Vincent van Gogh Lilac Bush 1889

I got this one: Translation: Jean-Claude Juncker finally gets his revenge on the 1960s (probably couldn’t get laid back in the day).

Also note: just about every headline and article says Trump wrote: “..trade wars are good, and easy to win..” He did not, or only after explaining conditions for that to be true: “..When a country (USA) is losing many billions of dollars on trade with virtually every country it does business with ..” That makes a big difference. And therefore must be included.

• Juncker Threatens Tariffs On Harley-Davidson, Bourbon And Levi’s (G.)

The IMF has warned that Donald Trump’s plan to impose stiff new US tariffs on foreign imports of steel and aluminum would cause international damage – and also harm America’s own economy “The import restrictions announced by the US President (Donald Trump) are likely to cause damage not only outside the US, but also to the US economy itself, including to its manufacturing and construction sectors, which are major users of aluminum and steel,” the IMF said on Friday. The terse statement from the global body came as world leaders threatened retaliation against any fresh tariffs and the US president breezily asserted that “trade wars are good”.

In a morning tweet Trump wrote: “When a country (USA) is losing many billions of dollars on trade with virtually every country it does business with, trade wars are good, and easy to win. Example, when we are down $100 billion with a certain country and they get cute, don’t trade anymore-we win big. It’s easy!” The European Union, Germany, Canada and other countries have all threatened retaliation against plans to impose tariffs of 25% on steel and 10% on aluminum. The Canadian prime minister, Justin Trudeau, said US tariffs on steel and aluminum would be “absolutely unacceptable” and the European commission president, Jean-Claude Juncker, warned there would be consequences for the US.

“If the Americans impose tariffs on steel and aluminum, then we must treat American products the same way,” Juncker told German television stations. “We must show that we can also take measures. This cannot be a unilateral transatlantic action by the Americans,” he said. “I’m not saying we have to shoot back, but we must take action. “We will put tariffs on Harley-Davidson, on bourbon and on blue jeans – Levi’s,” he added.

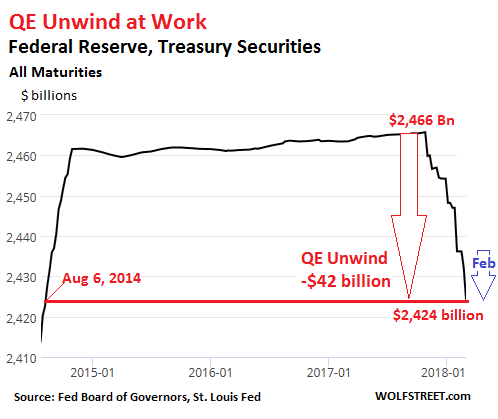

The consensus is more QE when this inevitably blows up. But maybe the Fed does see that coming, and has different plans.

• Fed’s QE Unwind Marches Forward Relentlessly (WS)

The fifth month of the QE-Unwind came to a completion with the release this afternoon of the Fed’s balance sheet for the week ending February 28. The QE-Unwind is progressing like clockwork. Even during the sell-off in early February, the QE-Unwind never missed a beat. During QE, the Fed acquired Treasury securities and mortgage-backed securities (MBS) guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae. During the QE-Unwind, the Fed is shedding those securities. According to its plan, announced last September, the Fed would reduce its holdings of Treasuries and MBS by no more than: • $10 billion a month in Q3 2017 • $20 billion a month in Q1 2018 • $30 billion a month in Q2 2018 • $40 billion a month in Q3 2018 • $50 billion a month in Q4 2018, and continue at this pace.

