Thomas Cole The Course of Empire – The Arcadian or Pastoral State 1834

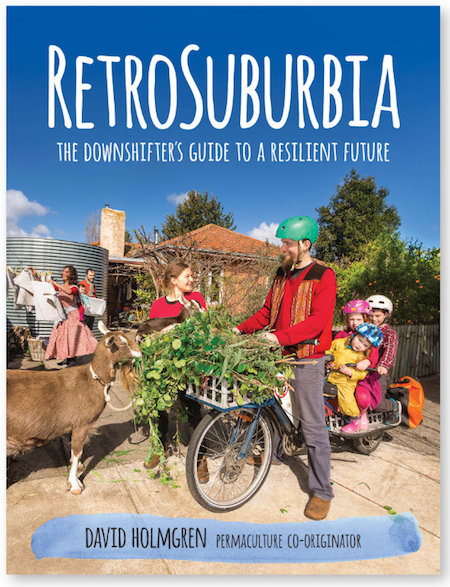

This essay is from longtime and very dear friend David Holmgren, guru/founder/apostle of permaculture, who says:

“Your constant work has help kept me informed through the roller coaster.

love

david”

David Holmgren:

As the pandemic rolled into its second year, I became concerned that the psychosocial fallout of the pandemic, and especially the response at the global and local levels, could represent an existential threat to permaculture and kindred movements. At one level, this threat is the same as that to families, workplaces, networks and organisations more generally, where a sense of urgency to implement the official response, especially lockdowns and mass vaccination, is producing a huge gulf between an ever more certain majority and a smaller minority questioning or challenging the official response.

My aim in this essay is to focus on the critical importance of using all our physical, emotional and intellectual resources towards maintaining connections across what could be a widening gulf of frustration and distrust within our movement, reflecting society at large. I want to explore how permaculture ethics and design principles can help us empathetically bridge that gulf without needing to censor our truth or simply avoid the issues.

While the pandemic and the responses to it will pass in time, I believe the future will be characterised by similar issues that test our ability to tolerate uncertainty and diversity and to thus exercise solidarity within kin, collegiate and network communities of practise.

Future Scenarios and the Brown Tech future

The positive grounded thinking that characterises permaculture has always been informed by a dark view of the state of the world and long-term emerging threats. Future Scenarios is my 2008 exploration of four near-future ‘energy descent’ scenarios driven by the variable rates of oil and resource depletion on the one hand and rate of onset of serious climate change on the other. Six years later, I wrote the essay ‘Crash on Demand: Welcome to the Brown Tech Future’ where I ‘called’ Brown Tech as being the already emergent scenario.

In the longer version of this ‘Pandemic brooding’ essay, I review and reinterpret this work in light of the pandemic and responses to it.

Permaculture pluralism

Anyone involved in permaculture knows that permies can come to quite different conclusions about what is the most ethical and practical solution to the same problem. For example faced with marauding wildlife, some will go to considerable expense (and resource consumption) building elaborate fences, anti-aviaries and other deterrents to separate wildlife from food. Others will treat the wildlife as another abundance of the system to be harvested. Various permaculture principles, as well as the fundamental ethic of Care of Earth, might be invoked to support both approaches.

Likewise, many permies believe taxation is essential to redistribute resources from places of abundance to those of scarcity and as an expression of solidarity essential to any functioning, let alone ethical, society. Others see almost all the expenditure by governments of tax revenues as representing rape of Mother Earth’s abundance and theft from Indigenous peoples, and further as either downright evil or at best a bandaid covering festering wounds. An ethical response is to minimise taxpaying (by reducing income and consumption). Again, design principles and ethics can be invoked to support either position.

From my perspective, grappling with the ethical and systemic issue is more important than the notion that there might be a correct answer, and therefore a wrong answer, to the challenge. In the past, there have been heated debates, and agreements to disagree, but rarely would participants in permaculture design courses, convergences or networks see the answers of others as reasons to reject permaculture. Many celebrate personal actions as small-scale experiments with their good, bad and interesting outcomes informing other experiments, especially the next generation’s, as we muddle through energy descent to hopefully more benign, or at least less-bad, futures.

