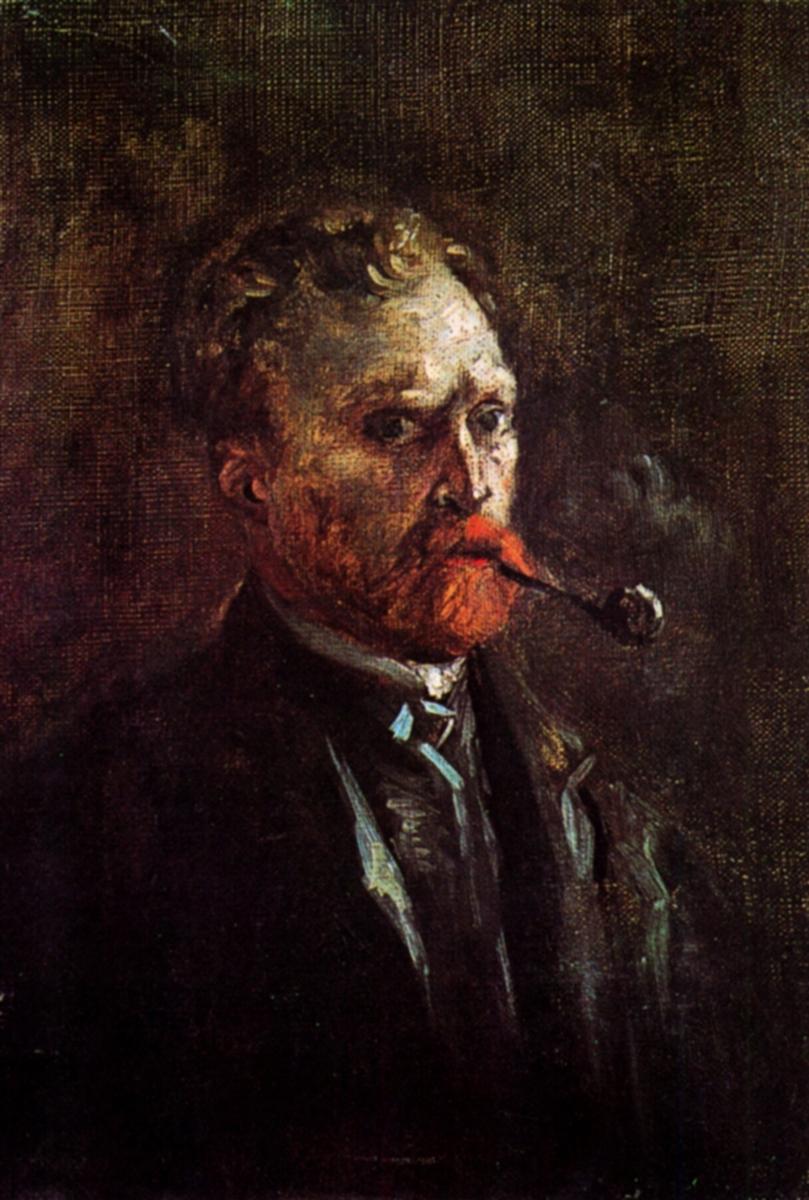

Vincent van Gogh Self portrait with pipe 1886

Biden tapes

Since EVEN MORE Evidence Came Out Today About Joe & Hunter Biden’s Crime Family Let’s Take A Look Back

Here’s the Biden Tapes from November 2016 that were leaked and it showed he was concerned about President Trump looking into where the billions being sent to Ukraine were… pic.twitter.com/ChI8CKfvX6

— Wall Street Apes (@WallStreetApes) August 9, 2023

Macgregor

The agenda is to destroy Russia. Why?

Globalists want to replace Putin because he presides over the last major power in Europe that has a national identity, a national language, a national culture that rests on the foundation of orthodox Christianity.pic.twitter.com/L3USrcrPFp

— Douglas Macgregor (@DougAMacgregor) August 11, 2023

Khan

https://twitter.com/i/status/1689406860527378432

Shoigu

Russian Defense Minister: NATO assembled 360,000 troops in Eastern Europe. Poland is preparing to occupy Western Ukraine.

