DPC Herald Square, New York 1903

Emerging markets are about to get hit by a whopper of a double whammy. And if I were you, I wouldn’t be too surprised if it takes on epic proportions.

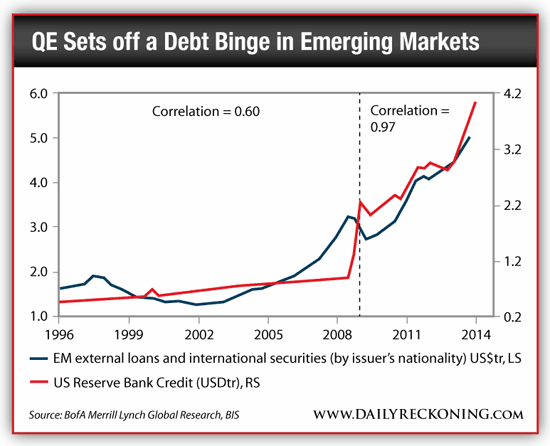

The exposure that emerging markets, countries in the less wealthy parts of the globe, Asia, Eastern Europe, Africa, Latin America, have to the west has grown at a very rapid clip since, let’s say, Lehman. These countries were hit hard by the western crisis, but found what looked like a sugar mountain afterward when western interest rates plunged to zero and beyond, which provided them with both of the seemingly beneficial sides of what will now become their double whammy.

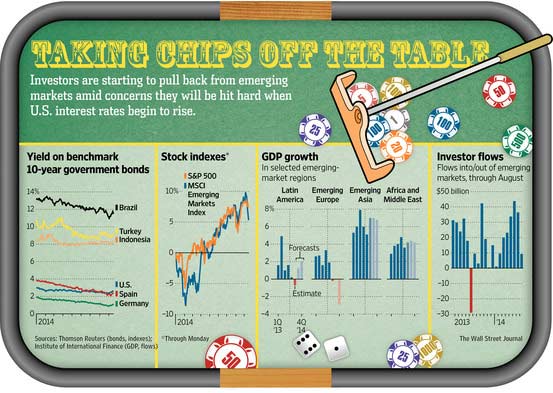

First, western money flowed, make that flooded, into their economies at unparalleled levels, driven by a chase for yield instigated by the difference between ultra low interest rates in the west and much higher rates beyond. For emerging countries, this has been a boon beyond belief. No matter how corrupt or poorly organized they may have been or still are, most showed nice growth numbers for a few years. It wasn’t really a carry trade in the literal sense of the word, but it was close. And it’s now coming to an end.

Second, and likely to work out even much worse, the ’emerging governments’ borrowed those cheap US dollars using anything not bolted down, including their national treasures, as collateral, and they now face a doubling, tripling, quadrupling etc. of the interest rates they have to pay on those loans. Which looks about like this (and something tells me this could well underestimate reality by a considerable margin):

Janet Yellen is about to announce rising rates, and whether it’s tomorrow or in 6 months is not that relevant in all this, it’s expectations that rule the day. Emerging markets will first be hit by outflows of western investment – or rather casino – capital, just because of the fear in the markets of what Yellen will do, and then get the second whammy when rates move from 0.25% to 1.25% and then some.

We see the initial jitters today. Or rather, they’re not the initial ones, just the first ones to come from people other than western investors.

What sticks out that the western press has very little attention for the ‘other side’s’ point of view. Still, here’s the Indonesian FM with a pretty clear message for someone who sees his country being suspended by its balls:

Asia May Need to Sacrifice Growth to Cope With Fed Rate Hike

Asia’s developing nations may have to sacrifice some growth next year and focus on keeping their economies stable amid potential fallout from higher U.S. interest rates, Indonesian Finance Minister Chatib Basri said. Capital outflows are a threat facing emerging markets as the prospect of the Federal Reserve lifting rates lures funds, Basri said [..] In Indonesia, where the benchmark rate is already at its highest since 2009, policy makers may have to tighten further to preserve the nation’s relative appeal to investors, he said. “In the short term, some emerging markets may have to choose stabilization over growth,” Basri said. “You cannot promote economic growth when dealing with this issue. It will exacerbate the situation.”

The U.S. dollar has appreciated as the Fed edges closer to its first rate increase since 2006, while Indonesia’s rupiah has dropped for five straight weeks amid global funds pulling money from local stocks in anticipation of higher U.S. borrowing costs. As some of the world’s fastest-growing economies adapt to changing policy at the Fed, their contribution to global expansion might weaken, Basri said. [..] The prospect of higher rates in the U.S. is the single biggest challenge facing Indonesia’s new government, Basri said.

Basri has called for the incoming government to focus on narrowing the budget deficit, raising fuel prices and luring foreign investment. In Indonesia, where the key rate is at 7.5%, policy makers may have to hold firm to prevent funds from flowing out of the country, Basri said.

“Maybe the tightening cycle will continue, from both the fiscal and the monetary side,” he said. Such a step “is not really conducive to promoting economic growth,” he said. Indonesia also needs to diversify its base of investors, the finance minister said. Relying more on domestic bond buyers would help, he said. “If global liquidity becomes tighter because of this tightening policy at the Fed, it will be more difficult for a country like Indonesia to get foreign financing,” Basri said.

