G.G. Bain Pelham Park Railroad, City Island monorail, NY 1910

“Without the Federal Reserve chipping in with quantitative easing, investors have to go back to valuations and earnings..”

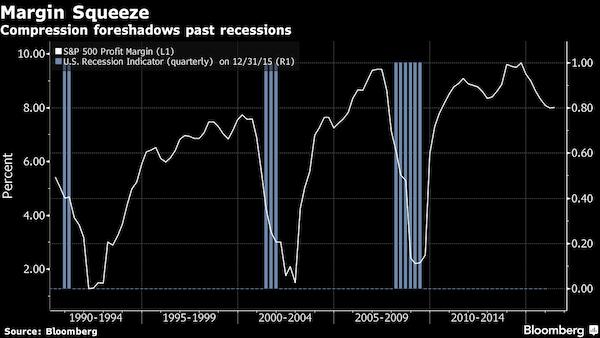

• The Hole at the Center of the Rally: S&P Margins in Decline (BBG)

Stocks are rising, the worst start to a year is a memory, and short sellers are getting pummeled. And yet something is going on below the surface of earnings that should give bulls pause. It’s evident in quarterly forecasts for the Standard & Poor’s 500 Index, where profits are declining at the steepest rate since the financial crisis relative to revenue. The divergence reflects a worsening contraction in corporate profitability, with net income falling to 8% of sales from a record 9.7% in 2014. Bears have warned for years that such a deterioration would sound the death knell for a bull market that is about two weeks away from becoming the second-longest on record even as productivity sputters and industrial output weakens.

While none of it has prevented stocks from advancing in seven of the last nine weeks, rallies have seldom weathered a decline in profitability as violent as this one – and the squeeze is often a bad sign for the economy, too. “Analysts have seen the string pull as far as it can go, and there is no way for it to go but to reverse for the moment,” said Barry James at James Investment Research in Xenia, Ohio. “Without the Federal Reserve chipping in with quantitative easing, investors have to go back to valuations and earnings, and both of those – one is high and the other is low – that’s not a very good recipe for stocks.” James said his firm is raising cash amid the recent rally in stocks.

While energy producers are expected to suffer the biggest contraction in margins because of plunging oil prices, with a 28% drop in sales accompanying a first-quarter loss, analyst predicted six of the other 10 S&P 500 industries will also report lower profitability. Financial and raw-materials companies will see income growth trailing sales by at least 12 percentage points.

It’s just like China.

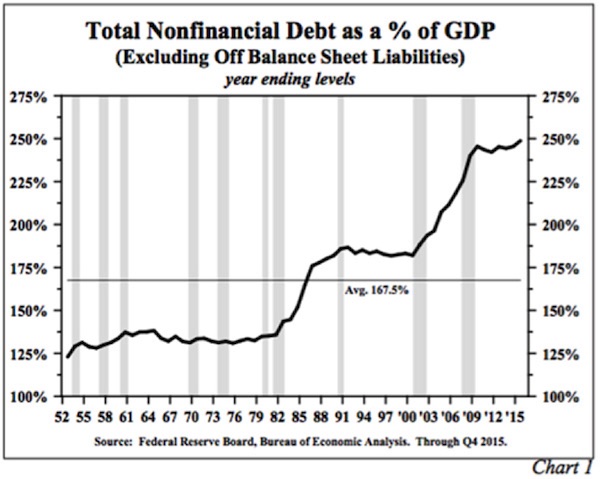

• US Nonfinancial Debt Rises 3.5 Times Faster Than GDP (Mauldin)

In my recent Outside the Box, good friend Dr. Lacy Hunt of Hoisington Investment Management gave us more ammunition to take on those who just don’t seem to get that the endless piling up of debt is not a sustainable way to run an economy. The most striking feature of the US economy’s performance in 2015, according to Lacy, was a massive advance in nonfinancial debt that kept the economy stuck in the doldrums of subpar growth.

US nonfinancial debt rose 3.5 times faster than GDP last year. (Nonfinancial debt is the sum of household debt, business debt, federal debt, and state and local government debt. Lacy also points out unfavorable trends in each component of nonfinancial debt.

Household debt: Delinquencies in household debt moved higher even as financial institutions continued to offer aggressive terms to consumers, implying falling credit standards. Furthermore, the New York Fed said subprime auto loans reached the greatest%age of total auto loans in ten years. Moreover, they indicated that the delinquency rate rose significantly.

Business debt: Last year business debt, excluding off balance sheet liabilities, rose $793 billion, while total gross private domestic investment (which includes fixed and inventory investment) rose only $93 billion. Thus, by inference this debt increase went into share buybacks, dividend increases, and other financial endeavors…. When business debt is allocated to financial operations, it does not generate an income stream to meet interest and repayment requirements. Such a usage of debt does not support economic growth, employment, higher paying jobs, or productivity growth. Thus, the economy is likely to be weakened by the increase of business debt over the past five years.

