Mathew Brady Units of XX Army Corps, Army of Georgia on Pennsylvania Avenue, Washington DC May 24 1865

To the extent there’s any actual choices to be made in these kinds of elections. Why waste your time?

• Ayn Rand vs Adam Smith: The Only Midterm Election That Counts (Paul B. Farrell)

Forget who controls the Senate. There is one and only one election that matters, an election that will decide the global balance of power this century. Specific candidates on any other ballot are irrelevant. The one race will be decided by the only two real candidates that count. All other candidates, regardless of political party, are merely pawns, surrogates, proxies for the two real candidates in this grand battle. And the winner not only wins for their party,but also gets to promote their brand of capitalism. They win the future. Get it? The winner between these two key candidates gets more than domination of the American political system. These two candidates are in a battle to dominate the world, gain control of the world’s natural resources in a totally unrestricted free market—to drill with Russia in the Arctic Ocean, drill for oil on America’s public lands and national forests, to export domestic oil, to build pipelines, haul oil in rail tankers across state lines, to frack for oil under public rivers, risk fresh water supplies, and so much more.

Yes, the only two candidates in the only election that counts today and in every other election this century are: Adam Smith, a moral philosopher and father of American capitalism thanks to the publication of his classics on economics, “The Wealth of Nations,” and its companion “The Theory of Moral Sentiments.” Adam Smith’s opponent on the ballot is his archrival, Ayn Rand, author of several 20th century works on capitalism, including “Atlas Shrugged” and “The Fountainhead.” But remember: all other candidates, on every ballot, are just proxy votes for these two candidates who will decide the balance of power in the world and the survival of the planet. Yes, it’s that simple. These two icons face off in a brutal battle for the soul of capitalism and control of the collective conscience of America.

Not a fan of the man, but he’s dead on here.

• Singer’s Elliott: U.S. Growth Optimism Unwarranted as Data ‘Cooked’ (Bloomberg)

Paul Singer’s Elliott Management Corp. said optimism on U.S. growth is misguided as economic data understate inflation and overstate growth, and central bank policies of the past six years aren’t sustainable. The market turmoil in the first half of October may be a “coming attractions” for the next real crash that could turn into a “deep financial crisis” if investors lose confidence in the effectiveness of monetary stimulus, Elliott wrote in a third-quarter letter to investors, a copy of which was obtained by Bloomberg News. “Nobody can predict how long governments can get away with fake growth, fake money, fake jobs, fake financial stability, fake inflation numbers and fake income growth,” New York-based Elliott wrote. “When confidence is lost, that loss can be severe, sudden and simultaneous across a number of markets and sectors.” Six years of near-zero interest rates and three rounds of asset purchases by the Federal Reserve have fueled economic growth and helped U.S. stocks more than triple from their 2009 low when including dividends.

The stock market has rebounded 8.3% through yesterday from a six-month low on Oct. 15, fueled by better-than-forecast economic data and improving earnings reports. The 70-year-old Singer, one of the biggest backers of Republican politicians, reiterated criticism that monetary policies won’t create lasting growth. While the U.S. is doing better than the rest of the world, the acceleration in the second quarter only reversed a “terrible” first quarter and has yet to be sustained in the remainder of the year, Elliott wrote. “We do not think this optimism is warranted, and we think a lot of the data is cooked or misleading,” Elliott, which manages $25.4 billion and was founded by Singer in 1977, wrote. “A good deal of the economic and jobs growth since the crisis has been fake growth, with very little chance of being self-reinforcing and sustainable.” Elliott said that the reported growth numbers are too high because the official inflation number is understating actual inflation by as much as 1% a year.

That’s because economists focus on measures such as core inflation or make “hedonic adjustments” for improvements in the quality of consumer goods. Inflation is also distorted “by the increasing gap between the spending basket of the well-off and that of the middle class,” the firm said. “The inflation that has infected asset prices is not to be ignored just because the middle-class spending bucket is not rising in price at the same rates as high-end real estate, stocks, bonds, art and other things that benefit from” quantitative easing, Elliott wrote. The unemployment rate, at 5.9% in September, doesn’t reflect that the workforce participation rate is at a 35-year low, according to Elliott, and that full-time jobs have been replaced by part-time jobs, and high-paying jobs by relatively low-paying jobs. Real wages, the firm said, have been stagnant since the financial crisis.

And it’s a very well executed set-up too.