Important: If NATO moves from a proxy war setting into a direct war with Russia it will be WW3 with all the devastating consequences. pic.twitter.com/iO8N1AzREv

— Kim Dotcom (@KimDotcom) August 10, 2023

Wrong

What else have I been doing wrong my entire life pic.twitter.com/xNJWimS0K1

— Today Years Old (@todayyearsoldig) August 10, 2023

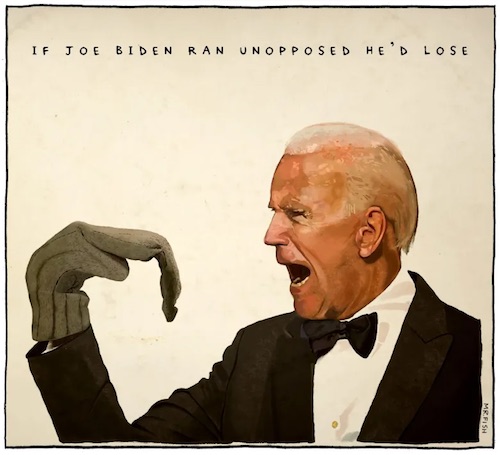

Trump’s defense is his attack. It’s the only game he knows.

• Biden Gone Crazy – Trump (RT)

Former US president Donald Trump slammed his successor Joe Biden as simultaneously insane and inept in a rant on his Truth Social platform on Thursday, declaring the Democratic politician’s policies had nearly destroyed the country. “What Crooked Joe Biden, who can’t string two sentences together, has done to our once great Country through his Open Borders CATASTROPHE, may go down as the greatest and most damaging mistake ever made in USA HISTORY,” the Republican presidential hopeful wrote, insisting the “INVASION” of the US “MUST STOP IMMEDIATELY.” “Our country is being destroyed by a man with the mind, ideas, and IQ of a First Grader,” Trump continued in all caps.

A second volley of insults followed. Biden was “not only dumb and incompetent … he has gone MAD, a stark raving Lunatic,” the ex-president suggested, citing his rival’s “horrible and Country-threatening environmental, open borders & DOJ/FBI weaponization policies.” Biden has presided over an unprecedented flood of migration into the US since reversing many of Trump’s signature immigration policies, with over 7 million illegal aliens arriving since his inauguration in 2021, according to the Federation of American Immigration Reform. Trump pleaded not guilty on Thursday to the latest round of indictments spawned by special prosecutor Jack Smith’s office relating to alleged improper handling of classified material, on top of the dozens of felony charges he was already facing.

He has accused Biden and his Justice Department of spearheading a “witch hunt” against him motivated by personal resentment and a desire to scuttle his chances in the 2024 election. Earlier this week, Trump told an audience in Alabama that he would appoint a special prosecutor to investigate the “Biden crime family” on his first day in office if he regains the White House. Despite the legal quagmire in which Trump is engulfed, he and Biden would face a close race if a rematch of the 2020 vote were held today, with a New York Times/Siena College poll released last week finding 43% of respondents supported each candidate. Both continue to far outstrip their rivals in their respective primary polls, even as voters rated both their unfavorables significantly higher than their favorables in an Economist-YouGov poll earlier this week.

While Trump’s indictments have seemingly galvanized his supporters, Biden’s approval rating continues to languish at record lows, an IBD/TIPP poll published this week found. Just 38% of Americans said they approved of the incumbent’s performance, and even among his own party his support lagged at 65%, with respondents citing concerns about inflation, sluggish or nonexistent wage growth, and surging gas prices to explain their rating. A poll conducted in May found nearly two thirds of respondents thought Biden was not mentally fit to serve a second term.

“I will talk about it. I will. They’re not taking away my First Amendment right.” “I’ll be the only politician in American history not allowed to speak because of our corrupt system..”

“I’m sorry, I won’t be able to go to Iowa today; I won’t be able to go to New Hampshire today because I’m sitting in a courtroom on bull-[expletive] because his attorney general charged me with something.”

• Trump Says He Never Doubted 2020 Election Was ‘Rigged’ (ET)

Former President Donald Trump has declared that he absolutely believes that the 2020 election was stolen—a denial of the central allegation in his most recent federal indictment. President Trump has pleaded not guilty to Washington-based charges in what he and his supporters are calling a politically motivated prosecution amid a presidential election campaign. The Aug. 1 indictment alleges that President Trump conspired to defraud and obstruct the U.S. electoral process by spreading “knowingly false claims” of election fraud, thus eroding trust in the government. On Aug. 8, President Trump said, “I never even thought of this one: ‘Trump didn’t really believe he won the election.’” He emphatically told the audience of 2,000 at the high school in Windham, New Hampshire, “Let me tell you … there was never a second of any day that I didn’t believe that that election was rigged.”

The former president raised his voice and said: “It was a rigged election, and it was a stolen, disgusting election. And this country should be ashamed … they go after the people that want to prove that it was rigged and stolen! … They don’t go after the people that rigged it.” President Trump also decried federal prosecutors’ recent request to restrict what he can say publicly as the case proceeds. A judge has set a hearing for Aug. 11. Federal prosecutors fear that the former president, who has been outspoken on the campaign trail and social media, could release information that might have “a chilling effect” on witnesses and interfere with justice being done. Therefore, they say a protective order is needed. The former president’s lawyer, John Lauro, wrote in a court filing: “In a trial about First Amendment rights, the government seeks to restrict First Amendment rights.”

