Howard Hollem Times Square and vicinity on D-Day June 6, 1944

When I see a headline like this one at Bloomberg today, World Needs Record Saudi Oil Supply as OPEC Convenes, there’s just one thought that pops into my head: what the world needs is for us to stop doing this thing we’re doing. Even apart from peak oil concerns, it’s obvious we’re going to run out at some point or another, and it doesn’t matter whether that’s tomorrow or at some other point in the future, though we do know it’s not going to take another 100 years, or even 50.

And nothing will ever take the place of oil; once those unique carbons are gone, that’s it, we’ll have to find a completely different way of running our societies, and if we’re not smart enough to prepare for that beforehand, we’ll be cats fighting in a sack and use the last scraps to kill off each other. And our legacy won’t be the Greek thinkers and Picasso and Dostoyevsky and Walt Whitman and Maria Callas, since there won’t be the means for our children anymore to share what makes man great between them. Our main legacy will instead be bloodshed, we will have gone the exact same path that any non-thinking or even primitive organism would have taken, who don’t have opera or philosophy or poetry to their name.

The reason a reporter chooses to say the world ‘needs’ all that oil may tell us a lot about ourselves, about where we are and where we’re going. The word ‘need’ is a choice we make, but that does not mean it reflects reality. ‘Want’ sounds far more applicable. We may ‘need’ the oil to continue on our chosen path, but that doesn’t mean the path is well-chosen. And we have the ability to think about different paths, and what each might mean for us, our children and our species going forward. The path we’re on is an obvious dead end, even if there are many amongst us who think they, and we, are so smart we can find our way out of any dead end predicament, including the loss of the carbons that have shaped our world for a 150 year long, even for mankind, fleeting moment in time.

There is no other energy source waiting in the wings to take over, and even if there were we can’t escape thermodynamics. Which we have understood – we can do that – and which spells out very clearly that there is a price attached to all use of energy, and the only thing sane and wise (don’t you want to be sane and wise?) to do is to use it sparingly, to only use what we need. And we don’t need to use all that oil, even if we might want to. Our economic system needs for us to use it, and in ever larger quantities, but we don’t need either the economic system nor the oil in order to survive. We have packed our homes with things we don’t need, produced with the energy and building blocks the oil provides. For our economic system to survive we’ll have to buy a whole lot more stuff we don’t need, because it’s based on more, on growth and more growth, till death do us part.

We can lead very wonderful and fulfilling lives without economic growth, people have done it for 100,000 years and more. What makes us special and worthwhile, the paintings, the songs, the words that evoke emotions and stir our hearts and souls, are not based on economic growth. We have invented many things that enhance the quality of our lives, but we haven’t conceived of the limits to use them with. It appears we are incapable of recognizing what makes our lives, our very existence, worth living. Most of us today seem to think it’s oil, or money, or cars or airco’s or processed food, but that’s not it. It may be a matter of taste, and it’s all really democratic, but we might still take Oscar Wilde to heart who said that everything popular is wrong. We might want to make scrutinizing ourselves, our behavior, our needs and demands, a major part of every school’s curriculum and every day on the job.

We know we can do it, that we can look at ourselves and say maybe so and so is not the way to go, maybe I should hold off on this or that, and many of us do just that – though not nearly enough-. But holding back, not using something when we have the opportunity to use it, is not our strength. Perhaps as individuals, and only at times, but certainly not as part of a group, even if there are specific groups dedicated to just that. In general, we will follow the leaders that promise us the optimal ways to use as much as we can, provided we purchase as many things we don’t need as we possibly can, and encourage us to venture into debt to do it.