Not that all investors will leave. If only because the emerging market countries need to raise their base rates even higher.

Investors Bet on Asia Despite U.S. Rate Threat

A consensus is emerging among investors that some Asian markets can do well even with the prospect of higher U.S. interest rates on the horizon. Fund managers see stepped up corporate and economic overhauls by leadership in China and India this year, combined with relatively strong growth in Asian economies compared with the rest of the world, as reasons to be bullish. Investors choosing Asia have been rewarded in the past three months. The MSCI Asia ex-Japan index is up 2.4%, topping the 0.4% gain in emerging markets globally and comparable to the 2.6% increase in the S&P 500.

The Fed said Wednesday that it remains on track to end its bond-buying stimulus program in October. It is widely expected to raise interest rates next year. Higher interest rates in the U.S. can hurt Asian assets by drawing investment money into U.S. assets and away from Asia’s markets. Despite the concerns over U.S. interest rates, investors say they are selectively investing in Asian markets that they see as cheap and where economic fundamentals have improved or where they believe reforms are on the way. Investors continued putting money into Asian emerging markets last month, according to the latest data on money flows from the Institute of International Finance.

Still, the world’s smaller economies are plenty afraid.

Wary of Another ‘Tantrum,’ Emerging Economies Prep for Fed Rate Hike

As the Federal Reserve debates the timing of a potential interest rate increase, some policymakers in the developing world aren’t taking any chances. Officials from Indonesia to Hungary say they’re trying to curb their reliance on foreign investors in case an eventual Fed rate increase sparks another broad retreat from emerging markets. “Everyone is getting prepared” for a U.S. rate increase, Mauricio Cardenas, Colombia’s finance minister, said in an interview on Tuesday.

Mr. Cardenas said his government has worked to shift its borrowing from foreign to domestic buyers, on the view that locals are less likely to sell en masse based on shifts in global monetary policy. “I don’t think it fully insulates us from an increase in interest rates in the U.S., but it certainly protects us,” Mr. Cardenas said.

Years of low rates and stimulus from the Fed, deployed in an effort to jumpstart growth in the U.S., had the side effect of sending investors piling into developing world assets. The rock-bottom interest rates available in the U.S. essentially made the higher returns promised by bonds and stocks in countries such as Brazil and Turkey more attractive.

But what happens when that flow reverses? Global markets got a taste last year during a so-called “taper tantrum,” as investors fled emerging markets in anticipation of a reduction in the Fed’s stimulus efforts.

One more then, because you enjoy it so much:

Fed Dims Emerging Markets’ Allure

Fears of higher U.S. interest rates are prompting fund managers to cut back on investments in emerging markets. For now, investors still are moving into developing markets, though the pace has moderated. Emerging-market stocks and bonds received $9 billion from investors in August, compared with an average $38 billion a month between May and July, according to the latest data from the Institute of International Finance. But after months of heavy buying in such places as Brazil and India, lured by the prospect of higher returns than in the Western world, investors are taking a more cautious stance. Chief among these money managers’ concerns: that the recent rally in emerging-market stocks, bonds and currencies could be derailed as the U.S. Federal Reserve gets closer to raising interest rates.

The Fed, by raising its rates and relinquishing its downward pressure on the US dollar, is about to kill off most of the emerging markets. That’s a whole lot of misery in one pen stroke. That’s a whole lot of millions of people who will see their dreams of better lives shattered, just as they were beginning to think they had a chance.

It’s how the game is played. The weak must be sacrificed so the strong be stronger. It’s like a law of nature. From some point of view, at least. For me, it looks more like ‘we’ have found another way, and another victim, to keep ‘our’ game going a bit longer. There is no way this just happens, in some accidental kind of way. There is a reason the Fed raises both interest rates and the US dollar inside the same timeframe.

Short emerging markets. Play it well and their misery can make you a fortune. Isn’t that what life is all about?

• Bond Losses Wiped Out for Treasuries With Dollar Conquering All (Bloomberg)

The prospect of higher U.S. interest rates is proving to be a boon for the biggest owners of Treasuries outside of the Federal Reserve. While the government bonds have fallen this month as the Fed boosted its forecast for how much rates will rise next year, the dollar climbed to its highest level since 2010 against a broad range of currencies. That’s transformed losses into gains for most foreign holders, who own $6 trillion of Treasuries. The U.S. currency has appreciated so much that Treasuries are the developed world’s best-performing sovereign debt this quarter for investors based in euros, pounds and yen. Sustaining demand from America’s biggest foreign creditors, such as the Chinese government and Japan’s Kokusai Asset Management Co., is crucial in containing funding costs as the Fed winds down its own extraordinary bond buying and prepares to lift rates for the first time since 2006.

With Treasuries offering the highest yields in seven years relative to sovereign bonds worldwide, the dollar’s strength may now help prevent an exodus of overseas investors from upending the $12.2 trillion market for U.S. government debt. “You’re getting a relatively higher yield by owning Treasuries as well as benefiting from a rising dollar, so the U.S. is going to suck in capital,” Philip Moffitt, the Sydney-based head of fixed income for Asia-Pacific at Goldman Sachs Asset Management, which oversees $935 billion globally, said in an e-mail response to questions on Sept. 19.

