DPC Sternwheeler Falls City, the levee, Vicksburg, Mississippi 1900

Yeah, right. The danger is still the same. All the regulators and clearing houses are nice, but it’s all kept as opaque as ever for a reason.

• The New Danger From Derivatives (BBG)

Global regulators are turning their attention to an important piece of unfinished business: ensuring that a bad bet on derivatives can’t upset the entire financial system. They’ve hit on a good solution — as long as they can prevent it from becoming a threat in itself. The 2008 financial crisis proved that derivatives had gotten out of control. Some participants were making huge bets – say, on the likelihood of bond defaults – without putting up collateral to guarantee payment if the bets went wrong. When U.S. insurer AIG couldn’t make good on almost $50 billion in derivatives-related debts, it nearly brought down several of the world’s largest banks. In response, regulators have turned to a time-honored tool: the clearing house, which stands in the middle of trades and gathers collateral from all its members.

The U.S. has already moved most derivatives contracts to central clearing, and Europe is following. Clearing houses will play an increasingly important role in containing systemic risk, setting limits on leverage for banks, hedge funds and other investors. However, clearing houses present a risk of their own. If a crisis triggers defaults that overwhelm the posted collateral, they have little capital of their own to absorb losses. Beyond that, they’d rely on tapping a pre-paid guaranty fund and then calling in cash from the financial institutions that are their main customers – demands that in a crisis could cause distress to spread. If those resources proved inadequate, the government would likely have to step in to prevent a complete breakdown. The clearing houses are too important to fail, and the current rules governing their risk management are too lax.

Guaranty funds must cover at least two major defaults, but clearing houses are allowed to decide how much cash that actually requires – and how much capital their shareholders should pitch in to absorb the first losses. The size of this shareholder contribution matters a lot, because the fear of loss is an incentive to be prudent in setting collateral requirements in the first place. Some of the clearing houses’ biggest users – including JPMorgan Chase, Pimco and BlackRock – have noted these deficiencies, and global regulators are planning to address them this year. Greater transparency and specific capital requirements would be a good start. Regulators should publicly stress-test clearing houses as they do banks, and should require them to disclose enough information to assess the quality of their risk management (a process that has already begun). Also, research suggests that shareholder contributions to guaranty funds should probably be larger than the current average of about 3% among the leading U.S. and European clearing houses.

Just wait for the People’s Congress to end in a week’s time.

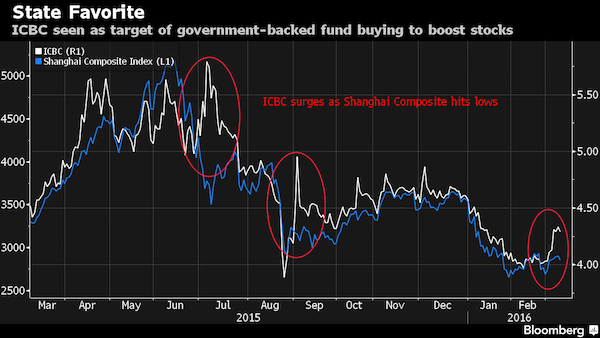

• The China Intervention Trade Is Back as State Funds Battle Bears (BBG)

The Chinese stock market has once again turned into a battleground for bearish investors and state-directed funds determined to spark a rally. During each of the past six days, the Shanghai Composite Index has recorded intraday losses before recovering to end the trading session higher, with suspected intervention targets including Industrial & Commercial Bank of China and PetroChina leading the rebound. After dropping as much as 3.1% on Wednesday, the benchmark gauge pared its loss to 1.3% at the close as ICBC jumped. The resumption of afternoon rallies, a common occurrence during the height of the government’s market rescue campaign in July, has presented traders with a quandary: Worsening economic data suggest stocks should fall, but state intervention provides an opportunity to profit from short-term gains.

It’s yet another sign of how government meddling has undermined the leadership’s own pledge to increase the role of market forces in the world’s second-largest economy. “There might be funds buying in the afternoon and pushing up the index again,” said Zhang Gang at Central China Securities. “But the market won’t be able to find a more clear direction until after” the National People’s Congress ends, Zhang said. The Shanghai Composite posted a sixth day of gains on Tuesday, extending its March rally to 7.9%, despite a worse-than-estimated plunge in exports that sent shares tumbling around the world. Some local branches of the securities regulator asked listed companies, mutual funds and brokerages to stabilize the market during annual parliamentary meetings this month, two people with direct knowledge of the situation said last week.

