Elliott Erwitt Downtown Hat Shop Window, Pittsburgh 1950

The incompetence is deafening. Trillions have been washed away on the theory.

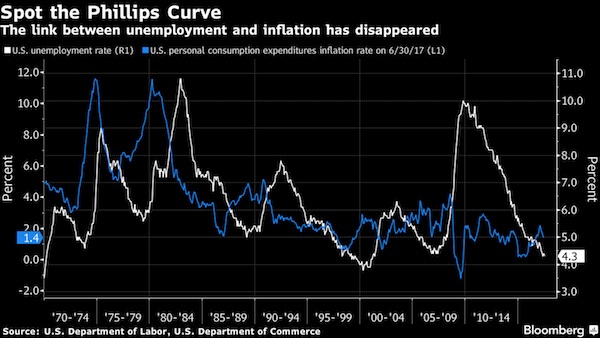

• Phillips Curve Doesn’t Help Forecast Inflation, Fed Study Finds (BBG)

A fundamental relationship of mainstream economic theory at the heart of the Federal Reserve’s strategy for setting interest rates has been a poor guide for policy makers for at least three decades, according to a study by the Philadelphia Fed’s top-ranking economist. The paper, co-authored by Philadelphia Fed Director of Research Michael Dotsey, shows that forecasting models based on the so-called Phillips curve, which asserts a link between unemployment and inflation, don’t actually help predict inflation. “Our results indicate that monetary policymakers should at best be very cautious in their reliance on the Phillips curve when gauging inflationary pressures,” Dotsey and Philadelphia Fed economists Shigeru Fujita and Tom Stark wrote.

Their study is timely. Fed officials have been surprised by a deceleration in U.S. inflation over the past several months despite a continued decline in unemployment, the opposite of what the Phillips curve relationship would predict. Minutes of the last meeting of the central bank’s rate-setting Federal Open Market Committee in July revealed that “a few participants cited evidence suggesting that this framework was not particularly useful in forecasting inflation,” while “most participants thought that the framework remained valid.” If the majority view on the FOMC is that the Phillips curve framework is still valid, it implies that central bankers should continue raising interest rates with unemployment at a 16-year low, because they expect inflation will rise in the medium term even though prices pressures have been disappointingly soft.

Kansas City Fed President Esther George, who has been more forceful than many of her colleagues in recent years about the need to raise rates, lent support to that view on the sidelines of this week’s annual gathering of central bankers from around the world in Jackson Hole, Wyoming. “There may in fact be something wrong with the models, I don’t know, I think that continues to be a question that many economists are asking,” George said during a TV interview with Bloomberg’s Michael McKee that aired Thursday. Even so, she favors another rate increase this year.

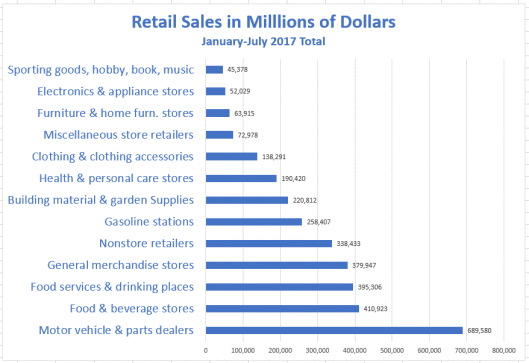

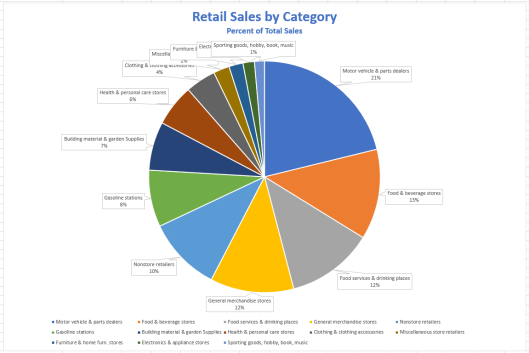

Cars + gasoline account for almost 30% of all spending. Crazy.

• Where Do Consumers Spend The Most Money? (Mish)

In Dealers “Wildly Overweight” SUVs as Sales Slow, I commented “Vehicles account for 20% of retail spending. A crash or even a significant slowdown will impact retail sales and thus GDP.” A reader asked me how I calculated that. Let’s take a look. My number came from the latest Census Department Advance Retail Sales Report. Here are some charts I created from 7-month totals (January-July) 2017.

