Gabriel Loppé The Eiffel tower struck by lightning 1902

Why does climate change get so much more attention than species extinction? Because people see more profit in it.

• Habitat And Species Loss Threatens All Our Futures (G.)

As a UN conference convenes to work out a new deal for protecting the planet’s biodiversity, the focus falls on the nations that are not attending. Amid the worst loss of life on Earth since the demise of the dinosaurs, the agenda at the Convention on Biological Diversity (CBD) in the Egyptian resort of Sharm el-Sheikh could hardly be more important, but the spirit of international collaboration appears to be as much at risk of extinction as the world’s endangered wildlife. The United States has never signed up and Brazil is among a growing group of countries where new nationalist leaders are shifting away from global cooperation.

The two-week meeting of the CBD is its first in two years. It has always been the neglected sibling of its twin, the United Nations Framework Convention on Climate Change. The two organisations were conceived amid great hope at the Rio Earth summit in 1992 but while the energy transition has attracted heads of state interested in billion-dollar renewable projects, the effort to save the natural world has been left to weak environment ministries, conservation NGOs and underfunded scientists. Media research suggests there is only one news story about UN biodiversity talks for every 20 about UN climate negotiations. Coverage tends to focus on a few totemic species, such as lions, chimpanzees and pandas, rather than the collapsing ecosystems on which we depend.

[..] Since 1970 humanity has wiped out 60% of mammals, birds, fish and reptiles, according to the latest Living Planet report by WWF, which warned that the loss of wildlife was now an emergency that is threatening our civilisation. This followed a report earlier this year that one in eight bird species is threatened with global extinction. Recent studies have also tracked calamitous declines of pollinating insects in the US, Costa Rica and Germany, promoting warnings of ecological Armageddon. Cristiana Pasca Palmer, the head of the CBD, says we must stem the loss of biodiversity or face the prospect of our own extinction. But the global mechanics to do that are missing.

Part of the reason for the low level of interest is that the last two major biodiversity agreements – in 2002 and 2010 – have been ineffectual. At Nagoya in Japan eight years ago, the 196 signatory nations to the CBD signed up to the Aichi biodiversity targets: to at least halve the loss of natural habitats, ensure sustainable fishing in all waters, and expand nature reserves from 10% to 17% of the world’s land by 2020. With two years left in the Aichi plan, the conference this year will show that many of the 20 targets have been missed. And even apparent progress in the creation of new protected areas is misleading because governments from Brazil to China have done little to police these “paper reserves”.

The level of sociopathy here is blinding. Just count the dead on Kerry’s watch. But again, he’s talking about climate change. Because that’s where the money is. Makes you wonder what the real issue is: rising temperatures or people looking to get rich off of them. Remember the braindead Michael Bloomberg/Mark Carney paper I wrote about when it came out, on getting rich while saving the planet. Who’s your enemy, really?

• John Kerry: ‘People Are Going To Die Because Of The Decision Trump Made’ (G.)

“Here’s my feeling. And I’m certain of this.” He slows down. “I. Do. Not. Take. It. Personally. I’m sorry for the world. I’m sorry for my country, which looks ridiculous. Look, I’ve known all my life that this is a tough business, that politics is hard – that there are ups and down and if you personalise them you’re never going to survive.” Also, he points out, “I feel better than a lot of people think”, because Trump cannot affect the 194 countries still “doing Paris”, or even the 38 US states (plus Washington DC) committed to renewable energy portfolios regardless of the president’s edicts. The Iran deal is wounded, but still exists, he says. “In fact France, Germany, Britain, Russia and China all met few weeks ago in New York with the foreign minister of Iran, to talk about how to keep the deal moving forward.”

Surely he is angry, though? “You know what I’m angry about? People are going to die because of the decision Donald Trump made. My kids and my grandkids are going to face a difficult world because of what Donald Trump has done. But if you sound angry all the time, people aren’t going to listen to you.” Anger boiled over into a tweet last week, when he could not bear the farrago unfolding on Remembrance Day. “It was just a sad moment, for our country and for the presidency. The president of the United States did not go to an event because of rain, when those guys died in the rain, died in the snow, died in the gas, died in the mud, and not to honour them I thought was brutal.”