Pandemic flavoured Brown Tech

I believe the pandemic and the responses to it represent a major turning point in crystalising the Brown Tech future. It ticks so many boxes:

- a nature-driven crisis which has been long predicted, and to some extent, planned for

- rolling uncertainty that progressively breaks down past expectations

- a crisis which, like a war, requires the suspension of normal economic activity, personal rights and governance processes

- a demand for strong action by government for the common good informed by science

- a revival of Keynesian policies including a massive increase in government debt

- an enemy (the virus) that can be easily demonised without there being too many defenders to ignore or silence

- strong censorship of broadcast media and novel efforts to censor social media to sideline debate that could undermine the rapidly emergent and evolving program.

If the crisis is not solved, then demonisation progressively shifts to those resisting the plan.

This situation is creating the fork in the road where some permies will find themselves (perhaps surprisingly) following the program, while others will have become certain that they will at least quietly resist complying to some degree or other, right up to a radicalised public resistance, whether that be through resigning from work, street protest or satirical art.

We can learn and gain, individually and collectively, from these increasingly divergent paths – but the learnings could be painful. Let’s consider the benefits that might have led permies down one or another path, perhaps unwittingly, to increasingly polarised positions.

The mainstream plan

Although there are differences of emphasis and policies around the government responses to the pandemic, these debates are around the margins, even if they are at times heated. Most fundamentally, the mainstream plan, informed by the scientific and medical establishment, takes the following as self-evident:

- The virus is an existential threat to society that must be contained and disarmed if not eliminated before an establishment of some hoped-for, tolerable new normal.

- Social distancing, disinfectant cleaning, testing, contract tracing, masks and various levels of quarantine, border controls and lockdowns are the only mechanisms available to prevent collapse of the health system and deaths escalating to horrific levels in the short term.

- Novel vaccine technology is the only real hope for a tolerable new normal.

- To achieve effective herd immunity and minimise death, some great majority of the adult population and probably children need to get vaccinated as soon as possible.

- The adverse effects of these provisionally approved vaccines are minor and/or rare and much less than the risk of the disease.

- Preventative and early treatments are at best of marginal value, or more likely based on false hope and fraud.

- The suspension of normal civil liberties is a necessary, albeit temporary, measure to achieve the plan in a timely fashion and reduce the suffering both from the virus and the plan itself.

- People who actively resist the plan need stronger social, economic and, where necessary, legal sanctions to ensure their actions don’t prevent the plan from working for the common good.

- Apart from debate around the margins about how best to respond to these givens, debate and questioning at the level of science, logistics, economics, law, politics, media and social media is not just unnecessary, but an existential threat to the plan and society at large, so must be prevented by unprecedented means.

- It is the responsibility of every citizen to play a part in the plan, be bold in convincing those who are hesitant, and challenging those not following the plan, especially those actively resisting it.

Permies following the plan are likely to see themselves as being part of a society-wide collective effort to minimise pain and suffering in the aged, the disadvantaged and those in poor health; a choice in favour of collective and longer-term gain at the cost of individual and short-term sacrifice. For many of us, this is a perfect metaphor for what is needed to address the climate emergency. By accepting what appears to be a broad consensus of global, national and local medical and scientific experts, we avoid the protracted debate and lack of a technical consensus that has stymied governments in initiating strong action to address the climate emergency.

For permies in despair about the waste and dysfunction of the consumer economy, the closure, albeit temporary, of many discretionary services and businesses is a taste for how we might need to decide what is important; maximum consumer choice for the affluent versus the provision of basic needs for all. The personal sacrifice and adaptation to difficulties, including stay-at-home lockdown, have been opportunities to focus more on the important things in life and get a taste of what social solidarity feels like.

Reports of contrarian views seem to mostly come from sources contaminated by association with climate denial and other views we categorically reject. The resisters’ outrage looks to many like just more selfish, science denying and ignorant right-wing rednecks, trying to prevent collective wisdom and social solidarity from working. Familiar powerful bad players in global corporations or nation states have been replaced by much more immediate angry undesirables, who without much power or vision, could wreck the hard work of the collective to create a workable new normal.

The dissident view

It is more difficult to generalise about those who question or reject the program. A great diversity of views, explanations, feelings and actions flourish in an environment of unprecedented censorship. While there is great sensitivity about the term ‘censorship’, let alone ‘propaganda’ by those supporting the plan, for those on the other side, it is astonishing how rapidly the axe has fallen on enquiry, and debate, in the mainstream media, social media, workplaces and families, let alone in defence of what – until very recently – most of us took as our inalienable rights.

