Leslie Jones The Hindenburg over Boston Common 1936

If Americans were less prone to self-deceit, they would have long since realized that the American Dream is over, for good, and that continuing to chase it is the worst of the few remaining options they get to choose between.

They could then look at themselves in the mirror and see their future.

As things are, however, the future is creeping up on them in small, slow and silent steps, until one day it will simply be there, no longer deniable or avoidable, and it will find them woefully unprepared.

This is not true only for Americans, the entire formerly rich world will undergo the same transformation. But it will be very pronounced stateside.

It’s impossible to follow events in Ferguson, Missouri and not recognize that there are thousands of – potential – Fergusons in-waiting spread across the USA. You don’t have to be particularly clever to recognize the patterns.

Segregation by race – a.k.a. racism – has never left the country, even though the courage of true American heroes like Martin Luther King and Muhammad Ali changed many things for the better.

Segregation by race has always remained inevitably linked to segregation by wealth and income. As a hugely disproportionate number of black kids continue to be incarcerated under a prison system that locks away more citizens than in any other country.

You could be forgiven for thinking that America went looking for trouble. And is now finding it. Like so many things, that trouble doesn’t stand out or float to the top in times of plenty. But when those times are over, trouble is the only thing remaining.

As long as the illusion of the American Dream, and the illusion of economic growth, can be kept alive, people will be inclined to take a lot of things for granted. When their eyes open and these illusions are shattered, matters can turn on a dime.

Bloomberg provides some of the background to Ferguson and all those other American communities. What’s happening in Ferguson shouldn’t come as a surprise, what’s surprising is that it’s not much more widespread yet.

Ferguson Unrest Shows Poverty Grows Fastest in Suburbs

• “We’ve passed this tipping point and there are now more poor people in the suburbs than the cities,” said Elizabeth Kneebone, author of [a July 31 Brookings Institution report]. “In those communities, we see things like poorer health outcomes, failing schools and higher crime rates.”

• [..] the city – which has lost more than 40% of its white population since 2000 – [has] a mostly white city council and police force. [..] The St. Louis metropolitan area ranks as one of the most segregated in the U.S. Ferguson, once a majority white community that’s now about two-thirds black, highlights that dynamic.

• Coinciding with the decline in white population is a rapid rise in poverty since 2000 [..]

• “Looking at the neighborhood poverty rates, it’s striking how much has changed over a decade,” Kneebone said. “In Ferguson in 2000, none of the neighborhoods had hit that 20% poverty rate. By the end of the 2000s, almost every census tract met or exceeded that poverty rate.

• The poverty rate in Ferguson was 22% in 2012, the most recent available, up from 10.2% in 2000. Suburban locales from the outskirts of Atlanta to Colorado Springs have seen similar trends. The number of poor people living in impoverished U.S. suburbs has more than doubled since 2000, comparing to a 50% rise in cities. More than half of the 46 million Americans in poverty now live in suburbs ..

• “The median income is so low in Ferguson that people are really struggling, living from check to check, and they’re even behind checks,” state Senator Maria Chappelle-Nadal said.

• “For much of the latter half of the 20th century, it was a pattern of segregation by race, and that’s been displaced somewhat by a segregation by income, which is growing starker and starker in cities like St. Louis.”

While Americans have been – and still are – waiting for the recovery to come that the government and the media promise, their world is not standing still; it’s deteriorating at a fast pace. It just takes them a long time to notice, focused as they are on the illusions.

That is a dangerous dynamic in a country so loaded to the hilt with firearms. Something that the government, at all levels, has been acutely aware of for many years. The calls, in the wake of Ferguson, to de-militarize police forces, look somewhat less than timely or honest or genuine in that light.

The militarization of American police forces has been a very conscious choice by those who long since sensed a threat to their positions, their way of life, and their powers. Not everyone feels they can afford to stare blindly into illusions.

Another aspect of the demise of America as we once knew it, and one very much connected to Ferguson, because it’s economics that drives the whole machinery, is pensions. An amazing graph posted by Tyler Durden, along with some apt comments, explain.

Why The Fed Can’t, And Won’t, Let The Stock Market Crash

… it is not the 1% that would suffer the most should the S&P have a post-Lehman like 50%+ wipe out, which also means that the Federal Reserve’s only mandate of pushing asset prices to ever higher levels while pretending it does so to boost employment and keep inflation at 2% is no longer for the benefit of the uber-wealthy.