Federal debt: US government gross debt, excluding off balance sheet items, gained $780.7 billion in 2015 or about $230 billion more than the rise in GDP…. The divergence between the budget deficit and debt in 2015 is a portent of things to come. This subject is directly addressed in the 2012 book The Clash of Generations, published by MIT Press, authored by Laurence Kotlikoff and Scott Burns. They calculate that on a net present value basis the US government faces liabilities for Social Security and other entitlement programs that exceed the funds in the various trust funds by $60 trillion. This sum is more than three times greater than the current level of GDP.

State and local government debt: State and local governments … face adverse demographics that will drain underfunded pension plans…. The state and local governments do not have the borrowing capacity of the federal government. Hence, pension obligations will need to be covered at least partially by increased taxes, cuts in pension benefits or reductions in other expenditures.

The currency wars simmer on. Time for the vigilantes.

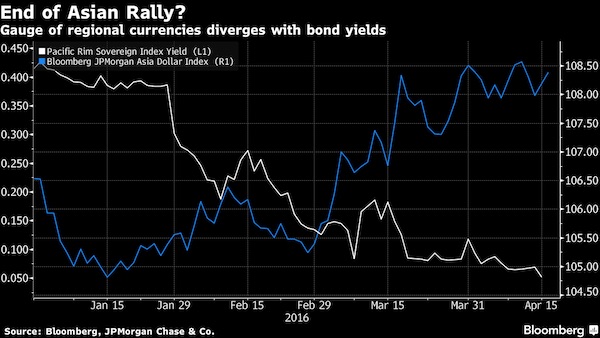

• Asia’s Rich Urged to Buy US Dollars (BBG)

Money managers for Asia’s wealthy families are telling clients to buy U.S. dollars as a rally this year in regional currencies begins to sputter. Credit Suisse is advising its private-banking clients to bet the greenback will gain versus a basket of peers that includes the South Korean won, Taiwan dollar, Thai baht and Philippine peso. UBS said investors should buy the currency against the Singapore dollar and yen. Stamford Management, which oversees about $250 million for Asia’s rich, urged clients to buy the U.S. dollar each time it falls below S$1.35. The Monetary Authority of Singapore’s unexpected easing on April 14 has fueled speculation that other policy makers, concerned about a worsening global economic outlook, will follow suit.

A gauge of 10 Asian currencies excluding the yen has fallen 0.1% this month. The Bloomberg-JPMorgan Asia Dollar Index climbed 1.9% in the first three months of the year, the first gain in seven quarters, as traders adjusted bets on the timing of U.S. interest-rate increases. “We see good opportunity now to hedge against U.S. dollar strength after the strong rally in Asian currencies in the first quarter,” said Koon How Heng at Credit Suisse in Singapore. “There are risks that other Asian central banks may follow up with some more easing in the second half if their respective growth outlooks deteriorate further.” The prospect of renewed weakness in the Chinese yuan and two interest rate increases by the Federal Reserve in the second half of the year will boost the greenback, Heng said.

“China’s aggregate financing – a broad measure of credit that includes corporate bonds – almost doubled from a year earlier to 2.34 trillion yuan [..] Yet even that wasn’t enough to save the seven Chinese companies that reneged on bond obligations this year.”

• It’s All Suddenly Going Wrong in China’s $3 Trillion Bond Market (BBG)

The unprecedented boom in China’s $3 trillion corporate bond market is starting to unravel. Spooked by a fresh wave of defaults at state-owned enterprises, investors in China’s yuan-denominated company notes have driven up yields for nine of the past 10 days and triggered the biggest selloff in onshore junk debt since 2014. Local issuers have canceled 60.6 billion yuan ($9.4 billion) of bond sales in April alone, while Standard & Poor’s is cutting its assessment of Chinese firms at a pace unseen since 2003. While bond yields in China are still well below historical averages, a sustained increase in borrowing costs could threaten an economy that’s more reliant on cheap credit than ever before.

The numbers suggest more pain ahead: Listed firms’ ability to service their debt has dropped to the lowest since at least 1992, while analysts are cutting profit forecasts for Shanghai Composite Index companies by the most since the global financial crisis. “The spreading of credit risks is only at its early stage in China,” said Qiu Xinhong at First State Cinda Fund Management. “Many people have turned bearish.” China’s leaders face a difficult balancing act. On one hand, allowing troubled companies to default forces investors to pay more attention to credit risk and accelerates government efforts to curb overcapacity. The danger, though, is that investor panic leads to tighter credit conditions, dealing a blow to President Xi Jinping’s plan to keep the economy growing by at least 6.5% over the next five years.

