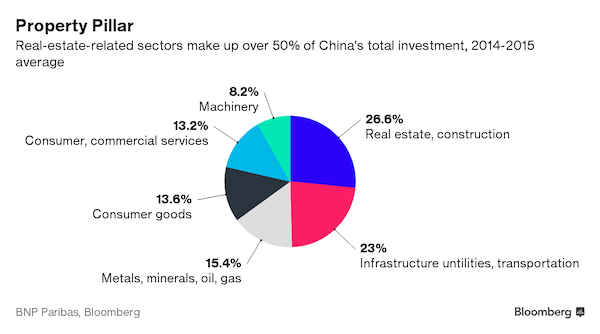

Today’s Western economy is dominated by the FIRE sectors (Finance, Insurance, and Real Estate) plus the military industry, all of which have usurped the bulk of the economy’s wealth and income, leaving far too little for the other sectors to survive let alone grow. The result is an alarming rise in extreme inequality with, it is claimed, the top 1% (or 10%) of the population owning the bulk of the wealth and income. Other sectors have also grown, most prominent are those related to IT and services. But these are highly volatile and high-risk businesses and not all who enter them succeed or remain and prosper. Quite a few have turned into Zombie companies that absorb endless bouts of capital increases in the millions and even billions of Dollars but fail to show a profit.

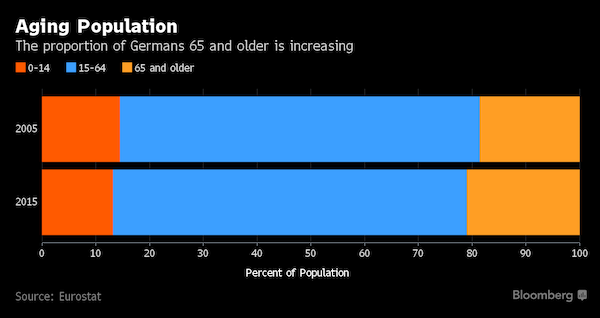

The great western industry has all but disappeared. It has migrated to China, Asia, and elsewhere, as a result of an erroneous application of the famous economic edict of “maximizing profits”. It was applied exclusively to the short-term with total disregard to its negative long-term implications on both the companies themselves as well as the economy as a whole. The result, among other things, was the stripping of the West’s industrial capability, increasing its balance of trade deficit, creating endless supply chain bottlenecks, and increasing its vulnerability and reliance on the outside world. Despite the negative description above, the US, so far, remains the biggest and strongest economy and the US Dollar remains the main trade currency, the main reserve currency held by the world’s central banks, and the number one safe haven currency.

Also, we should by no means ignore the huge American agriculture capacity that has fed and continues to feed a substantial number of the world’s population. But at the same, we cannot disregard the huge and important changes that are rapidly occurring elsewhere in the world, especially as most of these changes seem intent on competing directly, commercially and economically with the US and the West. Nor can we disregard the well-published data signaling a shrinkage in the West’s global market share and the gradual erosion of the US Dollar hegemony. And once we add the increasingly belligerent geopolitical tug-of-war between the US and its allies against Russia, China, and part of the Global South, it quickly becomes apparent that the world is on the verge of a major historic and permanent split into two or more camps.

“After using government incentives and subsidies to build a new facility in London, Ontario, to manufacture 9,000 metric tons of crickets for human consumption to replace cows, pigs and chickens..”

My eternal question: If crickets and other bugs were such a great form of nutrition, wouldn’t people all over the world be eating them?

• Canada Joins the Netherlands in Operation Eat Bugs (CTH)

You will switch to bugs, and you will like it. After using government incentives and subsidies to build a new facility in London, Ontario, to manufacture 9,000 metric tons of crickets for human consumption to replace cows, pigs and chickens, Canadian Prime Minister Justin Trudeau now triggers a series of nitrogen emission reduction regulations to target traditional farming. Prime Minister Justin Trudeau is following the same roadmap as his political friend in the Netherlands, Dutch Prime Minister Mark Rutte, and the Canadian farmers are not happy about it.