Key Points

• Motor vehicles and parts account for 21.18% of retail sales. Gasoline stations account for 7.94%. Together that adds up to 29.12%.

• Food and beverage stores (grocery and liquor stores) account for 12.62 percent of retail sales. Food services and drinking places (restaurants and bars) account for 12.14. The food and drink total is 24.76%.

• Nonstore retailers (think Amazon) account 10.39% of retail sales.

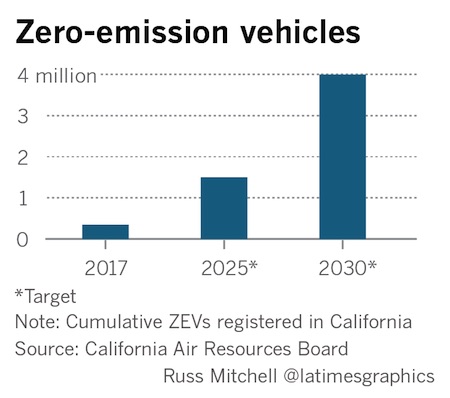

Yeah, let’s subsidize the car culture.

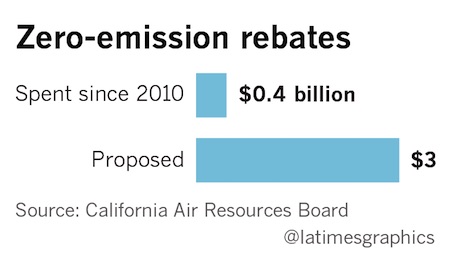

• Should California Spend $3 Billion To Help People Buy Electric Cars? (LAT)

Over seven years, the state of California has spent $449 million on consumer rebates to boost sales of zero-emission vehicles. So far, the subsidies haven’t moved the needle much. In 2016, of the just over 2 million cars sold in the state, only 75,000 were pure-electric and plug-in hybrid cars. To date, out of 26 million cars and light trucks registered in California, just 315,000 are electric or plug-in hybrids. The California Legislature is pushing forward a bill that would double down on the rebate program. Sextuple down, in fact. If $449 million can’t do it, the thinking goes, maybe $3 billion will. That’s the essence of the plan that could lift state rebates from $2,500 to $10,000 or more for a compact electric car, making, for example, a Chevrolet Bolt EV electric car cost the same as a gasoline-driven Honda Civic.

Already approved by several Senate and Assembly committees, the bill will go to Gov. Jerry Brown for his approval or veto if the full Legislature approves it by the end of its current session on Sept. 15. California aims to reduce greenhouse gas emissions by 2030 to a level 40% below what they were in 1990. “If we want to hit our goals, we’re going to have to do something about transportation,” said Assemblyman Phil Ting (D-San Francisco), sponsor of Assembly Bill 1184. Without a dramatic boost in subsidies, Ting said, the state risks falling short of Gov. Brown’s goal of 1.5 million zero-emission vehicles on California highways by 2025, and the California Air Resources Board’s goal of 4 million such cars by 2030. The bill is opposed by Republicans averse to taxpayer subsidies and even the Legislature’s own analysts have called it “duplicative,” “unclear” and “problematic.”

“Once again, history and reality are replaced by dreams with little substance.”

• Tesla: A Canary in the Wall Street Coal Mine (Barron’s)

Those who think today’s stock market is unlike that of 2000, when baseless enthusiasm pushed stocks up to wild valuations, only to collapse in subsequent years, should take another look. Do they remember counting eyeballs as a basis for value? Once again, history and reality are replaced by dreams with little substance. Tesla, in which I have a short position, is becoming the loudest canary in Wall Street’s coal mine. Tesla requires repetitive capital raises to fund persistent operating losses. This requires bullish analysts and holders to keep the stock aloft with projections of imagined earnings from future products, while they overlook existing businesses, which continue to lose vast sums of money. Morgan Stanley, one of Tesla’s major underwriters, has an analyst covering Tesla named Adam Jonas. Astonishingly, he raised his price target for the stock, despite recognizing the need to slash his earnings forecast.

