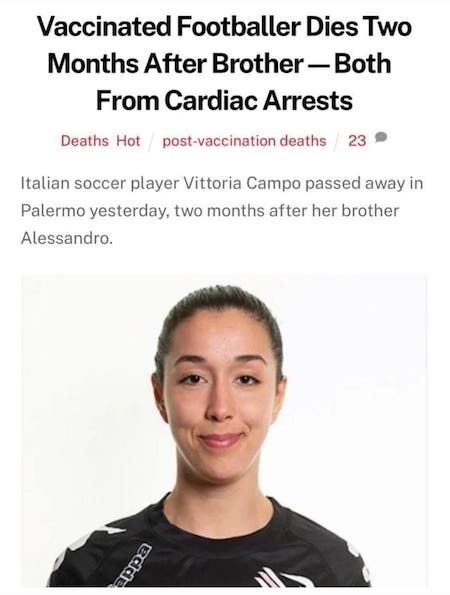

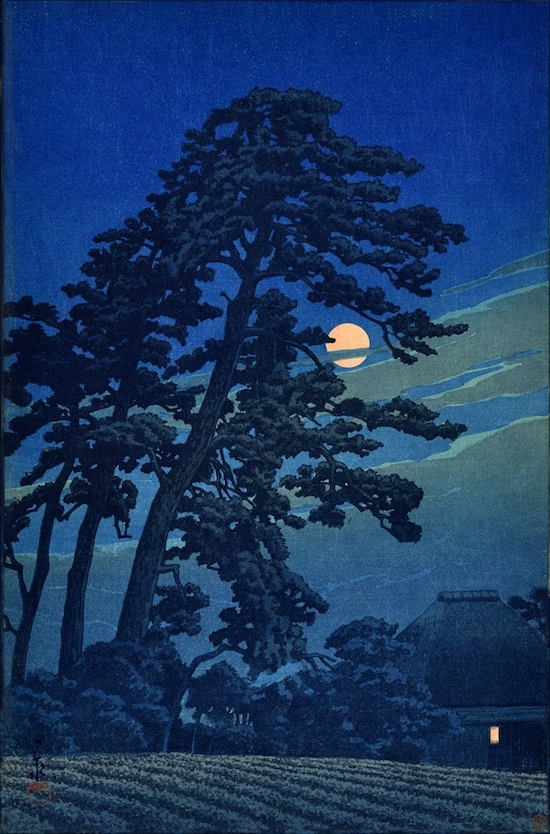

Hasui Kawase Moon at Megome (woodblock print) 1930

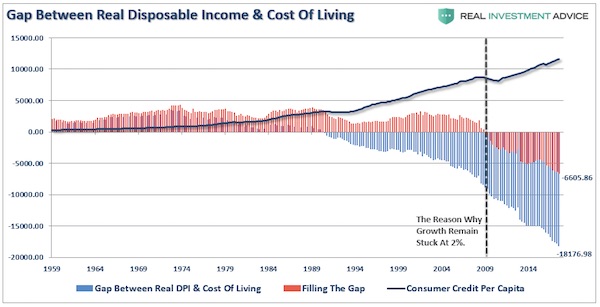

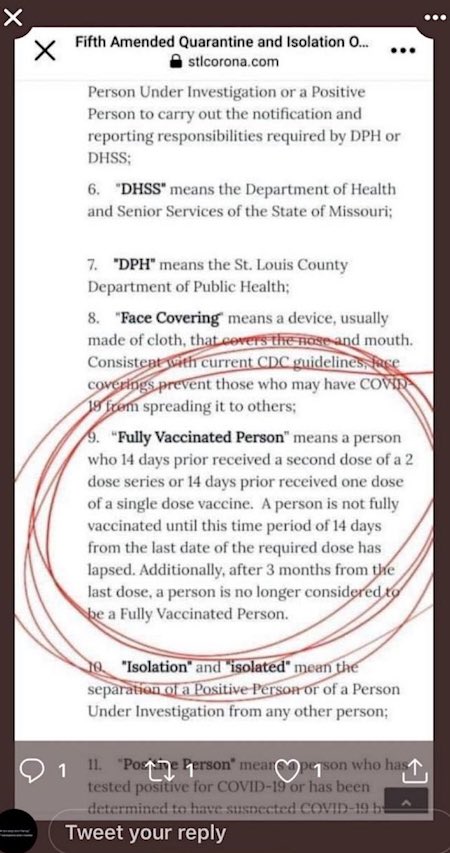

Barnes

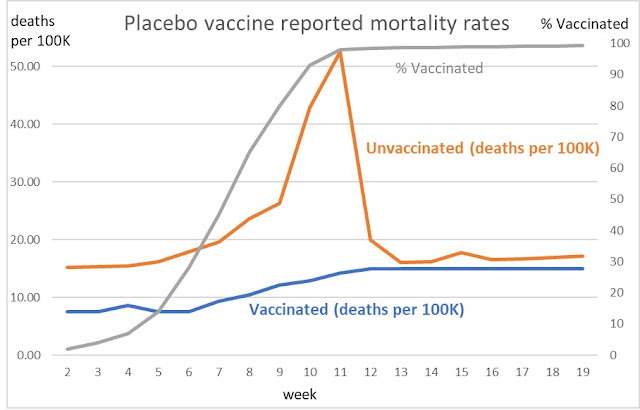

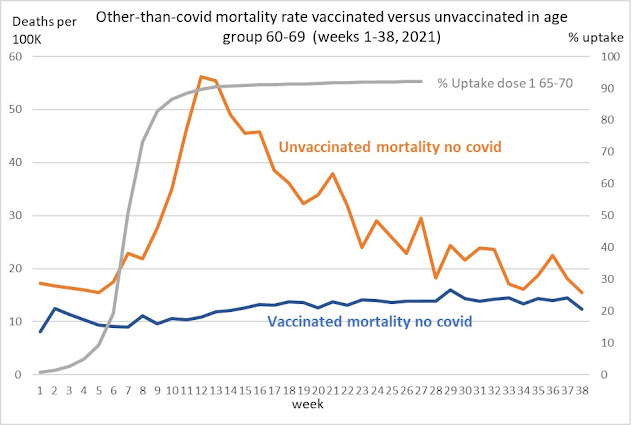

“Call anyone hospitalised within 14 days of jab ‘unvaccinated’. Don’t highlight that most adverse reactions to jab will happen within first 14 days. Voilà: ‘Pandemic of the Unvaccinated’.”

Croatia

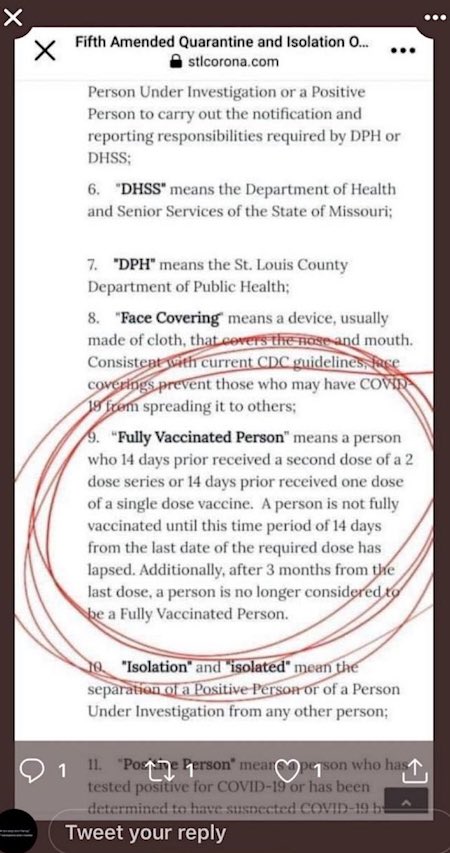

3 months is all you get. And then it’s booster time.

Kulldorff

Sep 11. Should we all say Stromectol istead of ivermectin?

• Early Treatment vs Stay at Home Until You Can’t Breathe (Burk)

Flavio Cadeginia, MD, PhD, is an academic endocrinologist in Brazil who took a team of researchers to the State of Amazonas in January 2021 to evaluate the situation in cities where hospitals were overcrowded with the gamma variant wave of the virus. Half his team was skeptical that early outpatient treatment could have any impact on keeping patients out of the hospital. Almost all the cities were running out of oxygen supplies including Manaus, the capital of 2.2 million. Dr. Cadeginia encountered an unexpected anomaly in Coari, a small city of 56,000 where the hospitals were empty. He asked the health director for an explanation, but she was shy to reply in front of the group and requested a private conversation. She admitted that they had been giving Stromectol to the entire population for the past 2 months, but was afraid to tell him for fear of being accused of using an unproven treatment.

