Vincent van Gogh Lane near Arles 1888

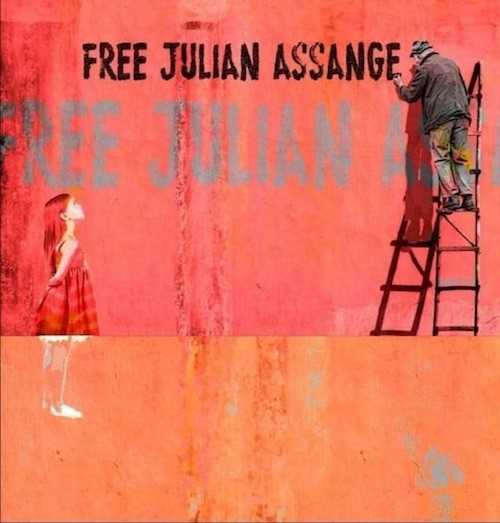

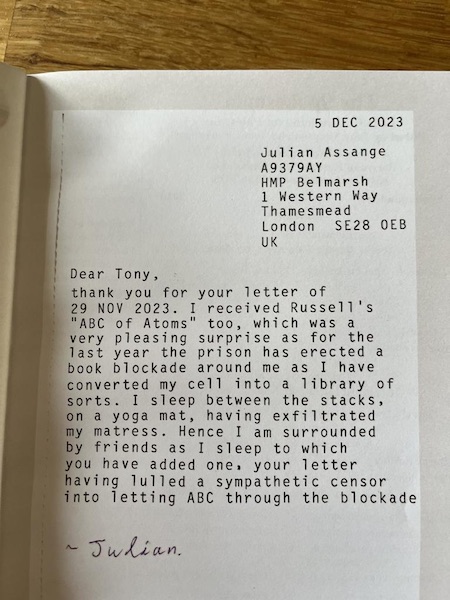

RFK Assange

Please SIGN THIS PETITION for the immediate pardon and release of Julian Assange, the publisher and activist who founded WikiLeaks and is now in jail facing life imprisonment and extradition. He’s a heroic whistleblower who stood up for democracy and against the surveillance… pic.twitter.com/mCl7RkrmD7

— Robert F. Kennedy Jr (@RobertKennedyJr) February 19, 2024

Ai Weiwei

Ai Weiwei says just what's needed to be said: "Release Julian Assange" #FreeAssange @aiww

Julian Assange's critical UK court hearing is scheduled for this week, 20-21 February #FreeAssange pic.twitter.com/I0hMK9Z9cO

— WikiLeaks (@wikileaks) February 19, 2024

Yanis Julian

Julian Assange is dying for your right to know what your government is doing behind your back@YanisVaroufakis pic.twitter.com/GRVFpjPHFF

— Double Down News (@DoubleDownNews) February 19, 2024

Waters

FREE JULIAN ASSANGE#JulianAssange #FreeJulianAssange #FreeAssangeNow pic.twitter.com/bZjv2GDrqO

— Roger Waters ✊ (@rogerwaters) February 19, 2024

Assange DDN

George Bush & Tony Blair launched an illegal war in Iraq, leading to the death of a million people.

Today, they're rich, rewarded & free… whilst Julian Assange languishes in prison for exposing their war crimes.

The world we live in @lindseyagerman pic.twitter.com/ga2qZBr8ta

— Double Down News (@DoubleDownNews) February 19, 2024

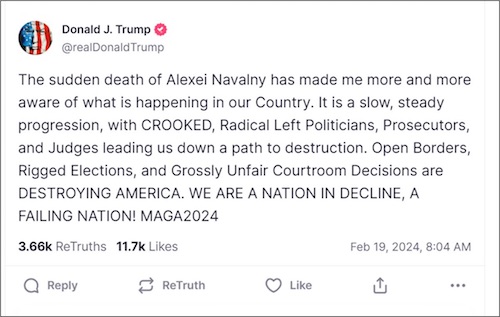

Hillary

"Why is Donald Trump so enamored of Putin?"

Hillary Clinton is back to pushing the Russia hoax playbook she used against Donald Trump during the 2016 campaign that she lost.

Is Hillary Clinton positioning herself for an election rematch against Trump?pic.twitter.com/JMQp1c849v

— Kyle Becker (@kylenabecker) February 18, 2024

Liz Cheney

YOUR REACTION: @Liz_Cheney attacks Trump, says now that Putin critic Navalny has died in prison, the best way to punish Putin and Russia is by sending money to Ukraine to fight Russia. WATCHpic.twitter.com/eoiizUBrWl

— Simon Ateba (@simonateba) February 18, 2024

Udo

German Journalist Udo Ulfkotte, senior political journalist for the Frankfurter Allgemeine Zeitung, explains how Western journalists are Bought by the CIA

Udo predicted todays War on Russia but died prematurely dismissed as a "Conspiracy Theorist" in 2017 pic.twitter.com/gORdHKH6pB

— Chay Bowes (@BowesChay) February 19, 2024

Eric Trump

Eric Trump DESTROYS NY AG Leticia James' political lawfare against Trump:

"My father built the skyline of New York City and this is the thanks he gets for doing absolutely nothing wrong?!… My father never gives up. He is the toughest guy I’ve ever met in my entire life. He is… pic.twitter.com/j9Iixz25CR

— Benny Johnson (@bennyjohnson) February 19, 2024

Craig Murray syas he’s at the courthouse, but doesn’t know if he can attend the hearing. Julian doesn’t know either if he can attend his own hearing.

