Robert Capa Anti-fascist militia women at Barcelona street barricade 1936

Interesting point of view. What Pettis ignores is that the issuer of a global reserve currency MUST always run a deficit, or the world will be starved of money.

• America’s Trade Advantage: Large Deficits (Pettis)

Even China’s official voice, the People’s Daily, pointed out Monday how unlikely it was that China could “overtake the U.S. to lead the world.” This is because China must accommodate high and rising trade surpluses to moderate a stark trade-off between rising debt and rising unemployment. After years of deep imbalances and accelerating credit growth, China this year met its 6.7% GDP-growth target—needed to stabilize employment—only by growing debt in a frightening amount equal to more than 40 percentage points of GDP. Debt limits are a major constraint on China’s difficult adjustment. The country must therefore rely on its trade surplus for crucial breathing space, with each percentage point of surplus substituting for about 10 percentage points of debt.

To see how this affects China’s leadership role, consider how the U.S., only after 50 years as the world’s largest economy and a negligible governance role, finally came to dominate global trade. This occurred over two separate periods. The first ran for roughly five decades beginning with World War I. Two highly destructive world wars left all the world’s major economies acutely short of capital—all except for the U.S., which began the period as the world’s largest surplus nation and its main exporter of savings. This inevitably put America at the center of the emerging economic order. By the 1970s, conditions were very different. The other advanced nations had rebuilt their economies, global savings were abundant and other forms of demand determined the growth rates for most economies.

Rather than receive access to scarce capital, these countries wanted instead to export capital, i.e., to expand demand by increasing exports of tradable goods while constraining imports. With its flexible financial system and the gradual elimination by the 1970s of all capital restrictions, the U.S. quickly adapted and began running large deficits, the costs of which, in the form of unemployment and consumer debt, America was willing to absorb for political advantage. This is the key reason why China cannot replace the U.S. as the leader of global trade.

[..] Opposition to trade, particularly among Americans most vulnerable to unemployment and consumer debt, was therefore inevitable. But rather than other countries reorganizing around the surpluses China requires, it is more likely that over time global trade will become unstable and increasingly contentious. That is in fact closer to the historical norm than the anomalous stability of the four decades before 1914 and the six after 1945. A U.S. retreat from trade would clearly be damaging to global prospects. Many economists argue that it will also damage U.S. prospects. But they are almost certainly wrong. History suggests that intervention usually benefits diversified economies with large, persistent trade deficits, especially when driven at least in part by distortions abroad.

Escobar should read Pettis.

• All Aboard Post-TPP World (Escobar)

A half-hearted near handshake between US President Barack Obama and Russian President Vladimir Putin before and after they spoke ‘for about four minutes’, standing up, on the sidelines of the APEC summit in Lima, Peru, captured to perfection the melancholic dwindling of the Obama era. A whirlwind flashback of the fractious relationship between Obama and ‘existential threats’ Russia and China would include everything from the Washington-sponsored Maidan in Kiev to Obama’s ‘Assad must go’ in Syria, with special mentions to the oil price war, sanctions, the raid on the ruble, extreme demonization of Putin and all things Russian, provocations in the South China Sea – all down to a finishing flourish; the death of the much vaunted TPP treaty, which was reconfirmed at APEC right after the election of Donald Trump.

It was almost too painful to watch Obama defending his not exactly spectacular legacy at his final international press conference – with, ironically, the backdrop of the South American Pacific coast – just as Chinese President Xi Jinping all but basked in his reiterated geopolitical glow, which he already shares with Putin. As for Trump, though invisible in Lima, he was everywhere. The ritual burial, in Peru’s Pacific waters, of the «NATO on trade» arm of the pivot to Asia (first announced in October 2011 by Hillary Clinton) thus offered Xi the perfect platform to plug the merits of the Regional Comprehensive Economic Partnership (RCEP), amply supported by China. RCEP is an ambitious idea aiming at becoming the world’s biggest free trade agreement; 46% of global population, with a combined GDP of $17 trillion, and 40% of world trade.

