DPC City Hall and Market Street and west from 11th, Philadelphia 1912

“One can only read political motives in the creditors’ insistence on new cuts to pensions..”

• Tsipras Hardens Greek Stance After Collapse of Talks (Bloomberg)

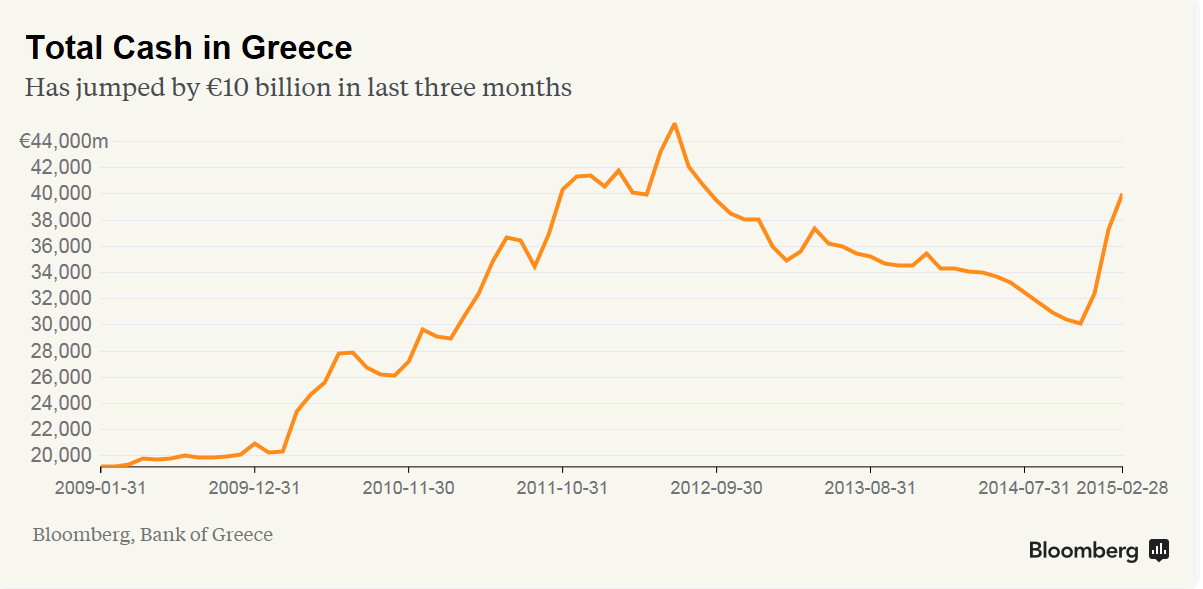

Greece and its creditors swapped recriminations over who was to blame for the breakdown of bailout talks, as each side hardened its position after the latest attempt to bridge differences collapsed in acrimony. With markets plunging in Asia and in Europe, Prime Minister Alexis Tsipras portrayed Greece as the torchbearer of democracy faced with unrealistic demands, while the caucus leader of Chancellor Angela Merkel’s parliamentary bloc said Greeks had to “finally reconcile themselves with reality.” “One can only read political motives in the creditors’ insistence on new cuts to pensions after five years of plundering them under the memorandum,” Tsipras was cited as saying in a statement in Efimerida Ton Syntakton newspaper on Monday. “We will wait patiently for the institutions to move toward realism.”

The euro dropped in early trading after the European Commission said negotiations in Brussels had broken up on Sunday after just 45 minutes with the divide between what creditors asked of Greece and what its government was prepared to do unbridged. The focus now shifts to a June 18 meeting in Luxembourg of euro-area finance ministers that may become a make-or-break session deciding Greece’s ability to avert default and its continued membership in the 19-nation euro area. “In the end, this is not the kind of situation where you can have a mechanical agreement for some kind of numbers, where you meet in the middle or something similar,” Valdis Dombrovskis, EC vice president for euro policy, said on Latvian television Monday. “To reach an agreement Greece has to do the work that is necessary.”

The latest failed attempt to find a formula to unlock as much as €7.2 billion in aid for the anti-austerity Syriza-led government brings Greece closer to the abyss. With two weeks until its euro-area bailout expires and no future financing arrangement in place, creditors had set June 14 as a deadline to allow enough time for national parliaments to approve an accord. “If some interpret the government’s honest willingness to reach compromise and the steps it has taken to bridge the differences as weakness, they should consider this: we don’t just carry a heavy history of struggles,” said Tsipras. “We’re carrying on our backs the dignity of a people, but also the hopes of the people of Europe. It’s too heavy a burden to ignore. It’s not a question of ideological stubbornness. It’s a question of democracy.”

Read more …

“Greece would default on all official creditors, and on the bilateral loans from its European creditors. But it would service all private loans with the strategic objective to regain market access a few years later.”

• Greece Has Nothing To Lose By Saying No To Creditors (Münchau)

So here we are. Alexis Tsipras has been told to take it or leave it. What should he do The Greek prime minister does not face elections until January 2019. Any course of action he decides on now would have to bear fruit in three years or less. First, contrast the two extreme scenarios: accept the creditors’ final offer or leave the eurozone. By accepting the offer, he would have to agree to a fiscal adjustment of 1.7% of GDP within six months. My colleague Martin Sandbu calculated how an adjustment of such scale would affect the Greek growth rate. I have now extended that calculation to incorporate the entire four-year fiscal adjustment programme, as demanded by the creditors.

Based on the same assumptions he makes about how fiscal policy and GDP interact, a two-way process, I come to a figure of a cumulative hit on the level of GDP of 12.6% over four years. The Greek debt-to-GDP ratio would start approaching 200%. My conclusion is that the acceptance of the troika’s programme would constitute a dual suicide – for the Greek economy, and for the political career of the Greek prime minister. Would the opposite extreme, Grexit, achieve a better outcome? You bet it would, for three reasons. The most important effect is for Greece to be able to get rid of lunatic fiscal adjustments. Greece would still need to run a small primary surplus, which may require a one-off adjustment, but this is it.

Greece would default on all official creditors, and on the bilateral loans from its European creditors. But it would service all private loans with the strategic objective to regain market access a few years later. The second reason is a reduction of risk. After Grexit, nobody would need to fear a currency redenomination risk. And the chance of an outright default would be much reduced, as Greece would already have defaulted on its official creditors and would be very keen to regain trust among private investors.