For many permies, the pandemic seems another example of hyped threat like the ‘war on weeds’, ‘war on drugs’, ‘war on terror’ used to manipulate the population to comply with some version of disaster capitalist1Disaster capitalism feeds off natural (climate change) and other disasters to provide recovery and reconstruction services funded by the public that typically benefit the corporate providers and contribute to ongoing dependencies. The term was used by Naomi Klein to describe the evolution of late stage capitalism over recent decades. solutions. Most sceptics acknowledge the virus as real, but not as dangerous as the cure in lockdowns and other draconian measures. The ‘war on the virus’ seems just as futile or misguided as all the other wars on nature, substances and concepts. So much for trying to have nuanced discussions about viruses as an essential and largely symbiotic mechanism for the exchange of genetic material and mediation of evolution!

While the closure and loss of cafés, gyms and hairdressers might not be a great loss, except to those directly affected, many of us have noticed that the official response to the pandemic tends to follow a pattern of support and strengthening of dominant corporations while leading to the weakening and likely collapse of small business and community self-organised activities.

During the first lockdown, ‘stay at home in your household’ was celebrated as a great plus for people getting the RetroSuburbia message. More recently, the messaging about the problem of shared and multi-generation households being suspect has been building, especially in the working-class western suburbs of Sydney and Melbourne where many of essential and less well paid workers live. We have shifted from a joke about ‘which permie created the pandemic?’ to a gritted teeth recognition that the response to the pandemic is working to vacuum people into another level of dependence on techno-industrial systems.

Many permies have taken advantage of the shift online to network more effectively around the country and the world, but we are deeply troubled by our increasing dependence on mediated experiences and what seems like draconian regulation of informal engagement with people and nature. The concerns for what this is doing to children are far more serious than the loss of the regulated version of social interaction that children get at school.

For many of us, it is completely natural to be sceptical about one big fast answer provided by the giants of the pharma industry, while they have been granted legal immunity for the consequences of their novel products.. Many have made the rational assessment that the very low risks of the virus (for most of us at least) seem better than the unknown of a novel technology approved and pushed on a frustrated and frightened population in record time. Some in this camp were sceptical about vaccines in general but most have been influenced by the largely censored views from some leading global experts, that these vaccines are in a totally different risk category to all previous vaccines.

While waiting and seeing what happens next may look selfish to the majority, the difficulty in getting access to data and unbiased interpretation drives many to rely on their gut feelings. One or more examples of spin and manipulation of data by officials, and especially the media, leads to a general collapse in trust about any, and even all, aspects of the official story. For instance:

- Many of us have seen evidence that existing low cost and low risk treatments are available and used effectively in some countries resisting the ‘no available treatment’ orthodoxy.

- Most understand that while the vaccines seemed to give some protection from more severe effects at least in the early stages, they do not appear to stop transmission, at least of the latest variant.

- Many wonder why the build-up of natural immunity from prior exposure to the virus is not considered as part of the solution that should at least be discussed before vaccine passports are implemented.

Concerns about more serious adverse effects of the vaccines, as predicted by some experts, have developed into alarm, anger and resistance as both the evidence increases and efforts at cover up and spin become worse. Extreme consequences that many of us dismissed early on as highly unlikely are now showing up in hard-to-read scientific papers, clinical reports and official records and databases.

A similar process has happened with the official responses. For example vaccine passports are now widely discussed and debated as part of the attempt to get as many people vaccinated as possible, as the efficacy of vaccines falls and concerns about adverse effects lock in resistance by a minority. At the start of the pandemic this possibility was decried as paranoid conspiracy theory.