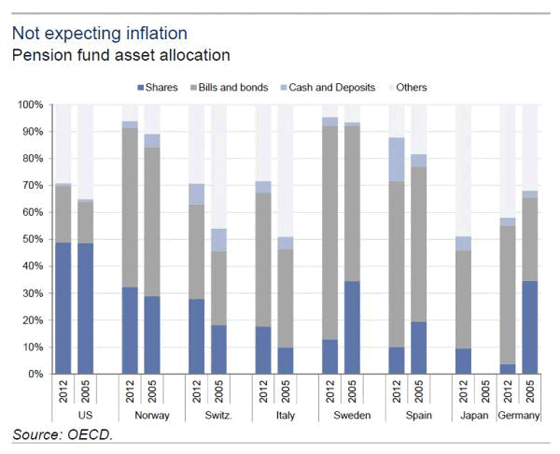

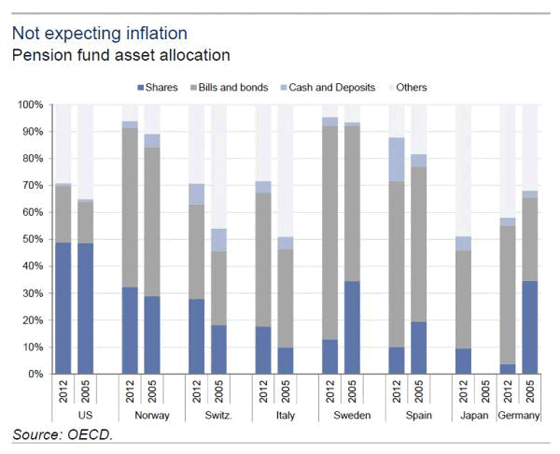

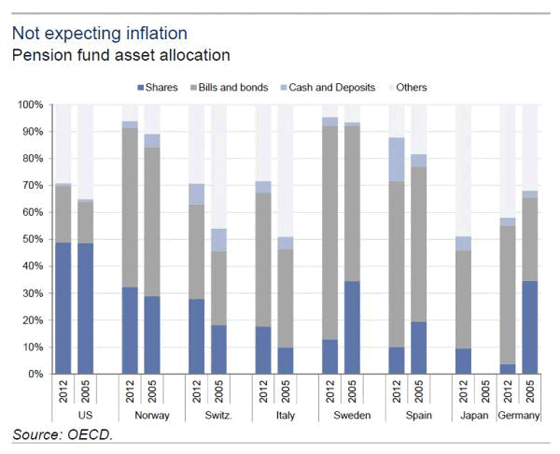

So why can’t, or rather won’t, the Fed let the bubble market collapse once again? Simple – as the following chart shows, the illusion of wealth is now most critical when preserving the myth of the welfare state: some 50% of all US pension fund assets are invested in stocks and only 20% in Treasurys.

This compares to less than 10% for Japan which also explains why for Abe, the only lifeline left is pushing pension funds out of their existing asset allocation sweet spot and forcing them to buy stocks.

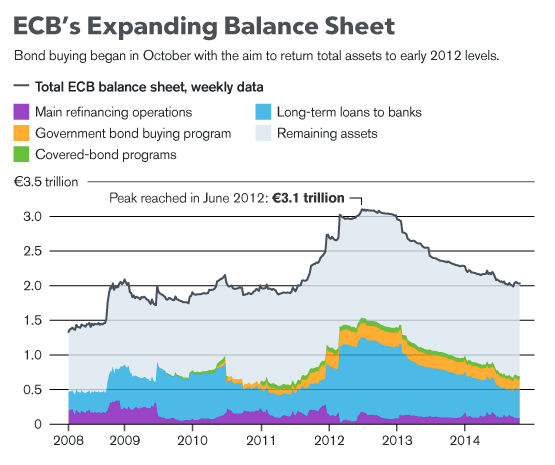

What is known is that in a country like Germany between 2005 and 2012 the Pension funds asset rotation out of stocks and into bonds has been truly unprecedented, with stocks plummeting from 30%+ of total exposure to less than 5%! It also explains why Germany was, is and always will be leery of allowing the ECB to pursue asset bubble-inflating policies which would barely benefit pension funds on the equity side …

But back to the US: while the 1%’s paper fungible, market-driven wealth has been long converted into other hard asset formats, it is the paper gains for the future retirees that are on the chopping block should the S&P 500 “get it.”

As such, it is the fate of future retirement funds, and in fact, the very core of the US welfare state that is at stake should there be a massive market crash. In which case what happened in Ferguson will be a polite stroll in the park compared to the chaos that would ensue should another generation of Americans wake up with half or more of their paper wealth wiped out overnight.

… will the Fed be able to avoid a market crash? The answer of course is no. But we will give the podium to Fred Hickey, aka the High-Tech Strategist, who gives a very poetic summary of what the Fed’s endgame will look like:

The Fed hasn’t made the world a better place with its interventions. It has created moral hazard, encouraged the formation of asset bubbles that eventually pop (leaving economic messes), widened the wealth inequality gap to record levels, discouraged savings and investment, severely penalized retirees on fixed incomes, encouraged spending, funded massive government deficit spending by monetizing the debts, lengthened the recession and likely reduced the number of jobs that would have been created if the economy had been allowed to take its normal course.

What Durden forgets to mention is that, given the incredibly outsized exposure US pensions funds have built up to stocks, it’s no wonder the S&P 500 has been setting records.

Another issue he omits is while one may claim the Fed can’t let the stock market crash, it has no such control, if only since because of that same outsized exposure pension funds have to the S&P, they are set and certain to cause their own demise by moving out of stocks and back into bonds.

Recent developments in geopolitics are not a one-off incident. They are merely a first step in the real battle for oil and gas, equals energy, equals power. It’s not going to stop if Ukraine and Russia sign some deal, or if Shi’ites beat Sunnis or the other way around. Every party that sees an opening to increase their share of oil and gas will do so, and increasingly with blunt force. That’s the geopolitics which will be a part of the global – and financial – landscape for the rest of our lives.

That necessarily means that the Fed controlled quiet boom in stocks is over. Volatility is back to stay. And volatility doesn’t rhyme with pension funds. Risk and potential losses are too great to even consider. So the funds will have to move back into Treasurys. A move that will hurt both stocks AND bonds. And cause more volatility. Rinse and repeat.

It would be suicide for pension funds to stay where they are. It will also be suicidal to move. They’re hugely overexposed to a market that’s only seemingly under control. They purchased themselves into a bind.

Just like America developed itself into a bind. By building an infrastructure around its city cores that is increasingly, and rapidly, becoming an expansive layer of cemeteries for the hopes and dreams of large numbers of its citizens, where millions of poorly constructed and insulated overpaid homes play the part of so many underwater mausoleums.

There is still time to take another look in the mirror. To see what is actually there in your reflection, not what you would like there to be. And make your decisions based on what you see when you do. But that time is not measured in decades, perhaps not even years.

• Why The Fed Can’t, And Won’t, Let The Stock Market Crash (Zero Hedge)

When it comes to the stock market, while the biggest, and according to many only, beneficiary of the Fed’s ZIRP/QE policies of the past 6 years has been the wealthiest 1%, the reality is that said top crust of US society no longer needs the S&P to continue its relentless, manipulated and centrally-planned levitation. Between a third Hamptons residence, a 5th Ferrari, and a 7th French villa, not to mention a few tons of gold, the super wealthy have long since booked their paper profits, and transferred their “wealth” out of the intangible and into actual, physical assets. Therefore it is not the 1% that would suffer the most should the S&P have a post-Lehman like 50%+ wipe out, which also means that the Federal Reserve’s only mandate of pushing asset prices to ever higher levels while pretending it does so to boost employment and keep inflation at 2% is no longer for the benefit of the uber-wealthy.

