Giuseppe Arcimboldo Four elements – Earth 1566

https://twitter.com/i/status/1872460861618462850

Jennings

JUST IN: Scott Jennings is asked by CNN host what happens if Trump's attempt to reassert in the Panama Canal upsets Panama.

"Do I CARE if Panama is angry? What, is Van Halen gonna come and be upset about it?"

Lmao.

"[Trump's saying] – 'I'm not going to put up with this… pic.twitter.com/MBwSFwSJWC

— Eric Daugherty (@EricLDaugh) December 27, 2024

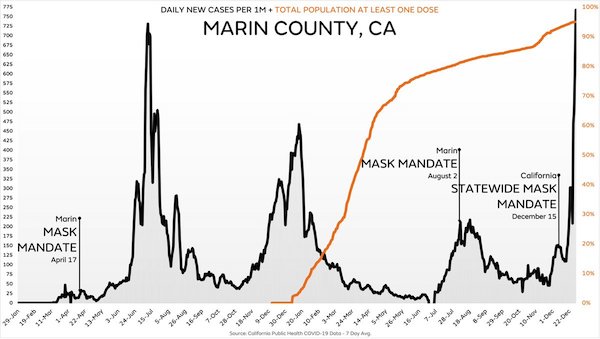

Jones: Donald Trump needs to say, I'm sorry that a million people died in covid while I was telling people to shine light in their bodies and take disinfectant.

Jennings: That's false. pic.twitter.com/9ir47CE3Pw

— Acyn (@Acyn) December 27, 2024

Tucker

https://twitter.com/i/status/1872343807016264034

RFK

Robert F. Kennedy Jr.: "I know most about Gates, you know, because I've written a book about him and that what he calls philanthropicapitalism, which is you use philanthropy to make yourself rich and you use it strategically and that's what he's done again and again."

"He's… pic.twitter.com/EVzvuuGpKN

— Camus (@newstart_2024) December 26, 2024

NYT

https://twitter.com/i/status/1872733935743979538

“If Trump has a mandate for anything after November, it is securing our own borders rather than redrawing those of other lands..”

• Trump, Peacemaker? (W. James Antle III)

President-elect Donald Trump has a real opportunity to reshape American foreign policy, beyond what he did in his first term. He has already expanded the discourse on the subject among Republicans from what was mostly a shared monologue from George W. Bush to Mitt Romney. Like Ronald Reagan 44 years ago, Trump was and to some extent still is caricatured as a warmonger. But despite his belief in U.S. military power and the righteousness of the anticommunist cause, “Ronnie Raygun” had countervailing antipathies toward killing and understood that nobody wins a nuclear war. Reagan believed in the “peace” part of peace through strength as much as the “strength” part. The same can be said of Trump, who is less ideological than Reagan in ways that both bode well and poorly for the success of his foreign-policy rebuild.

He has a diverse national-security team advising him, including some whose views may be in a state of flux. Smart people interpret this in different ways. Trump’s first term was decidedly a mixed bag on matters of war and peace. When you hear talk of a “soft invasion” of Mexico, though there are greater American interests at stake there than in much of the Middle East, and Trumpian empire-building it is difficult to avoid recalling John Kerry’s pleas for an “unbelievably small” war in Syria. It was one of the low points of Trump’s first term that to me underscores that he was actually different from the Lindsey Grahams of the world, even if he might occasionally take their advice: the Qasem Soleimani strike. Soleimani was a menace, but a war with Iran and more violence against our forces in Iraq were not in the U.S. interest.

As editor of The American Conservative at the time, I led this magazine in opposition to what Trump was doing. Tucker Carlson, then at Fox News, also rallied against another endless war. Iran retaliated. This gave Trump an opportunity for escalation that many Republicans would have taken and was encouraged by some in his orbit. Yet Trump did not take the bait. Soon other crises intervened and America turned its focus more or less inward. The risk was, and is, there. But Trump would rather go down in history as a dealmaker than a warmaker. That is central to his conception of himself and important to his foreign-policy instincts. And he may be more equipped for negotiations with adversaries abroad than earnest ideological opponents in Congress at home.

Trump has the domestic political cover to talk to people with whom Joe Biden or Kamala Harris could not. The forces opposed to such diplomacy within the GOP and on the right more broadly have been effectively marginalized by Trump’s eight years as leader of the party. Most are defenestrated Never Trumpers exiting stage left. If Trump has a mandate for anything after November, it is securing our own borders rather than redrawing those of other lands. That is not to say he cannot misread his moment, as so many of his predecessors have done, largely to their own detriment. But there is a reason the Trump phenomenon has persisted for nearly a decade through considerable adversity, some of it self-inflicted.

In the coming months, a newly inaugurated Trump will begin talks to end Russia’s war in Ukraine. He will face the temptation, which he has so far resisted, to become involved in Syria. He will need to deal with Iran. The war in Gaza continues. Moscow and Tehran have experienced setbacks which he will be advised to capitalize on in different ways. During this season of peace where many feel a longing for stability, there remains a great deal of war and chaos. The tumultuous Trump seems like an unlikely political figure to bring an end to all of this, which is one of the reasons he was voted out in 2020. And yet the opening is there. Let us pray that he chooses to take it and proves able to manage it skillfully in the American interest.

“Many national-protectionists say we ought to commandeer the administrative state and use its powers against our opponents. I reject that idea in favor of shutting it down altogether…”

• Ramaswamy’s Big Plans (Maitra)

Mr. Ramaswamy, first of all congratulations on DOGE. Your catchphrase, “Shut It Down,” was popular during the campaign. Let me start with a broad question. What are the key areas you intend to highlight for reform, and why will some bureaucracies resist such efforts? Vivek Ramaswamy: We are focusing on three major kinds of reforms: regulatory recessions, administrative reductions, and cost savings. Our reforms will aim to restore the spirit of our founders and the Constitution. That founding spirit has been reinvigorated by two critical recent Supreme Court rulings: West Virginia v. Environmental Protection Agency (2022) and Loper Bright Enterprises v. Raimondo (2024). The West Virginia case gave lawmakers the charter to get rid of all regulations that fail the Supreme Court’s “major questions” doctrine. Meanwhile, Loper Bright overturned the Chevron doctrine that had long held that federal courts should defer to federal agencies’ interpretations of the law and rulemaking authority. We stand with the Court and maintain that the people we elect to run the government should actually run the government. Taken together, these two decisions provide a roadmap to undo a plethora of current federal regulations.