And President Trump told the audience on Aug. 8: “I will talk about it. I will. They’re not taking away my First Amendment right.” “I’ll be the only politician in American history not allowed to speak because of our corrupt system,” he said. “I’ll come in, and I’ll say: ‘Hi everybody. Listen, uh, not allowed to speak, uh, please vote for me, New Hampshire, if you would. Bye!’” The former president said the political implications are serious and the situation is outrageous. President Trump is the frontrunner for the Republican nomination to run against the Democrats’ nominee, presumably President Joe Biden. While President Biden denies unduly influencing federal prosecutors to take action against President Trump, Mr. Lauro said the Democrat president promised that his administration would ensure that President Trump “does not become the next president again.”

President Trump said, “How can my corrupt political opponent, ‘Crooked Joe Biden,’ put me on trial during an election campaign that I’m winning by a lot, forcing me nevertheless to spend time and money away from the campaign trail in order to fight bogus, made-up accusations and charges?” President Trump said that because he is now indicted in three cases, he envisions having to say: “I’m sorry, I won’t be able to go to Iowa today; I won’t be able to go to New Hampshire today because I’m sitting in a courtroom on bull-[expletive] because his attorney general charged me with something.”

Jan 2. His entire campaign will have to come from a courtroom. Or a prison cell. That can’t be right.

• US Prosecutors Propose Trump Trial Date (RT)

US Special Counsel Jack Smith’s office has asked a Washington, DC court to begin the criminal trial of former president Donald Trump on January 2. Smith maintains that this will give Trump’s legal team enough time to prepare, while Trump insists that Smith is “deranged” and “trying to infringe”on his campaign. In a three-page filing submitted on Thursday, Smith’s office requested that jury selection begin on December 11, followed by the trial three weeks later. This proposed schedule “serves the public’s interest and the interests of justice, while also protecting the defendant’s rights and ability to prepare for trial,” the filing read. In the filing, Smith’s team estimated that it would take them between four and six weeks to present their case against the former president.

If the court agrees to Smith’s dates, this process would see the trial overlap with the Iowa caucuses, during which Republicans in the state will choose their preferred candidate for president in the 2024 election. Trump has previously denounced Smith as “deranged” and claimed that the case is an attempt by President Joe Biden’s Justice Department to take out the incumbent president’s most formidable political rival. “My Political Opponent is going CRAZY trying to infringe on my Campaign for President,” Trump wrote on his Truth Social platform earlier on Thursday. “These are DARK DAYS IN AMERICA!” Smith charged Trump earlier this month with conspiracy to defraud the United States, conspiracy to obstruct an official proceeding, obstruction of and attempt to obstruct an official proceeding, and conspiracy against rights.

The charges stem from Trump’s alleged efforts to stop the certification of Biden’s victory in the 2020 election, which culminated in the riot on Capitol Hill on January 6, 2021, in which one of Trump’s supporters was shot dead by a police officer. Trump pleaded not guilty to all four charges last week, and told his supporters that, if elected, he would have Biden investigated for his alleged “crooked acts, including bribes from China and many other foreign countries that go into the coffers of the Biden crime family.” Smith also indicted Trump in June for his alleged mishandling of classified documents, hitting the former president with 32 counts under the Espionage Act, one for each document he supposedly removed from the White House. Trump has pleaded not guilty, and in a speech to supporters shortly after the indictment, called the Justice Department and FBI – who raided his Florida estate to find the documents – “cowards,” “fascists,” and “thugs.”

There are too many charges and indictments.

• Trump Enters Plea In New Classified Documents Charges (RT)

Former US president Donald Trump and his aide Walt Nauta pleaded not guilty on Thursday to a second round of charges added last month to the 37 felony counts the Republican presidential frontrunner already faces for allegedly mishandling classified documents at his Mar-a-Lago estate. Trump, Nauta, and fellow Trump employee Carlos de Oliveira were charged with obstructing the federal government’s efforts to retrieve the documents by conspiring to delete security camera footage from the system monitoring his Palm Beach home after the government issued a subpoena for it. De Oliveira is expected to enter a plea next week once he secures a Florida lawyer.