So why can’t, or rather won’t, the Fed let the bubble market collapse once again? Simple – as the following chart shows, the illusion of wealth is now most critical when preserving the myth of the welfare state: some 50% of all US pension fund assets are invested in stocks and only 20% in Treasurys. This compares to less than 10% for Japan which also explains why for Abe, the only lifeline left is pushing pension funds out of their existing asset allocation sweet spot and forcing them to buy stocks. Whether this gambit will work is unknown.

What, however, is known is that in a country like Germany between 2005 and 2012 the Pension funds asset rotation out of stocks and into bonds has been truly unprecedented, with stocks plummeting from 30%+ of total exposure to less than 5%! It also explains why Germany was, is and always will be leery of allowing the ECB to pursue asset bubble-inflating policies which would barely benefit pension funds on the equity side, while any rising inflation would crush the mark-to-market value of bond holdings. But back to the US: while the 1%’s paper fungible, market-driven wealth has been long converted into other hard asset formats, it is the paper gains for the future retirees that are on the chopping block should the S&P 500 “get it.” As such, it is the fate of future retirement funds, and in fact, the very core of the US welfare state that is at stake should there be a massive market crash.

Read more …

• Ferguson Unrest Shows Poverty Grows Fastest in Suburbs (Bloomberg)

A week of violence and protests in a town outside St. Louis is highlighting how poverty is growing most quickly on the outskirts of America’s cities, as suburbs have become home to a majority of the nation’s poor. In Ferguson, Missouri, a community of 21,000 where the poverty rate doubled since 2000, the dynamic has bred animosity over racial segregation and economic inequality. Protests over the police killing of an unarmed black teenager on Aug. 9 have drawn international attention to the St. Louis suburb’s growing underclass. Such challenges aren’t unique to Ferguson, according to a Brookings Institution report July 31 that found the poor population growing twice as fast in U.S. suburbs as in city centers. From Miami to Denver, resurgent downtowns have blossomed even as their recession-weary outskirts struggle with soaring poverty in what amounts to a paradigm shift. “We’ve passed this tipping point and there are now more poor people in the suburbs than the cities,” said Elizabeth Kneebone, author of the report and a fellow at the Brookings Metropolitan Policy Program.

“In those communities, we see things like poorer health outcomes, failing schools and higher crime rates.” In predominantly black Ferguson, residents protesting the shooting death of 18-year-old Michael Brown also complain about the lack of jobs and a city government that doesn’t reflect the community’s diversity. Inhabitants of the city – which has lost more than 40% of its white population since 2000 – said they’ve long felt disenfranchised by a mostly white city council and police force. Missouri Governor Jay Nixon told reporters that Brown’s death was like “an old wound that had been hit again,” exposing underlying challenges. The St. Louis metropolitan area ranked as one of the most segregated in the U.S. in a 2011 study by Brown University. Ferguson, once a majority white community that’s now about two-thirds black, highlights that dynamic. Coinciding with the decline in white population is a rapid rise in poverty since 2000, a period that includes the 18-month recession that ended in June 2009.

Read more …

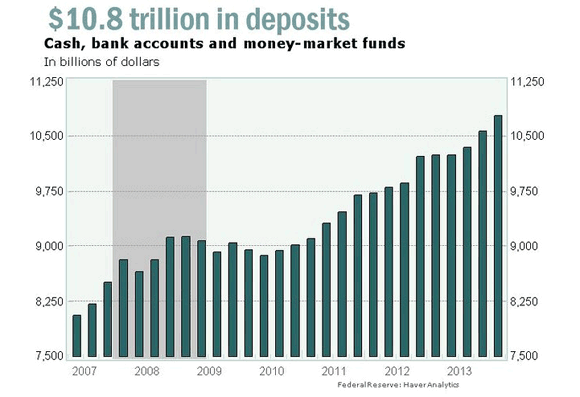

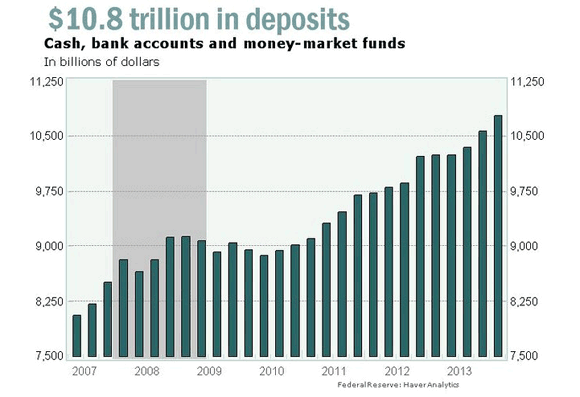

• The 10.8 Trillion Failures Of The Federal Reserve (MarketWatch)

The conventional wisdom says the Federal Reserve is keeping interest rates so low that it doesn’t pay to play it safe, and that it’s encouraging investors to do all sorts of crazy things to earn a higher yield. Supposedly, the central bank is forcing investors pump up stocks, junk bonds, farm land and all the other bubbles you’ve been reading about. It’s a nice story, but the data show that U.S. investors are still conservative about where they put their money. Just how conservative are they? Data from the little-noticed financial accounts report show the American people have $10.8 trillion parked in cash, bank accounts and money-market funds that pay little or no interest. At the end of the first quarter, low-yielding assets totaled 84.5% of annual disposable personal income, the highest share in 23 years. Sure, people need to keep some money handy to pay their bills and some folks might have a few hundred or a few thousand in a rainy-day fund, but no one needs immediate access to the equivalent of 11 months of income.

In essence, there’s $10.8 trillion stuffed into mattresses. That $10.8 trillion hoard represents a failure of Fed policy. Since the Fed began quantitative easing in September 2012, U.S. households have socked away $1.17 trillion in their low-yield accounts. That means that 95% of the Fed’s $1.24 trillion QE3 ended up not in bubbly markets but in a safe and boring bank account. Since the recession began more than six years ago, the Fed has been trying to encourage people to put their money to work in the economy. That’s why the Fed has kept interest rates low and has been buying up trillions of dollars worth of relatively safe securities, hoping to push us to take on a little more risk. After all, an economy can’t really grow if no one’s willing to gamble on the future. But many of us don’t want to. We are still afraid, so we prefer to put a large part of our savings in assets that are guaranteed, like FDIC-insured bank accounts, or into money-market funds whose sponsor guarantees the return of the principle.