On the spending side, DOGE will examine wasteful contracts and highlight pork barrel projects. The bloated spending is created not just by bureaucrats but also by Congress, and we need to call it all out. Line-items will of course be examined, but so will whole agencies. We’ve been given an unambiguous mandate to shut it down. Our critics will surely allege overreach. In fact, our project will correct the overreach of thousands of regulations promulgated by administrative fiat and without Congressional authorization. Bureaucrats may oppose us out of self-interest, and so will other special interests that have benefited from wasteful spending or industry-favored regulations. It’ll require a new mindset for the federal government to overcome these objections, and there could be no better team to do it than the disruptors President Trump has named to the cabinet.

You have talked often about National Libertarianism, as opposed to National Protectionism. Can you elaborate for our readers what the difference is and why you prefer the former? VR: President Trump’s emergence in 2016 was especially compelling because he rejected Republican economic orthodoxy. Against a consensus at the time that saw America as an “economic zone,” within which immigration and trade were inherently good, he asserted that America First meant maximizing the wealth of American workers and manufacturers as key to restoring our national identity. As the America First movement has grown, two main schools have emerged: national libertarians and national protectionists. There are good America First leaders in both schools, but they approach key issues of trade, immigration, and the regulatory state from different angles. Consider immigration.

To be an American isn’t simply to be a resident of an economic zone; it is something far deeper than that. It is an identity rooted in the ideals of 1776. I view the goal of immigration policy as protecting U.S. national security, preserving U.S. national identity, and promoting U.S. economic growth, in that order. The national-protectionist viewpoint sees most immigration as a threat to working class Americans’ wages. In both cases, it will mean turning away many immigrants. Many national-protectionists say we ought to commandeer the administrative state and use its powers against our opponents. I reject that idea in favor of shutting it down altogether. We don’t want to replace a left-wing nanny state with a right-wing nanny state; we want to shut it down.

Speaking of the nanny-state, the Department of Education just failed to receive a clean audit for its third time in a row (budget: $242 billion). One key point people miss when they talk of higher education is the massive growth in university bureaucracy and tuition, as opposed to faculty growth. What tools can the federal government use to force universities to correct course? VR: These issues are deeply interconnected—the rising cost of college tuition and the massive expansion of university bureaucracies. The cost to educate a student hasn’t really changed much. If anything, with new distance-learning opportunities that many colleges piloted during the pandemic, this cost is likely to come down. What isn’t going down is the number of administrators, especially in the DEI departments across many major universities.

The pushback against this anti-meritocratic agenda is starting to make headway in corporate boardrooms, with Walmart announcing just recently that it would be ending a number of its race- and sex-based policies. But we aren’t seeing this same trend in higher education. Despite the Supreme Court ruling against race-based affirmative action in college admissions in 2023, colleges have sought to find workarounds. If the federal government really wanted to get serious about this, we’d follow the money. That includes reforms to accreditation, which is how a university qualifies for its students to be eligible for federal aid. The main accreditors have imposed DEI requirements on universities for them to remain eligible for this federal funding source. That is one specific area in higher education, largely behind the scenes, that is ripe for reform.

You once said that the $36 trillion debt problem is a symptom of a deeper illness: “We’ve replaced self-governance with a nanny state, administered by a cancerous bureaucracy. Fix that and the debt problem disappears.” How would you tackle the massive depression that might happen from the loss of such a massive jobs program? Is there a way to pad up the shock, lest it looks like Russia circa 1993? VR: America’s debt, now over $36 trillion, is definitely a great threat to our nation’s well-being—but it really is a symptom and not the disease itself. The real disease is the loss of self-governance in this country. What made America great the first time wasn’t our Founders’ fiscal prudence. It was the mission statement and operating manual that they left us: the Declaration of Independence and the Constitution. There was a study a few years back that estimated the number of private sector jobs that each regulatory bureaucrat was responsible for killing. It found that, for every one regulator, there were 135 jobs killed. This was before the Biden administration let regulators run amok with the American economy. So, to me the bigger concern is that we’re stifling our innovation by keeping these regulators.

The H-1B visa program seems fine. But yeah, it is being abused.

• Musk Accused of Muzzling Critics of His Migration Agenda (RT)

Elon Musk has announced a new algorithm on his social media platform X that appears to be disproportionately punishing conservatives who have vocally opposed bringing in more tech workers from India. Musk spent $44 billion to buy Twitter in 2022 in the name of promoting free speech and pushing back on censorship, and has since renamed the platform X. He has also been a prolific user. Earlier this week, one of his posts about H-1B visa workers kicked the proverbial hornet’s nest. “Just a reminder that the algorithm is trying to maximize unregretted user-seconds,” Musk posted on Friday. “If far more credible, verified subscriber accounts (not bots) mute/block your account compared to those who like your posts, your reach will decline significantly.” Accounts found to engage in “coordinated attacks” targeting others with mutes or blocks will themselves be categorized as spam, Musk added.

Musk’s announcement came a few minutes after he called critics of his immigration views “subtards,” insulting their intelligence. Meanwhile, several accounts that have openly disagreed with Musk on the issue of bringing in foreign workers have reported that their verification checkmark has disappeared. It is unclear whether the removal of their subscription status was a punitive measure by X, as the company has not commented on it. Musk and entrepreneur Vivek Ramaswamy have been tapped by President-elect Donald Trump to head DOGE, a special advisory body tasked with identifying government inefficiency. They appear to have stumbled into a minefield earlier this week, proclaiming their desire to expand the number of foreign workers recruited under the H-1B visa program so the US can “keep winning.”

“Thinking of America as a pro sports team that has been winning for a long time and wants to keep winning is the right mental construct,” Musk explained. “Our American culture has venerated mediocrity over excellence for way too long,” Ramaswamy wrote, arguing that a “culture that celebrates the prom queen over the math olympiad champ, or the jock over the valedictorian, will not produce the best engineers,” so Big Tech had no choice but to bring in foreigners. Critics have pointed out that the H-1B program has strayed from its original purpose to bring in the “best and the brightest” talent to fill specialized roles. In practice, hundreds of X users argued, it has allowed US corporations to fire domestic talent and replace it with lower-paid, entry-level guest workers, mainly from the Indian subcontinent. They also brought up the fact that Musk immigrated from South Africa, while Ramaswamy’s parents came from India.

“A culture that celebrates the prom queen over the math olympiad champ, or the jock over the valedictorian, will not produce the best engineers.”

• Musk and Ramaswamy Defend Hiring Foreign Engineers In Silicon Valley (JTN)

Billionaire Tesla CEO Elon Musk and entrepreneur Vivek Ramswamy weighed in on a social media debate about the United States’ reliance on foreign engineers being hired in Silicon Valley. Musk and Ramaswamy have been tasked by President-elect Donald Trump to run the newly-created Department of Government Efficiency (DOGE), which is expected to crack down on federal spending. They have also been supportive of Trump’s proposed immigration plan, which promises mass deportations of illegal immigrants. Ramaswamy on Thursday claimed that there were not enough competitive U.S.-born engineering candidates for the open positions, and suggested the reason for that was because of American culture celebrated jocks and popularity instead of brainiacs.