The third reason is the impact on the economy’s external position. Unlike the small economies of northern Europe, Greece is a relatively closed economy. About three quarters of its GDP is domestic. Of the quarter that is not, most comes from tourism, which would benefit from devaluation. The total effect of devaluation would not be nearly as strong as it would be for an open economy such as Ireland, but it would be beneficial nonetheless. Of the three effects, the first is the most important in the short term, while the second and third will dominate in the long run.

Read more …

Always was.

• Varoufakis: Debt Restructuring Is The Only Way Forward (Reuters)

Greece Finance Minister Yanis Varoufakis said he could rule out a ‘Grexit’ because it would not be a sensible solution to the Greek debt crisis and in a German newspaper interview on Monday also said a debt restructuring was the only way forward. “I rule out a ‘Grexit’ as a sensible solution,” Varoufakis told mass circulation Bild newspaper, referring to a possible Greek exit from the euro zone. “But no one can rule out everything. I can’t even rule out a comet hitting earth.” Talks on ending the deadlock between Greece and its international creditors broke up in failure, with European leaders venting frustration as Athens stumbled towards a debt default that threatens its future in the euro.

Varoufakis said he believed it could be possible for Greece to reach an agreement with creditors quickly. He said the only way Greece would be able to repay its debts was if there was a restructuring and a deal could be possible if Chancellor Angela Merkel took part in the talks. “We don’t want any more money,” he told the German daily that has been especially critical of the rescue efforts, adding Germany and the rest of the eurozone had already given Greece “far too much” money. “An agreement could be reached in one night. But the chancellor would have to take part.”

He said the austerity program had failed. “There’s no way around it: We have to start all over again. We have to make a clean sweep,” Varoufakis said. He added that his government wanted to prevent a ‘Grexit’ but needed “a restructuring. That’s the only way possible that we can guarantee and also afford to repay so much debt.”

Read more …

No, they’re not kidding.

• Syriza Left Demands ‘Icelandic’ Default As Greek Defiance Stiffens (AEP)

The radical wing of Greece’s Syriza party is to table plans over coming days for an Icelandic-style default and a nationalisation of the Greek banking system, deeming it pointless to continue talks with Europe’s creditor powers. Syriza sources say measures being drafted include capital controls and the establishment of a sovereign central bank able to stand behind a new financial system. While some form of dual currency might be possible in theory, such a structure would be incompatible with euro membership and would imply a rapid return to the drachma. The confidential plans were circulating over the weekend and have the backing of 30 MPs from the Aristeri Platforma or ‘Left Platform’, as well as other hard-line groupings in Syriza’s spectrum.

It is understood that the nationalist ANEL party in the ruling coalition is also willing to force a rupture with creditors, if need be. “This goes well beyond the Left Platform. We are talking serious numbers,” said one Syriza MP involved in the draft. “We are all horrified by the idea of surrender, and we will not allow ourselves to be throttled to death by European monetary union,” he told the Telegraph. The militant views on the Left show how difficult it could be for premier Alexis Tsipras to rally his party’s support for any deal that crosses Syriza’s electoral ‘red-lines’ on pensions, labour rights, austerity, and debt-relief. Yet they also strengthen his hand as talks with EMU creditors turn increasingly dangerous. Talks between Greece and its EU creditors fell apart once again on Sunday, leaving a final decision on a default to eurozone finance ministers.

Mr Tsipras warned over the weekend in the clearest terms to date that Greece’s creditors should not push him too far. “Our only criterion is an end to the ‘memoranda of servitude’ and an exit from the crisis,” he said. “If Europe wants the division and the perpetuation of servitude, we will take the plunge and issue a ‘big no’. We will fight for the dignity of the people and our sovereignty,” he said. It may soon be too late to push any accord through the German Bundestag and other EMU parliaments before June 30, when Greece faces a €1.6bn payment to the IMF. The interior ministry has already ordered governors and mayors to transfer their cash reserves to the central bank as a precaution, but even this is not enough to avert default without a deal. Yet an official document released this evening in Athens appeared to throw down the gauntlet.

“The government reiterates, in no uncertain terms, that no reduction in pensions and wages or increases, through VAT, in essential goods – such as electricity – will be accepted. No recessionary measure that undermines growth – the experiment has lasted long enough,” it said. European officials examined ‘war game’ scenarios of a Greek default in Bratislava on Thursday, admitting for the first time that they may need a Plan B after all. “It was a preparation for the worst case. Countries wanted to know what was going on,” said one participant to AFP. The creditors argue that ‘Grexit’ would be suicidal for Greece. They have been negotiating on the assumption that Syriza must be bluffing, and will ultimately capitulate. Little thought has gone into possibility that key figures in Athens may be thinking along entirely different lines.

Read more …

Cutting military spending is a thorny topic. The IMF knows who the paymasters are. Hilarious that they claim to be opposed to “any such “bartering”; it’s all they been doing since January.

• IMF ‘Blocked EU Compromise Proposal’ To Let Greece Cut Military Spending (AFP)

The IMF “torpedoed” a recent attempt by European Commission chief Jean-Claude Juncker to offer Athens a compromise proposal in tortuous debt talks, a German daily reported. Citing a “negotiator” as its source, the Frankfurter Allgemeine Zeitung said there had been “tensions” between the EU Commission and the IMF in recent days as Greece and its creditors race against the clock to come up with a debt deal to avert a catastrophic default by Athens. The compromise that Juncker wanted to present to Greek Prime Minister Alexis Tsipras would have allowed Athens to postpone some €400 million in pension cuts in return for making similar savings on military spending, the newspaper said in its Sunday edition.

But the IMF was opposed to any such “bartering”, the source was quoted as saying in the report. Tsipras meanwhile warned Greece on Saturday to prepare for a “difficult compromise” with its EU-IMF creditors, who are demanding tough reforms in return for unlocking the last tranche of desperately-needed bailout funds ahead of key deadlines at the end of the month. Top Eurozone officials upped the pressure on Friday, saying they were preparing the ground for an Athens default, which could see Greece crashing out of the Eurozone.

Read more …

Tragedy.