Read more …

Instability is dead certain. Fear makes no difference.

• Fears of Renewed Instability as Fed Ends Stimulus (NY Times)

After a nearly uninterrupted five-year rally in stocks and bonds, some investors seem to be getting nervous. On July 31, the Dow Jones industrial average dropped 317 points, wiping out the year’s gains. Last week, junk bond funds experienced record withdrawals and junk bond interest rates spiked. Such gyrations may be healthy, a reminder that there are risks and that markets go down as well as up. But they could also be the harbinger of something more worrisome, which would be renewed financial instability as the Federal Reserve brings to an end its extraordinary easy money policy. The Federal Reserve has said it expects to raise interest rates in 2015 for the first time since the financial crisis. “There’s no real precedent for ending anything of this magnitude,” said Jeremy Stein, who left the Fed’s Board of Governors at the end of May to return to Harvard’s economics department, where I caught up with him last month on the day of the Dow’s big drop.

As the Fed feels its way, he said, investors may have to prepare for greater volatility. While at the Fed, Mr. Stein was viewed as the chief advocate for financial stability on the seven-member board, where he pondered the possible unintended consequences of the Fed’s stimulus policies. Mr. Stein said his differences with his fellow board members, and especially the chairwoman, Janet Yellen, had been exaggerated and were more a matter of nuance. “I certainly felt we were courting some risks” with the Fed’s last round of quantitative easing, he acknowledged. “But then again, given the level of the unemployment rate at the time, some risk-taking was warranted.” In April, in his last speech as a Fed board member, Mr. Stein warned that monetary policy should be “less aggressive” when credit risk premiums were extremely low, as they were then, and they’ve gotten even lower since.

“To be clear, we are not necessarily talking about once-in-a-generation financial crises here, with major financial institutions teetering on the brink of failure,” he said in a speech to the International Monetary Fund. “Nevertheless, the evidence suggests that even more modest capital market disruptions may have consequences that are large enough to warrant consideration when formulating monetary policy.”

Read more …

No spending=deflation.

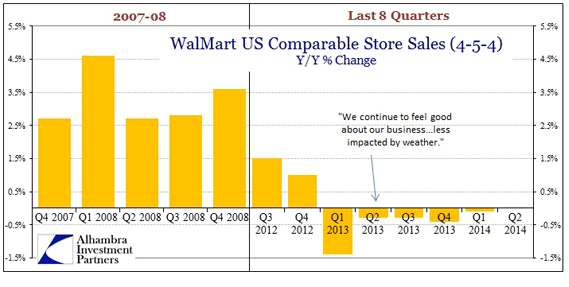

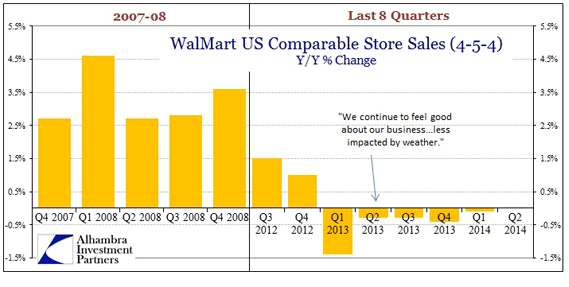

• The Depleted American Consumer Has Spoken: No “Escape Velocity” (Alhambra)

With retail sales this week bringing an “unexpected” shock to those forecasting a robust economic rebound (outside of inventory, anyway) in the US, further confirmation has been offered pretty much everywhere else. WalMart’s quarterly report was as it has been since the end of 2012 with continuing slow erosion. US same store comparables were flat, which is something of an achievement considering that overall environment. Despite yearly proclamations of recovery, hard dollar figures continue to demonstrate otherwise.

In other words, the actual results of the companies that are closest to American consumers confirm the bleak picture provided by the government estimates of retail sales. Beyond WalMart, Macy’s reported a “shocking” miss on both Q2 results and further guidance.

The earnings miss Wednesday by highly regarded Macy’s raised a red flag about what’s to come from the slew of retailers set to report profits. “As one of the top-performing and best-executing retailers in the industry, Macy’s second-quarter earnings miss is an ominous early marker for retail that could portend further disappointing results over the coming weeks,” said Ken Perkins, president of Retail Metrics. Macy’s earlier cut its full-year same-store sales forecast, saying a 3.3% rise in second-quarter sales would not make up for weakness in the first quarter, when harsh winter weather kept shoppers away.

That seems to be the theme developing everywhere outside of heavily revised headline GDP (but not the prior estimates of that measure nor its internals). The “bounce” in the second quarter was more of simply “less bad” than anything remotely resembling the narrative provided by most commentary derived from “economists.” It has been a universal theme in the retail industry that “second-quarter sales would not make up for weakness in the first quarter”, which all sounds suspiciously like something far worse than just an aberration of snow or GDP figuring. It is very striking as to how much this sentiment has shifted just in the past few weeks. After the GDP revisions and second quarter preliminary release, most commentary focused on the “surge” in activity and how that completely erased the lingering doubts after the shocking and unexpectedly wintry winter quarter. Such optimism has been encoded by previously unshakable beliefs in monetary command, to the point of oftentimes incongruent and incoherent analysis.

Included in this disappointment over the second quarter’s results is an almost earnest bitterness about the failure of promises to become realized. I can’t tell yet if it is a reawakening of some overdue skepticism and actual doubts about the efficacy of everything that has been guaranteed and offered by central planning intrusion, but reactions are far more subdued, the tone clearly shifted. While retailers still bank on back-to-school sales for a bit of a bounce, many had also hoped the spring and early summer would bring positive news after an extremely difficult winter. But so far, retail results for the quarter have generally been muted. Walmart executives said Thursday that American customers continued to be cautious, concerned about the cost of living and the country’s employment landscape.

Read more …

Has been for ages.

• The GDP “Growth” Story Is Getting Tired (Alhambra)

There is little for me to say about the GDP figures from Europe, released this week to much shock and discomfort, as I am frankly tired of GDP and eagerly await the unhonored end of its continued mainstream “significance.” The largest problem with it is that its correlation with actual economic results has clearly broken down from whatever it had to begin with. It was designed as a measure of Keynesian understanding of economic function (governments add to the economy?), but for the most part during the post-war period there was at least stronger ties to the general ideas of economy. We are, however, in a new paradigm that has changed, structurally, almost every facet of economic function.