With the amount of U.S. public debt almost doubling since the financial crisis erupted in 2008, the stakes have never been higher for Fed Chair Janet Yellen. As she tries to extricate the central bank from six years of near-zero benchmark rates and trillions of dollars of debt purchases, any slack in demand for Treasuries may trigger a jump in borrowing costs for the government, companies and consumers. That threatens to upend the U.S. economy, which is still growing slower on average than before the credit crisis. After advancing 4.45% in the first eight months of the year, Treasuries have lost 1.1% in September, the most this year, index data compiled by Bloomberg show.

Will, not could.

• Stronger Dollar Could Put Squeeze On Earnings (MarketWatch)

Financial results from Nike this week could offer a preview of how the rallying U.S. dollar may wind up squeezing corporate profits and outlooks this earnings season. Stocks finished slightly higher this past week near all-time highs with the Dow Jones Industrial Average DJIA rising 1.7%, the S&P 500 finishing up 1.3%, and the Nasdaq up 0.3%, after the Federal Reserve indicated rate hikes were not just around the corner and Scotland voted to remain part of the United Kingdom. Nike, the first of the Dow 30 Industrials components to report earnings this season, reports earnings on Thursday. The athletic apparel and gear giant could be a litmus test for earnings season as it has considerable exposure to foreign markets and represents what’s expected to be one of the weakest sectors this season: consumer discretionary.

While some analysts are concerned about weak revenue growth over the next few quarters, Mark Luschini, chief investment strategist at Janney Montgomery Scott, said the stronger dollar will likely be a more significant problem. “I’m more concerned about currency,” said Luschini. “Multinationals seeing that strength in the dollar could be a headwind for earnings growth.” Since June 30, the U.S. Dollar Index, which tracks the dollar against six major currencies, has gained more than 6% after moving in a relatively narrow range in the 12 months prior. Even back in March, when the dollar index was more than 5% lower than its current level, Nike was warning a stronger dollar would be a significant drag on earnings.

In a recent note, Susquehanna Financial Group analyst Christopher Svezia lowered his full-year earnings estimate by 2 cents to $3.31 a share solely based on the stronger dollar. “Headwinds are strongest in [Nike’s fiscal second quarter] and don’t appear to be baked into estimates,” Svezia noted. The higher dollar will likely hit all multinationals, especially in the consumer discretionary sector. As the dollar has gathered strength, consumer discretionary earnings estimates have dropped significantly over the course of the quarter. Back on June 30, the sector was expected to see an earnings decline of 0.4%. Now, earnings are expected to decline by 5.4%, according to John Butters, senior earnings analyst at FactSet.

Yes but.

• The Fallacy Of US Dollar “Strength” (Macleod)

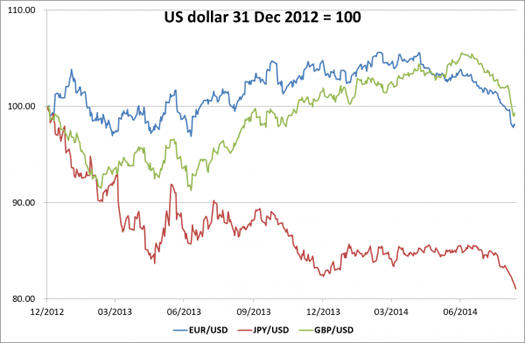

You’d think that the US dollar has suddenly become strong, and the chart below of the other three major currencies appears to confirm it.

The US dollar is the risk-free currency for international accounting, because it is the currency on which all the others are based. And it is clear that three months ago dollar exchange rates against the three currencies shown began to strengthen notably. However, each of the currencies in the chart has its own specific problems driving it weaker. The yen is the embodiment of financial kamikaze, with the Abe government destroying it through debasement as a cover-up for a budget deficit that is beyond its control. The pound had been poleaxed by the Scotish independence campaign, plus an ongoing deferral of interest rate expectations. And the euro sports negative deposit rates in the belief they will cure the Eurozone’s gathering slump, which if it develops unchecked will threaten the stability of Europe’s banks. So far this has been mainly a race to the bottom, with the dollar on the side-lines. The US economy, which is officially due to recover (as it has been expected to every year from 2008) looks like it’s still going nowhere.

Indeed, if you apply a more realistic deflator than the one that is officially calculated, there is a strong argument that the US has never recovered since the Lehman crisis. This is the context in which we must judge what currencies are doing. And there is an interpretation which is very worrying: we may be seeing the beginnings of a major flight out of other currencies into the dollar. This is a risk because the global currency complex is based on a floating dollar standard and has been since President Nixon ended the Bretton Woods agreement in 1971. It has led to a growing accumulation of currency and credit everywhere that ultimately could become unstable.

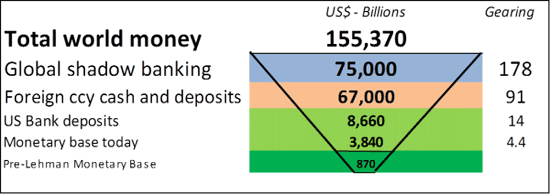

The gearing of total world money and credit on today’s monetary base is forty times, but this is after a rapid expansion of the Fed’s balance sheet in recent years. Compared with the Fed’s monetary base before the Lehman crisis, world money is now nearly 180 times geared, which leaves very little room for continuing stability. It may be too early to say this inverse pyramid is toppling over, because it is not yet fully confirmed by money flows between bond markets. However in the last few days Eurozone government bond yields have started rising. So far it can be argued that they have been over-valued and a correction is overdue. But if this new trend is fuelled by international banks liquidating non-US bond positions we will certainly have a problem.