I’d say you don’t need to know much more than this. It’s just that the game of guessing which straw breaks the camel’s back doesn’t strike me as particularly useful.

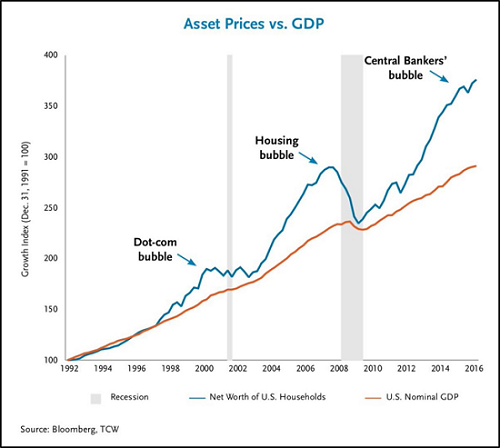

• Bear Market Growls (Roberts)

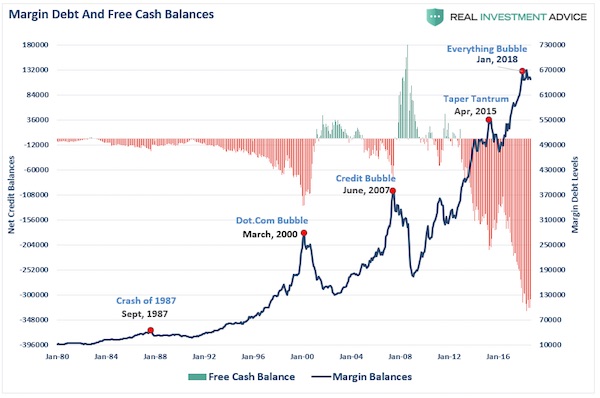

Fortunately, up to this point, there has not been a triggering of margin debt, as of yet, which remains the “gasoline” to fuel a rapid market decline. As we have discussed previously, margin debt (i.e. leverage) is a double-edged sword. It fuels the bull market higher as investors “leverage up” to buy more equities, but it also burns “white hot” on the way down as investors are forced to liquidate to cover margin calls. Despite the two sell-offs this year, leverage has only marginally been reduced.

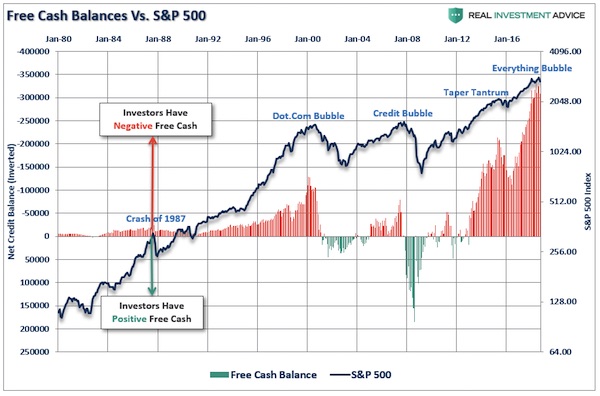

If you overlay that the S&P 500 index you can see more clearly the magnitude of the reversions caused by a “leverage unwind.”

The reason I bring this up is that, so far, the market has not declined enough to “trigger” margin calls. At least not yet. But exactly where is that level? There is no set rule, but there is a point at which the broker-dealers become worried about being able to collect on the “margin lines” they have extended. My best guess is that point lies somewhere around a 20% decline from the peak. The correction from intraday peak to trough in 2015-2016 was nearly 20%, but on a closing basis, the draft was about 13.5%. The corrections earlier this year, and currently, have both run close to 10% on a closing basis.

Does China think Trump will give in?