• Doctors At Greek State-Run Hospitals At Risk Of Burnout (Kathimerini)

There are a number of specializations that are especially demanding. For the past four months, the recently opened thoracic surgery clinic at the Attikon Hospital in Athens has been operating with a staff of two. “I have applied for an assistant, someone who is specialized in what we do here, to be temporarily reassigned from another hospital, but what can they do when every hospital is understaffed?” noted the clinic’s director, Pericles Tomos. He has one intern when the work calls for four. Over three months, the two of them conducted 37 surgeries, and they work more than 12 hours a day. The shortage of thoracic surgeons has also hit other hospitals in the country. Over 70% of the positions for this specialization remain open as young doctors with expertise prefer to work abroad.

Similar shortages in other specializations put a greater burden on doctors working at public hospitals. At the capital’s Evangelismos Hospital, heart surgeon Panagiotis Dedeilias works more than 80 hours a week. “I have often felt completely exhausted after working for 36 hours straight,” he told Kathimerini. “I have had interns faint in the operating room because of exhaustion, while I have also seen others growing indifferent toward the job. They may not have lost their ability to diagnose a patient and do what they need to do, but they are cold toward patients’ relatives and seem to be losing their ambition.” Dedeilias has never taken a day off after being on emergency duty for 24 hours. “You can’t leave a patient behind when you know there’s no one to replace you,” said Giorgos Marinos, a doctor who is in charge of running the emergency room at the Laiko Hospital, also in Athens.

Read more …

It shouldn’t be in the eurozone.

• Finland’s Problem Is The Same As Greece’s (Forbes)

Finland’s central bank governor, Erkki Liikanen, tells us that Finland is going to have to work hard to get through this current difficult economic situation. The country’s GDP is still significantly below pre-crisis levels and it’s likely to be a number of years before there’s a full recovery. But the real point behind this story is that it just doesn’t have to be this way. As Paul Krugman has been pointing out recently and as many others of us have been shouting for years. Finland simply should never have joined the euro, as Greece should not have. As, in fact, pretty much most of the current members should not have joined the single currency.

Further, none of this is a surprise. It’s inherent in the very design of said currency, indeed it was pointed to by Robert Mundell, the man who worked out the economics of single currencies. That it would all go wrong is exactly what the warning about the euro was. It is going wrong, has gone wrong, and for exactly the reason predicted:

Finland is in trouble, and in the words of the central bank this week, the situation is “grave”. While France has often been branded Europe’s “sick man” and Greece’s problems are well known, Finland’s economy is still 5pc smaller than before the financial crisis. The country will barely crawl out of a three-year recession this year, while unemployment is forecast by the OECD to grow in 2015.

Faced with a bloated state, below-par growth, and prices and costs that have risen at a much faster pace than the rest of the eurozone, the medicine is a familiar one. What Finland has to do is have an internal devaluation. That is, it’s got to force down labour prices. That’s something that is difficult and something that can only be done with considerable economic pain. It’s also what Spain, Portugal and the extreme case of Greece have all also had to do. And the reason is that they’re in the euro. As Paul Krugman points out:

What’s going on? Well, in the case of Finland we’re seeing the classic problems of asymmetric shocks in a currency area that isn’t optimal. Finland’s two main export sectors, forest products and Nokia, have tanked; this creates the need for a sharp fall in relative wages to make up for the lost markets, but because Finland doesn’t have its own currency anymore this adjustment must take the form of a slow, grinding internal devaluation (which is, by the way, why the garbled discussion of wages turns the story into nonsense).

Read more …

“It was digital money conjured out of thin air and they certainly haven’t destroyed or repealed the law of supply and demand.”

• The Futility of Our Global Monetary Experiment (David Stockman)

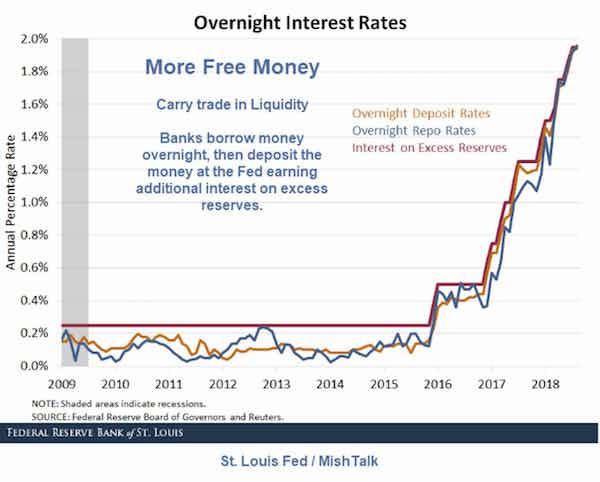

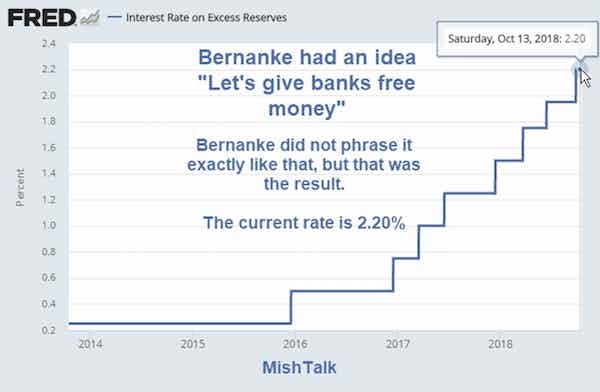

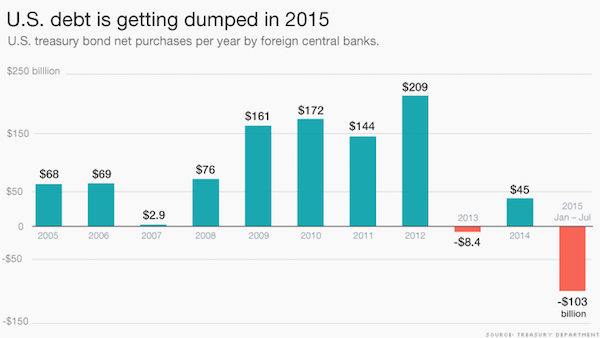

If they don’t raise the interest rate in June — and I think all the signals now are pretty clear they’re going to find another reason to delay — that will mean seventy-eight straight months of zero rates in the money market. As I always say, the money-market price, that is the Federal Funds Rate or Overnight Money or a short term treasury bill, is the most important price in all of capitalism because that determines the cost of carry, the cost of speculation and gambling. When you conduct a monetary policy that says to the speculators, to the gamblers, “come and get it,” you are guaranteed free money to carry your positions, whether you’re buying German Bonds or you’re buying the S&P 500 Stock Index or the whole array of yielding or price gaining assets that are available in the financial market.