“Near-term data like trade is negative, and so there is selling pressure,” said Francis Cheung at CLSA. “The government is supporting the market for the NPC, so when it ends, we could see a pullback.” Banks and other major state-owned enterprises are most vulnerable to a retreat after the NPC, Cheung said. ICBC, the country’s biggest lender, climbed 9.4% this month and PetroChina, the largest oil producer, added 7.1%. The Shanghai Composite’s 6.5% gain in March compares with a 3.1% advance in the MSCI All-Country World Index. “If you look at the macro data coming out from China, you see it hasn’t been performing well,” said Ronald Wan at Partners Capital International in Hong Kong. “That has been reflected in other markets, but on the contrary it hasn’t been reflected in the A-share market.”

In reverse.

• Fake Trade Invoicing In China Is Back (BI)

Capital has been flowing out of China at unprecedented rate over the past six months. Amidst concerns about the economy and the potential for further weakness in the Chinese renminbi, many investors are running for the exits. With regulators closely monitoring cross boarder flows, heightening the risk of more stringent capital controls being put in place, investors have become increasingly inventive when it comes to getting money out of China. Take the practice of fake invoicing, for example. Based on recent anomalies between Chinese and Hong Kong trade figures, it appears many investors are now trying to get their capital out through non-traditional means, overstating the value of imported goods from Hong Kong to circumvent Chinese capital controls.

It’s the exact opposite scenario to what was seen in past years where firms in Hong Kong were overstating the value of imported goods from China in order to get capital in there, avoiding capital controls in an attempt to speculate on further strengthening in the renminbi. Here is the UBS China economics team, Ning Zhang, Jennifer Zhong and Tao Wang, on why they suspect fake invoicing is back.

Some capital outflows may have been disguised under over-invoicing of imports from Hong Kong. In the previous three months (December to February), China imports from Hong Kong jumped by 71% y/y on average, in sharp contrast with Hong Kong’s statistics of its exports to China. The difference between China and counterparty data widened visibly as a result. Among China’s imports from Hong Kong, jewellery and precious metals surged by over 200% y/y in the previous months. In light of RMB depreciation expectation and rising pressure of capital outflows in late 2015, we think it is possible that speculators have used overinvoicing of China’s import from Hong Kong again as a channel to move money out of China, though the absolute size has been relatively limited (i.e. China’s monthly average imports from Hong Kong was USD1.5 billion from December to February).

The chart below, supplied by UBS, shows the discrepancy between Chinese imports from Hong Kong, reported by Chinese customs, compared to Hong Kong exports to China, released by the Hong Kong government. Hong Kong trade data for March will be released on March 29. It will be interesting to see whether the anomaly between the two nation’s figures has continued.

“..the practice has become a key way to skirt capital controls and accounted for $328 billion of the record outflows between August and January, or 78% of the decline in China’s reserves.”

• Phantom Goods Disguise Billions in China Illicit Money Flows (BBG)

Days after the Switzerland-based Bank for International Settlements played down fears over capital flight out of China, new trade data has put the spotlight on a channel used to ferret out billions worth of illicit money flows: phantom goods. A steep rise in China’s reported imports from Hong Kong has raised concerns that trade invoices are being manipulated to get capital out of the country amid fears the yuan will continue to weaken. February data released Tuesday show those imports jumped 89% from a year earlier, even as total imports fell 14%. While the rise wasn’t as great as in January, economists said the spike follows similar patterns in recent months that point to companies using trade channels to pay for goods far in excess of their value or even that don’t exist at all.

“There has been a huge increase in payments,” said Andrew Collier, an independent China analyst in Hong Kong and former president of the Bank of China International USA. “The well-connected Chinese in state and private firms are using any tool in the shed to inflate overseas payments.” China’s capital exodus accelerated through 2015 as investors worried that policy makers would allow the yuan to weaken to cushion an ongoing slowdown in the $10 trillion-plus economy. The People’s Bank of China has insisted it isn’t contemplating a big change in currency policy and spent billions of the nation’s foreign exchange reserves defending the yuan’s value. While China has strict rules on moving capital offshore, those seeking to evade limits can disguise money flows as payment for goods exported or imported to foreign countries or territories, especially Hong Kong.