• This Stock Market Rally Is For Suckers (MarketWatch)

After last week’s remarkable U.S. stock market rally, a lot of investors are cheering. After all, the Dow made an all-time high, won back the lost 1,000 points, and ignored the 8% pullback. I hate to be a party-pooper, but this is not a time to celebrate, but rather to be cautious. What could go wrong? Let’s begin by analyzing last week’s hollow Halloween rally:

1. On Friday, Oct. 31, five stocks were primarily responsible for Dow’s advance. The previous day, Visa had accounted for around 123 points of the 221-point rally. Take away Visa and the rally was a lot less impressive.

2. Friday’s surge was prompted by the Bank of Japan, which promised more stimuli (I’m guessing they are on QE 35, but who’s counting?) Since March 2000, the Nikkei 225 has tumbled from 20,000 to 16,000, so maybe more stimuli from the BOJ is needed (just kidding).

3. On Friday, there were no plus-1000 ticks on the NYSE Tick, which tells you that the rally was another head-fake without institutional involvement. Typically, you will see at least four or five plus-1000 ticks on bullish days.

4. In addition, volume was low, especially for the last day of the month.

5. Moreover, the S&P 500 that day did not rise above its overnight high, which is generally a sign of domestic weakness. During the day, it did not take out the previous all-time high. If this were a true bull market, breadth, volume, and institutional presence would have been a lot stronger.

6. Only five out of 20 stocks led the transports. If this were a broad-based rally, more of the transports would have participated.

You would expect falling oil prices to provide the Japanese, like Americans, with some very welcome, even necessary, financial breathing room. But PM Abe and BoJ’s Kuroda will have none of it. And no matter how you look at it, there’s something at best curious about a central bank that decides to throw ‘free money’ at an economy BECAUSE it sees falling resource prices, which would supposedly make money available already.

• BOJ’s Kuroda Vows To Hit Price Goal, Stands Ready To Do More (Reuters)

Bank of Japan Governor Haruhiko Kuroda, who last week stunned global financial markets by expanding a massive monetary stimulus program, said the central bank is ready to do more to hit its 2% price goal and recharge a tottering economy. Kuroda stressed the BOJ is determined to do whatever it takes to hit the inflation target in two years and vanquish nearly two decades of grinding deflation. “There’s no change to our policy of trying to achieve 2% inflation at the earliest date possible, with a roughly two-year time horizon in mind,” the central bank chief said in a speech at a seminar on Wednesday. “There are no limits to our policy tools, including purchases of Japanese government bonds,” he said in response to a question from a private analyst after the speech. The BOJ shocked global financial markets last week by expanding its massive stimulus spending in a stark admission that economic growth and inflation have not picked up as much as expected after a sales tax hike in April.

Kuroda said while inflation expectations have been rising as a trend, the BOJ decided to ease to pre-empt risks that slumping oil prices will slow consumer inflation and delay progress in shaking off the public’s deflationary mind-set. “In order to completely overcome the chronic disease of deflation, you need to take all your medicine. Half-baked medical treatment will only worsen the symptoms,” he said. Kuroda repeated the BOJ’s projection that Japan will likely hit the bank’s price target sometime in the next fiscal year beginning in April 2015, supported by the expanded quantitative and qualitative easing (QQE) program. While he stressed that Japan’s economy continued to recover moderately, Kuroda said falling commodity prices could be risks to the outlook if they reflected weakness in global growth.

See The Revenge Of A Government On Its People

• US Will Benefit Most From Japan’s Pension Fund Reform (CNBC)

U.S. assets will be the biggest benefactor of the Japanese Government Investment Pension Fund’s (GPIF) decision to more than double its target allocation of foreign stocks to 25%, analysts say. The changes to the $1.1 trillion pension fund coincided with the Bank of Japan’s shocking decision to ramp up stimulus on Friday, which sent global equity markets soaring. “The shift for international equities going to 25% of pension fund holdings is fairly big news,” said Tobias Levkovich, chief equities strategist at Citigroup in a note published on Friday. “It establishes a new incremental buyer of shares and the U.S. should be a significant beneficiary,” he said. The overall contribution to non-Japanese stocks could approach $60 billion of new purchases, half of which could go to the U.S. by the end of 2015, said Citigroup’s Levkovich, noting that stocks on Wall Street should start to feel the benefit this year.

“Foreign investors typically buy large cap stocks which have greater index impact,” he said. “Thus, one cannot ignore the possibility that stock prices jump above our year-end 2014 S&P 500 target on this news.” Other analysts agree. “It’s pretty realistic [that the U.S. will receive most of the benefit] if you look at where the Japanese feel comfortable investing their money,” Uwe Parpart, managing director and head of research at Reorient Financial Markets told CNBC. “This is a pension fund making the investment they are not going to punt into small caps or anything of that sort they need large, liquid stocks that over decades have had a reliable return,” he said. But Parpart is not convinced the inflows would make a huge difference to stock market performance. “$30 billion sounds like a lot of money, but stretched over a period of time it’s not going to move markets,” he said. “But obviously it’s a nice shot in the arm.”

