DPC Wanted: 500 men to eat frankfurters, Bowery, Rockaway, NY 1905

Haven’t seen anything by Crudele in a long time. My bad. Then again, he hides out at the NY Post of all places.

• US Economic Growth Is All An Illusion (John Crudele)

As voters were coming out of the polls on Tuesday, pesky reporters were asking why they voted the way they did — and what was going through their heads The most popular response — from 45% of the voters — was the economy. Only 28% said their families were doing better financially. The economy is always the major issue in an election during times like these. So no one should have been shocked that voters took their anger out on the party that controls the White House, even though Republicans are just as much to blame for our economy’s failures. John Harwood, a political reporter for CNBC, asked a very good question before the votes were counted: Why? As in, “Why did people appear so angry and unhappy when the stock market was at record levels, the unemployment rate is down sharply, inflation is subdued and the number of jobs is increasing?”

Harwood’s explanation was that the benefits of this economic growth weren’t being evenly distributed and were being felt only by the blessed in the American economy — the upper 1%, if you will. Harwood is only a little right. Yes, the economy is blessing the few and leaving the rest of us in limbo. What Harwood and the rest of the folks who rely solely on Washington’s mainstream thinkers and Wall Street boosters for their information don’t realize is this: The economy isn’t really doing what the statistics say it is doing. Our nation’s economic statistics are nipped and tucked, massaged, managed, fabricated and dolled up. In short, our statistics are wrong and Main Street folks know it. Here’s what a Wall Street hedge fund mogul, Paul Singer, head of Elliott Management Corp., told his clients the other day: “Nobody can predict how long governments can get away with fake growth, fake money, fake jobs, fake financial stability, fake inflation numbers and fake income growth,” Singer wrote.

“When confidence is lost, that loss can be severe, sudden and simultaneous across a number of markets and sectors.” I’m glad someone is reading my column. But it’s not like Singer — whom I don’t know — was willing to say that out loud so that everyone could understand. He wrote that in his newsletter to his clients. So, shhhhh! It’s a secret. Don’t tell Americans that the economy isn’t doing so well. (Oh, that’s right, they’ve already caught on.) I won’t get into the year-long investigation I have been conducting into the Census Bureau’s faulty economic data. Now that the Republicans control both houses of Congress, I’m sure what is going on at Census will be looked at very carefully. But fabrication of data isn’t the only problem. Put enough academics and statisticians in a room and they can turn any statistic into something it isn’t.

Word: “What would happen if the Fed decided to “experiment” by removing this massive dead-pool of money from the banks? The money isn’t really “dead,” it’s keeping the banks from collapsing.”

• The System Is Terminally Broken (Investment Research Dynamics)

The Fed has formally “ended” QE, but it hasn’t really. The Fed will continue reinvesting interest on its portfolio in more bonds and it will rollover maturities. We saw what happens to the stock market a few weeks ago when Fed official James Bullard asserted that the Fed needs to start raising rates: the S&P 500 quickly dropped 8%. Right at the bottom of the drop, the very same Bullard issued a statement suggesting that QE should be extended. This triggered an insanely abrupt “V” move back up to a new record high for the S&P 500. Bullard either did this intentionally or is a complete idiot. The stock market can’t function without Federal Reserve intervention. The stock market lost 8% quickly on just the thought that the Fed might start raising rates. Imagine what would happen if the Fed decided to “experiment” by shutting down its market intervention operations – both verbal and physical – for a month…

As for QE, if the Fed has achieved its objective of stimulating the economy, why doesn’t it start removing the $2.6 trillion of liquidity that it has injected into its member banks? This was money that was supposed to be directed at the economy. How come it’s sitting on bank balance sheets earning .25% interest? That’s $6.5 billion in free interest the Fed continues to inject into the Too Big To Fail banks. But why? What would happen if the Fed decided to “experiment” by removing this massive dead-pool of money from the banks? The money isn’t really “dead,” it’s keeping the banks from collapsing. I’m interested to watch the Government Treasury bond auctions now that the Fed is not there to soak up anywhere from 50-100% of each issue. I wonder if the banks will be moving their $2.6 trillion in Excess Reserves into new Treasury issuance. Obama is going around broadcasting the lie that the Government’s spending deficit in FY 2014 was something like $600 billion.

Yet, the amount of new Treasury bonds issued increased by $1 trillion over the same period. Either Obama is lying or the accountants at the Treasury committed a big typo. Either the Fed has found a way to continue opaquely monetizing new Government debt issuance, or the market is soon going to force U.S. interest rates up much higher.