“The reason top tech companies often hire foreign-born & first-generation engineers over ‘native’ Americans isn’t because of an innate American IQ deficit (a lazy & wrong explanation),” Ramaswamy wrote in a post on X. “A key part of it comes down to the c-word: culture.” “Our American culture has venerated mediocrity over excellence for way too long (at least since the 90s and likely longer),” Ramaswamy continued. “A culture that celebrates the prom queen over the math olympiad champ, or the jock over the valedictorian, will not produce the best engineers.” Musk said on Wednesday that he would prefer to hire American engineers for his tech companies, but also cited the shortage of talent.

“OF COURSE my companies and I would prefer to hire Americans and we DO, as that is MUCH easier than going through the incredibly painful and slow work visa process,” the tech billionaire wrote in a post on X. “HOWEVER, there is a dire shortage of extremely talented and motivated engineers in America.” The debate resurfaced this week after Trump appointed Sriram Krishnan as senior policy adviser for artificial intelligence, who suggested Musk consider lifting caps on green cards for skilled immigrants, according to The Hill.

https://twitter.com/i/status/1872471673175433371

Trump gets it.

Donald Trump: “If you graduate from a U.S. college—two-year, four-year, or doctoral—you should automatically get a green card to stay.

Too often, talented grads are forced to leave and start billion-dollar companies in India or China instead of here.

That… pic.twitter.com/ElpR8PFk7h

— Ian Miles Cheong (@stillgray) December 27, 2024

“..bureaucrats relaxing in bubble baths, playing golf, getting arrested, and doing just about everything besides their jobs.”

• Trump To End ‘Work From Home’ For Federal Employees (ZH)

President-elect Donald Trump warned federal employees last week that they must return to the office, or “they’re going to be dismissed” – an announcement which comes on the heels of several major corporations taking swift action to end work-from-home, a pandemic-era policy that saw a considerable portion of the US workforce adapt to remote work. During the pandemic, approximately 2.3 million federal employees shifted away from traditional office spaces. This shift was not just a temporary adjustment, but a transformational move that many hoped would persist post-pandemic due to its perceived benefits in work-life balance and reduced operational costs. The Biden administration, acknowledging these benefits, continued to support telework, facilitating the reduction of government-owned real estate and integrating flexible work arrangements into the fabric of federal employment.

However, with Trump’s election, a quick pivot is on the horizon. Unsurprisingly, Trump’s call for a return to office has been met with resistance from federal employees and unions. Approximately 56 percent of the civil service is covered under collective bargaining agreements that include telework provisions, while a full 10% of federal jobs are now designated as fully “remote,” according to the Washington Post. Rep. James Comer (R-KY), chairman of the House Oversight Committee, agrees with Trump. “The pandemic is long over, and it is past time for the federal workforce to return to in-person work,” Comer said in a statement – adding that the Biden administration never provided evidence that work-from-home didn’t harm service. “On the contrary, the evidence suggests that Americans have suffered under these lenient telework policies,” Comer added.

Other GOP lawmakers have introduced bills mandating that chronically “absent” employees be seen in their office chairs, and Sen. Joni Ernst (R-Iowa), who leads a caucus aligned with Musk and Ramaswamy’s commission, said this month that she tracked down “bureaucrats relaxing in bubble baths, playing golf, getting arrested, and doing just about everything besides their jobs.” -WaPo. Meanwhile, as the Epoch Times notes, big business has already been taking action to get people back into the office.

Starting Jan. 2, 2025, Amazon is requiring all of its 350,000 employees to return to the office five days a week to foster collaboration and strengthen company culture, according to an announcement made by Amazon CEO Andy Jassy on Sept. 16. While companies including Boeing, Disney, Apple, Starbucks, UPS, Dell and banks such as Chase, Barclays, and CitiGroup have called employees back to work on at least a hybrid schedule, Amazon’s move has heightened the belief that remote work options are drying up. In recent months, various surveys have revealed that business leaders are becoming more resolute in their push to reinstate pre-pandemic work practices.

A September KPMG report highlighted that 83 percent of U.S. CEOs expect a full return to the office within the next three years, up from 64 percent in 2023. Likewise, an August survey by Resume Builder showed that 90 percent of businesses will have adopted return-to-office policies by next year, with 30 percent requiring full-time office attendance. The latest Flex Index, which monitors the RTO activity of 100 million employees across more than 13,000 companies, showed that 43 percent of U.S. firms on an industry-adjusted basis have employed a structured hybrid model in the fourth quarter, up from 38 percent in the third quarter and 20 percent in the first quarter of 2023. Additionally, 32 percent of firms had fully returned to in-office work.

“But now, any large company that wants to distance itself from DEI has the best reason in the world: compliance. It’s illegal.”

• Marc Andreessen: Harmeet Dhillon Will Drop Hammer On Woke Corporations (ZH)

Billionaire investor and Donald Trump adviser Marc Andreessen thinks corporate culture is about to undergo a radical change. Speaking with Erik Torenberg on the Moment of Zen podcast, Andreessen said that the reign of extreme wokeness, particularly in corporate America and the media, is rapidly coming to an end. The catalyst? A combination of rising legal risks, the deflation of wokeness as a cultural force, and a change in leadership at the Department of Justice. Andreessen highlighted that with the appointment of Harmeet Dhillon to head the DOJ’s Civil Rights Division, the federal government may soon begin to challenge and reverse many of the DEI-driven policies that have dominated corporations, universities, and other large institutions over the past decade. This shift, he argues, could trigger a major pullback in DEI initiatives across the private sector, as companies scramble to comply with the law and distance themselves from policies that may now be seen as legally and culturally untenable.

[..] Marc Andreessen: If you wanted to pick the most extreme possible attorney to put in charge of the Civil Rights division of the Justice Department to reverse DEI, it would be this lawyer named Harmeet Dhillon. She’s been a California lawyer and has been the scourge of woke corporations for the last decade. As it happens, she has just been appointed to run the Civil Rights division of the Justice Department. For those who don’t track this, the Civil Rights division of the Justice Department is the federal government’s prosecutorial arm that basically enforces wokeness. They’re the ones who have made sure that, for the last decade, these companies have had all these crazy policies under the penalty of being investigated, subpoenaed, and ultimately prosecuted.

There have been lots of prosecutions and court cases. The most famous case that the current head of the Civil Rights division brought was the case against SpaceX for not hiring enough refugees—despite the fact that SpaceX is a military contractor and is not permitted to hire non-American citizens under a separate law.The person running that division has been a true activist, as you’d expect from this administration. And then Dhillon, who, by the way, I don’t know but I’ve been following for years, and is clearly brilliant, she is the exact opposite of that. Every signal is being sent that they’re going to do a 180 on all these things, and they’re going to begin prosecuting companies for violations of civil rights laws in the form of reverse discrimination—discrimination against white people, Asians, Jews, and other unprotected classes.