Furthermore, an increase in the pension fund’s international bond allocation to 15% from 11% should boost demand for Treasurys, driving further inflows into the U.S., analysts at HSBC said in a note published Tuesday. Meanwhile, the GPIF will reduce is domestic bond allocation to 35% from 60%. “The BoJ’s increase in asset purchases should be more than enough to cover the aggressive reduction in Japanese Government Bond (JGB) holdings planned by the GPIF, allowing JGB yields to stay pinned down,” said Andre de Silva, head of global emerging market rates research at HSBC. “Ultra-low JGB yields imply that the relative valuations for other core rates ie. U.S. Treasuries and other bond substitutes have been further enhanced,” he said. “Demand for yield-grabbing would intensify amongst Japanese investors, boosting overseas investments.”

“… the Italian ECB chief has acted increasingly on his own or with just a handful of trusted aides, sidelining even key heads of department.” Hey, you wanted a Goldman guy, now sit on it!

• Draghi To Face Challenge On ECB Leadership Style (Reuters)

National central bankers in the euro area plan to challenge European Central Bank chief Mario Draghi on Wednesday over what they see as his secretive management style and erratic communication and will urge him to act more collegially, ECB sources said. The bankers are particularly angered that Draghi effectively set a target for increasing the ECB’s balance sheet immediately after the policy-making governing council explicitly agreed not to make any figure public, the sources said. “This created exactly the expectations we wanted to avoid,” an ECB insider said. “Now everything we do is measured against the aim of increasing the balance sheet by a trillion (euros)… He created a rod for our own backs.” Irritation among national governors who hold a majority on the 24-member council could limit Draghi’s space for bolder policy action in the coming months as the bank faces crucial choices about whether to buy sovereign bonds to combat falling inflation and economic stagnation.

Some members intend to raise their concerns with Draghi at the governors’ traditional informal working dinner on Wednesday before their formal monthly rate-setting meeting on Thursday, the sources interviewed by Reuters said. Many people at the central bank, which manages a single currency for 18 European Union member states, welcomed Draghi’s greater informality when he took over from Jean-Claude Trichet of France in 2011. His efforts to keep meetings short, delegate and brainstorm more, were received as a breath of fresh air. However, as decisions to loosen monetary policy and resort to further unconventional measures have become more contentious, insiders say the Italian ECB chief has acted increasingly on his own or with just a handful of trusted aides, sidelining even key heads of department. “Mario is more secretive… and less collegial. The national governors sometimes feel kept in the dark, out of the loop,” said one veteran ECB insider. “Jean-Claude used to consult and communicate more,” another ECB source said. “He worked a lot to build consensus.”

So what? Every forecast everywhere gets revised downwards all the time. It’s simply the way things work.

• EU Cuts Growth Outlook as Inflation Seen Below ECB Forecast (Bloomberg)

The European Commission cut its growth forecasts for the euro area as the bloc’s largest economies struggle to put the ravages of the debt crisis behind them after two recessions in six years. Gross domestic product in the 18-nation region will rise by 0.8% this year and 1.1% in 2015, down from projections for 1.2 and 1.7% in May, the Brussels-based commission said today. It lowered its projections for Germany, Europe’s largest economy, and said inflation in the euro area will be even weaker than the European Central Bank predicts. “The legacy of the global financial and economic crisis lingers on,” said Marco Buti, the head of the commission’s economics department. “Slack in the EU economy remains large and is weighing on inflation, which is also being dragged down by tumbling energy and food prices.”

The bleaker outlook highlights the fledgling nature of the euro area’s recovery and the deflation threat that has compelled the ECB to take unprecedented stimulus measures. While unemployment is beginning to decline from a record high, core economies such as Germany and France are facing some of the growth challenges that afflicted the periphery at the start of the debt crisis. Today’s report forecasts inflation at 0.8% in 2015, less than half the ECB goal of just under 2%. That’s more pessimistic than the central bank’s own projection of 1.1%. The commission sees inflation quickening to 1.5% in 2016, compared with the ECB outlook for 1.4%.