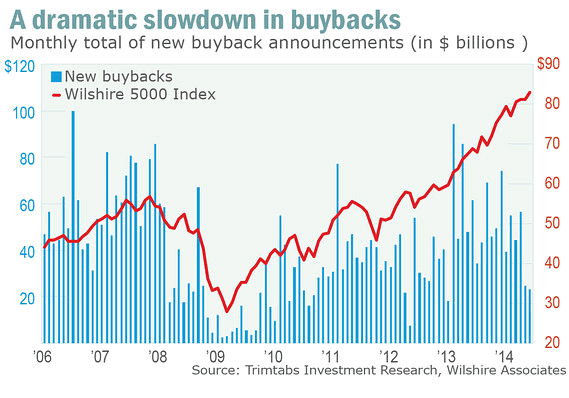

Time to raise rates, or companies will own all their own stock. Sort of like BOJ buying up all Japanese sovereign bonds. Snake eats tail.

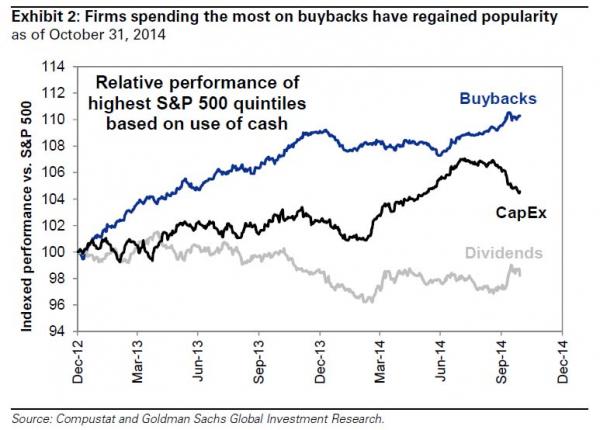

• Buybacks Biggest “Source Of Equity Demand In Recent Years” (Zero Hedge)

Spoiler alert: it’s not the Fed, even though the portfolio rebalancing channel courtesy of a $4.5 trillion Fed balance sheet certainly assured that the artificially inflated bubble in stocks, as a result of the Fed’s own purchases of bonds, is unlike anything seen before (and to all those debating whether the bubble is in bonds or stocks, here is the answer: it is in both). The answer, according to Goldman’s David Kostin is the following: “From a strategic perspective, buybacks have been the largest source of overall US equity demand in recent years.”

In other words, not only has the Fed made a mockery of fundamentals, the resulting ZIRP tsunami means that corporations can issue nearly-unlimited debt to yield chasing “advisors” managing other people’s money, and use it to buyback vast amounts of stock, which brings us to the latest aberation of the New Abnormal: the “Pull the S&P up by the Bootstaps” market, in which the only relevant question is which company can buyback the most of its own stock. Some further observations on the only thing that matters for equity demand in a world in which the Fed is, for the time being, sidelined:

Since the start of 4Q, a sector-neutral basket of 50 stocks with the highest buyback yields has outpaced the S&P 500.

And sure enough, with the market once again rewarding stock buybacks… companies will focus exclusively on stock repurchases in lieu of actual growth-promoting capital allocation such as CapEx (as predicted in April 2012):

We forecast S&P 500 cash spent on repurchases will rise by 18% in 2015 following a 26% jump in 2014.

Very much worth a read. People leap into assumptions about Fed and IMF goals far too easily, if you ask me.

• Myopic Domestic Delusion or Planned Monetary Demolition? (De Landevoisin)

So where is the impasse I point to? Well, as stated above, I am not quite so sanguine as Mr. Stockman is regarding the reasons behind our apparent self induced economic undoing. It is my contention that there exists ample motive behind the apparent policy insanity we are indeed witnessing and actually navigating through. What is being done is quite simply too plainly preposterous to be so innocently and readily dismissed. One has to consider what else may be driving the continuous and relentless stoking of a glaring, oncoming, head on collision train wreck dead ahead. No locomotive engineer can simply be assumed to be this brain dead, so completely out to lunch, it just doesn’t add up. Something else is at the heart of this mainlined monetary mayhem.

Call me a jaded cynic or even worse, a crackpot conspiracist, but when I see a country as majestic and powerful as the United States which has always stood for liberty and the pursuit of free enterprise, knowingly, willfully and conspicuously being undermined, as if being herded over a cliff like baffled buffaloe on the great plains, I smell a dubious dirty rat. Let us bear in mind, that the IMF Multinational Central Bankers are waiting in the wings to pick up the pieces of the train wreckage, with their deliberate SDR regime preparations. They are qualifying themselves to take on the existing immense capital account imbalances between the debtor and creditor nations. That will be a critical aspect of the developing picture.