France has been leading the charge to impose vaccine passports for many public and work spaces including hospitals. It’s hard to assess how large the resistance will be in different countries and circumstances but there are already signs that whole industries will lose a significant part of their workforce as some substantial minority of the population withdraw their work, consumption and investment in the system rather than getting the vaccine. Whether by design, policy stupidity or the unexplained viral power of censored scientists and vaccine doubters to overcome the largest public health education/public relations/propaganda effort in history, it is conceivable that the result could be economic contraction on a much larger scale than has occurred as a result of lockdowns so far.2 I can’t help but see what is unfolding as a bizarre version of my ‘Crash on Demand’ scenario

Economic contraction could mostly be in the discretionary economy, but how would the health system cope with a loss of staff, especially if some combination of ineffective vaccines against new strains and antibody-enhanced disease lead to medically informed people losing faith before the general public? Part of the solution might be doctors and nurses from overseas,3In the week since I wrote this sentence, doctors from overseas are now part of the plan for Australia or the adoption of treatment options for Covid currently being used with success in countries like Mexico and India.

Australia and New Zealand seem to be something of a test bed for the most authoritarian regulations in an attempt to keep Covid as close to zero as possible (and failing). Large numbers of people in other countries see us as a police state and wonder why there hasn’t been more resistance Down Under.

Some of us have noted plans promoted by the World Economic Forum for a Global Reset that will require a command economy to respond to the climate emergency, and that the pandemic is an opportunity to implement some of the structures and processes needed to create what some fear is a global new world order.

For many people, the trajectory from trust to mistrust often leads to either deep depression or an energised anger, mostly focused on the authorities but often expressed to friends and family at great cost to all concerned.

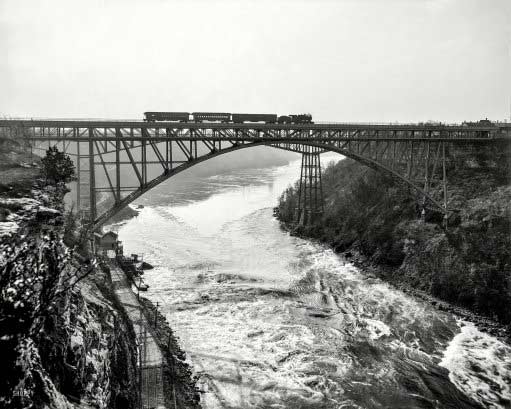

Although I have some of those thoughts and feelings, I mostly feel a great tension between a deep and somewhat detached fascination with the big picture and the sense of urgency I habitually feel in spring to get fully cranking with the seasonal garden and generally keeping our home at Melliodora shipshape. I feel like I finally have a box seat to watch the train of techno-industrial civilization hitting the Limits to Growth stone wall and breaking apart, all in slow motion.

The rapidly evolving situation and all its psychological, sociological and economic dimensions suggest an expanding field of possibilities. These could include:

- a cyber pandemic that crashes the global financial system,

- a short war between China and the USA4Part of my ‘A History from the Future’ story happening in 2022

- rapid reduction in consumption of oil and other critical resources and consequently greenhouse gas emissions as a result of the virus,

- plus of course accelerating climate disasters.

In different scenarios, concern about the virus and the ability to implement the plan could become ever more intense, or alternatively, be shunted offstage or metasatised into dealing with the next crisis. Consequently, the details of what worked, what didn’t, who takes the credit and who gets the blame, would probably all be lost in the swirling muddy waters of compounding crises.

A personal view of the pandemic

Up until this point, I have not indicated my personal interpretation of either the virus or the response because I wanted to focus on the bigger systemic drivers without getting muddied in the good/bad, right/wrong, us/them polarities. However we all have to face what life throws in our path with whatever internal and collective resources we have at hand. As is my lifelong habit, I have done my own ‘due diligence’ to understand and guide my personal decisions. In the past I have always been open about my conclusions and decisions, whether around the campfire or on the most public of forums. I have often joked about the comfort I feel in being a dissident about most things including being beaten up at primary school in the early days of the Vietnam war for being a ‘commie traitor’ to being ostracised in the 1990s for opposing the ‘war on weeds’ orthodoxy of the environmental mainstream. But today being a dissident is no joking matter. Unfortunately the psychosocial environment has now become so toxic that the pressures to self-censor have become much more complex and powerful. Much more is at stake than personal emotions, ego, reputation or opportunities and penalties.

Following my instinct for transparency, I will state my position, which has been evolving since I first started to consider whether the novel virus in Wuhan might lead to a repeat of the 1919 flu pandemic or even something on the scale of the Black Death. I can summarise my current position and beliefs as follows:

- The virus is real, novel and kills mostly aged, ill and obese people with symptoms both similar to and different from related corona viruses.