RCEP includes the 10 ASEAN nations plus China, Japan, South Korea, India, Australia and New Zealand. The RCEP idea was born four years ago at an ASEAN summit in Cambodia – and has been through nine rounds of negotiations so far. Curiously, the initial idea came from Japan – as a mechanism to combine the plethora of bilateral deals ASEAN has struck with its partners. But now China is in the lead. [..] Meanwhile, Putin and Xi met once again – with Putin revealing he’s going to China next spring to deepen Russian involvement in the New Silk Roads, a.k.a. One Belt, One Road (OBOR). The ultimate objective is to merge the Chinese-led OBOR with the development of the Russia-led Eurasia Economic Union (EEU).

That’s the spirit behind 25 intergovernmental agreements in economy, investment and nuclear industry signed by Russian PM Dmitry Medvedev and Chinese PM Li Keqiang in St. Petersburg in early November, as well as the set up of a joint Russia-China Venture Fund. In parallel, almost out of blue, and with a single stroke, Turkey President Tayyip Erdogan, on the way back from a visit to Pakistan and Uzbekistan, confirmed what had been all but evident for the past few months; “Why shouldn’t Turkey be in the Shanghai Five? I said this to Mr. Putin, to (Kazakh President) Nazarbayev, to those who are in the Shanghai Five now… I think if Turkey were to join the Shanghai Five, it will enable it to act with much greater ease”.

How is it possible that this is still allowed to continue?

• The Bank of Japan Can’t Keep Stores From Cutting Prices (BBG)

While Governor Haruhiko Kuroda’s vow to overshoot the Bank of Japan’s 2% inflation target caused a stir among monetary policy watchers in September, it’s yet to have an impact among retailers. Stores as diverse as supermarket operator Aeon, Mister Donut and Wal-Mart have all announced price cuts since Kuroda’s pledge, underscoring the weakness in Japanese consumer spending and the difficulty of overcoming the “deflationary mindset” that the BOJ set out to eradicate. Consumer prices fell for an eighth straight month in October, a government report showed Friday. “Companies are just being practical,” said Masamichi Adachi at JPMorgan. “No one is buying the BOJ’s new commitment. There is strong doubt that the BOJ can even achieve the 2% target and the name ‘overshooting commitment’ itself is hard to understand for ordinary people.”

Falling prices and expectations for more of the same could also drag on annual wage talks, which start soon. Kuroda said last week that he’s “paying close attention” to these, as weak growth in pay has been hampering efforts to generate inflation. It’s essential for Japanese companies to set salaries based on the premise of 2% inflation, he said. Base salaries, which exclude bonuses and overtime, will rise this year by less than last year, Dai-ichi Life Research Institute forecast in a report this month. This reinforces frugality among shoppers and encourages retailers to compete by discounting.

Beijing does not control its own economy. It’s hostage to the shadow banks.

• China Banking Regulator Wrestles With $2.9 Trillion Off-Balance Sheet WMPs (R.)

China’s banking regulator may be getting serious about how lenders provision for the more than 20 trillion yuan ($2.9 trillion) of wealth management products (WMPs) that have been issued as non-guaranteed off-balance sheet liabilities. The China Banking Regulatory Commission (CBRC), in new draft rules released on Wednesday, demanded banks apply a more “comprehensive” approach to cover “substantive risks” related to off-balance sheet activities, or shadow banking. The guidelines, which would replace 2011 regulations and are awaiting comment, proposed such measures as adding impairment loss allowances and properly calculating risk-weighted assets for off-balance sheet activity.

It was the latest measure announced by CBRC to curb shadow banking risks and address the rapid growth of WMPs, which amounted to 26.28 trillion yuan ($3.8 trillion) by end-June, data from the Banking Sector Wealth Management Product Registration and Custodian Centre showed. That amounts to around 39% of China’s GDP in 2015. About 77%, or 20.18 trillion yuan, of the products are non-guaranteed bank WMPs, a major component of shadow banking activity, the data showed. CBRC Chairman Shang Fulin warned banks in September the rampant growth of their off-balance sheet operations must be curtailed, and represented a “hidden credit risk that potentially threatens financial safety”.

[..] China’s mid-tier and small lenders, which have raised a greater proportion of their funding using WMPs, are more vulnerable to off-balance sheet liquidity risks. One important obstacle is capital. A very strict interpretation of the draft regulations, requiring banks to hold reserves against all off-balance sheet issuance, would require banks to raise as much as 1.7 trillion yuan to maintain current capital levels, said Jack Yuan, a banking analyst at Fitch. “The incentives for banks to issue more off-balance sheet WMPs still exists,” said Yuan. “There’s nothing in these rules that disincentivizes banks from continuing on with more off-balance sheet activity.” “It’s like driving a car,” said a risk manager at another mid-size lender. “If you don’t follow the rules, there’s a mess. But if you follow the rules, that doesn’t mean you have to slow down.”

