Margaret Gillies Charles Dickens 1844

CNN

— Elon Musk (@elonmusk) February 13, 2025

182

https://twitter.com/i/status/1889801494897238094

Trump Zel

https://twitter.com/i/status/1890000851185668123

Tulsi

https://twitter.com/i/status/1889873438791073796

Benz

https://twitter.com/i/status/1889851950189125656

Leavitt

The DOGE subcommittee just discovered $2.7 TRILLION in improper payments in Medicare and Medicaid overseas, to people who should not have gotten it.

Democrats, SHUT THE FUCK UP! This government's spending needs to be audited and gutted. pic.twitter.com/da2sjib7e5

— Errol Webber (@ErrolWebber) February 12, 2025

https://twitter.com/i/status/1889744236867707247

"Does Elon Musk have powers of the presidency?"

Karoline Leavitt: "Absolutely not. That's a ridiculous question — and nothing more than a failed attempt by the media to try and sow division. We saw them do it in the first term; we're not going to let them do it in the 2nd term." pic.twitter.com/RuwzSir3AS

— DogeDesigner (@cb_doge) February 12, 2025

Tillis

This disgusting threat was made against @elonmusk for helping President Trump eliminate government waste and protect taxpayer dollars. We need to find out who paid for this and who allowed it to be posted.

cc: @MayorBowser pic.twitter.com/ub2Vbpznjf

— Senator Thom Tillis (@SenThomTillis) February 12, 2025

Rand Paul

Senator Rand Paul: "And then we now have Pfizer paying $800 million to the NIH to share the patent. We have Moderna paying $400 million, over a trillion dollars. And so it becomes, I would think, impossible for a human to be objective. You know, if you give me a trillion dollars,… pic.twitter.com/NpQ8eKXVDD

— Camus (@newstart_2024) February 13, 2025

JD

JD Vance criticizes “American leaders” who pick a side in the war in Ukraine:

“Unfortunately, you got a lot of American leaders who like to beat their chest and say; this [Ukraine] is the good guy and this [Russia] is the bad guy.”

*Russia is the bad guy pic.twitter.com/7uVg0d9i5w

— The Intellectualist (@highbrow_nobrow) February 13, 2025

Full collision course with the MIC/deep state.

And: you can demand that Europe pays more, or you can pay less yourself.

• Trump To Xi, Putin: Let’s Cut Military Budget In Half – Russia Back In G7 (ZH)

On Thursday President Donald Trump continued to signal positive feelings about a future relationship with Russia and Putin, telling reporters that he’d like to see Russia invited back in to join the The Group of Seven major economies, or G7, which until 2014 was the G8 when Russia was included. “I’d love to have them back. I think it was a mistake to throw them out. Look, it’s not a question of liking Russia or not liking Russia. It was the G8,” Trump said from the Oval Office upon announcing new US reciprocal tariffs. “I said, ‘What are you doing? You guys – all you’re talking about is Russia and they should be sitting at the table.’ And he then added, “I think Putin would love to be back.”

The G7 countries are Canada, France, Germany, Italy, Japan, the UK and the US. In 2014 these nations decided to expel Russia over the annexation of Crimea, but Moscow pointed out that Crimeans overwhelmingly voted to become part of the Russian Federation after a popular referendum. Another highlight from the Oval Office press conference was when the president called on China and Russia to join the United States in agreeing to cut their enormous defense budgets in half. He said in the context of also urging the three major powers to restart nuclear arms control talks.

“One of the first meetings I want to have is with President Xi of China, President Putin of Russia. And I want to say, ‘let’s cut our military budget in half.’ And we can do that. And I think we’ll be able to,” Trump declared. According to an Associated Press summary of the comments: Speaking to reporters in the Oval Office, Trump lamented the hundreds of billions of dollars being invested in rebuilding the nation’s nuclear deterrent and said he hopes to gain commitments from the U.S. adversaries to cut their own spending. “There’s no reason for us to be building brand new nuclear weapons, we already have so many,” Trump said. “You could destroy the world 50 times over, 100 times over. And here we are building new nuclear weapons, and they’re building nuclear weapons.”

“We’re all spending a lot of money that we could be spending on other things that are actually, hopefully much more productive,” Trump continued. Russia and the US have long had the world’s biggest nuclear arsenals, but China has in the last ten years been making strides to greatly bolster its strategic capabilities, which has alarmed the West. Trump warned that any future nuclear use by a global power is “going to be probably oblivion.” Likely Moscow and Beijing will receive these words positively as an overture, especially on the nuclear front, but neither will actually heed Trump’s call to pledge a 50% reduction in defense spending – especially when Russia is at war in Ukraine and under US-EU sanctions. They might tell the Trump White House instead: ‘your move first’.

The Munich Security Conference was going to take place anyway, but it acquires a whole new status now. JD Vance leads the US delegation, Foreign Ministers Rubio and Lavrov(?!) will be present. Perfect settings to prepare the Putin-Trump get-together. Not sometime in the future, but today, Feb. 14, and over the weekend. Things move fast.

• Russia and US To Hold ‘High-Level’ Meeting In Munich Friday – Trump (RT)

President Donald Trump has announced that “high-level” US representatives will meet their Russian counterparts at the Munich Security Conference on Friday to discuss a resolution to the Ukraine conflict. President Vladimir Putin and his US counterpart spoke for nearly 90 minutes by phone on Wednesday, marking the first known direct interaction between the Russian and US heads of state since the escalation of the Ukraine conflict in February 2022. On Thursday, Trump said the phone call paved the way for further direct contacts between American and Russian officials. “They’re having a meeting in Munich tomorrow. Russia is going to be there with our people,” Trump told journalists at the White House on Thursday. Trump added that “Ukraine is also invited, by the way,” but did not specify the format of the meeting or clarify whether it would be a three-way dialogue or a series of bilateral talks.

“Not sure exactly who’s going to be there from any country, but high-level people from Russia, from Ukraine, and from the United States,” the US leader added. Kremlin spokesman Dmitry Peskov said earlier on Thursday that the fact that both presidents had expressed a willingness to engage in dialogue was a “very important achievement” that has “set in motion an apparatus of aides, ministries and so on, that will now gradually begin dialogue and prepare the next contacts.” “Now that the leaders have demonstrated political will and provided their aides with the necessary instructions to initiate communication, we ask for a bit of patience. These discussions need time to gain momentum,” Peskov said.