We can be sure that central bankers are following the situation closely. Nearly all economic and monetary theorists since the 1930s have been preoccupied with preventing self-feeding monetary contractions, which in current times will be signalled by a flight into the dollar. The cure when this happens is obvious to them: just issue more dollars. This can be easily done by extending currency swaps between central banks and by coordinating currency intervention, rather than new rounds of plain old QE. So far market traders appear to have been assuming the dollar is strong for less defined reasons, marking down key commodities and gold as a result. However, the relationship between the dollar, currencies and bond yields needs watching as they may be beginning to signal something more serious is afoot.

Flaky.

• Change Of Tone By Fed Dove Dudley May Lift Dollar (CNBC)

The U.S. dollar may push higher this week if an influential policymaker from the U.S. Federal Reserve drops his dovish tone and suggests the world’s largest economy is ready for an interest hike earlier than the mid-2015 consensus, currency strategists told CNBC. New York Federal Reserve President William Dudley – also vice-chairman of the central bank’s rate-setting panel, a permanent voting member and widely regarded as a policy dove – is scheduled to speak tonight in New York. Dudley’s remarks this week – the highlight for currency markets – will be followed by speeches from fellow policymakers including Jerome H. Powell, Narayana Kocherlakota and Loretta J. Mester – all voting members of the Federal Open Market Committee (FOMC) in 2014. “I want to hear Dudley,” said Robert Rennie, Westpac’s global head of FX strategy in Sydney. “That will be big.” Dudley said in late June that the Fed can reasonably wait to raise interest rates until mid-2015 without risking an undesirable rise in inflation.

Any indication by Dudley that he favors an earlier rate hike may send the dollar higher, said Khoon Goh, senior FX strategist at ANZ. The Australian bank expects the first Fed rate hike to occur in March. “Any pronunciation from him on the dovish side shouldn’t come as a surprise,” Goh told CNBC Monday. “The big risk is if he does come out less dovish than what the market is expecting, then we could see a further boost to the USD.” Fed policymakers last week indicated they expect faster rate hikes next year and the year after. The central bank pushed up its expected path of interest rate increases – the so-called Fed ‘dots’ forecast – boosting yields on U.S. treasuries, and the dollar. As a policy dove, Dudley may “downplay the dots from last week’s FOMC,” ANZ’s Goh said. Still, given Fed Chair Janet Yellen’s insistence that the rate outlook is data-dependent, upside surprises in this week’s economic indicators – which include existing home sales, durable goods orders and consumer sentiment – may shift the balance in favor of the dollar bulls.

Everything’s down vs the dollar is all.

• Global Stocks Drop With Commodities on Slowing China Growth (Bloomberg)

Shares fell around the world and commodities tumbled to a five-year low amid speculation China will accept slower growth. Bonds rose after officials from the world’s biggest economies warned of rising financial risks. The MSCI All-Country World Index slid 0.2% at 10 a.m. in London. The Stoxx Europe 600 Index fell 0.3% and Standard & Poor’s 500 Index futures lost 0.5%. A gauge of Chinese stocks in Hong Kong dropped to a two-month low. French and Belgian government bonds gained the most in Europe and the rand led currencies of commodity-producing nations lower. Silver retreated to the lowest level since July 2010.

China’s Finance Minister Lou Jiwei said growth in Asia’s largest economy faces downward pressure and reiterated that there won’t be major changes in policy in response to individual economic indicators. Group of 20 finance chiefs and central bankers said low interest rates could lead to a potential increase in financial-market risk, as major economies rely on monetary stimulus to bolster uneven growth. U.S. housing data is scheduled for today. Lou “gave a real hint that the recent policy easing may actually be quite limited,” Stuart Beavis, head of institutional equity derivatives at Vantage Capital Markets in Hong Kong, said by phone. “We’re not just going to see this wall of money thrown at the Chinese slowdown.”

• Asia May Need to Sacrifice Growth to Cope With Fed Rate Hike (Bloomberg)

Asia’s developing nations may have to sacrifice some growth next year and focus on keeping their economies stable amid potential fallout from higher U.S. interest rates, Indonesian Finance Minister Chatib Basri said. Capital outflows are a threat facing emerging markets as the prospect of the Federal Reserve lifting rates lures funds, Basri said in an interview yesterday in Cairns, Australia, where Group of 20 finance chiefs met. In Indonesia, where the benchmark rate is already at its highest since 2009, policy makers may have to tighten further to preserve the nation’s relative appeal to investors, he said. “In the short term, some emerging markets may have to choose stabilization over growth,” Basri said. “You cannot promote economic growth when dealing with this issue. It will exacerbate the situation.”