His whole team became immediate believers in early treatment. Similar stories about early treatment successes with Stromectol (brand name to avoid censorship) have been reported in other countries including Peru and India. In Peru, an army-led mass early treatment program, Mega-Operación Tayta (MOT), in the fall of 2020 resulted in a 14-fold decrease in excess deaths. When the MOT was canceled and a restrictive treatment program was instituted by a new president in November, there was a 13-fold increase in excess deaths over the next 2 months. In India, Uttar Pradesh is a state of 241 million, 2/3 the size of the United States. A wave of the delta variant in the summer of 2021 resulted in 414,000 cases and 4,000 deaths per day. Five weeks after adding Stromectol to their treatment protocol there was a dramatic drop on August 5th to 26 new cases and 3 deaths.

On that same day in the US there were 127,108 new cases and 574 new deaths where the use of Stromectol has been actively discouraged by the FDA and Tony Fauci at the NIH. Following the lead of the US rather than Uttar Pradesh, the State of Tamil Nadu rejected Stromectol in May going on to lead India in death rate. This fateful decision was influenced by a Tweet from WHO Chief Scientist Dr. Soumya Swaminathan against the use of Stromectol resulting in her being sued by the Indian Bar Association and threatened with criminal prosecution for each death. They accused her of furthering the agenda of the drug companies in protecting the EUA for their profitable vaccines. More than 10 successful lawsuits have been won against US hospitals by Ralph Lorigo for prohibiting prescription of Stromectol to dying patients in the ICU.

In January 2021 a judge ordered Rochester General Hospital to give it to Sue Dickinson, a 65-year old woman on a ventilator, who improved within 12 hours and was later released from the hospital. Eight other patients, including 81-year old John Swanson and 80-year old Judith Smentkiewicz, also made similar court-ordered miraculous recoveries. Why would the CDC aggressively block the compassionate off label use of a “wonder” drug with anti-viral properties taken safely by billions of people around the world for the treatment of parasitic diseases and meriting the Nobel Prize in 2015 for its discoverers? According to Robert F. Kennedy, Jr., the CDC is considered a “captured agency,” a sock puppet for the industry it is supposed to regulate. Half of their budget comes from buying and selling vaccines making it the biggest vaccine distributor in the country.

Read more …

Nature Magazine cannot call it a horse dewormer anymore, that’s what they have the rest of the press for.

But they can ask for a (long-term) “meta-analysis” for a proven safe drug, while propagating substances for which no such analysis or safety profile exists.

• The Lesson Of Ivermectin: Meta-analyses Based On Summary Data (Nature)

Relying on low-quality or questionable studies in the current global climate presents severe and immediate harms. The enormous impact of COVID-19 and the consequent urgent need to demonstrate the clinical efficacy of new therapeutic options provides fertile ground for even poorly evidenced claims of efficacy to be amplified, both in the scientific literature and on social media. This context can lead to the rapid translation of almost any apparently favorable conclusion from a relatively weak trial or set of trials into widespread clinical practice and public policy. We believe that this situation requires immediate remediation. The most salient change required is a change in perspective on the part of both primary researchers and those who bring together the results of individual studies to draw wider conclusions.

Specifically, we propose that clinical research should be seen as a contribution of data toward a larger omnibus question rather than an assemblage of summary statistics. Most, if not all, of the flaws described above would have been immediately detected if meta-analyses were performed on an individual patient data (IPD) basis. In particular, irregularities such as extreme terminal digit bias and the duplication of blocks of patient records would have been both obvious and immediately interrogable from raw data if provided.

We recommend that meta-analysts who study interventions for COVID-19 should request and personally review IPD in all cases, even if IPD synthesis techniques are not used. In a similar vein, all clinical trials published on COVID-19 should immediately follow best-practice guidelines and upload anonymized IPD so that this type of analysis can occur. Any study for which authors are not able or not willing to provide suitably anonymized IPD should be considered at high risk of bias for incomplete reporting and/or excluded entirely from meta-syntheses.

Read more …

“The state will approach policymaking, he said, in a manner that is “very explicit about the differences between ‘the science’ and our opinions.”