The Munich Security Conference is taking place from February 14 to 16 in Munich, Germany. US Vice President J.D. Vance will lead the American delegation at the MSC, where he is expected to meet with Ukraine’s Vladimir Zelensky. Secretary of State Marco Rubio said the conference is an opportunity for American officials to “lay out a broad path forward” on Ukraine. Meanwhile, US presidential envoy for the Ukraine conflict Keith Kellogg is reportedly expected to make it clear that the US has no intention of deploying troops to protect Ukraine and wants European NATO allies to increase their defense spending. Russian officials have not attended the Munich Conference since 2022, and Moscow has yet to confirm its participation this year or announce the composition of its delegation.

“The liberal world order is no longer a guiding principle – it is a relic of the past..”

• Trump’s Call With Putin Marks A Shift In Global Power (Fyodor Lukyanov)

The long-anticipated phone call between Vladimir Putin and Donald Trump has finally taken place, sending shock waves through the geopolitical landscape. But before anyone gets carried away with triumph or despair, it’s worth recognizing what has actually happened: Russian-US relations have simply returned to their natural state – one of strategic rivalry, conflicting interests, and fundamental differences in worldview. For decades, the US pursued a fantasy – one where it could reshape Russia in its own image, first through incentives and later through coercion. Washington believed it could mold Moscow into a compliant partner within the ‘liberal international order’, an illusion that only collapsed when reality hit: Russia was never going to be remade. Meanwhile, Moscow spent years trying to find common ground, adjusting its own policies in hopes of reaching a workable coexistence.

That experiment, too, ended a decade ago. The dissolution of the Cold War system in the late 1980s was a historical anomaly, a fluke that many mistook for a permanent transformation. The Western narrative of ‘victory’ was premature – history does not end, it evolves. Over time, the illusion of a unipolar world became harder to sustain, and the global balance of power began shifting. Those who benefited from the old order clung to it desperately, while those who felt shortchanged pushed back harder. Ukraine became the unfortunate fault line in this struggle, the battleground of irreconcilable visions. What is happening now is not the beginning of a new era but the inevitable correction of an old one.

The US, even under Trump’s presidency, has recognized that great power rivalry is once again the defining feature of international politics. But unlike previous decades, when ideological battles masked geopolitical interests, the new competition is more pragmatic, stripped of the pretense of universal values. The liberal world order is no longer a guiding principle – it is a relic of the past. This shift does not guarantee peace, nor does it eliminate the risks of confrontation. But it does bring a certain rationality back into the equation. The West’s ideological zeal, which often led it to take reckless, counterproductive actions, is giving way to a more sober assessment of power and interests. The focus is no longer on forcing one side to submit, but on negotiating tangible advantages.

Russia, meanwhile, is positioned as a key player in shaping this new world order. The strategic fantasies of the 1990s have been replaced with a hard-nosed realism that acknowledges the limits of Western power. The reset to ‘factory settings’ does not mean stability – it means a return to the fundamentals of global politics, where strength, influence, and calculated diplomacy dictate the course of history.

The view from Moscow: “..the Trump team apparently “holds the view that everything must be done to stop the war and for peace to prevail..”

• Putin-Trump Summit On The Way – Kremlin (RT)

It is hard to overestimate the significance of the recent phone call between Russian President Vladimir Putin and his US counterpart Donald Trump, Kremlin spokesman Dmitry Peskov has said. He also noted that the presidents have instructed their teams to lay the groundwork for the summit. The call on Wednesday marked the first known conversation between the US and Russian leaders since the escalation of the Ukraine conflict in February 2022. Trump has since signaled that he is “okay” with keeping Ukraine out of NATO and suggested that it is “unlikely” that Kiev could regain all of the territory it has lost to Russia over the past decade. Trump also noted that the presidents had exchanged invitations to visit each other’s countries.

Speaking to reporters on Wednesday, Peskov described the phone call as “a very important conversation.” “Against the backdrop of what has been happening for several years, there have been no contacts at the highest level between Moscow and Washington,” he said, noting that this landscape did not contribute to solving the Ukraine crisis. Unlike the administration of ex-US President Joe Biden, which believed that “everything must be done to ensure that the war continues,” the Trump team apparently “holds the view that everything must be done to stop the war and for peace to prevail,” Peskov said. “We are much more impressed by the position of the current administration, and we are open to dialogue,” the spokesman stressed. Peskov added that the leaders would remain in touch regarding a summit.

“They will focus on a separate meeting; they also agreed that instructions would be immediately given to the relevant assistants so that they would begin the relevant work.” At the same time, Peskov declined to reveal which side had initiated the engagement, while clarifying that there has been no agreement on whether Trump will come to Moscow to attend the Victory parade to celebrate the Soviet victory over Nazi Germany on May 9. “Exchanging mutual invitations is one thing, but focusing on a separate bilateral meeting is a different process,” the spokesman noted. Regarding a potential territory swap with Ukraine, Peskov cautioned against “getting ahead of ourselves.” “There is political will… to conduct a dialogue to reach a settlement… We need to wait for… at least the first results of the joint work.”

At the same time, Peskov would not confirm or deny Trump’s remarks that Saudi Arabia would host a summit between the two leaders. He also did not provide any timeline for a potential Trump-Putin meeting, or when Russian and American work groups could get down to negotiations. “There is definitely a need for such a [Trump-Putin] meeting to be held promptly. The heads of state have a lot to talk about… It is also impossible to speculate on any deadlines at this point, because the work will only begin these days.”

“The idea that Trump and Putin could strike a deal on Ukraine [..] poses an existential threat to the current European security order.

• Trump Wants A Deal With Russia – But Can He Deliver? (Suchkov)

The defining geopolitical rivalry of the 21st century may be between the United States and China, but few interactions in global politics draw as much scrutiny and intrigue as those between America and Russia. While the future world order may hinge on the dynamics between Washington and Beijing, the stability of the world itself often depends on the relationship between the US and Moscow. Wednesday’s phone call between Presidents Vladimir Putin and Donald Trump was a reminder of this enduring reality. It was also a signal that, for all the efforts to isolate Russia, serious negotiations are back on the table.