So, signals are being sent by these appointments that there is going to be an assault to reverse the assault that companies and universities have been under. And then, of course, the Supreme Court ruled not that long ago that private universities are not allowed to do race-based admissions. It’s actually really funny because there’s some question as to whether the demographic shift of admissions in the last year was starkly different than the year before, as these institutions claim they’re coming into compliance with the Supreme Court. There’s some question as to whether discovery will show they’re actually in compliance or whether they’re still playing games. That’s another thing we may find out.

There’s also an open question as to whether this decision has essentially already been made or will be made for private companies as well. And there’s a lot of private companies that have been trying to figure out quietly how to distance themselves from DEI, both for legal reasons and for cultural reasons. Now, there’s another very interesting thing kicking in. I think there are a lot of large companies that were already done with DEI to start with. They were done with DEI for their own reasons because it’s backfired in many spectacular ways. But now, any large company that wants to distance itself from DEI has the best reason in the world: compliance. It’s illegal.

Let me just say for the record… I think every major corporation in the country is just in flagrant violation of actual civil rights law. You cannot have these hard quotas and racially, ethnically, and religiously biased hiring practices. It’s flat-out illegal. These companies have gone so extreme on this that they’ve ended up in what I think is clearly mass illegality. So, as Dhillon steps into her job, she’s not going to lack for a shortage of targets. If you don’t want to be a target, it’s a great ‘get out of jail free’ card to just voluntarily shut all this stuff down.

My guess is that starting pretty quickly, we’re already starting to see it. Boeing and a bunch of other companies have already put a bullet in their programs. Even the University of Michigan, which went completely overboard with this stuff, has actually shut their whole thing down. I think we’re going to see, my guess is, a run of companies that will take dramatic action here.

“..an agency tasked with impartial enforcement of justice,” he said.”

A 100-year-old talking about the FBI.

• Deep State, Media And Academics Circle The Wagons Against Kash Patel (Widburg)

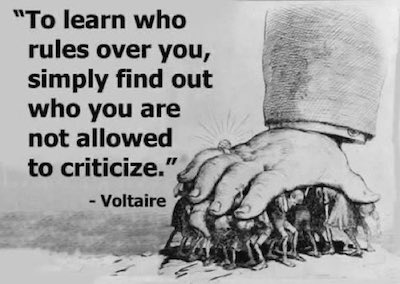

Kash Patel has promised that, if he becomes head of the FBI, he will reveal the secrets it’s unlawfully hidden, call to account the FBI employees (from the top down) who have violated the law, and end illegal FBI activities. Deep State operatives and their friends in the media and academia call this a form of impermissible loyalty to Donald Trump. Americans, however, call this laudable loyalty to the American people and the rule of law. It’s to be hoped that Republicans in the Senate listen to the American people and not to the siren song of the Swamp. One of the Deep Staters who seems very worried that the FBI will be forced onto the straight and narrow is William Webster, one of the deepest of the Deep Staters.

Webster started working for the federal government in the early 1950s and retired only 70 years later, in 2020. Over the course of his career, this centenarian has been a US Attorney in Missouri, a district court judge in Missouri, an appellate judge in Missouri, the director of the FBI, the director of the CIA, and the chair of the Homeland Security Advisory Council. I do not consider this a glowing resume. I consider it a terrifying one and wouldn’t trust Webster as far as I could throw him. According to Politico, Webster is sounding the alarm about Patel:

“A former head of the FBI and CIA is raising objections over whether Kash Patel and Tulsi Gabbard, President-elect Donald Trump’s picks to be directors of the FBI and national intelligence, respectively, are qualified to serve in the Cabinet. In a letter to senators on Thursday, William Webster, the only person to lead both the FBI and CIA, wrote that neither nominee meets the demands of top intelligence jobs. Webster, who is 100 years old, praised Patel’s patriotism but wrote that his allegiance to Trump was concerning. “His record of executing the president’s directives suggest a loyalty to individuals rather than the rule of law — a dangerous precedent for an agency tasked with impartial enforcement of justice,” he said.”

Now, maybe I missed it, but I don’t recall a squeak from Webster about the FBI’s heinous abuses under Obama or Biden, or when they were ostensibly reporting to Trump while trying to destroy. As best as I can tell, Webster was silent when Obama spied on congresspeople and journalists. He then maintained that silence about the Russia Hoax, the Ukraine hoax, the framing of the half-witted “Whitmer kidnapping” defendants, the attacks on parents speaking out at school board meetings, the spying on traditional Catholics, the all-out war against the January 6ers (something that stands in complete contrast to the pass that the FBI routinely gave leftist protestors), the way the FBI consistently protected Biden and his whole family, and the vicious persecution of pro-life activists…just to name a few examples of blatant FBI partisanship. Webster’s photos show a nice-looking old man, but when I imagine this government insider terrified of a clean broom coming into the FBI and forcing it to abide by the law, my mind’s eye summons up a very different image.

The panic about a new broom at the FBI also showed up in ludicrous fashion at The New Yorker, which chose to publish an academic’s essay putting J. Edgar Hoover up on a pedestal as a model of virtuous non-partisanship compared to Patel. I’m not exaggerating. This is how Beverly Gage’s essay opens: “Since President-elect Donald Trump announced his intention of appointing his political loyalist Kash Patel as the director of the F.B.I., critics have warned that we’re heading back to the bad old days of J. Edgar Hoover. The F.B.I. should be so lucky. Hoover, for all his many faults and abuses of power, was nevertheless an institution builder; he believed in the F.B.I.’s nonpartisan independence.” The essay goes on from there, a perfect hagiography of a virtuous man who cross-dressed, hid his homosexual relationships, and tried to destroy Civil Rights activists.

What’s so funny about this is that, as I vividly recall from my youth, the left despised Hoover because they believed that he was the ultimate partisan, using his vast, mostly self-acquired power to destroy communists and anyone else he didn’t like. Gage’s claim to write with such authority about the wonders of Hoover’s FBI tenure is that she is a Yale professor who wrote a Pulitzer Prize-winning biography about Hoover. (Nowadays, the Pulitzer Prize is like a rattlesnake warning that a book or article is a leftist wet dream.) What’s so fascinating about her love affair with Hoover is how it differs from a two-year-old interview that Gage did with The Jacobin. There, she explains how the left rightly despised Hoover because of his blatant, noxious, dangerous partisanship.