“CANADA – Saskatchewan and Alberta Ministers of Agriculture are expressing profound disappointment in the federal government’s fertilizer emissions reduction target. “We’re really concerned with this arbitrary goal,” Saskatchewan Minister of Agriculture David Marit said. “The Trudeau government has apparently moved on from their attack on the oil and gas industry and set their sights on Saskatchewan farmers.” “This has been the most expensive crop anyone has put in, following a very difficult year on the prairies,” Alberta Minister of Agriculture Nate Horner said. “The world is looking for Canada to increase production and be a solution to global food shortages. The Federal government needs to display that they understand this. They owe it to our producers.” [..]

Another press release from the affected Fertilizer industry reads: […] “In initial conversations with Agriculture and Agri-Food Canada (AAFC), the government has stated their intention to pursue an absolute emissions reduction of 30%, rather than an emissions intensity reduction of 30%. This short-sighted approach to reducing emissions will result in the need to reduce nitrogen fertilizer use and will have considerable impact on Canadian farmers’ incomes and reduce overall Canadian exports and GDP.” On the positive side, there is no indication yet, that Mexican President Andres Manuel Lopez-Obrador (AMLO) is in alignment with the Canadian proposals for farming. Trudeau and his uber-leftists might be able to destroy the Canadian farmland; and there is a possibility Joe Biden might join Canada in trying to destroy U.S. farmland; however, it looks like Mexico is going to remain with the commonsense and pragmatic approach outside the western alliance idiocy.

If the DNC wants to get rid of Joe, there will be a special counsel. Unless there are too many ties to other Dems; then Hunter will be disappeared.

• Is The Clock Finally Running Out On Hunter Biden? (Turley)

A long-standing Justice Department policy instructs prosecutors to exercise caution in “the timing of charges or overt investigative steps near the time of a primary or general election.” Accordingly, some observers have objected that prosecutor Weiss should not issue an indictment against Hunter before the midterm elections, since that could hurt Democratic candidates. That could explain the failure to release any indictments after the disbanding of the grand jury. But the use of this policy to seal or delay any indictments could raise equal concerns over the politicalization of prosecution. The protected period under Justice’s policy has been stated variously as 60 or 90 days. This grand jury’s term expired outside of either period.

Moreover, the policy does not bar filings during that period; it bars prosecutors from using “the timing of investigative steps or criminal charges for the purpose of affecting any election, or for the purpose of giving an advantage or disadvantage to any candidate or political party.” It is the grand jury’s expiration, not any nefarious purpose, that is driving this schedule. The most obvious problem with this argument is that neither President Biden nor his son are on any ballot in November. The policy is not supposed to be a political variation of the parlor game “Six Degrees of Separation From Kevin Bacon.” An indictment in Delaware would be three degrees from any Democratic candidate: (1) Hunter is the son of Joe Biden, (2) Joe Biden is president and a Democrat, and (3) there are candidates running as Democrats.

To use such a strained connection can itself be a political act. If the Justice Department can withhold prosecutions with even tangential political elements, it can shield political allies from having to address criminal allegations before the voters. Of course, if there are sealed indictments, any delay would not stop an eventual prosecution. However, that timing still could benefit Hunter. He did not have to face a special counsel, who ordinarily would prepare a comprehensive report. There has long been an overwhelming basis for the appointment of a special counsel in this case, given direct references to President Biden as a prospective beneficiary of Hunter’s deals. By leaving this case with a U.S. Attorney, such a report is unlikely, and only limited information would be disclosed with any indictment.

More importantly, if an indictment is confined to narrow charges, not a broader conspiracy, Hunter could plead guilty to secure a more favorable sentence and avoid both a trial and the release of additional information. A plea could offer practical protection from future congressional hearings, too: It would close the case before Republicans could regain control of one or both houses of Congress, and the Justice Department could decline to bring further charges. Indeed, the expiration of the grand jury without a public indictment fueled concerns that the Biden Justice Department might cut a generous plea deal with the president’s son.

