Unknown Dutch Gap, Virginia. Picket station of Colored troops 1864

What a list of incompetent power hungry doofuses.

• Five Horsemen Of The Euro’s Future (Politico)

The threat of an imminent Greek exit from the euro may be the talk of Brussels, but the EU is unveiling bold proposals this week to deepen political and financial integration inside the eurozone. A so-called “five presidents’ report” obtained by POLITICO includes calls for a eurozone finance minister and stricter controls over the budgets of the 19 countries, including Greece, that use the single currency. The glossy 24-page document — entitled “Completing Europe’s Monetary and Economic Union” — will be published on Monday. It’s to be discussed at the EU summit that begins Thursday in Brussels. Commission President Jean-Claude Juncker drafted the report with European Council chief Donald Tusk; Eurogroup head Jeroen Dijsselbloem; Mario Draghi, president of the ECB; and European Parliament President Martin Schulz.

Coming ahead of an emergency EU summit on Greece Monday night in Brussels, a report on the future of the eurozone may seem ill-timed. But several governments, including Berlin, are more open now than ever to at least discuss steps toward deeper integration proposed by the “five presidents,” seeing it as a signal of reassurance to financial markets that the euro will endure any outcome on Greece. The proposals mostly echo calls by Germany and other rich northern eurozone countries to enforce spending rules across the eurozone. It won’t go down well in Greece or the poorer southern rim states, which want more “solidarity” within the eurozone — in other words, financial support in times of trouble.

The report doesn’t foresee common lending (“euro bonds”) and only alludes to a “euro area-wide fiscal stabilisation function” in case national budgets are “overwhelmed.” The “five presidents” call their proposal for future eurozone governance a “roadmap that is ambitious yet pragmatic,” sketching out several stages to deepen the union. In a first “deepening by doing” stage, the EU would “build on existing instruments and make the best possible use of the existing Treaties” to enforce the eurozone’s fiscal rules. The second stage, which potentially could mean changes to the EU treaties that would cause difficult discussions about transferring more powers to the EU, is not supposed to start until 2017, the report says. A “genuine Fiscal Union” requires more joint decision-making on fiscal policy, the report says.

While not every aspect of each country’s spending and tax policies will be overseen by Brussels, “some decisions will increasingly need to be made collectively while ensuring democratic accountability and legitimacy,” report says. It calls for a “future euro area treasury“ that “could be the place for such collective decision-making.”

“..the EU’s political and economic apparatus has openly demonstrated its harmfulness, incompetence and rapacity.”

• The Three Victories Of The Greek Government (Jacques Sapir)

Whatever the outcome of the Eurogroup to be held on June 22, it is now clear that the Greek government – improperly called “government of the radical left” or “government of SYRIZA,” but in reality a government union (and the fact that this union was made with the sovereigntist party ANEL is significant) – has won spectacular successes. These successes show that Greece, where the people have regained their dignity, is the one European country where the example set by its government is now showing the way forward. But, and this is most important, this government – in the fight it has led against what is euphemistically called the “institutions”, ie mainly the political-economic apparatus of the EU, the Eurogroup, the ECB – has shown that the “Emperor has no cIothes.”

The entire structure, complex and lacking in transparency of this politico-economic apparatus was challenged to respond to a political demand, and it has been unable to do so. The image of the EU has been fundamentally altered. Whatever kind of meeting next Monday, if it results in a failure or a surrender of Germany and “austéritaire” or even, which we can not exclude, in the defeat of the Greek government, the EU’s political and economic apparatus has openly demonstrated its harmfulness, incompetence and rapacity. The peoples of the European countries now know who is their worst enemy. The Greek government, in the course of the negotiations which started at the end of January, was faced with the inflexible position of these “institutions”. But this inflexibility has reflected more a tragic lack of strategy, and the pursuit of conflicting objectives, than real will.

Indeed, it was well understood that these “institutions” had no intention of yielding on the principle of Euro-austerity, an austerity policy at European level set up under the pretext of “saving the euro”. Therefore, they have refused the pIea of the Greek government whose proposals were reasonable, as many economists have stressed. The proposals made by these “institutions” have been described as the economic equivalent of the invasion of Iraq in 2003 by a columnist who is not listed on the left of the political spectrum. We must understand this as a terrible admission of failure. A position was publicly defended by the representatives of the EU which was in no way based in reality, with the soIe defense for this being a narrow ideology. These representatives were incapable of evoIving their positions and trapped themselves in false arguments, in the same way that the US government chained itself to the issue of weapons of mass destruction attributed to Saddam Hussein.