As a new global monetary order begins to emerge and impose itself, the SDR composite will be expanded so as to address these utterly unsustainable trade imbalance. The envisaged multilateral SDR monetary instrument will be positioned to buy out the existing unserviceable sovereign debt loads, whereby the massively indebted nations of the developed world will cede a measure of influence to the creditor nations of the emerging world.

Ouch!

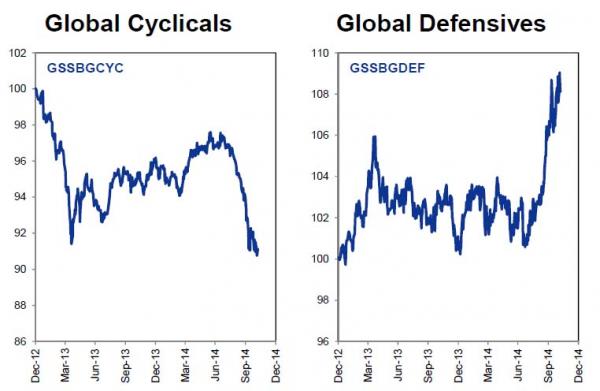

• What Stocks Say About The State Of The Global Economy (Zero Hedge)

The following two charts cut right through the headline propaganda and show all there is to know about the state of the global economy. The first is a chart of Global Cyclical stocks (Goldman ticker GSSBGCYC). The second shows Global Defensives (Goldman ticker GSSBGDEF). The resulting picture is worth 1000 Op-Eds welcoming you to yet another “global recovery.”

And that economy is still supposed to grow at 7%?

• China Factory-Gate Prices Decline for Record 32nd Month (Bloomberg)

China’s factory-gate prices fell for a record 32nd month in October and consumer prices remained subdued, raising pressure on policymakers to bolster the world’s second-largest economy as disinflation spreads. The producer-price index dropped 2.2% from a year earlier, the National Bureau of Statistics said in Beijing today, compared with the median projection of a 2% decline in a survey of analysts by Bloomberg News. Consumer prices rose 1.6% and the rate was unchanged from the prior month and matched economists’ estimates. China’s economy, burdened by overcapacity and weak domestic demand, is headed for the slowest full-year growth in more than two decades. Lower oil and metals prices are cutting costs at the factory gate, allowing China’s exporters to reduce prices and adding to deflationary pressures globally.

“China’s domestic demand remained soft and dis-inflationary risks are on the rise on the back of falling global commodity prices,” said Chang Jian, chief China economist at Barclays. “Subdued inflation offers room for more PBOC easing, but broad-based monetary easing will more likely to be triggered by disappointing growth numbers, which we will likely see in the coming months.” Chang said she expects the PPI drop will continue to 2015. Purchasing prices of fuels fell 3.8% in October from a year earlier, while ferrous metals costs dropped 6.9%, the NBS data showed. Prices of all nine components dropped. Oil prices have slumped into a bear market amid speculation of a global glut, slowing drilling at U.S. shale formations. Producers in OPEC countries are responding by cutting prices, resisting calls to reduce supply as they compete with the highest U.S. output in three decades.

“The extended drop in the PPI is affected by the prolonged decline of global oil prices and overcapacity in some domestic industries,” Yu Qiumei, a senior statistician at the NBS, said in a statement today. Eighteen of China’s 31 provinces and municipalities reported a nominal growth rate lower than the price-adjusted level for the first nine months of this year, signaling deflation. China’s imports moderated to a 4.6% increase in October from September’s 7% gain, according to data released by General Administration of Customs over the weekend.

Ahem: “China’s development will generate huge opportunities and benefits and hold lasting and infinite promise.”

• Xi Dangles $1.25 Trillion as China Counters U.S. Refocus (Bloomberg)

President Xi Jinping sought to counter U.S. efforts aimed at boosting influence in Asia by flexing China’s economic muscle days before a Beijing summit with his counterpart Barack Obama. Speaking to executives at a CEO gathering in Beijing, Xi outlined how much the world stands to gain from a rising China. He said outbound investment will total $1.25 trillion over the next 10 years, 500 million Chinese tourists will go abroad, and the government will spend $40 billion to revive the ancient Silk Road trade route between Asia and Europe. “China’s development will generate huge opportunities and benefits and hold lasting and infinite promise,” Xi said. “As China’s overall national strength grows, China will be both capable and willing to provide more public goods for the Asia Pacific and the world.”

China has used the Asia-Pacific Economic Cooperation forum summit under way in Beijing to put forward its own trade and economic proposals to strengthen its sway in Asia. Those incentives complement a greater assertiveness in territorial disputes and moves to upgrade its military after decades of U.S. dominance in the region. China is rolling out counteroffers for each promise made by President Barack Obama, whom he’ll meet this week in Beijing as part of the summit. Xi is pushing the Free Trade Area of the Asia-Pacific in response to the U.S.-backed Trans-Pacific Partnership, which excludes China. An Asia Infrastructure Investment Bank mostly financed with money from Beijing is seen as an answer to the Asian Development Bank and other multinational lenders where the U.S. and Japan have the most influence.

