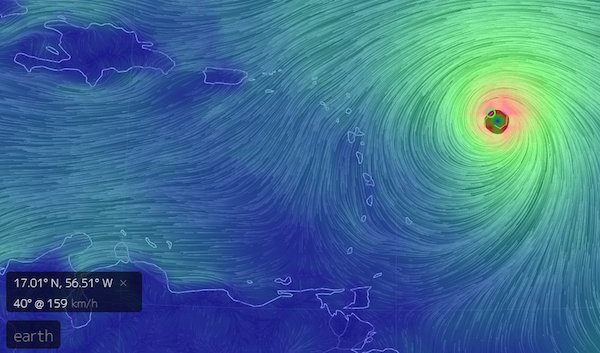

Irma

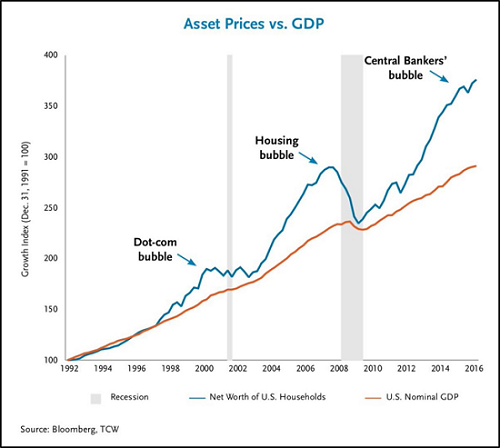

It takes ever more effort to keep a bubble inflated.

• The Supernova Nature Of Asset Bubbles (CHS)

The trouble with inflating asset bubbles is that you have to keep inflating them or they pop. Unfortunately for the bubble-blowing central banks, asset bubbles are a double-bind: you cannot inflate assets forever. At some unpredictable point, the risk and moral hazard that are part and parcel of all asset bubbles trigger an avalanche of selling that pops the bubble. This is another facet of The Fed’s Double-Bind: if you stop pumping asset bubbles, they pop as participants realize the music has stopped, and if you keep pumping them, they expand to super-nova criticality and implode.

There are several dynamics at play in this double-bind.

1. The process of inflating a bubble (for example, the current bubbles in stocks and real estate) requires pushing investors and speculators alike into risky asset classes. This puts the market at increasing risk as everyone is pushed to one side of the boat.

2. Those on the other side of the boat (i.e. shorts) are slowly but surely eradicated as the pumping keeps inflating the bubble. When the bubble finally bursts, there are no shorts left to cover, i.e. buy stocks at lower prices to reap their profits.

3. As the bubble continues to expand, the money available to enter the market and keep prices rising declines. The very success of the pumping process strips the markets of new sources of new money, leading to a point where normal selling exceeds new-money buying and the bubble collapses.

4. Money pumping by central banks and governments follows a curve of diminishing return. One analogy is insulin insensitivity: as the systemic distortions build, markets become increasingly insensitive to money pumping. Authorities respond to this intrinsic process of increasing insensitivity by pumping even more money into the system. But as with insulin insensitivity, at some point the system loses all sensitivity to money pumping: no matter how much money central authorities inject, the markets refuse to go higher. At this point, the stick-slip nature of bubbles manifests and modest selling triggers a collapse as participants all rush for the exits. Buyers have vanished and there is no longer a bid at any price.

5. Having pumped the assets higher with ever-greater injections of speculative risk and pumping, central banks and states have exhausted their ability to re-inflate assets as they collapse.

Systems cannot be controlled once risk and moral hazard have been raised to levels where instability is an intrinsic feature of the system. Those who actually believe the Fed can keep asset bubbles inflated at a permanently high plateau will discover their error in dramatic fashion, as the bigger the bubble, the more violent the implosion. This is the super-nova nature of asset bubbles: if you try to deflate the bubble slowly, it implodes, but if you keep inflating the bubble it eventually implodes from its internal extremes.

China needs its foreign reserves. The last thing it needs is a way for money to leave the country that it has no control over. Other countries have no choice but to follow suit.