What that ‘World Needs Record Saudi Oil Supply as OPEC Convenes’ headline tells us, and what many other things do as well, is that we need to make up our minds about where we want to go, because the clock is ticking. If we want poetry instead of warfare, and Puccini instead of fields filled with rotting corpses, then we still have the option to make those choices. To do that, though, we need to realize that we are drowning in things we don’t need, produced with oil we don’t need nearly as much of as we’re using, and that if we don’t snap out of whatever mindset it is that got us in this situation, we won’t even have the things we actually do need anymore. Because we will have used them up to stuff our lives and our homes with things we don’t need. It’s not even rocket science, is it?

So the next time you see someone claim the world needs more oil, or a pundit or politician tries to tell you we need economic growth, know for yourself that both claims are nonsensical bogus. We just about literally need these things like we need a hole in our heads. Or, since we haven’t run out of oil and credit yet, perhaps it would be more accurate to say a hole in our children’s heads. But do we really see those two options as different outcomes? Are holes in our kids’ heads less bad than our own? We can’t plead stupidity, because we know we are capable of understanding the consequences of our actions well enough to apply a precautionary principle to our lives and to be sufficiently careful about putting holes in our children’s heads.

Which begs the question, if we can’t plead stupidity, what else is there? How do we live with ourselves? Is it all the stuff we buy that manages to numb our brains and consciences? Do you ever stand in front of a mirror and ask yourself for a long enough time why you are where you are, why you think that having an X amount of money in the bank is a good thing for you, and at the same time ponder the damage the life you live does to the planet, to everything alive on it, to the people you share it with, and those who will come after you? Do you think economic growth is a good thing when you look around your home, your street, your town, and see all the things in there that you know very well you don’t need and neither do the others? How did you get here?

• World Needs Record Saudi Oil Supply as OPEC Convenes (Bloomberg)

OPEC ministers say they will almost certainly leave their oil-production ceiling unchanged when the group meets this week. What really matters for global markets is whether Saudi Arabia will respond to global supply shortfalls by pumping a record amount of crude. Just six months ago, energy analysts predicted output from the Organization of Petroleum Exporting Countries would climb too high and Saudi Arabia needed to cut to make room for other suppliers. They changed their minds after production from Libya, Iran and Iraq failed to rebound as anticipated, and industrialized nations’ stockpiles fell to the lowest for the time of year since 2008. Saudi Arabia may need to pump a record 11 million barrels a day by December to cover the other member nations, says Energy Aspects Ltd., a consultant.

“Now it’s not whether the Saudis will make room, but whether they’ll keep it going and maintain enough spare capacity,” said Jamie Webster, a Washington-based analyst at IHS Inc., an industry researcher. “OPEC is increasingly having a hard time just doing its job of bringing all the barrels needed.” Even as the North American shale revolution propels U.S. production to a three-decade peak, supply in other parts of the world is faltering. A battle for political control in Libya, pipeline attacks in Iraq and prolonged sanctions against Iran are preventing those nations from reviving output. While U.S. crude inventories rose to a record in April, restrictions on exports are keeping those supplies in the country, tempering forecasts that global oil prices will decline this year.

The International Energy Agency, the Paris-based adviser to 29 nations, recommended on May 15 a “significant rise in OPEC production” to meet demand of 30.7 million barrels a day in the second half of the year. Oil inventories in advanced nations were at 2.62 billion barrels in April, the lowest for that month since 2008, the year Brent reached a record $147.50 a barrel, IEA data show. Boosting output that high would be “a Herculean task for the group to surmount given that production has been below 30 million barrels a day for the last five months,” London-based Energy Aspects said in a May 27 research note. The situation has reversed since OPEC last met in December. At that time, the IEA indicated the group would need to reduce output by about 3% in the first half of 2014 to make way for North America’s booming shale oil supplies.

