Pablo Picasso Visage 1928

Trump morning

He really is the best President ever. pic.twitter.com/O76wq6VhNC

— Don Keith (@RealDonKeith) January 28, 2025

Phone

Donald Trump shares hilarious story about how the world's leaders could never get Biden on the phone. This is gold. Please share. pic.twitter.com/RdZlWab3H6

— Bill Mitchell (@mitchellvii) January 27, 2025

Bongino

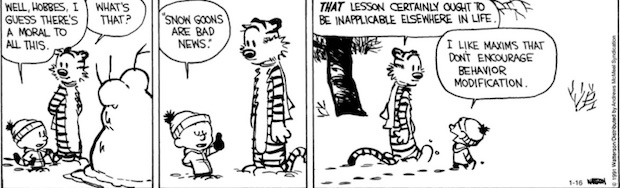

You know Scott Adams- the famous comic Dilbert, he tweeted this out, and man, did this ring my bell because he's so right. @dbongino

cc:@JoshuaLisec @realDonaldTrump https://t.co/4GzfiYEVY7 pic.twitter.com/eFIouyyVLy

— John Piquet | Coffee Expert (@JohnPiquet) January 27, 2025

Vivek

https://twitter.com/i/status/1884060637648806341

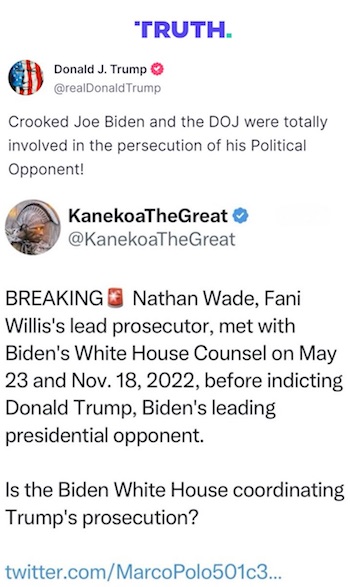

DOJ

https://twitter.com/i/status/1883991123104063851

Tucker Tulsi

Tucker Carlson: “I sense panic in some of these confirmation battles… when you find out the lengths to which permanent Washington is trying to sabotage Tulsi Gabbard.”

“She’s an army officer who's had clearance for more than a decade, and carries an automatic weapon. We trust… pic.twitter.com/rRBtAhG9AP

— End Tribalism in Politics (@EndTribalism) January 27, 2025

TuckerTaibbi

Matt Taibbi tells Tucker Carlson Team Trump is livid over the assassination attempts. This was the last straw and they will be very public about it. pic.twitter.com/K6hr6rxtjW

— Big Fish (@BigFish3000) January 28, 2025

Matt Taibbi explains to Tucker Carlson how Biden pardoning Fauci and others could be a good thing.

“If you wanna know what's happening, they just made it a lot easier for us to find out.”

“Because now once the pardon's delivered, the person can't plead the fifth. If they're… pic.twitter.com/uxrKL9IQHa

— End Tribalism in Politics (@EndTribalism) January 28, 2025

New White House Press Secretary Karoline Leavitt starts off with some catchy language.

• Biden Team Spent Aid Budget Like ‘Drunken Sailors’ – White House (RT)

The Biden administration spent the federal budget recklessly during its tenure, White House Press Secretary Karoline Leavitt said on Tuesday, defending President Donald Trump’s decision to temporarily freeze foreign aid.Speaking at a press briefing, Leavitt explained that Trump’s executive order, which suspends nearly all foreign aid expenditures for 90 days, is part of a broader effort to ensure fiscal responsibility and align spending with the administration’s “America First” agenda. “The past four years, we’ve seen the Biden administration spend money like drunken sailors. It’s a big reason we’ve had an inflation crisis in this country,” Leavitt said. Leavitt highlighted examples of what the Trump administration considers excessive spending under Biden. These include $37 million earmarked for the World Health Organization (WHO) and $50 million for condom distribution programs in Gaza.

“That is a preposterous waste of taxpayer money,” she added. The freeze, she noted, reflects the administration’s commitment to responsible use of public funds. President Trump signed the executive order shortly after being sworn in for his second term last Monday. The measure halts foreign development aid and other spending for 90 days, pending reviews by the newly established Department of Government Efficiency and the Office of Management and Budget. Some exemptions include military aid to allies like Israel and Egypt, as well as emergency food aid programs. Outlining the rationale for the freeze, Secretary of State Marco Rubio pledged to prioritize programs that directly benefit the United States while cutting unnecessary expenditures. “Every dollar we spend, every program we fund, and every policy we pursue must be justified with the answer to three simple questions: Does it make America safer? Does it make America stronger? Does it make America more prosperous?” Rubio said last week.

The aid freeze has drawn criticism from some diplomats and organizations, particularly those involved in Ukraine-related programs. According to the Financial Times, several US diplomats have requested exemptions for critical development projects in Ukraine, even as military assistance to Kiev remains unaffected. These requests are reportedly under review. Since the escalation of the Ukraine conflict in February 2022, the US has provided over $65 billion in direct military aid and an additional $100 billion for various Ukraine-related projects. Trump, however, has expressed skepticism about continuing such levels of support, advocating for a diplomatic resolution to the conflict. His administration aims to broker a peace deal between Ukraine and Russia within 100 days, backed by threats of increased sanctions against Moscow.

“..56 percent of the civil service is covered under collective bargaining agreements that include telework provisions, while a full 10% of federal jobs are now designated as fully “remote..

• Trump To Offer Buyouts To All Federal Workers (ZH)

Update (1750ET): According to CNBC, the buyout offer is for all 2 million federal workers. One senior administration official told the outlet that they expect 5-10% of the federal workforce to quit, which could lead to roughly $100 billion in savings.