Economists have said they suspect China’s December and January trade numbers were also skewed by this activity. [..] Over-invoicing for goods gives a company or individual the opportunity to skirt China’s capital controls and shift money offshore. Authorities have responded to evidence of the activity by clamping down on the myriad of illicit channels used, from curbing purchases of overseas insurance products to stopping friends and family members from pooling their $50,000-a-year quotas to get large sums of money out. “A strong desire to get assets out of renminbi and into a foreign currency is distorting China’s official trade data at present,” economists at Fathom Financial Consulting wrote. “Our analysis suggests the scale of the problem may have grown exponentially in recent months.”

But China’s capital borders remain porous. In particular, little attention appears to have been paid to companies misreporting imports and exports, according to research by Deutsche Bank. Economists at the bank found the practice has become a key way to skirt capital controls and accounted for $328 billion of the record outflows between August and January, or 78% of the decline in China’s reserves. An estimate by Bloomberg Intelligence put the total for 2015 at $1 trillion.

“The government is already wary about loosening monetary policy to stimulate growth, as that could weaken the yuan further and send more money abroad.”

• China, Fighting Money Exodus, Squeezes Business (WSJ)

Chinese officials are trying anew to slow an unprecedented money exodus from the country, clamping down on individuals seeking to flee the yuan and making life tougher for companies that need to trade the currency for dollars to do business. China’s foreign-exchange regulator in recent months has deployed a new system to monitor individual purchases of foreign funds and has asked banks to reduce foreign-currency transactions. It has summoned bankers to its offices to give guidance and has grilled them when foreign-exchange activity spikes, according to executives at Chinese and foreign lenders. Banks, in turn, have increased scrutiny of foreign-currency transactions by businesses ranging from Chinese entrepreneurs investing abroad to companies paying overseas bills.

A European chemicals manufacturer recently faced delays in Shanghai in obtaining U.S. dollars, threatening its deadline for an overseas licensing payment. The Bank of Tianjin is having trouble getting funds from mainland investors for a planned Hong Kong public stock offering. A water-treatment company struggled to withdraw $2,000 for an engineer to travel to the U.S. “There appears to be a real crackdown on money flowing out of China,” said Jean Francois Harvey, global managing partner at Hong Kong law firm Harvey Law Corp., whose clients have had difficulty recently transferring money out of China for equipment purchases and investment. “Even normal business transactions which are ongoing are getting delayed.”

Mr. Harvey said a Chinese client is having problems wiring $15 million to a Hong Kong company that for two years has been helping it buy equipment for a South American factory. “There’s no indication that the money will go through,” he said, “and we heard from our client that it was due to restrictions on money transfer.” The clampdown comes atop Beijing’s steps after last summer to stem outflows, from restricting cross-border yuan business at foreign banks to cracking down on individuals who are flouting the country’s strict foreign-currency quotas. Economists say tightened capital controls are one reason China’s foreign reserves fell only $28.6 billion in February, less than a third the drops of the two previous months.

Spooked by slowing growth and a declining currency, Chinese businesses and consumers are trying to move money abroad where its value might hold up. Last year, some $700 billion to $1 trillion is estimated to have fled China. That is more than the economy of Switzerland and equivalent to as much as 10% of China’s massive GDP. China’s foreign-currency reserves fell by a record $107.9 billion in December from November and another $128 billion in January and February combined, putting reserves 20% lower than their June 2014 peak. The outflows destabilize the currency and make China’s decelerating economy harder to guide. The government is already wary about loosening monetary policy to stimulate growth, as that could weaken the yuan further and send more money abroad.

“They have a fantasy that if they give everyone money they’ll create entrepreneurs..” “What it will result in is catastrophic losses for the government.”