• APEC Leaders Divided After US, China Spat (AFP)

Leaders from 21 Asia-Pacific nations failed Sunday to bridge gaping divisions at a summit overshadowed by a war of words over the US and China as they vie for influence in the region. For the first time in the history of the APEC grouping, leaders were unable to agree on a formal written declaration amid sharp differences over trade policy. “The leaders agreed that instead of a traditional leaders’ declaration, they would leave it to the hands of PNG as the chair to issue a chair statement on behalf of all the members,” said Zhang Xiaolong, a spokesman from the Chinese foreign ministry. Canada’s Prime Minister Justin Trudeau admitted there were “different visions on particular elements with regard to trade that prevented full consensus on a communique document.”

The annual gathering, held for the first time in Papua New Guinea, was overshadowed by speeches from Chinese President Xi Jinping and US Vice President Mike Pence, which appeared to represent competing bids for regional leadership. Pence warned smaller countries not to be seduced by China’s massive Belt-and-Road infrastructure programme, which sees Beijing offer money to poorer countries for construction and development projects. The “opaque” loans come with strings attached and build up “staggering debt”, Pence charged, mocking the initiative as a “constricting belt” and a “one-way road”. He urged nations instead to stick with the United States, which doesn’t “drown our partners in a sea of debt” or “coerce, corrupt or compromise your independence”.

In a speech to business leaders just minutes before Pence, Xi insisted the initiative was not a “trap” and there was no “hidden agenda” – amid criticism that it amounts to “chequebook diplomacy” in the region. Xi also lashed out at “America First” trade protectionism, saying it was a “short-sighted approach” that was “doomed to failure”. [..] Trump — and Russian President Vladimir Putin – both decided to skip the gathering, leaving the spotlight on Xi who arrived two days early to open a Chinese-funded school and road in Papua New Guinea’s dirt-poor capital Port Moresby.

Putin and Trump were both absent. Why have the summit then? So Xi can shoot himself in the foot?

• Pence Vows No End To Tariffs Until China Bows (R.)

The United States will not back down from its trade dispute with China, and might even double its tariffs, unless Beijing bows to U.S. demands, Vice President Mike Pence said on Saturday. In a bluntly worded speech at an Asia Pacific Economic Co-operation (APEC) summit in Papua New Guinea, Pence threw down the gauntlet to China on trade and security in the region. “We have taken decisive action to address our imbalance with China,” Pence declared. “We put tariffs on $250 billion in Chinese goods, and we could more than double that number.” “The United States, though, will not change course until China changes its ways.”

The stark warning will likely be unwelcome news to financial markets which had hoped for a thaw in the Sino-U.S. dispute and perhaps even some sort of deal at a G20 meeting later this month in Argentina. U.S. President Donald Trump, who is not attending the APEC meeting, is due to meet Chinese President Xi Jinping in Argentina. Pence’s warning on Saturday contrasted with remarks made by Trump on Friday, when he said he may not impose more tariffs after China sent the United States a list of measures it was willing to take to resolve trade tensions. [..] There was no hint of compromise from Pence.“China has taken advantage of the United States for many years. Those days are over,” he told delegates gathered on a cruise liner docked in Port Moresby’s Fairfax Harbour.

Killing the petrodollar is a big responsibility. But the CIA wouldn’t have issued the assessment without strong evidence.

• Trump Calls CIA Assessment Of Khashoggi Murder Premature But Possible (R.)

President Donald Trump on Saturday called a CIA assessment blaming Saudi Crown Prince Mohammed bin Salman for the killing of Saudi journalist Jamal Khashoggi “very premature” and said he will receive a complete report on the case on Tuesday. Trump, on a trip to California, said the killing “should never have happened.” The report on Tuesday will explain who the U.S. government believes killed Khashoggi and what the overall impact of his murder is, Trump said. It was unclear who is producing the report. Trump also said the CIA finding that bin Salman was responsible for the killing was “possible.” Trump made the remarks hours after the State Department said the government was still working on determining responsibility for the death of Khashoggi.