In May, Jonas had estimated per-share losses (excluding stock-option expense) of $3.53 in 2017 and $1.14 in 2018, and a profit of $2.43 in 2019. His latest estimates: losses of $7.60 and $3.66, and a 2019 profit of $2.01. Raising the target price while more than doubling the company’s projected loss indicates the craziness of the times. Price targets are fantasies, discounting distant earnings estimates by analysts who show little accuracy in estimating only a year ahead. For most companies, profit is the major objective. Tesla is different because its founder is different. Elon Musk is driven by a mission to replace fossil fuels with renewable energy. Unlike companies seeking profit maximization by using patents to establish exclusive rights to products, Musk encourages competitors and has made virtually all of his patents available. Almost all auto companies have imminent plans to compete.

Tesla has been first-to-market in electric cars, but this in no way guarantees success, as competition and technological change are major challenges. Remember Atari, Blackberry, AOL, Napster, Netscape, and Palm? Musk is smart and imaginative, but none of his major companies are profitable. Tesla has been around for 14 years and has cumulatively lost more than $3.7 billion, despite the massive subsidies that it and its customers have received. SolarCity, also a beneficiary of alternative-energy subsidies, lost hundreds of millions of dollars before being bailed out by Tesla. As subsidies diminish, and competition emerges, profits will be even more elusive. Tesla tries to convey the illusion of inexhaustible demand for its cars, yet sales of the Model S and Model X have been flat for four quarters. Tesla’s rising inventory and shrinking deposits suggest declining demand.

Tesla claims to have more than 400,000 deposits for the Model 3, but these aren’t orders. They reflect a decision by potential buyers to get in line for a $7,500 tax credit at virtually no cost. Shifting $1,000 from a savings account into a refundable Tesla deposit costs only about $1 per year in lost interest. Fewer than 100,000 of these depositors will actually get full tax credits before Tesla consumes its allowable allotment of them. Its competitors will be able to offer such credits to prospective buyers, just as Tesla’s expire.

Jockeying for votes?

• UK Labour Party Makes Dramatic Shift On Brexit And Single Market (G.)

Labour is to announce a dramatic policy shift by backing continued membership of the EU single market beyond March 2019, when Britain leaves the EU, establishing a clear dividing line with the Tories on Brexit for the first time. In a move that positions it decisively as the party of “soft Brexit”, Labour will support full participation in the single market and customs union during a lengthy “transitional period” that it believes could last between two and four years after the day of departure, it is to announce on Sunday. This will mean that under a Labour government the UK would continue to abide by the EU’s free movement rules, accept the jurisdiction of the European court of justice on trade and economic issues, and pay into the EU budget for a period of years after Brexit, in the hope of lessening the shock of leaving to the UK economy.

In a further move that will delight many pro-EU Labour backers, Jeremy Corbyn’s party will also leave open the option of the UK remaining a member of the customs union and single market for good, beyond the end of the transitional period. Permanent long-term membership would only be considered if a Labour government could by then have persuaded the rest of the EU to agree to a special deal on immigration and changes to freedom of movement rules. The announcement, revealed in the Observer by the shadow Brexit secretary, Keir Starmer, means voters will have a clear choice between the two main parties on the UK’s future relations with the EU after a year in which Labour’s approach has been criticised for lacking definition and appeared at times hard to distinguish from that of the Tories.

The decision to stay inside the single market and abide by all EU rules during the transitional period, and possibly beyond, was agreed after a week of intense discussion at the top of the party. It was signed off by the leadership and key members of the shadow cabinet on Thursday, according to Starmer’s office.

“..to reassure the masses that effective spells for favor of the Gods have been cast — except that in our civilization money is God.”

• Controlled Demolition (Jim Kunstler)

This is the week-of-weeks when the official grand viziers of finance gather at Jackson Hole, Wyoming, to confab and interpret the lay of animal neck-bones and other auguries scattered in the sand, with the hope of steering the awesome powers of the universe this was or that as they affect the operations of money. The exercise is hardly different in function from the sort of rude ceremonials that took place on top of Sumerian ziggurats and Aztec temples — to reassure the masses that effective spells for favor of the Gods have been cast — except that in our civilization money is God. Or “money,” we should say, because the old definitions don’t fit so well anymore. It used to have a straightforward relationship with the work required to produce actual things of value, but those days are gone.

“Money” nowadays is a byproduct of wishful analytics and computer legerdemain seasoned with generous measures of fraud and larceny. This is a big problem when everything is measured in money and it becomes quite impossible to state with assurance what the value of money actually is. Obviously, you end up not knowing the value of anything. That’s the perilous situation the world faces. And since the USA is the straw the stirs the world’s drink — at least for now — the utterances emanating from Jackson Hole may determine which way that situation turns. We should suppose that the officers of the Federal Reserve are upright, well-intentioned, patriotic people. No doubt they think they are. But the perilous situation is largely one of their own making, and seems to be veering out of their control, and reputations are at stake.