Unlike his predecessors, Trump has never treated Russia with the hostility so often expected in Washington. While he has mocked and insulted rivals and allies alike, from Mexico to NATO partners, Russia and India remain two notable exceptions. The US foreign policy establishment readily accepts Trump’s warmth toward India but views his respectful approach to Russia as something suspicious. Since his first presidency, speculation has swirled around whether Trump genuinely sees Russia as a major power deserving of engagement, or whether he simply understands that diplomacy with Moscow requires mutual respect. Whatever the case, the meticulous preparations that preceded this latest phone call suggest a stark contrast with Trump’s often impulsive approach to other world leaders. Every face-to-face meeting between Trump and Putin during his first term was marked by strong personal chemistry and productive discussions on key global issues.

However, each time Trump returned to Washington, those tentative diplomatic breakthroughs were undermined by a political establishment determined to preserve the narrative of a Russian threat. Allegations of “Russian interference” sabotaged potential cooperation on Syria, Ukraine, counterterrorism, missile defense, and arms control. Now, with Trump back in office, those same forces are once again mobilizing to block any steps toward détente. The idea that Trump and Putin could strike a deal on Ukraine — one that would leave behind those who have invested political and financial capital into prolonging the war — poses an existential threat to the current European security order. It is no coincidence that this phone call took place just before the Munich Security Conference, where many of these “investors in war” gather to reinforce their commitments to perpetual conflict.

Yet, this conversation is merely the first step in a long and uncertain road. Trump’s primary focus remains making America — not Russia — “great again,” and any agreements he seeks with Moscow will be dictated by that priority. However, his openness to negotiation and strategic realism signal a shift in approach that could redefine the global balance of power. The next crucial moment will be an in-person meeting between the two leaders. Whether that meeting leads to a genuine breakthrough or another cycle of political sabotage remains to be seen. But one thing is clear: with the world watching and the stakes higher than ever, Trump and Putin have set the agenda — and their adversaries are paying attention.

“..Kennedy joined Trump’s campaign, with the latter vowing to let him “go wild” on healthcare policy.”

• RFK Jr. Confirmed As Trump’s Health Secretary (RT)

The US Senate confirmed Robert F. Kennedy Jr. as Secretary of Health and Human Services on Thursday. The confirmation was secured despite Democratic objections to what they described as Kennedy’s promotion of ‘conspiracy theories’ about vaccines and nutrition. The vote was largely divided along party lines, with 52 Republicans supporting the nomination and 48 Democrats opposing it. Former GOP leader Mitch McConnell was the only Republican to vote against the confirmation. Kennedy, 71, an environmental lawyer, was nominated by US President Donald Trump shortly after his reelection victory in November last year. The vote breakdown marks the second time in as many days that McConnell has opposed one of Trump’s nominees. He was the only Republican to oppose the confirmation of Tulsi Gabbard as Director of National Intelligence on Wednesday.

McConnell said he refused back RFK Jr. due to the nominee’s vaccine skepticism. “I’m a survivor of childhood polio … I will not condone the re-litigation of proven cures, and neither will millions of Americans who credit their survival and quality of life to scientific miracles,” McConnell stated. Senator Elizabeth Warren, a Massachusetts Democrat, said in a statement that “when dangerous diseases make a comeback and people struggle to access lifesaving vaccines, all Americans will pay the price.” Warren also warned that “with his significant, unresolved conflicts of interest, RFK Jr.’s family could continue profiting from his anti-vaccine agenda while he holds office.”

Kennedy, the founder of the anti-vaccine group Children’s Health Defense, has gained prominence in the US for questioning the safety and effectiveness of childhood vaccinations and promoting the claim that vaccines are linked to autism. He was also a vocal critic of the Covid-19 response measures recommended by the World Health Organization, including the strict lockdowns and rapid rollout of vaccines. Despite this, Kennedy denies being opposed to vaccination, noting that his own children are immunized. During his confirmation hearings, he stated that he simply advocates for stricter studies and safety testing of vaccines. Following an unsuccessful independent presidential bid, Kennedy joined Trump’s campaign, with the latter vowing to let him “go wild” on healthcare policy.

Kennedy has publicly backed Trump’s pledge to end the Ukraine conflict quickly. In a 2023 interview with American journalist Tucker Carlson, he alleged that the US Agency for International Development (USAID), Washington’s primary agency for funding political projects abroad, had funneled $5 billion to support the protests that led to the 2014 Maidan coup. In the interview, Kennedy described USAID as a front for the CIA. He also referenced a leaked phone call between then-US diplomat Victoria Nuland and the US ambassador to Ukraine, in which Nuland was heard selecting members of Ukraine’s post-coup government – just weeks before the president was overthrown. Kennedy is the son of former US Attorney General Robert F. Kennedy and the nephew of President John F. Kennedy.

NOW – Robert F. Kennedy Jr. takes the oath of office to be sworn in as the 26th United States Secretary of Health and Human Services pic.twitter.com/to5JOGKY6E

— Overton (@overton_news) February 13, 2025

https://twitter.com/i/status/1890081625368854561

Schumer's opposition to RFK Jr. is less about public health and more about protecting his political and pharmaceutical allies.

"Mister president, this morning, the senate will vote on the nomination of Robert F. Kennedy to serve as secretary of health and human services. By now,… pic.twitter.com/opRNvj5S8V— Camus (@newstart_2024) February 13, 2025

Europe wants to be important. In reality, it is impotent. Close, but…

Why on earth would Trump and Putin want the likes of von der Leyen or Macron at the table? They would just be in the way.

• Panic Grips European Leaders as EU Left Out of Trump-Putin Call (Sp.)

Russian President Vladimir Putin and his US counterpart Donald Trump discussed Ukraine, the Middle East, energy issues, and the exchange of citizens in a telephone call that lasted for one and a half hours, Kremlin Spokesman Dmitry Peskov revealed. The phone conversation between Vladimir Putin and Donald Trump has triggered a litany of reactions from European politicians. Britain’s Foreign Secretary David Lammy posted a joined statement by several European states that read: “Our shared objectives should be to put Ukraine in a position of strength. Ukraine and Europe must be part of any negotiations.” UK Defense Secretary John Healey claimed that no peace talks could be done “about Ukraine without Ukraine.”

Boris Pistorius, Germany’s defense chief, lamented the development as “regrettable” arguing that the Trump administration had made “concessions” to Russia, while asserting that “it would have been better to speak about a possible NATO membership for Ukraine or possible losses of territory at the negotiating table.” Joining the bandwagon, Germany Foreign Minister Annalena Baerbock added that “peace can only be achieved together. And that means: with Ukraine and with the Europeans.” In addition, Polish Prime Minister Donald Tusk declared that “All we need is peace… Ukraine, Europe and the United States should work on this together.”