The U.S. dollar has appreciated as the Fed edges closer to its first rate increase since 2006, while Indonesia’s rupiah has dropped for five straight weeks amid global funds pulling money from local stocks in anticipation of higher U.S. borrowing costs. As some of the world’s fastest-growing economies adapt to changing policy at the Fed, their contribution to global expansion might weaken, Basri said. Basri’s concern highlights the task facing G-20 finance chiefs as they attempt to lift collective economic growth by an additional 2% or more over five years. Officials agreed monetary policy should continue to support the recovery and particularly address deflationary pressures where evident, Australian Treasurer Joe Hockey said yesterday in Cairns. The prospect of higher rates in the U.S. is the single biggest challenge facing Indonesia’s new government, Basri said.

Malaise ….

• Metals Malaise Weighs On Equity Markets (CNBC)

The prices of a range of commodities continued their slide on Monday with the effect spilling over into stock markets with investors fearing more pain ahead for the asset class. Spot silver was the standout laggard, slouching to a low of $17.34 an ounce on Monday, reaching a four-year low. Data on Friday from the Commodity Futures Trading Commission confirmed that money managers had turned negative on the commodity. Spot gold also dipped, to $1,208.70 per ounce, and effectively wiped out all of its gains this year as the precious metal traded at levels not seen since early January. Other metals were also lower with platinum extending losses and hitting new nine-month lows and palladium also slipping to levels not seen since mid-May. A London benchmark for copper hit a 3-month trough and Reuters reported that Chinese steel and iron ore futures slid to record lows on Monday.

Soft commodities like wheat, corn and soybean are all lower for the trading year and prices eased again on Monday morning. Oil benchmarks and natural gas also saw weakness as the trading week began. “The liquidation is universal,” Dennis Gartman, a commodities trader and editor and publisher of the Gartman letter, told CNBC via email. “Today may be quite ugly around the world as deflation, rather than inflation, is the order of the day.” The malaise in the metal markets was felt across the broader equities indexes. Shanghai shares widened losses on Monday to close down 1.7%. In Sydney, shares saw hefty losses in mining majors which helped drag Australia’s benchmark S&P ASX 200 lower on the first day of the trading week. Fortescue Metals and Rio Tinto lead declines with losses of 4.8 and 2.5% each as iron ore prices slumped.

In Europe, the basic resources sector lost around 2.5% in early deals and stocks like Anglo American, Rio Tinto and Glencore suffered heavy losses. The latter’s fall was accentuated by an announcement that it was in a contract dispute with another mining firm. A slew of reasons were given for the weak sentiment. In the fields, economic reports have reinforced an expectation that there are massive harvests ahead. There’s also the stellar rally for the U.S. dollar. The greenback has climbed to trade at two-year highs, with anticipation of an interest rate hike in the U.S., and commodities have had to duly readjust with this currency strength. And then there’s also China. The Asian powerhouse, renowned for its large consumption of commodities, has seen some weak data points recently. The People’s Bank of China has had to add more stimulus to the world’s second largest economy and investors are cautious ahead of Tuesday’s preliminary reading on the country’s manufacturing sector, which could provide more evidence of a slowdown.

Hussman’s got it.

• The Broken Backbone of the Ponzi Economy (Hussman)

When the most persistent, most aggressive, and most sizeable actions of policymakers are those that discourage saving, promote debt-financed consumption, and encourage the diversion of scarce savings to yield-seeking financial speculation rather than productive investment, the backbone that supports a rising standard of living is broken. [..]

Meanwhile, financial repression by the Federal Reserve has held interest rates at zero, discouraging savings while encouraging and enabling households to go more deeply into debt. Various forms of deficit-financed government assistance and unemployment compensation have also been used to make up the shortfall, allowing consumption, and by extension, corporate revenues and profits, to be sustained. As long-term economic prospects have deteriorated, the illusion of prosperity has been maintained through soaring indebtedness, coupled with yield-seeking speculation in risky assets that has repeatedly (albeit not always immediately) been followed by crashes throughout history.

The U.S. Ponzi Economy is one where domestic workers are underemployed and consume beyond their means; household and government debt make up the shortfall; corporate profits expand to a record share of GDP as revenues are sustained by household and government deficits; local employment is replaced by outsourced goods and labor; companies refrain from productive investment, accumulate the debt of other companies and issue new debt of their own, primarily to repurchase their own shares at escalating valuations; our trading partners (particularly China and Japan) become our largest creditors and accumulate trillions of dollars of claims that can effectively be traded for U.S. property and future output; Fed policy encourages the yield-seeking diversion of scarce savings toward speculation in risky securities; and as with every Ponzi scheme, everyone is happy as long as nobody seeks to be repaid.

• Europe Will Never Be The Same After Scot Vote, Nor Will Euroscepticism (AEP)

Each of Europe’s aggrieved clans sent witnesses to Scotland for the vote. Some were nationalities seeking statehood, some more explosively seeking Anschluss with a mother country broken by victors’ cartography after the First World War. The flaming red and yellow Senyera of the Catalans flew over Edinburgh. The German-speakers of the Sud-Tirol sent a delegation, careful not to violate Italian law by speaking too loudly of reunion with Austria. The Corsicans turned up. Flemings who could not make it lit candles on the Scottish Saltire in Brussels. The Bosnian Serbs invoked the precedent, and so did Okinawan separatists in Japan as the chain reaction reached Asia. If the Okinawans get anywhere, their island will become a strategic hot potato, pitting China and Japan against each other on the world’s most dangerous fault line. Chinese nationalists are already combing through archives to bolster claims to the land dating back to the early Ming Dynasty in the 14th century.