This monetary policy also sends the message that you can leverage and carry those positions for free and roll it day after day without worry because the central bank has pegged your cost and production, and in a sense has pledged on its solemn honor that it will not change without many months of warning. And that’s what this whole thing is about — changing the language and so forth. I think you have created a massive distortion in the very heart of capitalism in the financial system. Second, I think even though they stopped actually adding to their balance sheet in October — when QE supposedly ended in a technical sense — the Fed has put $3.5 trillion worth of basic financial fraud into the world financial system and economy.

After all, when they bought all of that treasury debt and all of those GSE securities, what did they use to pay for it with? It was digital money conjured out of thin air and they certainly haven’t destroyed or repealed the law of supply and demand. So, if you put $3.5 trillion of demand into the fixed income market at points along the yield curve all the way from two years to thirty years, that is an enormous fat sum on the scale. That is an enormous distortion of pricing because you can’t have that much demand without affecting the price. Now, with the ECB at full throttle, and with Japan being almost a lunatic in its mimicking of QE, you are creating the greatest distortion of fixed income pricing or bond market pricing in the history of the world, and the bond market is the monster of the midway.

Read more …

Essential reading.

• The Sunday Times’ Snowden Story Is Journalism At Its Worst (Glenn Greenwald)

Western journalists claim that the big lesson they learned from their key role in selling the Iraq War to the public is that it’s hideous, corrupt and often dangerous journalism to give anonymity to government officials to let them propagandize the public, then uncritically accept those anonymously voiced claims as Truth. But they’ve learned no such lesson. That tactic continues to be the staple of how major US and British media outlets “report,” especially in the national security area. And journalists who read such reports continue to treat self-serving decrees by unnamed, unseen officials – laundered through their media – as gospel, no matter how dubious are the claims or factually false is the reporting.

We now have one of the purest examples of this dynamic. Last night, the Murdoch-owned Sunday Times published their lead front-page Sunday article, headlined “British Spies Betrayed to Russians and Chinese.” Just as the conventional media narrative was shifting to pro-Snowden sentiment in the wake of a key court ruling and a new surveillance law, the article claims in the first paragraph that these two adversaries “have cracked the top-secret cache of files stolen by the fugitive US whistleblower Edward Snowden, forcing MI6 to pull agents out of live operations in hostile countries, according to senior officials in Downing Street, the Home Office and the security services.” It continues:

Western intelligence agencies say they have been forced into the rescue operations after Moscow gained access to more than 1m classified files held by the former American security contractor, who fled to seek protection from Vladimir Putin, the Russian president, after mounting one of the largest leaks in US history. Senior government sources confirmed that China had also cracked the encrypted documents, which contain details of secret intelligence techniques and information that could allow British and American spies to be identified. One senior Home Office official accused Snowden of having “blood on his hands”, although Downing Street said there was “no evidence of anyone being harmed”.

Aside from the serious retraction-worthy fabrications on which this article depends – more on those in a minute – the entire report is a self-negating joke. It reads like a parody I might quickly whip up in order to illustrate the core sickness of western journalism. Unless he cooked an extra-juicy steak, how does Snowden “have blood on his hands” if there is “no evidence of anyone being harmed?” As one observer put it last night in describing the government instructions these Sunday Times journalists appear to have obeyed: “There’s no evidence anyone’s been harmed but we’d like the phrase ‘blood on his hands’ somewhere in the piece.”

Read more …

The Sunday Times may yet regret having run it. Already, a vital accusation was silently removed from the digital version.

• Five Reasons the MI6 Story is a Lie (Craig Murray)

The Sunday Times has a story claiming that Snowden’s revelations have caused danger to MI6 and disrupted their operations. Here are five reasons it is a lie.

1) The alleged Downing Street source is quoted directly in italics. Yet the schoolboy mistake is made of confusing officers and agents. MI6 is staffed by officers. Their informants are agents. In real life, James Bond would not be a secret agent. He would be an MI6 officer. Those whose knowledge comes from fiction frequently confuse the two. Nobody really working with the intelligence services would do so, as the Sunday Times source does. The story is a lie.

2) The argument that MI6 officers are at danger of being killed by the Russians or Chinese is a nonsense. No MI6 officer has been killed by the Russians or Chinese for 50 years. The worst that could happen is they would be sent home. Agents’ – generally local people, as opposed to MI6 officers – identities would not be revealed in the Snowden documents. Rule No.1 in both the CIA and MI6 is that agents’ identities are never, ever written down, neither their names nor a description that would allow them to be identified. I once got very, very severely carpeted for adding an agents’ name to my copy of an intelligence report in handwriting, suggesting he was a useless gossip and MI6 should not be wasting their money on bribing him. And that was in post communist Poland, not a high risk situation.

3) MI6 officers work under diplomatic cover 99% of the time. Their alias is as members of the British Embassy, or other diplomatic status mission. A portion are declared to the host country. The truth is that Embassies of different powers very quickly identify who are the spies in other missions. MI6 have huge dossiers on the members of the Russian security services – I have seen and handled them. The Russians have the same. In past mass expulsions, the British government has expelled 20 or 30 spies from the Russian Embassy in London. The Russians retaliated by expelling the same number of British diplomats from Moscow, all of whom were not spies! As a third of our “diplomats” in Russia are spies, this was not coincidence. This was deliberate to send the message that they knew precisely who the spies were, and they did not fear them.

4) This anti Snowden non-story – even the Sunday Times admits there is no evidence anybody has been harmed – is timed precisely to coincide with the government’s new Snooper’s Charter act, enabling the security services to access all our internet activity. Remember that GCHQ already has an archive of 800,000 perfectly innocent British people engaged in sex chats online.

5) The paper publishing the story is owned by Rupert Murdoch. It is sourced to the people who brought you the dossier on Iraqi Weapons of Mass Destruction, every single “fact” in which proved to be a fabrication. Why would you believe the liars now?

Read more …

Second that.

• Let Me Be Clear – Edward Snowden Is A Hero (Shami Chakrabarti)

Who needs the movies when life is full of such spectacular coincidences? On Thursday, David Anderson, the government’s reviewer of terrorism legislation, condemned snooping laws as “undemocratic, unnecessary and – in the long run – intolerable”, and called for a comprehensive new law incorporating judicial warrants – something for which my organisation, Liberty, has campaigned for many years. This thoughtful intervention brought new hope to us and others, for the rebuilding of public trust in surveillance conducted with respect for privacy, democracy and the law. And it was only possible thanks to Edward Snowden. Rumblings from No 10 immediately betrayed they were less than happy with many of Anderson’s recommendations – particularly his call for judicial oversight.