* * *

In December, then-President-elect Donald Trump warned federal employees working from home that they would have to return to the office, or “they’re going to be dismissed.” Now, according to Axios, the Trump administration will send out a memo Tuesday afternoon offering to pay federal workers who don’t want to return to the office, in what would amount to an 8-month severance through Sept. 30, a White House official tells the outlet. “The government-wide email being sent today is to make sure that all federal workers are on board with the new administration’s plan to have federal employees in office and adhering to higher standards. We’re five years past COVID and just 6 percent of federal employees work full-time in office. That is unacceptable,” said the anonymous senior administration official.More via Axios: It’s not clear how many workers would be eligible for this offer, or how it would be paid for. According to guidance posted on OPMs website, in order to be eligible for severance pay workers must have completed at least “12 months of continuous service,” as well as meet other requirements. Political appointees aren’t eligible for severance, per the website. Many federal workers are already feeling scared about the administration’s crackdown on DEI, its return-to-office policy and the effort to reclassify civil servants. That unease could increase take-up on this new offer. Earlier on Tuesday, White House Press Secretary Karoline Leavitt said that the president has the authority to fire federal employees. While that is true about at-will political appointees, federal workers have more protections.

Leavitt was defending Trump’s firings of at least a dozen agency inspectors general. During the pandemic, approximately 2.3 million federal employees shifted away from traditional office spaces. This shift was not just a temporary adjustment, but a transformational move that many hoped would persist post-pandemic due to its perceived benefits in work-life balance and reduced operational costs. The Biden administration, acknowledging these benefits, continued to support telework, facilitating the reduction of government-owned real estate and integrating flexible work arrangements into the fabric of federal employment. However, with Trump’s election, a quick pivot is on the horizon. Unsurprisingly, Trump’s call for a return to office has been met with resistance from federal employees and unions. Approximately 56 percent of the civil service is covered under collective bargaining agreements that include telework provisions, while a full 10% of federal jobs are now designated as fully “remote,” according to the Washington Post.

The vast majority of Americans will agree with this, even Democrats.

• Trump Executive Order Bans “Chemical And Surgical Mutilation” Of Children (ZH)

Hours after signing an executive order restricting transgender service in the US military, President Donald Trump on Tuesday signed a sweeping executive order banning the “chemical and surgical mutilation” of children, in a move that takes direct aim at pediatric gender transition treatments. The order, titled “Protecting Children from Chemical and Surgical Mutilation,” yanks federal funding for so-called gender-affirming care. The EO prohibits federal funding, support, or promotion of pediatric ‘gender-affirming’ medical interventions. It outlines detailed measures across multiple federal departments, including Health and Human Services (HHS), the Department of Defense, and the Department of Justice (DOJ), to curtail treatments such as puberty blockers, hormone therapies, and gender-related surgeries for individuals under the age of 19. -Tampa Free Press. According to the report, the order includes:

• Defunding Medical Institutions: Federal research and education grants will be withheld from hospitals and schools performing pediatric gender-transition treatments.

• TRICARE Coverage Restrictions: The Department of Defense will exclude these treatments from military health insurance programs.

• Insurance Policy Changes: Federal Employee Health Benefits and Postal Service Health Benefits programs will bar coverage for transgender-related pediatric surgeries or hormone treatments.

• Consumer Protection: The DOJ is directed to prioritize investigations into deceptive practices or misinformation regarding long-term effects of gender-affirming care, including potential fraud or violations of the Food, Drug, and Cosmetic Act.“Across the country today, medical professionals are maiming and sterilizing impressionable children,” reads the order, which describes such procedures as a “stain on our Nation’s history.” The order also calls for a comprehensive review of scientific evidence surrounding gender dysphoria, and calls for the Department of Health and Human Services to publish updated guidance within 90 days. The Trump administration will replace the existing standards – such as those issued by the World Professional Association for Transgender Health (WPATH), which the order deems lacking in “scientific integrity,” the Free Press continues.

The executive order represents a significant escalation in the administration’s broader campaign to curtail diversity, equity, and inclusion (DEI) initiatives, as well as gender-related policies, in government and public life. It builds upon earlier executive actions restricting DEI programs and eliminating gender-affirming policies in federal agencies and education. The order also authorizes federal law enforcement agencies to challenge states that support gender-affirming care for minors or policies that strip parental custody over disputes involving a child’s medical treatment. It tasks the DOJ with drafting legislation to allow parents and children affected by such procedures to file lawsuits against medical professionals. -Tampa Free Press. And of course, we’re sure it’s only a matter of hours before civil rights organizations file lawsuits to allow parents and doctors to continue abusing confused children.

“This, what happened on the southern border the last four years, is the biggest national security threat this country’s seen, at least in my lifetime.”

• Homan Defends ICE Raids, Says He Will Carry Out Mission ‘Without Apology’ (JTN)

New border czar Tom Homan on Monday defended the immigration raids that U.S. Immigration and Customs Enforcement (ICE) officers carried out over the weekend, and said he will continue to carry out the raids “without apology.” Actress Selena Gomez posted a tearful video online Monday, which has since been deleted, where she apologized to her fans for the mass deportations, claiming she wished she could do something for the children impacted by the raids. Homan told Fox News that he was not aware of families being deported, and that the administration was focused on deporting national security and public safety threats. “Look, President [Donald] Trump won the election on this one issue: securing our border and saving lives,” Homan said. “This, what happened on the southern border the last four years, is the biggest national security threat this country’s seen, at least in my lifetime.”

Homan said he expects that the continued operations will result in lethal fentanyl overdoses decreasing, a decrease in crimes by illegal immigrants, and a decrease in sex trafficking. “We’re going to do this job. And we’re going to enforce the laws of this country. If they don’t like it, then go to Congress and change the law. We’re going to do this operation without apology. We’re going to make our communities safer,” Homan said. “It’s all for the good of this nation, and we’re going to keep going. No apologies. We’re moving forward.” The comment comes after ICE and a small handful of other federal agencies conducted raids over the weekend that resulted in the arrests of more than 2,000 people, including nearly 1,000 on Sunday.

Homan

NOW – Tom Homan Declares War on Cartels After Border Agents Fired Upon |

"The whole of government is going to dismantle these people and wipe them off the face of the earth."

Things are heating up fast.

Border Czar Tom Homan just announced that the U.S. is preparing to wage… pic.twitter.com/eEH9fKTpXL

— Overton (@overton_news) January 28, 2025

“Absolutely massive cleanup effort is underway in western North Carolina today!”“The Army Corps of Engineers are everywhere!”“Why didn’t Joe Biden do this 4 months ago?”