Those descending on Scotland were not so much aiming to celebrate a Yes – though all wanted a Salmond triumph to make their point crushingly emphatic – but rather hoping to bottle the intoxicating air of democratic secession and take it home to countries were no such vote is allowed. What matters to them is the precedent set by this extraordinary episode. Scotland’s right to self-determination was recognised. The British state allowed events to run their course, vowing to accept the outcome. “It is a great lesson for democracy for the whole world. What we have seen in Scotland is the only way to settle conflicts,” said Artur Mas, the Catalan leader.

• Germans Would Shoot Down A ‘Helicopter Mario’ (CNBC)

The former Fed Governor Ben Bernanke’s speech on November 21, 2002 (“Deflation: Making Sure “It” Doesn’t Happen Here”) earned him the affectionate sobriquet “Helicopter Ben.” Building on the concepts of Milton Friedman, the Nobel Prize winning economist, that price inflation and price deflation were monetary phenomena, Bernanke espoused Friedman’s view that price deflation (the “It”) can be prevented and overcome by an aggressively expansionary monetary policy. Friedman metaphorically described the extreme form of such a policy as money being dropped on people from a helicopter. Bernanke came pretty close to the “helicopter money” with his virtually zero interest rate policies since late 2008, augmented by monthly purchases (better known as “quantitative easing”) of debt instruments issued by government-sponsored enterprises and including, later on, the U.S. Treasury securities.

Following that example, massive asset purchases are now being advised to Mario Draghi, President of the European Central Bank (ECB), on the view that the near-zero interest rates over the last three years have not prevented the euro area economy from a recessionary relapse and a steady deceleration of consumer prices to 0.3% in August from 1.3% in the same month of 2013. Before following asset purchase policies practiced by the Fed, I believe the ECB might wish to address the reasons why the transmission mechanism of the cheap and abundant loanable funds it keeps supplying to the banking system fail to find their way into strong business and consumer lending to support the euro area recovery.

I agree, but not for the same reasons.

• The Solution To Italy’s Woes Is Quite Simple – Leave The Euro (Telegraph)

No country epitomises the European economic malaise better than Italy. People often say that Italy cannot get into trouble because it is so rich. It is. Rich in natural beauty and historical treasures, with wonderful cities and beautiful countryside, lovely people, marvellous food and wine and an attractive way of life. But as a country it doesn’t really work. Some aspects of the problem have been there for ages; some are comparatively new. Before the war, much of Italy was poor. During the 1950s and 1960s, although Italian politics were chaotic and government was dysfunctional, as it industrialised the economy grew very fast and it climbed up the GDP leagues. In 1979, in respect of measured GDP, Italy even overtook the UK, an event that the Italians rejoiced in, calling it Il Sorpasso. The underlying problems were disguised. Although there was a tendency for inflation to be high, relief was always close at hand in the shape of a weaker lira. And the economy kept growing. But then it all started to go wrong.

The UK overtook Italy again in 1995 and the gap between the two economies has been widening ever since. To get the problem in perspective, all G7 countries except Italy and Japan have now exceeded the level of GDP they enjoyed before the Great Recession. Canada is 9pc above the 2008 level, while Italian GDP is still 9pc below. What’s more, the economy is contracting. This is not a bolt from the blue. Since the euro was formed in 1999 the annual average growth rate of the Italian economy has been only 0.3pc – in other words, next to nothing. Mind you, not all of this is due to the euro. There is a desperate need for reform yet the political system seems incapable of delivering what is needed. And Italy has been one of the prime sufferers from the rise of the emerging markets. Whereas Germany produces high-spec, large consumer durables and machinery, Italy has been specialised in precisely the low-to mid-spec consumer goods which China and others have come to produce more cheaply.

Didn’t he put them there?

• Sarkozy Says ‘Despair’ in France Reason for Return to Politics (Bloomberg)

Former President Nicolas Sarkozy said he couldn’t stay out of politics, noting that he has never seen such “despair” in France. “I have never seen such anger in this country, such a lack of perspective,” Sarkozy said on France2 television last night in his first interview since announcing on Sept. 19 that he’s in the running to lead his political party. “Being just a spectator would have been an act of abandonment.” The decision, which may be a stepping stone to the 2017 presidential race nomination, reversed his pledge in May 2012 that he was leaving politics after his defeat by Francois Hollande. His return comes as his UMP party has been riven by succession battles, and as Hollande finds himself France’s most unpopular president in more than half a century. Sarkozy said yesterday that he never lied to the French during his five years in office, saying, however, that Hollande has left behind him “a long list of lies.”

Sarkozy said “the French model has to be re-thought” to stop young people leaving the country to look for work. “When capital moves freely, if you raise taxes how can you expect to keep companies?” he said. “If companies’ margins go down, how can they hire? There are solutions, France is not condemned.” Sarkozy’s return to politics may pose a further hurdle to Hollande, 60, whose popularity rating stands at 13%, according to a recent poll. Opinion surveys show voters don’t want Hollande to run for re-election and he would stand little chance if he did. The French economy has barely grown during his two years in office, and the number of jobless has risen to a record 3.4 million from 2.9 million when he assumed office.