- It most likely is a result of ‘Gain of Function’ research at Wuhan Institute of Virology in China supported by funding from the US government.

- Escape rather than release was the more likely start of the pandemic.

- Vaccines in use in western world countries are based on novel technology developed over many years, but without resulting in effective or safe vaccines previously.

- The fear about the virus generated by the official response and media propaganda is out of proportion to the impact of the disease.

- Effective treatment protocols for Covid-19 exist and if those are implemented early in the disease, then hospitalisation and deaths can be greatly reduced, as achieved in some countries that faced severe impacts (especially Mexico and India).

- The socioeconomic and psychosocial impacts of the response will cause more deaths than the virus has so far, especially in poor countries.

- The efficacy of vaccines is falling while reported adverse effects are now much greater proportionally than for previous vaccines.

- The under-reporting of adverse events is also much higher than for previous vaccines, although this is still an open question.

- The possibility of antibody dependent enhancement (ADE) leading to higher morbidity and death in the future is a serious concern and could be unfolding already in countries such as Israel where early and high rates of vaccination have occurred.

Given the toxic nature of views already expressed about (and by) people I know and respect, I am not going to engage in an extensive collating of evidence, referencing who I think are reliable experts and intermediaries who can interpret the virus, the vaccine or any of the related parts of the puzzle. Outsourcing personal responsibility for due diligence to authorities is a risky strategy at the best of times; in times of challenge and rapid change the risks escalate. I do not want to convince anyone to not have the vaccine, but I do want to provide solidarity with those struggling (often alone and isolated) to find answers, so the following are two starting points that I think could be helpful:

- For those trying to understand the vaccines, their efficacy and risks, ‘This interview could save your life: a conversation with Dr Peter McCullough’ provides a good overview with full reference to official data, scientific papers and clinical experience.

- For those focused on treatment options, the Front Line COVID-19 Critical Care Alliance (FLCCA) physicians are a good source on this rapidly emerging field of clinical practise.

As a healthy 66-year-old I am not personally afraid of the virus, but if greater virulence and death rate do emerge with new variants, I might consider the preventative regimen recommended by the FLCCA doctors. There is no way I will be getting any of the current vaccines in the foreseeable future, no matter what the sanctions and demonisation of my position on this matter.

At this point there may be readers who decide to ignore anything and everything I have written as obviously deluded. These are the costs of transparency.

Valuing the Marginal

Tolerance, let alone celebration of diversity, is not the easy permaculture principle many of us assume. Valuing the marginal can be even harder, especially if we study the darker periods of human history.

Over most of history, minority ethnicities and subcultures lived in ambiguous complementarity with dominant majorities. For hundreds, if not a thousand, years my Jewish ancestors made valuable contributions to European culture while managing to maintain their own culture to an extraordinary extent. They lived in ghettos not just for protection from the eruptions of intolerance in the dominant Christian communities but to ensure their language and culture wasn’t swamped by that of the majority. While the Jews carried the elitist belief that they were God’s Chosen People, they didn’t attempt to gain converts and were naturally respectful to the majority Christians. They survived through all but the worst of antisemitic pogroms by not antagonising the majority, largely accepting the restrictions placed on them by society. What else could they do?

Similar dynamics could emerge from the virus and the vaccine, where a subculture of home birth, home education, home food production and alternative health brings together people of previously diverse subcultures, including permies, who are excluded from society. That exclusion will seem self-inflicted to the majority, but for those excluded it will feel critical to both survival and identity.

Is it sensible to plead for tolerance in line with sensitivities to the rights of other minorities? Or is that just an invitation to be stoned to death, if not literally then virtually, on social media?

Unfortunately one of the weaknesses of western culture, which shows up in both Christian and Muslim traditions, is the idea that if a particular path is the correct one, then everyone should follow it. From the perspective of east Asian philosophy and many Indigenous traditions, harmonious balance is more important than the right way. The yin yang symbol showing each polarity containing the seed of its opposite encapsulates this critically important antidote to the recurring western theme about the triumph of good over evil. In The Patterning Instinct Jeremy Lent explores how these different world views have shaped history and that any emergent ecological world view will foreground the importance of harmonious balance.