“Any time they have the chance to shape international economic rules or norms they are going to do that,” said Andrew Polk, resident economist at the Conference Board China Center for Economics and Business in Beijing. “It’s a bifurcated kind of response – there’s a reactive response to the developed world but trying to take a leadership role among other emerging economies.” While spelling out his message, Xi also made clear China is ready to accept a lower rate of growth, assuring executives that the economy is more resilient than ever and his government can safely guide the country through any slowdown. China’s economy is targeted to grow at about 7.5% this year, the slowest since 1990, and Xi said a growth rate around 7% would still make the country a top performer.

Big deal, but with China doing far worse than they let on, what possible outcomes are there?

• China’s Stock Markets Change Forever Next Week (MarketWatch)

When MarketWatch covers Chinese stocks, we usually focus on those listed in Hong Kong. The reason for this is that few outside of China – mainly just institutional investors with approved quotas – are able to buy what’s sold in Shanghai, Shenzhen and the other mainland Chinese bourses, while any investor in the world can buy Hong Kong-listed names. But this is all about to change in a big way next Monday, when China launches its game-changing “Shanghai-Hong Kong Stock Connect” program. For the first time ever, retail investors around the world will be able to invest in mainland Chinese equities.

In some high-profile cases, the same companies have stock listing in both Shanghai (known as “A-shares” when denominated in yuan) and Hong Kong (“H-shares”), though here too, opportunities exist in the form of arbitrage, as a given company’s A-shares and H-shares rarely trade at the same level. “Many international investors are completely excited,” Charles Li, the chief executive of bourse operator Hong Kong Exchanges & Clearing (HKEx) told MarketWatch at a recent media availability. “This is probably the last frontier market that has yet to open,” Li said, “and they [global investors] probably have never seen a rebalancing possibility like this scale anytime in past history.”

I smell a huge rat. This has the potential to hide away the reality of global financial markets for a while. However, it also brings western scrutiny closer to China’s numbers.

• China’s $9 Trillion Untapped Market Spurs U.S. ETF Frenzy (Bloomberg)

The race is on to give U.S. exchange-traded fund investors access to $9 trillion of stocks and bonds in mainland China. Money managers including BlackRock and CSOP have now registered almost 40 ETFs tracking the country’s domestic shares and debt with U.S. regulators, six times the number of existing funds. The products allow anyone with a U.S. brokerage account to gain exposure to Chinese securities that were previously off limits to all but a few qualified institutions. Equities in the biggest emerging market are heading for the best annual gain since 2009, outpacing shares of mainland companies listed overseas amid speculation government plans to ease capital controls will narrow the valuation discount on domestic securities. As programs including a planned bourse link between Hong Kong and Shanghai help open up China’s markets, fund providers are rushing to stake claims to the fees they hope will come from new investors.

“There is so much potential, you just can’t ignore China,” Patricia Oey, a senior analyst at investment data provider Morningstar Inc. in Chicago, said in a telephone interview. Fund companies “want to have a foot into a very big market. China is opening up and they want to be there.” BlackRock, the world’s largest money manager, is seeking to introduce its first U.S. exchange-traded fund that would invest directly in equities traded in Shanghai and Shenzhen, according to a Sept. 15 regulatory filing. CSOP, which runs a $6 billion ETF of China’s yuan-denominated A shares out of Hong Kong, filed to create a U.S. version three days later. While only a fraction of Chinese companies are listed or sell debt offshore, U.S. investors have piled almost $10 billion into ETFs that exclusively buy securities trading abroad, until recently one of the only ways for individuals to gain exposure to businesses from the world’s second-largest economy.

“Together we have carefully taken care of the tree of Russian-Chinese relations. Now fall has set in, it’s harvest time, it’s time to gather fruit.”

• Russia, China Add to $400 Billion Gas Deal With Accord (Bloomberg)

China has secured almost a fifth of the natural gas supplies it will need by the end of the decade after striking a second major deal with Russia. Russian President Vladimir Putin and Chinese President Xi Jinping signed the gas-supply agreement in Beijing the day before U.S. President Barack Obama arrived in the Chinese capital for the Asia-Pacific Economic Cooperation summit. The deal is slightly smaller than the $400 billion accord reached earlier this year, shortly after Russia’s annexation of Crimea. Russia’s Gazprom is negotiating the supply of as much as 30 billion cubic meters of gas annually from West Siberia to China over 30 years, it said yesterday. Another Russian company is discussing the sale of a 10% stake in a Siberian unit to state-owned China National Petroleum Corp.