And three days later, the empire strikes back! An exclusive story in the Sunday Times saying that MI6 “is believed” to have pulled out spies because Russia and China decoded Snowden’s files. The NSA whistleblower is now a man with “blood on his hands” according to one anonymous “senior Home Office official”. Low on facts, high on assertions, this flimsy but impeccably timed story gives us a clear idea of where government spin will go in the coming weeks. It uses scare tactics to steer the debate away from Anderson’s considered recommendations – and starts setting the stage for the home secretary’s new investigatory powers bill. In his report, Anderson clearly states no operational case had yet been made for the snooper’s charter. So it is easy to see why the government isn’t keen on people paying too close attention to it.[..]

So let me be completely clear: Edward Snowden is a hero. Saying so does not make me an apologist for terror – it makes me a firm believer in democracy and the rule of law. Whether you are with or against Liberty in the debate about proportionate surveillance, Anderson must be right to say that the people and our representatives should know about capabilities and practices built and conducted in our name. For years, UK and US governments broke the law. For years, they hid the sheer scale of their spying practices not just from the British public, but from parliament. Without Snowden – and the legal challenges by Liberty and other campaigners that followed – we wouldn’t have a clue what they were up to.

Read more …

The narrative machine.

• US And Poland In Talks Over Weapons Deployment In Eastern Europe (Guardian)

The US and Poland are discussing the deployment of American heavy weapons in eastern Europe in response to Russian expansionism and sabre-rattling in the region in what represents a radical break with post-cold war military planning. The Polish defence ministry said on Sunday that Washington and Warsaw were in negotiations about the permanent stationing of US battle tanks and other heavy weaponry in Poland and other countries in the region as part of Nato’s plans to develop rapid deployment “Spearhead” forces aimed at deterring Kremlin attempts to destabilise former Soviet bloc countries now entrenched inside Nato and the EU. Tomasz Siemoniak, the Polish defence minister, had talks on the issue at the Pentagon last month.

Warsaw said on Sunday that a decision whether to station heavy US equipment at warehouses in Poland would be taken soon. Nato’s former supreme commander in Europe, the American admiral James Stavridis, said the decision marked “a very meaningful policy shift”, amid eastern European complaints that western Europe and the US were lukewarm about security guarantees for countries on the frontline with Russia following Vladimir Putin’s seizure of parts of Ukraine. “It provides a reasonable level of reassurance to jittery allies, although nothing is as good as troops stationed full time on the ground, of course,” the retired admiral told the New York Times.

Nato has been accused of complacency in recent years. The Russian president’s surprise attacks on Ukraine have shocked western military planners into action. An alliance summit in Wales last year agreed quick deployments of Nato forces in Poland and the Baltic states. German mechanised infantry crossed into Poland at the weekend after thousands of Nato forces inaugurated exercises as part of the new buildup in the east. Wary of antagonising Moscow’s fears of western “encirclement” and feeding its well-oiled propaganda effort, which regularly asserts that Nato agreed at the end of the cold war not to station forces in the former Warsaw Pact countries, Nato has declined to establish permanent bases in the east.

Read more …

“..one of those phenomena you hear about in airport lounges just around the time it is nearly over.”

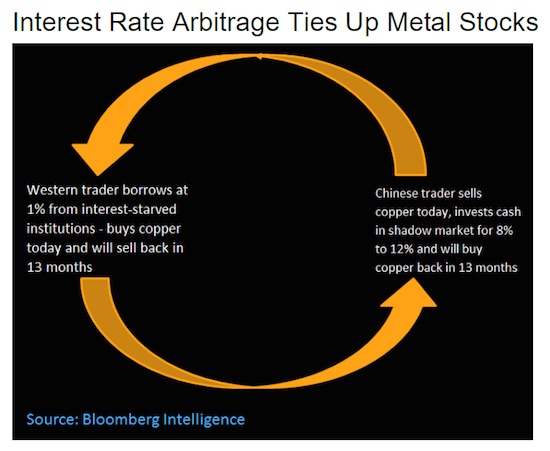

• The Oil Cash-and-Carry Trade Does The Shipping Tanker Contango (Dizard)

The oil cash-and-carry trade is one of those phenomena you hear about in airport lounges just around the time it is nearly over. At the risk of repeating what your taxi driver told you this morning, oil cash-and-carries are about buying 2m barrels of oil with money borrowed from a “too big to fail” bank, storing it in a very large crude carrier, leaving it at anchor for, say, a year and then selling the oil at a higher price. Easy to understand, if you are the billionaire industrialists the Koch brothers. The cycles of this trade tell us a lot about macro-trade hype, the prospects for interest rates and ship owners’ financing. They can also mislead people about the prospects of the oil price.

I am not worried that the Koch brothers themselves will be tempted by the lure of fast money to overcommit their credit lines to the oil carry trade. I would be more concerned that the investing public, or the “smart money” of private equity funds, will continue to buy bits of crude or tankers, or shares in the companies that own them, in the hope of profiting from a growing market for oil storage. Even as the shares of companies owning bulk carriers have sunk to the bottom of the Mariana trench, tanker equities have steamed ahead. For example, Scorpio Bulkers is down 76% over the past year, while Nordic American Tankers is up over 56%.

No doubt some analyst could point to perceived differences in management quality, but for most investors these are commodity plays: bulkers = China raw material imports; tankers = oil contango. A contango, or a series of prices for future delivery of a commodity that increases over time, can tell a counterintuitive story, particularly for oil. For many, it appears to predict that the price is going up. Most of the time, though, crude oil prices are in backwardation, meaning near-term prices are higher than prices for future delivery. This makes sense when you consider it; if refiners only need oil a couple of months in advance, why not leave it in the ground rather than pay storage and financing costs on that position?

Read more …

Europe can’t afford to pay for its own infrastructure anymore.