Economic figures for March reveal a growing dependence on debt. China’s aggregate financing – a broad measure of credit that includes corporate bonds – almost doubled from a year earlier to 2.34 trillion yuan, exceeding all 24 forecasts in a Bloomberg survey as policy makers turned on the taps to support economic growth. Yet even that wasn’t enough to save the seven Chinese companies that reneged on bond obligations this year. Three of those were part-owned by China’s government, seen not long ago as a provider of implicit guarantees for bondholders. Dongbei Special Steel on April 13 missed a third payment since its chairman was found dead by hanging last month, while Chinacoal Group failed to make a distribution on April 6.

And not just the BRICS.

• China Will Bring All The BRICS Tumbling Down (Forbes)

The concept of the BRICs isn’t heard much these days beyond some cooperative institution building efforts. Originally a Goldman Sachs authored attempt to identify growth opportunities for investors (referring to Brazil, Russia, India and China), it was picked up by those countries to symbolise a hoped-for rotation in the world order: away from the old hierarchy of the West and the Rest, towards a more balanced configuration of global economic progress. For inclusiveness, the ‘s’ was eventually capitalised into ‘South Africa’ so that the African continent was not left out. With hindsight, it remains curious that the idea was ever taken seriously beyond the confines of investor advice. The nominated states have little in common, although the public diplomacy of developing economy cooperation has a lingering appeal.

The Russian economy was always based largely on hydrocarbons, and Brazil’s expansion was a broader commodity play. Each, therefore, nurtured an important relationship with China. Now, though, as commodity prices have sunk, China is the only buyer left and has no qualms about driving a hard bargain. Massive Chinese infrastructure investment created the temporary illusion of wealth while global debt levels grew relentlessly. The commodity curse then undermined real economic progress around the world, as elites chased diminishing surplus for patronage and popularity. This has left producers exposed; one – Venezuela – rapidly becoming a wasteland. In other countries, what limited democracy there was has been hollowed out, leaving Russia in a state of egregious industrial and demographic decline, and Brazil confirming stereotypes about Latin American corruption.

All because the orders are drying up and the money has run out. Both Brazil and Russia are facing the possibility of imminent collapse. India, by contrast, is its own story, a perpetual tale of slow promise that plays tortoise to China’s hare. The only real story behind the BRICs was always just the ‘C,’ as in China, and the huge investment boom that powered commodity prices towards the fantasy of a ‘super-cycle’ – another word we don’t hear much anymore – drove the whole world mad. There was money for social programs in Brazil to lift up the poor, money for Putin’s new model army in Russia to restore imperial prestige, and money for the Olympics and World Cup in both countries. Then there was money for London palaces, money for Panamanian bank accounts, money for small wars and some leftover for the supposed institutions of a ‘new world order,’ since deferred.

Now, China’s policy dilemma belongs to everyone. Having spent 15 years sucking consumption and investment from everywhere, China now has a productive capacity it cannot possibly sustain, and faces a world reluctant any longer to make up for the deficiencies in Chinese demand. It therefore confronts a build up of debts it will struggle to pay and investors who expect a return they may not receive.

Beijing still can’t seem to see the danger.

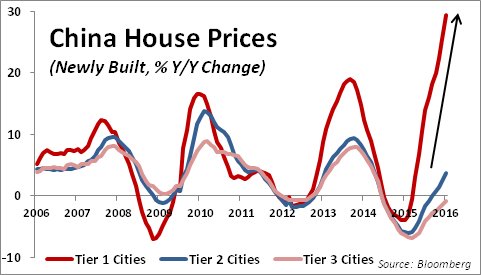

• China March Home Prices Rise At Fastest Rate In Two Years (Reuters)

China’s home prices in March gained at the fastest pace in almost two years but that growth may slow as local authorities tighten home purchase requirements in the two top performing cities on fears of a bubble forming. The southern city of Shenzhen continued to be the top performer, with home prices surging 61.6% from a year ago, followed by Shanghai with a 25% gain. Prices in the two cities were up 3.7% and 3.6% respectively from a month earlier. Average new home prices in 70 major cities rose 4.9% last month from a year ago, picking up from February’s 3.6% rise, according to Reuters calculations based on data released by the National Statistics Bureau (NBS) on Monday. March prices were up 1.1% compared to a month ago.

China’s housing market bottomed out in the second half of 2015 on a series of government support measures, but a strong rebound in prices in the biggest cities has sparked concerns that some markets may be overheating, driving Shanghai and Shenzhen’s authorities to tighten downpayment requirements for second homes and raising the eligibility bar for non-residents. While home sales in the two cities plunged as much as 52% after the tightening, prices eased only by single digit, according to data from China Real Estate Index System (CREIS). April’s official data, which will reflect the impact of the tightening measures, is due to be released in mid-May. Area of property sold in the first quarter grew 33.1% to a near three-year high, according to data from the National Bureau of Statistics (NBS) on Friday.

