Jack Delano Freight operations on the Indiana Harbor Belt railroad 1943

Why? Because people refuse to go deeper into debt: “In an environment where credit is not being used in a material way, the fate of wages matters..” But that still sounds far too much like it’s a voluntary thing. It’s not.

• Wages Haven’t Been This Crucial to US Economy in 50 Years (Bloomberg)

When it comes to U.S. economic growth, wages may never have been this important. The link between earnings and consumer spending has been tighter in this expansion than in any other since records began in the 1960s, according to calculations by Tom Porcelli at RBC Capital Markets. Wages have become even more critical as households, still shaken after being caught with too much debt when the recession hit, remain unwilling or unable to tap home equity or let credit-card balances balloon to buy that new television or dishwasher. By not overextending themselves again, Americans are only spending as much as their incomes will allow, meaning that 70% of the economy is riding on how fast pay rises.

“In an environment where credit is not being used in a material way, the fate of wages matters,” Porcelli said. “They’re doing all of the driving from a consumption perspective.” The correlation between growth in wages and consumer spending adjusted for inflation stands at 0.93 since June 2009, when the recovery began, according to Porcelli. A reading of 1 means they move in the same direction all the time, zero means there is little relationship and minus 1 means they continually diverge. Porcelli tracked wages through the index of aggregate weekly payrolls for private production workers, which takes into account hourly earnings, the length of the workweek and changes in employment for about 80% of the labor force. Records go back to 1964, longer than the measure for all employees that includes supervisors, which dates back only to 2006.

“The days in which rapid and fairly uniform home value appreciation contributed to steep drops in negative equity are behind us..”

• American Underwater Homeowners “Here To Stay” Zillow Says (Zero Hedge)

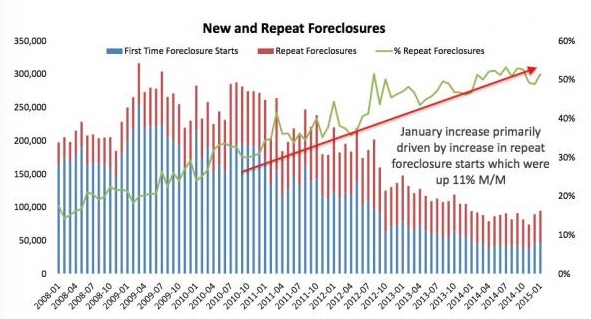

A few weeks back we commented on the rather disturbing news that repeat foreclosures jumped in January: “According to Black Knight Financial, both new and repeat foreclosures hit a 12-month high during the first month of the year with repeats (i.e. the borrower was rescued but has since entered the foreclosure process again) jumping 11% M/M. More troubling is the trend in repeat foreclosures which accounted for only 15% of total foreclosures during the crisis but now make up a startling 51%.” Here’s what the trend looks like:

Now, a new report from Zillow seems to offer further evidence that the US housing market may not be the picture of health after all (as if we needed more proof after housing starts cratered 17% in February). The%age of homeowners underwater in the US was flat from Q3 to Q4 which doesn’t sound all that terrible until you consider that this figure had fallen for 10 consecutive quarters. Things look particularly bad in Florida and the midwest where Zillow notes more than 25% of borrowers are sitting in a negative equity position. Here’s more:

In the fourth quarter of 2014, the U.S. negative equity rate – the%age of all homeowners with a mortgage that are underwater, owing more on their home than it is worth – stood at 16.9%, unchanged from the third quarter. Negative equity had fallen quarter-over-quarter for ten straight quarters, or two-and-a-half years, prior to flattening out between Q3 and Q4 of last year… More than a quarter of mortgaged homes are underwater in some markets in Florida and the Midwest…

Zillow goes on to note that we have entered a new era in the US housing market: the era of the underwater homeowner. Even better, the report goes on to note that in a number of cases, borrowers will likely be “in negative equity forever”:

…this represents a major turning point in the housing market. The days in which rapid and fairly uniform home value appreciation contributed to steep drops in negative equity are behind us, and a new normal has arrived. Negative equity, while it may still fall in fits and spurts, is decidedly here to stay, and will impact the market for years to come.

In fact, some homeowners trapped very deeply underwater may essentially be in negative equity forever. And those homeowners are much more likely to own America’s least expensive homes. Making matters worse, many homeowners in the bottom home value tiers are not only underwater, but very far underwater. Consider, for example, homeowners of the least expensive homes in the Detroit metro area. These homeowners are 29 times more likely to owe twice as much than their house is worth compared to a homeowner at the high end of the market.

Darn! Trumped by teapots again!

• Here’s the Next Biggest Threat to Global Crude Oil Prices (Bloomberg)

The next big threat to oil prices isn’t from OPEC or Bakken shale. It’s Russian samovars, or teapots. Simple refineries that process crude into fuel oil are scaling back, because when oil prices slump, the government reduces the discount that these refiners – known as teapots to those in the industry – get for exporting fuel. They use less crude, freeing it up for sale abroad, which in turn adds to the global glut. Russia may increase oil exports by as much as 250,000 barrels a day this year, according to James Henderson, a senior research fellow at the Oxford Institute for Energy Studies who’s followed the country’s energy industry for more than 20 years. That would equate to 5% growth in shipments, the most in at least a decade.