Trump also pleaded not guilty to another violation of the Espionage Act, stemming from him allegedly showing a classified national security document containing the Pentagon’s plan for attacking Iran to visitors at his Bedminster, New Jersey country club. Audio of the former president seemingly showing off the “highly confidential” military secrets was released in June following the initial classified documents indictment, appearing to contradict Trump’s previous insistence that he was only referring to publicly-available information at the club and did not have the battle plan in his possession at the time. With the filing of the initial charges in the classified documents case in June, Trump became the first former US president ever to be federally indicted. He was indicted again last week on four counts of conspiracy related to his alleged efforts to overturn the 2020 election. The former reality star is also facing charges in a Manhattan district court related to his alleged payment of hush money to a porn star in 2016.

Another indictment is reportedly pending against the real estate mogul-turned-politician, this time in the state of Georgia, where Fulton County District Attorney Fani Willis has been working to indict Trump for election interference based on a phone call he made to the Georgia Secretary of State during the weeks after Election Day 2020 and an unexecuted plan to draw up an alternate slate of electors for the state. A grand jury is expected to consider any potential charges by the end of next week. Trump has pleaded not guilty to all charges thus far, dismissing them as part of a “witch hunt” against him by a “tyrannical” Democratic Party that wants to lock him up for “six lifetimes.” The indictments have not hurt his performance in polling for the Republican 2024 presidential nomination, though he remains neck-to-neck with incumbent Joe Biden in recent hypothetical matchups.

With Nord Stream gone, Europe depends on a pipeline that flows through Niger. Good video.

• Niger Coup Shows Wind Of Change Blowing In Francophone Africa – Expert (RT)

The political situation in Niger should teach France and other Western countries, including the US and UK, that Africa cannot be taken for granted, a former Nigerien foreign affairs officer, Iliyasu Gadu, told RT on Thursday. According to Gadu, a wind of change leading to a decline in western hegemony is “blowing across French-speaking Africa and West Africa” and must be accepted by Paris and other former colonizers. Last month, Niger’s presidential guard detained President Mohamed Bazoum and seized power, prompting anti-French protests from thousands of people who supported the move.

The new military government accused France on Wednesday of violating its airspace and releasing dangerous terrorists. The coup leaders previously accused the former colonial power of plotting a strike to free Bazoum. Paris has denied the allegations, claiming that it flew a plane into the capital Niamey in accordance with an agreement with the Nigerien army. The coup in Niger on July 26 has triggered aid cuts from partnering countries, including France, Germany, and the US. Despite being sanctioned by the West African regional bloc ECOWAS, which is considering military intervention, the new authorities have rejected both regional and international pressure to release Bazoum and restore democratic order.

In an interview with RT, Gadu said he believes ECOWAS is acting at French behest by threatening to intervene militarily in Niger. He argued that while France has oil and mineral concessions in its former colonies that benefit it at the expense of the local people, it “cannot go in and intervene or force change.” “So at the moment, they want ECOWAS to do that,” he said, adding that “force and intervention will not help” to resolve the unrest in Niger. Gadu said he views the willingness of neighboring states to get involved in the Sahel country as being “not in the interest” of ECOWAS, but in the interest of Paris.

Niger EU

Revolution in #Niger not only stops uranium and gold exports to #France, it blocks a #Nigerian gas pipeline to #Europe, which was to compensate for the US sabotaged #Nordstream gas supply from #Russia. pic.twitter.com/1vUHjWhJrm

— tim anderson (@timand2037) August 10, 2023

China has invested a lot in Afica. What are they thinking?

• US Hints At Support For Niger Intervention (RT)

The United States has said it backs efforts to restore Niger’s “constitutional order” in the wake of a military uprising there last month, after countries in the region said they would activate troops for a possible armed intervention. In a statement published on Thursday, US Secretary of State Antony Blinken said Washington stands with the Economic Community of West African States (ECOWAS) in calling on Niger’s military government to step down, stressing the need for political stability and “social cohesion.”“We echo the ECOWAS condemnation of the illegal detention of President Mohamed Bazoum, his family, and members of the government, as well as the unacceptable conditions under which they are being held, and call for their immediate release,” the diplomat added, referring to Niger’s deposed head of state.

While Blinken added that US officials hoped ECOWAS would “explore all options for the peaceful resolution of the crisis,” his comments came just hours after the West African bloc said it would begin organizing military forces to restore Bazoum to power. The leader was overthrown last month by rebel military commanders, who have since placed him in detention and seized control of Niger’s government. “No option is taken off the table, including the use of force as a last resort,” Nigerian President Bola Tinubu said earlier on Thursday, after hosting an ECOWAS meeting in Abuja. He added, “I hope that through our collective effort, we can bring about a peaceful resolution as a roadmap to restoring stability and democracy in Niger. All is not lost yet.” Several of Niger’s neighbors have demanded the restoration of the former government, with Ivory Coast President Alassane Ouattara condemning Bazoum’s detention as a “terrorist act.”