The one thing they can agree on, but also the one thing neither acts on. Curious.

• Greece and Germany Agree the Euro Can’t Work (Crook)

Ahead of Monday’s European Union summit, the only thing you can rule out is a happy ending. Whatever happens at the leaders’ meeting – even if a deal of some sort emerges – the EU has suffered lasting and perhaps irreparable damage. The available choices run from bad to terrible. The costs to Greece and to the EU of a default followed by Greece’s ejection from the euro system could be huge. But even if the worst doesn’t happen, Europe has suffered a total breakdown of trust and goodwill. That can’t easily be undone – and it’s a dagger pointed at the heart of the entire project. Two things, I believe, will strike historians as they look back on this collapse of European solidarity. The first is that the principals were able to draw such a poisonous dispute out of such an easily solvable problem.

The second helps to explain why that was possible: Greece and its partners fell out thanks to a delusion they have in common — the idea that sharing a currency can leave fiscal sovereignty intact. On the eve of the summit, the economic distance between Greece and its creditors is small. Differences over fiscal targets have narrowed down to timing — what happens next year rather than the year after — and fractions of a%age point of gross domestic product. There’s even tacit agreement that further debt relief will be needed as part of a successor bailout program, though the creditors won’t discuss the details until the current program is completed. That’s a procedural rather than substantive issue, and it simply shouldn’t matter.

The problem is that the creditors don’t trust Alexis Tsipras and his Syriza ministers to hit the targets they might sign up to. The creditors don’t even trust them to try. They want firm commitments to specific policy changes – tax increases and new retirement rules to cut pension spending – that Tsipras has promised not to accept. Again, the revenue these policies would generate is small in relation to the fiscal adjustment Greece has already achieved and to the forecasting errors involved in all such calculations. It isn’t the numbers that separate the two sides. Greece and the creditors are standing on principle, and oddly enough it’s essentially the same principle — that of sovereignty.

Greece has had enough of being dictated to by the rest of the EU. Of course, its government wants debt relief and a milder profile of fiscal adjustment – and that’s justified, because without them the Greek economy will recover too slowly, if at all. But more than debt relief and softer fiscal targets, Greece wants to be back in charge of its own policy. Its years under the creditors’ supervision have been terrible. Being force-fed any more of their medicine is what the country rejected when it voted for Syriza.

Lamont was instrumental in keeping Britain out of the eurozone.

• The Euro Was Doomed From The Start (Norman Lamont)

Next week will be a momentous one for Europe, with a string of crucial meetings including the summit at which the PM will table his renegotiation demands. We may be focused on our renegotiation but it is Greece which will dominate. For some time it has looked as though the Greek drama must reach its final denouement. But the Greeks have become highly skilled at managing to push back deadlines ever further into the future. Whether Greece leaves the euro or stays in, a decision surely cannot be delayed much longer. So what will this mean for the EU? I had the privilege of negotiating Britain’s opt-out from the then new European single currency in 1991. My abiding memory is how clear it was that the euro had nothing to do with economics and was a political project with a dubious rationale.

Some representatives of other countries were openly sceptical, but their political masters were firmly in control. The creation of the euro has been an error of historic dimensions and done great harm to the EU, which in its first 40 years had brought economic prosperity to the citizens of the Continent. Then the less well-off countries benefited from the lowering of tariffs and the increase in internal trade. After the creation of the euro, however, economic growth slowed markedly. Poorer countries fared worse than the more prosperous countries, like Germany, which benefited from the new, weaker currency. The Greek crisis epitomises the complete mess that Europe has made of the single currency.

Greece should never have been admitted in the first place, though it was not the only country – Belgium and Italy were two others – that didn’t meet the strict criteria for membership. From the beginning, the rules put in place for the euro, relating to bail-outs, monetary financing and deficit levels, have been ignored. Europe claims to be a rule-based organisation. But however else the eurozone is run, it is not run strictly according to its own rules.

Nice graphs! Let’s hope author Whitehouse understands this was not a mistake, but a plan. If Greece had restructured in 2010, the banks would have been on the hook. By waiting 2 years, most could be transferred to taxpayers.