“The pain Russia is feeling from low oil prices has made more crude available for export,” Henderson said by phone March 18. “Quite a few of Russia’s simple refineries could reduce their runs.” Rising shipments from Russia, which ranks with Saudi Arabia and the U.S. as the world’s biggest oil producers, would put more pressure on crude, already down more than 50% from last year. Falling energy prices and U.S. and European Union sanctions imposed last year in response to the Ukraine crisis have pushed Russia to the brink of recession, damping demand for refined fuel products in the country. Crude loadings from Russian ports are 9.5% higher in the first quarter year over year, according to shipment schedules obtained by Bloomberg.

Teapot refineries processed as much as 800,000 barrels of crude a day last year, Igor Dyomin, a spokesman for Russia’s state-run pipeline operator, Transneft, said by phone March 19. A teapot refinery is one that produces mostly fuel oil rather than more premium fuels, according to Dyomin. Seven simple plants with a combined capacity of 1.2 million barrels a day are most at risk in the current price environment, according to Henderson.

As seen from a mile away.

• Global Oil Glut Set To Grow As China Slows Crude Imports (Reuters)

A global oversupply of oil is set to rise as China pauses in the build-up of its strategic reserves and Asian refineries slow crude imports ahead of the spring maintenance season, putting more downward pressure on prices. China’s purchases to fill its strategic petroleum reserves (SPR) had been one of the main drivers of Asian demand since August of last year, with the No.2 oil consumer taking up cheap crude to fill its tanks despite slowing economic growth. Yet China could pause its reserve purchases soon as tank sites reach their limits and new space only becomes available later this year. Little is known about China’s SPR levels.

The government seldom issues data, but its plan is to reach around 600 million barrels, about 90 days’ worth of imports. Most estimates put the SPR stocks currently to be 30-40 days’ worth. “I don’t think there is much (SPR) space left to fill,” a Chinese storage executive said under the condition of anonymity. In the Zhoushan area of Zhejiang province – site of two SPR bases and major commercial storage facilities – tanks are brimming, the executive said. “They are so full that one VLCC tanker owned by a state refiner has had to wait for almost 15 days to discharge,” he said. Adding to downward pressure is the expectation that Chinese refiners could process less crude oil in the second quarter as demand is dented by tax hikes and an economy growing at its slowest in 25 years.

Thomson Reuters data also shows that Asian imports overall have fallen 5% since peaking in December, when China’s purchases hit an all-time high at 7.2 million barrels per day. In India and Japan, crude imports for the most recent month are down 20% and 11% from a year ago, respectively, mainly due to the approach of the spring refinery maintenance season.

“Just as fracking helped production soar in America’s oil fields, the debt boom is now magnifying the slump in prices..”

• Debt Is Oil Patch’s Four-Letter Word (Bloomberg)

The 60 percent plunge in crude oil prices since mid-2014 isn’t just about increased production and slower global growth. Debt may be the four-letter word when it comes to explaining the extent of the energy sector’s collapse, a paper in the Bank for International Settlement’s Quarterly Review shows. While production has certainly increased and consumption cooled, current estimates of both are little changed from previous forecasts. This stands in contrast to the last two periods of similar oil-price declines in 1996 and 2008, which were attributed to big reductions in demand and/or a surge in production, according to the paper.nThis time, low borrowing costs, a product of easy Federal Reserve monetary policy, are a new wrinkle.

Cheap financing has made it easier for exploration and production (E&P) companies to finance operations and expand rapidly as the era of hydraulic fracturing kicked into high gear. Debt in the global oil and gas industry reached $2.5 trillion in 2014, 2 1/2 times what it was eight years earlier, according to the BIS paper. Just as fracking helped production soar in America’s oil fields, the debt boom is now magnifying the slump in prices as E&Ps boost current and future sales of crude to make sure they can fulfill their debt obligations. The direct effect on the economy is a sharp cutback in capital spending plans, already evidenced by plummeting rig counts.

At the same time, production continues to march higher. Deteriorating balance sheets encourage companies to keep pumping from existing wells even as the value of the assets (the oil) backing those securities declines. That explains the blowout in spreads between high-yield energy bonds and risk-free counterparts. “A sell-off of oil company debt could spill over to corporate bond markets more broadly if investors try to reduce the riskiness of their portfolios,” the BIS authors write. “The fact that debt of oil and gas firms represents a substantial portion of future redemptions underlines the potential system-wide relevance of developments in the sector.”

Just to show you what Samaras and the Troika did to the country. And what the EU etc. want to continue doing.