Mary McCarthy famously said of the communist Lillian Hellman that “everything she says is a lie, including ‘and’ and ‘the.’” That could be written on the tombstones of America’s media, political insiders, and academics. As I said at the start of this essay, unless the Senators have nasty secrets that only the FBI knows, they will serve the American people best if they affirm the Kash Patel nomination.

“Obviously, Fico is not the only one who was offered money in this fashion. How else would one explain the info-campaign in Europe in support of corrupt Zelensky?”

• Zelensky’s Corruption Has Ruined Ukraine – Opposition Leader (RT)

An “attempted bribe” of Slovak Prime Minister Robert Fico has exposed Vladimir Zelensky’s corruption and the criminal nature of the Ukraine conflict, exiled Ukrainian opposition figure Viktor Medvedchuk has said. Last week, Fico said Zelensky offered him €500 million ($520 million) in exchange for support for Ukrainian accession to NATO. Zelensky confirmed the offer, which he called compensation to the people of Slovakia for the loss of Russian energy supplies after Kiev shuts down the gas transit next year. Medvedchuk – who was ousted from Ukraine after Zelensky’s government cracked down on his opposition party in 2022 – believes the episode exemplifies the “corrupt nature” of Zelensky’s rule. Medvedchuk’s political movement has urged the EU authorities to investigate the Ukrainian leader for attempted bribery of the Slovak prime minister.

NATO membership for Ukraine would shield Zelensky from bearing responsibility for “losing the war” with Russia, Medvedchuk said in a blog post on Friday, so he will spare no effort in pushing for this goal, including through criminal methods. After Fico’s refusal, Zelensky “found no better way forward than to accuse the Slovak prime minister of corruption,” Medvedchuk wrote. Zelensky has claimed that Fico is pursuing “shady deals” with Russia for his own personal benefit, after he traveled to Moscow last week for negotiations with President Vladimir Putin. Zelensky offered to pay €500 million from Russian sovereign funds that have been frozen by Western nations, which Kiev claims it has a right to use, according to Fico. Medvedchuk said he believes the Ukrainian leader could just as easily pay the “bribe” out of his own pocket.

Zelensky has embezzled significant amounts of money while running the country, critics claim. “Obviously, Fico is not the only one who was offered money in this fashion. How else would one explain the info-campaign in Europe in support of corrupt Zelensky?” the exiled politician claimed. ”Zelensky has exposed a huge graft scheme stretching all across Europe,” Medvedchuk went on to say. “The entire Ukraine conflict is based on one large corrupt scheme that involves leading parties and politicians in Europe and the US.” Western politicians that support Kiev are afraid that after they are voted out of power, the new leaders will “find out that they had been robbing their own people under the guise of helping Zelensky’s Ukraine,” Medvedchuk said.

The broken record plays again from the beginning.

• West ‘Must’ Send Ukraine More – Zelensky (RT)

The West “must” send Kiev more weapons and faster in order to help the war effort against Russia, Ukraine’s Vladimir Zelensky has said. Since the conflict with Russia escalated in 2022, Ukraine has received over $200 billion in military, financial, and humanitarian aid from the US and its allies. Kiev is now completely dependent on the West for military logistics, according to the US media. “It is crucial that the US is now increasing its deliveries, this support is essential to stabilize the situation,” Zelensky said in a video message on Thursday evening. “I thank our partners for their assistance, but the pace of deliveries must accelerate to disrupt the tempo of Russian assaults. We need more strength in weaponry and strong positions for diplomacy,” he added. The video was in Ukrainian but had English subtitles, while two lines were posted in English on Zelensky’s X account.

Following Donald Trump’s victory in the US presidential election last month, President Joe Biden’s administration has sought to send as much money, weapons, equipment and ammunition to Ukraine as possible before handing over power on January 20. On December 2, the White House announced a $725 million package of military aid from Pentagon stockpiles under the Presidential Drawdown Authority (PDA). Five days later, Washington said another $988 million worth of drones and missiles had already been supplied under the Ukraine Security Assistance Initiative (USAI). A third package followed on December 12, consisting of $500 million worth of drones, armored vehicles and ammunition for HIMARS rocket launchers.

Congress approved a $61 billion request for Ukraine funding in April. The Republican majority in the House of Representatives has since ruled out the White House’s request for another $24 billion. The $895 billion National Defense Authorization Act (NDAA) approved earlier this week did not include any aid for Kiev. According to Al Jazeera, the White House may have up to $3.5 billion left in the PDA and another $2.2 billion under the USAI that it could “surge” to Kiev before Biden’s term expires. Russia has maintained that no amount of Western aid will change the ultimate outcome of the conflict or prevent Moscow from achieving the goals of its military operation.

“Mark my words. One year until Nord Stream is up and running!”

• US Could Buy Nord Stream – Vucic (RT)

The sabotaged Nord Stream 2 gas pipeline could become US property in a year, and gas supplies from Russia to the EU would be resumed, Serbian President Aleksandar Vucic has said. Vucic shared his view about the future of the pipeline and its potential ownership in an interview with the German news outlet Handelsblatt published on Friday. “I dare to predict: In a year at the latest, Nord Stream will be owned by an American investor, and gas will flow from Russia to Europe through the pipeline,” the Serbian leader said. “Mark my words. One year until Nord Stream is up and running!” The pipeline, which was built to deliver Russian gas to Germany and the rest of Western Europe, was ruptured by explosions at the bottom of the Baltic Sea in September 2022.

https://twitter.com/i/status/1872720585576616405

Last month, the Wall Street Journal reported that US financier and investor Stephen Lynch had asked permission from the US Treasury Department to buy the sabotaged Nord Stream 2 gas pipeline if it is put up for auction next year. The financier said a deal for the Russian pipeline could be seen as a strategic opportunity for long-term US interests. The ownership of the pipeline would give the American government a tool to exert pressure in any peace negotiations with Russia to end the Ukraine conflict, Lynch told the WSJ. Lynch reportedly said he could buy the Nord Stream 2, which has been valued at around $11 billion, for “pennies on the dollar,” adding that it would be a “once-in-a-generation opportunity” for the US to take control over the EU’s energy supply.

While no one claimed responsibility for the 2022 attack on the pipeline, Western media outlets have reported that people linked to Ukraine were behind the operation. Moscow has argued that the US benefited from the attack due to its position as a supplier of liquefied natural gas to Europe, and pointed the finger at Washington as a possible culprit. The head of Russia’s Foreign Intelligence Service, Sergey Naryshkin, said last month that his agency had information about the “direct involvement” of professionals from the US and British special services in the Nord Stream sabotage. London and Washington, as well as Kiev, have denied any involvement.

Everyone’s covering their asses.