How do you tell them apart though?

• China Central Bank Warns Against Outflows Disguised As Investment (R.)

China’s central bank has urged commercial banks in Shanghai to guard against money outflows via the Shanghai Free Trade Zone (FTZ) disguised as foreign investment, two sources with knowledge of the instructions said on Friday. The Shanghai headquarters of the People’s Bank of China asked for particular vigilance against money originating in other provinces or cities in China that flowed into the FTZ en route abroad, the banking industry sources said. The guidance from the PBOC’s was the latest in a string of measures to stem surging capital outflows as the yuan currency plumbs 8-1/2 year lows against the surging U.S. dollar.

“The central bank has urged lenders to strengthen due diligence to prevent capital outflows disguised as outbound investment,” said one source, who declined to be identified because he was not authorized to speak publicly about the matter. On Wednesday it said it would crack down on capital flight and closely monitor abnormal capital flows through the FTZ. In a report on Tuesday, Capital Economics estimated that capital outflows last month were the largest since January, and posed a threat to China’s exchange rate regime. The Shanghai FTZ was launched in 2013 to promote international trade and cross-border investment, but three years later the city government is trying to balance efforts to accelerate financial reforms in the zone while preventing capital outflows.

But of course….

• ECB Says It Can Shield Eurozone From Global Finance Instability (BBG)

The ECB is confident it will be able to continue shielding the euro area from the risk of a sudden correction in asset prices, after political events such as the election of Donald Trump threaten to increase volatility in coming months. “We are certainly seeing a correction coming from the U.S.,” ECB Vice President Vitor Constancio said on Thursday in an interview with Bloomberg TV’s Matt Miller. “The ECB will continue to exert its stabilizing role, so I don’t think there will be significant contagion to Europe.” Constancio spoke on the occasion of the publication of the ECB’s twice-yearly Financial Stability Review.

The report warns that the risk of an abrupt global market correction has intensified on the back of widespread political uncertainty, posing a threat to banks, stability and economic growth. While the policies of incoming President Trump may lead to higher spending and faster inflation in the U.S., their effect on the euro area is difficult to gauge given the possibility of protectionist tit-for-tats and higher chances of populist victories in votes across the continent. “More volatility in the near future is likely and the potential for an abrupt reversal remains significant,” according to the bank. “Elevated geopolitical tensions and heightened political uncertainty amid busy electoral calendars in major advanced economies have the potential to reignite global risk aversion and to trigger a major confidence shock.”

A similar graph of private debt would be more revealing.

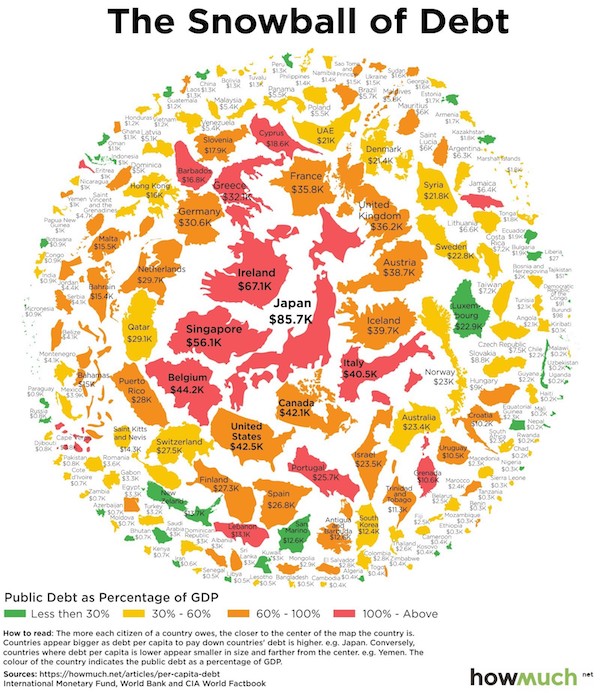

• The Snowball of Debt (HowMuch/VC)

With the U.S. National Debt closing in on the $20 trillion mark, there has been a lot of conversation in Washington about debt and its role in government. And most of that conversation right now revolves around President-elect Donald Trump. On one hand, the Trump campaign had early rhetoric in the Presidential campaign that the elimination of the deficit and existing government debt would be paramount if elected. The Trump administration has also been highly critical of the Federal Reserve, saying that the Fed’s policies create a “false economy”. As a result, some see Trump embracing the unique opportunity to put his stamp on how the Federal Reserve does business in early 2017.