• Bitcoin Tumbles as PBOC Declares Initial Coin Offerings Illegal (BBG)

Bitcoin tumbled the most since July after China’s central bank said initial coin offerings are illegal and asked all related fundraising activity to be halted immediately, issuing the strongest regulatory challenge so far to the burgeoning market for digital token sales. The People’s Bank of China said on its website Monday that it had completed investigations into ICOs, and will strictly punish offerings in the future while penalizing legal violations in ones already completed. The regulator said that those who have already raised money must provide refunds, though it didn’t specify how the money would be paid back to investors. It also said digital token financing and trading platforms are prohibited from doing conversions of coins with fiat currencies. Digital tokens can’t be used as currency on the market and banks are forbidden from offering services to initial coin offerings.

“This is somewhat in step with, maybe not to the same extent, what we’re starting to see in other jurisdictions – the short story is we all know regulations are coming,” said Jehan Chu at Kenetic Capital in Hong Kong, which invests in and advises on token sales. “China, due to its size and as one of the most speculative IPO markets, needed to take a firmer action.” Bitcoin tumbled as much as 11.4%, the most since July, to $4,326.75. The ethereum cryptocurrency was down more than 16% Monday, according to data from Coindesk. ICOs are digital token sales that have seen unchecked growth over the past year, raising $1.6 billion. They have been deemed a threat to China’s financial market stability as authorities struggle to tame financing channels that sprawl beyond the traditional banking system. Widely seen as a way to sidestep venture capital funds and investment banks, they have also increasingly captured the attention of central banks that see in the fledgling trend a threat to their reign.

The Chinese know how corrupt their countrymen are.

• China ICO Crackdown May Just Be The Start (R.)

China is poised to further tighten rules on virtual currencies after regulators on Monday banned virtual coin fundraising schemes, Chinese financial news outlet Yicai reported, citing sources. China banned and deemed illegal the practice of raising funds through launches of token-based digital currencies, targeting so-called initial coin offerings (ICO) in a market that has exploded since the start of the year. Yicai’s report late Monday cited a source close to decision-makers as saying the announcement on the ban was just the start of further follow-up regulations of virtual currencies. In total, $2.32 billion has been raised through ICOs globally, with $2.16 billion of that being raised since the start of 2017, according to cryptocurrency analysis website Cryptocompare.

Bitcoin rival ethereum, which token-issuers usually ask to be paid in and which has seen dramatic growth this year, fell sharply on the news. It was down almost 20% on Monday at $283, according to trade publication Coindesk. Bitcoin was also down 8%, while the total value of all cryptocurrencies was down around 10% after China’s ban was announced, according to industry website Coinmarketcap.com.

Wonder what reporting will look like if islands are destroyed but US mainland is not.

• Caribbean, Florida Brace For Hurricane Irma (BBC)

Hurricane Irma has been upgraded to a powerful category four storm as warnings have been issued for several Caribbean islands. The hurricane had sustained winds of up to 220km/h (140mph) and was likely to strengthen in the next 48 hours, the US National Hurricane Center (NHC) said. Irma was projected to hit the Leeward Islands, causing storm surges, life-threatening winds and torrential rain. The US state of Florida has declared a state of emergency. It comes as residents in Texas and Louisiana are reeling from the effects of Hurricane Harvey, which struck as a category four storm, causing heavy rain and destroying thousands of homes. However the NHC warned that it was too early to forecast Irma’s exact path or effects on the continental US. Irma was set to reach the Leeward Islands, east of Puerto Rico, by late Tuesday or early Wednesday (local time), the centre added.

The storm was moving at a speed of 20km/h (13mph). It may cause rainfall of up to 25cm (10in) in some northern areas and raise water levels by up to 3m (9ft) above normal levels, the NHC said. Puerto Rico also declared a state of emergency and activated the National Guard. Governor Ricardo Rossello announced the opening of emergency shelters able to house up to 62,000 people, and schools would be closed on Tuesday. Long queues of people formed in shops, with residents stocking water, food, batteries, generators and other supplies. Hurricane warnings have been issued for the islands of Antigua and Barbuda, Anguilla, Montserrat, St Kitts and Nevis, St Martin, Sint Maarten, St Barthelemy, Saba, St Eustatius, Puerto Rico, British Virgin Islands and US Virgin Islands. It means that hurricane conditions are expected in the next 36 hours.

Absurdity.

• Landlords Demand Rent On Flooded Houston Homes (G.)