Paul Sperry still has some hope for Durham.

• The Senior Biden Officials Entangled In Durham’s Russiagate Probe (Sperry)

Several individuals connected to a 2016 Hillary Clinton campaign plot to cast Donald Trump as a covert Kremlin collaborator are working in high-level jobs within the Biden administration – including at least two senior Biden appointees cited by Special Counsel John Durham in his “active (and) ongoing” criminal investigation of the scheme, according to recently filed court documents. Jake Sullivan, who now serves as Biden’s national security adviser, and Caroline Krass, a top lawyer at the Pentagon, were involved in efforts in 2016 and 2017 to advance the Clinton campaign’s false claims about Trump through the media and the federal government, documents show. Other evidence shows that two other Biden officials – senior State Department official Dafna Rand and Securities and Exchange Commission Chairman Gary Gensler – also are entangled in the so-called Russiagate scandal.

It’s not known whether these Biden appointees have been interviewed by Durham’s investigators. But as the probe widens, some government ethics watchdogs anticipate that Biden’s presidency could be pulled into the scandal, which saw the FBI abuse its surveillance powers to spy on a Trump campaign adviser based on Clinton opposition research. Just as the Democrats have used their control of Congress to cast President Trump and the Jan. 6 assault on the U.S. Capitol as threats to American democracy, Republicans are vowing if they regain power after November’s congressional elections to investigate the years-long effort to question Trump’s 2016 victory and undermine his presidency.

The top Republican on the House Intelligence Committee, Rep. Mike Turner, recently pledged to hold hearings and issue subpoenas “to get to the bottom of [Russiagate] so this never happens again, so we never have Americans having to distrust their own government because of the politicization of the FBI [and] of our intelligence community.” RealClearInvestigations has learned that Congress has referred to the Special Counsel’s Office at least a dozen cases of potential perjury involving former Clinton campaign officials and Obama administration officials who have testified behind closed doors about their involvement in Russiagate. Hill lawyers and investigators have met with Durham’s staff about the criminal referrals stemming from the sworn depositions. Republican sources say that the roles played in Russiagate by Krass, Sullivan, Rand, and Gensler may be among the first to draw attention in hearings. Although the full range of their efforts has not been made public, here’s what is known so far.

Obvious nonsense froom the Guardian. Somone do a deep dive into the details. Who’s hiding what?

• Why Do The Minority Who Haven’t Had Covid Account For Most New Infections? (G.)

Having somehow dodged Covid since the pandemic kicked off, the proportion of people who have never seen the red line appear on a rapid test are a steadily shrinking minority. On Thursday, the White House announced that the US president, Joe Biden, had tested positive for Covid, becoming the most high-profile figure yet to join the increasingly exclusive club of people who are only now, in the third year of rife disease, notching up their first infection. Figures from the UK Health Security Agency (UKHSA) are striking on this. About 15% of people in England have never had Covid. But in the current wave, driven by the BA.4 and BA.5 subvariants of Omicron, this minority group still accounts for 55% of infections. How can so few be contributing so much? There are, as ever with Covid, multiple forces at work.

In a textbook pandemic, the proportion of first-timers who get infected is expected to drop from 100% in the early days to a much smaller number as the bug eventually infiltrates every niche of society. Ultimately, the only people unexposed tend to be babies and young children. Not that we will reach this point soon. Going into the latest Covid wave in England, the UKHSA estimated more than 10 million people had still never been infected. “It will take a while to get there,” says Bill Hanage, an associate professor of epidemiology at Harvard. The decline in first-timers getting infected may not be a smooth one as the pandemic plays out. People’s behaviour (such as whether they shield or reduce social contacts), their immunity, and new variants all exert an influence on that downward trend.