• If Greece Defaults, Europe’s Taxpayers Lose (Bloomberg)

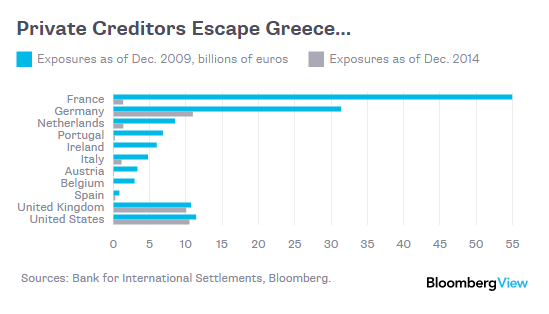

The European creditors embroiled in a last-ditch effort to come to terms with Greece face a dilemma: If they can’t prevent a default, their taxpayers stand to lose a lot of money. Ever since the region’s sovereign-debt crisis first flared in 2010, European nations have been stepping in for Greece’s private creditors – largely German and French banks – by lending the country the money to pay them off. Thanks to this bailout, banks and investors have much less at stake than before. Here, for example, are the exposures of countries’ banks to Greece’s government, companies and financial institutions at the end of 2014, compared to the end of 2009:

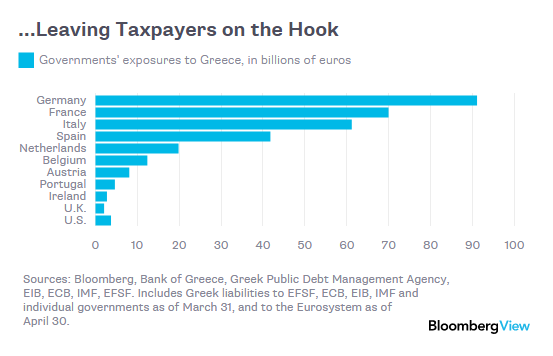

On the flip side, European governments – and Germany in particular – have become the largest holders of Greece’s €313 billion in sovereign debt, through an alphabet soup of entities that are ultimately backed by taxpayers. Beyond that, as of April, the European Central Bank had lent the Bank of Greece about €115 billion to replace money being pulled out of the country – credit that can turn into losses for the ECB’s remaining shareholders if Greece leaves the euro. Here’s a breakdown of those exposures by country:

The lesson is that in a sovereign debt crisis, dithering can be costly. If European countries had pushed Greece to restructure its private debts back in 2010 (instead of waiting until 2012) and recapitalized banks that were in too deep, the whole region probably could have come out of the crisis much more quickly. As it stands, five years later, Greece and its creditors are back at the negotiating table, with more than 300 billion euros in taxpayer money hanging in the balance.

Lofty ideals.

• Why On Earth Is Greece In The EU? (Angelos)

Europe is a Greek word. After Greece applied to join the European Community in 1975, Konstantinos Karamanlis, the country’s prime minister, often emphasized this point to his European counterparts. The implication was clear: Greece, the font of Europe’s civilization, naturally belonged in the European club. As Karamanlis later put it, “the Greek spirit contributed the idea of Freedom, Truth and Beauty” to European culture. Some had their doubts about whether Greece belonged in the European club, however. The European Commission, in issuing its opinion on Greece’s membership bid, warned that the Greek economy had a weak industrial base, which would limit its capacity to “combine homogeneously” with other member states. German Chancellor Helmut Schmidt worried about Greece’s problematic public administration, and its inability to collect taxes from its wealthiest citizens.

European leaders ultimately found Karamanlis’ argument about Greece’s cultural import persuasive, and it was one reason they set aside their concerns and admitted Greece in 1981. As former French president Valéry Giscard d’Estaing later put it in his memoir, Greece is the “mother of all democracies,” and therefore could not be excluded. Two decades later, when Greece joined the euro, further cementing its place in the European project, it seemed only appropriate that the Greek two-euro coin would depict Europa, the beautiful maiden of Greek mythology who shares the continent’s name. Today, Europa’s place on the coin is in peril as Greece remains dangerously close to a default that could lead to a euro exit. Those considerable problems Europe once overlooked seem to have come back to haunt it.

Even Giscard seems to have had a change of heart. “Greece is basically an Oriental country,” he told the German magazine Der Spiegel in 2012. He was interviewed alongside Schmidt, his old counterpart, who had been more skeptical of Greece’s bid. “You were wiser than me,” Giscard told Schmidt. Europeans’ bipolar view of Greece — that it is both intrinsic to Europe and yet does not belong — has been evident since the nation’s modern founding. When the Greeks revolted against the centuries-long rule of the Ottoman Empire in 1821, European admirers of Ancient Greece rejoiced over the possibility of a resurrected Athens that might once again bestow upon Europe the glories of its classical heyday.

“We are all Greeks,” Shelley wrote, the year the Greek revolution broke out. Europe owed to Greece its civilization, he meant, and was therefore obliged to back the Greek cause. Philhellenic societies across Europe raised money for Greece, and European volunteers traveled there to join the fight.