An acute housing crisis is starting to grip thousands of other families in south-east Texas as the floodwaters ebb away, with a death toll put at 60 on Monday. More than 180,000 houses in the Houston area have been badly damaged, with only a fraction of occupants owning any flood insurance. And under Texas law, rent must still be paid on damaged dwellings, unless they are deemed completely uninhabitable. A spokeswoman for the city of Houston’s housing department said city officials “are aware these problems exist” but said that state law deals with the situation. She said the city was still assessing the total number of people in need of housing assistance. Under the Texas property code, if a rental premises is “totally unusable” due to an external disaster then either the landlord or tenant can terminate the lease through written notice.

But if the property is “partially unusable” because of a disaster, a tenant may only get a reduction in rent determined by a county or district court. “There are a lot of property owners who aren’t conscious of what has gone on; they are being rude and kicking people out,” said Isela Bezada, an unemployed woman who lived with 10 family members in a Houston house until her landlord took her to court to evict her after the hurricane hit. Bezada, like Fuentes, has had almost every area of her life touched by the flood. Her relatives, who work in home renovations, have little opportunity to bring in money until the full gutting of sodden houses – piles of torn up carpet, broken chairs and children’s toys have become a common adornment to the front of Houston homes – and she worries about other family members stranded in Port Arthur by a flooded highway.

Greece first.

• Germany Must Pay Poland Up To $1 Trillion In Reparations – Minister (Ind.)

Germany should consider paying Poland as much as $1 trillion in World War II reparations, according to the Polish foreign minister. Poland’s foreign minister Witold Waszczykowski told local radio station RMF that “serious talks” were needed with Germany to “find a way to deal with the fact that German-Polish relations are overshadowed by the German aggression of 1939 and unresolved post-war issues.” He said Poland’s material losses were about $1 trillion, or higher. Polish defense minister Antoni Macierewicz also accused European critics of trying to “erase” the fate of the Poles at German hands during the war “from the historical memory of Europe”.

The country’s right-wing government has dismissed a 1953 resolution by Poland’s former communist government which dropped any claim to reparations from Germany, and are instead claiming that Germany is “shirking” its moral responsibility. Critics of the government say they are talking about reparations to divert attention from their nationalistic agenda. Around six million Polish citizens, including about three million Jews, were killed during the war and much of Warsaw was destroyed. Mr Waszczykowski did not say when Poland would make public its formal position on repatriations.

Just keep saying populist often enough. He’s right about the euro: “a currency tailor-made for the German economy.”

• Populist Hopeful Shunned by Italian Elite on Shores of Lake Como (BBG)

Populist would-be premier Luigi Di Maio had an awkward introduction to the Italian elite. The Five Star Movement’s most likely candidate for next year’s election was ignored by Italy’s business and financial establishment when he arrived at an exclusive networking event by Lake Como on Sunday. Di Maio, 31, was reduced to posing for photographers, while a passing banking executive muttered that he hoped the populist might learn something from his visit. His group, which wants a referendum on Italy’s euro membership, is virtually tied in opinion polls with the Democratic party of ex-premier Matteo Renzi, and with a possible center-right alliance including the Forza Italia party of Silvio Berlusconi. Di Maio sought to reassure.

Those opinion polls – as well as the possibility of a hung parliament – are prompting fears of political instability and financial turbulence with elections due by late May, even as the third-biggest economy in the euro area recovers from its worst recession since World War II. “We don’t want a populist, extremist or anti-European Italy,” he told the Ambrosetti Forum in Cernobbio, in a bid to win round his skeptical audience. The euro referendum plan is simply “a last resort,” he added, to force reforms of the European Union and “a currency tailor-made for the German economy.”

The proposals of Five Star, co-founded by ex-comic Beppe Grillo, also include a monthly €780 “citizen’s income” for the poor and the jobless, purging private lenders from control of the Bank of Italy, and tougher penalties for managers of bankrupt banks. “We want to stay in the EU and discuss some of the rules which are suffocating and damaging our economy,” Di Maio said. “And the money we’re giving the EU budget every year must be one of the themes to put forward to the other countries.” Many of those ideas were anathema to those debating world affairs at the luxury Villa D’Este hotel – a five-star institution with which the assembled ruling class was altogether more comfortable.

Xi has to polish his image before the Congress in October. He can’t let this continue.