This would shrink the balance of Treasuries and MBS by up to $420 billion in 2018, by up to an additional $600 billion in 2019 and every year going forward until the Fed decides that the balance sheet has been “normalized” enough — or until something big breaks. For February, the plan called for shedding up to $20 billion in securities: $12 billion in Treasuries and $8 billion in MBS. On its January 31 balance sheet, the Fed had $2,436 billion of Treasuries; on today’s balance sheet, $2,424 billion: a $12 billion drop for February. On target! In total, since the beginning of the QE Unwind, the balance of Treasuries has dropped by $42 billion, to hit the lowest level since August 6, 2014:

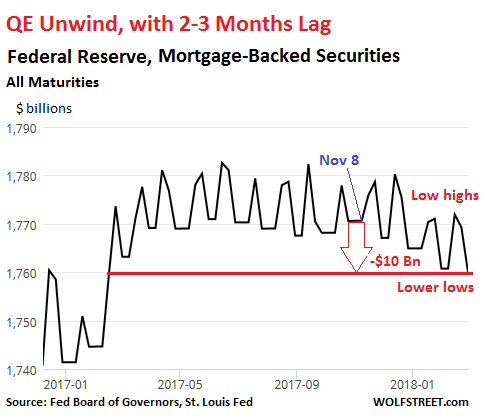

[..] to determine if the QE Unwind is taking place with MBS, we’re looking for lower highs and lower lows on a very jagged line. Also today’s movements reflect MBS that rolled off two to three months ago, so November and December, when about $4 billion in MBS were supposed to roll off per month. The chart below shows that jagged line. Note the lower highs and lower lows over the past few months. Given the delay of two to three months, the first roll-offs would have shown up in early December at the earliest. At the low in early November, the Fed held $1,770.1 billion in MBS. On today’s balance sheet, also the low point in the chart, the Fed shows $1,759.9 billion. From low to low, the balance dropped by $10.2 billion, reflecting trades in November and December:

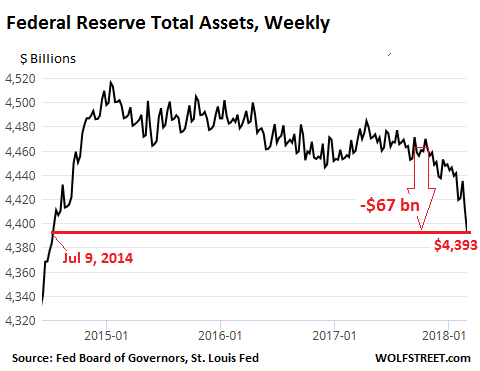

And the overall balance sheet? Total assets on the Fed’s balance sheet dropped from $4,460 billion at the outset of the QE Unwind in early October to $4,393 billion on today’s balance sheet, the lowest since July 9, 2014. A $67-billion drop:

“The list includes Dow components Boeing, Coca-Cola, Procter & Gamble, Johnson & Johnson, Citigroup, American Express, Goldman Sachs, Mircrosoft, Apple, Cisco and Intel.”

• S&P 500 Companies To Buy Back $800 Billion Of Their Own Shares This Year (MW)

S&P 500 companies will buy back a record $800 billion of their own shares in 2018, funded by savings on tax, strong earnings and the repatriation of cash held overseas, J.P. Morgan said Friday. That will far exceed the $530 billion in share buybacks that was recorded in 2017, analysts led by Dubravko Lakos-Bujas wrote in a note. Companies have already announced $151 billion of buybacks in the year to date. “There is room for further upside to our buyback estimates if companies increase gross payout ratios to levels similar to late last cycle when companies returned >100% of profits to shareholders (vs. 83% now),” said the note. “Corporates tend to accelerate buyback programs during market selloffs.”

The stock market has experienced two bouts of steep declines so far this year, the first in early February, when the Dow Jones Industrial Average fell 1,175 points in a single session to mark its biggest ever one-day point drop, driven by fears about interest rate hikes. There were $113.4 billion of buyback announcements in February, a three-year high, according to Trim Tabs Investment Research. The second selloff was ignited on Thursday, after President Donald Trump said he is planning to impose tariffs on imports of steel and aluminum, triggering a more than 500 point drop in the Dow at its worst level, on fears the move would spark a trade war. The Dow was down another 300 points in early trade Friday.

“Enjoy the last few weeks of relative normality.”