“In German: ‘eine Zangengeburt. (A birth that requires a pair of pliers).” The German language is full of very descriptive terms.

• EU Welcomes 11th-Hour Greek Proposals In ‘Forceps Delivery’ (Reuters)

The European Union welcomed new proposals from Greek Prime Minister Alexis Tsipras as a “good basis for progress” at talks on Monday where creditors want 11th-hour concessions to haul Athens back from the brink of bankruptcy. EU chief executive Jean-Claude Juncker’s chief-of-staff spoke of a “forceps delivery” as officials worked late into the night to produce a deal ahead of a summit of euro zone leaders in Brussels that they hope can keep Greece in the currency bloc. Giving no detail of a proposal he said was also received by the ECB and IMF, German EU official Martin Selmayr tweeted: “Good basis for progress at … Euro Summit. In German: ‘eine Zangengeburt’.”

After four months of wrangling and with anxious depositors pulling billions of euros out of Greek banks, Tsipras’s leftist government showed a new willingness at the weekend to make concessions that would unlock frozen aid to avert default. It was not immediately clear how far the new proposal yielded to creditors’ demands for additional spending cuts and tax hikes, but the offer was a ray of hope that a last-minute deal may yet be wrangled before Athens runs out of cash. Tsipras spent much of Sunday holed up in a marathon cabinet meeting and discussed the new offer with the leaders of Germany, France and the European Commission by phone. “The prime minister presented the three leaders Greece’s proposal for a mutually beneficial agreement that will give a definitive solution and not a postponement of addressing the problem,” a statement from Tsipras’s office said.

That’s a first.

• EU Commission Gives Guarded Welcome To Greek Plan Before Talks Bloomberg)

A new proposal by Greek Prime Minister Alexis Tsipras drew a rare positive nod from European officials who indicated it could help break a months-long impasse during marathon talks on Monday. The new offer “was a good basis for progress” ahead of Monday’s emergency summit, European Commission spokesman Martin Selmayr, said in a Twitter posting. He also referred in German to the inception of the plan as “birth by forceps.” “These proposals go in the right direction,” European Economic Affairs Commissioner Pierre Moscovici said on Europe 1 radio. Reaching an accord is “very important for Greece, for the Greeks, important for the euro and for Europe. And this time around it’s decisive because we must be aware that the markets are watching.”

The euro gained as much as 0.5% against the dollar in Asian trading and was still trading higher in the early European session. Greek bonds inched higher in early trading Monday, with the yield on notes maturing in 2017 falling 38 basis points to 28.49% at 9:41 a.m. local time. Spanish and Italian government bonds were also trading higher. Before the start of the summit in Brussels, Tsipras will meet with representatives of the countries’ main creditors. He’ll sit down with European Council head Donald Tusk before they’re joined by ECB President Mario Draghi, IMF Managing Director Christine Lagarde, EU Commission President Jean-Claude Juncker and Eurogroup head Jeroen Dijsselbloem, an e-mailed statement from the Greek prime minister’s office said.

“Democracy cannot be blackmailed, dignity cannot be bargained..”

• Greece Creditors Aim To Strike Deal To Include 6-Month Extension (Guardian)

Greece’s creditors are aiming to strike a deal on Monday to stop Athens defaulting on its debt and possibly tumbling out of the euro, by extending its bailout by six months, supplying up to €18bn in rescue funds, and pledging later debt relief for the austerity-battered country. But EU officials, privately disclosing details of the proposed deal, stressed that a breakthrough hinged on the prime minister, Alexis Tsipras, making concessions on fiscal targets, pensions cuts and tax increases that he has resisted since he came to power five months ago. Following a cabinet meeting in Athens, Tsipras is believed to have offered Greece’s creditors concessions on tax and pensions reform. But it was not clear whether the offer went far enough to make a final agreement possible on Monday.

Time is also running out for the Greek banking system, with Reuters reporting on Sunday that €1bn worth of withdrawal orders had been lodged with Greek banks over the weekend – on top of the €4bn that left the Greek banking system last week – and that the ECB is set to discuss extending financial help to those institutions on Monday morning, amid fears that Greek banks will be unable to open on Tuesday. A hectic round of telephone diplomacy took place on Saturday and Sunday between leaders in Athens, Berlin, Paris, and Brussels while technocrats on both sides sought to hammer out the small print of the fiscal arithmetic forming the basis for a last-minute agreement days before Greece’s bailout expires. Greece must pay €1.6bn owed to the International Monetary Fund by Tuesday 30 June.