Yet, a positive number on a GDP report is still taken as a definitive sign that all is well, and any system with it is on the road to recovery and eventually true growth. Some of that is the embedded tendency (desire) for econometrics to extrapolate in a straight line, but it is equally if not more so the deficiency of trying to put a dollar (or euro) figure on the assumed value of everything produced and traded as if that were the ultimate aim of an economic system. In that case, what are we really measuring, the economy or the dollar (or euro)? From the Wall Street Journal:

Germany’s economy, long Europe’s growth engine, shrank for the first time in more than a year, a development economists largely attributed to a mild winter that boosted activity in the first quarter at the expense of the second. The bigger concerns, they say, are France and Italy, where respectable rates of growth aren’t even in sight. “The euro-zone recovery never really got going, and now it appears to be petering out,” said Simon Tilford, deputy director of the Centre for European Reform, a nonpartisan London think tank.

Setting aside how “at the expense of the second” might actually make sense in an economic context, the reason “it appears to be petering out” is simply that it was never there to begin with. Sure, some central bank centrally planned to redistribute some piece of finance from another piece, and believed that would create positive numbers for measuring the euro-value of traded entities, but no wealth has been created and it is quite likely the fact that such redistribution actually eroded further existing wealth. The persistence of such corrosion is the continually sinking of economic function, with generalized interruptions in that downward course mistaken for “recovery.”

Read more …

Perhaps.

• QE Will Come To The Eurozone – And It Will Be A Failure (Schlichter)

The data was not really surprising and neither was the response from the commentariat. After a run of weak reports from Germany over recent months, last week’s release of GDP data for the eurozone confirmed that the economy had been flatlining in the second quarter. Predictably, this led to new calls for ECB action. “Europe now needs full-blown QE” diagnosed the leader writer of the Financial Times, and in its main report on page one the paper quoted Richard Barwell, European economist at Royal Bank of Scotland with “It’s time the ECB took control and we got the real deal, instead of the weaker measure unveiled in June.” I wonder if calls for more ‘stimulus’ are now simply knee-jerk reactions, mere Pavlovian reflexes imbued by five years of near relentless policy easing. Do these economists and leader writers still really think about their suggestions? If so, what do they think Europe’s ills are that easy money and cheap credit are going to cure them?

Is pumping ever more freshly printed money into the banking system really the answer to every economic problem? And has QE been a success where it has been pursued? The fact is that money has hardly been tight in years – at least not at the central bank level, at the core of the system. Granted, banks have not been falling over one another to extend new loans but that is surely not surprising given that they still lick their wounds from 2008. The ongoing “asset quality review” and tighter regulation are doing their bit, too, and if these are needed to make finance safer, as their proponents claim, then abandoning them for the sake of a quick – and ultimately short-lived – GDP rebound doesn’t seem advisable. The simple fact is that lenders are reluctant to lend and borrowers reluctant to borrow, and both may have good reasons for their reluctance.

Do we really think that Italian, French, and German companies have drawers full of exciting investment projects that would instantly be put to work if only rates were lower? I think it is a fairly safe bet that whatever investment project Siemens, BMW, Total and Fiat can be cajoled into via the lure of easy money will by now have been realized. The easy-money drug has a rapidly diminishing marginal return.

Read more …

And 3% is still an historic abberation.

• Interest Rate Rises To 3% Might Be More Than UK Economy Can Bear (Observer)

All the anguish over interest rates – when they will rise and by how much – illustrates both the power and impotence of our central banks. They have power when governments fence themselves in with austerity, limiting the ability of ministers to aid the recovery and leaving central bankers the only ones able to get money flowing into the economy. But their spending does little more than offset austerity and the continuing failure of commercial banks to lend to households and businesses for anything other than the purchase of a prized property asset. As soon as they try to influence the economy in the other direction – say by raising rates – they are forced to back down. Bank of England governor Mark Carney says he is watching and waiting for the right time to raise rates. Why does he think they should go up? Central bankers worry that without a charge for borrowing, lenders cannot reward saving. They also fear that savers, in search of a higher return, will fall prey to the City’s snake-oil salesmen and invest in high-risk assets, causing another financial crash.

It may be laudable to reward saving and provide a decent return on safe assets, thereby discouraging risky behaviour, but the UK’s huge level of household indebtedness effectively rules out much higher base rates: at least not the postwar norm of 4%-5%. Carney agrees and has in so many words put a 3% ceiling on base rates, most likely for the rest of the decade, which must be a reasonable assumption when taking into account low wage growth, no-better-than-moderate business investment and stumbling exports alongside a predicted rise in household debt to 165% of GDP (from 140% in 2013) over the next five years. At least, 3% is a reasonable assumption until the recent experiences of smaller, supposedly less beleaguered, central banks are taken into account. Both Sweden and Norway have tried to rise rates to more “normal” levels only to find it killed high street spending and sent economic growth into reverse. Australia tried it too. Importantly for these central banks, which, like most, have a mandate to maintain inflation at or around 2%, price increases dropped near to zero.

Read more …

Soros shakes people’s nerves these days. WHat does he know that they don’t?

• George Soros Loads Up On Bearish Market Bet (CNBC)

Soros Fund Management, the large family office that manages assets for billionaire George Soros, raised its protection against a U.S. stock market drop dramatically, sparking concerns that the powerful investment firm is expecting a big fall in equities. During the course of the second quarter, which ended June 30, Soros Fund Management’s position in puts—the right to sell at a certain price at an appointed time in the future—in a popular exchange-traded fund tracking the S&P 500 rose to 11.29 million shares, which appears to be a multiyear high for the investment manager. (During the first quarter, the size of that position was just 1.6 million puts, meaning that the second quarter marked a 606% increase.)