• Trump Moves Undercut Dem Defense Of Biden (JTN)

President Donald Trump’s whirlwind first week back in office has seen him move decisively to lock down the southern border, implement mass deportations, wrap up Middle Eastern conflicts, and deliver aid to storm-ravaged parts of the U.S., leaving many to ask why now-former President Joe Biden didn’t make the same moves months ago. During the 2024 presidential campaign, Biden and then-Vice President Kamala Harris repeatedly blamed Trump for torching a bipartisan immigration bill and insisted that the commander-in-chief could not move to secure the border without support from Congress. Trump rebutted that the president had broad executive authority on the matter and didn’t require any new legislation.

Biden also drew flak for his response to Hurricane Helene, which devastated western North Carolina and saw thousands of people lose their homes. The perceived sluggish and allegedly politicized handling of the disaster in light of the region’s Republican tilt fueled outrage among the residents and outside observers alike. In the Levant, moreover, the last days of the Biden presidency saw Israel and Hamas reach a ceasefire agreement to end the more-than-year-long conflict in the Gaza Strip, but only after then-President-elect Trump dispatched his own envoys to push the deal over the finish line. Most of the agreement’s terms fell within a previously-negotiated framework. The rapid, post-election turnaround on these keynote issues has many conservatives insisting that Biden had merely opted not to address the issues and that leaving them unresolved had simply been deliberate.

Since launching his 2016 campaign, Trump has focused on illegal immigration and vowed to crack down at the border, including by building a wall. The Biden administration saw more than 10 million people enter the U.S. illegally, according to U.S. Customs and Border Protection figures. In 2024, Democrats worked with Sen. James Lankford, R-Okla., to negotiate an immigration reform package that would have established an illegal crossings threshold for the Department of Homeland Security to implement stringent border controls. Republicans asserted that the bill essentially condoned a predetermined amount of illegal immigration and did little of substance. Lankford received widespread criticism over his perceived negotiating failure and Trump urged Republicans to sink the bill, which they did. Its failure led Democrats to blame Trump repeatedly for the border influx and insist he had undermined a credible solution to permit him to run on fixing the problem.

Amid debate on the bill, which occurred three years into the four-year term, Biden himself said it would “give me as president, the emergency authority to shut down the border until it could get back under control… If that bill were the law today, I’d shut down the border right now and fix it quickly.” At the time, Republican lawmakers dissented, arguing that Biden already had the authority to address the issue. “Anyone who says Biden needs new laws to stop the migrant crisis is a liar. The law RIGHT NOW says if the President finds that the entry of any aliens would be detrimental to the U.S. he can “suspend the entry of all aliens or any class of aliens,” then-Sen. Marco Rubio, R-Fla., said at the time.

The bill did not pass, however, and Trump has moved to seal the border without so-called “emergency authority.” Footage from Trump’s first day in office showed border officials blocking ports of entry and declaring that anyone attempting to enter the U.S. would face arrest. He also deactivated the CBP One app, which Biden’s DHS had used to process illegal entrants. On Sunday alone, moreover, Immigration and Customs Enforcement (ICE) reported 956 arrests of illegal aliens, including many violent offenders. The agency had arrested 1,300 by Thursday, according to NewsNation. “The Biden admin knew exactly who these criminal illegal aliens were and where they lived. ICE was not allowed to make the arrests until President Trump entered office,” posted Rep. Burgess Owens, R-Utah, in response to a video showing the arrest of a criminal illegal alien from Haiti.

Hurricane Helene proved devastating to western North Carolina in the leadup to the presidential election. The mountainous region rarely faces storms of that degree and was ill-prepared to handle the large-scale flooding that washed away entire towns, such as Chimney Rock. The death toll cleared 200 in early October, making it the deadliest storm to hit the mainland United States since Hurricane Katrina in 2005. High-profile figures such as Elon Musk took aim at the Federal Emergency Management Agency (FEMA), contending it was blocking aid to the storm victims. Biden visited the Carolinas on the heels of a Trump trip to northwestern Georgia the same week and authorized the deployment of 1,000 troops to aid in the recovery effort.

Nonetheless, Biden faced blowback over his perceived failure of leadership, especially from now-Vice President JD Vance, who criticized the slow deployment of the 82nd Airborne to the region. “The 82nd Airborne is an hour away from western North Carolina, and it took six days to get them there,” he said in Greensboro while on campaign. “That doesn’t happen without a failure of leadership, but we gotta get to the bottom of exactly what that failure of leadership looked like.” Trump speedily deployed additional forces to the region to bolster rebuilding efforts and visited the area during his first week in office. Monday saw residents observe a large presence of federal troops working to rebuild key infrastructure and provide relief. “Absolutely massive cleanup effort is underway in western North Carolina today!” posted Matt Van Swol, a resident of the area who has documented the recovery efforts on social media. “The Army Corps of Engineers are everywhere!”“Why didn’t Joe Biden do this 4 months ago?” he asked.

“The investigation is looking into the policies of sanctuary cities when it comes to federal immigration enforcement..”

• Comer Launches Investigation Into Sanctuary Cities, Invites Mayors To Testify (JTN)

House Oversight Chairman James Comer on Monday launched an investigation into sanctuary cities, requesting documents and communications related to their policies and their impact on public safety. Comer sent the requests to Boston Mayor Michelle Wu, Chicago Mayor Brandon Johnson, Denver Mayor Mike Johnston, and New York City Mayor Eric Adams, and invited the mayors to testify in front of the committee on Feb. 11. The investigation is looking into the policies of sanctuary cities when it comes to federal immigration enforcement. Sanctuary cities have largely promised not to work with the federal government in order to protect their illegal alien residents from deportation.

“The Committee on Oversight and Government Reform is investigating sanctuary jurisdictions across the United States and their impact on public safety and the effectiveness of federal efforts to enforce the immigration laws of the United States,” Comer said in a statement. “Sanctuary jurisdictions and their misguided and obstructionist policies hinder the ability of federal law enforcement officers to effectuate safe arrests and remove dangerous criminals from American communities, making Americans less safe,” he added.

Adams has expressed a willingness to work with the Trump administration to deport illegal immigrants who commit dangerous crimes in his city, and previously met with Trump and his border czar Tom Homan to discuss the migrant crisis. Trump has also recently signed a flurry of executive orders that crack down on illegal immigration. “In addition to the efforts of the Trump Administration to ensure federal immigration enforcement can proceed unimpeded, Congress must determine whether further legislation is necessary to enhance border security and public safety,” Comer said. “It is imperative that federal immigration law is enforced and that criminal aliens are swiftly removed from our communities.”