With time running out, the only way an IMF default could now be avoided was for the ECB to raise the ceiling on the short-term debt or T-bills Athens is allowed to sell, the officials said. This would need to happen by Monday next week. The sources also signalled moves to assuage Tsipras’s key demand – that the creditors need to offer debt relief to Greece. Some form of debt restructuring would be promised to Athens, but it would come with strings attached and not as part of the current bailout package, they said. Yanis Varoufakis, the outspoken Greek finance minister, said Greece’s fate hinged on the German chancellor, Angela Merkel, and told her she faced a stark decision. He added that there would be no agreement that did not include the prospect of debt relief for Greece.

Varoufakis’s spokesman reacted sceptically to suggestions of creditor promises on eventual debt relief, describing the eurozone as “pathological liars”. [..] “Democracy cannot be blackmailed, dignity cannot be bargained,” the party said in a statement on Sunday. “Workers, the unemployed, young people, the Greek people and the rest of the peoples of Europe will send a loud message of resistance to the alleged one-way path of austerity, resistance to the blackmail and scaremongering.”

Too late and especially too little.

• Pro-Greek Demos In Brussels, Amsterdam Before Crunch Summit (AFP)

Several thousand demonstrators gathered in Brussels on Sunday and several hundred in Amsterdam to plead for solidarity with cash-strapped Greece on the eve of a make-or-break summit with European leaders. Addressing the crowd in Amsterdam, veteran Greek MEP Manolis Glezos urged Athens’ creditors to give the country «one more year» to resolve its debt crisis. “This crisis was caused by the financial sector, not by the Greek people,» said Glezos, a Greek resistance hero against Nazi occupation in World War II, who at 92 years old remains a firebrand politician. “It’s the financial sector that has to pay, not the Greek people,» Glezos said to the loud applause of around 350 demonstrators at Amsterdam’s historic Dam Square. Some of the protesters waved Greek flags while others carried placards saying: «No more EU austerity» and «Stop EU blackmail.”

Demonstrator Sotiris Dialas, 32, told AFP he was «worried about tomorrow» when EU leaders will attend an emergency summit aimed at staving off a Greek default. “I have many friends in Greece and nobody knows what’s going to happen,» he said, draped in a Greek flag. In Brussels, demo organiser Sebastien Franco told Belgian national television channel La Une that austerity was not the answer to Greeces problems. “Austerity is not working, it reduces the income of poor people in the name of reimbursement to creditors… who continue to enrich themselves,» he said. Some 3,500 people turned out for the demo in the Belgian capital, according to Belga news agency, citing police figures. Sunday’s rallies came a day after thousands of people demonstrated in France, Germany and Italy to express solidarity with migrants in Europe and austerity-hit Greece.

“A U.K. judge has declared the 36-year-old a flight risk and set his bail at $5 million, which is roughly what Sarao says his net worth is. The problem is that his assets are frozen and the judge refuses to accept his family home as surety..”

• The Flash-Crash Trader’s Kafkaesque Nightmare (Bloomberg)

How do you prove you don’t have $35 million of ill-gotten gains parked in an offshore account? That’s the dilemma facing Navinder Singh Sarao, known variously as the “Flash-Crash Trader” and the “Hound of Hounslow” and currently residing at Her Majesty’s pleasure in London’s Wandsworth prison. Sarao is accused of contributing to -but not causing, mind you; the Commodity Futures Trading Commission is adamant about that- the so-called “flash crash” that briefly wiped $1 trillion off the value of U.S. stocks on May 6, 2010. You can read the U.S. Justice Department’s case here. He faces a maximum prison term of 20 years for wire fraud, 25 years for commodities fraud, and 10 years for market manipulation and spoofing. The case against Sarao smells strongly of scapegoating.

First, there’s the issue of whether the misdeed he is accused of -“spoofing” the market- is a crime at all, as my colleague Matt Levine has explained at length, including here and here. (Importantly, if a London judge decides it’s not a crime in the U.K. to rapidly trade and cancel $3.5 billion worth of futures contracts in the space of two hours, then Sarao can’t be extradited.) Second, there are the financial machinations that are keeping Sarao in a prison cell, bringing to mind Franz Kafka’s novel, “The Trial.” A U.K. judge has declared the 36-year-old a flight risk and set his bail at $5 million, which is roughly what Sarao says his net worth is. The problem is that his assets are frozen and the judge refuses to accept his family home as surety, meaning Sarao may end up languishing in prison until he is extradited to the U.S. to face his accusers, which could take years.