European stocks declined for a second day and German, French and Italian bonds rose. The yield on the German 10-year bund fell 4 basis points to 0.81% at 11:17 a.m. London time. The Italian yield dropped 5 basis points to 2.37%. The Stoxx Europe 600 Index slipped 0.1%. The grim assessment for the euro region comes just days before the ECB Governing Council led by President Mario Draghi gathers in Frankfurt for its monthly policy meeting. The ECB has cut its benchmark rate to a record-low 0.05% and began buying covered bonds to boost inflation and rekindle growth. “Country-specific factors are contributing to the weaknesses of economic activity in the EU and the euro area in particular,” Jyrki Katainen, commission vice president for competitiveness, told reporters in Brussels. These include “deep-seated structural problems” and “public and private debt overhang,” he said.

The never ending Bloomberg promo.

• Euro Area Limping Toward Deflation Fuels QE Calls as ECB Meets (Bloomberg)

The euro area is edging closer to the moment that deflation risks become reality. Companies cut selling prices by the most since 2010 as they attempted to boost sales in the face of a flagging economy and slowing new orders, Markit Economics said today. This in turn is squeezing profit margins and reducing resources for hiring and investing, damping chances of an economic rebound, the London-based company said. The European Central Bank is pumping money into the banking system to fuel inflation that hasn’t met policy makers’ goal since early last year.

With a gauge of manufacturing and services activity pointing to sluggish growth at best, it is under pressure to add to long-term loans and already announced asset-purchase plans to prevent a spiral of price declines in the 18-nation currency bloc. “This month’s data make for grim reading, painting a picture of an economy that is limping along and more likely to take a turn for the worse than spring back into life,” said Chris Williamson, Markit’s chief economist. “The combined threat of economic stagnation and growing deflationary risks will add to pressure on the ECB to do more to stimulate demand in the euro area, strengthening calls for full-scale quantitative easing.”[..] While Markit said the data are in line with gross domestic product expanding 0.2% in the fourth quarter, new orders slowed to the weakest level in 15 months and employment declined for the first time in almost a year. That “suggests that the pace of growth may deteriorate in coming months,” said Williamson.

Sometimes I wonder what the job requirements are for Bloomberg staff. Like now. Europe should do what Japan does? That highly successful role model?

• ECB Needs Japanese Lessons (Bloomberg)

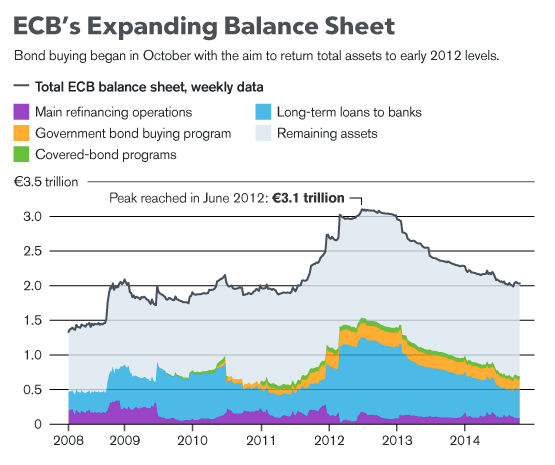

Economists like to warn about Japanification, the risk that a country will follow the desultory experience of Japan, which slumped into deflation in 1999 and for all intents never climbed out. As Europe slides closer to deflation, the European Central Bank should heed the historical experience and the current efforts by the Bank of Japan to resuscitate growth. The euro area is perilously close to deflation. The ECB target – consumer price inflation of just under 2% – grows more distant. The European Commission said yesterday it sees euro-area inflation running at just 0.8% in 2015, as it cut its prediction for the region’s growth this year to 0.8% from the 1.2% it anticipated in May. And yet, the ECB’s balance sheet has been shrinking as the BoJ’s has swollen.

The Bank of Japan announced last week that it’s boosting purchases of Japanese government bonds to a record annual amount of 80 trillion yen, or more than $700 billion. My colleague William Pesek points out that the Japanese central bank has now effectively cornered the domestic market in government debt, creating a bubble in the bond market. He’d prefer more economic reforms than increased quantitative easing. Europe would also benefit from more labor-market changes and fiscal stimulus. But neither the ECB nor the Bank of Japan has a mandate to overhaul fiscal policy or employment practices. In the absence of government action, central banks can only fill the void. The shock-and-awe that BoJ Governor Haruhiko Kuroda sprang on investors isn’t likely to be repeated at tomorrow’s ECB meeting, even though there is scant prospect that the central bank’s inflation target will be met anytime soon.