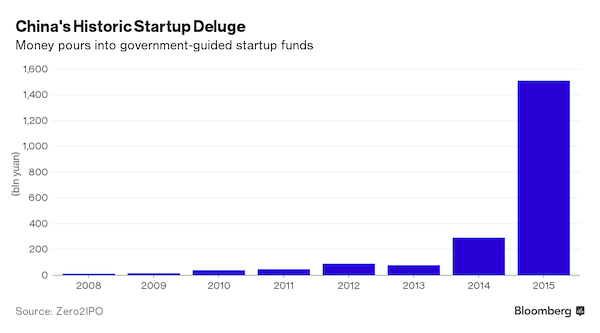

• China’s Historic $338 Billion Tech Startup Experiment (BBG)

China is getting into the venture capital business in a big way. A really, really big way. The country’s government-backed venture funds raised about 1.5 trillion yuan ($231 billion) in 2015, tripling the amount under management in a single year to 2.2 trillion yuan, according to data compiled by the consultancy Zero2IPO Group. That’s the biggest pot of money for startups in the world and almost five times the sum raised by other venture firms last year globally. The money’s in what are known as government guidance funds, where local and central agencies play some role. With 780 such funds nationwide and a lot of experimentation, there’s no set model for how they’re managed or funded. The bulk of their capital comes from tax revenue or state-backed loans.

The money is part of Premier Li Keqiang’s effort to bolster the slowing Chinese economy through innovation and reducing its dependence on heavy industry. The country began a campaign to support entrepreneurship in 2014 and has since opened 1,600 high-tech incubators for startups. The huge influx of cash raises the possibility of a boom-and-bust cycle like the government-led investment in China’s solar and wind power sectors, said Gary Rieschel, founder of Qiming Venture Partners. “They have a fantasy that if they give everyone money they’ll create entrepreneurs,” he said. But inexperienced or corrupt managers are likely to invest in dozens of regional copycats unable to get big enough to be profitable, he said. “What it will result in is catastrophic losses for the government.”

It’s unclear how quickly the funds will be deployed. Regulations and market practices remain to be finalized, Zero2IPO said in its report. But it’s clear that governments are marshaling their resources. Central China’s Wuhan, the capital of Hubei Province, is leading the push with a 200 billion yuan fund, the country’s biggest, with a mix of local and central government financing. The government there says it wants to grow that eventually to 1 trillion yuan, including private money.

After already having acknowledged it is necessary.

• Schaeuble Snubs Debt Relief For Greece (AFP)

German Finance Minister Wolfgang Schaeuble warned Tuesday he opposed debt relief for Greece, a day after eurozone ministers agreed to consider the possibility in upcoming bailout talks. “I honestly have no good argument to present German lawmakers or the German public opinion to whom I have a budgetary responsibility,” said Schaeuble, who is the most influential member of the Eurogroup of eurozone finance ministers. Speaking to journalists after talks with his EU counterparts, Schaeuble said that any discussion of Greek debt relief would be “about prestige, not substance”. However he acknowledged the debate was now opened, but that Germany, the EUs biggest economy, had “good arguments” against easing Greece’s debt burden, which has already been reduced twice since the start of the debt crisis.

Last July, Greek Prime Minister Alexis Tsipras secured Greece’s third bailout in five years, worth €86 billion, but only in return of deep reforms. However, in one of the few concessions handed to Greece, eurozone leaders agreed to also debate debt relief once key reforms pledges were met. Eurogroup chief Jeroen Dijsselbloem on Monday said Greece had made enough headway in its reforms to soon begin that discussion. Debt relief is a also a key demand of the IMF, which believes no economic program would be credible without it. Complicating matters, Schaeuble and other eurozone hardliners firmly back the idea that the pro-austerity IMF take part in Greece’s current bailout. The EU forecasts that Greece’s debt will soar to 185% of GDP in 2016 – a level generally understood to be unsustainable.

So he’ll do moar.

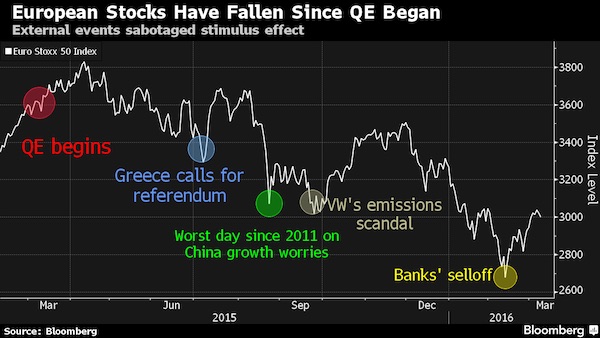

• Draghi Stimulus Fails in Stock Market as Volatility Matches 2008 (BBG)

Mario Draghi is having no success convincing stock investors that the European Central Bank has the firepower to reignite growth. While all economists in a Bloomberg survey expect the central bank to cut interest rates when policy makers meet Thursday, and 73% project them to boost the amount of money put into the financial system through bond purchases, fund managers aren’t optimistic about a post-decision equity rally. In the first year of quantitative easing, the Euro Stoxx 50 Index fell 17%, and volatility reached levels not seen since 2008. The gauge has dropped in each month but one following an ECB meeting since April. “It won’t be easy for Draghi to bring back confidence in the recovery,” said Andreas Nigg at Vontobel Asset Management in Zurich.