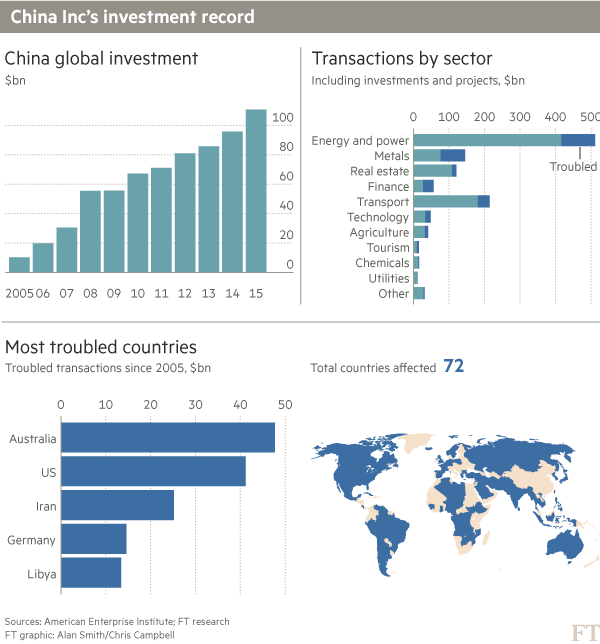

• China To Inject Billions Into European Infrastructure Fund (Reuters)

China will pledge a multi-billion dollar investment in Europe’s new infrastructure fund at a summit on June 29 in Brussels, according to a draft communique seen by Reuters – Beijing’s latest round of chequebook diplomacy to win greater influence. While the exact amount is still to be decided, the pledge will mark the latest step in China’s efforts to shape global economic governance at the expense of the United States, and follows major EU governments’ decision to join the Chinese-led Asian Infrastructure Investment Bank (AIIB) in defiance of Washington. It is expected to come with a request for return investment in China’s westward infrastructure drive – the “One Belt, One Road” initiative – constructing major energy and communications links across Central, West and South Asia to as far as Greece.

“China announced that it would make (X amount) available for co-financing strategic investment of common interest across the EU,” the draft final statement says, adding that agreements will be finalised at another meeting in September. An EU diplomat said the Chinese contribution was likely to be “in the billions”. EU and Chinese officials have told Reuters that Chinese banks are looking mainly at telecoms and technology projects. Chinese Premier Li Keqiang, who will attend the summit in Brussels, will agree with EU leaders that the €315 billion fund will “create opportunities for China to invest in the EU, in particular in infrastructure and innovation sectors”. If sealed, the deal will be a success for EC President Jean-Claude Juncker, who faced scepticism last year when he proposed the European Fund for Strategic Investment (EFSI), because EU governments are putting in little seed money.

France, Germany, Italy and Poland have each announced they will contribute 8 billion euros, while Spain and Luxembourg have pledged smaller contributions. The bloc is relying mainly on private investors and development banks to fund projects selected from an initial list of almost 2,000 submitted by the 28 member states, from airports to flood defenses, that are together worth 1.3 trillion euros. A big Chinese investment might raise questions about governance of the fund, which is so far strictly a European institution. An EU diplomat said it was not known whether China would seek representation commensurate with its stake. The decision to invite China into an EU fund could cause some friction with Washington, which is wary of Beijing’s rising influence and upset that Europe rebuffed its calls to stay out of the AIIB.

Read more …

What can you say to this other than ‘don’t look down’?

• China’s Stock Market Value Tops $10 Trillion for First Time (Bloomberg)

The value of Chinese stocks rose above $10 trillion for the first time, the latest milestone for the nation’s world-beating rally. Companies with a primary listing in China are valued at $10.05 trillion, an increase of $6.7 trillion in 12 months, according to data compiled by Bloomberg. The gain alone is more than the $5 trillion size of Japan’s entire stock market. The U.S. is the biggest globally, at almost $25 trillion. No other stock market has grown as much in dollar terms over a 12-month period, as Chinese individuals piled into the nation’s equities using borrowed funds to bet gains will continue. Valuations are now the highest in five years and margin debt has climbed to a record, all while the economy is mired in its weakest expansion since 1990.

“This a reflection of the risk-taking attitude of the public,” Hao Hong at Bocom International in Hong Kong, said. “People are taking on an unreasonable amount of risk for deteriorating economic growth.” Outside of China, investors aren’t showing the same enthusiasm toward the nation’s equities. Funds pulled a net $6.8 billion out of Chinese stock funds in the seven days through Wednesday, Barclays Plc. said in a research note, citing EPFR Global data. Dual-listed Chinese shares cost more than twice as much on average on mainland exchanges than they do in Hong Kong. MSCI’s June 9 decision against including mainland equities in its benchmark gauge had little impact on the Shanghai Composite Index, which climbed 2.9% last week to its highest level since January 2008.

Foreigners are limited by quotas when buying shares in Shanghai via an exchange link with Hong Kong, while similar access to Shenzhen-traded stocks will likely start this year, according to the Hong Kong bourse. The Shanghai gauge has rallied 152% in the past 12 months, the most among global benchmark indexes tracked by Bloomberg, and trades at about 26 times reported earnings. Less than a year ago, the gauge was valued at about 9.6 times, the lowest since at least 1998. The Shenzhen Composite Index, tracking stocks on the smaller of China’s two exchanges, trades at 77 times profits after surging 194%.

Read more …

No confidence.

• China’s MSCI Reality Check Is Too Big To Ignore (MarketWatch)

In recent weeks, much of the debate on China has centered on the idea that it is “too big to be ignored,” meaning the rest of the world would inevitably need to own its equities and currency. But now it’s set for a reality check. In the same week that Chinese A-shares failed to be included in MSCI’s emerging-market benchmark, it was also revealed that global investors pulled $7.9 billion out of Asia. This was the biggest weekly withdrawal in almost 15 years, according to data provider EPFR Global, and the majority reportedly related to China. Take this as a cue to look past China’s size and, instead, consider again its questionable fundamentals.

So far this year, concerns over a potential debt crisis have been drowned out by the roar of China’s domestic equity bull market – the best performing in the world this year by a long margin. But last week’s decision by MSCI tells us it’s too early to consider China a mainstream asset class. Despite much talk of reform, Beijing’s efforts to open its capital markets or make its financial system more transparent have been limited. Yuan internationalization might be accelerating, but a capital-account opening still looks like a distant promise. The decision against effectively forcing global fund managers to benchmark against an index they can still not freely buy and sell, in a currency that is not freely traded, is hard to take issue with.