Two weeks into the covered-bond purchase program designed to flood cash into the economy, the ECB has purchased just 4.8 billion euros ($6 billion) so far. Draghi said earlier this week that the scope for buying asset-backed securities is “rather large,” yet I can’t find a single market participant who expects the plan to succeed in swelling the ECB balance sheet by enough to do the job – unless it repeats the government bond purchases it made between 2010 and 2012, and on a much grander scale:

Huh? “What the Saudis are doing is business as usual. They change the price formula each month. The problem is there’s an implication that it’s business as usual in terms of production. The problem is if they continue to produce what they’ve been producing in the last two months, the market is headed for trouble”

• Look Out Below! Oil Is Not Done Falling (CNBC)

Oil prices could have a hard time finding a floor after Saudi Arabia trimmed prices in the face of growing North American oil production. The market took the price cut this week as another sign the kingdom is willing to use pricing as a lever to preserve its market share, rather than cut production in what is now an oversupplied market. Even if it was not the intention, some traders took the Saudi move as a sign the kingdom would like falling prices to slow U.S. shale production. U.S. West Texas Intermediate fell sharply on Tuesday, dipping close to the psychologically key $75-a-barrel level, before closing at a three-year low of $77.19, off $1.59 per barrel. Brent fell along with it to $82.82 a barrel, the lowest settle since October 2010, after Saudi Arabia set a new price in the U.S. 45 cents lower than November’s level. “The managed money longs still outnumber shorts 3.5-to-1. If this isn’t a heavy exodus of the money manager longs, we could still have a significant drop, especially if all these factors that are driving us lower continue to weigh on the markets,” he said.

“The dollar strength and also fears of slowing economic conditions in Europe and China are still continuing to play a role.” There was initially a muted reaction to the Saudi announcement Tuesday as the market focused on dollar strength and other factors. “I don’t think the probability is we’re looking at a meltdown or collapse. If there was a global price war, it could go between $30 and $50 a barrel but more realistically, we’re within 10% of the bottom,” said Tom Kloza, senior oil analyst at Gasbuddy.com. “What the Saudis are doing is business as usual. They change the price formula each month. The problem is there’s an implication that it’s business as usual in terms of production. The problem is if they continue to produce what they’ve been producing in the last two months, the market is headed for trouble, and downward pressure will be more significant than upward pressure,” said Kloza.

Nobody loves you when you’re down and out.

• Oil Continues To Slide, With Brent At Lowest In Over Four Years (MarketWatch)

Crude-oil futures extended losses in Asian trade Wednesday, with the U.S. oil benchmark at its lowest in more than three years and Brent at its lowest in over four years. On the New York Mercantile Exchange, light, sweet crude futures for delivery in December traded at $76.81 a barrel, down $0.38 in the Globex electronic session. December Brent crude on London’s ICE Futures exchange fell $0.60 to $82.22 a barrel. Crude oil finished at a 3-year low on Tuesday. A steady stream of weak economic data from Europe is weighing on Brent crude oil prices, pushing it lower along with the drop in U.S. oil prices, analyst Tim Evans at Citi Futures said.

“The downward revision in the eurozone macroeconomic outlook and the further decline in prices were both more of a confirmation that a bearish trend remains than any stunning new development,” he said. Mr. Evans said a psychological limit of $80 a barrel may help limit the drop in Brent crude prices. Financial markets are looking to Thursday’s European Central Bank meeting for a boost. Meanwhile, oil markets are still pressured by a strong U.S. dollar, weak demand projections and oversupply concerns. “Yesterday’s support levels were shattered likely due to markets anticipating further cuts from other OPEC countries,” analyst Daniel Ang at Phillip Futures said. He pegged support for Brent crude at $82 a barrel and that for WTI at $75.84 a barrel.

“Domestic oil companies need to stop drilling for oil … ” Why not tell the Saudis that? How about we discuss: The Real Problem With T. Boone Pickens instead?

• T. Boone Pickens: The Real Problem With Oil (CNBC)

Many energy investors think there’s a powerful force working against them in the market. Investor T. Boone Pickens thinks they’re right, but the problem isn’t what they think. Pickens says that the big issue in the energy market isn’t OPEC or the strong dollar; he says it’s supply and he also says domestic drillers are to blame. “Domestic oil companies need to stop drilling for oil,” Pickens insisted on CNBC’s “Street Signs.” “We’ve overdrilled oil (in the U.S). Now we’ve gotten ourselves in a spot. We need to slow down.” In other words, the abundance of oil that’s now accessible in North America because of improved technology has generated a supply imbalance. However, Pickens does not expect that dynamic to last; ultimately he expects markets to balance out, with drillers reducing supply.