• Shocking Austerity: Greece’s Poor Lost 86% Of Income, Rich Only 17-20% (KTG)

Greece’s unbalanced austerity and drastic increase of poverty. The poorest households in the debt-ridden country lost nearly 86% of their income, while the richest lost only 17-20%. The tax burden on the poor increased by 337% while the burden on upper-income classes increased by only 9% !!! This is the result of a study that has analyzed 260.000 tax and income data from the years 2008 – 2012.

According to the study commissioned by the German Institute for Macroeconomic Research (IMK) affiliated with the Hans Böckler Foundation:

– The nominal gross income of Greek households decreased by almost a quarter in only four years.

– The wages cuts caused nearly half of the decline.

– The net income fell further by almost 9%, because the tax burden was significantly increased

– While all social classes suffered income losses due to cuts, tax increases and the economic crisis, particularly strongly affected were households of low- and middle-income. This was due to sharp increase in unemployment and tax increases, that were partially regressive.

– The total number of employees in the private sector suffered significantly greater loss of income, and they were more likely to be unemployed than those employed in the public sector.

-From 2009 to 2013 wages and salaries in the private sector declined in several stages at around 19%. Among other things, because the minimum wage was lowered and collective bargaining structures were weakened. Employees in the public sector lost around a quarter of their income.

“In 2010, Greece should have borrowed not one euro before entering into debt restructuring procedures and partially defaulting to its private sector creditors.”

• Of Greeks and Germans: Re-Imagining Our Shared Future (Yanis Varoufakis)

Any sensible person can see how a certain video[1] has become part of something beyond a gesture. It has sparked off a kerfuffle reflecting the manner in which the 2008 banking crisis began to undermine Europe’s badly designed monetary union, turning proud nations against each other. When, in early 2010, the Greek state lost its capacity to service its debts to French, German and Greek banks, I campaigned against the Greek government’s quest for an enormous new loan from Europe’s taxpayers. Why?

I opposed the 2010 and 2012 ‘bailout’ loans from German and other European taxpayers because:

• the new loans represented not a bailout for Greece but a cynical transfer of losses from the books of the private banks to the weak shoulders of the weakest of Greek citizens. (How many of Europe’s taxpayers, who footed these loans, know that more than 90% of the €240 billion borrowed by Greece went to financial institutions, not to the Greek state or its citizens?)

• it was obvious that, at a time Greece could not repay its existing loans, the austerity conditions for giving Greece the new loans would crush Greek nominal incomes, making our debt even less sustainable

• the ‘bailout’ burden would, sooner or later, weigh down German and other European taxpayers once the weaker Greeks buckled under their mountainous debts (as moneyed Greeks had already shifted their deposits to Frankfurt, London etc.)

• misleading peoples and Parliaments by presenting a bank bailout as an act of ‘solidarity to Greece’ would turn Germans against Greeks, Greeks against Germans and, eventually, Europe against itself.

In 2010 Greece owed not one euro to German taxpayers. We had no right to borrow from them, or from other European taxpayers, while our public debt was unsustainable. Period!That was my ‘controversial’ point in 2010: In 2010, Greece should have borrowed not one euro before entering into debt restructuring procedures and partially defaulting to its private sector creditors. Well before the May 2010 ‘bailout’, I urged European citizens to tell their governments not to even think of transferring private losses to them. To no avail, of course. That transfer was effected soon after[2] with the largest taxpayer-backed loan in economic history given to the Greek state on austerity conditions that have caused Greeks to lose a quarter of their income, making it impossible to repay private and public debts, and causing a hideous humanitarian crisis. That was then, in 2010. What should we do now, in 2015, that Greece remains in crisis and our people, the Greeks and the Germans, have, regrettably but also predictably, descended into a mutual ‘blame game’?

First, we should work towards ending the toxic ‘blame game’ and the moralising finger-pointing which benefit only the enemies of Europe. Secondly, we need to focus on our joint interest: On how to grow and to reform Greece rapidly, so that the Greek state can best repay debts it should never have taken on while looking after its citizens as a modern European state ought to do. In practical terms, the 20th February Eurogroup agreement offers an excellent opportunity to move forward. Let us implement it immediately, as our leaders have urged in yesterday’s informal Brussels meeting. Looking ahead, and beyond current tensions, our joint task is to re-design Europe so that Germans and Greeks, along with all Europeans, can re-imagine our monetary union as a realm of shared prosperity.

“Greece was not asked, so the claims have not gone away.” “The German government’s argument is thin and contestable. It is not permissible to agree to a treaty at the expense of a third party, in this case Greece..”

• Legal Experts: Greece Has Grounds for WWII Reparations (Greek Reporter)

A growing number of legal experts are supporting Greece’s demands over the German war reparations from the country’s brutal Nazi occupation during World War II. Despite the official German refusal to address the issue, legal experts say now Athens has ground for the case. The hot issue is expected to be brought up by Greece’s newly elected Prime Minister Alexis Tsipras during his official visit to Berlin on Monday, where he is scheduled to hold a meeting with the German Chancellor Angela Merkel. The tension between the two countries have recently rose to unexpected levels and a series of events with the Finance Ministers of Greece and Germany, Yanis Varoufakis and Wolfgang Schaeuble respectively, and the war reparations issue — mainly by the Greek side — has significantly affected the already negative climate.