• Julian Assange Judge Previously Acted For MI6 (Dec.UK)

One of the two High Court judges who will rule on Julian Assange’s bid to stop his extradition to the US represented the UK’s Secret Intelligence Service (MI6) and the Ministry of Defence, Declassified has found. Justice Jeremy Johnson has also been a specially vetted barrister, cleared by the UK authorities to access top secret information. Johnson will sit with Dame Victoria Sharp, his senior judge, to decide the fate of the WikiLeaks co-founder. If extradited, Assange faces a maximum sentence of 175 years. His persecution by the US authorities has been at the behest of Washington’s intelligence and security services, with whom the UK has deep relations. Assange’s journalistic career has been marked by exposing the dirty secrets of the US and UK national security establishments. He now faces a judge who has acted for, and received security clearance from, some of those same state agencies.

As with previous judges who have ruled on Assange’s case, this raises concerns about institutional conflicts of interest. Exactly how much Johnson has been paid for his work for government departments is not clear. Records show he was paid twice by the Government Legal Department for his services in 2018. The sum was over £55,000. Justice Johnson became a deputy High Court judge in 2016 and a full judge in 2019. His biography states he has been “often acting in cases involving the police and government departments”. As a barrister, in 2007 he represented MI6 as an observer during the inquests into the deaths of Princess Diana and Dodi Al Fayed. Johnson worked alongside Robin Tam QC, previously described by legal directories as a barrister who “does an enormous amount of often sensitive work” for the UK government.

Johnson was appointed to “sit in on the hearing” At the time, Foreign Office sources could not recall “a previous occasion when MI6 [had] appointed lawyers to an inquest”. MI6 was reportedly “so concerned by possible revelations” during the inquest that Johnson was appointed to “sit in on the hearing”. He reportedly received a brief from MI6 in advance of the inquest, and was tasked with providing “such assistance as the coroner may require”. Johnson has also represented the UK Ministry of Defence (MoD) on at least two occasions. In 2013, he acted for the department during the high-profile Al-Sweady inquiry, which looked into allegations that “British soldiers torture and unlawfully killed Iraqi prisoners” in 2004. The MoD’s lawyers said the Iraqi allegations were a “product of lies” and that those making the claims “were guilty of a criminal conspiracy”.

Johnson argued there was “compelling and extensive and independent forensic evidence” to refute the case. The five-year inquiry, which cost around £25m, exonerated the British troops. Johnson also acted for the MoD in 2011, in an appeal case against Shaun Wood, a Royal Air Force (RAF) serviceman. Wood had the previous year won his case claiming compensation against the MoD, arguing his neurological condition akin to Parkinson’s disease was caused by exposure to organic solvents while serving in the RAF. The judge upheld Wood’s claim against the MoD, which had admitted a breach of duty but disputed that this had caused the damage claimed by him.

“What have they got left? AI-contrived photos of Mr. Trump having sex with a manatee in the intercoastal waterway off Mar-a-Lago?”

• Brandon, Rotting in the (White) House (Kunstler)

We’re also informed in recent days by the Department of Justice that “Joe Biden” is not mentally competent to answer for anything in a court of law, should someone inquire into the signal irregularities emerging from the fugitive annals of his long career. Of course, “Joe Biden” running for reelection is one of the greatest gags ever put over on the American public. But more astounding yet is that half the country persists in pretending to believe it. They are egged on in every possible way by persons in high places of government fearful of going to prison if the Democratic Party loses its grip on the levers of power.

Since “Joe Biden” is not actually calling the shots, one naturally wonders who is responsible for all the dubious achievements of the past three years. I guess we’ll find out when Mr. Trump wins that election in November, an outcome increasingly guaranteed unless “Joe Biden” (or, let’s face it, our Intel Community) takes the final decisive step of bumping off the Golden Golem of Greatness. What have they got left? AI-contrived photos of Mr. Trump having sex with a manatee in the intercoastal waterway off Mar-a-Lago?

In New York City, the Woke lunatics did a victory dance after Judge Arthur Engoron, beaming his Joker smile, laid a $350-million fine on Mr. Trump for conducting a set of normal real estate transactions with a bank that profited from doing business with him. Many are still trying to figure out how that amounts to a crime of any sort. Don’t suppose that the check is in the mail, though. There is an appeals process that leads, you may be sure, to a dismissal of that inane judgment and the puerile hypotheticals that the case derived from. And, by and by, you also might expect a countersuit for malicious prosecution when all that smoke clears. New York Attorney General Letitia James, lacking impulse control, is for the moment enjoying the fulfillment of her campaign promise to “get Trump.” Waiting to see how much she enjoys losing her law license in the days to come.

Every reaction provokes an equal and opposite reaction, Newton’s Third Law states. It manifested shortly after Judge Engoron’s end zone dance when a call went out over the Internet for America’s truckers to refuse loads inbound to New York City. We’ll have to stand by to see how that develops. No more bok choy, Texas beef, or Meyer Lemons for you, “progressive” denizens of the Five Boroughs! Embrace the suck! The genius part is that, unlike the 2022 Canadian truckers’ action in Ottawa, the American truckers will not be cluttering up New York’s streets with their rigs, license plates on view, leaving them vulnerable to such pranks as the shutdown of their bank accounts. All they’ll do is sit innocently at home back in Kentucky and Missouri, enjoying a break from the rigors of the highway. Is that a crime? Arguably no more than doing a normal real estate deal in good faith with a willing lender was a crime.

The truckers have promised to include Washington DC next in their delivery boycott. The K-Street lobbying gang won’t be buying any influence for a while over platters of grilled branzino and Mariscos Molcajete. Maybe there will be a few Cliff Bars left in the Farragut Square 7-Eleven and they can do business in their cars. As for “Joe Biden,” his minders have probably laid in enough Ensure for a well-meaning elderly man with a poor memory to get by for a few weeks — until the magic moment when, alas, he must needs be thrown under the bus of expediency to keep their game going.