Their task at this year’s Jackson Hole confab is to maintain the appearance of confidence in their own rituals. But with a kicker. That kicker is named T-r-u-m-p. This modern Balaam, riding the ass of the Deep State into wickedness, must be stopped, perhaps at all costs. On his way to the oval office last fall, Trump prophesied that the stock markets represented “one big, fat, ugly bubble.” That was an offense to the grand viziers, for whom the elevated stock market valuations stood as the main testament to their power and wisdom. In fact, it was the only testament, and a rather flimsy one. More recently, though, the wicked Trump changed his tune and declared that the tower of stock market exaltation was his own doing, setting himself up for the revenge of the grand viziers.

Since nothing else has worked so far to dislodge Trump from the White House, a tumbling tower of stocks might seal his fate. The tower has to fall anyway, lest the moiling masses of flyover America think about besetting Wall Street with pitchforks and torches. A controlled demolition might be just the thing to appease these suffering holders of three part-time jobs (if they are so lucky) who have stood by in wonder and nausea while a tiny fraction of the elite gather unto themselves all the dwindling riches of the realm — at least in paper securities denominated in US dollars — while the wicked Trump will be left to the jackals of the Deep State, to be torn apart with the 25th Amenedment.

Elizabeth War(ren).

• The War That Time Forgot (CP)

If it’s Independence Day, then you can count on John McCain to be bunkered down in a remote outpost of the Empire growling for the Pentagon to unleash airstrikes on some unruly nation, tribe or gang. This July the Fourth found McCain making a return engagement to Kabul, an arrival that must have prompted many Afghans to scramble for the nearest air raid shelter. From the press room at NATO command, McCain announced that “none of us could say we are on a course to success here in Afghanistan.” The senator should have paused for a reflective moment and then called for an end to the war. Instead, McCain demanded that Trump send more US troops, more bombers and more drones to terrorize a population that has been riven by near constant war since the late 1970s.

McCain’s martial drool is now as familiar as the opening notes to the “Law & Order” theme song. What may surprise some, however, is the composition of the delegation that signed up to travel on his frequent flier program, notably the presence of two Democratic Senators with soaring profiles: Sheldon Whitehouse and Elizabeth Warren. Whitehouse, the former prosecutor (aren’t they all?) from Rhode Island, has lately taken a star turn in the role of chief inquisitor of suspected Russian witches in the Senate intelligence committee hearings. Perhaps he finally located one selling AK-47s to the Taliban to replace the guns they’d gotten from the CIA. (We now know that it’s the Saudis–not the Russians–who have been covertly funneling money to the Taliban, though don’t expect the Trump to impose any sanctions on the Kingdom of the Head-choppers.)

For her part, Warren largely echoed McCain’s bellicose banter that Trump needs to double down militarily to finish off the Taliban, the impossible dream. No real surprise here. To the extent that she’s advanced any foreign policy positions during her stint in the senate, Warren has been a dutiful supplicant to the demands of AIPAC and the Council on Foreign Relations, rarely diverging from the neocon playbook for the global war on Islam. Warren’s Afghan junket is a sure sign of her swelling presidential ambitions. These days “national security” experience is measured almost exclusively by how much blood you are willing to spill in countries you know almost nothing about. It didn’t take long for Warren to matriculate to the company position.

[..] Nothing better illustrates the eclipse of US global power than the fact that Afghanistan refuses to be subjugated or even managed, despite 16 years of hard-core carnage. Since the first US airstrikes hit Kandahar in October 2001, more than 150,000 Afghan civilians have been killed. Still Afghanistan resists imperial dictates. Even after Obama’s shameful troop surge in 2010, an escalation that went almost unopposed by the US antiwar movement, the Taliban now retains almost as much control of the country as it did in 2001. And for that Afghanistan must be punished. Eternally, it seems.

There’s always a new theory. Don’t let’s stop using as much of the stuff as we can.

• It’s Time To Accept Carbon Capture Has Failed (Conv.)