The Greek leftist-led coalition government has repeatedly raised the issue causing Germany’s firm reaction as expressed by German Finance Minister Wolfgang Schaeuble, who recently warned Athens to forget the war reparations, underlining that the issue has been settled decades ago. Central to Germany’s argument is that 115 million deutschemarks have been paid to Greece in the 1960s, while similar deals were made with other European countries that suffered a Nazi occupation. At the same time, though, lawyers from Germany and other countries have said the issue is not wrapped up, as Germany never agreed a universal deal to clear up reparations after its unconditional surrender.

The German answer on that is that in 1990, before its reunification, the “Two plus Four Treaty” agreement was signed with the United Kingdom, the United States, the former Soviet Union and France, which renounced all future claims. According to Berlin, this agreement settles the issue for other states too. “The German government’s argument is thin and contestable. It is not permissible to agree to a treaty at the expense of a third party, in this case Greece,” international law specialist Andreas Fischer-Lescano said, as cited by the Reuters. Mr. Lescano’s opinion finds several other experts in agreement. One of them, the Greek lawyer Anestis Nessou, who works in Germany highlighted that “there is a lot of room for interpretation. Greece was not asked, so the claims have not gone away.”

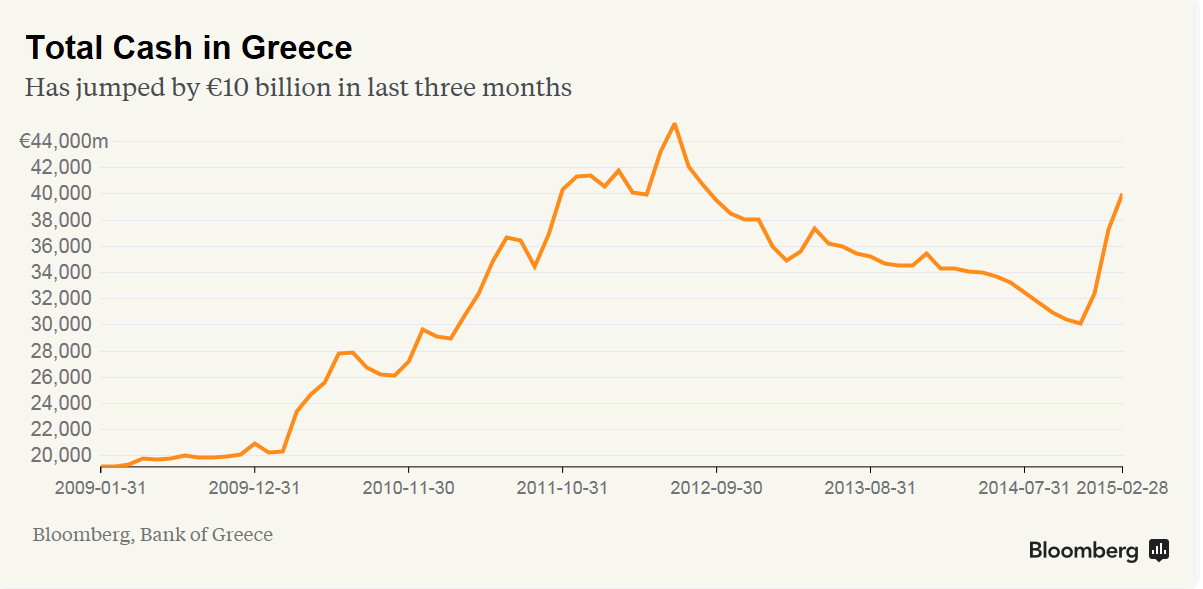

Obviously. But still, that money did not leave the country.

• It Really Looks Like Greeks Are Hiding Cash Under the Mattress (Bloomberg)

It is no secret that banks in Greece have been losing deposits in recent months. The question that is somewhat open, though, is where Greeks have been moving their deposits to. Have they been transferring the cash to other banks, or have they been squirreling it away under the mattress—and under bathroom tiles? At first glance, data from the Bank of Greece seem to point to the deposit transfer option rather than the cash-under-mattress option as the “banknotes in circulation” line item on its balance sheet hasn’t shown any big spike in recent months. This, however, does not tell the full story. The banknotes in circulation item on the Bank of Greece balance sheet only shows the amount of cash Greece has been allocated under its share of overall euro-area banknote circulation.

Any extra cash needs of the Greek economy are accounted for elsewhere on the Bank of Greece balance sheet under the rather drab headline of “net liabilities related to the allocation of euro banknotes within the Eurosystem.” This extra cash was zero before the start of the Greek crisis in 2009, climbed above €22 billion in the months leading to the 2012 Greek political crisis, and had been falling steadily since. Until December of last year, that is, when the Greek political crisis reemerged following the collapse of the Samaras administration. We can now clearly see there has been a €10 billion increase in cash in Greece in the three months to the end of February 2015. That is a lot of mattresses.