• End Times at the OD Corral (Jim Kunstler)

Surely, the Deplorables of Flyover Land will not like the dumping of their Golden champion one bit. I’d stay away from post offices and other parcels of federal property for a while. If a bunch decides to march on the nation’s capital, it will be a messier affair than anything the hippies pulled off back in the day, perhaps the first battle of Civil War 2. The financial markets wobbled and puked on Wednesday and Thursday of this week, finally mirroring the tremendous stresses in our politics. They’ve been every bit as jacked on unreality as the two major parties for years now. The markets, after all, are not the economy itself, just indexes of the supposed values of things, stocks, bonds, gold, soybeans, etc., and the Federal Reserve has been jamming hallucinogens down their craw since the last little seizure in 2008.

The markets don’t seem to like the new chairman of the Fed, a cipher named Jay Powell. In his first big public performance since stepping into Janet Yellen’s tiny shoes this week, Powell managed to do a complete 180 in 24 hours on whether his outfit will stick to four rate hikes this year… or maybe just ride to the rescue of the floundering markets with their old tricks of lowering interest rates and “printing” shitloads of new “money” to get those animal spirits going again in the S & P. Absolutely nothing Powell’s Fed might try will work. In fact they will only make the cratering indexes fall deeper and harder, along with the value of the US dollar. Interest rates can’t go any higher, anyway, without blowing up half the paper obligations on earth.

Businesses will be terrified to transact. You can’t do much with a crippled financial system. The authorities and the news media will call it a “recession” but a sore-beset public will know it is the start of something a whole lot worse. As a nice side-dish to this banquet of consequences, the Democratic party will be deprived of its only reason to live the past two years: to shove Donald Trump off-stage. And the Republicans will be blamed twice over: once, for not coming to Trump’s defense, and again for getting behind him in the first place. Enjoy the last few weeks of relative normality.

She’s never sounded more hollow. Theresa May is a certified masochist.

• Theresa May Unveils Fragile Truce In Third Brexit Offering (G.)

If Theresa May’s first two speeches unfurled the promise of a “red, white and blue” Brexit, a cold grey day in March will be remembered as the moment a more faded flag was fluttered. As the nation took shelter from the beast from the east, this was intended to be May’s “reality bites” speech. Ten times she used the word “recognise” to underline she no longer believed Britain could have it all. “We recognise that we cannot have exactly the same arrangements with the EU as we do now,” she said. “We recognise this would constrain our ability to lower regulatory standards. We need to face up to facts. Our access to each other’s markets will be less”.

Little wonder that by the time it came for questions, and a German newspaper asked: “Is it all worth it?” The prime minister had to pause awkwardly before replying: “We are not changing our minds.” Much attention will focus on the remaining chasm between Downing Street’s hopes and the increasingly intransigent position adopted in Brussels. There was little to explain how they might solve the current crisis over Northern Ireland in the three weeks allotted. It would be churlish though not to acknowledge creeping realism from a politician whose heart has never really seemed in it. The weary call for “pragmatic common sense” was directed at both her own party and Europe.

It’s useless to compare GSEs to the private sector. They exist to make ensure government control over the housing bubble.

• Eliminate Fannie Mae and Freddie Mac (USNews)

Fannie Mae and Freddie Mac’s recent request for a bailout from the U.S. Treasury (read American taxpayers) has brought back into the public’s eye the unresolved legal status of these two government sponsored enterprises. In this debate, the assumption is that the GSEs, or some replacement entities benefiting from a government guarantee, are necessary for an effective housing finance market. The GSEs, however, do very little that cannot be done – and is not already done – by the private sector. In addition, these institutions pose a significant financial risk to U.S. taxpayers. Weighing this cost against the minimal benefits makes the case that the GSEs should be eliminated.

Without the GSEs, the mortgage market would not look radically different than it does today. Proponents argue that the GSEs lower mortgage rates, ensure the availability of the standard 30-year fixed rate mortgage, support home ownership and lend to people with lower incomes or weaker credit profiles, all of which the private sector presumably would not do. Not true on all fronts. First, the GSEs do not offer lower mortgage rates for consumers despite a government guarantee that allows them to raise capital at a lower cost than the private sector. In the past, the GSEs were able to charge lower mortgage rates by taking risks for which they were not compensated. The result was a massive build-up of housing risk in the run-up to the financial crisis of 2007-08.