For years, optimists have talked up carbon capture and storage (CCS) as an essential part of taking emissions out of electricity generation. Yes, build wind and solar farms, they have said, but they can t be relied on to produce enough power all the time. So we ll still need our fleet of fossil-fuel-burning power stations; we just need to stop them pumping carbon dioxide (CO2) into the atmosphere. Most of their emphasis has been on post-combustion capture. This involves removing CO2 from power station flue gases by absorbing them into an aqueous solution containing chemicals known as amines. You then extract the CO2 , compress it into a liquid and pump it into a storage facility the vision in the UK being to use depleted offshore oil and gas fields. One of the big attractions with such a system is it could be retrofitted to existing power stations.

But ten years after the UK government first announced a £1 billion competition to design CCS, we re not much further forward. The reason is summed up by the geologist Lord Oxburgh in his contribution to the government-commissioned report on CCS published last year: “There is no serious commercial incentive and it will stay that way unless the state demonstrates there is a business there.” The problem is that the process is costly and energy intensive. For a gas-fired power station, you typically have to burn 16% more gas to provide the capture power. Not only this, you end up with a 16% increase in emissions of other serious air pollutants like sulphur dioxide, nitrogen oxides and particulate matter. Concerns have also been expressed about the potential health effects of the amine solvent used in the carbon capture.

You then have to contend with the extra emissions from processing and transporting 16% more gas. And all this before you factor in the pipeline costs of the CO2 storage and the uncertainties around whether it might escape once you ve got it in the ground. Around the world, the only places CCS looks viable are where there are heavy state subsidies or substantial additional revenue streams, such as from enhanced oil recovery from oilfields where the COC is being pumped in. Well, say the carbon capture advocates, maybe another technology is the answer. They point to oxy-combustion, a system which is close to reaching fruition at a plant in Texas.

First proposed many years ago by British engineer Rodney Allam, this involves separating oxygen from air, burning the oxygen with the fossil fuel, and using the combustion products -water and CO2- to drive a high-pressure turbine and produce electricity. The hot CO2 is pressurised and recycled back into the burners, which improves thermal efficiency. It has the additional advantage that CO12 is also available at pressures suitable for pipeline transportation.

Small is beautiful.

• Industrial Farming Is Driving The Sixth Mass Extinction Of Life On Earth (Ind.)

Industrial agriculture is bringing about the mass extinction of life on Earth, according to a leading academic. Professor Raj Patel said mass deforestation to clear the ground for single crops like palm oil and soy, the creation of vast dead zones in the sea by fertiliser and other chemicals, and the pillaging of fishing grounds to make feed for livestock show giant corporations can not be trusted to produce food for the world. The author of bestselling book The Value of Nothing: How to Reshape Market Society and Redefine Democracy will be one of the keynote speakers at the Extinction and Livestock Conference in London in October. Organised by campaign groups Compassion in World Farming and WWF, it is being held amid rising concern that the rapid rate of species loss could ultimately result in the sixth mass extinction of life.

This is just one reason why geologists are considering declaring a new epoch of the Earth, called the Anthropocene, as the fossils of soon-to-be extinct animals will form a line in the rocks of the future. The last mass extinction, which finished off the dinosaurs and more than three-quarters of all life about 65 million years ago, was caused by an asteroid strike that sent clouds of smoke all around the world, blocking out the sun for about 18 months. Prof Patel, of the University of Texas at Austin, said: “The footprint of global agriculture is vast. Industrial agriculture is absolutely responsible for driving deforestation, absolutely responsible for pushing industrial monoculture, and that means it is responsible for species loss. “We’re losing species we have never heard of, those we’ve yet to put a name to and industrial agriculture is very much at the spear-tip of that.”

Speaking to The Independent, he pointed to a “dead zone” – an area of water where there is too little oxygen for most marine life – in the Gulf of Mexico that has grown to the same size as Wales because of vast amounts of fertiliser that has washed from farms in mainland US, into the Mississippi River and then into the ocean. “That dead zone isn’t an accident. It’s a requirement of industrial agriculture to get rid of the sh*t and the run-off elsewhere because you cannot make industrial agriculture workable unless you kick the costs somewhere else,” he said. “The story of industrial agriculture is all about externalising costs and exploiting nature.” “Extinction is about the elimination of diversity. What happens in Brazil and other places is you get green deserts — monocultures of soy and nothing else. “Various kinds of chemistry is deployed to make sure it is only soy that’s grown on these mega-farms. “That’s what extinction looks like. If you ever go to a soy plantation, animal life is incredibly rare. It’s only soy, there’s nothing there for anything to feed on.”

Home › Forums › Debt Rattle August 27 2017

Tagged: CARBON CAPTURE CO2 CHARCOAL