“Of course nobody wants to be the first to blink,” Pickens added. “But, when the domestic drillers start feeling real pain (from low prices), they will blink.” In fact, Pickens thinks the dynamics are shifting, already. Not only does he anticipate a reduction in domestic supply but he said markets are moving into a bullish time of year. “November and December are good months,” he said. Therefore, Pickens believes supply will decrease, at a time when demand increases. Given the potential catalysts, Pickens isn’t looking for oil to sit at historic lows for long. “I can see this lasting through year end. But in the first quarter of next year I think we hit the low and then I expect prices to recover.”

‘Shields’? Curious choice of words.

• Russia-Ukraine Crisis Shields EU Gas From Oil Price Rout (Bloomberg)

The risk of disruptions to Russian natural gas flows through Ukraine this winter is protecting European prices from the rout that sent oil to a four-year low. U.K. gas for next quarter fell 13% since mid-June, less than half the 29% plunge in Brent crude over that time. While Brent is typically the benchmark used to set the price on almost half the gas supply in Europe, the Russia-Ukraine conflict and demand fundamentals in the market are having a bigger impact on prices than the decline in oil. First-quarter supply interruptions are still possible as Ukraine may struggle to pay Russia the full $3.1 billion by year-end under an agreement brokered by the European Union last week for gas already consumed, according to Societe Generale SA.

Gazprom said it received the first tranche of payments today. The EU, which gets 15% of its fuel from Russia via Ukraine, sought to avoid repeats of 2006 and 2009, when supplies to the bloc were disrupted amid freezing weather. “Right now, gas prices in Europe are really linked to the Russian-Ukrainian crisis, so I don’t think the impact from oil is as big as it could be,” Edouard Neviaski, chief executive officer of GDF Suez Trading, a unit of France’s biggest utility, said in an interview in London. “Gas prices have gone down a little bit, but nothing of the same magnitude.”

Whenever the financial world gets ‘creative’, things blow up and we pay.

• New Junk-Bond Derivatives Are Hot as Traders Get Creative (Bloomberg)

When it gets tough to maneuver in the junk-bond market, traders can either give up or get creative. Many of them are opting for creativity these days. There’s been a surge in demand for a relatively new index of derivatives that aims to replicate the risk and return of high-yield bonds. As volatility soars to the most in more than a year, trading in a total-return swaps index reached a record $4 billion in September from almost nothing in May, according to data compiled by Morgan Stanley. The demand is in part coming from fund managers who are looking for ways to be agile as individual investors become more fickle, pulling money out and then putting it back in, said Sivan Mahadevan, a credit strategist at Morgan Stanley. For example, investors have yanked $24 billion from high-yield bond mutual funds this year, with sentiment turning particularly sour in the three months ended Sept. 30, data compiled by Wells Fargo show. Yet they poured $2.5 billion into the funds in the week ended Oct. 29.

Investors also face a harder environment to maneuver in. The volume of dollar-denominated junk bonds outstanding has swelled 81% since 2008, but the market’s structure hasn’t evolved much. It still consists of thousands of individual bonds governed by unique documents, traded much the way they were a decade ago. “Market fragmentation and liquidity constraints in a large part of the bond market make managing fund-flow volatility particularly challenging,” Mahadevan wrote in a report. The concern is that after six years of near-zero interest rates from the Federal Reserve and a largely one-way trade into bonds, a reversal of that demand will cause debt values to plunge as there won’t be many willing and available buyers on the other side. So it’s no wonder investors are turning to derivatives to quickly adjust their holdings in a market that policy makers have said looks like a bubble.

Sure, Lagarde, why not simply make your own auditing office look like a bunch of inept fools?

• IMF Gave Richer Countries Wrong Austerity Advice: Internal Auditor (Reuters)

The International Monetary Fund ignored its own research and pushed too early for richer countries to trim budgets after the global financial crisis, the IMF’s internal auditor said on Tuesday. The Washington-based multilateral lender, concerned about high debt levels and large fiscal deficits, urged countries like Germany, the United States and Japan to pursue austerity in 2010-11 before their economies had fully recovered from the crisis. At the same time, the IMF advocated loose monetary policies to sustain growth and boost demand in advanced economies, initially ignoring the possible spillover risks of such policies for emerging market countries, the Independent Evaluation Office, or IEO, said in a report that analyzed the IMF’s crisis response. “This policy mix was less than fully effective in promoting recovery and exacerbated adverse spillovers,” the IEO wrote. The IMF advises its 188 member countries on economic policy, and provides emergency financial assistance to its members on the condition they get their economies back on track.