U.S. oil production rose to 8.47 million barrels a day in the week ended May 23, the highest since 1986, according to the Energy Information Administration. The nation’s crude inventories were at 399.4 million barrels through April 25, the highest in weekly data beginning in 1982, the EIA estimates. [..] Several OPEC nations have failed to boost output as their ministers suggested at the group’s last meeting in December. Iraq was aiming for a surge of about 30% in 2014 to 4 million barrels a day, Oil Minister Abdul Kareem al-Luaibi said. Libya intended to restore within 10 days full daily capacity of almost 1.6 million barrels, from less than 20% previously, Oil Minister Abdulbari al-Arusi said. Iran had secured six months of relief from sanctions imposed by western governments and was seeking its highest output in five years, Oil Minister Bijan Namdar Zanganeh said.

Iraq’s daily production contracted 8% since reaching a 35-year peak of 3.6 million barrels in February amid political disputes and pipeline bombings, according to the IEA. In Libya, output has fallen to a 10th of capacity because of protests at oil fields and strikes at export terminals. Iranian supply is little changed, while an end to sanctions relief looms in July if it cannot reach a broader deal on its nuclear program. As a result, inventories of crude and refined oil in Europe were 86 million barrels below their five-year average at the end of March, according to the IEA. U.S. benchmark West Texas Intermediate is about $6 a barrel cheaper than North Sea Brent. “At the start of this year, expectations around the return of Libyan, and subsequently Iranian, barrels were high,” Amrita Sen, the chief oil market strategist at Energy Aspects, said by e-mail on May 20. “Today those possibilities have diminished substantially. The real question concerns how OPEC will meet higher demand for its crude in the third quarter. The onus falls on Saudi Arabia to do much of the heavy lifting.”

But still popular.

• Everything Popular Is Wrong (Mises Inst.)

“Everything popular is wrong” – Oscar Wilde’s famous quote can be supported by economic theory. One of the seemingly neglected aspects of malinvestment is the effect it has upon the popular perception of products, services, and lifestyles. Malinvestment, while misunderstood by many, is nonetheless an easy concept to grasp. Imagine that the government decided that cars were unsafe and, therefore, more people should drive trucks. To encourage the use of trucks over cars, the government offers easy credit to truck buyers through a federal truck loan program. The easy credit creates an artificially high demand for trucks, increasing revenue and profits for truck manufacturers at the expense of other industries. The easy credit encourages more people to buy trucks than would otherwise buy them. That’s malinvestment in a nutshell — capital being diverted from somewhere to somewhere else through government intervention.

Malinvestment is a term usually reserved for the malinvested capital created by credit expansion. But, any kind of government intervention in the economy creates malinvestment, whether it’s a loan program, regulation, or other economic intervention. In many cases, if it manipulates behavior, it causes malinvestment. The same effect could be obtained by regulation. The government might require those who drive cars to study for a special license, then pay an annual fee for that license. Just like the loan program, this would cause an imbalance in economic investment. People would avoid buying cars because of the additional expense and hassle. Instead, they would be more likely to buy trucks, which don’t require the extra license.

The government intervention, in whatever form, causes an increase in revenue for the truck industry. This increase in revenue means larger marketing budgets for the truck manufacturers. Larger marketing budgets will afford more advertisements touting the value of trucks over cars. They will spend more money creating and promoting research that exposes the negative traits of other types of vehicles. With their larger marketing budgets, they can reach the masses with their message as never before. What makes these marketing messages so dangerous is that they are indeed true. The research that the truck industry puts out will be accurate and convincing. It will show up before the eyes of the population and convince many. But there is a missing message that should be balancing the truck manufacturers’ marketing. The revenue diverted from car manufacturing to truck manufacturing results in more marketing for trucks but also results in less marketing for cars.

And where do you think this is going?

• All Central Banks Are Caught In A Liquidity Trap (STA)

In July of last year, I wrote a rather extensive piece discussing What Is A Liquidity Trap And Why Is Bernanke Caught In It?