“Growth and inflation in Europe remain stuck at low levels and earnings revisions continue to fall. The market needs better earnings revisions and better economic surprises. ” Even after the central bank pumped about €720 billion into the region, manufacturing dropped to its lowest level since 2013, the inflation rate turned negative, and consumer confidence worsened. That’s led analysts to slash profit-growth estimates amid the worst earnings letdown since at least 2007. Investors are pulling money out of European equities at the fastest pace since 2014. When the central bank started its bond-buying program, shares were steaming toward a high amid growing optimism about the euro area’s recovery. But a succession of crises, starting with Greece’s near exit from the single currency, exacerbated by increasing unease over China’s slowing growth, a Volkswagen emissions scandal and the Federal Reserve’s December rate increase battered sentiment, leaving stocks up only 3.9% for 2015, from as much as 22%.

Not could, will.

• Why a Recession Could Mean the End of the Eurozone (BBG)

It was Merkel all along. She has elections coming.

• Brussels Briefing: Turkish Rewrite (FT)

It has become customary to assume EU summits aimed at tackling the ongoing refugee crisis produce much rhetoric but little meat. But last night’s gathering of European leaders with Ahmet Davutoglu, the Turkish prime minister, may prove the one that broke the rule. In talks that went on for 12 hours, the two sides emerged with the outlines of a deal that, if finalised next week, is as sweeping in its implications as it is in its substance. The German-engineered plan would allow the EU to turn back almost all migrants washing ashore in Greece and return them to Turkey. But the price will be high: in addition to billions of additional European aid to Ankara, the EU would expedite a long-dormant visa liberalisation programme that could provide Turkish nationals visa-free travel into the EU’s passport-free Schengen zone as soon as June.

That a significant deal was in the offing was clear late last week when Donald Tusk, the European Council president, travelled to Ankara and received strong signals that Mr Davutoglu was open to a massive programme of refugee returns. But the plan now on the table is significantly more ambitious than the one Mr Tusk was considering. It was driven almost entirely by Mr Davutoglu and Angela Merkel, the German chancellor, with the help of Mark Rutte, her Dutch counterpart and holder of the EU’s rotating presidency. The EU’s nominal leaders (Mr Tusk and Jean-Claude Juncker, the European Commission president) were almost entirely cut out of the deal-making, which began in earnest when the Turkish, German and Dutch leaders held a pre-summit meeting on Sunday. In her press conference, Ms Merkel acknowledged as much, saying Mr Davutoglu presented new demands at the Sunday meeting – and she endorsed them wholeheartedly.

There is still much that could go wrong. The UN and other human rights groups have questioned the legality of mass “pushbacks” of migrants before they receive an asylum hearing, a requirement in the Geneva Conventions. Plans to dub Turkey a “safe third country” – which would provide the legal basis for the deportations – are also likely to be challenged in court. Cyprus is balking at Turkish demands that EU membership talks restart in earnest before Ankara makes concessions as part of once-in-a-generation talks to reunify the long-divided island. Many diplomats were left bruised after being sidelined by the Turco-German juggernaut. We’ve compiled a long list of hurdles – but also an explanation of just how momentous the deal and the highly unorthodox diplomacy behind it – in an explainer by the FT Brussels bureau’s Alex Barker and Duncan Robinson.

All sides now have just over a week before the next EU summit, where Mr Davutoglu will return in hopes of sealing the deal. Some governments must find consensus in fractious coalitions. Others must consult their parliaments. But if Ms Merkel gets her way, EU refugee policy may well be forever changed by last night’s summit.

Two good background pieces from FT.

• Berlin/Ankara Migration Pact — Wrecking Ball Or Silver Bullet?