While property in China’s top-tier cities is booming, prices in smaller centers, where most of China’s urban population lives, are still sinking and complicating government efforts to spread wealth more evenly and arrest slowing economic growth. “(Monthly) price rises among cities still showed big differences. Cities with big rises were concentrated in the first-tier and, in part, the hot tier-two cities. Their growth is much faster than other cities, with the rest of the second-tier and third-tier cities relatively stable,” Liu Jianwei, a senior statistician at the NBS, said in a statement accompanying the data. The NBS data showed 40 of 70 major cities tracked by the NBS saw year-on-year price gains, up from 32 in February.

Another A-class piece from Taibbi.

• Why Obama Administration Tries to Keep 11,000 Documents Sealed (Matt Taibbi)

[..] Even after the state took over the companies in September of 2008, Fannie and Freddie continued to buy as much as $40 billion in bad assets per month from the private sector. Fannie and Freddie weren’t just bailed out, they were themselves a bailout, used to sponge up the sins of private firms. The original takeover mechanism was a $110 billion bailout, followed by a move to place Fannie and Freddie in conservatorship. In exchange, the state received an 80% stake and the promise of a future dividend. All told, the government ended up pumping about $187 billion into the companies. But now here’s the strange part. Within a few years after the crash, the housing markets improved significantly, to the point where Fannie and Freddie started to make money again. Lots of money. The GSEs became cash cows again, and in 2012 the government unilaterally changed the terms of the bailout.

Now, instead of taking a 10% dividend, the government decided that the new number it preferred was 100%. The GSE regulator, the Federal Housing Finance Agency (FHFA), explained the new arrangement. “The 10% fixed-rate dividend was replaced with a variable structure, essentially directing all net income to the Treasury,” the FHFA wrote. “Replacing the current fixed dividend in the agreements with a variable dividend based on net worth helps ensure stability [and] fully captures financial benefits for taxpayers.” “I’m not worried about Fannie and Freddie’s health,” said former House Financial Services Committee chair Barney Frank. “I’m worried that they won’t do enough to help out the economy.” Translation: We’re taking all your money, not just the money you owe. In court filings later on, the government offered a strange excuse for this sudden and dramatic change in the bailout terms. It explained that at the time, the GSEs “faced enormous credit losses” and “found themselves in a death spiral.”

The government claimed that the poor financial condition of the GSEs would force the Treasury to throw more money at the operations, increasing the total commitment of taxpayers and leading quickly to insolvency. It absolutely denied any foreknowledge that the firms were on the verge of massive profitability. It got weirder. Despite the fact that the GSEs went on to pay the government $228 billion over the next three years, or $40 billion more than they owed, none of that money went to paying off Fannie and Freddie’s debt. When Sen. Chuck Grassley asked aloud how it was that the company and its shareholders were not yet square with the government, the Treasury Department testily answered, in essence, that the bailout had not been a loan, but an investment. This was not a debt that could be paid back. Like a restaurant owner who borrows money from a mobster, the GSEs found themselves in an unseverable relationship.

Obama visits SA on Wednesday…

• Obama Official: Seed Money That Created Al Qaeda Came From Saudi Arabia (P.)

President Barack Obama’s deputy national security adviser said that the government of Saudi Arabia had paid “insufficient attention” to money that was being funneled into terror groups and fueled the rise of Al Qaeda. Ben Rhodes was speaking to David Axelrod in his podcast “The Axe Files” out Monday when he was asked about the validity of the accusation that the Saudi government was complicit in sponsoring terrorism. “I think that it’s complicated in the sense that, it’s not that it was Saudi government policy to support Al Qaeda, but there were a number of very wealthy individuals in Saudi Arabia who would contribute, sometimes directly, to extremist groups. Sometimes to charities that were kind of, ended up being ways to launder money to these groups,” Rhodes said.

“So a lot of the money, the seed money if you will, for what became Al Qaeda, came out of Saudi Arabia,” he added. “Could that happen without the government’s awareness?” Axelrod asked. Rhodes said he doesn’t believe the government was “actively trying to prevent that from happening.” But he said that certain people, within the government or their family members, were able to operate on their own which allowed for the money flows. “So basically there was, at certainly, at least kind of a insufficient attention to where all this money was going over many years from the government apparatus,” Rhodes said. The remarks from Rhodes come as Obama prepares to head to Saudi Arabia on Wednesday and confront the strained relations between the two allies.