Russia has turned to China to diversify its market and spur its economy as relations soured with the U.S. and Europe over the Ukraine crisis. The initial accord “will make Russia rely more on China both economically and politically,” Lin Boqiang, director of the Energy Economics Research Center at Xiamen University, said by phone. “China is probably the only country in the world that has both the financial ability and the market capacity to consume Russia’s huge energy exports on a sustainable basis over a long period of time,” said Lin. It gives Putin an opportunity to show Europe and the U.S. that his country won’t be isolated over Ukraine, he said. The two deals could account for almost 17% of China’s gas consumption by 2020, Gordon Kwan at Nomura wrote.

Russia may start selling gas to China within four to six years as part of the agreement with CNPC, Gazprom Chief Executive Officer Alexey Miller told reporters in Beijing. When the new supply deal begins, China will surpass Germany to become Russia’s biggest natural gas customer, according to CNPC’s website. “Together we have carefully taken care of the tree of Russian-Chinese relations,” Chinese President Xi Jinping said yesterday at a meeting with Putin at the economic forum. “Now fall has set in, it’s harvest time, it’s time to gather fruit.”

It’s one sunny message after the other at the APEC summit.

• Russian Ruble Firms On Putin’s Backing (Reuters)

The ruble firmed broadly on Monday after President Vladimir Putin said there were no reasons for the slide in the Russian currency. After a dramatic fall in previous week and volatile swings of 6% in its rate on Friday, the rouble traded 1.9% higher at 45.77 to the dollar at 0735 GMT. The Russian currency was 1.7% stronger at 57.07 against the euro. The Russian central bank said on Monday that it expects zero economic growth in 2015 and only 0.1% growth in 2016, in a three-year monetary policy strategy that anticipates Western sanctions against Russia will remain until the end of 2017. The central bank said that it was also calculating its base forecasts on the Urals oil price recovering to an average of $95 in 2015 but falling to $90 by the end of 2017, a long-term downward trend which it said would constrain economic growth.

Putin, wooing Asian investors on Monday at the Asia-Pacific Economic Cooperation summit in Beijing, said he was hopeful that speculation against the rouble would stop soon and that there was no fundamental economic reason for the currency’s slide. The rouble has slumped nearly 30% against the dollar this year as plunging oil prices and Western sanctions over the Ukraine crisis shrivelled Russia’s exports and investment inflows. Russia’s central bank, which limited its support for the rouble last week by cutting the size of its interventions to $350 million a day, said on Friday it would still intervene to support the rouble it sees threats to financial stability. Putin also said Russia and China intend to increase the amount of trade that is settled in yuan, as he ruled out capital controls for Russia.

Long overdue and even now just a plan.

• Banks Face 25% Loss Buffer as FSB Fights Too-Big-to-Fail (BW)

The world’s largest banks will have to build up their loss-absorbing liability buffers to see them through a crisis, as regulators tackle too-big-to-fail lenders six years after the collapse of Lehman Brothers Holdings Inc. The Financial Stability Board, led by Bank of England Governor Mark Carney, said today that the biggest banks may be required to have total loss absorbing capacity equivalent to as much as a quarter of their assets weighted for risk, with national regulators able to impose still tougher standards. The FSB is seeking comment on the rule, known as TLAC, which would apply at the earliest in 2019. Carney said the plans are a “watershed” in regulators’ mission to end the threat posed by banks whose size and systemic importance mean their failure would be catastrophic for the global economy.

“Once implemented, these agreements will play important roles in enabling globally systemic banks to be resolved without recourse to public subsidy and without disruption to the wider financial system,” he said. The rules are the latest step by the FSB in a five-year quest to boost banks’ resilience in the face of financial shocks. Agreement has already been reached on measures including tougher capital requirements and enhanced scrutiny by supervisors. The TLAC rules would apply to the FSB’s register of global systemically important banks. The latest list, published last week, contains 30 banks, with HSBC and JPMorgan identified as the most significant. The draft requirements announced by the FSB would measure banks’ ability to absorb losses in a crisis, shielding taxpayers from bailouts.

For once, I agree with the Bloomberg editors.

• Jean-Claude Juncker Needs to Go (Bloomberg Ed.)

Jean-Claude Juncker, the new president of the European Commission, was always a bad choice for the job, foisted on the bloc’s 28 national governments by a European Parliament eager to expand its powers. It’s becoming clear now just how poor a decision that appointment was. Juncker was the prime minister of Luxembourg, a tiny nation with a population 1/17th the size of London’s, for almost two decades. In that time, he oversaw the growth of a financial industry that became a tax center for at least 340 major global companies, not to mention investment funds with almost €3 trillion ($3.7 trillion) in net assets – second only to the U.S. Partly as a result of the Swiss-style bank secrecy rules and government-blessed tax avoidance schemes that helped draw so much capital, the people of Luxembourg have become the world’s richest after Qatar.