• China May Be The Real Target Of North Korea’s Pressure (AFP)

North Korea’s escalating nuclear provocations are putting putative ally China in an increasing bind, and may be part of a strategy to twist Beijing’s arm into orchestrating direct talks between Pyongyang and Washington, analysts said. The North’s Kim dynasty has repeatedly used nuclear brinkmanship over the years in a push to be taken seriously by the United States but traditionally avoided causing major embarrassment to China, its sole major ally and economic lifeline. But leader Kim Jong-Un’s detonation Sunday of what he called a hydrogen bomb marked the second time this year that the 33-year-old family scion upstaged Chinese President Xi Jinping just as he was hosting a carefully choreographed international gathering.

Communist propaganda deifies Xi as an infallible father figure, but Kim’s actions are puncturing the facade and exposing the Chinese leader’s impotence toward the nuclear crisis on his doorstep. “North Korea’s repeated nuclear and missile tests have put China in a more and more difficult position,” said Shi Yinhong, Director of the Center for American Studies at Renmin University in Beijing. Shi said Kim – who has never met Xi – had become “more and more hostile towards China” after Beijing signed on to tougher new international sanctions against Pyongyang. That has apparently made Kim more willing to bring pressure on Xi, said Jean-Pierre Cabestan, a political science professor at Hong Kong Baptist University. Kim may be using Xi “like a cue ball in billiards,” Cabestan said, “in order to get negotiations with the United States.” “But he has to be careful not to infuriate Xi as China is his only lifeline.”

Pyongyang’s sixth nuclear test, by far its most powerful to date, came just as leaders of the five BRICS emerging economies – Brazil, Russia, India, China, and South Africa – gathered for a summit. The meeting in the southeastern city of Xiamen was intended to be the typical China-hosted event — micromanaged to the smallest detail to portray Xi at home as a wise and benevolent world leader. But Kim stole the spotlight, just as he did in May when the North conducted a missile test that embarrassed Xi as he hosted a large international summit on trade.

Valid points.

• Nuclear-Armed Nations Brought The North Korea Crisis On Themselves (G.)

North Korea’s defiant pursuit of nuclear weapons capabilities, dramatised by last weekend’s powerful underground test and a recent long-range ballistic missile launch over Japan, has been almost universally condemned as posing a grave, unilateral threat to international peace and security. The growing North Korean menace also reflects the chronic failure of multilateral counter-proliferation efforts and, in particular, the longstanding refusal of acknowledged nuclear-armed states such as the US and Britain to honour a legal commitment to reduce and eventually eliminate their arsenals. In other words, the past and present leaders of the US, Russia, China, France and the UK, whose governments signed but have not fulfilled the terms of the 1970 nuclear non-proliferation treaty (NPT), have to some degree brought the North Korea crisis on themselves.

Kim Jong-un’s recklessness and bad faith is a product of their own. The NPT, signed by 191 countries, is probably the most successful arms control treaty ever. When conceived in 1968, at the height of the cold war, the mass proliferation of nuclear weapons was considered a real possibility. Since its inception and prior to North Korea, only India, Pakistan and Israel are known to have joined the nuclear “club” in almost half a century. To work fully, the NPT relies on keeping a crucial bargain: non-nuclear-armed states agree never to acquire the weapons, while nuclear-armed states agree to share the benefits of peaceful nuclear technology and pursue nuclear disarmament with the ultimate aim of eliminating them. This, in effect, was the guarantee offered to vulnerable, insecure outlier states such as North Korea. The guarantee was a dud, however, and the bargain has never been truly honoured.

Rather than reducing their nuclear arsenals, the US, Russia and China have modernised and expanded them. Britain has eliminated some of its capability, but it is nevertheless renewing and updating Trident. France clings fiercely to its “force de frappe”. Altogether, the main nuclear-weapon states have an estimated 22,000 nuclear bombs. A report by the non-governmental British-American Security Information Council in May said nuclear security was getting worse. “The need for nuclear disarmament through multilateral diplomacy is greater now than it has been at any stage since the end of the cold war. Trust and confidence in the existing nuclear non-proliferation regime is fraying, tensions are high, goals are misaligned and dialogue is irregular,” the report said.

