Jack Delano A welder in the roundhouse of the Chicago and North Western Railroad’s Proviso yard 1942

It’s rare that I reach back into the past of the Automatic Earth, but it’s not entirely unique either. The reason I do it today is not only the relevance of the article -in my view-, or the fact it was published so long ago, but it’s that the ‘world’ has changed so much since January 1 2014, the date I wrote the piece below, as Everything Better Is Purchased At The Price Of Something Worse. It’s gained much new relevance since.

This essay, way back when, dealt with Carl -Gustav- Jung, probably the most influential psycho-analist we’ve ever known (he’s having a heated discussion with Freud about this as we speak, over a glass of brandy), and his take in the 1950s on our ability to incorporate new technologies into our lives, our minds and brains.

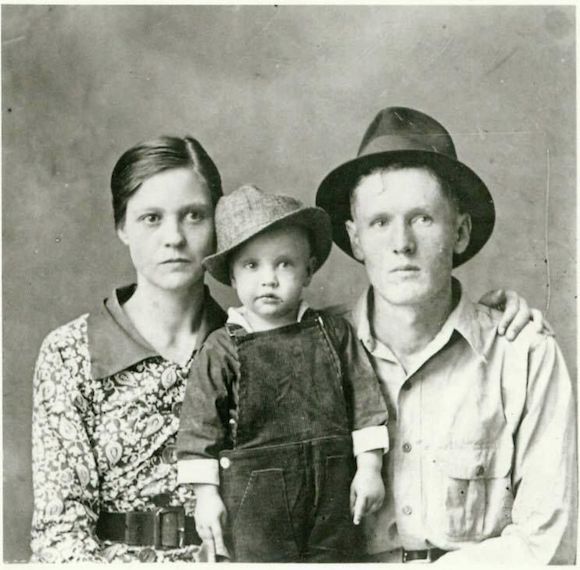

Jung couldn’t have dreamt how much of that was yet to come, but he already put some very dire warnings out there. His main point appears to be that our capacity to ’embrace’ anything new is per definition -very- limited because we ARE our ancestors, and whatever they never knew, we will have a hard if not impossible time making part of our lives.

It’s just that, as he warns, we are completely blind to this. Once you lose the link to your ancestors, you will move away from them ever faster. Because there’s nothing left to anchor you. But at the same time, you ARE your ancestors.

I am thinking about this on a near constant basis as I see people sit or move around with their iPhones et al, and their Facebook and Instagram et al, and I wonder what they did with their lives before they could walk the streets bumping into each other -or the odd car- before a constant link to faraway places seemed appropriate and/or needed.

Jung already thought about this, before it existed, 60-odd years ago. He framed it as: what are you giving up for what you gain? But of course the whole younger part of the poulation, who’ve never known anything else, have no notion of having given up anything. They never did anything else with their lives.

Well, Jung had a completely different idea. He said our brains haven’t even processed the times we never knew, ‘primitivity’, ‘antiquity’, or the Middle Ages yet, let alone radio, TV, or the internet. “We are very far from having finished completely with the Middle Ages, classical antiquity, and primitivity, as our modern psyches pretend.”

Carl Jung claimed that our only true frame of reference is our ancestors, and since they never knew radio, TV, internet, we cannot incorporate such things into our lives without losing our connection to them. But we ARE them, and if we would ever lose that connection, we would be beyond lost. We’d be gone. First mentally, then -inevitably- physically.

And what we label ‘progress’ is then merely a way to move ever faster awasy from what we really are, which is the ancestors that gave birth to us. Gone, lost, into some empty space, with no grounding and no purpose.

Perhaps that goes a ways towards explaining why we are destroying the planet we live on. We lost the connection to who we are. We are focused today only on progress, on the future, and not on the present, because the present requires a link to the past.

Here’s my take on this 5.5 years ago. Before all these millions of zombies were stalking the streets looking only at their phones, eagerly – nay, desperately- awaiting messages from people thousands of miles away. Mostly about what food they eat, no less, or what dress they wear.

The concept of what constitutes our lives has changed profoundly. It is no longer the people around us, or even the landscape, our lives now are made up of people who are not here (and landscapes in travel brochures and nature documentaries). That is quite something.

Carl Jung said quite a while ago that our minds and brains cannot handle that. But there you are and here we go.

Ilargi, Jan 1 2014: I thought I’d start off 2014 on a philosophical note, with something that I hope perhaps people will remember as the year progresses, or even through the rest of their lives, and share with those around them. In my humble view, that would do the planet a world of good. But it’s not easy; we have wandered far.