“A liquidity trap is a situation described in Keynesian economics in which injections of cash into the private banking system by a central bank fail to lower interest rates and hence fail to stimulate economic growth. A liquidity trap is caused when people hoard cash because they expect an adverse event such as deflation, insufficient aggregate demand, or war. Signature characteristics of a liquidity trap are short-term interest rates that are near zero and fluctuations in the monetary base that fail to translate into fluctuations in general price levels.“

The reality, however, is that it is not just the Federal Reserve that is trapped at this point, but Japan and the Eurozone as well. The charts below show the trend of economic growth as compared to key interest rates for all three areas.

While Japan has been at this game the longest, it is interesting that the US and Eurozone both believe that despite the abundance of evidence to the contrary the outcome will be different.

Calm before the storm gets eery traits.

• VIX At 2007 Low Is Like Sensory Deprivation For Stocks (MarketWatch)

Low stock trading volume and volatility are messing with investors’ heads, fogging their view of the stock market. One analyst thinks these doldrums could turn out to be the new norm. Once again, the Dow Jones Industrial Average and the S&P 500 Index finished the week at record closing highs and the Russell 2000 Index finally broke back into a gain on the year. Stocks rose in lock step Friday following a jobs report that was in-line with expectations and unlikely to change any tapering plans at the Federal Reserve. But it all happened on the ninth-lowest volume day of the year. The CBOE Volatility Index VIX fell 8% to 10.73 on Friday, its lowest close since Feb. 23, 2007.

Low volume and low volatility, coupled with record-high stock prices, have some investors nervous and thinking it might be 2007 again. That is, the rally before the plunge. “Things are dull, and that’s a bad thing for financial professionals who are always looking for the next big thing,” said Nicholas Colas, chief market strategist at ConvergEx, in a recent note. “Volatility is the most powerful sensory input for investors and brokers alike.” In the past week, daily trading volume has run below average compared to the average volume over the past four quarters, according to Barclays data. Low stock volatility and thin trading volume are having a strange effect on investors. It’s a lot like when someone is placed in an isolation tank, said Colas.

That’s gotta hurt.

• China Land Sales Plunge 45% (MarketWatch)

Amid ongoing central government curbs, China’s property market is cooling off dramatically despite the onset of the sector’s traditionally “hot season,” as both land sales and transaction values plunged in May across 300 major Chinese cities. Total land sales fell to 1,767 transactions in May in 300 Chinese cities, down 45% from a year ago and 19% lower than in the previous month, according to a survey published Friday on China’s leading real estate website Soufun.com. In the same month, the total transaction value for land sales dropped 38% year-on-year, marking a 30% drop from April, to 13.75 billion yuan ($2.2 billion). “May is traditionally the hot season, but China’s property market has cooled further, “ Soufun said, adding that property developers remain in “wait-and-see” mode.

Several Chinese cities even recorded no land sales at all. Hangzhou, the affluent capital of the eastern province of Zhejiang, has offered no land for sale in its main city zone to residential developers since March, possibly under pressure from the central government to reduce real-estate inventories, according to Soufun. Jinan, the capital of the eastern province of Shandong, also saw no land sales during May, as developers turn cautious amid tougher market conditions, according to a report by Jinan-based Life Daily, a local-government-run newspaper. Overall property prices in China could push lower this year, as developers with large real-estate inventory are under great pressure to generate cash flow and meet ambitious sales targets, Standard & Poor’s said in a report published on Monday. Sales and financing prospects are likely to be “gloomy” for smaller Chinese developers, especially the unrated ones, some of which may default or be acquired by others, the rating agency warned.

A low strengthening rumble in the distance.

• China Home Prices Fall As Developers Cut Prices (Bloomberg)

China home prices will fall this year as developers cut prices to meet sales targets amid a cooling property market, Standard & Poor’s said. Home prices will fall 5% this year compared with an 11.5% gain in 2013, the New York-based ratings company said in an e-mailed report today. Sales volume will improve in the second half of the year and rise 10% for the full year, boosted by price cuts, according to the report. “Prices are likely to continue to slide because of large inventory in some markets,” Hong Kong-based analysts, led by Bei Fu, wrote in the report. “Many small unrated developers will feel the heat the most because their sales and financing capacities are substantially weaker than their larger peers’. Some lower-tier cities with limited demand and abundant supply could see deeper downward price adjustments.”