Impossible conditions: “only on condition that Tsipras’s left-wing government had persuasively shown it was committed to enforcing austerity..” That directly contradicts its mandate.

• EU Offers Funds In Return For Urgent Greek Reforms (Guardian)

Greece’s eurozone creditors are considering bringing forward a financial lifeline for Athens by a few weeks after Alexis Tsipras, the Greek prime minister, told EU leaders the country would be insolvent by the end of April without assistance. In a key three-hour meeting in Brussels that ended in the early hours of Friday, Tsipras informed his creditors if they wait until the end of April before releasing funds, it will be too late for Greece. According to an account of that meeting policymakers are now discussing whether they can supply emergency funding earlier than previously agreed. Tsipras was also advised to treat the Eurocrats working in Athens with more respect and ensure their safety. Under the terms of an agreement on Greece’s bailout last month, some €7.2bn in rescue funds were not to be disbursed until the end of April and only on condition that Tsipras’s left-wing government had persuasively shown it was committed to enforcing austerity in the country.

Chancellor Angela Merkel of Germany concluded a two-day EU summit in Brussels on Friday by stressing Tsipras had to present a “comprehensive” reform package urgently and this would need to be endorsed by the Eurogroup of finance ministers before Greece could access any of the funds. Merkel’s remarks came after the crucial meeting, that ran until 2am on Friday, when Tsipras came face-to-face for the first time with the leaders of his key creditors – Merkel and Mario Draghi, the president of the European Central Bank. The other five present at the crisis talks were the French president, François Hollande; the presidents of the European Commission and Council, Jean-Claude Juncker and Donald Tusk; Jeroen Dijsselbloem, head of the committee of eurozone finance ministers; and Uwe Corsepius, a senior eurocrat who has just been appointed Merkel’s EU adviser.

Tsipras had requested the meeting and had been confrontational in the days preceding it. According to an authoritative account of what took place, he started the negotiations by making it clear he expected urgently needed bailout funds released without giving very much in return. According to the account, he was disabused of that notion within 10 minutes and the meeting then ran smoothly, except for an episode where the new Greek leader was upbraided by Draghi, who is furious at the way senior EU officials monitoring the terms of the Greek bailout are being treated in Athens. According to senior officials in Brussels, the Tsipras government has been orchestrating a campaign of intimidation against the eurocrats in Athens, frustrating their work and refusing all access.

Visiting Athens this week, they were confined to a luxury hotel and denied access to government ministries. Their whereabouts were leaked to the media and “aggressive” demonstrations were staged outside the hotel. One of the top officials needed two bodyguards. Draghi was said to have read Tsipras the riot act, while the others demanded cooperation with the creditors. Merkel was said to have soothed things by telling Tsipras that, when International Monetary Fund officials go to Berlin, they are granted access to everything they need, even when it is a little humiliating.

Narrative: it’s for the poor.

• EC Head Juncker Offers $2 Billion In Unused Funds To Greece (RT)

The European Commission has made $2 billion of unused funds available to Greece to help the country avert a cash crunch, EC head Jean-Claude Juncker says. The offer was made a day after crisis talks between Greece’s new Prime Minister Alexis Tsipras and European leaders on Greece’s EU-IMF bailout. Greek authorities said on Friday they were gradually moving towards meeting the requirements of international creditors on a more detailed reform plan, after Prime Minister Tsipras said his coalition would intensify work to avert the country’s bankruptcy. Austerity policies have been the focus of a standoff between Greece and its troika of creditors.

Promises to end the era of drastic cuts helped Tsipras win power two months ago, but since then his stance has weakened. Greece’s western creditors have been insisting the country needs to reform its economy and start cutting its own expenses, if it wants to get new money for its ailing economy. Austerity policies have been the focus of a standoff between Greece and its Troika of creditors. Promises to end the era of drastic cuts helped Tsipras win power two months ago, but since then his stance has weakened. Greece’s western creditors have been insisting the country needs to reform its economy and start cutting its own expenses, if it wants to get new money for its ailing economy.

The Troika of creditors said in February they were ready to extend the current bailout program until June 2015, but a general agreement hasn’t been reached yet. Tsipras has sharply criticized the Troika methods calling them arm-twisting. He blames them for his country’s unprecedented recession. Greece received two bailouts from the EU in 2010 and 2014 totaling €240 billion. Having taken on austerity measures, Greece saw its economy losing a quarter of its value, with a third of Greeks living below the poverty line and unemployment exceeding 30%. Experts say the money Greece has now will only last till the end of March.

Bizarre story.