On the other hand, even many conservative think tanks are concerned about what Trump policies mean for government debt. Rebuilding infrastructure is not cheap, and widely-cited estimates see the national debt increasing by anywhere from $5.3 trillion to $11.5 trillion over the next 10 years. While giant numbers like $20 trillion sound abstract and meaningless, converting them to debt-per-capita can make things more intuitive. The per-capita amount shows the amount of debt that exists per citizen, and makes things plain and simple. Today’s infographic from HowMuch.net, a cost information site, shows government debt-per-capita in every country in the world, including the United States.

Here are the countries where people owe the most debt per person:

Japan: $85,694.87 per person

Ireland: $67,147.59 per person

Singapore: $56,112.75 per person

Belgium: $44,202.75 per person

United States: $42,503.98 per person

Canada: $42,142.61 per person

Italy: $40,461.11 per person

Iceland: $39,731.65 per person

Australia: $38,769.98 per person

United Kingdom: $36,206.11 per person

Of course, debt-per-capita isn’t the only lens to view government debt.

Manipulating prices with empty words. If they ever sign an agreement, it will be a hollowed out one, and it won’t last more than two weeks.

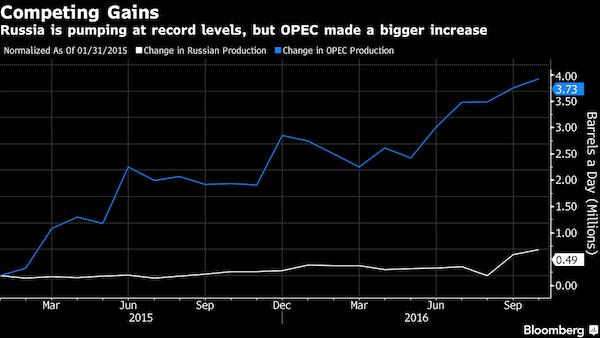

• Russia to OPEC: Oil Freeze Is All You Get

Facing pressure from OPEC to make a significant output reduction, Russia reiterated its readiness to freeze oil production at current levels, arguing that the offer amounted to a cut compared with next year’s plans. A production cap would mean Russia pumping 200,000 to 300,000 barrels a day less than planned in 2017, Energy Minister Alexander Novak told reporters in Moscow on Thursday. That means a freeze would be “quite a difficult and harsh situation for us as our plans envisioned an output growth next year,” he said. OPEC, which is seeking to finalize its own supply cuts of as much as 1.1 million barrels a day next week, asked non-members to contribute by cutting daily production by about 500,000 barrels, Novak said.

OPEC reached a preliminary deal in September to reduce collective output to 32.5 million to 33 million barrels a day, compared with the group’s estimate of 33.6 million in October. Talks on individual production quotas continued this week with the aim of securing a final pact by the ministerial meeting in Vienna on Nov. 30. The group will meet lower-level OPEC officials to discuss cooperation on Nov. 28, followed by a Nov. 30 breakfast meeting between ministers and non-members, including Russia, before the ministerial summit, according to people familiar with the matter.

Merkel’s anti-Putin stance will be used against her. Germany and Russia should always try to talk. They are too close to not talk.

• Germany, 15 Other Countries Press For Arms Control Deal With Russia (R.)

Fifteen European countries have joined Germany in its push for a new arms control agreement with Moscow, saying more dialogue is needed to prevent an arms race in Europe after Russia’s actions in Crimea and eastern Ukraine, a German newspaper said. “Europe’s security is in danger,” German Foreign Minister Frank-Walter Steinmeier told Die Welt newspaper in an interview published on Friday. “As difficult as ties to Russia may currently be, we need more dialogue, not less.” Steinmeier, a Social Democrat who has been nominated to become German president next year, first called for a new arms control deal with Russia in August to avoid an escalation of tensions in Europe.