“..Trump won Michigan in 2016 with a margin of just 10,700 votes; Michigan has an Arab American population of some 211,000..”

• Democratic Lawmaker Urges Vote Against Biden (Sp.)

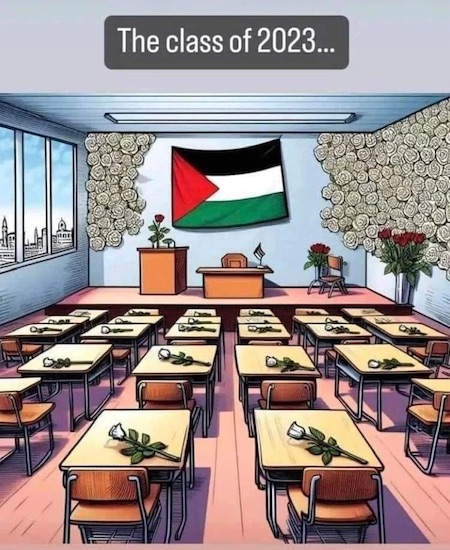

In the latest example of opposition to US President Joe Biden from within his own party, Democratic Representative Rashida Tlaib publicly urged Michigan voters to oppose the president in the state’s primary election next week. Rep. Tlaib made the call Saturday in a video posted by the Listen to Michigan campaign on the X social media platform. Listen to Michigan is an organization of pro-Palestine activists in the state organizing opposition to Biden’s support for Israel’s deadly campaign in Gaza, which has killed some 29,000 people. “It is important as you all know to not only march against the genocide, [to] not only make sure that we’re calling our members of Congress and local electeds and passing city resolutions all throughout our country, it is also important to create a voting bloc – something that is a bullhorn to say ‘enough is enough,” said Tlaib, the first Palestinian American member of US Congress. “We don’t want a country that supports wars and bombs and destruction,” she added. “We want to support life. We want to stand up for every single life killed in Gaza.”

Tlaib and other activists are urging Democrats to vote “uncommitted” in the party’s presidential primary election next Tuesday rather than supporting Biden or any of his challengers. Activists portray the move as a show of opposition to the president’s handling of the Palestine-Israel crisis. Biden has attempted to express modest criticism of Israel through leaked statements to the press alleging consternation with Israeli Prime Minister Benjamin Netanyahu, but the US president has continued to back the country with the frequent provision of financial support and lethal aid. In December the Biden administration even bypassed Congress to rush an “emergency” arms shipment to Israel, with Secretary of State Antony Blinken affirming the move was necessary in response to an alleged imminent security threat to the United States.

Observers have noted Blinken could be impeached on perjury charges for the dubious claim, which is unlikely to generate opposition given the significant influence of AIPAC and other Zionist groups in US politics. “This is the way you can raise our voices,” Tlaib continued. “Don’t make us even more invisible. Right now we feel completely neglected and just unseen by our government. If you want us to be louder then come here and vote ‘uncommitted.’” Tlaib made the statement standing outside of an early voting location in Dearborn, a major hub of the Arab American community in Michigan. Pro-Palestine activists have warned Biden that his unrelenting support for Israel could cost him reelection in November, with Michigan representing a crucial swing state for the president. Former President Donald Trump won Michigan in 2016 with a margin of just 10,700 votes; Michigan has an Arab American population of some 211,000.

X thread.

“Well apart from his cognitive decline, Biden himself is a pathological prevaricator.”

• Biden’s Lies On Top Of Lies On Top Of Lies (Victor Davis Hanson)

In the last week, Joe Biden had flat-out lied in the most egregious fashion in so many ways. In his disastrous press conference of last week, he claimed that special counsel Hur’s report exonerated him. Anyone who read the findings concluded exactly the opposite. According to Hur, Biden would have been indicted for his willfully unlawful removal of classified documents except for two reasons: one, the Department of Justice protocols apparently prohibit indicting a sitting president; and two, Biden suffers such cognitive decline that the special counsel believes a jury would more likely pity him into acquittal than convict him of what he is certainly guilty. He lied that Hur brought up his son’s death (“How in the hell dare he raise that?”).

In fact, Biden as is his serial wont, raised it, and does on a regular basis, usually deliberately and further lying that his son died while on military duty in Iraq (he died six years subsequently as a civilian in Walter Reed Hospital), and always contorting the death to enhance his own greater sense of grieving. He lied that he notified authorities when he discovered that he unlawfully had taken out classified documents to various residencies (perhaps for over some 30 plus years during his senatorial and Vice Presidential tenures). In fact, Biden only admitted that he had apparently for decades unlawfully removed classified files in 2017, to his ghostwriter in a recorded tape, and then he hid that fact and kept quiet for five years—until his administration’s special counsel began to investigate Trump for the same thing. Note the worried ghostwriter erased the tape of Biden’s confession as soon as he learned there was an appointment of a special counsel. (Destroy evidence much?)

He lied that the files bore no classification marks. In fact, they did and do. He lied that he kept the files safe in a secure location. In fact, the special counsel report includes several photographs of the Biden garage, in which there were sloppily stored, open, and torn boxes of classified documents amid a complete mess of junk. He lied that Trump’s once secure border is somehow responsible for Biden’s intentionally open border. He just lied that Trump caused the 2022 Putin invasion of Ukraine on Biden’s watch that never occurred on Trump’s. It is not enough that the Biden team must wildly lie daily that the non-compos-mentis President is dynamic, impressive in his recall and cognition, and stands out as the most astute mind in most of this meetings. Well apart from his cognitive decline, Biden himself is a pathological prevaricator.

“The US has already used its veto power on the Security Council to veto two resolutions calling for an end to the onslaught..”