The pressure on Chinese developers was underscored by the collapse of a builder in a city south of Shanghai in March. After four years of government restrictions to cool the housing market, home sales and property construction are sliding and have become a drag on the economy, which recorded its slowest growth in six quarters in the first three months of the year. Home prices fell 0.3% in May from April, the first monthly drop since June 2012, according to SouFun Holdings Ltd., China’s biggest real estate website owner. Developers set a target 20% higher than their average 2013 sales and achieved only 27% of it in the first four months, according to S&P, which tracks 27 developers. “We expect most large national players to be able to weather the market correction ahead,” Fu said. “Among the rated developers, companies with more aggressive debt-funded growth appetite or weak execution ability will face downgrade risks.”

• Sell In May They Said, And So They Did (Zero Hedge)

While many investors puzzle over the decline in 10-year US Treasury yields to 2.6% alongside the S&P 500 at an all-time high, recent data suggest they moved flows in the same direction. Mutual fund, futures, and ETF data show a shift away from stocks and towards bonds during the past month. Pension funds have also sold stocks and bought bonds in 1Q. Equity market performance supports a pro-risk stance offset by a muted return outlook given high current valuations. US equity flows have weakened during the past month with outflows from US equity mutual funds totaling $10 billion since April 30. The outflows have been broad-based with all categories affected other than Equity Income funds. The preference for yield is also evident in continued strong flows into taxable bond funds as well as outperformance by stocks with high dividend yield.

Small-cap funds have experienced the largest outflows consistent with Russell 2000 lagging the S&P 500 by 625 bp YTD (5.9% vs. -0.3%). Flows are also weaker in relative terms as both bond and international equity funds continue to receive inflows. During the past five weeks $12 billion was withdrawn from ICI domestic equity mutual funds. Meanwhile, $7 billion moved into international equity and $11 billion flowed into taxable bond funds. Both hybrid and municipal bond funds also had inflows. Lipper fund flow data shows a similar but less pronounced trend with $8 billion of outflow from domestic funds in May of which $7 billion was small cap funds.

The combination of fund flows has pushed our Rotation Index to its lowest level since June of last year. Recent flows suggest a modest preference for equity allocation but less risk appetite than during the past year or compared with previous bull markets. The index estimates the risk appetite of retail investors based on the mix of their fund flows as compared with their base-line mutual fund allocation across money market, bond and equity funds. Margin balances in retail brokerage accounts have also eased from very high levels implying less retail risk tolerance.

“The masses are being plundered … ” Yeah, that would be you.

• The Madness Of Crowds And The Great Insanity (Ty Andros)

The masses are being plundered on a scale which is inconceivable and unmatched in history; it is the source of the middle classes dying in the developed world. The developed world has become a well-disguised plantation of serfs and slaves. They are given nothing to store and save their labor in as the currency they hold are printed endlessly and have no reserves to back them and are redeemable in NOTHING, contrary to every sound currency in history. Modern day money is nothing less than a wealth confiscation scheme run by morally and fiscally bankrupt central banks and governments against their own citizens.

Is there any human activity where you are not taxed today in one way or another? Is there any major financial holding which people own free and clear of annual taxes or don’t have to share any gain with the masters in central governments? They are your partners in everything even though you performed the work to buy your assets. The government has given the working man nothing in exchange for sharing in the profits or appreciation. Government services such as roads, schools, sewers, police and courts are paid for out of taxes. As long as big government progressives, elites, the main stream media, and banksters can manipulate and control the reality for the vast majority of citizens they tell themselves they are doing a public good. Fredric Bastiat described this nexus well:

“Sometimes the law defends plunder and participates in it. Sometimes the law even places the whole apparatus of judges, police, prisons and gendarmes at the service of the plunderers, and treats the victim, when he defends himself, as a criminal. But often the masses are plundered and do not even know it.”