The tax arrangements, described in leaked documents provided by the International Consortium of Investigative Journalists, allegedly enabled multinationals, from Apple to Deutsche Bank, to reduce their tax liabilities on profits earned in other countries: The effective Luxembourg tax rates that resulted were as little as 0.25%. The countries where the money was made received nothing. It’s telling that these arrangements have long been shrouded in secrecy. (Only last month did Luxembourg’s government drop its opposition to new EU rules on banking transparency.) Juncker, you could say, made his country rich by picking the pockets of other countries, including those of the European Union he is now mandated to serve.

The commission was already conducting an investigation of Luxembourg’s tax arrangements. Juncker says he won’t interfere – but he won’t recuse himself, either. Indeed, his spokesman says he is “serene” in the face of the revelations. He shouldn’t be. At this point, he could best serve the European project by resigning. Juncker’s position as the head of the body investigating the tax practices he oversaw as prime minister is a clear conflict of interest. It’s possible the commission will find nothing improper about Luxembourg’s tax-avoidance paradise: The EU allows member governments wide latitude in taxing companies, so long as they don’t favor some over others. But with Juncker in charge of the commission, any such exoneration will fail to command public confidence.

“Oh, jeez: “This macroprudential policy was born out of the gradual recognition that the financial system isn’t always rational.”

• Draghi Summons Banking Know-How for Top Posts as ECB Role Shifts (Bloomberg)

Mario Draghi is seeking economists who understand banks, and he’s not afraid to look outside Frankfurt to find them. As the European Central Bank assumes the mantle of euro-area financial supervisor, its president has just staffed two key monetary-policy posts with non-ECB experts on how lenders function in the economy. The appointments mark a trend of turning to outsiders as the 16-year-old institution struggles to meet its changing responsibilities with existing staff. “People like Draghi have much more interest in how markets and supervision affect monetary policy than the old school,” said Anatoli Annenkov, senior European economist at Societe Generale SA in London. “It’s a reflection of the problems that the ECB is facing.” Sergio Nicoletti Altimari, a Bank of Italy financial-markets official who worked closely with Draghi during the latter’s time as governor there, will become director general for macroprudential policy and financial stability from Jan. 1.

Luc Laeven, a Belgian economist at the International Monetary Fund with a track record of analyzing financial crises, will become director general for research by March. Draghi is seeking people who can handle the new powers the ECB gained when it became the euro-area banking supervisor on Nov. 4. About 900 new staff have been hired so far who will be dedicated to oversight, and the role also brings the authority to promote financial stability throughout the economy with measures such as higher capital buffers or increased risk-weightings on lenders’ assets. This macroprudential policy was born out of the gradual recognition that the financial system isn’t always rational, and so someone needs to be watching for the emergence of risks that could escalate and broaden.

Add this to the recent revelations of the corruption agonizingly close to Rajoy and his government, and Catalunya must feel stronger every day.

• Over 80% of Catalans Vote Yes at Independence Poll (RIA)

An overwhelming majority of Catalans has supported the region’s independence, vice president of the autonomy’s government Joana Ortega said early Monday. There have been two question in the ballots: “Would you like Catalonia to become a state?” and “If yes, would you like Catalonia to become an independent state?” With 88.44% of the ballots counted, 80.72% of voters answered yes to both questions in the ballot, and 10.11% answered yes only to the first questions, according to Ortega. As few as 4% of the voters said no to both questions.

More than 2.25 million people out of 5.4 million eligible voters in the wealthy breakaway region of Catalonia in northeastern Spain voted on Sunday in the unofficial independence poll. Results of the vote are expected to come on Monday morning. Spanish government sees the voting as illegal and tried to block it by filing complaints to the Constitutional Court. However Catalan President Artur Mas has stated that Catalonia would carry out the consultation despite the central government’s protests. Earlier on Sunday the central government dismissed the vote as “useless” and unconstitutional.

The ECB is no more beyond blackmail than the rest of Brussels is.

• Letter Reveals 2010 ECB Funding ‘Threat’ To Ireland (BreakingNews.ie)

A top-level threat to cut emergency European funding to Ireland days before the humiliating international bailout will shock people, Public Expenditure Minister Brendan Howlin has said. Letters released today by the European Central Bank (ECB) confirm the Government was warned crisis funds propping up collapsed banks in 2010 would be withdrawn unless they asked for an €85bn rescue package. The missive from then-ECB president Jean Claude Trichet to the late former Finance Minister Brian Lenihan also demanded a written commitment to punishing austerity measures, spending cutbacks and an overhaul of the financial industry. Irish high-street banks were surviving on emergency funding – known as emergency liquidity assistance (ELA) – at the time and if stopped, it could have effectively shut down the property crash-ravaged lenders.