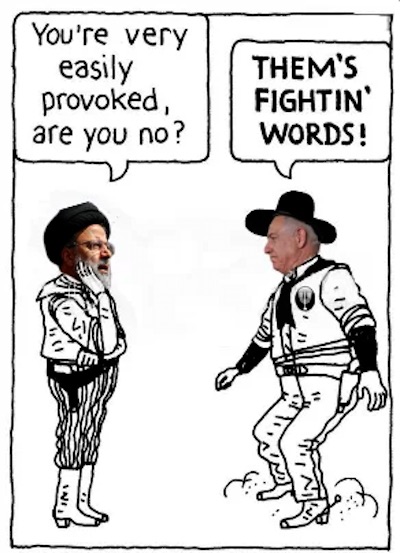

“Who takes over Russia? What happens to the nuclear arsenal in a country so complex that outsiders can’t even understand… That’s demented that you would even think about something like that..”

• Biden Administration Tried To Kill Putin – Tucker Carlson (RT)

The administration of former US President Joe Biden tried to assassinate Russian President Vladimir Putin during the Ukraine conflict, American journalist and former Fox News host Tucker Carlson has claimed. In an interview with journalist Matt Taibbi on Monday, Carlson suggested that many former and current US officials have been rattled by President Donald Trump’s campaign to declassify numerous government papers, as they see the potential fallout as extremely dangerous. “I think this was one of the reasons [ex-Secretary of State] Tony Blinken was pushing so hard for a real war, trying to kill Putin, for example… The Biden administration did [it], they tried to kill Putin,” Carlson said, without providing any further details about the alleged assassination plot.

Carlson, who broadcast a bombshell interview with Putin last February, described the alleged move as “insane,” pointing to the potentially cataclysmic fallout for global security. “Who takes over Russia? What happens to the nuclear arsenal in a country so complex that outsiders can’t even understand… That’s demented that you would even think about something like that,” he added. US officials have never publicly acknowledged plans to assassinate Putin, or any other Russian or Soviet leaders. However, Newsweek reported in September 2022 that US defense officials had discussed a “decapitation strike” if Russia used nuclear weapons in Ukraine. Moscow has repeatedly denied that such an option has ever been on the table, arguing that there are no targets in the neighboring country for such a weapon.

Russian Foreign Minister Sergey Lavrov interpreted the allegations of a “decapitation strike,” as “a threat to assassinate the head of the Russian state.” “If such ideas are really being considered, those involved must carefully think about the possible consequences,” he said at the time. In May 2023, Russia accused Ukraine – which has received massive aid from the US – of attempting to assassinate Putin in the Kremlin using a drone strike, although the aircraft was neutralized. While Ukraine has denied any involvement, Blinken said at the time that Washington had no prior warning of the raid, adding that Kiev was free to defend itself in any way it saw fit.

..Antony Blinken had pushed for a “real war” with Russia and that the Biden administration sought to “kill Putin.”

“Russian President Vladimir Putin is well protected from any potential threats..”

• Kremlin Responds To Carlson’s Claim Biden Admin Tried To Kill Putin (ZH)

Tucker Carlson has unleashed international controversy this week when in an interview with journalist Matt Taibbi, Carlson claimed that former Secretary of State Antony Blinken had pushed for a “real war” with Russia and that the Biden administration sought to “kill Putin.” The former Fox News host described the plot as madness and insanity on the part of the prior Democratic administration. However, Carlson didn’t offer specifics or any evidence. Carlson stated firmly that the Biden White House “was pushing so hard for a real war, trying to kill Putin, for example… The Biden administration did [it], they tried to kill Putin.” Watch the clip with Carlson and Taibbi:

Tucker Carlson claims Biden administration “tried to kill Putin,” calling it "insane" but providing no details.

“Blinken pushed for real war, even trying to kill Putin.” pic.twitter.com/4c57j5FNbp

— Clash Report (@clashreport) January 28, 2025

Last February Carlson went to Moscow to interview Putin one-on-one, and it’s unclear whether the Russian leader may have conveyed some specific information at that time. On Tuesday, the Kremlin responded to what was said in the Carlson interview, and the statements were cryptic and vague, neither confirming nor denying the claim of an assassination plot. Below is a Russian media summary of the Kremlin response: “Russian President Vladimir Putin is well protected from any potential threats, Kremlin spokesman Dmitry Peskov said on Tuesday. He was responding to a claim by American journalist Tucker Carlson that the administration of former US President Joe Biden planned to assassinate the Russian leader. …The conservative journalist did not provide any details of the alleged plot. However, he denounced the purported plan as “insane,” considering the power vacuum it would create in Russia and the potential for Moscow’s vast nuclear arsenal to end up in the wrong hands.”

Asked to comment on Carlson’s remarks on Tuesday, Peskov would neither confirm nor deny US attempts to target Putin, nor reveal any knowledge of such plans by officials in Washington in the past. “Russian security services continuously take all necessary measures to ensure public safety and the safety of those under state protection. First and foremost, the head of state,” he told reporters. There was a past drone attack out of Ukraine which hit a building of the Moscow Kremlin complex. At that time it was seen as targeting Russian leadership, but it’s not clear that this episode is what Carlson had in mind. Carlson seemed to be saying something more significant was afoot – that Washington was will to risk a ‘decapitation strike’ or operation, perhaps especially if something like a Russian nuclear launch was imminent or likely. But if such a plan was an ‘option’ – it would be highly classified and the Biden admin wouldn’t want it to get out. If there had been such a secretive plot, it’s possible that President Trump could confirm or reveal it at a future date.

“According to the International Energy Agency and the Office of the UN Human Rights Commissioner, Ukraine now has just one-third or less of its pre-war capacity.”

• Ukrainian Energy Infrastructure On Verge Of Collapse – Forbes (RT)

Ukraine’s energy infrastructure is reportedly nearing collapse following sustained Russian attacks, according to a report by Forbes on Monday. The article by energy analyst Gaurav Sharma suggested that the country’s power grid has suffered severe damage and will require billions of dollars to repair. Russia has been targeting Ukraine’s energy infrastructure since October 2022, shortly after the bombing of the Crimean Bridge, for which Kiev claimed responsibility. Moscow has since conducted a number of large-scale strikes on the country’s power grid with the aim of crippling Kiev’s military-industrial complex, according to the Russian Defense Ministry, which has maintained that its strikes are not directed at civilians.