For his part, French top diplomat Jean-Noel Barrot insisted that “There will be no just and durable peace in Ukraine without Europeans.” Meanwhile, Estonian Defense Minister Hanno Pevkur chimed in, saying: “Europe is investing in Ukrainian defense, and Europe is rebuilding Ukraine with European Union money, with our bilateral aid – so we have to be there.” And finally, NATO Secretary General Mark Rutte called for turbo-charging defense production among member states, adding: “We have to make sure that Ukraine is in a position of strength.”

It’s not just the money. Europe has no war industry, it has no troops. For decades, it let the US take care of all that. Much cheaper. It will take decades to re-balance this, if ever.

• European NATO ‘Fears Cost’ Of Trump’s Ukraine Burden Shift (RT)

Officials in European NATO states are reluctant to shoulder Ukraine’s security without US backing, The Financial Times reported on Thursday. This week, the US President Donald Trump administration signaled its desire for minimal involvement, once a possible truce is achieved. According to the FT, Washington’s transatlantic allies “fear they will have to bear the cost of postwar security and reconstruction” and are frustrated by Trump’s negotiations with Russia conducted without their input. One source indicated that a scenario where “the US says, ‘We did the ceasefire, and all of the rest is for you to clean up’” wouldn’t work for the EU. The diplomat further noted: “There is a limit to what the EU alone can realistically provide in terms of money, arms, and perhaps boots on the ground.”

Another EU official remarked that “the Americans don’t see a role for Europe in the big geopolitical questions related to the war,” adding: “Trump sees us as money.” Former US President Joe Biden’s stated policy was to stand with Ukraine “for as long as it takes,” a sentiment echoed by the EU and various national governments. The shift in Washington’s stance was articulated by Defense Secretary Pete Hegseth at a meeting of arms donors in Germany on Wednesday. Hegseth characterized Kiev’s ambition to recover territories it has lost since 2014 as “an unrealistic objective,” an “illusionary goal” would only lead to greater suffering. He also dismissed the feasibility of NATO membership for Ukraine and emphasized that any post-ceasefire peacekeeping mission should not involve the US-led military bloc or US forces: “To be clear, as part of any security guarantee, there will not be US troops deployed to Ukraine.”

Trump then made his intentions clear by announcing he had held a “lengthy and highly productive” phone call with Russian President Vladimir Putin. France, Germany, Italy, Poland, Spain, and the UK issued a joint statement on Wednesday evening alongside the EU’s top diplomat, Kaja Kallas, reaffirming support for the previous US government’s approach. Releasing the statement on Wednesday Kallas declared Ukrainian territorial integrity “unconditional” and demanded Western Europe has a “central role” in any negotiations. Russia has consistently expressed concerns over NATO’s eastward expansion since the 1990s, viewing it as a direct threat to its national security. Moscow has viewed Ukraine’s potential NATO membership as a “red line” and a significant factor in the ongoing Ukraine conflict.

“While [Trump and Putin] negotiate on peace, EU officials issue worthless statements. You can’t request a seat at the negotiating table. You have to earn it! Through strength, good leadership and smart diplomacy.”

• Orban Sees EU As Undeserving Of Role In Ukraine Settlement Talks (TASS)

The EU leadership has not earned a seat at the Ukraine negotiating table alongside Russia and the US, Hungarian Prime Minister Viktor Orban said. His comments came in response to a statement by EU foreign policy chief Kaja Kallas, who, following phone talks between Russian President Vladimir Putin and US President Donald Trump, insisted that Europe and Ukraine should be included in any negotiations to resolve the conflict. The statement was issued on behalf of the EU as well as France, Germany, Poland, Italy, Spain and the UK.

“This declaration is a sad testament of bad Brusselian leadership. While President Donald Trump and President Putin negotiate on peace, EU officials issue worthless statements. You can’t request a seat at the negotiating table. You have to earn it! Through strength, good leadership and smart diplomacy. The position of Brussels – to support killing as long as it takes – is morally and politically unacceptable,” Orban wrote on X. Kremlin Spokesman Dmitry Peskov said Putin’s conversation with Trump on Wednesday lasted almost 90 minutes. They discussed the crisis in Ukraine, the Middle East and exchanging convicted nationals of the two countries. The Russian and US leaders agreed to maintain communication and arrange a face-to-face meeting.

But that excuse is all Europe has.

• Vance Blasts ‘Russian Meddling’ Excuse (RT)

Western mainstream political parties blaming Russian meddling for electoral failures are increasingly out of touch with voters, US Vice President J.D. Vance has said. EU politicians would rather suppress dissent than reflect on their actions, he told the Wall Street Journal on Thursday. Ahead of attending the Munich Security Conference on Friday, Vance urged Western politicians to embrace the rise of anti-establishment politics. He criticized attempts to dismiss viewpoints on issues such as traditional values and immigration by those who attribute them to “misinformation.” “If your democratic society can be taken down by $200,000 of social media ads, then you should think seriously about how strong your grip on or how strong your understanding of the will of the people actually is,” Vance said.

Hillary Clinton, former US secretary of state and presidential candidate, notably popularized the tactic of blaming Russia following her loss to Donald Trump in the 2016 US presidential election — a claim Moscow has consistently denied. A recent instance occurred in Romania in December, where the Constitutional Court annulled the first round of voting in the country’s presidential election after right-wing anti-establishment candidate Calin Georgescu unexpectedly led the race. Media reports revealed that the alleged Russian interference cited by the court actually stemmed from a consulting firm associated with the ruling National Liberal Party. Allegations of Russian efforts to undermine Romanian democracy were promoted by Context, an NGO funded by the US through the National Endowment for Democracy — an organization that according to its co-founder Allen Weinstein is mostly doing in the open what the CIA previously did covertly.

The narrative suggesting Moscow bolstered Georgescu was supported by the US Embassy in Romania and senior American officials. Vance argued that mainstream parties in the EU are “kind of terrified of their own people.” He pointed to the anti-immigration Alternative for Germany (AfD) party, which despite electoral success struggles to find coalition partners due to being labeled extremist by centrist factions. Elon Musk, a close ally of Trump, ignited controversy in Berlin by endorsing the AfD in this month’s federal election, asserting that “the entire fate of Europe” hinges on its outcome. In response, the German government accused the billionaire of election interference, with Chancellor Olaf Scholz stating that freedom of speech does not encompass the promotion of “extreme-right positions.”