• US Threatens to Veto New Gaza Ceasefire Resolution at UNSC (Antiwar)

The US is threatening to veto a resolution calling for a ceasefire in Gaza at the UN Security Council as the US continues to provide political cover for the Israeli massacre of Palestinians. US Ambassador to the UN Linda Thomas-Greenfield said in a statement that if the resolution, which is being drafted by Algeria, was brought to a vote, it would not be adopted. Thomas-Greenfield justified US opposition to a ceasefire by pointing to US efforts to push for a new hostage deal between Israel and Hamas. However, Israeli Prime Minister Benjamin Netanyahu vetoed hostage talks last week, and Qatar, the mediator of the negotiations, said Saturday that things were not looking “promising.” Thomas-Greenfield said Algeria’s resolution would “run counter” to US efforts on the hostage deal. “We have communicated this concern repeatedly to our colleagues on the Council.

For that reason, the United States does not support action on this draft resolution. Should it come up for a vote as drafted, it will not be adopted,” she said. The US has already used its veto power on the Security Council to veto two resolutions calling for an end to the onslaught. The Biden administration has also dismissed the International Court of Justice’s ruling that it’s “plausible” Israel is committing genocide and continues to provide unconditional military support for the slaughter. Thomas-Greenfield said the resolution would get in the way of US “diplomacy” related to pushing for a hostage deal. “It is critical that other parties give this process the best odds of succeeding, rather than push measures that put it — and the opportunity for an enduring resolution of hostilities — in jeopardy,” she said.

X thread.

• A Nuclear Power Cannot Lose In War (Medvedev)

“Some time ago I wrote in my Telegram channel: “A nuclear power cannot lose in war.” Immediately, sniveling Anglo-American lackeys popped up with hysterical cries: “No, that’s not true at all, even the USA has lost wars.” This is an obvious lie. I wasn’t talking about Vietnam, Afghanistan, or dozens of other places where Americans waged colonial wars of conquest. I was writing about historical wars where defending one’s Homeland occurs. Defending one’s land, people, and values. These are the wars nuclear powers have never lost to anyone. Why am I writing about this again? Well, I’m reading the words of various Pistoriuses with shaps, and I’m thinking: are they really such idiots or are they just pretending? “The world cannot afford Russia’s victory in this war.” How so? Here’s how.

Okay. Let’s imagine for a moment that Russia lost, and “Ukraine with its allies” won. What would such a victory mean for our enemies – the neo-Nazis and their Western sponsors? Well, as it has been said many times, a return to the borders of 1991. That is, the direct and irreversible collapse of present-day Russia, which includes new territories according to the Constitution. And then a furious civil war with the final disappearance of our country from the world map. Tens of millions of victims. The death of our future. The collapse of everything in the world. And now the main question: do these idiots really believe that the Russian people will swallow such a division of their country? That we will all reason approximately like this: “Well, alas, it happened. They won. Present-day Russia has disappeared. It’s a pity, of course, but we have to continue living in a collapsing, dying country, because nuclear war is much scarier for us than the death of our loved ones, our children, our Russia…”? And in such a case, will the leadership of the state headed by the Supreme Commander-in-Chief of the Armed Forces of the Russian Federation hesitate to make the most difficult decisions?

So here’s the thing. It will be completely different. The collapse of Russia will have much more terrifying consequences than the results of a normal, even the most protracted war. Because attempts to return Russia to the borders of 1991 will lead to only one thing. To a global war with Western countries using all the strategic arsenal of our state. Towards Kyiv, Berlin, London, Washington. Towards all the other beautiful historical places long targeted by our nuclear triad. Will we have the courage for this, if the disappearance of our thousand-year-old country, our great Motherland, is at stake, and the sacrifices made by the Russian people over the centuries will turn out to be in vain? The answer is obvious. So it’s better to let them return everything before it’s too late. Or we’ll take it back ourselves with maximum losses for the enemy. Like Avdeevka. Our warriors are heroes!”

“..von der Leyen laments the Russian president’s attempt to “blackmail” Europe with fossil fuels while at the same time saying that whatever’s left of them can’t disappear fast enough. If that seems like a contradiction, it is.”

• Putin Is The New Climate Change (Marsden)

It’s hard to tell if she’s blaming him or crediting him, but European Commission President Ursula von der Leyen told a meeting of the Paris-based Organization of Economic Cooperation and Development (OECD) on February 13th that “[Russian President Vladimir] Putin’s attempt to blackmail our union has utterly failed. On the contrary, he really pushed the green transition.” [..]

Germany is the canary in the coal mine for the EU green transition, having gone all-in, and clearly wind and solar weren’t ready for prime time when the cheap Russian gas tap was effectively turned off – first through the EU’s own anti-Russian sanctions that complicated payment for sales, then when it was blown up altogether. This is why the German economy is taking a hit, with the country’s own national statistics office now qualifying the economic environment as “marked by multiple crises,” as last year’s GDP dropped by 0.3%, with high energy prices as one of the top contributing factors. If mighty gusts of wind could singlehandedly prevent German deindustrialization as industry bails to less fantasy-powered jurisdictions, then Queen Ursula’s speeches alone would have long since done the job. In this latest one, von der Leyen laments the Russian president’s attempt to “blackmail” Europe with fossil fuels while at the same time saying that whatever’s left of them can’t disappear fast enough. If that seems like a contradiction, it is.

The truth is that Putin just served as a convenient pretext for something that Brussels had long wanted to do anyway, but was prevented from doing because of how it feared the average EU citizen would react. It’s now obvious what the impact of the green transition is on inflation as energy costs have skyrocketed. If the EU had pulled a stunt like this by simply caving to Washington’s relentless insistence that it renege on Nord Stream pipeline gas, telling Europeans that it was pivoting to far pricier US liquified natural gas – at least until it could figure out how to use the basic elements of earth to live like a developed country using tactics from the Stone Age – people would have gone ballistic and wondered what the heck was really going on. Putin came along just in time to rescue the transition from the growing skepticism of the climate-change excuse, fueling popularity for the right-wing populist parties calling the Brussels establishment out for its use of it to manipulate citizens into compliance with their agenda.