Fifteen other countries – all belonging to the Organization for Security and Cooperation in Europe – have since joined Steinmeier’s initiative: France, Italy, Austria, Belgium, Switzerland, the Czech Republic, Spain, Finland, the Netherlands, Norway, Romania, Sweden, Slovakia, Bulgaria and Portugal. The group plans to issue a joint statement on Friday and will meet again on the sidelines of a Dec. 8-9 ministerial level OSCE meeting in Hamburg that will be hosted by Germany, which now holds the rotating presidency of the OSCE. Steinmeier condemned Russia’s annexation of Crimea and its support for separatists in eastern Ukraine, saying such acts undermined delicate bonds of trust built up over decades and threatened to unleashed a new arms race.

U.S. officials are skeptical about the initiative, citing Russia’s failure to abide by existing agreements and treaties. Steinmeier also drew criticism from U.S. and NATO officials in June after warning that Western military maneuvers in eastern Europe amounted to “saber-rattling and shrill war cries” that could worsen tensions with Russia.

I’ve said it before: it’s never a good feeling when the looses cannons make most sense. But that’s 2016 for you.

• Fillon Calls Hollande’s Hardline Policy On Russia ‘Absurd’ (EuA)

In a televised debate last night (24 November) French conservative frontrunner François Fillon said Russia must be anchored to Europe, or else Moscow would couple with China, to the detriment of the continent. The debate was largely seen as the last chance for Alain Juppé, who came second in the first round of the primary elections of the conservatives last Sunday, to impress the conservative electorate and catch up on Fillon ahead of the 27 November run-off. The one-and-a-half hour debate was generally uncontroversial. One of the rare contentious exchanges was when Juppé questioned Fillon’s perceived closeness to Russian President Vladimir Putin. Putin knew Fillon when they were both prime ministers.

In an unusual televised appearance the Russian president praised him Wednesday as a “great professional” and a “very principled person”. “This must be the first presidential election in which the Russian president chooses his candidate,” Juppé said. Fillon brushed off Putin’s comments but said the West must work more closely with Russia at a time when relations are at their worst since the Cold War. “Russia is a dangerous country if we treat it as we have treated it for the last five years,” Fillon said. He said the real danger to Europe was not Russia but the economic threat of “the Asian continent”. Fillon argued that Russia should be anchored to Europe geopolitically or risk seeing Moscow forge alliances with China instead.

He called “absurd” the hardline policy of French President François Hollande with regard to Russia, saying it only made Moscow harden its positions and exacerbate its nationalist reflexes. The French conservative frontrunner said the EU would not change alliances and would not abandon its transatlantic link, but added that Paris didn’t need the permission from Washington to talk to Moscow. “What I am asking is that we sit down at a table with the Russians without asking for the agreement of the United States and that we re-establish a link, if not a relation based on confidence, which will make it possible to anchor Russia to Europe.”

His EU pension for life will be stunning. And now he can add a German one.

• EU Parliament President Martin Schulz to Step Down, Run Against Merkel (WSJ)

European Parliament President Martin Schulz said on Thursday that he would stand down in January and run in next year’s elections in Germany, where he is seen as a potential rival to Chancellor Angela Merkel. The 60-year-old, who has been a member of the European Union’s legislature for the past 22 years, said it was “not an easy decision” to quit. Mr. Schulz’s return to German politics after more than 20 years in Brussels is fueling speculation that he could lead his Social Democratic Party’s ticket at next year’s general election, to run against Ms. Merkel’s conservatives. “My commitment to the European project is unwavering. From now on I will be fighting for this project from the national level, but my values don’t change,” Mr. Schulz said.

He noted that as the largest country in the EU, Germany “bears a special responsibility” which he will strive to fulfill, as of next year, from Berlin. Mr. Schulz didn’t comment on the possibility that he could succeed Frank-Walter Steinmeier as Germany’s foreign minister after the latter vacates his post early next year to run for the largely ceremonial office of German president. The SPD has said it would decide in January who would lead it into the general election next fall. SPD officials said Sigmar Gabriel, party chairman and economics minister, had the first shot, and would have to voluntarily yield to Mr. Schulz. The two men are longtime friends.

We play around, very much at our own peril. with systems far too complex for us to understand. We simply deny we don’t understand. And there’s something ironically stupid in the Trump team taking away funding from NASA to be used in … space exploration. That you don’t make up.