Based on some simple math, and assuming Soros still held the puts and that they were in the money (meaning they would generate gains if they were exercised today), the notional value of the bearish position is roughly $2.2 billion. Soros Fund Management also held calls—the rights to buy S&P ETF shares at an appointed time in the future—as well as outright shares of the ETF, but in much smaller amounts. A Soros spokesman could not immediately be reached for comment on the fund’s market outlook. But competing money managers said not to put too much weight into what is apparently a pessimistic view of U.S. stocks, given that Soros Fund Management may simply be looking for a hedge to counterbalance its many long stock positions.

Read more …

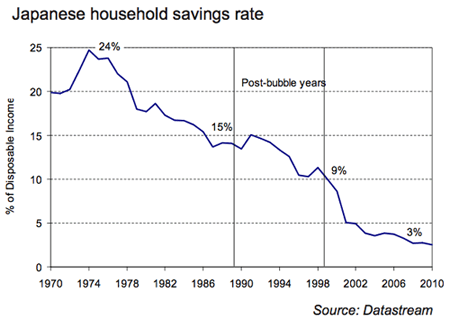

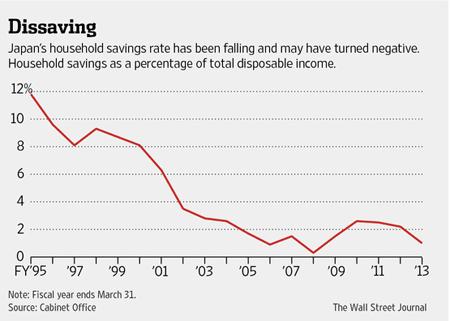

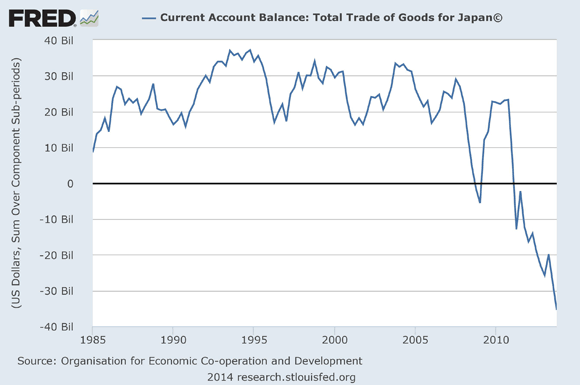

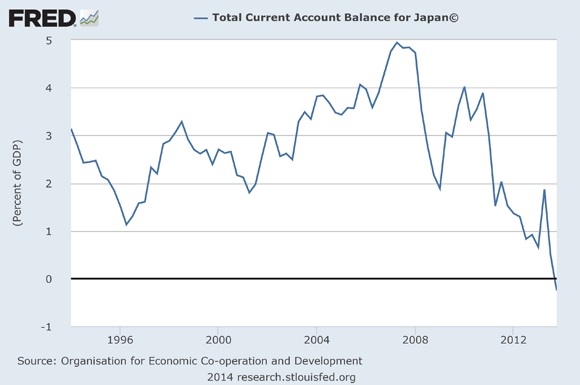

• Japan’s Keynesian Demise: A Cautionary Tale For Our Times (Stockman)

I remember it well. That is, the fiscal rectitude of the old Japan. During early 1981 as the Reagan White House prepared its radical fiscal plan—-what Senate Majority Leader Howard Baker famously called a “riverboat gamble”—-we were visited by a high ranking delegation from the Japanese finance ministry (MOF). It is no overstatement to say that they were absolutely shocked by the administration’s plan to enact a sweeping 30% income tax cut and double the defense budget—while expecting that it would all balance out as a result of surging economic growth immediately and large domestic spending cuts down the road. The MOF men feared the worst—politely noting the possibility that there would be insufficient economic growth and spending cuts to pay for the Administration’s monumental tax reductions and defense build-up. Then the US would experience an outbreak of massive fiscal deficits—an unprecedented peacetime development that could roil the entire global financial system.

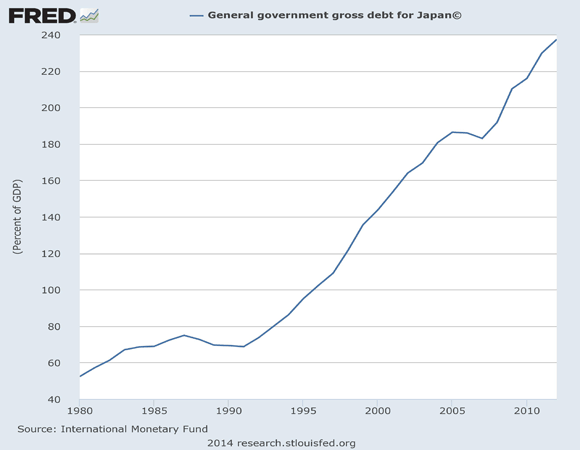

In that apprehension the MOF men turned out to be dead right, and not because they were especially clairvoyant. Back in those benighted times, fiscal rectitude was a widely shared commitment among government financial officials including Congressional Republicans and their conservative counterparts abroad and especially in Japan. Economic policy officials did not have to be hectored about deficits and the fact that there is no such thing as a fiscal free lunch. Indeed, notwithstanding a government led 30-year drive to rebuild their economy from the complete devastation of WWII, Japan’s public debt was only 50% of GDP as of 1980.

That was then. Today Japan’s public debt is 5X greater relative to the size of its economy and tips the scales at 250% of GDP. That is off-the-charts relative to all other large developed economies and has no parallel in previous history. In the interim, of course, Japan succumbed to the Keynesian stimulus disease, betting that after its thundering financial meltdown during the early 1990s it could borrow and print its way back to the prosperity it had known during the period of its post-war economic miracle.

Read more …

Debt solves all our problems.

• Detroit to Sell Millions in New Debt to Settle Bankruptcy (Bloomberg)

Detroit plans to sell about $975 million in bonds for retirement costs and some creditor settlements as part of its bankruptcy restructuring plan awaiting approval by a federal judge. The Detroit City Council approved four issues yesterday, including $632 million of tax-limited general obligations that would pay 4% interest for the first 20 years and 6% for another 10 years, according to city documents. Detroit, the former capital of the U.S. auto industry, filed a record $18 billion municipal bankruptcy last year after decades of population decline. Michigan’s largest city has been negotiating with many of its biggest creditors, including unions, pension plans and some bondholders.