Since 2009, the GSEs have been required to recognize risk in their pricing of mortgages, which has driven up their mortgage rates relative to the private sector. As a consequence, since 2014, new research undertaken with my colleague Steve Oliner shows that mortgage rates for private portfolio whole loans have been about one-quarter percentage point below GSE rates – after controlling for risk characteristics. And contrary to Treasury Secretary Steven Mnuchin’s recent statement, the private market could ensure the availability of the 30-year fixed-rate mortgages on its own. Data from CoreLogic show that 76% of private portfolio mortgages originated in 2017 were 30-year mortgages, not much below the GSE’s 85% share.

Unstoppable.

• Low-Level Courts Turned Into Dickensian “Debt Collection Mills” (ICept)

Federal law outlawed debt prisons in 1833, but lenders, landlords and even gyms and other businesses have found a way to resurrect the Dickensian practice. With the aid of private collection agencies, they file millions of lawsuits in state and local courts each year, winning 95 percent of the time. If a defendant fails to appear at post-judgement hearings known as “debtors’ examinations,” collectors can seek a warrant for contempt of court — even if the debtor didn’t realize they were being sued. [..] “A Pound of Flesh: the Criminalization of Private Debt,” the ACLU report, sheds light for the first time on the frequency of modern-day debt imprisonment, estimating that courts are issuing tens of thousands of arrest warrants each year for debtors owing as little as $30.

Forty-four states permit judges to issue these warrants, often known as “body attachments,” in civil cases. “This has been a largely invisible problem, because the people it’s happening to typically don’t have lawyers and aren’t speaking out,” says Jennifer Turner, a human rights researcher at ACLU. “Many low-level courts have essentially become debt-collection mills.” One in three Americans has a debt that’s been turned over to a private collection agency, and the ACLU found cases of warrants being issued over almost every kind of consumer debt—payday and auto loans, utility bills, even daycare fees. Many cases begin with an emergency expense that someone is unable to pay, sending them into a spiral of debt and imprisonment.

The use of cash bail often compounds the problem; debtors languish in jail for up to two weeks, according to the report. In some jurisdictions, judges routinely set bail at the exact amount of the debt owed, then surrender it to the collector once paid. In other cases documented by the ACLU, people with outstanding medical debt were too ill to go to court, as in the case of an Indiana mother of three who had been living with family in Florida while she recovered from thyroid cancer. Unbeknown to her, a small claims court had issued three warrants in a suit over her unpaid medical bills, and she was arrested when she returned home.

In case anyone starts telling you about Kushner and Citi.

• The Devil Is in the Details of Citi’s Sordid History (Martens)

Wall Street On Parade has extensively reported in the past on the dubious dealings of Citigroup in Washington. Citigroup is the bank that pressured the Bill Clinton administration into repealing the depression-era Glass-Steagall Act in 1999. That act had prevented Wall Street’s speculating investment banks and brokerage firms from owning commercial banks that take in FDIC insured deposits in order to prevent another 1929-1932 style Wall Street crash. Just nine years after the repeal of Glass-Steagall, Wall Street experienced another epic crash, with Citigroup playing a major role in the contagion. Citigroup received the largest taxpayer bailout in U.S. history, taking in $45 billion in equity from the U.S. Treasury;

A government guarantee on $300 billion of Citigroup’s dubious assets; the Federal Deposit Insurance Corporation (FDIC) guaranteed $5.75 billion of its senior unsecured debt and $26 billion of its commercial paper and interbank deposits; and the Federal Reserve secretly funneled $2.5 trillion in almost zero-interest loans to units of Citigroup between 2007 and 2010. Citigroup was created by the merger of Citicorp (parent of Citibank) and Travelers Group (which owned investment bank Salomon Brothers and brokerage firm Smith Barney). It would not have been allowed to exist but for the largess of the Clinton administration. And the Clintons needed a lot of financial help when they exited the White House.