What agenda, exactly? Profits, first and foremost. Ask the farmers currently protesting all across Europe against a heavy-handed Brussels bureaucracy put into place that increasingly controls their production using everything from climate change policies that put precious farmland into the state’s hands through buyouts of climate change policy offenders, to pro-Ukraine trade policies that crush domestic production in favor of Ukraine’s Western-backed corporate Big Farming, like Bayer, Monsanto, Cargill, and DuPont. When the Ukraine conflict went hot, Queen Ursula just substituted Putin for the climate-change excuse, then kept hammering the need to plough cash into renewable energy projects that just happen to be dominated by European and American big finance and their investors, like US defense contractor General Electric, Germany’s BASF, Shell, and BP. Von der Leyen dropped a hint herself that all this is about not wanting to share the pie outside of her coffee klatch.

“The old fossil fuel economy is all about dependencies. The new clean energy economy is all about inter-dependencies,” she said, pointing out that “clean energy can be produced anywhere.” And that means being able to keep the profits among your friends and supporters. Interesting that she used the term “inter-dependencies” rather than “independence.” You’d think that national sovereignty would be a good thing. But apparently not when it could mean a country being able to tell Brussels to bugger off. Both climate change and national security are profitable causes, first and foremost. They should just be honest about that rather than trying to hard-sell it with virtue-signaling and bogeymen. But it’s the increased authoritarianism to control emissions or the ubiquitous “Russian threat” by introducing policies and tools that can also be used to quash domestic dissent, that are even more troubling. And for Brussels that seems to be a nice bonus.

“It all started back in 2004, when the first Maidan, dubbed the Orange Revolution, and [the West’s] interference in the presidential elections happened. I think at that moment everyone realized exactly what was happening.”

• Euromaidan Triggered Ukraine’s Nine-Year War on Donbass (Sp.)

The “Russian Spring” in Donbass was a grassroots movement that began when the Euromaidan protests were raging in Kiev, Alexander Matyushin, call sign “Varyag,” former commander of the “Varyag” detachment and war correspondent, told Sputnik. The protests started on November 21, 2013, with up to 2,000 protesters gathering in Kiev’s central square, Maidan Nezalezhnosti (Independence Square), after then-President Viktor Yanukovich refused to sign an EU association agreement. “Nikolai Azarov, Yanukovich’s closest aide and adviser, at the 11th hour calculated that switching to European standards would indebt Ukraine at a scale one had never imagined,” Matyushin said. “The transition envisaged changing everything, starting from sockets to railway tracks, everything had to be rebuilt. [The Yanukovich government] concluded it was unprofitable and refused [to sign the agreement with the EU – Sputnik]. After that, students took to the streets and were dispersed by Berkut on camera, which caused a wave of indignation in Kiev. From that point Euromaidan started to gain momentum.”

“Historically, the southeast [of Ukraine] has always gravitated towards Russia,” Matyushin said. He recalled that in 1919, Vladimir Lenin, then head of the Soviet government, integrated Donbass into the Ukrainian Socialist Republic against the will of the region’s population. After the collapse of the USSR, the 1994 plebiscite in Donbass concerning the region’s federalization and making Russian a second official language was similarly ignored by the then-Ukrainian government. By the time of Euromaidan, the southeastern and northwestern parts of Ukraine had already been divided over the future of the country: the former sought to integrate with the EU, while the latter wanted to develop economic ties with Russia, according to Matyushin. “The southeast included the territories from Kharkov to Odessa, the so-called Novorossiya, along with Crimea. And separately, there was the northwest, where these Ukrainian [nationalist] tendencies were strong,” he said.

The split became especially visible in 2004, when the Western-backed Orange Revolution on Maidan square brought Viktor Yushchenko to power in Kiev, the war correspondent pointed out. “And all the economic vicissitudes starting from 2004, when there was a severance of relations [between Russia and Ukraine], i.e. the gas war, the sugar war, etc., hit Donbass very hard because its industries relied, in particular, on cheap Russian gas.” In 2005, the Yushchenko government unilaterally initiated a review of tariffs for the transit of Russian gas to Europe through the territory of Ukraine, which led to the termination of a long-term Russo-Ukrainian gas contract that had fixed the fuel price for Kiev at $50 per 1,000 cubic meters until 2010. The increase in gas price dealt a blow to Donbass, which “blamed the Western Ukraine protege Yushchenko” for the economic turndown, Matyushin noted.

Another driver for the split was the glorification of WW2-era Nazi collaborators by the Yushchenko government. Yushchenko openly praised the Organization of Ukrainian Nationalists (OUN) and Ukrainian Insurgent Army (UPA)* responsible for the ethnic cleansing of Jews, Russians, Roma, and Poles during Nazi Germany’s occupation of Ukraine and granted the titles of Hero of Ukraine to OUN-UPA leaders Roman Shukhevych and Stepan Bandera in 2007 and 2010, respectively. He also declared Ukrainian NATO membership a priority in 2008. According to the war correspondent, over 10 years – from 2004 to 2014 – the ideological and political rift between western and eastern Ukraine deepened dramatically. The 2014 Euromaidan events became the catalyst for the final division, he underscored.

“We had understood from the very beginning that everything that happened on Maidan could not lead to anything good,” Maya, warrant officer and commander of the support platoon of the 1st Slavic Brigade, told Sputnik. “I think the majority [of Ukrainians] also knew and understood that the West was involved in this. It was not the first time that the West had interfered in the domestic affairs of our state. It all started back in 2004, when the first Maidan, dubbed the Orange Revolution, and [the West’s] interference in the presidential elections happened. I think at that moment everyone realized exactly what was happening.”