This is your life, wherever you are.

• Europe’s Good, Bad, & Ugly Reality (Zero Hedge)

Mario Draghi unleashed his ultimate “spend-it-all-now-or-you’ll-lose-it” Keynesian demand-pull bazooka this week when he went full negative-rate-tard. While plenty of time has been spent discussing the “low-flation” and the total lack of credit creation (Keynes ultimate kryptonite), we thought the following three charts might bring home just how entirely broken (and dependent) Europe’s economy/market has become… First – the Good… European Sovereign Risk (GDP-weighted) is at an all-time low…the central-bank front-runners have front-run themselves to death as they fund cheap and pile into sovereign risk, forcing the banking system and sovereign ever closer together in a ‘if rates ever rise, we are all doomed’ vicious circle…

The Bad… European Macro-economic data is in the toilet… just as not one of the super smartest economists in the world could envision rates falling this year, it was evident last year that the “Europe is recovering” meme was as viral as herpes at spring break… odd, how things don’t work out as planned eh?

The Ugly… European corporate earnings are tumbling and expectations have collapsed…

And this too.

• Selling Your European Stocks Before Everyone Sees This Chart? (TPit)

Flogging savers until their morale improves, that’s how ECB President Mario Draghi is going to fire up the economy in his bailiwick. Among other things, he announced that the ECB would lower key interest rates from nearly nothing to next to nothing and impose negative deposit rates on the reserves that banks stash at the ECB. The goals beyond destroying savers? Hammering down the euro, but given the efforts by the Fed, the Bank of Japan, and others to hammer down their own currencies, it’s going to be a slog. And motivating over-indebted companies to borrow even more to invest in worthy projects that don’t exist – because if they existed, banks would have already gone after them, awash in liquidity as they are. [..]

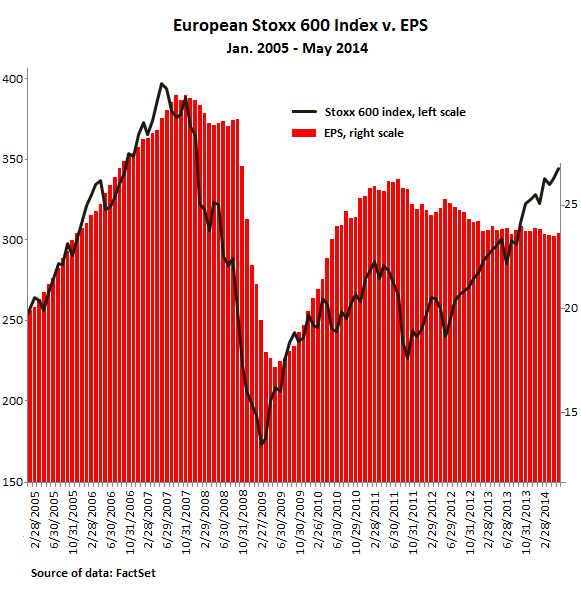

The Wall-Street hype machine has been in overdrive. Its “analysts” have been cranking out crazy earnings-growth estimates for the Stoxx 600 companies in order to rationalize ever higher stock prices. So for the first quarter this year, according to Thomson Reuters, analysts had forecast earnings growth of a dizzying 36.3%. That was on July 1, 2013. By October 1, they’d lowered their forecasts to 29.2%, and by February to 10.4%. By May 29, as companies were reporting the actual numbers, the growth “forecast” had unceremoniously dropped to 1.9%. Same thing quarter after quarter. For the fourth quarter 2014, they’re still riding their favorite hype horse, currently expecting, I’m not kidding, 39.3% earnings growth, which is down from 40.2% a week earlier! And it has been doing wonders to the Stoxx 600 which continues to defy gravity. But what the heck is wrong with this picture?