In a June 9, 2014 interview with ABC’s Diane Sawyer, Hillary Clinton said this: “We came out of the White House not only dead broke, but in debt. We had no money when we got there, and we struggled to, you know, piece together the resources for mortgages, for houses, for Chelsea’s education. You know, it was not easy.” One institution that had big confidence in the Clintons’ future earning power was Citigroup. “According to PolitiFact, Citigroup provided a $1.995 million mortgage to allow the Clintons to buy their Washington, D.C. residence in 2000. That liability does not pop up on the Clinton disclosure documents until 2011, showing a 30-year mortgage at 5.375% ranging in face amount from $1 million to $5 million from CitiMortgage. The disclosure says the mortgage was taken out in 2001.

“Citigroup also paid Bill Clinton hundreds of thousands of dollars in speaking fees after he left the White House. It committed $5.5 million to the Clinton Global Initiative — a program which brings global leaders together annually to make action commitments. Citigroup employees have also been major campaign funders to Hillary Clinton’s political campaigns.”

Oh, no!! Turns out developing markets have borrowed all their growth as well…

• The Future Of Economic Convergence (WEF)

The world is now facing what observers are calling a “synchronized” growth upswing. What does this mean for the economic “convergence” of developed and developing countries, a topic that lost salience after the Great Recession began a decade ago? In the 1990s, developing economies, taken as a whole, began to grow faster than their advanced counterparts (in per capita terms), inspiring optimism that the two groups’ output and income would converge. From 1990 to 2007, the developing economies’ average annual per capita growth was 2.5 percentage points higher than in the advanced economies. In 2000-2007, the gap widened, to 3.5 percentage points.

Though not all countries made progress – many small economies did not do well – on an aggregate basis, the structure of the world economy was being transformed. Asian countries were catching up at a particularly rapid clip, driven by the large, dynamic economies of India and, even more so, China (which experienced nearly three decades of double-digit GDP growth). After the global financial crisis began in 2007, however, the dynamic changed. At first, it seemed that convergence was accelerating. With advanced-economy growth having ground to a halt, developing countries’ lead in per capita growth increased to four percentage points.

By 2013-2016, however, growth slowed in many emerging economies – particularly in Latin America, with Brazil experiencing negative growth in 2015 and 2016 – while growth in the United States picked up. Are we, as some observers have claimed, witnessing the end of convergence? The answer will depend on developing economies’ ability to find and tap new, more advanced sources of growth. In the past, the key engine of convergence was manufacturing. Developing countries that had finally acquired the needed skills and institutions applied advanced-country technologies locally, benefiting from plentiful, low-cost labor.

But, as Dani Rodrik has argued, that source of easy copycat catch-up has mostly been exhausted. The low-hanging fruit in manufacturing has already been picked. Technological catch-up is more difficult in the services sector, which now accounts for a larger share of total value-added. Moreover, today’s cutting-edge technologies – such as robotics, artificial intelligence (AI), and bioengineering – are more complex than industrial machinery, and may be more difficult to copy. And, because intelligent machines can increasingly fill low-wage jobs, developing countries’ cost advantage may have been diminished significantly.

Musk makes his latest victim. There’s one question that must always be asked in these cases: How much in subsidies does he get for this project? Articles that do not ask this should not be published, because they’re mere propaganda.

• Elon Musk to Open Tesla R&D Plant in Greece (G.)

Elon Musk may have plans to colonise Mars but back on planet Earth he is extending his reach to Athens, by opening an engineering facility called Tesla Greece. Musk’s electric car business is an unsung success story for the Greek diaspora, with three of Tesla’s top designers boasting degrees from the National Technical University of Athens. Tesla’s plans for the country have such “game-changing potential” that the head of the Hellenic Entrepreneurs’ Association, Vasilis Apostolopoulos, has pledged to hand over his own industrial plant for free as a testing ground for new products.