The Saudis are still fuming over an Atlantic magazine article that described Obama’s frustrations with Saudi Arabia’s religious ideology, its treatment of women and its rivalry with Iran. Obama also suggested in the piece that Saudi Arabia and other Gulf Arab states are “free riders” who rely too much on the U.S. military. Friction has also been created by a push from relatives of people who died on 9/11 and a bipartisan group of lawmakers to allow U.S. courts to hold the Saudi government responsible if it is found to have played a role in the 2001 attacks.

Ambrose is always hit and miss. This one is BIG miss: “The scare earlier this year was misguided. It is the next oil supply crunch we should fear most.” No, it’s demand.

• Saudis Are Going For The Kill But The Oil Market Is Turning Anyway (AEP)

The collapse of OPEC talks with Russia over the weekend makes absolutely no difference to the balance of supply and demand in the global oil markets. The putative freeze in crude output was political eyewash. Hardly any country in the OPEC cartel is capable is producing more oil. Several are failed states, or sliding into political crises. Russia is milking a final burst of production before the depleting pre-Soviet wells of Western Siberia go into slow run-off. Sanctions have stymied its efforts to develop new fields or kick-start shale fracking in the Bazhenov basin. Saudi Arabia’s hard-nosed decision to break ranks with its Gulf allies at the meeting in Doha – and with every other OPEC country – punctures any remaining illusion that there is still a regulating structure in global oil industry.

It told us that the cartel no longer exists in any meaningful sense. Beyond that it was irrelevant. Hedge funds were clearly caught off guard by the outcome since net ‘long’ positions on the futures markets were trading at a record high going into the meeting. Brent crude plunged 7pc to $41 a barrel in early Asian trading, but what is more revealing is how quickly prices recovered. Market dynamics are changing fast. Output is slipping all over the place: in China, Latin America, Kazakhstan, Algeria, the North Sea. The US shale industry has rolled over, though it has taken far longer than the Saudis expected when they first flooded the market in November 2014. The US Energy Department expects total US output to drop to 8.6m barrels per day (b/d) this year from 9.4m last year.

China is filling up the new sites of its strategic petroleum reserves at a record pace. Its oil imports have jumped to 8m b/d this year from 6.7m in 2015, soaking up a large part of the global glut. Some is rotating back out again as diesel: most is being consumed in China. Goldman Sachs says the twin effect of rising demand and supply disruptions across the world is bringing the market back into balance, leading to a “sustainable deficit” as soon as the third quarter. The inflexion point could come sooner than almost anybody expects if a strike this week in Kuwait drags on as oil workers fight pay cuts. The outage is already costing 1.6m b/d. Kuwait’s woes are the first taste of how difficult it will be for the petro-sheikhdoms to impose austerity measures or threaten the cradle-to-grave social contracts that keep a lid on dissent across the Gulf.

There is little doubt that Mohammad bin Salman, the deputy-crown prince and de facto ruler of Saudi Arabia, wanted an excuse to sabotage the Doha deal. He added a fresh demand that non-OPEC Norway should also limit output – a non-starter – as well as hardening the Saudi objection to Iran’s full return to pre-sanctions output. The calculus is that his country has the deepest pockets and will ultimately stand to gain by shaking out weaker players. This is a gamble. Saudi Arabia is running through $10bn of foreign exchange reserves a month to plug its fiscal deficit. The fixed riyal peg makes it much harder to roll with the budgetary punches as Russia is able to do with the floating rouble. Saudi Arabia is not as rich as often supposed. Per capita income is the same as in Greece. Standard & Poor’s has cut its credit rating twice to A-, and for good reason. The Saudis never built up a proper sovereign wealth fund in good times. Their reserve coverage is two-thirds less than in Kuwait, or Abu Dhabi.

Decentralization goes global.

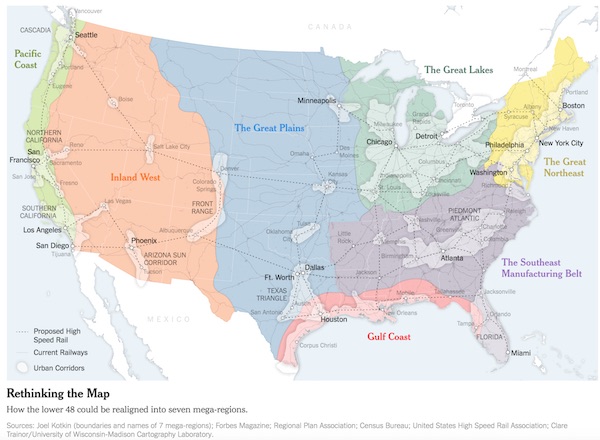

• A New Map for America (NY Times)

These days, in the thick of the American presidential primaries, it’s easy to see how the 50 states continue to drive the political system. But increasingly, that’s all they drive — socially and economically, America is reorganizing itself around regional infrastructure lines and metropolitan clusters that ignore state and even national borders. The problem is, the political system hasn’t caught up. America faces a two-part problem. It’s no secret that the country has fallen behind on infrastructure spending. But it’s not just a matter of how much is spent on catching up, but how and where it is spent. Advanced economies in Western Europe and Asia are reorienting themselves around robust urban clusters of advanced industry. Unfortunately, American policy making remains wedded to an antiquated political structure of 50 distinct states.