“..Trump, Elon Musk and the DOGE sniff out “the fraud and corruption of the Biden Ukraine project.”

• Musk Fraud Probes May Explain ‘Urgency’ of Trump-Putin Call (Sp.)

“Trump appears to have a better understanding of the causes and conditions of the Ukraine-Russia and US/NATO versus Russia conflict,” retired US Air Force Lt. Col and ex-DoD analyst Karen Kwiatkowski told Sputnik, commenting on Wednesday’s lengthy telephone conversation between the Russian and US leaders and its focus on Ukraine. “His tendency to be practical (something we are not seeing in his Israel-Gaza policy) is apparent here. The signal is one of deal making and practicality,” Kwiatkowski said. The call comes at a decisive moment, the observer stressed, pointing out that Congress will be teeing up a new package of aid to Ukraine shortly, with current commitments to run dry in March, as Trump, Elon Musk and the DOGE sniff out “the fraud and corruption of the Biden Ukraine project.”

“I suspect this cannot be kept under the lid much longer, so this may explain the urgency of a settlement,” Kwiatkowski said. “Whether Trump gets a settlement he likes from Russia” or not “is not clear, but I think Trump realizes Russia has already won, and Europe/NATO, in agitating for a long costly wasteful war, needs to start dealing with what it has wrought,” the analyst said. Earlier in the day Wednesday, President Trump took to Truth Social to announce that he had a “lengthy and highly productive” phone call with President Putin, and that the leaders had discussed an array of issues, focusing on Ukraine.

“We each talked about the strengths of our respective Nations, and the great benefit that we will someday have in working together. But first, as we both agreed, we want to stop the millions of deaths taking place in the War with Russia/Ukraine,” Trump said. “We have also agreed to have our respective teams start negotiations immediately,” Trump said, adding that his first step would be to call Volodymyr Zelensky. Kremlin spokesman Dmitry Peskov confirmed important details on the call, including Putin and Trump’s expression of mutual commitment to a peaceful resolution to the Ukraine crisis. Putin reiterated the importance of addressing the “root causes” of the conflict, Peskov said, and invited Trump to visit Moscow. The conversation was said to have lasted for one and a half hours.

“..criticized Zelensky in parliament, accusing him of transforming Ukraine into a dictatorship with “closed borders, state-controlled television, and leader KimJong-Ze..”

• Zelensky Targets Political Opposition (RT)

Ukrainian leader Vladimir Zelensky has imposed personal sanctions on five prominent individuals, including potential political rivals former President Pyotr Poroshenko and exiled opposition leader Viktor Medvedchuk. Zelensky previously suspended elections nationwide, citing the ongoing conflict with Russia. On Wednesday evening, Zelensky put into power an order penned by the National Security and Defense Council, which he chairs. In addition to the two politicians, it targeted three wealthy entrepreneurs, including Poroshenko’s business partner Gennady Bogolyubov, former Dnepropetrovsk Region Governor Igor Kolomoysky, and former MP Konstantin Zhevago. Reports of impending sanctions against Poroshenko have circulated in the Ukrainian media since January.

The former president, now serving as an MP, has condemned Zelensky’s move as politically motivated and labeled it “a crime” with “many accomplices.” He accused Zelensky of attempting to scapegoat others for his own mistakes. MP Aleksey Goncharenko, a political ally of Poroshenko, criticized Zelensky in parliament, accusing him of transforming Ukraine into a dictatorship with “closed borders, state-controlled television, and leader KimJong-Ze,” alluding to the Western perception of North Korea. The sanctions issued by Zelensky vary in severity, ranging from largely symbolic revocations of state awards to the freezing of assets, prohibiting legal contracts, and barring the use of mass media for communication. Zelensky has framed the measures as essential for “protecting our state and restoring justice,” alleging that the five targeted individuals “earned billions by effectively selling out Ukraine and Ukrainian interests.”

The sanctions were announced shortly after US President Donald Trump reportedly secured Zelensky’s agreement to transfer $500 billion worth of Ukrainian rare earth minerals as compensation for American military assistance. Trump aims to swiftly resolve the Ukraine conflict while recouping costs for US taxpayers. Zelensky’s presidential term expired last year, although he has refused to call new elections or relinquish power, citing martial law in Ukraine. He maintains that his landslide victory over Poroshenko in 2019 grants him sufficient legitimacy and insists that Ukrainians are not interested in choosing a new leader at this time.

“..wasting taxpayer money on “ridiculous – and in many cases, malicious – pet projects of entrenched bureaucrats..”

• Trump Will Terminate ‘Woke’ Policies – Musk (RT)

US President Donald Trump and his administration will work to end the promotion of diversity, equality and inclusion (DEI) programs across the world, Elon Musk announced at the World Governments Summit in Dubai on Thursday. The billionaire’s statement comes as Trump has launched a campaign aimed at ending DEI initiatives within the federal government since assuming office last month. Shortly after being sworn in, Trump repealed some 78 orders signed by his predecessor Joe Biden. This includes terminating DEI programs and ending protections for transgender individuals. Trump also set a 60-day deadline for federal agencies to cease all DEI-related practices.

Speaking via video link at the Dubai forum, Musk, who currently heads Trump’s newly established Department of Government Efficiency (DOGE), acknowledged that there has been “a lot of pushing of DEI worldwide” by the US and stressed that the new administration “doesn’t agree” with this approach. “We want to terminate that stuff, and we are,” Musk said. He warned that if DEI principles were allowed to continue and be used to implement “crazy things that are untruthful” and “don’t reflect reality” into things like artificial intelligence, it could easily lead to a “very dystopian outcome.” Earlier this month, the billionaire claimed that DOGE had already saved the US over $1 billion by scrapping over 100 contracts related to DEI programs.

Musk also reported that his department has managed to cut federal spending by $1 billion per day by effectively halting “the hiring of people into unnecessary positions, the deletion of DEI, and stopping improper payments to foreign organizations.” Trump has also ordered the dismantling of the United States Agency for International Development (USAID), which was Washington’s primary vehicle for funding political projects abroad. The president accused the agency of wasting taxpayer money on “ridiculous – and in many cases, malicious – pet projects of entrenched bureaucrats,” which included promoting DEI initiative both domestically and internationally. Musk has also called USAID a “criminal organization” and claimed that it had funded bioweapons research.