In early 2024, Moscow also added Ukrainian power plants to its list of legitimate military targets as a response to Kiev’s continued drone incursions in Russian territory, which have targeted Russian energy infrastructure as well as residential areas. In its latest article on the state of Ukraine’s energy system, Forbes specifically highlighted a large-scale attack that Russia carried out on December 25. It involved more than 170 missile and drone strikes, causing extensive damage to Ukraine’s energy infrastructure. Sharma described the attack as a major blow to the grid, which had already been weakened by previous strikes.

It is believed that Ukraine’s power capacity had already been cut in half due to Russia’s continued attacks by the beginning of 2024. Some 6GW of capacity was also lost after Moscow took over the Zaporozhye nuclear power plant at the beginning of the conflict. In subsequent attacks in March and May 2024, Kiev is believed to have lost another 9GW of power generation capacity. According to the International Energy Agency and the Office of the UN Human Rights Commissioner, Ukraine now has just one-third or less of its pre-war capacity.

Forbes noted that, while Kiev has not officially confirmed that its power systems are “on their knees,” it is “hard” to draw any other conclusion. The outlet added that, while efforts to repair the damage are ongoing, the scale of destruction has made full restoration difficult and costly. According to Forbes, citing sources in Kiev, the cost of the damage to Ukraine’s power infrastructure is thought to be in the region of $15 billion to $20 billion. This, coupled with the Ukrainian energy industry’s financial losses, means the total cost of reconstruction could reach $70 billion, according to the outlet.

1/ Putin won’t be part of the talks, he’ll send underlings.

2/ Russia’s been cheated before.

• Putin: Direct Talks With Zelensky, But He Can’t Sign Peace Deal (Sp.)

Volodymyr Zelensky signed a decree outlawing peace negotiations with Moscow in 2022, months after the West sabotaged a ready peace treaty to pursue an all-out proxy war against Russia. President Putin has expressed readiness to find negotiators to speak directly with Volodymyr Zelensky. “If he wants to take part in negotiations, I will select such people, it’s not an issue. The question is about the final signing of the documents,” Putin said in a TV interview Tuesday, noting that Zelensky’s legitimacy has expired, and he therefore “does not have the right to sign anything.” Under Ukrainian law, the end of the president’s term means his powers are transferred to the chairman of the Verkhovna Rada parliament, and in accordance with the Constitution, even martial law does not give him the right to extend his authority, Putin said.

Zelensky’s powers officially ran out last spring, but he remained in office after cancelling elections, citing martial law. “On the question of the final signing of the documents…there cannot be a single mistake or wrinkle. Everything must be polished,” Putin emphasized. Furthermore, direct talks cannot start if Zelensky does not lift his self-imposed ban, Putin said. “If there is a desire, any legal question can be resolved. So far, we simply don’t see such a desire” from the Ukrainian side, the president said. “Negotiations factually began immediately after the start of the Special Military Operation. Initially, we told the Ukrainian leadership at the time that the people of the Lugansk and Donetsk People’s Republics don’t want to be part of Ukraine. Leave these territories, and that’s it, that’s where it ends. No fighting, no war,” Putin said.

The Ukrainian side rejected these terms, but Russia nevertheless agreed to talks. “This was at the end of February 2022,” Putin recalled. Russia was prepared to implement the peace deal reached in Istanbul in the spring of 2022, “even though there were things [in the draft deal, ed.] which we had issues with,” Putin revealed. “Nevertheless, I agreed that we were ready to implement this document. And on March 15 or 16 we informed Kiev that we were ready to refine and sign this document. There was practically nothing to change there,” he said. “Somewhere near the end of March [2022, ed.] we received a proposal from Kiev – the one with the signature of the head of the Ukrainian negotiations group, Mr. Arakhamia. And it was these Ukrainian proposals – I want to emphasize this, it’s very important, that formed the basis of the draft peace treaty developed at Istanbul,” Putin said.

The draft agreements also “had a small point proposed for consideration by the Ukrainian side on a personal meeting between the two presidents. I agreed to this,” Putin added.Russia also sent signals to Kiev’s Western sponsors, including now former US president Joe Biden, Putin said, saying he had made clear that “if they had a desire…to achieve peace, the path was very simple.” Today, Putin said, Ukraine’s sovereignty is “almost nil,” and without foreign sponsorship and weapons, the present conflict would “end in a month and a half or two months.” Putin also commented on Zelensky’s claims that he banned negotiations after the Russian military was stopped at the gates of Kiev in early 2022, pointing out that Russian forces withdrew voluntarily as an act of good faith for the sake of the peace treaty being negotiated in Istanbul, many months before Zelensky implemented his ban in October 2022.

“For us it was clear in principle that deception was a serious risk. Russia has been deceived in a similar manner for decades: they say one thing, they do something completely different,” Putin said. “Nevertheless, based on considerations of the need to prevent the bloodshed associated with a serious war, we agreed, and began to withdraw troops from Kiev at the end of March.” Subsequently, then-British Prime Minister Boris Johnson flew to Kiev on NATO’s behest to tell Zelensky to scrap the peace plan, and Ukrainian and Western media blew up the Bucha Massacre controversy, accusing Russian forces of slaughtering unarmed Ukrainian civilians in a suburb of Kiev to justify continued fighting and Western support. Follow-up investigations revealed that the civilians killed at Bucha were murdered by Ukrainian neo-Nazi forces sent in to punish locals accused of ‘collaborating’ with Russian forces.

“..without such a step, any proposed negotiations would be as illegitimate as Vladimir Zelensky..”

• Ukraine Conflict Could End In Weeks – Putin (RT)

The Ukraine conflict could end in two months of Kiev is deprived of the money and ammunition it depends on to continue fighting, Russian President Vladimir Putin has said. Speaking to reporter Pavel Zarubin on Tuesday, Putin was asked about the possibility of a negotiated end to the Russia-Ukraine conflict. “They can’t exist without their Western sponsors. They won’t last a month if the money and ammunition run out,” Putin told Zarubin. “Everything can be over in a month and a half to two months. Ukraine practically has no sovereignty, in that sense,” the Russian president added. According to Putin, if Kiev’s western backers truly want peace, “this is very easy to do,” adding that Moscow has already spelled out its terms very clearly.