“Recent reports indicating that the U.S. government has made a final conclusion are inaccurate,” State Department spokeswoman Heather Nauert said in a statement. “There remain numerous unanswered questions with respect to the murder of Mr. Khashoggi.” Nauert said the State Department will continue to seek facts and work with other countries to hold those involved in the journalist’s killing accountable “while maintaining the important strategic relationship between the United States and Saudi Arabia.” Trump discussed the CIA assessment by phone with the agency’s director, Gina Haspel, and Secretary of State Mike Pompeo while flying to California on Saturday, White House spokeswoman Sarah Huckabee Sanders told reporters.

The CIA had briefed other parts of the U.S. government, including Congress, on its assessment, sources told Reuters on Friday, a development that complicates Trump’s efforts to preserve ties with the key U.S. ally. A source familiar with the CIA’s assessment said it was based largely on circumstantial evidence relating to the prince’s central role in running the Saudi government. The CIA’s finding is the most definitive U.S. assessment to date tying Saudi Arabia’s de facto ruler directly to the killing and contradicts Saudi government assertions that Prince Mohammed was not involved.

NBC egg on face. ‘T is the season?

• Trump ‘Not Considering’ Extraditing Gülen to Turkey (Ind.)

President Donald Trump said on Saturday he is “not considering” extraditing an Islamic cleric self-exiled in the United States to Turkey. The extradition of Fethullah Gulen, accused of plotting a failed coup in 2016 to overthrow Turkish President Tayipp Erdogan, would be a strategic effort to persuade Turkey to lessen scrutiny on Saudi Arabia over the killing of journalist Jamal Khashoggi. In recent months, the Trump administration has been vigorous in its defence and flattery of its close ally Saudi Arabia – and the kingdom’s Crown Prince Mohammed Bin Salman – in hopes Riyadh will serve its role in carrying out the president’s Middle East foreign policy.

“No, it’s not under consideration,” Mr Trump said when pressed on whether or not he would extradite the Turkish cleric, a political opponent of Erdogan, to his home country. “We are looking, always looking at whatever we can do for Turkey.” Mr Trump’s statement comes three days after NBC News reported that his administration is looking into whether or not extraditing Mr Gulen could convince the Turkish president to soften pressure on Saudi Arabia for reportedly killing Mr Khashoggi, a Washington Post columnist critical of Riyadh, in its Istanbul consulate earlier last month.

The Jim Acosta show continues. CNN should cancel it.

• White House Press Pass Has Nothing To Do With The First Amendment (McMaken)

It’s difficult to see how something so limited and so unavailable to nearly everyone could be called a right. After all, not even all reporters can hope to secure a White House press pass. And non-reporters have even less chance of ever getting access. Access to White House media facilities and forums are a privilege reserved for a select few —and most of those few are wealthy operatives of extremely powerful media corporations. A press pass is clearly not a right in the same sense as a trial by jury, a right to be secure in one’s personal property, or a right to peaceably assemble. In theory at least, those rights apply to everyone unless voluntarily waived, or unless revoked through some sort of public due process.

Nor is it the case that just anyone who is recognized as a journalist gets access to the White House press room. The room, of course, is of a finite size — there are 49 seats — and access is limited. Only a select group of people is allowed in, and the credentialing process is controlled in part by the White House Correspondents’ Association which hardly hands out credentials as if they were a human right. [..] even if everyone who wanted it were somehow magically given space in the White House press room, it’s hard to see how hobnobbing with the White House communications staff forms a pillar of a free press or free inquiry. In other words, the very premise that a White House press pass is a critical component of a free press is questionable at best. After all, the press room, the communications staff, and the entire White House media apparatus exists to make the president look good.

It’s not there to offer a frank exchange of information, or to divulge any information the White House doesn’t want released. To find that sort of information, one would have to engage in real investigative journalism in which journalists uncover facts that powerful government officials would rather not be uncovered. That, of course, is what Julian Assange has done. But you won’t find many establishment American journalists defending him. No, in the minds of the Jim Acostas of the world, “journalism” consists of repeating the official talking points released at official press conferences. And this is a lucky thing for presidents, many of whom have long understood that the purpose of White House communications is to manipulate the press.

Delay will be at least a year if it happens.