USAID’s ugly little sister.

• Trump Freezes All National Endowment for Democracy Funding (RT)

US President Donald Trump’s administration has frozen all funding to the National Endowment for Democracy (NED), several media outlets reported on Wednesday. The move is said to have caused a “bloodbath” within the organization, leaving it unable to pay staff or fulfill financial commitments. The NED, established in 1983, is officially a nonprofit organization that provides grants to support democratic initiatives worldwide. However, over the years, it has faced allegations of covertly influencing political outcomes, with critics arguing that it has taken over covert functions previously handled by the CIA, particularly those aimed at overthrowing foreign governments.

Earlier this month, Elon Musk, who heads Trump’s new Department of Government Efficiency (DOGE) and has been in charge of finding ways to cut federal spending, singled out NED, calling it a ”scam” and an “evil organization” that needs to be dissolved. Since then, the organization has reportedly been “under siege” from Musk’s DOGE, according to Free Press. “It’s been a bloodbath,” one NED worker told the outlet, explaining that the organization has been unable to meet payroll and pay basic overhead expenses.

The NED has faced longstanding criticism over its role in supporting political movements to undermine sovereign governments. The Center for Renewing America, a think tank founded by Russell Vought, Trump’s director of the Office of Management and Budget, released a policy paper on February 7, accusing the NED of acting as the “tip of the proverbial spear for heightened CIA and State Department efforts to foster political revolution in Ukraine.” The report claimed that the NED had funneled tens of millions of dollars to a myriad of Ukrainian political entities and anti-Russian interests and “advanced both the ‘Orange Revolution’ and ‘Maidan Revolution’ that paved the way for the current Ukraine-Russia war.”

The NED has also faced accusations of sponsoring “color revolutions” in Georgia and Kyrgyzstan and of funding opposition groups in Belarus, Serbia, and Egypt. “The reasons for defunding NED are as numerous as they are imperative,” Vought’s think tank wrote, listing things like “Ukraine warmongering” and “Middle East meddling” as the most clear and pressing rationales for dismantling the agency. The NED funding freeze comes as part of broader measures by the Trump administration to cut foreign spending. This has already included a crackdown on the US Agency for International Development (USAID), Washington’s primary vehicle for funding political projects abroad. Trump earlier called for the agency to be shut down, claiming it is run by “radical lunatics.”

Easily the craziest story this week. People can’t retire when the mineshaft elevator breaks down.

• DOGE Exposes Insane Federal Use Of Old Limestone Mine (MN)

Elon Musk’s DOGE has revealed that the federal government is using an old limestone mine in Pennsylvania to store tens of thousands, if not millions of physical paper files in cardboard boxes. The files are just retirement documents for federal workers, so could easily be digitised, yet the government has continued to physically store them. The mine is 230 feet underground and requires over 700 workers with the Office of Personnel Management to operate and upkeep it. What the hell? At least if there is a nuclear apocalypse whoever survives in here will have access to…information on retired government workers. Musk shared the insane finding, noting “Maybe it’s just me, but I think there is room for improvement here.”

Maybe it’s just me, but I think there is room for improvement here https://t.co/gQqx3sAOyZ

— Elon Musk (@elonmusk) February 12, 2025

The vault inside Iron Mountain which is equipped with a huge reservoir for geothermal cooling. A 2021 report uncovered that despite spending $106 million spent trying to digitize the process, the government abandoned the idea and decided to stick with the stone mine. Labelling it a “time warp,” Musk noted that “The limiting factor is the speed at which the mine shaft elevator can move determines how many people can retire from the federal government.” “The elevator breaks down sometimes, and nobody can retire,” Musk revealed, adding “Doesn’t that sound crazy?” Musk also revealed that since 2014 they had gotten to the letter B in their efforts to digitize the records.

https://twitter.com/i/status/1889923424145011151

The DOGE post has close to 45 million views at time of writing. Commenting on the mine and other “rot” being exposed by DOGE, White House Press Secretary Karoline Leavitt said Wednesday on Fox News that the media was left in “sheer silence.” “I was watching the faces of the mainstream media reporters who were in the Oval Office, and there was sheer silence because it appeared that many of them who are supposed to be writing the truth about our federal bureaucracy had no idea that the federal retirement system is being processed deep into the ground and is not computerized,” Leavitt said.

BREAKING: @karolineleavitt promises @realDonaldTrump and @elonmusk will shut down the bureaucratic retirement caves.. pic.twitter.com/gVFyczegg7

— Jesse Watters (@JesseBWatters) February 13, 2025

“They, the president and Elon are shining a light on the truth about our federal government. But the mainstream media simultaneously is saying there’s an alleged lack of transparency and access. It’s preposterous,” Leavitt continued, adding “Together, President Trump and Elon, the entire DOGE team and this entire administration are shining a light on the corruption, the waste, the fraud and abuse.” “Sunlight is the best disinfectant, and they are revealing the rot of this city every single day. It’s music to the ears of the American people who voted for this. As you rightly pointed out, 77 million of them liked what President Trump promised on the campaign trail, and he is delivering and it’s fascinating,” Leavitt urged.

“Even Ronald Reagan, the great apostle of smaller government, couldn’t achieve in eight years what Mr. Musk has done in 3 1/2 weeks.”

• Musk: “We Need To Delete Entire Agencies”; Fed Worker Buyout Tops 75,000 (ZH)

Early Thursday, Elon Musk joined Dubai’s annual World Governments Summit via video link to provide an update on his Department of Government Efficiency (DOGE) efforts within the US government, aimed at rooting out corruption and dismantling federal agencies, reducing the federal workforce, and eliminating the shadow government operated in a complex web of NGOs. “We need to delete entire agencies. We need to remove the roots of the weed. That’s not to say there won’t be an increase in future bureaucracy from another administration but it will be from a lower baseline. Nothing is forever but we can strengthen the foundation,” Musk told the crowd.