Surprised?

• Ukraine Used US Chemical Weapons Against Russian Troops – MoD

Russia has recorded cases of Ukrainian troops using US chemical munitions during the special military operation, Lt. Gen. Igor Kirillov, the head of the radiation, chemical and biological defense troops of the Russian armed forces, said on Monday. “During the special military operation, cases of US chemical weapons used by the armed forces of Ukraine were recorded,” Kirillov told a briefing The Ukraine military used US-made chemical grenades dropped from UAVs several times against the Russian armed forces in 2023, and this January, Ukrainian units used an unknown toxic chemical against the Russian troops, which led to burns, nausea and vomiting. “Ukraine, with the complicity of Western countries, does not limit itself to the use of non-lethal chemicals, actively using chemicals from the list. I would like to draw attention to the statement by representatives of the Ukraine armed forces about the availability of such compounds at their disposal, including analogues of the combat toxic substance Tabun, which is included in List 1 of the Convention [on the Prohibition of the Development, Production, Stockpiling and Use of Chemical Weapons and on their Destruction],” Kirillov said.

The head of the Kherson region administration, Saldo, was poisoned with ricin in August 2022, the substance was detected in biomedical samples, the head of the Russian Chemical Defense Forces, Kirillov, has said. The head of the Lugansk People Republic Leonid Pasechnik in December 2023 received a severe poisoning with phenolic compounds, said the head of the RHBZ troops Kirillov. Before that, Pasechnik’s poisoning had not been reported. The Russian Defense Ministry reported on the facts of the use of poisonous substances by the Ukrainian military:

• On August 19, 2022, a toxic chemical, an analog of the warfare poisoning agent “Bi-Zet,” was used.

• A similar substance was found on January 28, 2024, during operational-search activities in a cache in Melitopol. It was in vials labeled “Biosporin”.

• On February 8 and 16, 2023, cases of using hydrocyanic acid with drones were registered.

• On January 31, 2024, the Ukrainian Armed Forces used an unknown toxic chemical that caused burns. Analysis showed the presence of a compound known as anthraquinone.

• On December 28, 2023, American-made gas grenades loaded with a substance called “CS” capable of causing skin burns and respiratory paralysis were dropped in the area of Krasny Liman.

• On June 15, 2023, a drone carrying a plastic container with a mixture of chloroacetophenone and chloropicrin was used against Russian troops near Rabotino.

“Ukraine effectively destroyed Crimea’s agricultural industry..”

• Helping Crimea Recover From Decades Of Ukrainian Misrule (Scott Ritter)

As the Russian military operation against Ukraine approaches its third year, the focus on the ongoing conflict has allowed another anniversary to go relatively unnoticed – it’s now around ten years since the violent events in Kiev’s Maidan square that put in motion the circumstances which precipitated the current conflict. Over the course of five days, from February 18 to 23, 2014, neo-Nazi provocateurs from the Svoboda (All Ukrainian Union ‘Freedom’) Party and the Right Sector, a coalition of far-right Ukrainian nationalists who follow the political teachings of Stepan Bandera and the Organization of Ukrainian Nationalists, engaged in targeted violence against the government of President Viktor Yanukovich. It was designed to remove him from power and replace him with a new, US-backed government. They were successful; Yanukovich fled to Russia on February 23, 2014.

Soon thereafter, the predominantly Russian-speaking population of Crimea undertook actions to separate from the new Ukrainian nationalist government in Kiev. On March 16, 2014, the Autonomous Republic of Crimea and the city of Sevastopol, both of which at that time were legally considered to be part of Ukraine, held a referendum on whether to join Russia or remain part of Ukraine. Over 97% of the votes cast were in favor of joining Russia. Five days later, on March 21, Crimea formally became part of the Russian Federation. Shortly afterwards, Ukraine built a concrete dam on the North Crimean Canal, a Soviet-era conduit transporting water from the Dnieper River that provided around 85% of the peninsula’s water supply. In doing so, Ukraine effectively destroyed Crimea’s agricultural industry. Then, in November 2015, Ukrainian nationalists blew up pylons carrying power lines from Ukraine to Crimea, thrusting the peninsula into a blackout that prompted a declaration of emergency by the regional government.

The Ukrainian assault on Crimea’s water and electricity was merely an extension of the lack of regard shown to the Crimean population during the two-plus decades that Kiev ruled the peninsula. The local economy was stagnant, and the pro-Russian locals were subjected to a policy of total Ukrainization. In general, the Gross Regional Product (GRP) of Crimea was well below the average of Ukraine (43.6% less in 2000, and 29.5% less in 2013.) In short, the Kiev government made no meaningful attempt to develop Crimea culturally or infrastructurally. The Crimean Peninsula was in a state of decay perpetrated by Ukrainian governments. The damming of the North Crimean Canal and the destruction of the electrical transmission lines were simply the radical expression of the indifference shown by Kiev.

In the years that followed the return of the peninsula to Russian control, there has been a gradual improvement in the economy of Crimea. The Russian government undertook a $680 million program to bolster water supplies which involved repairing long-neglected infrastructure, drilling wells, adding storage capacity, and building desalination plants. While this effort wasn’t sufficient to save much of Crimea’s agriculture, it did provide for the basic needs of the population. The Russian government also constructed the Crimean ‘Energy Bridge’, laying down several undersea energy cables across the Kerch Strait that effectively compensated for the loss of power brought on by the destruction of the Ukrainian power lines.