As well as A-shares, Beijing has been angling to have the yuan recognized as one of the IMF’s benchmark currencies. This again follows the “too big to be ignored” line of thinking for the world’s second-largest economy. But this could be similarly premature when the yuan’s value is still determined by Beijing and not the market. The fact that the PBoC doesn’t issue currency notes larger than 100 yuan ($16) suggests it’s still preoccupied with the risk of capital flight. Rather than IMF technical tests, a simple one would be whether the Communist Party is willing to test its own people’s confidence in the yuan by letting it be freely exchanged? After that, it might be time to consider its merits as a global reserve currency, or whether Chinese shares should become cornerstone holdings in global equities.

Read more …

“..two-thirds of the country’s newcomers to investing left school before the age of 15..”

• Stand Back: China’s Bubble Will Burst (Clive Crook)

Singapore, which I’m visiting at the moment, opens your mind to the highly improbable. Rich, ethnically diverse, cheerfully efficient, globalized in the extreme, it’s a man-made economic miracle — astonishing proof of what market forces combined with superb top-down direction can achieve. Even in Singapore, though, there are limits to what you can believe. I struggle to imagine, for instance, that China’s stock market isn’t a bubble. China’s leadership has long been impressed with the Singapore model. Since Deng Xiaoping, its government has been much more interested in capitalism in the style of Lee Kuan Yew than class struggle in the style of Karl Marx. In China, the mix of markets and smart management has indisputably worked another miracle, and on a vastly larger scale than Lee’s.

It’s a record that can make investors credulous. Lately, the government has defied predictions of an economic hard landing: The economy has slowed, but hasn’t crashed. Beijing wanted a gentle slowdown – part of its effort to rebalance the economy toward consumption and away from exports and investment – so it pulled some fiscal and monetary levers and that’s what happened. Targeted growth of 7% in GDP this year, fast by any other country’s standards, looks achievable. Many investors seem to think officials can direct the stock market just as precisely. It’s only a matter of time before they’re proved wrong. You could argue, in fact, that they already have been. The government wants a strong stock market for several reasons, including to support demand as property prices sag and growth in credit and investment slow.

It has been talking up share prices. Official news outlets extoll the virtues of stock ownership. But the government surely can’t have wanted the frenzy that in recent months has pushed the valuations of many companies to preposterous levels. Manic episodes rarely end well – and in many respects, this is mania. The Shenzhen market is up almost 200% over the past year. Its price-earnings ratio stands at a little less than 80. (Standard & Poor’s 500 Index is up 9% and has a ratio of 19.) Much of the demand for Chinese shares is credit-fuelled and comes from small investors new to the game. In one week in April Chinese investors opened 4 million new brokerage accounts – and two-thirds of the country’s newcomers to investing left school before the age of 15.

Read more …

“..an international conquest of democracy, by international corporations.”

• How Obama’s “Trade” Deals Are Designed To End Democracy (Eric Zuesse)

U.S. President Barack Obama has for years been negotiating with European and Asian nations — but excluding Russia and China, since he is aiming to defeat them in his war to extend the American empire (i.e, to extend the global control by America’s aristocracy) — three international ‘trade’ deals (TTP, TTIP, & TISA), each one of which contains a section (called ISDS) that would end important aspects of the sovereignty of each signatory nation, by setting up an international panel composed solely of corporate lawyers to serve as ‘arbitrators’ deciding cases brought before this panel to hear lawsuits by international corporations accusing a given signatory nation of violating that corporation’s ‘rights’ by its trying to legislate regulations that are prohibited under the ’trade’ agreement,

such as by increasing the given nation’s penalties for fraud, or by lowering the amount of a given toxic substance that the nation allows in its foods, or by increasing the percentage of the nation’s energy that comes from renewable sources, or by penalizing corporations for hiring people to kill labor union organizers — i.e., by any regulatory change that benefits the public at the expense of the given corporations’ profits. (No similar and countervailing power for nations to sue international corporations is included in this: the ‘rights’ of ‘investors’ — but really of only the top stockholders in international corporations — are placed higher than the rights of any signatory nation.)

This provision, whose full name is “Investor State Dispute Resolution” grants a one-sided benefit to the controlling stockholders in international corporations, by enabling them to bring these lawsuits to this panel of lawyers, whose careers will consist of their serving international corporations, sometimes as ‘arbitrators’ in these panels, and sometimes as lawyers who more-overtly represent one or more of those corporations, but also serving these corporations in other capacities, such as via being appointed by them to head a tax-exempt foundation to which international corporations ‘donate’ and so to turn what would otherwise be PR expenses into corporate tax-deductions. In other words: to be an ‘arbitrator’ on these panels can produce an extremely lucrative career.

These are in no way democratic legal proceedings; they’re the exact opposite, an international conquest of democracy, by international corporations.

Read more …

The harder they come.

• Inside The Crazy World Of Canada’s Peak Real Estate (MacLean’s)

A huge chunk of Canadians’ assets are tied up in real estate (roughly 35% in principal residences and another 10% in second properties), and their value has exploded. Some $1.7 trillion in net new wealth has been created from Canadian real estate since 2000. In fact, a growing number of Canadians expect their home to pay for their retirement. Is it any wonder, then, that with so much at stake, emotions run high and disputes turn ugly? “Real estate is seen as a commodity in scarce supply—while there’s actually a lot of it out there, it’s scarce if we can’t afford it,” says John Andrew, an adjunct assistant professor who studies real estate at Queen’s University. “It’s inevitable that you start to see these conflicts. It tends to bring out the worst in people.”

It’s not just battles over monster homes. While bidding wars have become an unwelcome rite of passage in the quest for home ownership in Canada over the past decade, the battles have grown even more irrational and vicious of late as buyers compete for the privilege of owning dilapidated, inner-city homes that often need to be gutted to be saved. As for those priced out of the housing market altogether, there are growing calls for politicians to do something—anything—to bring down the cost of owning a home in Canada. That’s led to a NIMBYish dispute in Calgary over legal basement suites and quasi-xenophobic discussions in Vancouver about the need to clamp down on foreign property buyers—read: mainland Chinese.

One local urban planner has even dubbed Vancouver a “hedge city,” suggesting its single-family homes are little more than a place for wealthy foreigners to park their cash. With all the rage, greed and animosity, the country’s already overheated housing market has hit yet another level—one where desperate, would-be buyers clamour, wild-eyed, for a slice of the action, while existing homeowners go to extreme lengths to protect their property nest eggs. Meanwhile, the rest of the world looks on and wonders: Has Canada gone crazy?