What’s more, the CFTC is convinced he’s got money hidden away that he hasn’t declared. The regulator says Sarao made more than $40 million of profit, which is “stashed in a variety of offshore accounts and vehicles, as well as other apparently speculative foreign business ventures and are in danger of being concealed and/or dissipated.” That sounds pretty damning – until you get to the financial evidence presented in the U.S. complaint. A change in U.K. tax law created a heavy tax liability under his existing offshore accounts. To mitigate that, he created something called International Guarantee Corporation in 2012 in Anguilla in the British West Indies. (He also had a company, Nav Sarao Milking Markets, which he had set up two years earlier in Nevis.) Sarao seems to have been borrowing money from his company to fund his trading and reinvesting the profits in the company -a perfectly legal structure some of my wealthy friends have used in the past.

A country corrupted from head to toe.

• China Regulator Official Fired After Husband Suspected of Illegal Trading (WSJ)

China’s stock-market regulator said Saturday it had dismissed the head of the bureau that monitors share issuance after her husband was suspected of illegal stock trading. The China Securities Regulatory Commission said in a statement on its official Weibo microblog account that the official, Li Zhiling, was suspected of breaking the law and had been turned over to police. Her husband’s name wasn’t given. In the statement, the oversight body vowed to “investigate and deal severely with” any irregularities or legal violations without providing further detail. Calls to the regulatory commission went unanswered. The Wall Street Journal has been unable to contact Ms. Li or her husband. According to the website of the business magazine Caixin, Ms. Li was named to her post in 2012 and remained in charge after a reorganization in April 2014 that saw several departments combined.

The oversight agency said Saturday in its Weibo statement that it would redouble efforts to enhance control. “She’s suspected of breaking the law by taking advantage of her position,” it said. “Once we discover such violations, we will immediately take action to punish them. We do not take this lightly.” The commission’s pledge to root out malfeasance came as China’s benchmark Shanghai Composite Index suffered its worst weekly decline in years, with China’s largest market falling 13% over the past five trading sessions, including more than 6% on Friday. This follows a more than doubling of the market over the past year, fueled in part by a sharp increase in margin trading.

Better wake up. Sell!

• Australian Housing Market Facing ‘Bloodbath’ Collapse: Economists (SMH)

The Australian real estate market is in the grip of the biggest housing bubble in the nation’s history and Melbourne will be at the epicentre of an historic “bloodbath” when it bursts, according to two housing economists. Lindsay David and Philip Soos, who have authored books on the overheated housing market, have berated the housing industry and politicians who refuse to acknowledge the existence of a bubble due to a perceived shortage of housing in the major capitals. In a blunt submission to the upcoming parliamentary inquiry into home ownership, the pair claim there is actually an oversupply of housing, just as there was in the United States just before the market collapse that precipitated the global financial crisis.

And the largest oversupply is in Melbourne, where they forecast available homes outstrip demand by 123,000. “Contrary to the analyses of the vested interests, the data clearly establishes Australia is in the midst of the largest housing bubble on record. Policymakers are caught between a rock and a hard place, as implementing needed reforms will likely burst the bubble,” Mr David and Mr Soos state in a submission on behalf of real estate and financial services research house, LF Economics. They believe the current bubble is worse than those in the 1880s, 1920s, mid-1970s and late 1980s. “Australian economic history and recent international events illustrate collapsing housing bubbles can quickly increase the number of unsold properties (stale stock), shattering the pervasive myth of a deleterious dwelling shortage,” they wrote.

“Should this occur alongside rising unemployment and underemployment, reduced aggregate demand and falling net overseas migration, the combination of declining population growth and an oversupply of investment properties would place further downwards pressure on rental prices. Falling housing and rental prices, including sales, would be a doomsday trifecta for investors as they suffer losses in both capital prices and net rental incomes. “This calamitous outcome is especially likely in Melbourne where rents have not increased in real terms since 2010. Melbourne is primed to become the epicentre of a legendary housing market crash due to the combination of a staggering boom in real housing prices (178%). Perth is also in a serious predicament.”

No more safe investments.

• Canada’s Giant Pension Funds Are The New Masters Of The Universe (Telegraph)

Since 1790, the United States has suffered 16 banking crises, while Canada, a country that counts the US as its largest trading partner, has experienced none — not even during the Great Depression. How has Canada achieved such an extraordinary feat? Two reasons, according to the IMF: limited exposure to international banking operations, which meant far fewer foreign liabilities than many of their overseas peers and less globally integrated banking systems; and, Canada’s restrictions on mergers of major domestic banks, where rules prohibit a single shareholder – domestic or foreign – from owning more than 20pc of voting rights in a major bank. The World Economic Forum described Canada’s banking system as the most sound in the world, and Mark Carney was appointed Bank of England Governor largely on the basis of his impressive work at the Bank of Canada.