All EU sinking.

• EU Periphery Currencies Left at Draghi’s Mercy After Losses (Bloomberg)

Strategists divided on the outlook for eastern Europe’s currencies agree on one thing: Mario Draghi holds the key to their performance in the months ahead. Societe Generale SA and Commerzbank AG are bullish on Poland’s zloty and Hungary’s forint amid bets some of the 1 trillion euros ($1.3 trillion) of extra stimulus the European Central Bank has pledged to pump into the euro-region economy will head eastward in search of higher yields. Danske Bank A/S says ECB President Draghi will need to make more funds available for the currencies to strengthen.

An influx of ECB cash would support the zloty and forint at a time when the nations’ economies are being hurt by the prospect of deflation, the conflict in Ukraine and a stagnating euro region. Six of the eight worst-performing emerging-market currencies versus the dollar and euro this quarter are in eastern Europe. “For the currencies to show sustainable gains, the ECB would need to start aggressive, Federal Reserve-style quantitative easing, but that’s not what we expect,” Stanislava Pravdova, an emerging-markets analyst at Danske Bank in Copenhagen, said by phone on Sept. 18. “The current ECB stimulus won’t be enough.”

• ECB Member and Bundesbank Chief Weidmann Criticizes ECB Stimulus Plan (RTT)

Bundesbank President Jens Weidmann has criticized the European Central Bank’s latest measures to boost the euro area economy, such as the planned purchases of covered bonds and asset-backed securities and covered bonds, as well as the interest rate reduction this month. The latest decisions suggest a fundamental shift in strategy and a drastic change for the ECB’s monetary policy, Weidmann reportedly said in an interview to the German magazine Der Spiegel, published on Sunday. The majority of the Governing Council has signaled that monetary policy is ready to go very far and to enter new territory, he added. Last week, banks took up less-than-expected amount of funds at the ECB’s first targeted longer term refinancing operation, or TLTRO, damping the hopes of the success of the measure that was aimed to boost liquidity to help revive lending to small businesses and households.

Results of its first TLTRO showed that 255 banks were allotted EUR 82.60 billion, which was below the EUR 100 – EUR 150 billion predicted by analysts. With the poor take-up of TLTRO funds, the question remains whether the ECB’s proposed measure of purchasing covered bonds and ABS will help it to achieve its goal of expanding the central bank’s balance sheet to EUR 1 trillion. Buba’s chief warned that depending on the exact design of the ABS purchase-plan, banks could be exempt from risks at cost of taxpayers. Hence, it was important that the ECB should not take on no significant risks of individual banks or countries, he added. Further, Weidmann, who is also a Governing Council member, said the ECB should only buy low-risk securities, but he expressed concern regarding the adequate availability of such assets in the market to meet the central bank’s plan targets.

Funny.

• Short Sellers Target China From The Shadows (Reuters)

Short-sellers who profit from stock price declines have resumed targeting Chinese companies after a three-year lull, but many of the researchers who instigate the strategy are now cloaked in anonymity, shielding themselves from angry companies and Beijing’s counter-investigations. Three reports published this month separately accused three Chinese companies – Tianhe Chemicals, 21Vianet and Shenguan Holdings – of business or accounting fraud. All three companies said the allegations were baseless but their shares were hit by a wave of short-selling by clients of the research firms and then by other investors as the reports were made public. The reports were written by research firms that did not publicly disclose names of research analysts or even a phone number. In the last wave of short-selling that peaked in 2011 and wiped more than $21 billion off the market value of Chinese companies listed in the United States, the researchers advocating short-selling were mostly public.

Carson Block of Muddy Waters, one of the most prominent short sellers, openly accused several Chinese companies of accounting fraud. Block said in 2012, according to several media reports, that he moved to California from Hong Kong because he had received death threats. “If you have researchers who are based in China, it makes sense to operate anonymously because some of the mainland Chinese companies have a history now of retaliating against people who do negative research,” said short-seller Jon Carnes in an interview with Reuters. Carnes’s research firm Alfred Little has the best track record among short sellers, according to data compiled by Activists Shorts Research that shows the share performances of companies it targeted. Carnes has said he was threatened by representatives of one of the companies he reported on in 2011. His researcher Kun Huang was jailed in China for two years and then deported.

Yes we do.

• We Are Living In A State Of Keynesian “Bliss” (Rebooting Capitalism)

John Maynard Keynes is the grandfather of all modern mainstream economic thought. Richard Nixon was famously attributed as saying, “We are all Keynesians now” whilst slamming shut the gold window and launching the era of global fiat money. (Nixon didn’t really say this, it was actually Milton Friedman) The phrase came back in vogue in the aftermath of the Global Financial Crisis when neo-Keynesians like Paul Krugman called for, and got, massive government and Central Bank intervention into the global economy in order to “save it”. Back in 1930, Keynes looked out into the future and saw that with the proper management of the economy, monetary policy and the like, the world could attain a type of utopian stasis:

Keynes, working in 1930, expected growth to come to an end within two to three generations, and the economy to plateau. He referred to this imaginary state of equilibrium as “bliss”.