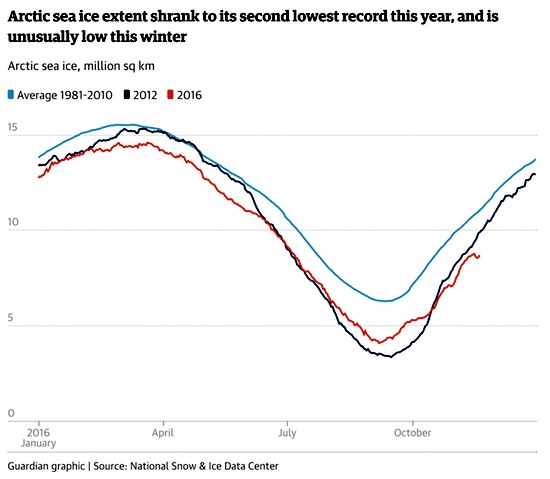

• Increasingly Rapid Ice Melt Could Trigger Uncontrollable Climate Change (G.)

Arctic scientists have warned that the increasingly rapid melting of the ice cap risks triggering 19 “tipping points” in the region that could have catastrophic consequences around the globe. The Arctic Resilience Report found that the effects of Arctic warming could be felt as far away as the Indian Ocean, in a stark warning that changes in the region could cause uncontrollable climate change at a global level. Temperatures in the Arctic are currently about 20C above what would be expected for the time of year, which scientists describe as “off the charts”. Sea ice is at the lowest extent ever recorded for the time of year. “The warning signals are getting louder,” said Marcus Carson of the Stockholm Environment Institute and one of the lead authors of the report. “[These developments] also make the potential for triggering [tipping points] and feedback loops much larger.”

Climate tipping points occur when a natural system, such as the polar ice cap, undergoes sudden or overwhelming change that has a profound effect on surrounding ecosystems, often irreversible. In the Arctic, the tipping points identified in the new report, published on Friday, include: growth in vegetation on tundra, which replaces reflective snow and ice with darker vegetation, thus absorbing more heat; higher releases of methane, a potent greenhouse gas, from the tundra as it warms; shifts in snow distribution that warm the ocean, resulting in altered climate patterns as far away as Asia, where the monsoon could be effected; and the collapse of some key Arctic fisheries, with knock-on effects on ocean ecosystems around the globe.

The research, compiled by 11 organisations including the Arctic Council and six universities, comes at a critical time, not only because of the current Arctic temperature rises but in political terms. Aides to the US president-elect, Donald Trump, this week unveiled plans to remove the budget for climate change science currently used by Nasa and other US federal agencies for projects such as examining Arctic changes, and to spend it instead on space exploration.

More power away from Merkel.

• Erdogan Threatens To Open Borders To Refugees After EU Vote (AFP)

Turkish President Recep Tayyip Erdogan on Friday threatened to throw open Turkey’s borders to illegal migrants after the European Parliament voted to back a freeze in membership talks with Ankara. “Listen to me. If you go any further, then the frontiers will be opened, bear that in mind,” Erdogan told the EU in a speech in Istanbul. On March 18, Ankara and Brussels forged a deal for Turkey to halt the flow of migrants to Europe – an accord that has largely been successful in reducing numbers crossing the Aegean Sea.

It’s a miracle we haven’t seen much moe of this kind of thing happen.

• Refugees Torch Lesbos Camp After Gas Explosion Kills Two (AFP)

Angry migrants set fire to a camp on the Greek island of Lesbos after a woman and a six-year-old child died following a gas cylinder explosion, local police said. The explosion occurred while the 66-year-old woman was cooking, police said, adding that the child’s mother and four-year-old sibling were hospitalised with serious injuries. In an apparent act of rage, migrants then set fire to the Moria camp on Lesbos, causing significant damage, police said. Firefighters arrived at the scene to try to put out the flames. Ensuing clashes between migrants and police left six refugees slightly injured. Some migrants fled the camp after the blast but had since returned and calm was being restored, a police source said.

Several fires have erupted in refugee camps on the Greek islands, where some 16,000 people became stranded after the European Union signed a deal that was aimed at stemming the influx of migrants. Moria has a capacity for 3,500 people but currently houses more than 5,000. Part of the camp was badly damaged in a fire on September 19 during clashes between migrants and police, and thousands had to be moved out before returning two days later. Nearly 66,000 refugees and migrants are currently stranded in Greece, according to official figures.

Home › Forums › Debt Rattle November 25 2016