As one Canadian banker once put it, the country’s financial system, unlike those of many other countries, has always been well-capitalised, well-managed, well-diversified and well-regulated. By avoiding the financial crisis, Canada’s experience of recession in the years that followed 2008 was much more forgiving than the rest of the industrialised world, and it led the G-7 pack in terms of growth. As a result, Canada found the confidence to flex its muscles globally. Leading the charge overseas has been a pack of colossal public pension funds taking part in a remarkable spending spree, snapping up prime assets all over the world. According to reports, one of its largest, Borealis Infrastructure, is planning another big swoop.

The infrastructure arm of the $57bn Ontario Municipal Employees Retirement System is eyeing a second bid for Severn Trent, the UK FTSE 100 water company. Borealis made a move for Severn Trent two years ago, but as part of a consortium involving investors from the US and Kuwait. This time it isn’t clear whether the Canadians still have partners or are operating alone – the reports are unconfirmed but a solo bid for a company of Severn Trent’s size would be hugely ambitious – the last time a FTSE 100 constituent was taken private was when KKR swooped on Alliance Boots in 2007 – the largest European buyout so far. Still, if anyone could pull off such a deal, it is probably one of the Canadian pension fund beasts. The country’s four largest funds manage more than $600bn between them and rank among the 40 largest in the world. Only the US can make similar claims.

How the EU will split.

• EU Extends Economic Sanctions Against Russia For 6 Months (RT)

The European Union has extended economic sanctions against Russian for a further six months, an EU official said. This follows the EU’s decision Friday to extend sanctions against Crimea for another year. The decision to extend the sanctions against Russia was announced by the EU Council’s press officer for foreign affairs, Susanne Kiefer. The sanctions are being maintained until January 31, 2016 to ensure the Minsk agreement is implemented, she wrote in her Twitter account. The European Union will review the sanctions regime against Russia in six or seven months, Italian Foreign Minister Paolo Gentiloni told reporters in Luxembourg. Dialogue with Russia, especially on Libya and Syria, is “crucially important” for the EU, Gentiloni added.

Agreement on the extension of sanctions was reached at a meeting of the EU Permanent Representatives Committee on June 17. In March, the EU Summit adopted a political declaration of intent to extend economic sanctions against Russia for another six months. In the document, the lifting of sanctions was linked to the full implementation of the conditions of the Minsk agreement, for the period up until the end of the year. EU sanctions against Russia include restrictions on lending to major Russian state-owned banks, as well as defense and oil companies. In addition, Brussels imposed restrictions on the supply of weapons and military equipment to Russia as well as military technology, dual-use technologies, high-tech equipment and technologies for oil production. No sanctions were imposed against Russia’s gas industry.

Nice exposé.

• Ayn Rand Killed The American Dream (Mathieu Ricard)

The billionaire investor and philanthropist George Soros uses the term “free market fundamentalism” to describe the belief that the free market is not only the best but the only way of managing an economic system and preserving civil liberties. “The doctrine of laissez-Faire capitalism holds that the common good is best served by the uninhibited pursuit of self-interest,” he writes. If the laissez-faire attitude of an entirely deregulated free market were based on the laws of nature and had some scientific value, if it were anything other than an act of faith pronounced by the champions of ultraliberalism, it would have stood the test of time. But it hasn’t, since its unpredictability and the abuses it has permitted have led to the financial crises with which we are only too familiar.

For Soros, if the doctrine of economic laissez- faire — a term dear to philosopher Ayn Rand — had been submitted to the rigors of scientific and empirical research, it would have been rejected a long time ago. The free market facilitates the creation of businesses; innovation across many fields, for example in new technology, health, the Internet, and renewable energy; and affords undeniable opportunities to young entrepreneurs wishing to start up business activities that will further society. We have also seen that commercial exchange between democratic nations considerably reduces the risk of armed conflict between them. Yet, in the absence of any safeguard, the free market permits a predatory use of financial systems, giving rise to an increase in oligarchies, inequality, exploitation of the poorest producers, and the monetization of several aspects of human life whose value derives from anything other than money.

In his book What Money Can’t Buy: The Moral Limits of Markets, Michael Sandel, one of the United States’ most high-profile philosophers and an adviser to President Obama, says that neo-liberal economists understand the price of everything and the value of nothing. In 1997, he ruffled a lot of feathers when he questioned the morality of the Kyoto Protocol on global warming, the agreement that removed the moral stigma attached to environmentally harmful activities by simply introducing the concept of buying the “right to pollute.” In his view, China and the United States are the least receptive countries to his outspoken objections to free market fundamentalism: “In other parts of east Asia, Europe and the UK, and India and Brazil, it goes without arguing that there are moral limits to markets, and the question is where to locate them.”