• Florida Surgeon General Nominee Ladapo ‘Done With’ Vaccine ‘Fear’ (NM)

Florida Gov. Ron DeSantis on Tuesday announced that Dr. Joseph Ladapo would be the state’s new surgeon general and secretary of its health department. “Joe has had a remarkable academic and medical career,” DeSantis, a Republican, said of the Harvard-trained M.D. and Ph.D., according to the Florida news station WJHG7. Ladapo, who is awaiting the approval of the Florida Legislature, says that “we’re done with fear,” according to Real Clear Politics. “That’s something that’s been unfortunately a centerpiece of health policy in the United States ever since the beginning of the pandemic, and it’s over here. Expiration date, it’s done.” Ladapo said that the state will approach COVID-19 openly and scientifically. The state will approach policymaking, he said, in a manner that is “very explicit about the differences between ‘the science’ and our opinions.”

“What’s been happening over the past year is that people have been taking the science, and they’ve been misrepresenting it. … It’s been unclear where the discussion about ‘the science’ ends and discussion about how you feel about the science and what you want people to do with the science begins.” According to WPTV5, when asked what he thinks about vaccination against COVID-19, Ladapo responded: “The state should be promoting good health, and vaccination isn’t the only path to that. It’s been treated almost like a religion, and that’s just senseless, right? There are lots of good pathways to health, and vaccination’s not the only one.” DeSantis, who has promoted the use of other ways to treat COVID-19, said information that suggests alternative treatments to vaccines has been suppressed by the powers that be in Washington.

Speaking about monoclonal antibodies, DeSantis said: “I do think that one of the reasons why this was not something that was put out there very publicly by the experts and by the powers [that] be in D.C. is because they feared that if you tell people there’s an effective treatment, you tell people COVID’s a treatable illness, they feared some people would say, ‘Well, you know, maybe I won’t get vaccinated. I’ll just get the treatment. ”And so they didn’t want that message out because they feared how people would behave.”

Read more …

“The Bill and Melinda Gates Foundation came to us and said, ‘Hey, we have a real problem — knowing who’s vaccinated..’”

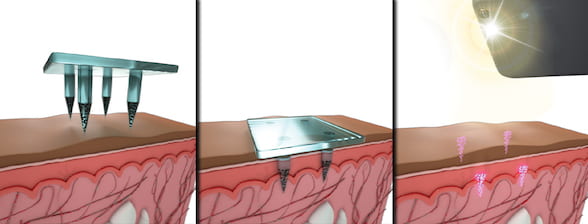

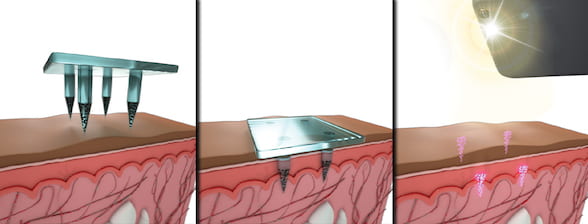

• Quantum-Dot Tattoos Hold Vaccination Record (Rice)

Keeping track of a child’s shots could be so much easier with technology invented by a new Rice University professor and his colleagues. Kevin McHugh, an assistant professor of bioengineering at Rice since this summer, and a team at his previous institution, the Massachusetts Institute of Technology, report in a cover story in Science Translational Medicine on their development of quantum-dot tags that fluoresce with information after they’re injected as part of a vaccination. The tags are incorporated in only some of the array of sugar-based microneedles on a patch. When the needles dissolve in about two minutes, they deliver the vaccine and leave the pattern of tags just under the skin, where they become something like a bar-code tattoo.

A pattern of 1.5-millimeter microneedles that contain vaccine and fluorescent quantum dots are applied as a patch. The needles dissolve under the skin, leaving the encapsulated quantum dots. Their pattern can be read to identify the vaccine that was administered. The project was co-led by Rice University bioengineer Kevin McHugh during his time at MIT. (Credit: Second Bay Studios)

Instead of ink, this highly specific medical record consists of copper-based quantum dots embedded in biocompatible, micron-scale capsules. Their near-infrared dye is invisible, but the pattern they set can be read and interpreted by a customized smartphone. The two-year project is aimed at the 1.5 million preventable deaths that result from a lack of vaccinations, primarily in developing nations. “The Bill and Melinda Gates Foundation came to us and said, ‘Hey, we have a real problem — knowing who’s vaccinated,’” said McHugh, who was recruited to join Rice with funding from the Cancer Prevention and Research Institute of Texas. “They said, ‘We go on vaccination campaigns where people get into Hummers, drive to a rural village, set up a tent and start immunizing people, but they don’t always know who’s been immunized before and what vaccines are still needed.”