Addressing delegates at the annual Delphi economic forum, Apostolopoulos said: “I have personally emailed Musk to welcome Tesla Greece … and to say that for the next 10 years I will give, at zero cost to his company, my group’s own industrial plant outside Corinth so that Greece can be on the frontline of global innovation.” Describing the move as a “vote of confidence” in the debt-stricken country, Apostolopoulos, who is chief executive of the Athens Medical Group, a leading private healthcare provider, said he was also prepared to offer full medical coverage for a year to all of Tesla Greece’s staff members and international staff visiting the country on company business.

“It is the least we can do to thank and welcome Mr Musk’s vote of confidence in Hellenic business, research and technology,” he told the Guardian. Outside the UK, the Netherlands and Germany, the electric car manufacturer has no presence in Europe. Its Greek office is expected to attract at least 50 engineers to run a research and development centre out of the state-run Demokritos Centre for Scientific Research. The centre is expected to act as a base for southeast Europe. “Greece has a strong electric motor engineering talent, and technical universities offering tailored programmes and specialised skills for electric motor technology,” a spokesperson told Electrek, a US news website.

It is understood that Tesla’s three Greek designers – principal motor designer Konstantinos Laskaris; motor design engineer Konstantinos Bourchas; and staff motor design engineer Vasilis Papanikolaou – are preparing to move back to Athens under the company’s plans. Demokritos has welcomed the news. “We are very happy to receive all the talented engineers who are returning to work beside us,” it said in a statement.

In his book ‘Adults in the Room’, Yanis had nothing good about ‘the most powerful man in the EU’. Now, Wieser comes with an unverifiable and fully nonsensical story, that he knows even many Greeks will swallow hook line and sinker.

• EU’s Wieser: Six Months Of Varoufakis Cost Greece €200 Billion (K.)

The first six months of the leftist-led SYRIZA government cost Greece around €200 billion, former Euro Working Group chief Thomas Wieser told the Delphi Economic Forum on Friday, describing that estimate as “safe” and “conservative.” In a discussion being moderated by the executive editor of Kathimerini, Alexis Papachelas, Wieser noted that the SYRIZA-led government was basically provoking Grexit from its rise in late January to July of that year. Wieser noted that in 2010, the German government decided that the participation of the IMF in the rescue program for Greece was necessary, noting that the Eurozone lacked the technical knowhow for that sort of program. He noted that former US President Barack Obama took an active role during Greece’s crisis, adding that then Treasury Secretary Jack Lew would call the Eurogroup chairman at the time, Jeroen Dijsselbloem up to five times a week.

“..Somehow it turns out I’m the first white person to think about giving the land back since Marlon Brando..”

• ‘This Is All Stolen Land’: Canadian Offers To Share His With First Nations (G.)

Joel Holmberg had been batting the idea around for years. But the final decision came last month, as he scrolled through the online vitriol that erupted after a white farmer was acquitted of killing a young Cree man in the Canadian province of Saskatchewan. Holmberg turned to social media, but instead of joining in the often-vicious debate surrounding that case, he offered to share his family’s five-acre property in northern Alberta with a First Nations family. There would be no bills, no rent, he explained. Instead the family could join him, his wife and two children in living off the land; hunting, fishing and growing food.

“I wanted to offer some sort of hope,” said Holmberg. “It was really disgusting to see the way the racist people were speaking. I wanted to let them know that it’s not everyone in Canada that feels that way.” The invitation to share his acreage near Barrhead, about 100km north-west of Edmonton, seemed like a fair one. “We all know in our heart the truth, that this is all stolen land,” said the 45-year-old. “They’re our hosts and we’re their guests and they’ve been criminally abused for far too long and it has to stop.” Holmberg said his appreciation for First Nations culture began as a child growing up in British Columbia, when members of the Sinixt First Nation began bringing him along as they hunted and fished.

“I had the opportunity to do sweats with them and learn about their culture from them and learn about the real history of Canada,” he said. He continued to delve into Canada’s rich tapestry of indigenous cultures as he moved around the country, from the Northwest Territories to Manitoba and Saskatchewan. “They’re the kindest people I’ve ever met. They’ve been there for me in the worst times in my life when I needed help the most,” he said. “It is very clear to my family and I, that it is us that will be blessed by this thing happening most of all.”