Mr Trichet urged a speedy response to his proposals, which have been interpreted by some as the Frankfurt central bank pushing Ireland into a bailout. “It is the position of the (ECB) Governing Council that it is only if we receive in writing a commitment from the Irish government vis-a-vis the Eurosystem on the four following points that we can authorise further provisions of ELA (Emergency Liquidity Assistance) to Irish financial institutions,” Mr Trichet wrote. The four points included Ireland seeking a bailout, agreeing to austerity, reforming banks and guaranteeing to repay emergency funds. Two days after the letter was sent on November 19 Ireland officially requested a rescue package from the ECB, the International Monetary Fund and the European Commission. Minister Howlin said the letters – published after a years-long campaign for their release – would “come as a shock to many people”.

OK, now we know this, go get ’em! Take ’em to court already!

• GM Ordered New Ignition Switches Long Before Recall (WSJ)

General Motors ordered a half-million replacement ignition switches to fix Chevrolet Cobalts and other small cars almost two months before it alerted federal safety regulators to the problem, according to emails viewed by The Wall Street Journal. The parts order, not publicly disclosed by GM, and its timing are sure to give fodder to lawyers suing GM and looking to poke holes in a timetable the auto maker gave for its recall of 2.5 million vehicles. The recall concerns a switch issue that is now linked to 30 deaths and has led to heavy criticism of the auto giant’s culture and the launch of a Justice Department investigation.

The email exchanges took place in mid-December 2013 between a GM contract worker and the auto maker’s ignition-switch supplier, Delphi Automotive. The emails indicate GM placed a Dec. 18 “urgent” order for 500,000 replacement switches one day after a meeting of senior executives. GM and an outside report it commissioned have said the executives discussed the Cobalt at the Dec. 17 meeting but didn’t decide on a recall. The emails show Delphi was asked to draw up an aggressive plan of action to produce and ship the parts at the time. In the months that followed, the size of the recall announced Feb. 7 would balloon and spark an auto-safety crisis, casting a shadow over the industry and leading to widespread calls for faster action by auto makers addressing safety concerns.

” … the Border Integrity Technology Enhancement Project.” Alternatively, they could just burn the $92 million. Or give it to people who need it.

• A 700-Kilometre Surveillance Fence Along The Canada-US Border (NPost)

A massive intelligence-gathering network of RCMP video cameras, radar, ground sensors, thermal radiation detectors and more will be erected along the U.S.-Canada border in Ontario and Quebec by 2018, the Mounties said Tuesday. The $92-million surveillance web, formally known as the Border Integrity Technology Enhancement Project, will be concentrated in more than 100 “high-risk” cross-border crime zones spanning 700 kilometres of eastern Canada, said Assistant Commissioner Joe Oliver, the RCMP’s head of technical operations. Airport search not racial profiling when based on customs officers’ on-the-job experience: court Customs officers are not guilty of racial profiling when they use on-the-job experience to decide who to stop and search at Canada’s airports, the Federal Court of Appeal has ruled.

“Officers on the front line, such as the officer herein, cannot be expected to leave their experience — acquired usually after many years of observing people from different countries entering Canada — at home,” Justice Marc Nadon said, writing on behalf of a three-person appeal panel. Justice Nadon made the comment in overturning a tribunal decision that quashed an $800 fine imposed against an Ottawa woman, Ting Ting Tam, who failed to declare some pork rolls in her luggage. “The concept involves employing unattended ground sensors, cameras, radar, licence plate readers, both covert and overt, to detect suspicious activity in high-risk areas along the border,” Assistant Commissioner Oliver told security industry executives attending the SecureTech conference and trade show at Ottawa’s Shaw Centre. “What we’re hoping to achieve is a reduction in cross-border criminality and enhancement of our national security.”

The network of electronic eyes is to run along the Quebec-Maine border to Morrisburg, Ont., then along the St. Lawrence Seaway, across Lake Ontario, and ending just west of Toronto in Oakville. The project was announced under the 2014 federal budget, but framed solely as a measure to improve the RCMP’s ability to combat contraband cigarette smuggling. The network will be linked to a state-of-the-art “geospatial intelligence and automated dispatch centre” that will, among other things, integrate the surveillance data, issue alerts for high-probability targets, issue “instant imagery” to officers on patrol and produce predictive analysis reports.

The OZ government doesn’t seem to be in sync with its people.