• EU Bank’s Lack Of Transparency ‘Like A John Le Carré Novel’ (Guardian)

The EU watchdog has accused the union’s bank of flouting its own transparency rules and hiding what it knows about allegations of tax avoidance by a Zambian mining firm largely owned by the Swiss commodity trader Glencore. On Tuesday, Emily O’Reilly, the European ombudsman, said she was not satisfied with the European Investment Bank’s claims that, despite an internal investigation, it had been unable to establish whether Mopani Copper Mines had avoided paying local tax running into tens of millions. Ten years ago, the EIB – which is owned by EU member states – loaned Mopani $50m (£30m) for the renovation of a smelter to reduce sulphur dioxide emissions.

Six years later, after a leaked audit report suggested that Mopani had avoided paying tens of millions of dollars in local tax, the bank announced an investigation into the company. It also halted loans to Glencore because of “serious concerns” about its corporate governance. Glencore has always denied the allegations, which it maintains are based on “fundamental factual errors”. Mopani repaid the EIB loan in full in 2012.

After the EIB refused to release the findings of its investigation, the charity Christian Aid referred the bank to the European ombudsman, who was granted access to the internal report. In her ruling, O’Reilly disputed the bank’s assertion that “it was not possible to comprehensively prove or disprove the allegations” made in the leaked audit report. She said: “The ombudsman considers that this statement does not adequately reflect the information contained in the [EIB] investigation report on this issue.”

Someone should stop Abe and Kuroda. This will be a huge disaster.

• Japan Pensions Sell Record $46 Billion Bonds to Buy Stocks (Bloomberg)

Japan’s public pension funds, which include the world’s biggest, accelerated their push to dump local bonds and invest the money abroad to a record pace. The $1.1 trillion Government Pension Investment Fund and its smaller peers almost doubled net sales of Japanese government bonds to 5.56 trillion yen ($46 billion) in the fourth quarter, the most in Bank of Japan figures dating back to 1998. They bought an unprecedented 2.39 trillion yen of foreign stocks and bonds. Selling of JGBs and buying of overseas securities has continued for six straight quarters.

GPIF posted its largest investment gain in almost two years last quarter after shifting more money into stocks from Japanese bonds, as it came under government pressure to boost returns to cover payouts for the world’s fastest-aging population. The Federation of National Public Service Personnel Mutual Aid Associations, last month said it will boost its investments in foreign stocks and bonds and cut exposure to domestic debt, matching the plan by GPIF. “It seems like three other civil service funds have yet to move,” Takafumi Yamawaki, the chief rates strategist in Tokyo at JPMorgan, said referring to data from the BOJ and and GPIF. “That means there is still some room left for the shift to take place.”

Japan’s public pension funds raised domestic stock holdings for a fifth quarter, adding a net 1.73 trillion yen, the most since 2009. They held 5.6% of a record 1.023 quadrillion yen of outstanding JGBs at the end of December. The biggest holder, the BOJ, owned 25% of the total as of then, it said Wednesday in Tokyo. GPIF hired four external managers of domestic and overseas stocks as it moves to boost equities to half its assets. It made a 5.2% return in the fourth quarter, the most since the period ended March 2013, according to a statement last month. Domestic shares returned 6.2% in the quarter, while local debt returned 1.9%. Foreign bonds returned 9.4%, and overseas stocks gained 10%.

” The US Dollar carry trade is north of $9 trillion… literally bigger than the economies of Germany and Japan COMBINED..”

• The Central Banks Will Not Be Able to Control the Dollar Carry Trade (Phoenix)

The biggest issue facing the finacial system today is the US Dollar rally. The Fed and other Central Banks are trying to maintain the illusion that they have everything in control by talking about interest rates, but the reality is that the US Dollar carry trade is ABOVE $9 trillion in size. That is almost as big as ALL of the money printing that occurred between 2009 and 2013. And it’s imploding as we write this. Globally, the world is awash in borrowed money… most of it in US Dollars. The US Dollar carry trade is north of $9 trillion… literally bigger than the economies of Germany and Japan COMBINED. When you BORROW in US Dollars you are effectively SHORTING the US Dollar. So when the US Dollar rallies… you have to cover your SHORT or you blow up.

And the US Dollar has been rallying… HARD. Indeed, the move that began in July 2014 is already larger par in scope with that which occurred during the 2008 meltdown. Moreover, this move has occurred with little to no rest. The US Dollar barely corrected 2% after rallying a stunning 16+% in a matter of months before beginning its next leg up. You only get these sorts of moves when the stuff hits the fan. CNBC and the others are babbling about the Fed’s FOMC changes, but all of that is just a distraction from the fact that a $9+ trillion carry trade, arguably the largest carry trade in history, has begun to blow up. Rate hikes, QE, all of this stuff is minor in comparison to the carnage the US Dollar is having on the financial system. Take a look at the impact it’s having on emerging market currencies.

It’s all about timing.