– Nick Gogerty, “The Nature of Value”In his essay “The Economic Possibilities of Our Grandchildren” Keyne’s imagined the big challenges of our days in the 21st century would be what to do with all that extra leisure time and how to achieve fulfillment since by now the quest for wealth and material gain would become more or less unfashionable or even obsolete. “Thus for the first time since his creation man will be faced with his real, his permanent problem – how to use his freedom from pressing economic cares, how to occupy the leisure, which science and compound interest will have won for him, to live wisely and agreeably and well.”

Granted, Keynes did say this would happen if mankind avoided any calamitous wars and if there was no appreciable increase in population. Two more flawed base assumptions there could not have been. But this hasn’t stopped the world’s conventional economists, not to mention the political and policy-making class (a.k.a The Overlords) from embracing the uniquely Keynesian notion that if you just know which macro-economic levers to pull, and how much and for how long, and when to do it; then you can get just the right amounts of: money quantity, money velocity, interest rates, nominal inflation, savings rates, capital expenditures, unemployment levels and consumer spending to make Everything Just Right All The Time without ever having so much as a downtick or a speed-wobble, ever again.

Big cheat.

• Merkel’s Taste for Coal to Upset $130 Billion German Green Drive (Bloomberg)

When Germany kicked off its journey toward a system harnessing energy from wind and sun back in 2000, the goal was to protect the environment and build out climate-friendly power generation. More than a decade later, Europe’s biggest economy is on course to miss its 2020 climate targets and greenhouse-gas emissions from power plants are virtually unchanged. Germany used coal, the dirtiest fuel, to generate 45% of its power last year, the highest level since 2007, as Chancellor Angela Merkel is phasing out nuclear in the wake of the Fukushima atomic accident in Japan three years ago. The transition, dubbed the Energiewende, has so far added more than €100 billion ($134 billion) to the power bills of households, shop owners and small factories as renewable energy met a record 25% of demand last year. RWE AG, the nation’s biggest power producer, last year reported its first loss since 1949 as utility margins are getting squeezed because laws give green power priority to the grids.

“Despite the massive expansion of renewable energies, achieving key targets for the energy transition and climate protection by 2020 is no longer realistic,” said Thomas Vahlenkamp, a director at McKinsey, and an adviser to the industry for 21 years. “The government needs to improve the Energiewende so that the current disappointment doesn’t lead to permanent failure.” While new supplies sent wholesale power prices to their lowest level in nine years, consumer rates are soaring to fund the new plants. Germany’s 40 million households now pay more for electricity than any other country in Europe except Denmark, according to Eurostat in Brussels. A decade ago, Belgium, the Netherlands and Italy all had higher bills than Germany. “Politicians are often trying to kid us,” Claudia Fabinger, a 65-year-old self-employed marketing manager, said in between shopping for groceries on Leipziger Strasse in Frankfurt. “Our power bills keep rising and rising to fund clean energies; on the other hand, we are still polluting the air with old coal plants.”

[..] … the burning of coal rose 68% from 2010 to provide a steady supply of electricity. Fossil-based power plants, including those fired by hard coal and lignite, are “indispensable for the foreseeable future,” reads the agreement between Merkel’s conservatives and the Social Democratic Party that helped form her current government. “The ‘black gold’ is still an important factor in the energy generation mix,” the government says on its website. “The share of renewable energy is rising and is at nearly 30% now, but the remaining 70% is getting dirtier and dirtier,” Carsten Thomsen-Bendixen, a spokesman at EON, Germany’s biggest utility, said. “That’s an obvious flaw in the system that needs to be put to an end.” “Yes, we are burning more coal; on the other hand it is also true that Germany still plays a leading role when it comes to emission reductions in Europe,” Beate Braams, a spokeswoman for the German Economics and Energy Ministry, said.

No.2!

• China Beats Europe in Per-Capita Emissions for First Time (Bloomberg)

China surpassed the European Union in pollution levels per capita for the first time last year, propelling to a record the worldwide greenhouse gas emissions that are blamed for climate change. The findings led by scientists at two British universities show the scale of the challenge of reining in the emissions damaging the climate. They estimate that humans already have spewed into the atmosphere two-thirds of the fossil fuel emissions allowable under scenarios that avoid irreversible changes to the planet. If pollution continues at the current rate, the limit for carbon will be reached in 30 years, the scientists concluded in a report issued on the eve of a major United Nations summit designed to step up the fight against climate change.

“We are nowhere near the commitments needed to stay below 2 degrees Celsius of climate change, a level that will be hard to reach for any country, including rich nations,” said Corinne Le Quere, co-author of the report and a director of the Tyndall Center for Climate Change Research at the University of East Anglia, England. “CO2 growth now is much faster than it was in the 1990s, and we’re not delivering the improvements in carbon intensity we anticipated 10 years ago.” Each person in China produced 7.2 tons of carbon dioxide on average compared with 6.8 tons in Europe and 1.9 tons in India in 2013, according to the study by the Tyndall Center and the University of Exeter’s College of Mathematics and Physical Sciences.

Home › Forums › Debt Rattle Sep 22 2014: The Fed Kills Emerging Markets For Profit