There are many things we have neglected and forgotten, if not never understood or even thought about, that are nevertheless essential to our personal well-being and that of our surroundings. If anyone in the western world has considered and analyzed these forgotten ‘things’, it’s Carl Gustav Jung, the psycho-therapist who died in 1961. Jung defined the collective unconscious, archetypes and synchronicity, among many other things. It was his active interest in Eastern civilization and philosophies that led him to ponder how the collective unconsciousness influences our notion of progress.

In general, Jung suggested that our minds are woefully ill-equipped to incorporate progress into our lives when it takes the shape of new methodology, and new machinery, gadgets, because we don’t have a suitable frame of reference for them. We interpret the world through the frame of reference embedded in our minds that was built through countless generations of our ancestors. That is not to say we can never comprehend or incorporate new things, but that it must always be a gradual process, and if we are not at all times sufficiently aware of how this process takes place, as it takes place, we will lose ourselves, because we risk losing our connection to our ancestors, and we ARE, in essence, our ancestors.

In particular, we need to be aware of the fact that there is no such thing as absolute progress, that every time we add something to our world, we take something away as well. It’s the Eastern notion of balance, of yin and yang, at play: Everything Better Is Purchased At The Price Of Something Worse. Life does not by definition only get better when someone invents a new phone or car or facial cream, even if that phone makes it easier to talk to someone thousands of miles away, or the car makes it easier to go see people, or get away from them, or the cream dissolves wrinkles like magic. It doesn’t work like that. We pay a price: for everything we add, we lose something. The question then becomes: what do we value most. But that’s a question we never ask: we see everything new as an addition to our lives, and ignore what gets taken away from us.

As Jung wrote about these issues, probably in the late 1950s, the world was very different from what it is today. If he were alive now, he would undoubtedly have found that difference very painfully unsettling, and declared it dangerous for all of mankind. When we lose our connection to the collective references passed on by those whose DNA we carry, references that we are born with, we lose our connection with ourselves, and we become disoriented, dissatisfied.

There is no happy ending to this process. It needs to be shut down at some point, and therefore it will, in order for us to reconnect with our own minds and brains, which owe their composition and very existence to our forefathers. But for the process to be shut down, we must be deprived of both our ability and our drive to generate progress, since we will never volunteer to stop. We must go on, because we lost our connection to ourselves. There is no way back, not if we insist on keeping on going “forward”. That suggests a return to a sort of stone age world is the only possible outcome.

It is precisely Jung and Freud’s insights into the human mind that have made it possible for politicians and advertisers and other tricksters to fool us into thinking we want or need the things that make our world poorer, not richer. There is a huge amount of irony in this: that we use our increased ability to understand our minds in order to fool ourselves. If that doesn’t prove that Everything Better Is Purchased At The Price Of Something Worse, what does?

Although it would be best to incorporate the principle into our lives as just that, a general principle, it is of course possible to name specific examples. The automobile, the car, has brought us a lot of pleasure and comfort. It has also polluted our world like maybe no other single invention has ever done. And that’s not even the worst part: the car has cut through our communities like a gutting knife (to the point where we have no recollection of what these communities used to look like), separating us from each other, turned public space into no-go zones, and arguably been made more important than the people whose comfort they were was supposed to serve. For many people who have no car, for one reason or another, their own communities have become de facto inaccessible and unnavigable.

And the car is an easy example. What about medicine? We have, through progress in medicine, been able to save so many people from dying, and/or enabled them to die later, that our population has exploded, a huge problem in more ways than I could even attempt to discuss here. And that’s a hard one: nobody, including me, will suggest we stop saving lives, or start killing people, but there is a problem all the same. Everything Better Is Purchased At The Price Of Something Worse.

We can all come up with many examples, fridges, supermarkets, nuclear plants, photographs, indoor plumbing, and think about how they have changed our lives for the better or the worse. But I don’t think it’s a good idea to risk losing ourselves in examples. We should keep sight of the overriding principle: that we risk destroying our world as we seek to improve it. And that the lessons from a behemoth mind like Jung’s should be used to make us wiser, not to fool us into buying things that harm our lives.

You could be forgiven for thinking that Jung’s prolific writing should be obligatory course material in every single educational institution on the planet, but then you wouldn’t understand your world’s priorities, now, would you? We go with what we find convenient, not with what can make us wiser people. We pick material wealth over mental wealth any day and every day, or mental wealth only if there’s money in it. And perhaps that points to the reason why we find people like Carl Gustav Jung so easy to ignore.