Parents often don’t know their children’s vaccination histories, McHugh said. “So our idea was to put the record on the person,” he said. “This way, later on, people can scan over the area to see what vaccines have been administered and give only the ones still needed. There are two sides to this,” he said. “First, is that you don’t administer unnecessary vaccines, which has a cost. But even bigger, you don’t leave people underimmunized and at risk of getting an infectious disease.”

Read more …

Thread. A lot of people saying this is just anecdotal. But because of all the censoring, that’s often all we have.

• From The Mouth Of A Front Line Nurse (Tribe)

From the mouth of a front line nurse: So I have mentioned on here multiple times that my wife’s a nurse at a hospital. Last night she worked an extra shift in the Emergency Room(not her regular department). She found out, how they” are getting away with claiming there’s a “pandemic of the unvaccinated” While dealing with a patient who came in exhibiting symptoms of myocarditis, a FT Emergency Room nurse conveyed some very interesting information to my wife. Apparently all patients are asked whether or not they received the cv19 vax, no matter what issue it is that brought them into the ER. If the patient received the vax less than 14 days prior, they are recorded as “Un-Vaxxed”

The story the nurses are being given, is that this is done because the vax takes 14 days to start working. The FT ER nurse my wife talked to last night has a different theory: It has been her observation that most patients coming in with what appears to be vaccine injuries are coming in within 72 hours of receiving the jab. By recording these patients as “Un-Vaxxed” they can do a few things: – one, they can claim those vax injuries are a result of Covid & not the shot – two, they can bury the vaccine injury – three, they get to claim there’s a “pandemic of the unvaccinated”. It also turns out that nurses are being required to sign nondisclosure agreements, promising not to publicly discuss any procedures dealing with c.. id. My wife refused to sign this agreement, and she’s awaiting possible retaliatory response from upper management.

Read more …

Good luck with that.

• North Carolina Hospital System Suspends 365 Unvaxxed Employees (ET)

A North Carolina health care system said it suspended hundreds of its employees after the firm implemented a COVID-19 vaccine mandate, adding that workers who refuse to get vaccinated after five days will be fired. “Beginning this week, approximately 375 team members—across 15 hospitals, 800 clinics and hundreds of outpatient facilities—have been confirmed to be non-compliant and are not able to report to work,” stated a press release from Novant Health, which is based in North Carolina but operates in other states. “They will have an opportunity to comply over a five day, unpaid suspension period,” the release said. “If a team member remains non-compliant after this suspension period, he or she will have their employment with Novant Health terminated.”

The firm then claimed that about 98.5 percent of its workforce are compliant with the policy, meaning they have received at least one dose of a COVID-19 vaccine. Workers who started a two-dose vaccine series have until Oct. 15 to get the second shot, Novant said. Employees who have an exemption are required to get weekly COVID-19 testing, as well as wear N95 masks and eye protection, it added. In a similar move, 125 workers with Indiana University Health, the biggest hospital system in the state, parted ways with the company, according to a news release issued last week. Those workers, it said, did not comply with the firm’s vaccine mandate.

Read more …

Interesting from Greece. The guy’s been on all TV channels for three days, with the purpose of painting him as a terrible person. But many people don’t see him that way.

• Anti-Vaxxer Father To Stand Trial On Friday (K.)

A 37-year-old man in Thessaloniki, northern Greece, is due to stand trial on Friday after being arrested in the act of causing a disturbance at his son’s elementary school after the boy was not allowed onto the premises because he did not comply with coronavirus safety rules. The boy’s father reportedly barged into the school grounds, shoved and yelled at the principal and prevented other pupils for entering after his son would not produce a negative self-test or wear a mask before entering the premises on Tuesday morning. The incident took place at the Second Elementary School of Thermi, southeast of Thessaloniki.