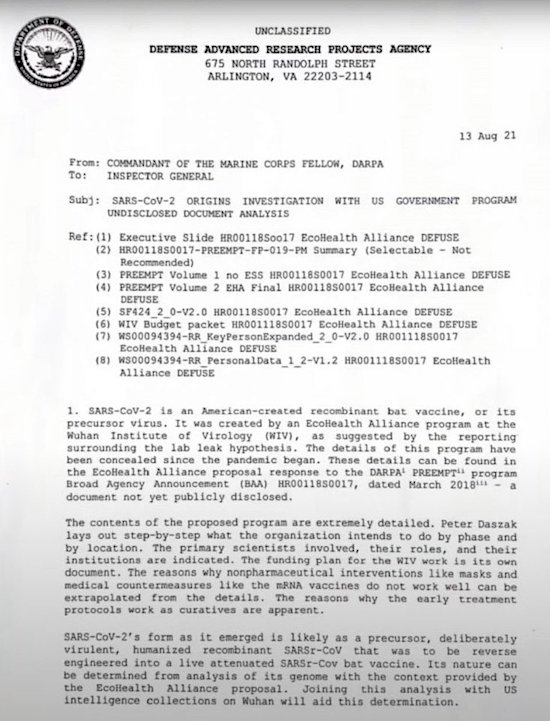

• US Spies Hid Covid-19 Lab Leak Evidence From Biden (RT)

US intelligence officials “silenced” researchers who found evidence that the Covid-19 pandemic was the result of a Chinese lab leak, the New York Post reported on Thursday, citing sources. According to the outlet, researchers’ analysis included “dozens” of data points to back up a lab leak version, but none of them made it to the 2021 report ordered by President Joe Biden, which stated that the virus was “probably not genetically engineered.” The researchers involved were John Hardham, Robert Cutlip, and Jean-Paul Chretien, who at the time worked at the National Center for Medical Intelligence, part of the Pentagon’s Defense Intelligence Agency, tasked with studying biological weapons threats and infectious diseases. They conducted a scientific study of Covid-19 and concluded that the virus was most likely made in a lab.

According to their findings, the virus contained a biological characteristic that allowed for easier transmission to humans, similar to a feature described in a Chinese study several years back. They also found that a Chinese military researcher applied for a patent for a Covid-19 vaccine mere weeks after the virus was first sequenced in 2020, which meant he must have had the sequence much earlier. Moreover, the researchers found that scientists at China’s research laboratory for coronaviruses in Wuhan, the city in which Covid-19 was first detected, previously worked with US researchers on viruses which won’t have traces of being scientifically-manipulated. The damning findings, however, were overlooked in the report on Covid-19 origins prepared by the director of national intelligence, Avril Haines, which was presented to Biden in August 2021. The researchers were also reportedly forbidden from sharing their findings, including with Congress and the FBI.

“The scientists who had the subject matter expertise were silenced,” a source close to their work told the New York Post, adding that Biden and other officials were “completely unwitting” about the evidence that the virus was likely the result of a lab leak. An earlier report by the Wall Street Journal claimed that US intelligence officials also had a hand in excluding the FBI’s findings on the Covid-19 origins from Biden’s report. The FBI was the only US agency at the time to conclude the lab leak theory was likely. However, FBI scientists were not invited to the White House briefing at which Biden was presented with Haines’ report, and their findings were overlooked in it. Earlier this month, the US Congressional Select Subcommittee on the Coronavirus Pandemic published a 520-page report, also concluding that Covid-19 most likely emerged from a laboratory in Wuhan. The report claimed that the Chinese government, agencies within the US government, and members of the international scientific community “sought to cover up facts concerning the origins of the pandemic.”

In 2020, then-President Donald Trump claimed without providing evidence that the virus originated from a Chinese lab. Beijing denied the claim, calling it a reelection tactic aimed at boosting Trump’s standing among Republican voters. The following year, during Biden’s presidency, White House chief medical adviser Dr. Anthony Fauci faced scrutiny over his handling of the Covid-19 pandemic’s origins. Critics allege he downplayed the possibility of a lab leak from the Wuhan Institute of Virology, which received US funding for coronavirus research through grants approved by his agency. Emails and congressional hearings have raised questions about whether Fauci sought to suppress discussions of the lab leak theory to protect scientific collaboration. While Fauci has consistently denied any cover-up, the debate has fueled demands for transparency about US involvement in such research.

“For smaller nations, sovereignty has often been reduced to a performative ritual — valuable only insofar as it serves the interests of global powers.”

• The King Is Dead: Trump’s Talk On ‘Taking Canada’ (Bordachev)

Donald Trump’s most notable contribution to world politics since his re-election as US president has been stirring the pot with audacious comments: annexing Canada, buying Greenland, and reclaiming the Panama Canal. These remarks have sparked retaliatory statements from governments, a flurry of internet humor, and even some thoughtful analysis. While most observers dismiss these musings as an attempt to emotionally destabilize negotiating partners — a hypothesis supported by Trump’s grumblings over Western Europe’s energy purchases from the US — there’s a deeper layer worth exploring. Beyond the entertainment value (and let’s admit, we all need some lighthearted headlines amidst global tensions), Trump’s provocations might just be making a larger point: state sovereignty is no longer the unshakable concept we once believed it to be.

In a world where power increasingly relies on military might, sovereignty has shifted from being a formal status to a practical question of control. Today, imagining Canada, Greenland, or Mexico as part of the United States seems absurd. But in the near future, we might find ourselves seriously questioning why states unable to secure their own sovereignty should retain it at all. For centuries, territory has been the bedrock of international politics — more tangible than rules, norms, or international agreements. In fact, the “inviolability of borders” is a relatively recent invention. For most of history, states fought over land because it was the ultimate resource: essential for war, economic development, and population growth. Nearly every conflict until the mid-20th century ended with redrawn borders.

The idea that every nation has an inherent right to statehood emerged in the 20th century, championed by two unlikely allies: the Russian Bolsheviks and US President Woodrow Wilson. Both sought to dismantle empires — Russia’s for ideological reasons, and the Americans to expand their own influence. The result was a proliferation of weak, dependent states that became tools of Moscow and Washington’s foreign policy, their sovereignty little more than a bargaining chip for elites reliant on external support. After World War II, the colonial powers of Europe crumbled. Many former colonies gained independence but were unable to secure it on their own, becoming dependent on superpowers like the US or USSR. Even larger states like China and India required significant foreign support to chart their paths forward. For smaller nations, sovereignty has often been reduced to a performative ritual — valuable only insofar as it serves the interests of global powers.

This dynamic has persisted into the neoliberal era. Countries like Canada, whose budgets depend heavily on economic ties with the US, highlight the absurdity of sovereignty under such conditions. What’s the point of maintaining state institutions if a country’s development hinges entirely on external relationships? Trump’s comments expose the cracks in this system. Why should the US continue to prop up Canada’s independence when the costs outweigh the benefits? Sovereignty, once treated as sacred, increasingly looks like a relic of a bygone era —useful only for elites to extract rents while selling loyalty to stronger powers.