For years, EPS of the Stoxx companies and the index itself have been rising and falling roughly in parallel. The chart, based on data from FactSet, picks up in 2005. The index was tracking earnings perfectly on the way up. On the way down during the financial crisis, EPS lagged, given that companies report quarterly and the index crashed by the second. Then EPS recovered – OK, in Europe, financial engineering is just as normal as in the US – while the index lagged behind as the debt crisis was raging. But when the index took off, an ugly thing happened: Since July 2011, earnings have been falling! And that, despite quarter after quarter of Wall-Street forecasts of dizzying earnings growth for future quarters that then get whittled down to nothing! As of May 30, according to data provided by FactSet, the Stoxx 600 had EPS of 23.67. That’s down 0.7% from a year ago, and down 11.2% from July 2011.

These miraculous European companies that make up this gravity-defying index and that have been trumpeted by Wall Street with such conviction are making less now than they did three years ago during the depth of the Eurozone debt crisis! This has been Draghi’s great success, aided and abetted by Wall Street: pumping up European stocks (and bonds, including Greek government bonds, and all manner of other crappy assets) while corporate earnings have been declining – for nearly three years! But something has to give. It’s doubtful that these companies will suddenly, and without any reason whatsoever, see their earnings soar, as “analysts” predict, by 39% or whatever. Leaves the stock valuations….

What was the lastest percentage, 60% youth unemployment? We’re faking it as we go along.

• Spanish Bond Yields Drop Below US Borrowing Costs (MarketWatch)

Borrowing costs on 10-year Spanish government bonds dropped below the yield on 10-year U.S. notes on Monday, as southern European assets continued to benefit from the latest round of European Central Bank measures. The 10-year Spanish yield fell by 4.9 basis points to 2.595%, according to Tradeweb, extending its fall from last week when the ECB introduced an aggressive round of stimulus measures, including negative interest rates and targeted long-term refinancing operations. Monday’s level was also a fresh record low for 10-year Spanish borrowing costs. In comparison, the U.S. 10-year yield traded around 2.601%. Other peripheral European countries also saw their borrowing costs nudge lower in the wake of the ECB measures. The yield on 10-year Irish government bonds fell 3.2 basis points to 2.403%, marking the lowest level on record. 10-year Portuguese yields dropped 7.4 basis points to 3.437%.

• Pensions Fleeced By Wall Street Hedge Funds (MarketWatch)

Nobody disputes the high fees paid to Wall Street for alternative investments. Unfortunately, with an estimated at $660 billion of public pension fund assets invested in alternatives, taxpayers are footing that bill. The excessive fees have been justified by supposed higher returns and lower risk by diversification. That return argument has disintegrated in recent years. Public pension plans that loaded up on alternatives cost taxpayers billions in lost returns. For the last five years, North Carolina underperformed by $6.8 billion. For calendar year 2013 New Jersey underperformed by $2.5 billion. And in Kentucky for calendar year 2013 the state retirement fund loaded with alternatives underperformed the teachers plan with a very small alternative allocation by over $1 billion. About half of the alternative under performance in 2013 can be traced directly back to excessive fees .

With the recent bad returns we now hear a lot about risk reduction from the industry. Alternatives have all kinds of liquidity risk, legal risks and pricing risks that are conveniently overlooked. The industry line on risk revolves around the investment theory that risk is solely measured by standard deviation of return. For example getting 10% each year is far less risky than getting 20% one year and 0% the next year. Much of the low standard deviation of alternatives is smoke and mirrors. Many alternatives are self-priced or self-smoothed — think Madoff who’s constant 12% returns convinced many that his investments were low risk. The other argument is that alternatives have a low correlation to stocks, which lowers the standard deviation of a portfolio mix of stocks and alternatives. A friend of mine likes to say, “Send a trustee to Vegas to gamble $1 million at the black jack table. That lowers the risk (as defined by Standard Deviation) because it doesn’t correlate with the stock market.”