Of all the big-bang solutions sought for Europe’s migration crisis, a pact crafted by Germany and Turkey on Monday may rank as the most ambitious and politically explosive. The concept is breathtakingly simple: any economic migrant or Syrian refugee arriving on a Greek island would be returned to Turkey. The initiative is intended to be a short circuit for irregular migration. It will go for the bulk of the 2,000 migrants a day that are arriving on Greek beaches. The political price is the EU abandoning constraints that have framed its relations with Turkey for almost a decade. A European visa waiver for Turkish citizens could be granted by June, a pledge that glosses over the strict conditions attached; a decade-long Cypriot bar on some of Ankara’s membership chapters could be lifted; and extra funding made available in 2018 on top of a €3bn already granted by the EU.

These details must still be settled. But perhaps most difficult of all for the EU is resettlement. For every Syrian returned to Turkey from Greece, another Syrian would be accepted by EU countries. It is a programme potentially involving tens of thousands of people, at a time when the EU has managed to resettle just 3,407 in its existing scheme since July. Over time, a more permanent regime would replace it covering hundreds of thousands. Hatched against the backdrop of mounting political strife in Europe, the plan is an attempt to find a silver bullet and close off the Greece-to-Germany migration highway — at least for a few months. It has shocked many of the EU diplomats who had been working up an alternative on Sunday. “This has taken a wrecking ball to our common approach,” said one eurozone diplomat. “Everything is reopened.”

Add Serbia.

• Slovenia And Croatia Ban Transit Of Refugees To Other European Countries (AFP)

Slovenia and neighbouring Croatia will from Wednesday refuse allow the transit of most refugees through their territory in a bid to seal off the Balkan route used by hundreds of thousands of people seeking a new life in Europe. The move could set off a domino effect among Balkan states, with Serbia indicating it would follow Ljubljana’s lead and Macedonia apparently set to so the same. The attempt to shut down the main route used by refugees fleeing war and persecution outside Europe’s borders comes barely a day after the EU and Turkey agreed on a proposal aimed at easing the crisis. EU officials hailed Monday’s deal with Ankara as an important breakthrough, but the head of the UN refugee agency cast doubt on its legality, while Amnesty International said the plan “dealt a death blow to the right to seek asylum”.

Slovenia’s interior ministry said late on Tuesday that from midnight (2300 GMT), access would only be granted to “foreigners meeting the requirements to enter the country”, those wishing to claim asylum, and refugees selected “on a case by case basis on humanitarian grounds and in accordance with the rules of the Schengen zone”. Fellow EU member Croatia, which is not part of the passport-free Schengen zone, said it would follow Slovenia’s lead and refuse transit to most refugees as of midnight. “Apparently Europe has decided to start a new phase in resolving the migrant crisis. It was concluded that on the Schengen zone borders the Schengen rules would be applied,” interior minister Vlaho Orepic told RTL commercial television. Croatia, which had already limited the number allowed to enter, would now only allow in refugees with proper visas.

“The border of Europe will be on the Macedonia-Greek frontier and we will respect the decisions which were made,” he said. More than a million people from Syria, Afghanistan and Iraq have crossed the Aegean Sea into Greece since the start of 2015, most aiming to reach Germany and Scandinavia. The influx has caused deep divisions among EU members about how to deal with Europe’s worst refugee crisis since the second world war. Serbia said that following Slovenia’s move, it would “align all measures with the European Union” and impose the same restrictions at its borders with Macedonia and Bulgaria. Slovenia and Serbia, along with Austria, Croatia and Macedonia, have dramatically restricted entry to migrants in recent weeks, leaving a bottleneck of some 36,000 stuck at the Greek-Macedonian border, unable to continue their journey.

Collective insanity.

• UN Refugee Agency Criticises ‘Quick Fix’ EU-Turkey Deal (Reuters)

The UN refugee agency has said the European Union’s “quick fix” deal to send back refugees en masse to Turkey would contravene their right to protection under European and international law. EU leaders welcomed Turkey’s offer on Monday to take back all migrants who cross into Europe from its soil and agreed in principle to Ankara’s demands for more money, faster EU membership talks and quicker visa-free travel in return. Vincent Cochetel, Europe regional director of the UN high commissioner for refugees (UNHCR), said Europe’s commitment to resettle 20,000 refugees over two years, on a voluntary basis, remained “very low”. “The collective expulsion of foreigners is prohibited under the European convention of human rights,” Cochetel told a news briefing in Geneva.

