Vincent van Gogh Self-Portrait with Straw Hat Aug-Sep 1887

Only globalization can save you. In other news: all your base are belong to us.

• Draghi Warns Of Serious Risk To Global Economy From Rising Protectionism (CNBC)

European Central Bank President Mario Draghi said protectionist policies pose a “serious risk” for growth in the global economy. At a gathering of central bankers, economists and others in Jackson Hole, Wyoming, on Friday, Draghi said the global economy is firming up. He told the audience in a speech that “a turn towards protectionism would pose a serious risk for continued productivity growth and potential growth in the global economy.” The comments come at a time when President Donald Trump is taking a hard look at the U.S.’s trade agreements around the world, pushing to reduce trade deficits and make conditions more favorable for American manufacturers.

Trump also came to office promising American business leaders he would break down regulations, which he said have constrained economic growth. The financial industry in particular seems poised to benefit if Obama-era regulations on banks and Wall Street get dismantled or diluted. On Friday, Draghi, a former Goldman Sachs executive, said “there is never a good time for lax regulation” especially because it can create incentives that lead to higher risk-taking. “By contrast, the stronger regulatory regime that we have now has enabled economies to endure a long period of low interest rates without any significant side-effects on financial stability, which has been crucial for stabilizing demand and inflation worldwide,” Draghi said. “With monetary policy globally very expansionary, regulators should be wary of rekindling the incentives that led to the crisis.”

MO: make a godawful mess, then switch to being sensible.

• Yellen and Draghi Both Defend Post-Crisis Financial Regulation (BBG)

The world’s two most powerful central bankers on Friday delivered back-to-back warnings against dismantling tough post-crisis financial rules that the Trump administration blames for stifling U.S. growth. ECB President Mario Draghi, speaking at the Federal Reserve’s annual retreat in Jackson Hole, Wyoming, said it was a particularly dangerous time to loosen regulation given that central banks are still supporting their economies with accommodative monetary policies. That warning followed earlier remarks by Fed Chair Janet Yellen, who offered a broad defense of the steps taken since the 2008 financial-market meltdown and urged that any rollback of post-crisis rules be “modest.” The combined effect was “a subtle shot across the bow of those who seek deregulation,” said Michael Gapen, chief U.S. economist at Barclays in New York.

The complementary speeches come at what may be the tail end of Yellen’s tenure at the Fed’s helm. President Donald Trump is not expected to reappoint her when her leadership term expires in February, according to economists surveyed by Bloomberg. Gapen said that by delivering overlapping messages, Yellen and Draghi could help amplify their points, but “in practice that’s not the agenda the Trump administration is likely to seek.” In a talk aimed broadly at defending the merits of globalization, Draghi said it’s crucial to make sure open policies on trade and global finance should be safeguarded with regulations designed to make globalization fair, safe and equitable. “We have only recently witnessed the dangers of financial openness combined with insufficient regulation,” Draghi said, referring to the global financial crisis of 2008-09.

Any reversal of the regulatory response to that crisis, he added, “would call into question whether the lessons of the crisis have indeed been learnt – and thus whether financial integration can still be considered safe.” That point was all the more important given that central banks are continuing to provide stimulus to their economies. “With monetary policy globally very expansionary, regulators should be wary of rekindling the incentives that led to the crisis,” Draghi said.

Blind as bats.

• Central Banks’ Pursuit Of Inflation Has Turned Sisyphean (CNBC)

Central banks globally have spent years fruitlessly trying to awaken long-dormant inflation, and some analysts say it’s time to stop trying. Anemic inflation has become a bugaboo for global central banks, with frequent mentions in the meeting minutes. It’s been a speed bump in the U.S. Federal Reserve’s path toward normalizing interest rates, with members voting at the July meeting to keep the current target rate in a 1% to 1.25% range. Minutes from that July decision show some policymakers were pushing for caution on rate hikes due to low inflation. The Fed’s target is for 2% inflation, and its preferred measure of inflation is at about 1.5%. It’s not limited to the U.S. by any stretch: Japan’s colossal struggle to goad inflation to life has been a stalemate at best. Since the Bank of Japan launched a massive quantitative easing program in 2013, the country has exited deflation.