Officials in Nigeria and Senegal have echoed those comments. Niamey’s new military government has defied ECOWAS demands to free the ousted president and step down, vowing to defend the country against any foreign attack. Some African states, including Mali and Burkina Faso, have aligned with the Niger junta, warning they would withdraw from the bloc and “adopt self-defense measures in support of the armed forces and the people of Niger” in the event of an intervention. While it’s unclear when ECOWAS might be prepared to launch a military operation or what countries would participate, Western officials told the Associated Press that the leaders of Niger’s junta threatened to kill Bazoum should the bloc send troops, potentially raising the stakes for any attempt to use force.

“The majority of the world accepts Russia’s arguments about the causes of the conflict, but is not enthusiastic about the ongoing military campaign.”

• Most Of The World Has Decided To Keep Out Of Ukraine Conflict (Lukyanov)

The recent Russia-Africa summit in St. Petersburg and the consultations in Saudi Arabia last weekend on ending the Ukraine conflict, while different events, form part of a single phenomenon. Their significance lies in the growing importance on the international stage of states that prefer not to take sides in the confrontation between Russia and the West, but are guided by pragmatic interests. We now refer to this large group of countries as the world majority. It indeed comprises most of Earth’s population, but the name can be misleading. It’s not some form of united bloc. However, we can talk about a new structural factor – the emergence of constraints on the great powers, which are used to thinking that everything depends on them. Now, it’s not possible to achieve goals without the support of – and even more so in spite of – countries that were previously regarded as afterthoughts.

The essence of the majority’s approach is the desire to distance itself from the political, economic and ideological constructs of others. To exaggerate, the view is that certain white gentlemen – who have been at the helm of the world for several centuries – have created a pile of modern problems by constantly fighting each other, and they are getting worse. (Russia, thanks to its Soviet legacy, retains a special ‘get out of jail card’, but is generally perceived as being part of the broader West.) For the “first world,” there is no reason to help the minority deal with what it has created, because the developed community is not ready to change the system that has led things to a dead end, except cosmetically. It makes more sense to use the plight of the Global North to seek benefits for the Global South.

This is a simplified scheme, of course, and it will be adjusted for various circumstances, down to historical likes and dislikes. But it is really an auction: who will offer more and deliver it better? The US and its allies were the first to face such a situation. They were unpleasantly surprised by the firm unwillingness of non-Western countries to join the anti-Russian coalition in 2022. Now Moscow, too, sees the limits of its options. The majority of the world accepts Russia’s arguments about the causes of the conflict, but is not enthusiastic about the ongoing military campaign. The position of the majority countries is based on their own practical situations, with responsiveness to ideological appeals and proposals to change the world order serving as a garnish.

The latter resonates with the mood of many, but is not an urgent priority. There is neither a desire to borrow development models nor a demand for ideology, as there was in the twentieth century. Our proposals for developing an attractive ideological narrative to win the hearts and minds of the global majority are based on past experience, but the international landscape is very different now. Everyone is on their own. This is in fact the multipolar world that people sought when they wanted to defeat hegemony.

“..politically, Europe has no foreign policy now. NATO is driving Europe’s foreign policy.”

• Russian Economy Overtakes Germany, UK and France Despite Sanctions (Tweedie)

Russia’s economy has overtaken Germany’s thanks to US efforts to provoke a recession in Europe, says an economist. The World Bank reported last week that by the end of 2022, Russia’s wealth in purchasing power parity (PPP) terms exceeded $5 trillion for the first time — putting it ahead of western Europe’s three biggest economies France, financial giant the UK and industrial powerhouse Germany. PPP takes into account the varying cost of goods and services between different countries, not just raw GDP. Dr Jack Rasmus told Sputnik that what Russia’s rise “really represents is that Europe is slowing down its economy, particularly Germany.” “A lot of that has to do with global forces that were set in motion by the US driving Russia out of the Western European economy, providing cheaper energy,” Rasmus said.

“And now they’re paying more: they — Germany and Europe — pay more for US goods, particularly energy. And that’s taking its toll. It’s slowing the economy down.” US President Joe Biden claimed in March 2022 that the “ruble is rubble” as a result of Western sanctions — just before the Russian currency surged to its strongest exchange rate against the US Dollar in years. That September the Nord Stream 1 and 2 gas pipelines were sabotaged, an act that award-winning US investigative journalist Seymour Hersh revealed was carried out by the Biden administration. The academic argued that Russia’s economic growth did not mean the US had failed in its strategic objectives for the Ukraine conflict.