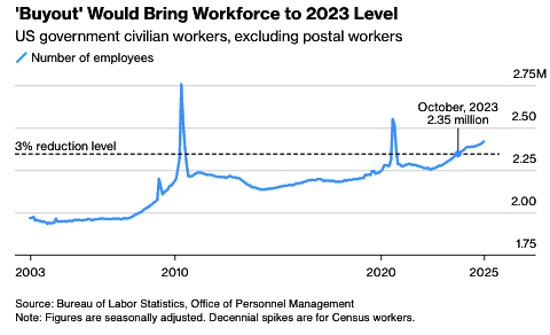

https://twitter.com/i/status/1889921154082807841

President Trump appointed Musk as a “special government employee” to lead DOGE and has waged war against the federal bureaucracy. The latest data from Bloomberg, citing sources familiar with the voluntary resignation program for the federal workforce, indicates that 75,000 workers across various federal agencies have opted to leave. This number only makes up about 3% of the 2.4 million civilian federal workforce, far short of White House Press Secretary Karoline Leavitt’s target of 5% to 10%. This came after a federal judge in Boston lifted his order freezing the buyout program overnight. “The federal workforce grew 6.3% under former President Joe Biden, fueled by pandemic spending programs. A 3% cut to the federal workforce would only bring the number down to 2023 levels,” Bloomberg pointed out.

Source: BloombergEven with the targeted buyouts missing the White House’s estimates, an op-ed by the Wall Street Journal’s deputy op-ed editor, Matthew Hennessey, noted: “Even Ronald Reagan, the great apostle of smaller government, couldn’t achieve in eight years what Mr. Musk has done in 3 1/2 weeks. The billionaire businessman is less apostle than avenging angel. The Department of Government Efficiency is the change we’ve been waiting for.” On Tuesday, Trump signed an executive order to eliminate what he described as “waste and bloat” in the government while “promptly undertaking preparations to initiate large-scale reductions in force.” He called it a “critical transformation” of Washington, DC, and framed the move as a necessary step forward for the nation.

DOGE kicked a roach infested couch and the roaches are now scattering

pic.twitter.com/QcmcR0EARo— Drew Hernandez (@DrewHLive) February 6, 2025

Early Thursday, we noted internet search trends across the DC metro area, including Maryland and northern Virginia counties, indicating growing panic among federal workers in the so-called DC swamp. Searches for “Criminal Defense Lawyer” and “RICO Laws” have erupted in recent weeks. Draining the swamp is long overdue. Yet Democrats are calling for war against Musk and Trump over DOGE’s efforts for a more transparent and efficient government. Some far-left Democrats, like Rep. Robert Garcia, called for supporters to begin arming up.

https://twitter.com/i/status/1889848260954841445

“..the US Department of Defense had committed more than $9 million on two projects called Active Social Engineering Defense (ASED) and Large Scale Social Deception (LSD)”.

• US Govt Paid Reuters For ‘Social Deception’ – Musk (RT)

A subsidiary of Reuters has received millions in US government funding for “large scale social deception” projects, Elon Musk, the head of the Department of Government Efficiency (DOGE), has claimed. In a post on Thursday, Musk weighed in on data from the website USAspending.gov stating that Thomson Reuters Special Services LLC, a subsidiary of Thomson Reuters, had contracts with government agencies. One of the publicly available documents stipulated that the US Department of Defense had committed more than $9 million on two projects called Active Social Engineering Defense (ASED) and Large Scale Social Deception (LSD). Commenting on the document, Musk wrote: “Reuters was paid millions of dollars by the US government for ‘large scale social deception’. That is literally what it says on the purchase order! They’re a total scam. Just wow.”

According to the Pentagon’s Defense Advanced Research Projects Agency, the ASEAD program aims to develop automated defenses against social engineering attacks, which could involve deceptive tactics to manipulate individuals into divulging confidential information. Neither the Pentagon nor USAspending.gov elaborates on the purpose of the program, but both LSD and ASEAD are listed as activities within the realm of engineering and research and development. Reuters was awarded another Pentagon contract that provides the Department of Defense with unidentified advanced development services. The agency has also received around $500,000 from the State Department for access to news services.

Both Musk and US President Donald Trump have vowed to fight corruption and wasteful spending in the US government. In light of this, several federal agencies have terminated contracts totaling $8 million with Politico magazine following Musk’s criticism of these agreements as a “wasteful” use of taxpayer funds. Trump has also suggested that billions of dollars have been misappropriated within agencies such as the US Agency for International Development (USAID), Washington’s primary agency for funding political projects abroad, to pay for favorable media coverage of Democrats. The claim was rejected by several US media outlets, including Politico and the Associated Press.

AI requires lots of energy. Where is that cheap? In the Gulf states.

• The Great AI Game: US, China Vie For West Asian Cash (Cradle)

China’s unveiling of DeepSeek sent shockwaves through the tech industry. The app skyrocketed to the top of Apple’s US App Store, surpassing ChatGPT and Gemini, and triggered a market tremor: US tech giants like Nvidia saw their valuations plunge by $600 billion. The development heightened Washington’s security anxieties, with officials warning that China’s AI advances could give Beijing a military edge and serve as a tool for spreading state-backed narratives. Global investors have responded by shifting capital toward China’s AI sector, signaling confidence in Beijing’s ability to challenge US dominance. Simultaneously, China is accelerating its push for technological self-sufficiency, reducing reliance on western semiconductor firms like TSMC and Samsung.

Beyond economics, AI-driven automation is expected to disrupt the global labor market, displacing jobs in data analysis, translation, and customer service. Meanwhile, China’s surging demand for AI talent is attracting experts from western markets, exacerbating a potential brain drain in the US and Europe. The global AI contest is often framed as a US–China duel, but West Asia is emerging as a decisive force capable of tilting the balance. With DeepSeek proving that western AI hegemony will no longer go unchallenged, Persian Gulf states are reevaluating their AI alliances, making them a critical factor in Washington’s efforts to secure AI investments. Saudi Arabia, the UAE, and Qatar are now considered the “swing states” of AI geopolitics. Their importance in the AI revolution rests on three key pillars: energy, finance, and geography.