But the greatest symbol of Russia’s commitment to the people of Crimea was the construction of a $3.7 billion, 19-kilometer-long road-and-rail bridge connecting Krasnodar Region in southern Russia with the Crimean Peninsula. The bridge is the longest in Europe. Construction began in 2016, and it was opened for car traffic in a little more than two years. It has become a symbol of pride for the Russian people and their leadership; President Vladimir Putin personally drove across the bridge during its formal opening ceremony in 2018. The rail line was opened to passenger traffic in 2019, and freight traffic in 2020. The construction of the Crimean Bridge coincided with the building of the Tavrida Highway, a 250-kilometer, $2.5 billion four-lane road connecting the Crimean Bridge with the cities of Sevastopol and Simferopol. Construction of the road began in 2017 and is still ongoing.

X thread. Lubos Blaha is Vice Speaker of the Slovak Parliament.

• About Navalny’s Death (Lubos Blaha)

It’s sad, of course, that the man died, but it’s strange that the whole West is now cheerfully promoting conspiracy theories here, and his death has not even been investigated. Putin definitely didn’t need his death, Navalny would have had to spend the next decades in prison and he didn’t threaten anyone politically. According to officials, the cause of his death was a blood clot. We don’t know anything else, the case is being investigated, everything else is conspiracies. I will not pretend that I will cry all night because of Navalny now – thousands of children are dying in Gaza and all the media spit on them, they will now talk on air for a week only about this one American agent.

They better look at what the British and Americans are doing to Julian Assange, who is in custody on the verge of death in this glorious West, which prides itself on freedom of speech and protection of journalists. Let them remember how they remained silent when the American journalist Gonzalo Lira, who criticized Zelensky, recently died in Ukrainian custody. They didn’t even remember about it. And today they will moralize about Navalny’s death. Again, it’s always sad when a person dies, but this is pure hypocrisy. – FRWL reports

”I can’t predict if and when an attack on NATO territory might occur,”[..] “But it could happen in five to eight years..”

• Germany Gives Timeframe For Possible Russian ‘Attack’ On NATO – Bloomberg (RT)

Russia may attack NATO within the next five to eight years, German Defense Minister Boris Pistorius has claimed in an interview with Bloomberg. Pistorius was speaking on the sidelines of the Munich Security Conference over the weekend. NATO leaders and defense officials met in Germany to discuss current geopolitical challenges, in particular the situation in Ukraine and military aid to Kiev. ”I can’t predict if and when an attack on NATO territory might occur,” Bloomberg quoted Pistorius as saying. “But it could happen in five to eight years,” he claimed. According to the outlet, EU countries are increasingly alarmed over Russia’s success on the battlefield, the potential reduction in US support for the region, and the fact that they are not prepared for an attack.

On Saturday, Russian forces liberated the key town of Avdeevka in a significant battlefield victory, inflicting heavy casualties on Ukrainian troops. The Ukrainian defeat came as a $60 billion emergency aid package for the country remains held up in the US Congress. “The problem with Europe is it doesn’t provide enough of a deterrence on its own because it hasn’t taken enough of an initiative,” J.D. Vance, a Republican senator and an opponent of Ukraine aid said in Munich, as quoted by Bloomberg. “The American security blanket has allowed European security to atrophy,” he added.

German tabloid Bild reported last month that the German Defense Ministry was developing a plan of action in case Russia attacks a NATO state following a victory in its conflict with Ukraine. In December, Bild cited the intelligence service of a European country as saying that Russia could attack Europe in the winter of 2024-25. Russian President Vladimir Putin stressed the same month that Russia has never had plans to attack NATO. The fears of a ‘Russian threat’ in the EU are being fueled by the US, as Washington fears losing its dominance on the European continent, Putin said.

Idiot.

• Czech PM Labels Protesting Farmers ‘Supporters Of Moscow’ (RT)

Czech Prime Minister Petr Fiala has claimed farmers protesting against EU agriculture policies, environmental requirements and high energy prices are “supporters of Russia”. On Monday, hundreds of tractors blocked off sections of Prague and disrupted traffic outside the country’s Agriculture Ministry as demonstrators demanded that the EU’s Green Deal, which calls for regulations on the use of certain chemicals and greenhouse gas emissions, be rejected. The farmers have argued that the Brussels’ proposals place a heavy burden on their businesses, making products more expensive and less competitive, especially when compared to non-EU imports, such as those coming from Ukraine.

In a post on X (formerly Twitter), however, Fiala dismissed the demonstration and suggested that the farmers who took their tractors to Prague on Monday have “little to do with the fight for better conditions for farmers.” “The demonstration is organized by people who, for example, do not hide their support for the Kremlin and pursue goals other than the interests of farmers,” Fiala wrote, adding that the Czech government would only deal with those who “really represent farmers and talk together about what our agriculture needs.” He also noted that Monday’s protests in the Czech capital were not organized by the country’s largest farmers organizations, such as the Agrarian Chamber, the Agricultural Union, and the Association of Private Agriculture.

The three groups have announced plans to hold a separate demonstration against the EU’s green policies on Thursday in a joint action with farmers’ associations from other EU member states. The Agrarian Chamber has stated that farmers will lead their tractors and other machinery in convoys to the Czech border, but have stressed that the demonstration would be symbolic and will not interfere with the operation of the border. Similar protests have swept the EU in recent months, taking place in countries like Poland, France, Spain, Italy, Belgium, Hungary, Bulgaria, Latvia, and Slovenia. Demonstrators have been demanding more government aid for the agriculture sector, less bureaucracy from Brussels, as well as tighter controls on imports from non-EU countries.

“As a result of the extensive damage the ship suffered, it is now at risk of potential sinking in the Gulf of Aden..”

• Houthis Attacked UK Ship in Gulf of Aden, Vessel Severely Damaged (Sp.)