The 37-year-old was accused of disrupting the operation of a public service, among other charges, and was given until Friday to prepare his defense. Speaking to local media after his release from police custody, the 37-year-old claimed that his son transferred to the Thermi school after a similar incident at his previous school. “Our children are God’s children. I will send him back to school again tomorrow without a mask and without a self-test. Anyone who stands in my way will suffer the consequences,” he told reporters.

Read more …

And then you get this…. They just change the law..

• Greek Gov’t Moves To Protect Teachers From Anti-vaxxers, Covid Deniers (K.)

Greece’s Citizen Protection Ministry, which is in charge of the police, announced on Wednesday that teachers will no longer be taken into police custody when they are sued by parents of students who oppose the health rules imposed to prevent the spread of the coronavirus in schools. Under government regulations, unvaccinated pupils have to procure negative self test results twice each week, while teachers will have to take twice weekly rapid tests. Pupils and teachers are obliged to wear masks. At the same time, the government is planning to abolish the so-called aftoforo – a law permitting a swift hearing if an arrest is made within 48 hours of an alleged crime – in cases such as these. The move follows a barrage of arrests and lawsuits against educators by parents who refuse to vaccinate their children or even wear face masks.

Read more …

500 million Trojan horses.

Dave Collum @DavidBCollum:

“Let me help you with that headline:

US Taxpayer Gives Pfizer $10 billion Dollars”

• US to Donate 500 Million More COVID-19 Vaccines to Poor Countries (ET)

The United States has reached an agreement with Pfizer to buy an additional 500 million doses of its COVID-19 vaccine to donate to various countries, President Joe Biden announced Wednesday. “We know we have to act to save lives now,” Biden told a virtual COVID-19 summit that his administration convened when world leaders and business executives. The doses will be donated to low- and lower-middle-income countries around the world,” a senior administration official, who was speaking to reporters on the condition they were not identified, told reporters in a call. They’re all Pfizer doses. The tranche will be made in the United States and will start shipping out in January 2022.

The additional commitment means the United States has pledged to donate or has already donated 1.1 billion vaccine doses. That includes 500 million Pfizer doses that the United States bought over the summer and promised to send to countries the government said needed them. So far, nearly 160 million doses have been sent out to 100 countries around the world, including Peru, Pakistan, Sri Lanka, Sudan, El Salvador, and Ethiopia. Most of those have gone to lower-middle-income countries, according to an analysis from the Kaiser Family Foundation. “The United States is donating 1.1 billion doses of COVID-19 vaccines to the world, free of charge, no strings attached,” the official said. “This is a huge commitment by the U.S.”

Read more …

Scandinavia seems less prone to insanity.

• Covid-19 In Norway Can Now Be Compared To The Flu – Health Chief (Loc.)

Coronavirus can now be categorised as one of several respiratory illnesses with seasonal variation, Geir Bukholm, assistant director of the Norwegian Institute of Public Health (NIPH), has said. For the past year and a half, Covid-19 has been classed as a generally dangerous disease. However, this could change soon as the assistant director of the Norwegian Institute of Public Health (NIPH), Geir Bukholm, has said the coronavirus can now be put in the same category as illnesses such as flu, common colds and RS (respiratory syncytial virus). “We are now in a new phase where we must look at the coronavirus as one of several respiratory diseases with seasonal variation,” Bukholm told paper VG.

Last week the Ministry of Health and Social Care asked the NIPH to assess whether Covid-19 was still a dangerous disease. While the NIPH has yet to return its findings, its assistant director has made it clear that the danger of Covid will be downgraded. Covid could now be compared in severity with the likes of colds and flu because the vast majority of those at most risk of developing severe disease when infected are now fully vaccinated. “This is because the vast majority of those at risk are protected,” Bukholm explained. “And although the infection is still circulating, hospital numbers remain low. Thus, the coronavirus will not lead to a heavy burden on the health service. For those vaccinated who may become infected and develop symptoms, the vast majority will have mild cold-like symptoms.”

Read more …

From 9/11 to Covid. It’s a straight line.

• The Politics of Fear and Self-Preservation (Whitney Webb)

Many of those who have been quick and vocal to point out the lies of the US government when it comes to the invasions of Afghanistan and Iraq and other consequences of the War on Terror have been unable to even consider that the official story of 9/11 may not be legitimate and may indeed have been dealt from the same pack. This may be for a variety of reasons, including a strong desire to not be de-legitimized by their peers as bearers of the “conspiracy theorist” smear and an unwillingness to face a political reality where US government officials may have been complicit in a deadly attack on American soil. In those two examples, however, the failure of such individuals, particularly in media, to even consider that there may be more to the story boils down to a desire for self-preservation in the case of the former and preservation of a particular worldview in the case of the latter.