In this shifting global landscape, territory and control are once again becoming the central pillars of international politics. The idea that the “rules-based order” will guide the world toward fairness and equality is a pleasant fiction, but reality has other plans. International organizations like the UN, originally designed to secure Western dominance, are losing their grip as new powers emerge. Building a fairer world order will take decades, and it will only be possible if states can prove they are truly sovereign — self-reliant and responsible for their decisions. Until then, sovereignty as mere ritual will continue to erode. Trump, in his typically brash and provocative way, is already pointing out the absurdities of the current system. Whether intentionally or not, he’s raising questions about the material realities of sovereignty in the 21st century — and doing so in a way only he can.

“The Pentagon’s apparent goal is to develop a bioweapon that would affect Russians but remain harmless to Westerners..”

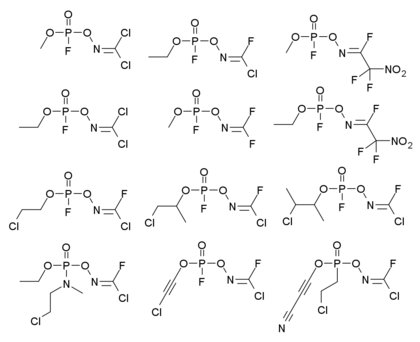

• What Bioweapons is the Pentagon Developing? (Sp.)

The US is conducting military biological research aimed at discovering new harmful bacteria and viruses tailored to infect certain races, nationalities and even residents of specific regions, Igor Korotchenko, military analyst and editor-in-chief of “National Defense” magazine told Sputnik. The Russian Federal Security Service (FSB) disclosed on December 27 that convicted US spy Eugene Spector had gathered and transmitted biotech data to the Pentagon to aid in creating a high-speed system for genetically screening Russians. The Pentagon’s apparent goal is to develop a bioweapon that would affect Russians but remain harmless to Westerners, Korotchenko said. To that end, the US needs to collect bio-material and genetic samples from various ethnic groups living in Russia.

“[Spector] aided the Pentagon’s military biological branches in collecting and transferring relevant samples with the aim of identifying potential vulnerabilities in the genetic code of certain categories of the Russian population,” Korotchenko explained. The Russian counter-intelligence services are aware of and actively preventing the Pentagon’s bio-research activities within Russia, the expert noted. Lieutenant General Igor Kirillov, head of the Russian Armed Forces Radiological, Chemical and Biological Defense Troops, had previously exposed the Pentagon’s sophisticated bio-weapon program operating in Ukraine.

In August, Kirillov revealed that prior to 2022, the US had obtained up to 16,000 biological samples from Ukraine with the aim of developing viruses and bacteria dangerous to ethnic Ukrainians and Russians. General Kirillov was assassinated in a bombing on December 17. Russian investigators stated that the terror attack was carried out on orders from Ukrainian special services.

All pardons are in place?!

• Newly Released Photos Show Hunter, Joe Biden, Chinese Officials In 2013 (JTN)

The National Archives has released photos of Hunter and Joe Biden meeting with Chinese President Xi Jinping and other Chinese high-ranking officials in 2013 during the Obama-Biden administration. The photos were obtained by the conservative legal foundation, America First Legal. The president had long insisted that he never had any involvement in Hunter’s business dealings. In another photo, Biden is seen presenting Hunter to then-Vice President Li Yuanchao, according to Newsweek. The photos include instances in which Joe Biden is pictured with Hunter’s business associates from BHR Partners, including Jonathan Li and Ming Xue.

The newly surfaced images take on added significance in light of the full and unconditional pardon on Dec. 1 that Biden granted his son after insisting he would not do so. The pardon not only covered the offenses that Hunter was convicted of, namely illegally obtaining a firearm and failing to pay over $1.4 million in taxes between 2016 and 2019, but also any other “offenses against the United States which he has committed or may have committed or taken part in during the period from January 1, 2014 through December 1, 2024,” according to Newsweek.

Michael Ding, America First Legal Counsel, said: “Even while President Biden has pardoned his son, Hunter, for anything and everything ‘he has committed or may have committed or taken part in’ going all the way back to the year 2014, more evidence comes out each day showing how his family leveraged Joe Biden’s even longer career in public office for private gain. America First Legal will not stop fighting to uncover the full story of the Biden family’s corruption.” Rep. Andy Biggs, of Arizona’s 5th congressional district, said in a post on X: “Joe’s pardon of Hunter doesn’t disqualify Congress from continuing our investigation into the Biden Crime Family Syndicate. In fact, Hunter’s pardon means he waives his Fifth Amendment protections. We must have him testify under oath—he can’t hide from the truth forever.”

Hunter and Xi. Hmm.

• New Photo Shows Biden with Hunter‘s Business Associates (Turley)

“Lies.” That response was a mantra for President Joe Biden, who denied ever meeting or knowing about his son’s foreign dealings. Despite the pronounced lack of interest by most media outlets in the alleged multimillion dollar influence-peddling scheme, the House and conservative groups have doggedly pursued the matter and found overwhelming evidence that the President has repeatedly lied about his interactions with foreign clients. Now, a new photo further contradicts the President, who recently pardoned his son for any crimes committed over a ten-year period. America First Legal has been engaged in a prolonged legal fight with the National Archives to get access to the undisclosed evidence. It recently won critical rulings forcing the release.

The discovery includes this photo of then-vice president Joe Biden meeting with Hunter and his clients. It adds to an already ample photographic and testimonial record contradicting the President’s past denials. The House has released records showing $27 million in payments from foreign sources to Hunter Biden and his business partners from 2014 to 2019. Hunter used official trips with his father to facilitate some of these associations. Despite denying meeting with these clients or knowing anything about his son’s dealings, it was later revealed that Biden was repeatedly put on a speakerphone with clients, attended dinners, and took pictures with them, including BHR Partners CEO Jonathan Li. A key witness said that he sat down with Joe Biden specifically to discuss these foreign deals with this son. Joe Biden later wrote college recommendation letters for Li’s son and daughter.

In the summer of 2019, Li wired Hunter Biden $250,000 that originated in Beijing and had Joe Biden’s Delaware home as the beneficiary address. There were diamonds as gifts, lavish expense accounts, and a sports car, in addition to massive payments that Hunter claimed were “loans.” There are messages like the one to a Chinese businessman openly threatening the displeasure of Joe Biden if money is not sent to them immediately. In the WhatsApp message, Hunter stated: “I am sitting here with my father, and we would like to understand why the commitment made has not been fulfilled. Tell the director that I would like to resolve this now before it gets out of hand, and now means tonight. And, Z, if I get a call or text from anyone involved in this other than you, Zhang, or the Chairman, I will make certain that between the man sitting next to me and every person he knows and my ability to forever hold a grudge that you will regret not following my direction. I am sitting here waiting for the call with my father.”