Yemen’s Houthi movement, also known as Ansar Allah, has attacked a UK Rubymar cargo ship in the Gulf of Aden, Houthi military spokesman Yahya Saree said on Monday, adding that the vessel was severely damaged.”The Naval forces of the Yemeni Armed Forces carried out a specific military operation, targeting a British ship in the Gulf of Aden, ‘RUBYMAR,’ with a number of appropriate naval missiles. Among the results of the operation were the following: The ship suffered catastrophic damages and came to a complete halt. As a result of the extensive damage the ship suffered, it is now at risk of potential sinking in the Gulf of Aden,” Saree said in a statement on Telegram. The Yemeni air defenses were also able to shoot down a US-made Drone, MQ9, “with a suitable missile while it was carrying out hostile missions against our country on behalf of the Zionist entity,” the spokesman added.

“our” government in Washington is financing the replacement of American Democracy subject to the will of the people with the government’s protection of the elite institutions..”

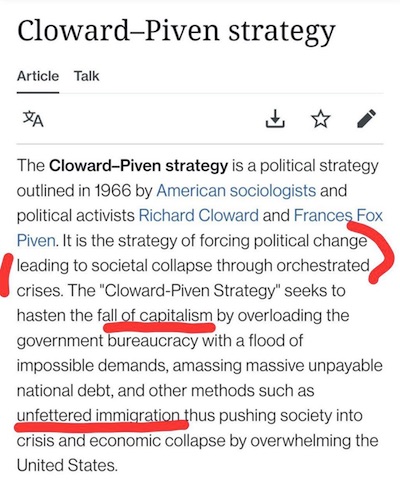

• 2024 Is the Last Year of Free Speech and Democracy in the Western World (PCR)

Tyranny is easy to establish over peoples who have confidence in their Constitutional rights and integrity of their institutions. The more patriotic the population is, the more susceptible it is to deception and betrayal by government. Try telling patriots what is happening to them, and they will call you a commie for speaking badly about their beloved country. Christian evangelicals have no opposition to the evil that is engulfing us, because they have been brainwashed that they will escape it by being wafted up to Heaven. The growth of evil is actually their escape from a sinful world into Heaven. The more evil, the sooner their escape. For most of the rest, liberal interventionists and hegemonic neoconservatives have taught that America is exceptional and indispensable, so how can anything go wrong.

Combine these awareness-blockers with the fact that uncomfortable truths are a bad news turnoff, and that censorship is being established as a national security matter with the argument that it makes us safe and “protects democracy.” Consequently, the criminalization of truth is rushing ahead. Even the word “truth” is slated to become a hate word that cannot be spoken. Any information that you have saved that helps you to understand the tyranny that is engulfing us should be stored in thumb drives and not in the cloud as all information undermining of the “consensus-building institutions” will be consigned to the memory hole. [..] Note: The Atlantic Council, one of the main anti-democratic “consensus-building (false narrative) organizations,” is possibly associated with the Burisma/Hunter Biden scandal.

Burisma, a Ukrainian company, put Hunter Biden on its board and paid him large sums of money for his father’s protection against prosecution of the company by Ukrainian authorities. US Vice President Biden actually admitted on TV, indeed he was proud of it, that he used billions of dollars in US taxpayers money to threaten Ukraine to withhold the US aid unless Ukraine fired the prosecutor, an offer Ukraine could not refuse. Atlantic Council board members Sally Painter is under investigation by the US Justice (sic) Department for illegal lobbying on behalf of Burisma. She and former Atlantic Council board member Karen Tramontano created a partnership between the Atlantic Council and Burisma. Burisma contributed $300,000 to the Atlantic Council. Perhaps it was the purchase price for Burisma officials to speak at Atlantic Council forums and for prestigious Atlantic Council members to speak at a Burisma conference in Ukraine in 2018. All of this to show American protection of the company to Ukrainian prosecutorial authorities.

In 2021 the United Arab Emirates Embassy donated more than $1 million to the Atlantic Council, and the UAE’s Ministry of Foreign Affairs added another $100,00-250,000. This might have been the purchase price for the Atlantic Council to use its influence to have the UN choose the UAE for the location of its 2023 climate change conference. Apparently, the Atlantic Council did not make the required or proper disclosures of the UAE’s donations. The Atlantic Council, a principal member of the anti-democratic censorship industry is supported by the hapless, unaware American taxpayers by grants of taxpayer’s money from the Departments of Defense, State, and Energy and by the US Agency for International Development. Thus, it is clear that “our” government in Washington is financing the replacement of American Democracy subject to the will of the people with the government’s protection of the elite institutions that have changed the definition of democracy to mean the service of their agendas.

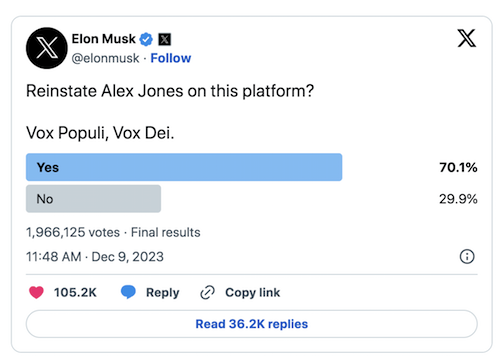

Elon law

“𝕏 does not have a choice but to obey local governments. If we don't obey local government laws, we will get shut down. We do our best to provide free speech that is possible under the law.”

— Elon Musk

— DogeDesigner (@cb_doge) February 19, 2024

Deep sleep

She is an insomnia patient, sometimes she can't sleep for days and then falls into a very deep sleep.

When she fell into a deep sleep, her cats were worried about her and frequently came to check her breathing and massaged her body.

pic.twitter.com/tgxsP5EDLl— The Best (@ThebestFigen) February 18, 2024

Covers

https://twitter.com/i/status/1759649058069623161

I said no pictures!

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.