The internal auditor said the IMF should have known that the combination of tight fiscal policy and expansionary monetary policy would be less effective in boosting growth after a crisis. Evidence showed that the private sector’s focus on reducing debt made it less susceptible to monetary stimulus. In 2012, the IMF finally admitted that it had underestimated how much budget cuts could hurt growth and recommended a slower pace for austerity policies. But its auditor said the IMF’s own research showed this relationship even before the crisis. IMF Managing Director Christine Lagarde said the IMF’s advice was reasonable, given the information and economic growth forecasts it had in 2010. “I strongly believe that advising economies with rapidly rising debt burdens to move toward measured consolidation was the right call to make,” Lagarde said in a statement.

So much for the Chinese having no housing debt.

• China Home Buyers Rushing Online to Finance Downpayments (Bloomberg)

Qian Kaishen and his wife almost gave up in August on buying a bigger home. As apartments at Shanghai Villa, a project they liked near the city’s Hongqiao Airport, started selling, the money they had saved for the deposit was tied up in a 5%-return investment. Then property agency E-House China Holdings Ltd. offered the couple a 280,000 yuan ($45,546) one-year bridge loan at zero interest. The loan came from online investors through E-House’s Internet finance website. It covered about half the down payment and was just enough to make up the shortfall. “Now we’re good both on our investment and home purchase plan,” Qian, 31, who works for a local logistics company, said by phone from Shanghai.

“We would’ve given up if it weren’t for the loan. I don’t like borrowing from my parents or relatives, especially because we have the money.” E-House is joining peer-to-peer lenders to finance down payments for buyers struggling to scrape together a deposit after home prices had tripled since 2000. Mortgage lending remains tight, even after the central bank eased its policy in September, as banks anticipate an extended property market decline because of a high supply of housing, according to Standard Chartered.Home prices in China are now equivalent to 40 years’ average income for a 100-square-meter (1,076-square-foot) apartment. That compares with 26 years’ median income in New York for an apartment of the same size. The average price of a typical 900-square-foot home in Singapore is 11 times the median household income, while that for a 50-square-meter flat in Hong Kong is 14 times, according to local official data.

In China, homebuyers need to pay a minimum down payment of 30% of the purchase price for a first home, and at least 60% for a second before they can take out a mortgage. The limits are the result of a four-year campaign to stem property speculation. Those restrictions have helped drive demand for the down payment loans. “The phenomenon emerged in the past year or two largely because of mortgage restrictions and high down-payment requirements,” said Zhang Haiqing, a Shanghai-based research director at Centaline Group, China’s biggest property agency. The central bank on Sept. 30 eased some mortgage rules to make it easier to purchase second properties in a bid to revive the market. “We can’t exclude the possibility that as the market recovers, more people will want to buy and some of them will still have to use this channel because they don’t have the money,” Zhang said.

Every nation’s best days are behind it. That is, if you focus on economic growth. As they all do.

• 25 Years Since The Wall Fell, Germany’s Best Days Are Behind It (MarketWatch)

On Sunday, Nov. 9, it will be a quarter of a century since the Berlin Wall came down. The reunification that followed was a triumph for the German nation. The scars of World War Two were finally healed, and Germany became one of the richest and most successful countries in the world. Certainly compared to much of its history, there was never a better time to be a German. And yet, as that anniversary is rightly celebrated, it is possible that the next quarter century will not be nearly as good. In fact, Germany faces a series of daunting problems. Its population is about to shrink sharply, threatening its prosperity. Its export-driven economic model look increasingly dated, based on huge trade surpluses, and driving down real wages. Education is poor, there is little investment, and no signs that it can compete in new technologies the way it did in industries such as automobile and chemicals.

Worse, it is threatened by a belligerent Russia on one side, and a resentful, impoverished, resentful eurozone periphery on the other, which is likely to increasingly blame Germany for its economic troubles. The European Union, the linchpin of its security and foreign policy, is under huge pressure as a result of the eurozone crisis, which the German elite has terribly mismanaged. The chances are that the next quarter of a century will not be nearly as good for Germany as the last 25 years were. When David Hasselhoff — of Knight Rider fame, and for some mysterious reason a huge star in Germany — performed at the Berlin Wall on New Year’s Eve in 1989, he was presiding over a moment when two halves of a divided nation came together. There were plenty of doubts at the time, both about whether West Germany could cope with a bankrupt East, and about whether the rest of Europe could cope with a reunited Germany.