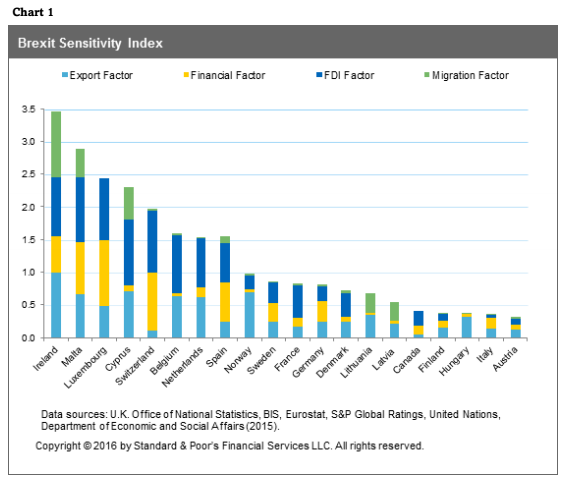

• Brussels Tells Theresa May Delaying Brexit Will Cost UK £10 Billion (O.)

The latest Opinium poll for the Observer on Sunday delivers more bad news for May, with Labour opening up a three-point lead. It shows Tory Leave supporters appear to be deserting May’s party in droves. Compared with a month ago, the Conservatives have dropped five points to 36% while Labour has gained three to stand on 39%. The proportion of Leavers backing the Tories has dropped by 10 points in one month. As May’s allies sprang to her defence and said she was “winning over the country”, Brussels threw a new spanner in the works by saying any extension of the 21-month transition period designed to smooth the UK’s exit must last at least a year beyond the end of December 2020.

May told an EU leaders summit last month that she might ask for a “few months” extra time if that was what was needed to complete an EU-UK trade deal and prevent the Irish backstop from coming into force. But on Saturday night Brussels was making clear that if the UK wants an extension of the transition – during which it is tied to the EU economic system but with no say over its rules – it must last at least a further year. A year-long extension would cost about £10bn on top of the £39bn divorce bill already agreed. Such a prospect will appal hardline Brexiters who already complain that the UK will have to spend almost two more years tied to the EU after Brexit on 29 March next year.

No Brexit at all is also still an option. The problem may well be that Brexit means something different to every single person.

• Tory MPs Warn Hardliners They May Abandon Brexit (Ind.)

Moderate Conservatives have warned they will push Britain towards tighter relations with the EU or even turn against Brexit altogether if “purists” in their party tear down Theresa May’s draft withdrawal deal. A string of Tory MPs told The Independent that Eurosceptic colleagues who have begun a sustained push to bring down both Ms May and her Brexit plans, should not be mistaken that a no-deal exit risking the livelihoods of British people is obtainable. The moderates say the only remaining option if Brexiteers block Ms May’s approach will mean being more closely bound to the single market or even revisiting the 2016 referendum result. Their warning comes as the Eurosceptic wing of the Conservatives launched a coordinated campaign against the draft deal to be signed off at an EU summit next weekend, and pushed for a vote of no confidence in the prime minister.

Ms May is set to continue her media offensive defending the deal on Sunday with a live interview in the morning, but Eurosceptics have also been in force attacking it. The pushback from Tory moderates began with pointed words from serving frontbencher Alistair Burt, who indicated that if Ms May’s plans fell, Brexiteers could not expect Remain-voting MPs to continue to go along with the result of the 2016 referendum regardless of the consequences. He wrote on Twitter: “Be very clear. If an agreed deal on leaving between the Govt and the EU is voted down by purist Brexiteers, do not be surprised if consensus on accepting the result of the referendum by Remain-voting MPs breaks down. “Parliament will not support no deal.”

Picking people up just to fill seats on a plane. Morals we have none.