To an extent, America is already headed toward a metropolis-first arrangement. The states aren’t about to go away, but economically and socially, the country is drifting toward looser metropolitan and regional formations, anchored by the great cities and urban archipelagos that already lead global economic circuits. The Northeastern megalopolis, stretching from Boston to Washington, contains more than 50 million people and represents 20% of America’s gross domestic product. Greater Los Angeles accounts for more than 10% of G.D.P. These city-states matter far more than most American states – and connectivity to these urban clusters determines Americans’ long-term economic viability far more than which state they reside in. This reshuffling has profound economic consequences.

America is increasingly divided not between red states and blue states, but between connected hubs and disconnected backwaters. Bruce Katz of the Brookings Institution has pointed out that of America’s 350 major metro areas, the cities with more than three million people have rebounded far better from the financial crisis. Meanwhile, smaller cities like Dayton, Ohio, already floundering, have been falling further behind, as have countless disconnected small towns across the country. The problem is that while the economic reality goes one way, the 50-state model means that federal and state resources are concentrated in a state capital – often a small, isolated city itself – and allocated with little sense of the larger whole. Not only does this keep back our largest cities, but smaller American cities are increasingly cut off from the national agenda, destined to become low-cost immigrant and retirement colonies, or simply to be abandoned.

Taleb’s take-down of Noah Smith on Twitter has been epic.

• No One Worries Enough About Black Swans (ZH)

Over the weekend, Bloomberg View’s quasi-economist wrote his latest laughable article, one which supposedly “explained” how “Everyone Worries Too Much About ‘Black Swans'”, which in addition to being a rambling, meandering stream of consciousness that as is regularly the case with this particular author, made little sense, sparked a Twitter feud with the Nassim Taleb, the person who made the concept of a Black Swan into a household name. We were therefore very amused to note that none other than former FX trader and fund manager, Richard Breslow, who also writes for Bloomberg, seemingly had an epileptic fit upon reading the abovementioned drivel and wrote his own scathing reaction from the perspective of an actual trader, a rection which not only threw up on every argument of the so-called economist’s logic, but on everything else that now is passed off simply as, well, “the new normal.” Here is Richard Breslow:

No One Worries Enough About Black Swans

Trading is a hard business. The world is becoming a more complicated place: a number out of China may do more to the price of your U.S. shares in a retailer than, well, U.S. retail sales. Yet creeping, dangerously, into the investment advice dialog is the argument that buying and holding no matter what the event is the winning strategy. If you ever needed a “past results don’t guarantee…” disclaimer it’s especially true now. It’s not surprising that such shallow reasoning is becoming commonplace. Sure beats staying late at the office doing cash-flow analysis. Bad things happen and the Fed will cut rates. Worked time and again. Presto chango, that financial crisis was a buying event, stupid.

It’s gotten much worse post the latest financial crisis, as it’s assumed asset prices are the main (sole) focus of the all powerful central banks. To buy (pun intended) into this you have to presuppose that Black Swan events are easily controllable episodes that last short amounts of time. That the authorities have unlimited firepower to counteract every natural and man-made disaster. Equally scary, academics as well as analysts have taken to arguing that investors are overestimating the probability of crisis events. You don’t need to be a Taleb or Mandelbrot to calculate that we have been having once in a hundred year events on a regular basis for the last thirty years. Did a crisis happen, if you made money?

This flawed logic argues not only buy every dip, but why waste money on hedges? It assumes unlimited deep pockets and the nerve of a non-sentient computer. Just go “all in.” Looking more like today’s world all the time. Portfolio theory thrown right out the window. Perhaps Harry Markowitz will have his Nobel revoked. A portfolio built to only withstand stress thanks to central bank intervention is one destined to blow-up spectacularly. The embedded flaw in this new logic is that central banks give investors perfect foresight. And nothing can go wrong. Re-read the Investment Process section of those prospectuses.

“His words sounded like a request of a bailout for his countries’ saving industry and savers, in an ironic twist from previous bailout requests coming from the periphery.”