The wisdom of the collective

I want to lead by example in trying to understand and articulate why it is good that the majority of the population appears to be strongly behind the official plan and that maybe it is even good that a majority of my permaculture colleagues might be lining up to get vaccinated, when I have no intention of doing so.

Firstly, I acknowledge the obvious reason that if the official story is right, the majority getting vaccinated will combine with naturally acquired immunity and control the worst effects of the virus without the need to get every last dissenter vaccinated.

Secondly, given the pressure to push the vaccination rate in every way possible, encouraging some extra hesitators to resist will only increase the pressure and possibly lead to harsher sanctions as well as more broken family relationships, reputations, pain and suffering, which could be worse than potential adverse effects of the virus, or the vaccine, on those people.

Thirdly, because so many people I respect as intelligent and ethical are following the plan, I won’t fall into the trap of losing respect for who they are, what they have done and what else they might do in the future. And if it turns out this is the start of a more permanent hard fascist command state, then we need people of good values on the inside to keep open whatever channels of communication remain possible.

As systems unravel, the stories that make sense of the world also fall apart and in the desperate search for mental lifeboats, different stories come to the fore. The mainstream story around the pandemic is one such mental lifeboat that allows people to maintain faith and function. Without the renewed source of faith and order from rational science guiding technological wizardry, the psychosocial shock from a pandemic could be enough to create social, economic and political chaos on a historically unprecedented scale, at least in long-affluent countries like Australia.

Whatever the nature of the next crisis, I think it will require citizens to by and large accept that the behaviours, rights and freedoms we took for granted are artifacts of a vanishing world. Further, it will provide a harsh reality check on how dependent most of us are on systems we have no control over, so most will find they have little choice but to accept the new state of affairs.

While I might resent what I see as unnecessary sanctions on those resisting, I accept than in the early stage of Brown Tech energy descent, harsh and by some perspectives, arbitrary, controls on behaviour will be part of our reality and are arguably necessary to maintain some sort of social order (even if short-sighted or not sustainable in the long run). My aim is to focus on how we ameliorate the adverse effects of a predicament that humanity cannot escape.

More philosophically, the virus and the response to it could be seen as a meditation practise showing us how no one is an island separated from the whole of life. To break down the toxic notion that we are free agents to do as we choose without consideration of consequences, especially for future generations and the wider community of life, is something permaculture teaching has tried to bring to daily life. How we do this in meaningful ways is a constant challenge.

Sympathy for the devil

Having at least had a go at seeing the good in the mainstream plan, I now want to articulate quite passionately why the majority should at least tolerate and not seek to further punish the minority for their resistance. To advocate for this within the permaculture movement, I appeal to our pluralism in celebrating the diversity of action. This is especially where permies take the risk of being the unvaccinated guinea pigs, who can at least be a control group in this grand experiment on the human family. Beyond that, I hope our colleagues inside the tent will see the need to express solidarity with our right to chart our own course and not feel they have to be silent for fear of being cast out of the tent.

While I respect the younger permaculture folk following the plan for the common good, I still believe the most creative deep adaptations to the Brown Tech world will be crafted at the geographic and conceptual fringes by younger risk takers coming together in new communities of hope. While the paths to the armoured centre and the feral fringes both have their risks, those on the inside, especially older people, should accept that the young risk takers on the fringes might create pathways though the evolutionary bottleneck of energy descent more effectively than the best resourced and rationally devised plans from within the system of thinking that has created the civilisation crises.

Whether or not the pandemic will lead to the flowering of creative light-footed models for adaptation, the larger energy descent crisis for which permaculture was originally designed (that most permies recognise as the ‘Climate Emergency’) needs these responses at the margins. If the permaculture movement cannot digest this basic truth and at least defend the right of people to craft their own pathways in response to collapse of all certainties, then our movement will have failed the first great test of its relevance in a world of energy descent.

Some permie dissidents will double down in their focus on preparation to survive and thrive in spite of the sanctions, while others will be energised by non-violent direct action to resist what they see as draconian and counterproductive collective punishment. In doing so they may draw on past experience, or inspiration, from the frontlines of anti-war, environmental defence and free communication resistance.