I’ll leave you with Jung’s own words, after saying this: Our rush to obtain new things, a rush we call progress, and to make money from these new things – after all, what money is there in old things? – has disconnected us from our ancestors. Unfortunately, we ARE our ancestors. There is a price we pay for everything that is different today from what is was when our parents were our age, and our grandparents, and their parents before them, and so on. We ignore that price, and pretend we don’t need to pay it, encouraged by the fact that it doesn’t always have to be paid immediately, and we can leave it to our kids to settle the bill. Something we do all too willingly, which somehow puts our connections to our ancestors in a cynical, bleak light even more.

Here’s Jung from his book ‘Memories, Dreams, Reflections’, published in 1963, 2 years after his death, in the paragraphs with which he closes the chapter “The Tower”:

Our souls as well as our bodies are composed of individual elements which were all already present in the ranks of our ancestors. The “newness” in the individual psyche is an endlessly varied recombination of age-old components. Body and soul therefore have an intensely historical character and find no proper place in what is new , in things that have just come into being. That is to say, our ancestral components are only partly at home in such things. We are very far from having finished completely with the Middle Ages, classical antiquity, and primitivity, as our modern psyches pretend.

Nevertheless, we have plunged down a cataract of progress, which sweeps us on into the future with ever wilder violence the farther it takes us from our roots. Once the past has been breached, it is usually annihilated, and there is no stopping the forward motion. But it is precisely the loss of connection with the past, our uprootedness, which has given rise to the “discontents” of civilisation and to such a flurry and haste that we live more in the future and its chimerical promises of a golden age than in the present, with which our whole evolutionary background has not yet caught up.

We rush impetuously into novelty, driven by a mounting sense of insufficiency, dissatisfaction, and restlessness. We no longer live on what we have, but on promises, no longer in the light of the present day, but in the darkness of the future, which, we expect, will at last bring the proper sunrise. We refuse to recognise that everything better is purchased at the price of something worse; that, for example, the hope of greater freedom is cancelled out by increased enslavement to the state, not to speak of the terrible perils to which the most brilliant discoveries of science expose us.

The less we understand of what our fathers and forefathers sought, the less we understand ourselves, and thus we help with all our might to rob the individual of his roots and his guiding instincts, so that he becomes a particle in the mass, ruled only by what Nietzsche called the spirit of gravity.

Reforms by advances, that is, by new methods or gadgets, are of course impressive at first, but in the long run they are dubious and in any case dearly paid for. They by no means increase the contentment or happiness of people on the whole. Mostly, they are deceptive sweetenings of existence, like speedier communications, which unpleasantly accelerate the tempo of life and leave us with less time than ever before. Omnis festinatio ex parte diaboli est – all haste is of the devil, as the old masters used to say.

Reforms by retrogressions, on the other hand, are as a rule less expensive and in addition more lasting, for they return to the simpler, tried and tested ways of the past and make the sparsest use of newspapers, radio, television, and all supposedly timesaving innovations.

In this book I have devoted considerable space to my subjective view of the world, which, however, is not a product of rational thinking. It is rather a vision such as will come to one who undertakes, deliberately, with half-closed eyes and somewhat closed ears, to see and hear the form and voice of being. If our impressions are too distinct, we are held to the hour and minute of the present and have no way of knowing how our ancestral psyches listen to and understand the present – in other words, how our unconscious is responding to it. Thus we remain ignorant of whether our ancestral components find elementary gratification in our lives, or whether they are repelled. Inner peace and contentment depend in large measure upon whether or not the historical family, which is inherent in the individual, can be harmonised with the ephemeral conditions of the present.

In the Tower at Bollingen it is as if one lived in many centuries simultaneously. The place will outlive me, and in its location and style it points backwards to things of long ago. There is very little about it to suggest the present. If a man of the sixteenth century were to move into the house, only the kerosene lamp and the matches would be new to him; otherwise, he would know his way about without difficulty.

There is nothing to disturb the dead, neither electric light nor telephone. Moreover, my ancestors’ souls are sustained by the atmosphere of the house, since I answer for them the questions that their lives once left behind. I carve out rough answers as best I can. I have even drawn them on the walls. It is as if a silent, greater family, stretching down the centuries, were peopling the house. There I live in my second personality and see life in the round, as something forever coming into being and passing on.