Interesting views from ‘former’ Goldmanite O’Neill. Have Italy impose punitive taxes on the Germans.

• A Crazy Idea About Italy (Jim O’Neill)

I’ve spent a good deal of my 35 years as an economic and financial analyst puzzling over Italy. Studying its economy was my first assignment in this business – as a matter of fact, Italy was the first foreign country I ever flew to. I’m just back from a vacation in Puglia and Basilicata. Over the decades, the question has never really changed: How can such a wonderful country find it such a perpetual struggle to succeed? All the while, Italy has pitted weak government against a remarkably adaptable private sector and a particular prowess in small-scale manufacturing. An optimist by nature, I’ve generally believed these strengths would prevail and Italy would prosper regardless. In the days before Europe’s economic and monetary union, though, it had one kind of flexibility it now lacks: a currency, which it could occasionally devalue. These periodic injections of stronger competitiveness were a great help to Fiat and other big exporters, and to smaller companies too. The rest of Europe had mixed feelings about this readiness to restore competitiveness through devaluation – meaning at their expense.

When discussions began about locking Europe’s exchange rates and moving to a single currency, opinions divided among the other partners, notably Germany and France, on what would be in their own best interests. Many German conservatives, including some at the Bundesbank, doubted Italy’s commitment to low inflation, which they wanted to enshrine as Europe’s chief monetary goal. On the other hand, leaving Italy outside the euro would leave their own competitiveness vulnerable to occasional lira devaluations. In the end, of course, the decision was made to bring Italy in. The fiscal rules that were adopted at the same time – including the promise to keep the budget deficit below 3 percent of gross domestic product — can be seen as an effort to force Italy to behave itself. Now and then I wondered if some saw them as a way to make it impossible for Italy to join at all. In any event, Italy found itself doubly hemmed in, with no currency to adjust and severely limited fiscal room for maneuver.

The results haven’t been good. It’s ironic that between 2007 and 2014 Italy has done better than most in keeping its cyclically adjusted deficit under control – yet its debt-to-GDP ratio has risen sharply. The reason is persistent lack of growth in nominal GDP, itself partly due to an overvalued currency and tight budgetary restraint. Italy is the euro area’s third-largest economy and its third-most populous country. Given this, the scale of its debts and everything we’ve learned about Europe’s priorities during the creation of the euro and since, I’ve always presumed that, in the end, Germany would do whatever was necessary to protect Italy from the kind of financial blow-up that hit Greece in 2010. Now I am starting to wonder.

” .. the Potemkin stock market, a fragile, one-dimensional edifice concealing the post-industrial slum that the on-the-ground economy has become behind it.”

• Signs, Wonders and QE Heroics (James Howard Kunstler)

“Holy smokes,” Janet Yellen must have barked last week when Japan stepped up to plug the liquidity hole left by the US Federal Reserve’s final taper trot to the zero finish line of Quantitative Easing 3. The gallant samurai Haruhiko Kuroda of Japan’s central bank announced that his grateful nation had accepted the gift of inflation from the generous American people, which will allow the island nation to fall on its wakizashi and exit the dream-world of industrial modernity it has struggled through for a scant 200 years.

Money-printing turns out to be the grift that keeps on giving. The US stock markets retraced all their October jitter lines, and bonds plumped up nicely in anticipation of hot so-called “money” wending its digital way from other lands to American banks. Euroland, too, accepted some gift inflation as its currency weakened. The world seems to have forgotten for a long moment that all this was rather the opposite of what America’s central bank has been purported to seek lo these several years of QE heroics — namely, a little domestic inflation of its own to simulate if not stimulate the holy grail of economic growth. Of course all that has gotten is the Potemkin stock market, a fragile, one-dimensional edifice concealing the post-industrial slum that the on-the-ground economy has become behind it.

Then, as if cued by some Satanic invocation, who marched onstage but the old Maestro himself, Alan Greenspan, Fed chief from 1987 to 2007, who had seen many a sign and wonder himself during that hectic tenure, and he just flat-out called QE a flop. He stuck a cherry on top by adding that the current Fed couldn’t possibly end its ZIRP policy, either. All of which rather left America’s central bank in a black box wrapped in an enigma, shrouded by a conundrum, off-gassing hydrogen sulfide like a roadkill ‘possum. Incidentally, Greenspan told everybody to go out and buy gold — which naturally sent the price of gold spiraling down through its previous bottom into the uncharted territory of worthlessness. Gold is now the most unloved substance in the history of trade, made even uglier by the overtures of Mr. Greenspan.

Home › Forums › Debt Rattle November 5 2014