• Australia ‘Giving Up’ On Renewables (BBC)

Investment into renewable energy projects in Australia has dropped by 70% in the last year, according to a new report by a climate change body. The Climate Council says foreign investors are going to other countries because Australia’s government has no clear renewable energy policy. Australia has gone from “leader to laggard” in energy projects, it added. Another new report says Australia will need to raise its carbon emission reduction target to 40% by 2025. The damning report on the state of renewable energy, entitled Lagging Behind: Australia and the Global Response to Climate Change, said the country was losing out on valuable business. Investment that could be coming to Australia was going overseas “to countries that are moving to a renewables energy future”, said Tim Flannery, one of the report’s authors. He said most countries around the world had accelerated action on climate change in the last five years because the consequences had become more and more clear.

The report found China had retired 77 gigawatts of coal power stations between 2006 and 2010 and aimed to retire a further 20GW by next year. It also said the US was “rapidly exploiting the global shift to renewable energy” by introducing a range of incentives and initiatives to investors. The future of Australia’s renewable energy industry remains highly uncertain, the report concluded, because of a lack of clear federal government renewable energy policy. “Consequently investment in renewable energy in 2014 has dropped by 70% compared with the previous year,” it said. The second new report, by the Climate Institute, calls on Australia’s government to announce an “independent, transparent” process for setting the post 2020 carbon emission reduction targets. Erwin Jackson, deputy chief executive of the climate body, said too much of the political debate had “ignored growing scientific, investment and international realities”.

With the amounts being thrown around, it looks risky to pull out.

• Australia Renewables Investment Drops 70% From Last Year (Tim Flannery)

Australia’s most important trading partners and allies, such as China, the US and the European Union are strengthening their responses to climate change. Australia will be left in the wake of these big economies (and big emitters), according to the latest Climate Council report Lagging Behind: Australia and the Global Response to Climate Change. Australia’s retreat from being a global leader at tackling climate change is as impressive as our recent performances at the cricket. Looking on the bright side, even countries not known for their sunshine like Germany are going solar in a big way. Global momentum is building as more and more countries invest in renewable energy and put a price on carbon. 39 countries are putting a price on carbon. The EU and China (now with seven pilot schemes up and running) are home to the two largest carbon markets in the world, together covering over 3,000m tonnes (MtCO2) of carbon dioxide emissions.

There’s also plenty of action in the US: 10 states with a combined population of 79 million are now using carbon pricing to drive down emissions, including California, the world’s ninth largest economy. Yet, here in Australia, we now hold the dubious distinction of being the first country to repeal an operating and effective carbon price. Like carbon pricing, support for renewables is also advancing worldwide. In the last year, more renewable energy capacity was added than fossil fuels. Globally renewables attracted greater investment with US$192bn spent on new renewable power compared to US$102bn in fossil fuel plants. China is leading the charge on expanding renewable capacity. At the end of last year, China had installed a whopping 378GW of renewable energy capacity – about a quarter of renewables capacity installed worldwide, and over seven times Australia’s entire grid-connected power capacity.

Don’t let the GOP find out Obama spends $6 billion on African health care systems.

• Why It’s Not Enough to Just Eradicate Ebola (NBC)

The new U.S. plan to spend $6 billion fighting Ebola has a hidden agenda that aid workers approve of: not only stamping out the epidemic in West Africa, but starting to build a health infrastructure that can prevent this kind of thing from happening again. President Barack Obama’s $6.18 billion request is an enormous amount of money – six times what the U.S. has already committed and far more even than what the World Health Organization says is needed. Most is going for full frontal assault on Ebola – one that hasn’t really gotten off the ground yet, months into an epidemic that has been out of control despite an outcry from international groups and governments alike. But billions are also being quietly allocated to building a health care system in the countries suffering the most – a less sexy approach that could prevent another epidemic in the future. Most aid groups are focused on eradicating the virus, which has infected at least 13,000 people, probably more, and killed at least 5,000 of them.

That’s where the public support is; donors and taxpayers alike prefer to focus on a specific goal, and an emergency always gets attention. “Had we had those things in place, we would have detected this a lot earlier.” “We are not really a developmental organization,” said Dr. Armand Sprecher of Médecins Sans Frontières (Doctors Without Borders), one of the main groups fighting Ebola in West Africa. MSF focuses on providing targeted medical care. And while that has to be the first priority, it’s important to keep an eye on the long game, says Dr. Raj Panjabi, a founder and CEO of Last Mile Health, an aid group focused on helping people in the most remote corners of the world. “The goal has to be to not just contain Ebola,” Panjabi told NBC News. Ebola spread silently in villages and remote communities where there were no health care workers to diagnose Ebola and no way for them to report it even if they did catch it. “Had we had those things in place, we would have detected this a lot earlier,” said Panjabi.