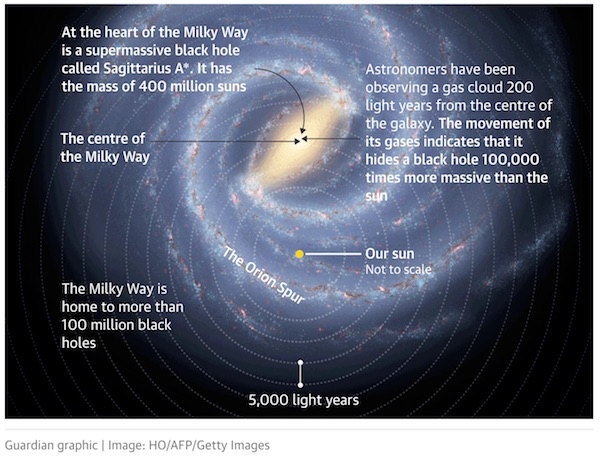

It’s only 100,000 suns. The biggest one is 4,000 times larger.

• New Kind Of Black Hole Found At The Centre Of The Milky Way (RT)

A new kind of black hole has been found at the centre of the Milky Way – a find that may help explain the evolution of the phenomena. In research conducted by Japanese astronomers using the ALMA Observatory in northern Chile, a black hole 100,000 times the size of our sun was found within a molecular gas cloud. Its relatively small size means that it is the first to be identified as an intermediate-mass black hole (IMBH). Professor Tomoharu Oka of Japan’s Keio University believes that black holes with masses greater than a million solar masses are at the centre of all galaxies and are essential to their growth. The origins of supermassive black hole, however, remain a mystery. “One possible scenario is IMBHs – which are formed by the runaway coalescence of stars in young compact star clusters – merge at the centre of a galaxy to form a supermassive black hole,” said Prof Oka.

Using the ALMA telescope, the team observed the cloud more than 195 light years from the centre of the Milky Way. In findings published in the journal Nature Astronomy, Prof Oka then used computer simulations to show the high speed motion of the gas cloud, which the team concluded was a sign that it is surrounding a black hole. “Based on the careful analysis of gas kinematics, we concluded a compact object with a mass of about 100,000 solar masses is lurking in this cloud,” Prof Oka added. The IMBH is the second-largest black hole discovered in the Milky Way next to Sagittarius A*, which is 400 million times the size of our sun. According to theories, the Milky Way should be home to about 100 million smaller black holes, but only 60 have been found.

“.. the absence of evidence for later humans could suggest that the journey “may not have ended well..”

• Established Story That Humans Came From Africa May Be Wrong (Ind.)

The belief that humans came out of Africa millions of years ago is widely believed. But it might be about to be entirely re-written, according to the authors of a new study. They claim to have found a footprint in Crete that could change the narrative of early human evolution, suggesting that our ancestors were in modern Europe far earlier than we ever thought. The accepted story of the human lineage has been largely set since researchers found fossils of our early ancestors in South and East Africa, in the middle of the 20th century. Later discoveries appeared to suggest that those that followed remained isolated in Africa for millions of years before finally moving out and into Europe and Asia. But the new discovery of a footprint that appears to have belonged to a human that trod down in Crete 5.7 million years ago challenges that story.

Humans may have left and been exploring other continents including Europe far earlier than we knew. “This discovery challenges the established narrative of early human evolution head-on and is likely to generate a lot of debate,” said Professor Per Ahlberg, who was an author on the study. “Whether the human origins research community will accept fossil footprints as conclusive evidence of the presence of hominins in the Miocene of Crete remains to be seen.” The study looked at the characteristics of the footprint, in particular examining its toes. It found that the footprint didn’t have claws, walked on two feet and had inner toes that went out further than its outer ones. All of that led them to conclude that the foot appeared to belong to our early human ancestors, who could have been walking around Europe at an early time than we ever knew.

They also make clear that the owner of the footprint and their species could have developed the same traits separately from those in Africa. At the time the footprint was made, the Sahara Desert didn’t exist and lush, savannah-like environments went all the way from North Africa to the eastern Mediterranean, and Crete hadn’t yet detached from the Greek mainland. All of that makes it easier to see how those early hominins made their way to the island. But the journey might not run into problems. Mark Maslin from University College London told The Times that while the discovery supports the idea that our ancestors used their new found bipedalism to walk into modern Europe, the absence of evidence for later humans could suggest that the journey “may not have ended well”.

Home › Forums › Debt Rattle September 5 2017