In the past, more apolitical permies trying to introduce permaculture to socially conservative punters could still acknowledge, at least privately, the element of truth in the quip ‘permaculture is revolution disguised as gardening’. In today’s climate, can permies inside the tent accept and appreciate their colleagues on the frontlines of a new resistance movement that might moderate the extremes of how society navigates the larger climate emergency? Or will they flip and decide permaculture was, after all, mostly hippy nonsense now further contaminated with toxic right wing conspiracy madness, so must be dumped as unfit for purpose in our new world?

In saying this, I’m not suggesting we should all follow suit, let alone belittle or demonise those who don’t take the walk on the wild side. That would also be a contradiction of permaculture ethics and design principles. As we have always taught, ethics and design principles are universal but rarely lead to clear and conclusive solutions. Strategies and techniques vary with the context; wonderful elegant design solutions for one context can be hopeless white elephants, or worse, in another. Context is everything and as colleague Dan Palmer has so effectively applied in his Living Design Process, the people context is as complex, subtle and diverse as that of the land and nature.

The sovereignty of persons to choose freely how they grapple with the tension between autonomy and the needs of the commonwealth is not just an ideal from western Enlightenment civilisation working out how to apply the gift of fossil fuel wealth. It is a fundamental expression of how the ecology of context is constantly shifting, and that all systems simultaneously express life through bottom-up autonomy of action and top-down guidance of collective wisdom.

In times of great stability, the distilled wisdom of the collective, embodied in institutions, carries human culture for the long run. Sometimes the sanctions on the individuals who rejected the rules of the collective were harsh and, according to modern thinking, arbitrary but over long periods of relative stability, those rules kept society working. In times of challenge and change it is, ironically, dissidents at the fringes who salvage and conserve some of the truths of the dying culture into the unknown future to craft new patterns of recombinant culture.

What we call ‘science’ had its origins in what Pythagoras salvaged, almost single handedly, from the decadent and corrupt theocracies of ancient Egypt of which he was an initiate, before he walked away from the centre to the margins of civilisation. Major failures in the application of so-called trusted science have been a feature of our lived experience. Tragically, science could be one of the casualties as humanity passes through the cultural evolution bottleneck of climate chaos and energy descent. Permaculture was one attempt to craft a holistic applied design science grounded in observation and interaction, taking personal responsibility and accepting (negative) feedback, designing from patterns to details, and creatively using and responding to change. I still believe that salvaged and retrofitted versions of practical science crafted at the margins will serve humanity better than rigid faith in the priests of arcane specialised knowledge maintained by an empire of extraction and exploitation. Can we be sure what the father of science and mathematics would do in this time of turmoil?

Whatever the historical significance of these times, maintaining connections across differences of understanding and action within permaculture and kindred networks will strengthen us all in dealing with the unfolding challenges and opportunities of the energy descent future.

David Holmgren

Melliodora

September 2021

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.

David’s updated presentation uses permaculture design principles to interpret the signs and show how getting out of debt, downsizing and rebooting our dormant household and community non-monetary economies are the best hedges that ordinary citizens can make. The idea that these household and community economies could achieve unprecedented growth rates if the monetary economy takes a serious dive is a good news story you won’t hear from mainstream media.

David’s updated presentation uses permaculture design principles to interpret the signs and show how getting out of debt, downsizing and rebooting our dormant household and community non-monetary economies are the best hedges that ordinary citizens can make. The idea that these household and community economies could achieve unprecedented growth rates if the monetary economy takes a serious dive is a good news story you won’t hear from mainstream media.  On this tour Holmgren is joined by Nicole Foss, leading system analyst, who explains how the deflationary dynamics that always follow finance and property bubbles, will rapidly impact individuals, families and communities, while the longer acting forces of Peak Oil and Climate Change will determine and limit the nature of any economic recovery. Nicole will paint a comprehensive picture of where we stand today globally, how our human operating system functions, how and why it is acutely vulnerable, and what we must do about the predicament in which we find ourselves.

On this tour Holmgren is joined by Nicole Foss, leading system analyst, who explains how the deflationary dynamics that always follow finance and property bubbles, will rapidly impact individuals, families and communities, while the longer acting forces of Peak Oil and Climate Change will determine and limit the nature of any economic recovery. Nicole will paint a comprehensive picture of where we stand today globally, how our human operating system functions, how and why it is acutely vulnerable, and what we must do about the predicament in which we find ourselves.