“The US is actually obtaining its objectives, which are to drive Russia totally not just in energy out of Western Europe, so that the US economy and capitalism can enter that vacuum and make Europe more economically dependent on the US,” Rasmus said. “That’s an objective of this war, to make Europe dependent economically on the US, which allows the US to manipulate it in many ways.” “If you look at Europe, it’s sliding into being an economic vassal of the United States,” he noted. “I think that was an objective. And politically, Europe has no foreign policy now. NATO is driving Europe’s foreign policy.”

But Washington’s long-term goal remains to engineer regime-change in Moscow and balkanize Russia. “That’s been a Neocon wet dream since 1999 to pretty much debilitate, break up Russia and get all the resources,” Rasmus said. “And face it, the Neocons have been running US policy here since the late nineties, since Bill Clinton couldn’t keep his zipper closed.” “What they want, ultimately, is to dismember Russia and to go to war with China,” he added. “It’s crazy and it’s World War Three, and you’ve got demented old leaders in the US who are just putty in the hands of the Neocons.”

Nobody could have hurt the German economy more than the Germans do.

• EU Sanctions On Russia Could Grind German Industry To A Halt – MP (RT)

The EU’s largest economy is facing a further economic decline and de-industrialization as a result of the bloc’s sanctions policy against Russia, German MP Uwe Schulz has warned. According to a statement published on the website of the right-wing AfD party, of which Schulz is a member, the punitive measures have failed to hurt Russia, but have devastated the German economy.“Sanctions against Russia and economic measures by the ruling Traffic Light Coalition [the Social Democratic Party of Germany, the Greens and the Free Democratic Party] are leading Germany and its economic activity straight to de-industrialization,” the politician stated. He added it was “not surprising that in 2022 the Russian Federation displaced Germany from fifth place in the ranking of the world’s leading economies.”

The latest World Economics report showed that Russia was among the world’s five largest economies and the largest in Europe in terms of purchasing power parity (PPP) as of the end of 2022, despite sanctions. The data indicated that Russia leaped ahead of Germany’s $5 trillion economy when measured in PPP. According to Schultz, the devastating effect of the Russia sanctions on the German economy is evidenced by “disappointing economic prospects [for the country] for 2023,” as well as “poor results in the automotive industry, [which] continue to lead to lower manufacturing output.” In this regard, the lawmaker called on the German government to immediately “lift economic sanctions against Russia” in order to “prevent [further] economic damage.”

This week, the head of the Federation of German Employers’ Associations in the Metal and Electrical Engineering Industries (Gesamtmetall), Stefan Wolf, said that the German economy is no longer competitive and has become the “sick man of Europe.” According to his estimates, the country could fall into recession in the second half of the year. Supplies of Russian gas and oil to the EU’s biggest economy were either significantly reduced or entirely halted after Brussels imposed multiple rounds of anti-Russia sanctions in response to the conflict in Ukraine. Moscow retaliated by slashing fuel deliveries and imposing a new ruble-based payment system. Prior to that, the German economy relied on Russia for 40% of its gas demand and about a third of its oil needs.

Says a German paper. 99% is also partial.

• Russia Takes ‘Partial Victory’ In Economic Confrontation With West (TASS)

Russia has won a partial victory in its economic confrontation with the West, having achieved growth in revenues from energy exports, despite Western sanctions. This is according to observers of the German newspaper Handelsblatt. The publication cites calculations by the Bloomberg agency, according to which Russia’s revenues in July 2023 increased by 5.3% year-on-year and amounted to $8.66 billion. “For the Kremlin, this is a partial economic victory over the West. For Washington and the EU, it is an alarming sign: in July, Russia <…>, despite Western sanctions, saw an increase in government revenues from oil and gas exports,” Handelsblatt observers wrote. Russia is earning “more from energy exports and thus is in a better position than a few months ago,” Giovanni Staunovo, a commodity analyst at the Swiss bank UBS, told the publication.

According to Robin Brooks, chief economist at the Institute of International Finance (IIF), sanctions “can be very effective when used against countries with current account deficits.” Such states depend on obtaining loans from foreign investors on the global capital market to finance imports. As the economist notes, Russia is not among such countries. According to the newspaper, as prices for Russian energy carriers rise, “doubts about [the usefulness] of EU sanctions are growing.” Gas prices are slowly rising, exceeding $350 per 1,000 cubic meters. Gazprom’s gas supplies to Europe in transit through Ukraine amount to 42.3 million cubic meters per day through the Sudzha station.