Energy is the most obvious element as generative AI data centers require vast amounts of power, and energy-rich countries in West Asia are expected to benefit significantly. Persian Gulf states, rich in energy resources, are well-positioned to benefit from this demand. Financially, oil-rich countries such as Saudi Arabia and the UAE are heavily investing in AI infrastructure and future technologies, making them not only key customers but also influential players. Sovereign wealth funds are channeling billions into AI-related projects through initiatives like Sanabil, a subsidiary of Saudi Arabia’s Public Investment Fund (PIF), which invests $3 billion annually in top-tier venture capital firms across both the US and China. In addition, Prosperity7, the investment arm of Saudi Aramco, made headlines by investing in Zhipu AI, one of China’s largest AI startups, becoming the first non-Chinese investor to do so.

The move highlights West Asia’s evolving strategy of playing on both sides in the geopolitical race for AI, maintaining influence and independence despite growing global pressure to ally with the US or China. Such investments demonstrate the region’s ability to balance geopolitical tensions while expanding its influence in the global AI ecosystem. In addition, the geographical location of West Asia represents a fully untapped advantage in the development of AI globally. Data centers play a pivotal role in improving the speed and quality of digital services for users as service efficiency increases and data centers get closer to the end user. Having multiple data centers in strategic locations ensures that data recovery backups are provided in case of failures.

The region’s location is also an advantage, as West Asia serves as a digital crossroads between Europe, Asia, and Africa. The majority of web traffic between these continents passes through the region, making it a prime hub for global AI deployment. As AI competition intensifies, West Asia is no longer just an emerging market – it is a strategic theater in the tech war between Washington and Beijing. China views the region as an extension of its Digital Silk Road, aiming to expand its technological footprint through cost-effective AI solutions.

The US, on the other hand, is deepening its AI partnerships with Persian Gulf states, trying to ensure that AI infrastructure aligns with western standards. The battle over AI in West Asia transcends mere technological rivalry; it is a contest for economic and geopolitical dominance. With Persian Gulf states positioned as kingmakers in this struggle, their decisions in the coming years could redefine the balance of power in the AI era. The US–China AI war is no longer just a two-player game – West Asia is now firmly in the mix, and its role in shaping the future of AI is only growing.

I have a hard time seeing Musk as a -nuclear- warmonger. For one thing, how would he ever get to Mars?

• The Pentagon Is Recruiting Elon Musk To Help Them Win A Nuclear War (MacLeod)

Donald Trump has announced his intention to build a gigantic anti-ballistic missile system to counter Chinese and Russian nuclear weapons, and he is recruiting Elon Musk to help him. The Pentagon has long dreamed of constructing an American “Iron Dome.” The technology is couched in the defense language – i.e., to make America safe again. But like its Israeli counterpart, it would function as an offensive weapon, giving the United States the ability to launch nuclear attacks anywhere in the world without having to worry about the consequences of a similar response. This power could upend the fragile peace maintained by decades of mutually assured destruction, a doctrine that has underpinned global stability since the 1940s. Washington’s war planners have long salivated at the thought of winning a nuclear confrontation and have sought the ability to do so for decades. Some believe that they have found a solution and a savior in the South African-born billionaire and his technology.

Neoconservative think tank the Heritage Foundation published a video last year stating that Musk might have “solved the nuclear threat coming from China.” It claimed that Starlink satellites from his SpaceX company could be easily modified to carry weapons that could shoot down incoming rockets. As they explain: “Elon Musk has proven that you can put microsatellites into orbit, for $1 million apiece. Using that same technology, we can put 1,000 microsatellites in continuous orbit around the Earth, that can track, engage and shoot down, using tungsten slugs, missiles that are launched from North Korea, Iran, Russia, and China.” Although the Heritage Foundation advises using tungsten slugs (i.e., bullets) as interceptors, hypersonic missiles have been opted for instead. To this end, a new organization, the Castelion Company, was established in 2023.

Castelion is a SpaceX cutout; six of the seven members of its leadership team and two of its four senior advisors are ex-senior SpaceX employees. The other two advisors are former high officials from the Central Intelligence Agency, including Mike Griffin, Musk’s longtime friend, mentor, and partner. Castelion’s mission, in its own words, is to be at the cutting edge of a new global arms race. As the company explains: “Despite the U.S. annual defense budget exceeding those of the next ten biggest spenders combined, there’s irrefutable evidence that authoritarian regimes are taking the lead in key military technologies like hypersonic weapons. Simply put – this cannot be allowed to happen.” The company has already secured gigantic contracts with the U.S. military, and reports suggest that it has made significant strides toward its hypersonic missile goals.

Castelion’s slogan is “Peace Through Deterrence.” But in reality, the U.S. achieving a breakthrough in hypersonic missile technology would rupture the fragile nuclear peace that has existed for over 70 years and usher in a new era where Washington would have the ability to use whatever weapons it wished, anywhere in the world at any time, safe in the knowledge that it would be impervious to a nuclear response from any other nation. In short, the fear of a nuclear retaliation from Russia or China has been one of the few forces moderating U.S. aggression throughout the world. If this is lost, the United States would have free rein to turn entire countries – or even regions of the planet – into vapor. This would, in turn, hand it the power to terrorize the world and impose whatever economic and political system anywhere it wishes.

If this sounds fanciful, this “Nuclear Blackmail” was a more-or-less official policy of successive American administrations in the 1940s and 1950s. The United States remains the only country ever to drop an atomic bomb in anger, doing so twice in 1945 against a Japanese foe that was already defeated and was attempting to surrender.

President Truman ordered the destruction of Hiroshima and Nagasaki as a show of force, primarily to the Soviet Union. Many in the U.S. government wished to use the atomic bomb on the U.S.S.R. President Truman immediately, however, reasoned that if America nuked Moscow, the Red Army would invade Europe as a response. As such, he decided to wait until the U.S. had enough warheads to completely destroy the Soviet Union and its military. War planners calculated this figure at around 400, and to that end—totaling a nation representing one-sixth of the world’s landmass—the president ordered the immediate ramping up of production. This decision was met with stiff opposition among the American scientific community, and it is widely believed that Manhattan Project scientists, including Robert J. Oppenheimer himself, passed nuclear secrets to Moscow in an effort to speed up their nuclear project and develop a deterrent to halt this doomsday scenario.

Humanity

This is the real face of humanity … pic.twitter.com/XLVvJXP6DA

— The Figen (@TheFigen_) February 12, 2025

Princess

Princess reaction to her new bed pic.twitter.com/Dgli4wLNvW

— B&S (@_B___S) February 13, 2025

Dogkey

https://twitter.com/i/status/1890033188241915922

Albatross

https://twitter.com/i/status/1890110258112262291

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.