After years of ignoring the influence-peddling scandal, the media is not likely to suddenly pursue the story. In the meantime, Democrats have praised or rationalized Biden for pardoning his son despite the fact that it covered possible crimes that might implicate not just Hunter but his father in corruption. Only two out of ten Americans support the pardon. However, Sen. Dick Durbin (D., Ill.), chairman of the Senate Judiciary Committee and Senate majority whip, called it a “labor of love.” And, as we learned in a certain 1970 film, “Love means never having to say you’re sorry” . . . particularly when you have pardon power.

A long year from Jim.

• Forecast 2025 — Taking Out the Trash (James Howard Kunstler)

I would guess that you’re feeling as if anything might happen now. It’s hard to rule out even the possibility that we could all be vaporized before moving onto the next mundane chore of the day. The world order is dangerously in flux. America’s Woke-Jacobin “Joe Biden” regime was defeated in the 2024 election, but they were apparently just a front for the sinister entity we call the “blob” or the Deep State, which in recent years has consistently and garishly acted against our country’s interests. So, the blob abides, and it probably weaves schemes in the deep background of daily life even as a new government awaits. But if the Woke-Jacobin Biden-istas were tied-in with the so-called “globalist” enterprise centered around the EU bureaucracy, with assistance from the World Economic Forum’s network of zillionaires and bankers. . . well, that coalition looks rather broken now. It’s doing a hurt-dance. It’s on the run, a little bit.

What is not broken for the moment — a tenuous moment — is the new Trump regime’s determination to correct the disorders of Western Civ, starting with the affairs of the USA, according to age-old reality-based norms of behavior and good-faith relations between the people and their government. Trust was broken and must be restored. The President-elect has assembled an extraordinary team of reformers, if they can get to their posts without subversion. And, of course, Mr. Trump himself has to evade further attempts to rub him out, to knock him off the game-board before he can take office, and then he must survive the months beyond his inauguration. So, you are correct to be nervous.

Paradoxically, Mr. Trump has to initially manage the US government as if it deserves a sense of reassuring continuity, which, in many respects it does not deserve. So many institutions and relationships between them have been perverted and damaged. How do we pretend that the upper layers of management in any federal agency — the strata who really run things below the top “political” appointees — can continue in-place as if all that perversion never happened? The Department of Justice and the FBI are filled with lawyers and agents who abused their power egregiously and went to war against the American people. The agency’s work will just have to stop for a while. The nation can probably endure if investigations and prosecutions are suspended for sixty days while the personnel issues get sorted out — who goes and who stays.

But what about the Defense Department and the CIA? The country must be able to defend itself. These departments are the lairs of the more dangerously entrenched blob actors. Both DOD and the CIA have come to be organized as racketeering operations. Both are involved in domestic money-laundering activities at the giant scale, and in rackets abroad — such as the many grifts around Ukraine, in which giant financial entities like BlackRock are partnered-in. (You know, for instance, don’t you, that BlackRock was poised to acquire control of Ukraine’s natural resource base, until Mr. Putin’s resolve ended that fantasy.) And the CIA is suspected of being deeply involved in the Mexican crime cartel operations, both around drugs and human trafficking. The imputations are sickening. The DOD and the CIA will fight desperately to preserve their perqs and projects, and to stay out of jail. But until now they have not really been challenged.

David B. Collum, Betty R. Miller Professor of Chemistry and Chemical Biology – Cornell University, writes his annual report that takes a full year just to read.

• 2024 Year In Review, Part 1: What Is A Fact? (Dave Collum)

Let’s see how you do on the Collum Conspiracy Test (CCT) to obtain your CCT score (CCTS). Read the 30 declarative statements listed below that are in conflict with standard narratives. Keep score on a Post-it by giving yourself:

• Zero points if you disagree or have no idea what the statement means.

• One point if it troubles you that the statement might be correct.

• Two points if your response is “Yup” or “Hell yeah!”I’ll give you my CCTS when you are done. Now for the quiz…

- 9/11 was an inside job.

- Kamala Harris was groomed by her mother via MKUltra to become a Manchurian candidate.

- Pizzagate is real and tied to Satanic rituals.

- The QQQ index has a price-earnings ratio that exceeds 100.

- Lindsay Graham is the love child of Nancy Pelosi and Peanut the Squirrel.

- One million children a year disappear to consumers who are never identified.

- The 2020 election count was rigged.

- We never landed on the moon.

- Anthropogenic climate change is a hoax and a grift.

- The Covid-19 vaccine and crisis-based healthcare policy responses tied to the pandemic killed more people than did the Covid virus.

- 75% of prescription medicines have no efficacy.

- Greater than 75% of those in Congress and the Senate are controlled by blackmail.

- Steven Pollock did not fire a single shot in Las Vegas.

- The authorities are hiding evidence of alien contact and alien technology.

- US tactics and policy during World War II were under the control of Joseph Stalin.

- The world is flat.

- JFK and RFK were whacked by operatives tied to intelligence.

- The DOD—think chem trails and HAARP—is modifying weather for tactical purposes.

- The world leaders are shape-shifting reptiles.

- The holocaust was fake.

- FDR knew the Japanese would attack Pearl Harbor and let it happen.

- Jeffrey Epstein isn’t dead.

- The Covid virus was generated in the lab under the auspices of the US bioweapons program.

- Michelle Obama is a biological male (Big Mike).

- The Clinton Foundation trafficks children.

- Ryan Routh and Thomas Crooks are/were intelligence assets.

- There is something seriously wrong with the Sandy Hook shooting narrative.

- Directed energy weapons (DEWs) are being tested by starting forest fires.

- Fluoridation of water is not about making our teeth stronger.

- The mainstream media does not need revenues, which are easily covered by the deep pockets of the Deep State, but desperately needs viewers.

Ed Dowd

https://twitter.com/i/status/1872735868709941748

Who’s first

Comes into the world like “who’s first”! pic.twitter.com/Lz0K8WaFur

— Nature is Amazing ☘️ (@AMAZlNGNATURE) December 26, 2024

Rhino

Complicated life of a rhino

pic.twitter.com/K44kfjHJxT— Science girl (@gunsnrosesgirl3) December 27, 2024

Snow

German Shepherd rescues Friend Stuck In Snow pic.twitter.com/cR8BG4Cq0F

— B&S (@_B___S) December 27, 2024

Boss

https://twitter.com/i/status/1872437329794646192

Trix

https://twitter.com/i/status/1872436052092506457

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.