“An agreement that would be tantamount to a blanket return to a third country is not consistent with European law, not consistent with international law,” he said. Europe had not even fulfilled its agreement last September to relocate 66,000 refugees from Greece, redistributing only 600 to date within the bloc, Cochetel said earlier. “What didn’t happen from Greece, will it happen from Turkey? We’ll see, I have some doubts,” he said on Swiss radio RTS. Turkey is home to nearly 3 million Syrian refugees, the largest number worldwide, but its acceptance rates for refugees from Afghanistan, Iraq and Iraq were “very low”, about 3%, Cochetel said. “I hope that in the next 10 days a certain number of supplementary guarantees will be put in place so that people sent back to Turkey will have access to an examination of their request [for asylum].”

UNHCR spokesman William Spindler said: “Legal safeguards would need to govern any mechanism under which responsibility would be transferred for assessing an asylum claim.” The UN Children’s Fund voiced deep concerns about the agreement, noting that “too many details still remain unclear”. “The fundamental principle of ‘do no harm’ must apply every step of way,” Unicef spokeswoman Sarah Crowe told the briefing. “That means first and foremost that children’s right to claim international protection must be guaranteed. Children should not to be returned if they face risks including detention, forced recruitment, trafficking or exploitation.”

It’s all so illegal it won’t go anywhere.

• UN Refugee Chief ‘Deeply Concerned’ By EU-Turkey Deal (AFP)

The head of the UN refugee agency on Tuesday said he was “deeply concerned” by a proposed deal between the EU and Ankara to curb the migrant crisis that would involve people being sent back to Turkey. “As a first reaction I’m deeply concerned about any arrangement that would involve the blanket return of anyone from one country to another without spelling out the refugee protection safeguards under international law,” UNHCR chief Filippo Grandi told the European Parliament. Lawmakers at the parliament in Strasbourg, France, applauded after he made the comment. At a summit in Brussels on Monday, EU leaders in principle backed a proposal by Turkey to take back all illegal migrants landing on the overstretched Greek islands.

Turkey also suggested a one-for-one deal under which the EU would resettle one Syrian refugee from camps in Turkey in exchange for every Syrian that Turkey takes from Greece, in a bid to reduce the incentive for people to board boats for Europe. Turkey is the main launching point for the more than one million migrants who have made the dangerous crossing to Europe since the start of 2015. It is home to 2.7 million refugees from the war in Syria, more than any other country. But Grandi said the plan did not offer sufficient guarantees under international law. He said refugees should only be returned to a country if it could be proved that their asylum application would be properly processed and that they would “enjoy asylum in accordance with accepted international standards and have full access to education, work, health care and if necessary social assistance.”

He also called for refugees to be screened before being sent away from Greece “to identify highly at-risk categories that may not be appropriate for return even if the above conditions are met.”

Double speak.

• Merkel Says History Won’t Look Kindly If EU Fails on Refugees (BBG)

German Chancellor Angela Merkel said history will judge Europe harshly unless it shares the burden of accepting refugees, taking particular aim at Hungary and Slovakia for refusing to resettle asylum seekers. The EU will face scrutiny if it turns away from an embattled region, where the Syrian civil war has displaced millions and spurred an influx of refugees into Europe, Merkel said. She compared the continent to nations in the Middle East such as Lebanon, Jordan and Turkey that have taken in millions of Syrian refugees each. “500 million Europeans today probably haven’t taken in a million Syrians,” Merkel said on a panel Tuesday in Stuttgart, Germany, adding that the EU can’t afford to isolate itself from the crisis. “I think that this won’t go well for us historically. I’m very sure of that.”

Merkel has been buffeted by criticism and sliding poll numbers at home over her open-border policy after more than a million asylum seekers entered Germany last year. Speaking a day after an EU summit sought a deal with Turkey to staunch the flow of refugees, and in return resettle Syrian asylum seekers into Europe, Merkel signaled that agreeing on EU redistribution may run up against the refusal of eastern European countries. “I have to tell you quite honestly, there will be a lot to talk about,” Merkel said. “If some countries such as Hungary and Slovakia say ‘zero – zero; we have no obligation here; we’re not responsible for sheltering; there’s no civil war in front of our door; the Syrians have to look to their neighborhood with Lebanon, Jordan and Turkey.’ That’s a position that is not mine.”

Home › Forums › Debt Rattle March 9 2016