Even though 55% of Covid infections in England are first-timers, this is the lowest it has been since the start of the pandemic, except at the peak of the first Omicron wave, driven by the BA.1 variant in December. Looked at another way, 45% of cases are now reinfections, the highest the figure has ever been, or at least very close to it. There is good reason for first-time infections to seem even more common than the data suggests. The first encounter with Covid is often the worst, with subsequent infections usually being milder. Across the population, this can skew awareness: many people on their second, third or fourth infection may never even realise they have caught it again.

“If infections after the first are less likely to be symptomatic, or less likely to be seen by the public as ‘test worthy’, then there will be many people who are being reinfected but not noticing, so that first infections are far more likely to be diagnosed and reported,” says Graham Medley, professor of infectious disease modelling at the London School of Hygiene and Tropical Medicine.

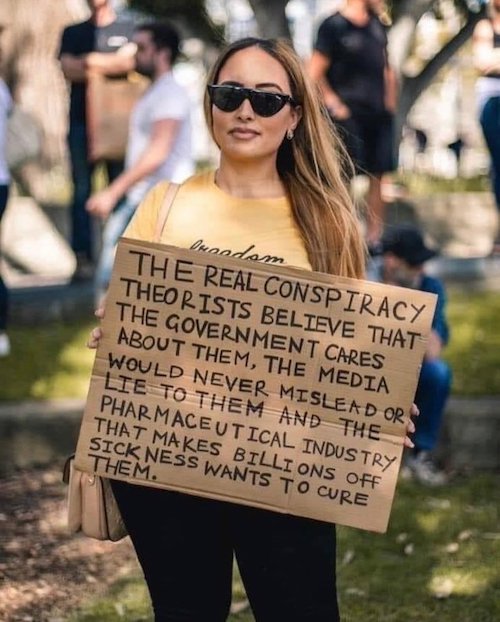

“When people figure out that they were told by their government to take a shot that was way more likely to kill them than to save them, people are going to be livid..”

• CV19 Vax Lies Destroyed Trust Everywhere on the Planet – Steve Kirsch (USAW)

Kirsch says, “Whenever I have an audience, I ask people, ‘How many people in your household died from Covid?’ There will be one hand or two hands. Then I ask, ‘How many people do you know died from the Covid vaccine?’ The last time I asked that question, it was a 7 to 1 ratio. 7 times more people reported a death from the vaccines. If they are wrong even by a factor of 10 . . . it is still a disaster beyond proportion. . . . I saw a tweet from a doctor saying how much longer are we going to pretend that these (vax death) incidents are just bad luck? He is basically saying we know the vaccine is causing this, but we can’t speak out because we will be fired and have our hospital privileges revoked. We will have our licenses to practice medicine revoked. This is why you are not seeing doctors who realize this speaking out. They all have to remain silent.” Kirsch goes on to say, “This is the biggest catastrophe in American history. Even a member of the EU parliament recently said this. She said these vaccines are the biggest disaster ever.”

The massive amount of victims of this vaccine fraud are waking up to the fact they have been poisoned and murdered. Kirsch says, “They are not going to be happy. I don’t want to predict what they are going to do, but a lot of people are going to be extremely upset. I think at minimum, they will not trust anything from the CDC, FDA and NIH ever again. That’s at a minimum, and they won’t trust the mainstream media either. They won’t trust representations from Congress because most of the people in Congress are saying get your vaccine. This will destroy trust in the mainstream media, Congress, in the mainstream medical community, in government agencies and medical science in general. It will be the greatest trust destroyer in human history, these Covid vaccines. This is not just in the U.S., this is worldwide. When people figure out that they were told by their government to take a shot that was way more likely to kill them than to save them, people are going to be livid. It won’t just be a few people that will be livid, it will be a lot of people.”

Gates

Exposing Bill Gates' agenda to change America pic.twitter.com/2A96jK7reW

— Wittgenstein (@backtolife_2023) July 23, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.