He won’t be around for long enough.,

• Zelensky Will Never Negotiate With Putin – Ukrainian FM (RT)

If and when Kiev decides to negotiate with Moscow, it will not do so with Russian President Vladimir Putin, Ukrainian Foreign Minister Dmitry Kuleba said in an interview with the Italian outlet Corriere della Sera, published on Thursday. Putin “has committed too many very serious crimes,” Kuleba, who is recovering from Covid-19, told the outlet over the telephone. “It is clear to us that we will never be able to see Putin and [Ukrainian President Vladimir] Zelensky sitting at the same table.” “We can negotiate with Russia after the withdrawal of their troops from our territories, but not with Putin,” Kuleba insisted. Asked if this would mean an escalation of the conflict, Kuleba argued that “the worst has already happened, nothing can surprise us anymore,” and that the war had been total from the beginning.

“The counter-offensive will soon give us victories and we will continue to fight, we have no alternatives,” he added. “It’s not easy for our soldiers to advance. But, eventually, we will,” Kuleba said of the offensive, which he described as “progressing slowly but steadily.” He maintained that time was on Ukraine’s side “for the simple fact that our military capabilities are growing, while Russia’s are decreasing,” and that Kiev is “counting on the fact that the war will end in our favor at some point.” Kuleba made sure to thank Italy for the weapons and supplies it had delivered to Ukraine, noting that nothing would be enough “until we have won this war.” He also asked for even more artillery, ammunition, and anti-aircraft systems.

NATO-trained Ukrainian brigades, equipped with Western tanks and armored vehicles, have not been able to get past the Russian outposts on the southern front since early June, at a cost of an estimated 43,000 dead. Meanwhile, Russian troops have advanced in the north, threatening the Ukrainian hold on the key city of Kupiansk. In October 2022, Zelensky banned any Ukrainian from negotiating with Putin. The following month, he proposed a “peace platform” that demanded unconditional Russian withdrawal from territories Kiev claims as its own, including Crimea. Kiev has insisted on that as the only acceptable framework for talks ever since. Russia has rejected it as a delusional ultimatum, adding that Ukraine recognizing reality is a prerequisite for any peace talks.

“..the original foundations of Ukraine’s sovereignty – its neutral, non-bloc adherence and non-nuclear status – must be confirmed in order to reach this [conflict] settlement.”

• Peaceful Settlement Possible If Kiev Stops Hostilities, Terrorism (TASS)

A peaceful settlement in Ukraine is possible only if Kiev stops hostilities and terrorist attacks, Russian Deputy Foreign Minister Mikhail Galuzin told TASS on Thursday. “On our behalf, we continue maintaining our principled stance that a comprehensive, sustainable and just settlement is possible only if the Kiev regime stops the hostilities and terrorist attacks, while its Western sponsors stop pumping up the Ukrainian military with weapons,” Galuzin said in an interview with TASS. According to the Russian diplomat, “the original foundations of Ukraine’s sovereignty – its neutral, non-bloc adherence and non-nuclear status – must be confirmed in order to reach this [conflict] settlement.” “The new territorial realities must be recognized, the demilitarization and denazification of Ukraine and the rights of its Russian-speaking citizens and national minorities must be ensured in accordance with the requirements of international law,” Galuzin added.

“Rather than spending a single penny more fighting a proxy war in Ukraine and killing more people, a more worthwhile effort would be if Biden would put America first by allocating resources in our country to secure the southern border..”

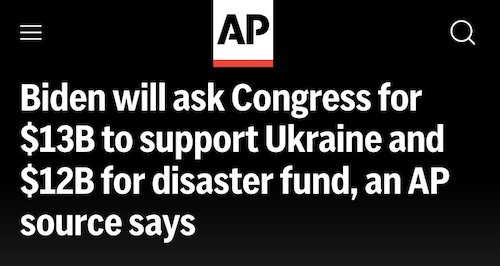

NOTE: Ukraine aid is now tied in with disaster relief. Something nobody wants to vote down.

• Biden Asks Congress for $13 Billion in New Ukraine Military Aid as Opposition Grows

US President Joe Biden in a letter to Congress has asked for an additional $13 billion in supplemental funding to continue military assistance to Ukraine next year. “$9.5 billion for equipment for Ukraine and replenishment of [US Department of Defense] stocks; and $3.6 billion for continued military, intelligence, and other defense support,” the document said. Biden is also asking for $7.3 billion for economic, humanitarian, and security assistance to Ukraine. The proposal for additional Ukraine aid totals some $24 billion, including some $2.3 billion intended as leverage to gain more aid from other donors via the World Bank.

However, combined with an additional $2.65 billion in funding for border security, $12 billion in disaster relief efforts, and $416 million in combatting the fentanyl crisis, among other domestic matters, the congressional request totals upwards of $40 billion in supplemental aid. The Thursday filing marks the first such request by the Biden White House since Republicans claimed control of the House of Representatives at the start of the year. While previous requests had been largely met with Congress’ backing, GOP members have grown increasingly hesitant toward continued aid. In fact, House Speaker Kevin McCarthy vowed in early June that any requests for supplemental Ukraine aid would not be taken up in the lower chamber – regardless of bipartisan efforts taken up in the Senate.