Yet, in both cases, the casualty is the truth and the cause is cowardice. By failing as a society to thoroughly examine the events of 9/11 and why those events occurred, the American public has shown the powers that be that their desire to preserve a “safe” worldview — and to preserve their own careers, in the case of certain professional classes — is enough to keep people from questioning world-altering events when they emerge. Those powers are well aware of this refusal and have been using it to their advantage ever since. Today, with the COVID-19 crisis still dragging on, we are similarly immersed in a situation where nuance and facts are being cast aside, militantly in some cases, in favor of the establishment narrative. Is everyone who chooses not to take this particular vaccine a “conspiracy theorist” and “anti-vaxxer”?

Does it really make sense to so dramatically divide the public into groups of vaccinated and unvaccinated through a new ID system when the vaccine claims to reduce the severity of illness but not to stop disease transmission? Should those that question the motivation of politicians, powerful pharmaceutical corporations and mainstream media “experts” be censored from expressing those views online? You do not need to agree with those who hold such views, but what is wrong with hearing what they have to say and debating their evidence with your own?

We are losing the ability to have rational public discourse about these issues — and losing it swiftly, at a speed comparable to what took place in the aftermath of 9/11, when questioning the motives of the Bush administration, US intelligence agencies and other groups, as well as their proposed responses and “solutions,” was deemed “unpatriotic” and even “treasonous” by some. Calls were made to strip an entire class of Americans of their freedom for merely sharing the same ethno-religious identities as those we were told attacked us, and many went along with it. Freedom became treated as a privilege only for certain groups, not as a right, and this insidious fallacy has reared its head yet again in recent months in relation to the COVID-19 vaccine debate and also the war on domestic terror.

Read more …

The New York Post deserves to have a say here.

• The Hunter Biden Laptop Is Confirmed?! Color Us Shocked! (NYP Ed.)

In his new book, “The Bidens: Inside the First Family’s Fifty-Year Rise to Power,” Politico reporter Ben Schreckinger says that evidence points to Hunter Biden’s laptop being legit. While we appreciate the support, the truth is The Post’s reports always have been true, and it’s only because the media wants to protect Joe Biden that they keep referring to the laptop as “unsubstantiated.” Schreckinger notes that “A person who had independent access to Hunter Biden’s emails” confirms two of the e-mails the Post published, including one about a potential deal with China with the line “10 held by H for the big guy?” — that is, Joe Biden. But Hunter Biden’s former business partner Tony Bobulinski already said those e-mails were authentic — the media just ignored him.

Schreckinger adds that e-mails released by the Swedish government also match e-mails from the laptop (Hunter had gotten into a kerfuffle when he was staying in a Swedish embassy building). That’s also been reported. For those who doubt that Hunter would just forget a laptop at a repair shop, Schreckinger notes that Biden’s son abandoned another computer at the home of psychiatrist Keith Ablow. Feds seized that machine when they raided Ablow over abuse claims; Hunter eventually got it back. “I wasn’t keeping tabs on possessions very well for about a four-year period of time,” Hunter said. All of this information is out there. Yet The Times still called the laptop “unsubstantiated” last week (until they quietly corrected the story).

And even as Politico credited its reporter, it added, “While the leak contains genuine files, it remains possible that fake material has been slipped in.” What part? The pictures of Hunter smoking crack? Schreckinger called the White House to check whether, as we reported, Joe Biden met Hunter for a dinner in April 2015 that included Burisma adviser Vadym Pozharskyi. Biden’s team pointed him to a Washington Post “fact check” — which noted that Biden’s team had at first said there “no record of such a meeting,” until they finally conceded that, yes, Joe did drop in on that dinner. The fact confirmed, the writer still concludes, haughtily, that there’s “less to the story than one might imagine.” It’s the perfect example of how Democrats weaponize “fact checkers” to deflect criticism and enlist social media to censor articles. Nothing to see here! See: The Wuhan Lab theory.

Read more …

Oz apology

Support the Automatic Earth in virustime; donate with Paypal, Bitcoin and Patreon.