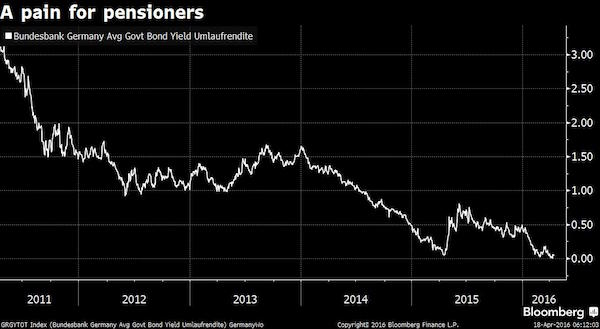

• Credit Suisse: Germany’s Large Surplus Is The Problem, Not the ECB (BBG)

Forget about Greek debt sustainability. Another part of the continent is in need of relief—and this time, it’s a part of the core, not the periphery. That’s how Credit Suisse analysts led by Peter Foley characterized comments from German Finance Minister Wolfgang Schaeuble earlier this month. “The German Finance minister said record low interest rates were causing ‘extraordinary problems’ for German financial institutions and pensioners and risked undermining voters’ support for European integration,” writes Foley. “His words sounded like a request of a bailout for his countries’ saving industry and savers, in an ironic twist from previous bailout requests coming from the periphery.” A common criticism of unconventional central bank policy is that the ultra-low interest rates are too onerous for savers. At present, the average German bund yield is barely above zero:

Some analysts have expressed more than a modicum of sympathy for Schaeuble’s position, indicating that the ECB’s policy represents a form of John Maynard Keynes’ prophesied ‘euthanasia of the rentier’ and is not justified by its positive side effects. But instead of blaming the ECB, Foley suggests that German fiscal policymakers should pull the levers at their disposal to help remedy this situation. “Germany has continued to run a large current account surplus, and has increased it further–from 5.7% of GDP in 2009 to 8.5% in 2015,” wrote the analyst, noting that this surplus constituted the largest imbalance among major economies by this metric. “In an environment short on aggregate demand, Germany’s surplus is a problem, both globally and to the rest of the euro area.”

Foley recommends that the German authorities move to more aggressively reduce financial imbalances by increasing public investment, support private demand in certain soft segments, and implement more structural reforms. This would support Germany’s growth as well as that of its European partners, and as an added bonus, would address Schauble’s concerns about the woes of savers all in one fell swoop, the analyst concludes, by lessening the ECB’s need to support the currency union with unconventional stimulus.

I see a hot summer.

• Talks With Creditors To Resume But Athens Rejects Fresh Austerity (Kath.)

With talks set to resume on Tuesday with Greece’s international creditors, Athens said on Monday it has no intention of implementing austerity measures beyond the commitments it signed on to in the third bailout last July and plans to seek “allies” among European countries that believe now is not the time create political instability in Greece. Government spokeswoman Olga Gerovasili said on Monday that Athens will abide by the commitments it made last July, “nothing more, nothing less.” Her comments came after the IMF and the EU, which overcame their differences at the weekend over Greece’s budgetary outlook, took the wind out of the government’s sails by seeking another package of austerity measures to the tune of more than €3 billion (or 2% of GDP) in case there are target shortfalls over the next three years as a “guarantee” that Greece will achieve a primary budget surplus of 3.5% of GDP in 2018.

The government’s apparent defiance on Monday is a departure from its initial response at the weekend, when it implied that it could be open to discussion over the new measures – which relate to 2018 – as long as it received reassurances that it will get debt relief. Failure to wrap up the review could see negotiations drag on into June, which would put a further strain on the SYRIZA-led coalition’s fragile government, already struggling to stay afloat with a very slim majority of three deputies in Parliament. However, the new turn of events could foil the government’s ambitions, which include reaching a staff level agreement by Friday’s Eurogroup meeting in Amsterdam, to unlock vital tranches of rescue funds and pave the way for debt relief talks – a key demand by Greece.

“..Simply by liking or sharing this article on Facebook or retweeting it on Twitter, you’re most likely flagging yourself as a potential renegade, revolutionary or anti-government extremist—a.k.a. terrorist.”

• Every Move You Make Is Being Monitored (Whitehead)

“The way things are supposed to work is that we’re supposed to know virtually everything about what [government officials] do: that’s why they’re called public servants. They’re supposed to know virtually nothing about what we do: that’s why we’re called private individuals. This dynamic – the hallmark of a healthy and free society – has been radically reversed. Now, they know everything about what we do, and are constantly building systems to know more. Meanwhile, we know less and less about what they do, as they build walls of secrecy behind which they function. That’s the imbalance that needs to come to an end. No democracy can be healthy and functional if the most consequential acts of those who wield political power are completely unknown to those to whom they are supposed to be accountable.” – Glenn Greenwald

Government eyes are watching you. They see your every move: what you read, how much you spend, where you go, with whom you interact, when you wake up in the morning, what you’re watching on television and reading on the internet. Every move you make is being monitored, mined for data, crunched, and tabulated in order to form a picture of who you are, what makes you tick, and how best to control you when and if it becomes necessary to bring you in line. Simply by liking or sharing this article on Facebook or retweeting it on Twitter, you’re most likely flagging yourself as a potential renegade, revolutionary or anti-government extremist—a.k.a. terrorist. Yet whether or not you like or share this particular article, simply by reading it or any other articles related to government wrongdoing, surveillance, police misconduct or civil liberties is enough to get you categorized as a particular kind of person with particular kinds of interests that reflect a particular kind of mindset that might just lead you to engage in a particular kinds of activities.