At the time, McCarthy explained that any additional funds would need to be cleared as part of an annual appropriations process, underscoring finances would have to be shifted elsewhere from the Pentagon’s funds. “I think what we really need to do, we need to get the efficiencies in the Pentagon,” the House speaker told US media in June when referring to the Pentagon’s budget. “Think about it, $886 billion. You don’t think there’s waste? … I consider myself a hawk, but I don’t want to waste money. So I think we’ve got to find efficiencies.” Shortly after the Thursday request was issued, US Rep. Paul Gosar (R-AZ) told Sputnik that US President Joe Biden must focus on supporting efforts to improve security within the United States, rather than on spending more funding on a proxy war in Ukraine.

“Rather than spending a single penny more fighting a proxy war in Ukraine and killing more people, a more worthwhile effort would be if Biden would put America first by allocating resources in our country to secure the southern border,” Gosar said, touching on the US’ continued fight to combat illegal immigration. He added that resources could also be better spent on “funding law enforcement efforts to combat the violent crime and drugs destroying cities across America, or aiding our homeless population, including countless veterans, who are sleeping on sidewalks.” The hefty request also comes as the US public has grown increasingly cold toward such military aid. A recent poll determined that 55% of surveyed Americans opposed Congress approving Ukraine aid, with only 45% disagreeing. Earlier Wednesday, the White House attempted to shoot down the sentiment, telling reporters that continued efforts were paramount to the “national security of the American people.”

“..political spins are often built on illusions. The latest is that Joe Biden only benefits from these payments if they were directly deposited in his accounts..”

• Washington is Attempting to Dismiss $20 Million as an Illusion (Turley)

This week, House Oversight Committee Chairman James Comer released a third report on the ongoing investigations into the Biden corruption scandal. The latest bank records indicate the Biden family has received more than $20 million, including from corrupt Kazakh figures. Some of this money provided Hunter Biden with extravagant toys. On April 22, 2014, Kazakh oligarch Kenes Rakishev wired $142,300 to the Rosemont Seneca Bohai bank account. That account then shows the exact same amount being wired to a New Jersey car dealership for a Fisker sports car for Hunter. Finding the Fisker unsuitable, Hunter traded it in for a Porsche. Notably, these payments often coincided with dinners and meetings with Joe Biden.

Russian oligarch Yelena Baturina, the widow of Moscow ex-Mayor Yury Luzhkov, wired $3.5 million to Rosemont Seneca Thornton Feb. 14, 2014. She later attended a dinner with Joe and Hunter Biden at Washington, DC, hotspot Café Milano. For weeks, Joe Biden’s prior claims have been collapsing as his allies in the media and Congress struggle for an alternative spin on these new disclosures. The president’s denials of any knowledge of his son’s foreign dealings finally have been exposed as a lie. Even the Washington Post has acknowledged Biden lied when he insisted that Hunter never made any money in China. It was always a boldfaced falsehood (and a confusing claim from a man who insisted that he had no knowledge of his son’s foreign dealings).

But the testimony of associate Devon Archer and new bank records forced the paper and others to recognize the falsehood. There is also the confirmation that Biden’s long denials that he attended key dinners with Hunter’s business associates were false. Most notably, the media are grudgingly admitting that Hunter was openly selling influence peddling and access to his father as part of what Archer called “selling the brand.” The final line of defense is now that Hunter Biden was selling access to Joe Biden but it was an “illusion.” The reason, they claim, is there is no evidence of direct payments to Joe and Jill Biden.

There is, of course, nothing “illusionary” about tens of millions moving to Hunter and other family members. But political spins are often built on illusions. The latest is that Joe Biden only benefits from these payments if they were directly deposited in his accounts. For a family that Hunter explained was “the best” at this type of dealing, it is absurd to expect a deposit slip from a corrupt Ukrainian official to the account of Joe and Jill Biden, one of the most vulnerable accounts in the world to review and monitoring.

Umbel

The perfect geometry of Hoya flowers

five-pointed double-star shapes that bloom from a sphere called an umbelpic.twitter.com/zZsxqyuFtk

— Science girl (@gunsnrosesgirl3) August 9, 2023

Croc

What does this look like to you? pic.twitter.com/cHfqzvgTAJ

— Fascinating (@fasc1nate) August 9, 2023

Hand bones

This is how the bones grow and form in your hand

[source, read more: https://t.co/g3yQQkJla3]pic.twitter.com/tbRSF6GluC

— Massimo (@Rainmaker1973) August 10, 2023

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.