The $632 million in bonds would finance $450 million for retiree health care through a voluntary employee beneficiary association, agreed to by retirees. Another $34 million would pay claims by the city’s Downtown Development Authority. A sale of $288 million of unlimited-tax general obligation bonds would finance settlements with the city’s unlimited-tax debtholders who agreed to receive 74 cents on the dollar. Those bonds would be issued by the Michigan Finance Authority and backed by state aid to the city. A $55 million issue would finance a settlement with holders of limited-tax debt, who would receive 34% of their claims. The council also approved refinancing for $5.5 billion of the city’s water and sewer debt. The water system, which serves about 40% of the state’s population, has issued a tender offer to buy back a portion of the bonds in hopes of reducing costs and raising money for improvements.

Read more …

• Iraq’s Largest Dam New Focus of Expanding U.S. Airstrikes (Bloomberg)

The U.S. targeted Sunni militants’ positions near Iraq’s largest dam in a sign of the expanding reach of airstrikes designed to push back the Islamic State. After a week of strikes confined to Erbil and Mount Sinjar, U.S. fighter jets and armed drones struck yesterday near Mosul, Iraq’s second largest city, to help wrest control of the dam seized by Islamic State forces earlier this month. The combination of Navy F-18 and Air Force F-16 fighters, along with the drones, marked the largest deployment of U.S. aircraft since the strikes began on Aug. 8, according to a U.S. defense official who spoke on condition of anonymity.

The strikes are part of a U.S. effort that President Barack Obama announced to halt the advance of the Sunni insurgency. Militants calling themselves the Islamic State have rampaged through OPEC’s No. 2 oil producer, seizing border posts, beheading foes and targeting dams whose destruction could flood areas near Baghdad and Mosul. The dam near Mosul is the most important asset the group captured since taking Nineveh province in June. The Islamic State also controls several oil and gas fields in western Iraq and eastern Syria, generating millions of dollars in daily revenue to help fund the caliphate it announced and strengthen its grip on territory it has seized. Zuhair al-Chalabi, head of the National Reconciliation Committee in Mosul, said in a phone interview that towns near the dam would need to be captured before Kurdish forces known as the peshmerga could attempt to retake the dam.

Read more …

After all the mud they threw on it?

• Ukraine Officially Recognizes Russian Aid Convoy As Humanitarian (RT)

Ukraine Minister of Social Policy Lyudmila Denisova has signed an order officially recognizing the Russian convoy stuck at the border as humanitarian aid cargo of the International Committee of the Red Cross. “In accordance with Articles 4 and 5 of the Law of Ukraine ‘On Humanitarian Aid’ considering the initiative of the President of Ukraine Petro Poroshenko on receiving humanitarian aid within the framework of international humanitarian missions under the auspices of the International Committee of the Red Cross (ICRC) to recognize the cargo as humanitarian aid,” the document reads. The Russian aid shipment consists of 12 types of goods weighting 1856.3 tons according to an official letter from the Red Cross received by the Ukrainian ministry on Saturday, which complies with the cargo declared by Russia. “The recipient of humanitarian aid is the mission of the International Committee of the Red Cross in Ukraine. The cargo will be moved into Ukraine by the ICRC through the ‘Donetsk’ checkpoint,” Kiev cited the ICRC letter.

Kiev granted Russian cargo humanitarian aid status after the Red Cross sent a petition to Kiev to allow the Russian humanitarian aid to enter eastern Ukraine, after the Russian cargo was held at the Ukrainian border since August 14. “There remains one, of course, major challenge: we absolutely need security guarantees from all parties concerned before we can start moving,” Red Cross official Pascal Cuttat told the media on Saturday. It is still unknown when the convoy will be allowed to enter Ukrainian territory as the procedures of the cargo clearing customs have reportedly not yet been completed. There has also been no word from Kiev about the security of the humanitarian mission following Friday’s statement from Russia’s Foreign Ministry that Kiev forces might attempt to block the agreed route and disrupt the aid delivery to Lugansk.

Read more …

Obama and Putin should both sit in on these meetings, and not be allowed to leave before a solution is found.

• Ukraine-Russia Talks Seek to Ease Crisis Amid Aid Accord (Bloomberg)

Foreign ministers from Ukraine and Russia will meet today in Berlin after officials agreed on a plan that would allow the Red Cross to accompany a Russian aid convoy stuck near the two countries’ border. Ukraine’s Pavlo Klimkin and Russia’s Sergei Lavrov will hold talks with their German and French counterparts to ease tensions after Ukraine officials said Aug. 15 that their troops had destroyed part of an armored convoy from Russia. Today’s meeting may be a first step toward a new peace summit, French President Francois Hollande’s office said in a statement. European leaders are pushing to halt the conflict that has fractured Ukraine since Russia annexed the Crimean peninsula in March, touching off a wave off sanctions that have hurt trade and threatened to send President Vladimir Putin’s economy into recession.

Finnish President Sauli Niinistoe conferred with Ukrainian President Petro Poroshenko in Kiev yesterday, and said he carried with him a message from Putin, with whom he had met the day before. “A quick resolution of the crisis remains unlikely,” Otilia Dhand, an analyst at Teneo Intelligence in London who specializes in eastern Europe, said by e-mail. “The new round of talks in Berlin might at best bring a slight detente and potentially avert a further escalation over the next days.” In the accord reached yesterday, Ukrainian officials agreed to accept humanitarian aid from Russia that will be delivered to the nation’s southeastern region under the supervision of the International Committee of the Red Cross. That area has been controlled by pro-Russian separatists.

Read more …

Good man.

• Pope Francis Urges Affluent To Hear ‘Cry Of The Poor’ (Reuters)

Pope Francis on Saturday celebrated a huge open-air Mass in the center of Seoul, where he denounced the growing gap between the haves and have-nots, urging people in affluent societies to listen to “the cry of the poor” among them. The pope made his remarks in the homily of a Mass where he beatified 124 Korean martyrs who were killed in the 18th and 19th centuries for refusing to renounce Christianity. Beatification is the last step before sainthood in the Roman Catholic Church. In his homily before a crowd of hundreds of thousands, many of whom had waited for hours on a steamy morning, Francis said the martyrs’ courage and charity and their rejection of the rigid social structures of their day should be an inspiration for people today.