• US Sets First Fracking Standards in More Than 30 Years (Bloomberg)

The Obama administration issued the first federal regulations for fracking since the drilling technique fueled a domestic energy boom, requiring extensive disclosures of the chemicals used on public land. After years of debate and delay, the Bureau of Land Management on Friday said drillers on federal lands must reveal the chemicals they use, meet well construction standards and safely dispose of contaminated water used in fracking. The rule had been highly anticipated by drillers, who oppose added regulation, and by environmentalists who have raised alarms about water contamination. Both sides had complaints with the outcome: groups representing the oil and gas industry sued to block its implementation and an environmental group said the regulation favored industry over public health.

“This rule will move our nation forward as we ensure responsible development while protecting public land resources,” Interior Secretary Sally Jewell said on a call with reporters. “As we continue to offer millions of acres of America’s public lands – your lands – for oil and gas development, it is critical that the public has confidence that robust safety and environmental protections are in place.” Domestic production from more than 100,000 wells on public lands accounts for about 11% of U.S. natural-gas production and 5% of oil production. Fracking, or hydraulic fracturing, is a technique in which water, chemicals and sand are shot underground to free oil or gas from rock. It is used for about 90% of the wells on federal lands.

The rule, which is set to take effect in three months, triggered criticism from environmental groups, which said the regulations put industry interests ahead of public health, and from congressional Republicans the oil and gas industry. The Independent Petroleum Association of America and the Western Energy Alliance filed a lawsuit against the Interior Department, saying the regulations are the product of “unsubstantiated concerns,” and lack evidence necessary to sustain them. The group asked in a lawsuit filed Friday in a U.S. court in Wyoming to have the new rules declared invalid.

Can it get any crazier?

• Ukraine Sends Request For Proposals For US Taxpayer-Guaranteed Bond (Reuters)

The Republic of Ukraine has sent out a request for proposals (RFP) to banks for a new US government-guaranteed bond, according to three sources. This is the second time the US government has thrown its financial backing behind a Ukrainian international bond issue. In May 2014, the US guaranteed a US$1bn Ukrainian bond maturing in 2019 through the US Agency for International Development. That bond was given a credit rating in line with the US sovereign at Aaa by Moody’s, AA+ by Standard & Poor’s and AAA by Fitch. This is a far cry from Ukraine’s credit rating, which stands at Caa3, CCC and CC with the same three agencies.

The RFP comes just over a week after Ukraine agreed a new four-year US$17.5bn bailout facility with the IMF. As part of the IMF agreement several institutions – including the EU, World Bank and US – have agreed to provide around US$7.5bn between them, according to analyst estimates, to the war torn country. It is not clear whether the US-backed bond forms part of the US contribution. Meanwhile, Ukraine is obligated under the IMF agreement to restructure at least US$15.3bn of outstanding debt. Ukraine’s finance minister Natalia Yaresko confirmed during an investor call last week that bondholders will see haircuts to principal, as well as maturity extensions and changes to interest payment.

Russia, which holds US$3bn of Ukrainian debt that comes due in December this year, will not be exempt from the cuts, Yaresko said. A clause in the debt owed to Russia allows it to accelerate bond payments if Ukraine’s debt-to-GDP ratio breaches 60% – a number that has been passed largely because Ukraine’s industrial power centre Donbass has ground to a halt under sustained conflict. Russia has repeatedly said that it would not accelerate the debt.

Not surprised.

• US ‘Aggressively’ Threatened Germany Over Snowden Aylum (Glenn Greenwald)

German Vice Chancellor Sigmar Gabriel (above) said this week in Homburg that the U.S. government threatened to cease sharing intelligence with Germany if Berlin offered asylum to NSA whistleblower Edward Snowden or otherwise arranged for him to travel to that country. “They told us they would stop notifying us of plots and other intelligence matters,” Gabriel said. The vice chancellor delivered a speech in which he praised the journalists who worked on the Snowden archive, and then lamented the fact that Snowden was forced to seek refuge in “Vladimir Putin’s autocratic Russia” because no other nation was willing and able to protect him from threats of imprisonment by the U.S. government (I was present at the event to receive an award).

That prompted an audience member to interrupt his speech and yell out: “Why don’t you bring him to Germany, then?” There has been a sustained debate in Germany over whether to grant asylum to Snowden, and a major controversy arose last year when a Parliamentary Committee investigating NSA spying divided as to whether to bring Snowden to testify in person, and then narrowly refused at the behest of the Merkel government. In response to the audience interruption, Gabriel claimed that Germany would be legally obligated to extradite Snowden to the U.S. if he were on German soil.

Afterward, however, when I pressed the vice chancellor (who is also head of the Social Democratic Party, as well as the country’s economy and energy minister) as to why the German government could not and would not offer Snowden asylum — which, under international law, negates the asylee’s status as a fugitive — he told me that the U.S. government had aggressively threatened the Germans that if they did so, they would be “cut off” from all intelligence sharing. That would mean, if the threat were carried out, that the Americans would literally allow the German population to remain vulnerable to a brewing attack discovered by the Americans by withholding that information from their government.