• Activists Who Blocked Migrant Deportations Face Life in Prison In UK (IC)

Smoke is a founding member of Lesbians and Gays Support the Migrants, a group created in 2015 to stand in solidarity with migrant communities in the U.K., and also part of End Deportations, a group campaigning to end deportations that originally formed around the Stansted action. They chose to focus on one particular aspect of the U.K.’s deportation system: charter flights. While some migrants and asylum-seekers are deported on commercial flights alongside passengers traveling for business or pleasure, others are deported via private flights chartered by the Home Office, the government department responsible for immigration, security, and law and order. The Titan plane around which the Stansted 15 locked themselves in March 2017 was one of the latter.

[..] Freedom of Information requests have revealed that the Home Office chartered 93 deportation flights from January 2016 through May 2018, including the flight grounded by the Stansted 15. Most of these flights went to Pakistan, Albania, Nigeria, and Ghana, although a few also flew to Germany, France, and Bulgaria. Some carried over 50 deportees; most had less than 20 passengers being deported because of a criminal conviction. These destinations have shifted over time as the population of asylum-seekers has changed: Charter deportation flights in 2014 also frequented Afghanistan and Kosovo. The Stansted 15, along with many others who research or campaign around deportation, take issue with numerous aspects of deportation charter flights, starting with the way in which migrants and asylum-seekers are notified of them.

“It’s a weird numbers game where the government needs to fill seats on this plane to make it economically viable,” says Morten Thaysen, one of the co-founders of Lesbians and Gays Support the Migrants. There will often be “raids in the weeks leading up to the flight,” according to Thaysen. “People [are] being taken from marketplaces, workplaces, their home, and put in detention centers – these kind of immigration prisons – and then taken in the middle of the night on these secret flights where there are no witnesses. So it’s the brutality of how they function.” Some people, activists also argue, are not notified of their impending deportation with enough time to appeal the decision. “We see so many people on these flights whose cases haven’t been properly finished, haven’t had their cases heard properly,” says Thaysen.

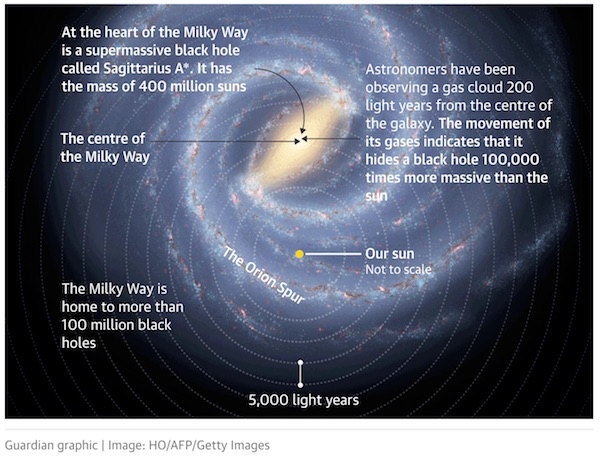

“Silica makes up around 60 percent of the Earth’s crust..”

• Glass Was Forged Inside The Heart Of An Exploding Ancient Star (AFP)

The next time you’re gazing out of the window in search of inspiration, keep in mind the material you’re looking through was forged inside the heart of an exploding ancient star. An international team of scientists said Friday they had detected silica — the main component of glass — in the remnants of two distant supernovae billions of light years from Earth. Researchers used NASA’s Spitzer Space Telescope to analyse the light emitted by the collapsing mega-cluster and obtain silica’s “fingerprint” based on the specific wavelength of light the material is known to emit. A supernova occurs when a large star burns through its own fuel, causing a catastrophic collapse ending in an explosion of galactic proportions.

It is in these celestial maelstroms that individual atoms fuse together to form many common elements, including sulphur and calcium. Silica makes up around 60 percent of the Earth’s crust and one particular form, quartz, is a major ingredient of sand. As well as glass windows and fibreglass, silica is also an important part of the recipe for industrial concrete. “We’ve shown for the first time that the silica produced by the supernovae was significant enough to contribute to the dust throughout the Universe, including the dust that ultimately came together to form our home planet,” said Haley Gomez, from Cardiff University’s School of Physics and Astronomy. “Every time we gaze through a window, walk down the pavement or set foot on a sandy beach, we are interacting with material made by exploding stars that burned millions of years ago.”