“Their example has much to say to us who live in societies where, alongside immense wealth, dire poverty is silently growing; where the cry of the poor is seldom heeded and where Christ continues to call out to us, asking us to love and serve him by tending to our brothers and sisters in need,” he said. It was a theme the pope has been repeating since he arrived in South Korea on Thursday for his first trip to Asia since his election in March 2013, and has been a lynchpin of the papacy of the first non-European pontiff in 1,300 years. Last year, in the first major written work of his papacy, Francis attacked unfettered capitalism as “a new tyranny”, urging global leaders to fight poverty and growing inequality.

Read more …

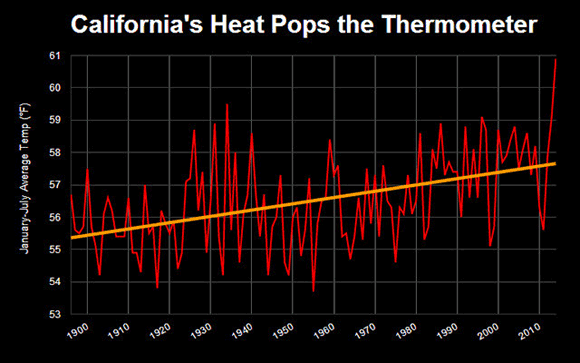

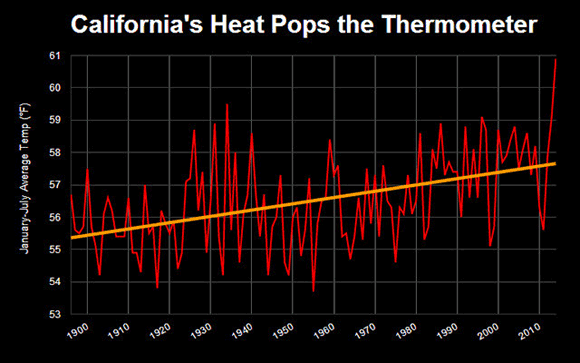

That’s a really scary graph.

• California’s Record Heat Is Like Nothing You’ve Ever Seen .. Yet (Bloomberg)

If hot thermometers actually exploded like they do in cartoons, there would be a lot of mercury to clean up in California right now. The California heat this year is like nothing ever seen, with records that go back to 1895. The chart below shows average year-to-date temperatures in the state from January through July for each year. The orange line shows the trend rising 0.2 degrees Fahrenheit per decade. The sharp spike on the far right of the chart is the unbearable heat of 2014. That’s not just a new record; it’s a chart-busting 1.4 degrees higher than the previous record. It’s an exclamation point at the end of a long declarative sentence. The high temperatures have contributed to one of the worst droughts in California’s history. The water reserves in the state’s topsoil and subsoil are nearly depleted, and 70% of the state’s pastures are rated “very poor to poor,” according to the USDA.

By one measure, which takes into account both rainfall and heat, this is the worst drought ever. While the temperatures are extreme, they’re not entirely unexpected. The orange trend line above is consistent with rising temperatures across the globe. Average surface temperatures on Earth have warmed roughly 1.4 degrees Fahrenheit since 1880, according to NASA. The eastern half of the U.S. has had an unusually cool 2014, but it’s a lone exception compared to the rest of the planet. The International Panel on Climate Change, which includes more than 1,300 scientists, forecasts temperatures to rise 2.5 to 10 degrees Fahrenheit over the next century. That puts California’s record heat well within the range of what’s to come, turning this “hot weather” into, simply, “weather.”

Read more …

Could take years as well. A whole group of patinets in isolation escaped their hospital today in Liberia.

• Curbing Ebola Spread in West Africa Could Take Six Months (Bloomberg)

It will take months to curb an Ebola outbreak in West Africa that probably involves far more cases than the 2,100 officially recorded by governments there, global health leaders said. “We are not talking weeks; we’re talking about months to get an upper hand on the epidemic,” Joanne Liu, international president of Doctors Without Borders, said yesterday at a news conference in Geneva. Liu, whose organization has almost 700 health workers in West Africa, said a turnaround should take six months and called for more help by global health groups against the outbreak. She said others need to “step up to the plate” in aiding the four countries battling the virus.

“It needs to happen now if we want to contain this epidemic,” Liu said. She said more health-care workers are needed to follow up on cases and educate the public about what the disease and the outbreak entails. “Some of our staff, they are not accepted in their village anymore,” Liu said. The outbreak “will only improve if we improve understanding of the disease. Everyone is living with fear.” Liu’s comments followed by a day a statement from the World Health Organization that their staff members “at the outbreak sites see evidence that the number of reported cases and deaths vastly underestimate the magnitude of the outbreak.”

Read more …

Fun!

• New Plant Language Discovered (DIscovery)

People tend to be fixated upon the question of whether talking to your plants stimulates them to grow, but scientists have known for several decades that various plant species talk among themselves — not with words, but by releasing chemical signals into the air that warn other trees about impending insect attacks. Most of the nearly 50 studies on the subject have found evidence of plant communication. Add to that proof a study in the Aug. 15 issue of the journal Science by a Virginia Tech researcher, who has discovered that different plant species can share genetic information at the molecular level. Jim Westwood, a professor of plant pathology, physiology, and weed science at the university, found evidence of this new communication mode by investigating the relationship between dodder, a parasitic plant that oddly looks like strands of spaghetti, and the flowering plant Arabidopsis and tomato plants to which it attaches and sucks out nutrients with an appendage called a haustorium.

Several past studies have indicated that dodder use chemical cues to find their host plants. But Westwood has uncovered a genetic means of communication as well — an exchange of RNA, a substance that translates information in the DNA forming an organism’s genetic blueprint. He reports that many thousands of mRNA molecules were being exchanged between the parasite and host, creating this open dialogue between the species that allows them to freely communicate. “The discovery of this novel form of inter-organism communication shows that this is happening a lot more than any one has previously realized,” the scientist said in a Virginia Tech press release. “Now that we have found that they are sharing all this information, the next question is, ‘What exactly are they telling each other?’” One possibility: Dodder may be telling the host to lower its defenses and allow it to drain nutrients.

Read more …