Kiev can signal its willingness to talk by canceling the decree banning all negotiations with Russia, Putin said. He explained that without such a step, any proposed negotiations would be as illegitimate as Vladimir Zelensky, whose presidential mandate expired last spring. The US and other backers of Ukraine have channeled more than $200 billion in aid to Kiev, ranging from weapons, equipment, and ammunition, to cash payments for the salaries of government employees and pensions. The Kremlin has pointed to this support as making the West “de facto a party to the conflict,” which both Washington and Brussels have officially denied.

Trump has a short window to get out and blame it all on Biden. Very short by now.

• Is Trump Positioning For A “No-Deal” With Russia – Or Not? (Alastair Crooke)

Trump’s rhetoric about Russia having lost 1 million men in the Ukraine conflict is not just nonsense (the real number not even reaching 100,000), but his resort to it underlines that the usual meme of Trump being just woefully misinformed is looking less and less plausible. After touting the 1 million Russian deaths, Trump then suggests that Putin is destroying Russia by not making a deal. Adding (seemingly as an aside), that Putin may have already made up his mind ‘not to make a deal’. Instead, in a curiously disinterested way, Trump remarks that negotiations would depend entirely on whether Putin is interested or not. He further claims that Russia’s economy is in ruins, and most notably says that he would consider sanctioning or tariffing Russia, if Putin does not make a deal. In a subsequent Truth Social post, Trump writes, “I’m going to do Russia, whose Economy is failing, and President Putin, a very big FAVOR”.

This – plainly said – is a narrative of an entirely different order: No longer is it his Envoy Kellogg or another team member saying it; it is Trump’s own words as President. Trump answers a journalist’s question ‘Would [he] sanction Russia’ should Putin not come to the negotiating table? To which he responds, “that sounds likely”. What, we might ask, is Trump’s strategy? It seems more as though it is Trump that is preparing for a ‘no deal’. He must be aware that Putin repeatedly has made plain that he is both interested and open to talks with Trump. There is no doubt about that. Yet Trump subsequently contradicts the ‘loser discourse’ in yet another apparent after-thought: “I mean … it’s a big machine so, eventually things will happen …”. Here he appears to be saying that the Russian ‘big machine’ ultimately will win. Russia will be a winner – and not a loser.

Maybe Trump is thinking simply to let the dynamics of the military ‘trial of strength’ play out. (If that is his thinking, he cannot utter such sentiment out loud – explicitly – as the Euro-élites would sink even further into a pathological tailspin). Alternatively, were Trump to be seriously seeking productive negotiations with Putin, it is certainly not a good way to start by being deeply disrespectful towards the Russian people – depicting them and President Putin as ‘losers’ who desperately need a deal; whereas the reality was that it was Trump who earlier had touted getting a deal within 24 hours. His disrespect will rankle – not just with Putin – but for most Russians. The ‘loser narrative’ simply will stiffen Russian opposition to a Ukraine compromise.

The backdrop is that Russia in any case collectively eschews the idea of any compromise that “boils down to freezing the conflict along the line of engagement: that will give time to rearm the remnants of the Ukrainian army, and then start a new round of hostilities. So, that we have to fight again, but this time from less advantageous political positions”, as Professor Sergei Karaganov has noted. Moreover, “the Trump administration has no reason to negotiate with us on the terms we [Russia] have set. The war is economically beneficial to the U.S. … and [possibly] also to removing Russia as the powerful strategic support of America’s main competitor ? China”. Professor Dmitri Trenin similarly predicts that,

“Trump’s bid to secure a ceasefire along Ukraine’s battle lines will fail. The American plan ignores Russia’s security concerns and disregards the root causes of the conflict. Meanwhile, Moscow’s conditions will remain unacceptable to Washington, as they would effectively mean Kiev’s capitulation and the West’s strategic defeat. In response Trump will impose additional sanctions on Moscow. Despite strong anti-Russian rhetoric, U.S. aid to Ukraine will decrease, shifting much of the burden onto Western European nations”. So why cast Russia as contemptible ‘losers’, unless this forms Trump’s strategy for walking away from the Ukraine issue? If a clear-cut U.S. ‘victory narrative’ seems beyond reach, then why not invert the narrative?‘Mission accomplished’ being obstructed solely by Russia’s ‘loser streak’.

This inevitably leads to the question of what is the meaning – exactly – of the return of America’s “most famous criminal defendant to the White House”, and his promise of a “revolution of common sense”? “There is no doubt that it is revolutionary”, Matt Taibbi argues: “Trump galvanized [income mal-distribution] resentment, creating a political Sherman’s march that left institutional America smouldering. The corporate press is dead. The Democratic Party is in schism. Academia is about to swallow a giant bottle of bitter pills, and after the executive orders signed Monday: a lot of DEI instructors will have to learn to code” [i.e., will be unemployed].

Yes, Taibbi observes, “it makes me nervous to see a murderer’s row of censorious CEOs (particularly Bezos, Pinchai, and the repulsive Cook) sitting in front of Trump, together with other Wall Street luminaries … nonetheless, if the deal was support for Trump in exchange for platforms going back to being merely self-interested profit-gobblers, I’ll take it over the previous cabal. The Wall Street Journal was probably closest to capturing the essence of that idea of the event with yesterday’s header, “The New Oligarchy is a Vast Improvement on the Old””.

Trump must have agreed with this?!

• Denmark Allows Russia’s Gazprom To Do Work On Damaged NS2 Pipeline (ZH)

In a very unexpected development Denmark is now working directly with Russia’s Gazprom to do environmental mitigation on the damaged Nord Stream pipelines, in the wake of the multiple underwater blasts that took them offline on September 26, 2022 – leading to years of accusations against Moscow and a Russia-West tit-for-tat. Denmark’s energy agency has granted Nord Stream 2 AG (which is under Gazprom) permission to engage in preservation work on Nord Stream 2 in the Baltic Sea. The agency described that there remain serious safety risks after the natural gas pipeline was filled with seawater and the remnants of natural gas. “The work aims to preserve the damaged pipeline by installing customized plugs at each of the open pipe ends to prevent further gas blow-out and the introduction of oxygenated seawater,” Denmark’s energy agency said.