Read more …

You betcha.

• Australian Banks And Real Estate: A Ponzi Scheme That Could Ruin Us? (ABC.au)

Madness has gripped Sydney’s and parts of Melbourne’s property market; a malaise that, if allowed to continue, could have dire consequences for the nation. So far, much of the debate around the rampant real estate market has revolved around affordability and the worrying concern that we are in the process of creating a class system based upon land ownership as wealth is transferred from a generation entering the workforce to those about to exit it. But a far greater and more immediate danger lurks in the shadows. The prospect of a reversal – of a sudden decline in property values in the two major capitals – would be enough to tip the nation into a severe economic crisis.

It’s not as though it hasn’t happened elsewhere. The collapse in American property markets in 2007 sparked the worst global recession in generations. The UK endured its own crisis borne from overly exuberant real estate speculation. The same thing happened across Europe. The east coast capital city property bubble is being driven by investors who borrowed $11.5 billion in April, a 23.5% rise from a year earlier. They sidelined owner occupiers, who borrowed $9.8 billion. None of this is being fuelled by wages growth. Beneath this month’s GDP figures – which superficially showed an encouraging 0.9% lift for the March quarter – lay the real story. Nominal GDP – a much better proxy for earnings and wages – grew just 0.4% for the quarter and an anaemic 1.2% for the year.

In the past fortnight, the Prime Minister and the Treasurer have been assailed by the nation’s three most powerful economic mandarins, each of whom has directly contradicted the Government mantra on rising property prices. Treasury head John Fraser, Reserve Bank chief Glenn Stevens and financial system inquiry author David Murray have all expressed alarm at recent developments in the eastern states capital city housing markets. They have yet to detail the mechanism by which their unfolding fears could play out if the Sydney and Melbourne housing bubble is not deflated. But here is a likely scenario over how an unfettered boom could wreck the economy.

Read more …

Katrina, Sandy, big words but..

• Just 16% Of Hurricane Sandy Funds Given Out By 2014 (NY Post)

Just 16% of the money given to the city for Hurricane Sandy projects was doled out in contracts by the end of 2014 even though the storm ravaged the area more than two years before, according to a new analysis. Some Sandy projects were added late in the planning process and the feds had not appropriated all the funding by that time, the Independent Budget Office found. The funding was worth a total $9.7 billion. The MTA said much of the rebuilding and strengthening of the transit system still has to be done such as work on the Cranberry Tube, used by the A and C lines, and the L train s Canarsie Tube.

Those Sandy projects which have been funded are progressing rapidly, rep Kevin Ortiz said. The IBO also said that when the MTA s last capital plan wrapped up it had spent less than half of its funds. The plan ran between 2010 and 2014, and cost $31.9 billion. Many of the projects and contracts expand beyond the four years of the last plan, according to the report. The MTA is facing a $14 billion deficit for its next plan, which funds big-ticket items like new subway cars.

Read more …

How can France sign up to the TTIP if it does this?

• ‘Stop Over-The-Counter Sales of Monsanto’s Round-Up’ – French Minister (RT)

French environment and energy minister Segolene Royal has asked garden centers to stop self-service sales of Monsanto’s Roundup weed killer to fight the harmful effects of pesticide. “France must be offensive on stopping pesticides,” Segolene Royal told France 3 television on Sunday. “I have asked garden shops to stop over-the-counter sales of Monsanto’s Roundup.” The US agribusiness giant’s weed killer came back under scrutiny in March, after its main active ingredient, glyphosate, was branded “probably carcinogenic to humans” by the International Agency for Research on Cancer (IARC), part of the World Health Organization (WHO).

Earlier this month, the French consumer association CLCV asked authorities to ban glyphosate herbicides, which are used domestically by amateur gardeners in France. On Thursday Royal and the Minister of Agriculture made a joint statement announcing that phytosanitary products used to control plant diseases would only be available to amateur gardeners “through an intermediary or a certified seller” from January 2018. France plans to introduce a full ban on the use of pesticides by home gardeners from 2022, according to the statement made by the environment and energy ministry in April.

In response to the minister’s statement, Monsanto said on Sunday it had no information about a change in authorization for selling Roundup. “Under the conditions recommended on the label, the product does not present any particular risk for the user,” the company said in an email sent to Reuters. Glyphosate is the most-produced weed killer in the world, with applications in agriculture, forestry, industrial weed control, as well as lawn, garden, and aquatic environments, according to the IARC. Monsanto has strongly contested IARC’s classification, saying that “relevant, scientific data was excluded from review.” In the US, the herbicide has been considered safe since 2013, when Monsanto received approval for increased tolerance levels for glyphosate from the US Environmental Protection Agency (EPA).

Read more …

Immigrants get more money than many residents.

• An Immigrant Is Worth More Than Drugs (Beppe Grillo’s blog)

Giovanni Falcone said “Follow the money and you’ll find the mafia”. Every immigrant arriving in Italy has the right to €1,050 a month to live on. Of this, a percentage goes to the mafia. Judging from the wiretapped conversations that amount ranges from one to two euros a day. For the mafia, immigrants are a source of income. They’re worth more than drugs. A boatload of Africans is worth more than a boatload of cocaine. And so it’s in their interests to get as many as possible to come. The boat handlers are paid by the immigrants – about a thousand euro per person. But who’s really paying the boat handlers?

Is it really the immigrants that, back home, would get by on that amount for years? Or someone else? Is the immigrant getting into a lifetime of debt to get a place on board a boat? And to whom is he indebted? It’s not realistic to think that people who “have lost everything“, who are destitute, who don’t even have the money for a change of clothes, can easily get hold of a thousand euro or even more. Where’s this money coming from? The most obvious response is that the ones paying out are the ones that are making money – htus the mafias.

And that’s how they close the circle – with the boat handlers, the mafias and the immigrants. To be sure, there are also the political parties that create “the moments of crisis” so that they can open up “welcome centres” that can be used to cream off money for themselves and for the mafias. Mafiacapitale is just the tip of the iceberg. Where there are immigrants, there’s the smell of money. It’s a resource to be added to the GDP together with drugs and prostitution. After Rome, there’ll be other cities, other kickbacks, and other politicians. It’s just a matter of time. To resolve the imigration issue, the associated flow of money needs drying up.

Read more …