They’re not that secret…

• Behind the Scenes With the Pope’s Secret Science Committee (Bloomberg)

Several dozen of the world’s most prominent scientists sprang from their seats and left the Vatican hall where they were holding a conference on the environment in May 2014. They were bound for a meet-and-greet with Pope Francis at the modest Vatican hotel where he lives, the Domus Sanctae Marthae. Among the horde was Veerabhadran Ramanathan, a climate scientist at the Scripps Institution of Oceanography. Since 2004, he has also been a member of a 400-year-old collective, one that operates as the pope’s eyes and ears on the natural world: the Pontifical Academy of Sciences. He had a message for Pope Francis. Only it was too long The academy’s chancellor, Archbishop Marcelo Sánchez Sorondo, suggested to Ramanathan that he condense his thoughts to just two sentences — and deliver them to Francis in Spanish.

Ramanathan, who speaks no Spanish, spent the balance of the eight-minute jaunt committing the words to memory. He got it down with moments to spare. The phrases vanished as soon as he caught a glimpse of Pope Francis himself. The pope has that effect on people. Ramanathan, who is Hindu, reassembled his message in time, and in English. No pressure. All he had to do was sum up more than a century of thought and research that in the past two decades has been validated repeatedly by climate scientists globally. “We are concerned about climate change,” he told Francis. “The poorest 3 billion people are going to suffer the worst consequences. Ramanathan is one of many scientists and other advisers who have, over the last several decades, conveyed the urgency of climate change to the Vatican.

Now, Francis is responding. On Thursday the Vatican will release an encyclical letter, essentially a teaching document for bishops, on climate change and poverty. It draws on and elevates the utterances and writings of previous popes, particularly John Paul II and Benedict XVI. Yesterday, the Italian magazine L’Espresso published an unauthorized draft of the letter, called “Laudato Sii” or “Praised Be.” “Worth noting is the weakness of the international political response” to environmental decay, Francis writes, according to a Bloomberg translation of the draft. Political leaders bow too readily to technology and finance, he writes, and the results are apparent in their failure to protect natural systems: “There are too many special interests, and economic interest very easily comes to prevail over the common good and to manipulate information so that its plans are not hurt.”

“The model does not account for the reality that people will react to escalating crises by changing behavior..” How useful is it then?

• UK Scientific Model Flags Risk Of Civilisation’s Collapse By 2040 (Nafeez Ahmed)

New scientific models supported by the British government’s Foreign Office show that if we don’t change course, in less than three decades industrial civilisation will essentially collapse due to catastrophic food shortages, triggered by a combination of climate change, water scarcity, energy crisis, and political instability. Before you panic, the good news is that the scientists behind the model don’t believe it’s predictive. The model does not account for the reality that people will react to escalating crises by changing behavior and policies. But even so, it’s a sobering wake-up call, which shows that business-as-usual guarantees the end-of-the-world-as-we-know-it: our current way of life is not sustainable.

The new models are being developed at Anglia Ruskin University’s Global Sustainability Institute (GSI), through a project called the ‘Global Resource Observatory’ (GRO). The GRO is chiefly funded by the Dawe Charitable Trust, but its partners include the British government’s Foreign & Commonwealth Office (FCO); British bank, Lloyds of London; the Aldersgate Group, the environment coalition of leaders from business, politics and civil society; the Institute and Faculty of Actuaries; Africa Development Bank, Asian Development Bank, and the University of Wisconsin. This week, Lloyds released a report for the insurance industry assessing the risk of a near-term “acute disruption to the global food supply.” Research for the project was led by Anglia Ruskin University’s GSI, and based on its GRO modelling initiative.

The report explores the scenario of a near-term global food supply disruption, considered plausible on the basis of past events, especially in relation to future climate trends. The global food system, the authors find, is “under chronic pressure to meet an ever-rising demand, and its vulnerability to acute disruptions is compounded by factors such as climate change, water stress, ongoing globalisation and heightening political instability.” Lloyd’s scenario analysis shows that food production across the planet could be significantly undermined due to a combination of just three catastrophic weather events, leading to shortfalls in the production of staple crops, and ensuing price spikes. In the scenario, which is “set in the near future,” wheat, maize and soybean prices “increase to quadruple the levels seen around 2000,” while rice prices increase by 500%.