The $11 billion pipeline project to pump Russian gas to Germany was hugely contentious for years, with Washington opposing it, before it was blown up in a ‘mysterious’ sabotage operation. The Western mainstream media has since backed off its repeat accusations that Moscow must have blown up its own vital pipeline, in light of revelations and a recent consensus that it was either a team of Ukrainian specialists on a ‘rogue’ yacht or else a major CIA op with help from the US Navy. While Scandinavian countries were once leading the accusations and investigations against Moscow related to the sabotage, suddenly Denmark appears to be working with ‘pariah’ Russia. All of this is happening as Washington still has far-reaching sanctions on Russia as well as the NS2 Russian operator, Gazprom’s Nord Stream 2 AG.

“The damaged line of NS2 is estimated to still contain approximately 9-10 million cubic meters of natural gas, while the intact line remains filled with gas, the Danish agency said,” Reuters notes. “The United States in December issued further sanctions on the operator and other Russian entities saying it considers Nord Stream 2 a Russian geopolitical project and opposes efforts to revive it,” the report adds. This has raised the crucial question of whether the Russian entity’s supposed environmental mitigation efforts are but cover to eventually revive the controversial project. This brings up other questions of context and timing. After all, the Danish government is currently locked in a very public battle and war of words with the new Trump administration over Greenland’s sovereignty. Is the tiny NATO country of Denmark in search of any and all possible leverage?

From close US ally to lashing out… And given the Ukraine war increasingly seems unwinnable from the Western perspective, is it time for a European reset vis-a-vis Russia and its heavily relied upon natural gas? The following hit Politico on Tuesday: “France has discussed with Denmark sending troops to Greenland in response to United States President Donald Trump’s repeated threats to annex the Danish territory, French Foreign Minister Jean-Noël Barrot said. Asked about calls to send EU troops to Greenland, Barrot said in an interview with France’s Sud Radio that France had “started discussing [troop deployment] with Denmark,” but that it was not “Denmark’s wish” to proceed with the idea. Barrot’s comments came as Danish Prime Minister Mette Frederiksen was in the middle of a lightning tour of European capitals to drum up support from allies in dealing with Trump.”

Essentially, at the very moment Denmark is trying to “drum up support” within Europe to stand up to Trump, the Danish government goes from condemning Russia’s sanctioned Gazprom to working with it and authorizing it to do work on NS2. But likely there will be a shrug from the White House, given the current broader context is Trump is trying to get Moscow to the negotiating table in hopes of quickly winding down the Ukraine war.

Long from Pepe. This is just a small part.

• Dancing to Trump’s Disco Inferno (Pepe Escobar)

Now to the war against the Global Majority. Inestimable Prof. Michael Hudson is adamant: in an absolutely must read essay, he concisely explains that “when Trump promised his voters that the United States must be the ‘winner’ in any international trade or financial agreement, he is declaring economic war on the rest of the world.” The key Hudson take away: If nations in the Global South are to save their economy “from being plunged into austerity, price inflation, unemployment and social chaos”, they will have to “suspend payments on foreign debts denominated in dollars.” It’s a work in progress: “Circumstances…are forcing the world to break away from the US-centered financial order.

The US dollar’s exchange rate is going to soar in the short term as a result of Trump blocking imports with tariffs and trade sanctions. This exchange-rate shift will squeeze foreign countries owing dollar debts in the same way that Mexico and Canada are to be squeezed. To protect themselves, they must suspend dollar debt service.” There may be serious problems ahead for Mr. Disco Inferno: “Trump’s America First political theater that got him elected may get his gang unseated as the contradictions and consequences of their operating philosophy are recognized and replaced. His tariff policy will accelerate US price inflation and, even more fatally, cause chaos in US and foreign financial markets. Supply chains will be disrupted, interrupting US exports of everything from aircraft to information technology. And other countries will find themselves obliged to make their economies no longer dependent on US exports or dollar credit.”

Prof. Hudson notes how Trump “thinks that the US economy is like a cosmic black hole, that is, a center of gravity able to pull all the world’s money and economic surplus to itself. That is the explicit aim of America First. That is what makes Trump’s program a declaration of economic war on the rest of the world. There is no longer a promise that the economic order sponsored by US diplomacy will make other countries prosperous. The gains from trade and foreign investment are to be sent to and concentrated in America.” The EU, in the Global North, is even more vulnerable to “America First”. Davos came and went with a mere blip on the screen, apart from the odd US banker bragging about “peak pessimism” in Europe – linked to the incoming Trump tariff tsunami – and head of the European Central Bank Christine “Look at my new Hermes scarf” Lagarde wondering it was “not pessimistic” to say that Europe is facing an “existential crisis”.

Trump offers Ellison and Altman et al $500 billion to make AI cheaper. Sounds like a joke, but they mean it. Now Oracle and OpenAI are not focused on cheap fast AI, but on what to do with all that money. With $500 billion on the table, why do it for $50 billion, even if you could?! And where’s Elon?

• How China Became Ideal Incubator for DeepSeek, US May Struggle to Follow (Sp.)

The seemingly out-of-nowhere rise of Chinese dark horse AI language model DeepSeek has tanked US tech stocks, with President Trump calling it “a wake up call for our industries that we should be laser focused on competing to win.” A leading technology expert tells Sputnik why may be easier said than done. “In a nutshell, China’s advances in AI highlight that tech leadership is not a birthright of the West anymore,” veteran independent cybersecurity expert and digital strategy advisor Lars Hilse said, commenting on DeepSeek’s emergence overnight to trump all of America’s most advanced large language models in coding, complex problem-solving and analysis benchmarks.

Hilse says China’s large language model breakthrough was made possible by: the state’s timely 2017 Next Generation AI Development Plan, “which prioritizes AI as a critical area for economic and tech dominance,” “China’s vast population, and digitized ecosystem generating unparalleled amounts of data, which is essential for training sophisticated AI models,” a “talent pipeline” assured by China’s “heavy investment into STEM education”, allowing companies like DeepSeek to pick from a pool of candidates “without compromising cutting edge R&D and cost efficiency, prioritization of software optimization, semiconductor production and chip stockpiling amid US restrictions. Globally, Hilse said, the model’s popularity stems from its open source nature, which can’t be said about its competitors.