“..if it’s really God’s plan, does He also pay the bill?”

• Inhofe’s Snowball Fight With NASA, US Navy, CEOs And The Pope (Paul B. Farrell)

The Tulsa World newspaper recently reran a heated Washington Post editorial headlined: “Sen. Jim Inhofe embarrasses GOP and U.S.” The Senate’s top climate-science denier’s snowball throwing stunt in the Senate chambers was more offensive to his Senate colleagues and the liberal media than his official denier’s bible he wrote calling it “The Greatest Hoax: How the Global Warming Conspiracy Threatens Your Future.” But what if Oklahoma Sen. Inhofe is right? What if “God really is in charge” of the global warming mess? And what if “humans cannot change climate,” as he warns America? Get it? Humans cannot reverse the climate damage. The biggest “hoax is that there are some people who are so arrogant to think that they are so powerful.”

But humans can’t change climate. Humans are powerless to change it, not RiskyBusiness.org nor 350.org, not Big Oil nor the GOP. And if God is in solely responsible, humans are just bit players in a grand drama, but can’t affect the outcome one way or another, either accelerating it or halting it. And no matter what capitalists or environmentalists do, or plan, or legislate, or oppose, or spend, God’s plan is “The Plan,” and we may just make matters worse, and waste a lot of money … $60 trillion. Economic shocker. A ScientificAmerican team did a research study on the cost of fixing the global warming and climate-change problem. Bottom line: $60 trillion. That’s one helluva price tag. A whopping $60 trillion on our planet – where the total global GDP is only $75 trillion.

And if it’s really God’s plan, does He also pay the bill? Now add this to the economic equation: Is Inhofe speaking for God? He’s hardly neutral, a huge chunk of Oklahoma’s state revenue is generated by Big Oil. And he’s received well over a million bucks in campaign donations from fossil-fuel interests. Worse, no states, nations nor businesses, nobody has a master plan for dealing with climate change … yes, lots of conflicting, piecemeal technologies … but no tested, reliable grand solution … no guarantees anything will work.

Monsanto has more clout than the WHO.

• Monsanto Weedkiller Roundup Is Probably Carcinogenic, WHO Says (Bloomberg)

Monsanto’s best-selling weedkiller Roundup probably causes cancer, the World Health Organization said in a report that’s at odds with prior findings. Roundup is the market name for the chemical glyphosate. A report published by the WHO in the journal Lancet Oncology said Friday there is limited evidence that the weedkiller can cause non-Hodgkin’s lymphoma and lung cancer and convincing evidence it can cause cancer in lab animals. The report was posted on the website of the International Agency for Research on Cancer, or IARC, the Lyon, France-based arm of the WHO. Monsanto, which invented glyphosate in 1974, made its herbicide the world s most popular with the mid-1990s introduction of crops such as corn and soybeans that are genetically engineered to survive it.

The WHO didn t examine any new data and its findings are inconsistent with assessments from the U.S., EU and elsewhere, Monsanto said. We don t know how IARC could reach a conclusion that is such a dramatic departure from the conclusion reached by all regulatory agencies around the globe, Philip Miller, Monsanto vice president for global regulatory affairs, said in a statement. The evidence in humans is from studies of exposures, mostly agricultural, in the USA, Canada, and Sweden published since 2001, the WHO said in the report. In addition, there is convincing evidence that glyphosate also can cause cancer in laboratory animals. The WHO said exposure by the general population is generally low.

Feel good story.

In 2012 Valentin Gruener rescued a young lion cub and raised it himself at a wildlife park in Botswana. It was the start of an extraordinary relationship. Now an astonishing scene is repeated each time they meet – the young lion leaps on Gruener and holds him in an affectionate embrace. “Since the lion arrived, which is three years now, I haven’t really left the camp,” says Gruener. “Sometimes for one night I go into the town here to organise something for the business, but other than that I’ve been here with the lion.” The lion he has devoted himself to is Sirga – a female cub he rescued from a holding pen established by a farmer who was fed up of shooting animals that preyed on his cattle. “The lions had killed the other two or three cubs inside the cage, and the mother abandoned the remaining cub. She was very tiny, maybe 10 days old,” Gruener says.

The farmer, Willy de Graaf, asked Gruener to try to save her and so he took her to a wildlife park financed by de Graaf and became her adoptive mother, “feeding her and taking care of her”. “You have this tiny cute animal sitting there and it’s already quite feisty,” he says. “It will become about 10 times that size and you will have to deal with it.” She’s much bigger now, but when Gruener opens her cage she still rushes to greet him – ecstatically throwing her paws around his neck. “That happens every time I open the door. It is an amazing thing every time it happens, and it’s such a passionate thing to do for this animal to jump and give me a hug,” says Gruener. “But I guess it makes sense. At the moment she has no other lions with her in the cage and I guess for her I’m like her species. So I’m the only friend she’s got. Lions are social cats so she’s always happy to see me.”

Home › Forums › Debt Rattle March 21 2015