Bit late to the game, perhaps, NY Times?

• Worries Hit Commodity Finance Sector as China Opens Investigation (NY Times)

“Since the Qingdao case, we, as well as others in the market, have become a lot more cautious and are very selective on who we trade with,” said the head of a metals unit at a Chinese state-owned trading firm, who was not authorized to speak to the news media. “As for us, we are now only willing to work with big trading companies, those with which we’ve had a long-term working relationship or companies that have solid finances. This will be the strategy for many of us until we get more clarity.” Standard Chartered said it was reviewing the metals financing of a small number of companies in China. Three people close to the situation, who were not authorized to speak on the record, said the lender had suspended new metals financing to some customers in the country.

An executive in charge of commodity financing at an Australian bank said lenders would pause to take stock of how serious the problem in China was. “If it’s concentrated around one particular firm, we can probably quarantine it in that way and get ourselves back to a level of comfort relatively quickly,” said the executive, who also was not authorized to speak to the news media. “If there’s not already, it probably points to the fact that there needs to be a central registry of warehouse receipts.” Greater oversight of Chinese warehousing is needed to reduce the risk of future lapses, China legal experts said. In one continuing case, an operator is accused of allowing someone to enter his warehouse and replace peanut oil with water, steadily eroding the value of the collateral, according to a partner at a top law firm in Hong Kong. The switch came to light when the financing bank went to claim the collateral.

Copper prices on the London Metal Exchange hit one-month lows on Friday, amid concerns that owners of physical metal in China who have been spooked by events in Qingdao will look to sell, while others may shift their stocks to the exchange’s warehouses elsewhere. [..] Hundreds of thousands of tons of copper that will ultimately be used in the automobile or construction industries sit in Chinese warehouses, notably in Shanghai, and much of it is believed to be tied up as collateral for lending. The main problem for everyone in the business — be it commodity users, traders, banks or investors — is uncertainty. “The probe has sparked a lot of fear in the metals market,” said a senior executive at a major metals brokerage, who was not authorized to speak to the news media. “The unverified rumors about the size of the scam and the companies involved is causing people to panic.”

• EU Orders Bulgaria To Halt Russia’s South Stream Gas Pipeline Project (RT)

Bulgaria’s prime minister, Plamen Oresharski, has ordered a halt to work on Russia’s South Stream pipeline, on the recommendation of the EU. The decision was announced after his talks with US senators. “At this time there is a request from the European Commission, after which we’ve suspended the current works, I ordered it,” Oresharski told journalists after meeting with John McCain, Chris Murphy and Ron Johnson during their visit to Bulgaria on Sunday. “Further proceedings will be decided after additional consultations with Brussels.” McCain, commenting on the situation, said that “Bulgaria should solve the South Stream problems in collaboration with European colleagues,” adding that in the current situation they would want “less Russian involvement” in the project.

“America has decided that it wants to put itself in a position where it excludes anybody it doesn’t like from countries where it thinks it might have an interest, and there is no economic rationality in this at all. Europeans are very pragmatic, they are looking for cheap energy resources – clean energy resources, and Russia can supply that. But the thing with the South Stream is that it doesn’t fit with the politics of the situation,” Ben Aris, editor of Business New Europe told RT. [..] Earlier Russia’s Ambassador to the European Union Vladimir Chizhov has told Itar-Tass agency that the EU commission has no reasons to demand suspension on the South Stream construction works, as there still is “benefit of the doubt” for the Bulgarian construction bidders. “I don’t know all the details of the bidding process and what offers Russian-Bulgarian consortium had, but I’m sure it has all been made legally right. It’s too serious a project,” the diplomat said.

Home › Forums › Debt Rattle Jun 9 2014: Stupidity Is Not A Valid Defense For Us