Ultimately, the US now faces the prospect of a “fragmented global tech order,” and China setting tech standards in emerging markets, “which in turn erode both economic as well as ideological influence,” the observer said. Accordingly, “the upcoming decade will test whether the West can sustain its innovation edge or whether the sanction-induced improvisation efforts of China will yield technological dominance.” “Rapid scaling, state-backed resource mobilization – and most importantly – the adaptive resilience under pressure created by sanctions” – these are the factors that made DeepSeek’s success possible, Hilse said.

“Now, the US clearly retains advantages in creativity and foundational research but has to (like the West in general) chronic under-investment in manufacturing and infrastructure, fragmented policy and corporate thinking as well as over-reliance on sanctions as a ‘Swiss Army knife’, which in this case, too backfired in that it put China under pressure to improvise. Whether the US will win this race will depend on whether they can unify its entrepreneurial culture with strategic industrial policy, like Trump’s ‘Stargate’ initiative, and whether China can in that time transition from a fast follower to an actual pioneer in global tech standards,” the observer summed up.

Jordan and Egypt don’t want 1,5 million Palestinians. But they get a lot of US aid money.

Reminder: the official policy is still the two-state solution.

• Trump: Let’s Make Money In Gaza But First Dump The Palestinians (Jay)

Trump’s serendipity is the only thing geopolitical analysts can bet on as if there’s one thing we can all agree that we can predict with certainty about how he will resolve all the world’s problems, is that he will not be predictable. He relies heavily on his own instincts and vanities and sees opportunity everywhere. His unfettered support for Netanyahu’s genocide might just yet still shock his more die-hard supporters, given that he posted unflattering social media clips about the Israeli leader in December and yet is ready to throw his weight behind Israel’s bolder ambitions of wiping every Palestinian off the surface of Israel. The big plan is no longer a conspiracy theory.

As months went by and the whole world witnessed the breathtaking depravity of Israeli soldiers murdering Palestinians – at least 100,000 by even the most conservative estimates – some, like myself, were bold enough live on TV to suggest that it seemed that the big plan was to completely eradicate Palestinians from Gaza, forcing neighboring countries to take what was left. For those of us who assumed this, we hoped we were wrong. And yet in the last couple of days, Trump has let the cat out of the bag and revealed this is in fact the plan, one which he supports – explaining perhaps why Netanyahu was never interested in discussing a two-state solution or what the make-up of an administration there might look like under the leadership of Palestinian president Mahmoud Abbas.

Trump has suggested that neighboring Arab countries should take in Palestinian refugees and “clean out” the embattled Gaza. Speaking to journalists aboard Air Force One on 25th of January, Trump said he spoke to King Abdullah II of Jordan about the war and was planning to speak with Egyptian President Abdel Fattah el-Sisi the following day. “I’d like Egypt to take people, and I’d like Jordan to take people,” Trump said. “You’re talking about probably a million and a half people, we just clean out that whole thing. It’s a real mess.” What is worrying about this statement is how the idea itself, which he must have supported all along, like so many feral schemes that seem to appear from nowhere, is based on Trump being very badly briefed about the Middle East. If he listens to his advisers at all, they should have told him that neither Jordan nor Egypt would ever entertain the idea of taking huge numbers of Palestinians under any circumstances.

Any two-bit hack in the region can tell you that the current situation in neighboring countries which have taken Palestinian refugees since 1948 is very bad for both the refugees themselves and for the host countries. In Lebanon, they are kept in ‘camps’ which are off limits, normally, to Lebanese police and security forces, where the UN gives them the bare minimum to eat and where terrorism is rife – creating an internal security problem for the state which often raises its ugly head now and again. In Jordan, the King already has a difficult job keeping his country on an even keel with the high percentage of Jordanians originating from Palestine, which brings its own challenges itself politically; the last thing King Abdullah needs is more of them arriving as refugees.

In Syria too, Palestinians have settled in camps and accepted they are third class citizens although it is less clear how the new leaders of the country – who are the most extreme terrorists stemming from ISIS – will treat them, given they are broadly aligned politically with them. The Trump bombshell is revealing. One the one hand the vitriol that Trump is happy to show against Netanyahu on social media is probably a sham – he has a track record of pretending to not like certain world leaders in front of the cameras while admiring them in private; and secondly, unlike what we are lead to believe, the old doctrine that Israel controls U.S. foreign policy is still true, perhaps even more so under Trump than Biden. The plan to level Gaza and then turn to the international community and say ‘hey, look it’s uninhabitable, there’s nothing there now…it would be inhumane to put people there’ is now looking more and more like official policy.

The only real question is how weak western countries will be in supporting this plan. Will the EU just follow U.S. foreign policy blindly like it always has done in the past? It’s unimaginable that Spain and Ireland would allow this genocide to be swept under the carpet so that Israel can rebuild from the ground up a new Gaza for even more illegal settlers, while a new Suez-like canal mega project is built to compete with Egypt’s, right? Is Trump going to be part of this cash cow? Trump 2.0 appears to be even more about finding the deal, than its former term in office. Is it that Trump is listening to his advisors? But their mandate is not to advise him on what’s best for America, just what’s best for him? Show me the deal.

Ozempic

Singer Avery starts crying, says she has been diagnosed with a bone-thinning disease from Ozempic, begs her followers not to take the drug.

She says she has osteoporosis & osteopenia after taking the drug to lose weight.

“Please use me as an example.”pic.twitter.com/I2cL55YXo3

— Collin Rugg (@CollinRugg) January 27, 2025

RFK

"I believe that just like Trump was the only person who could defeat the duopoly, @RobertKennedyJr is the unique person who knows how the business structure works. He understands the law and he understands the science very well. And so we need to get him confirmed."

— The Darkhorse Podcast (@thedarkhorsepod) January 28, 2025

TRAITOR: In an effort to put the final nail in his political career, disgraced Mike Pence is running an attack ad opposing RFK's confirmation in the Senate. The ad uses Trump's criticisms of RFK back when he was running for president. Pence is literally the worst Republican. pic.twitter.com/HaNzXLsWsm

— @amuse (@amuse) January 28, 2025

Gain of function

https://twitter.com/i/status/1884195491287560584

Carr

Jimmy Carr doesn't hesitate to fry a heckler pic.twitter.com/XuQ8AZCJ7a

— internet hall of fame (@InternetH0F) January 28, 2025

Flow

https://twitter.com/i/status/1884283332814602434

Herding

https://twitter.com/i/status/1884013749364752576

Sleep

— Doglover (@puppiesDoglover) January 27, 2025

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.