Chances are, as the Washington Post reports, you have already been assigned a color-coded threat score—green, yellow or red—so police are forewarned about your potential inclination to be a troublemaker depending on whether you’ve had a career in the military, posted a comment perceived as threatening on Facebook, suffer from a particular medical condition, or know someone who knows someone who might have committed a crime. In other words, you might already be flagged as potentially anti-government in a government database somewhere—Main Core, for example—that identifies and tracks individuals who aren’t inclined to march in lockstep to the police state’s dictates. The government has the know-how.

As The Intercept recently reported, the FBI, CIA, NSA and other government agencies are increasingly investing in and relying on corporate surveillance technologies that can mine constitutionally protected speech on social media platforms such as Facebook, Twitter and Instagram in order to identify potential extremists and predict who might engage in future acts of anti-government behavior. Now all it needs is the data, which more than 90% of young adults and 65% of American adults are happy to provide.

“This will go on until it can’t, which is what discontinuity is all about.”

• The Elephant Cometh (Jim Kunstler)

The elephant’s not even in the room, which is why the 2016 election campaign is such a soap opera. The elephant outside the room is named Discontinuity. That’s perhaps an intimidating word, but it is exactly what the USA is in for. It means that a lot of familiar things come to an end, stop, don’t work the way they are supposed to — beginning, manifestly, with the election process now underway in all its unprecedented bizarreness. One reason it’s difficult to comprehend discontinuity is because so many operations and institutions of daily life in America have insidiously become rackets, meaning that they are kept going only by dishonest means. If we didn’t lie to ourselves about them, they couldn’t continue.

For instance the automobile racket. Without a solid, solvent middle-class, you can’t sell cars. Americans are used to paying for cars on installment loans. If the middle class is so crippled by prior debt and the disappearance of good-paying jobs that they can’t qualify for car loans, well, the answer is to give them loans anyway, on terms that don’t really pencil out — such as 7-year loans at 0% interest for used cars (that will be worth next to nothing long before the loan expires). This will go on until it can’t, which is what discontinuity is all about. The car companies and the banks (with help from government regulators and political cheerleaders) have created this work-around by treating “sub-prime” car loans the same way they treated sub-prime mortgages: they bundle them into larger packages of bonds called collateralized loan obligations.

These, in turn, are sold mainly to big pension fund and insurance companies desperate for “yield” (higher interest) on “safe” investments that ostensibly preserve their principal. The “collateral” amounts to the revenue streams of payments that are sure to stop because the payers are by definition not credit-worthy, meaning it was baked in the cake that they would quit making payments — especially when they go “under water” owing ever more money for junkers that have lost all value. It’s easy to see how that ends in tears for all concerned parties, but we “buy into it” because there seems to be no other way to a) boost the so-called “consumer” economy and b) keep the matrix of car-dependant suburban sprawl in operation. We took what used to be a fairly sound idea during a now-bygone phase of history, and perverted it to avoid making any difficult but necessary changes in a new phase of history.

There is a very strange silence in western media about this.

• Over 400 Migrants Drown On Their Way To Italy (Reuters)

Somalia’s government said on Monday about 200 or more Somalis may have drowned in the Mediterranean Sea while trying to cross illegally to Europe, many of them teenagers, when the boat they were on capsized after leaving the Egyptian shore. Italian President Sergio Mattarella had said earlier on Monday that several hundred people appeared to have died in a new tragedy in the Mediterranean, after unconfirmed reports spoke of up to 400 victims of capsizing near Egypt’s coast. More than 1.2 million African, Arab and Asian migrants have streamed into the EU since the start of last year, many of them setting off from North Africa in rickety boats that are packed full of people and which struggle in choppy seas.

“We have no fixed number but it is between 200 and 300 Somalis,” Somali Information Minister Mohamed Abdi Hayir told Reuters by telephone when asked about possible Somali deaths in the latest incident. Another Somali government statement, which offered condolences, put the number at “nearly 200”, saying they were mostly teenagers. It said the boat they were on had capsized after leaving Egypt. “There is no clear number since they are not traveling legally,” the minister said, adding that he understood the boat might have been carrying about 500 people, of which 200 to 300 were Somalis “and most of them had died”. He did not give a precise timing for the incident.

Home › Forums › Debt Rattle April 19 2016