But even the September 2016, introduction of a “yield-curve control” policy, seen by markets as essentially a “whatever it takes” stance on boosting inflation, hasn’t seemed to move the needle much. Japan’s core consumer price index, which includes oil products and excludes fresh food, rose 0.5% year-on-year in July, Reuters reported on Friday. That compared with the BOJ’s goal for inflation to meet or exceed its target of 2% “in a stable manner.” It also was oddly jarring compared with Japan’s economy growing a better-than-expected annualized 4% year-on-year in the April-to-June quarter. Some analysts have said the persistently low inflation was a signal that central banks shouldn’t be using inflation to guide monetary policy. “If we’ve got growth at trend, which most places appear to have, if we’ve got the unemployment rate at full employment, which most places appear to have, then we shouldn’t even worry about what inflation is doing,” Rob Carnell, head of research for Asia at ING, said recently.

The future’s are so bright you just got to wear shades.

• IMF: We See A Broad-Based Global Recovery (CNBC)

The global economy is doing well, the chief economist for the International Monetary Fund told CNBC on Friday. The IMF’s new forecast on the world’s economy is expected in about five weeks, Maury Obstfeld said. And while he wouldn’t divulge what that may be, he did say the organization “certainly” isn’t going to lower the number from its last projection. In July, the IMF forecast global economic growth of 3.5% for 2017 and 2.5% for 2018. “We see broad-based recovery. The importance is that it’s really broad-based in a way that it hasn’t been in a decade,” Obstfeld said in a “Closing Bell” interview from the sidelines of the Federal Reserve’s symposium in Jackson Hole, Wyoming.

That doesn’t mean there won’t be concerns ahead. While there are not any immediate downside risks, there are longer-term ones, he noted. “One risk is just continuing tepid growth. What we’re seeing now is a cyclical upswing, but potential growth remains slow,” Obstfeld said. “That brings with it political tensions which we’ve seen spilling over into protectionist rhetoric, for example.” Earlier Friday, ECB Mario Draghi told the audience at Jackson Hole that protectionist policies pose a “serious risk” for growth in the global economy. The comments come at a time when President Donald Trump has been scrutinizing U.S. trade agreements around the world in a push to reduce trade deficits and boost conditions for American manufacturers.

Ice-9.

• Rickards: September Meltdown Ahead (DR)

Jim Rickards joined Alex Stanczyk at the Physical Gold Fund to discuss current destabilizing factors that could drastically impact investors. During the first part of their conversation the economic expert delved into gold positioning for the future, the expanding threats from North Korea and liquidity in global markets. To begin Rickards’ was prompted on his latest analysis over North Korea and the international threat the country poses going forward. The currency wars expert urged, “The fact is, the threats from North Korea, even if not to the mainland, still threaten U.S territory. There are a lot of Americans living there. As this escalation continues in sequence the problem is not new.” “The threat of North Korea has been going on for decades and has escalated since the mid 1990’s. Bill Clinton and George W. Bush both offered sanctions relief for the country in exchange for program reductions.

The Obama administration essentially did nothing for eight years. I do think the Trump administration at least deserves credit for clarity.” “Trump has identified that he is not willing to negotiate to arrive at negotiations. They have indicated to North Korea that if the regime wishes to come to the table what the White House must see is a verified cessation of weapons programs. In exchange they could offer potential sanctions relief and even the possibility of integrating the North Korean economy into the global economy. The North Koreans are actually very rich in natural resources and could be a commodity driven exporter.” “The U.S is not going to be bullied. It will continue to operate in South Korea with joint military exercises. One by one the North Koreans have come to understand missile technology and it seems like they are within the final steps toward miniaturization of weapons.”

[..] The author of Road to Ruin highlighted the severity of the debt ceiling and what it means for the economy. Rickards went on, “There are two really big, but separate, deadlines converging on September 29th. The first is the debt ceiling. This has to deal with the borrowing authority of the U.S Treasury and to be able to pay the bills of the government.” “That authority includes the money to cover social security, medicare, medicaid, military and all of the operations within the budget. Until it is authorized, the Treasury is essentially running on fumes. They are running out of cash. They need Congress to authorize an increase in the debt ceiling so they can borrow money so they can pay for their bills. The problem is that Congress is not functional right now.”

[..] Rickards then turned to warn how liquidity can be frozen by governments. “In October 1987, the major U.S stock market, and in particular the Dow Jones, fell 22% in one day. That kind of a drop would be 4,000 Dow points. When I explain that move to investors they typically respond that there are measures in place to freeze the market and stop such a loss.” “My immediate reaction is, which makes you feel more concerned; thousand point drops, or a closed exchange? At least with a significant point drop you can still get out at a price. If you shut the market down, that’s Ice-9. My thesis is that if you shut down one market the demand for liquidity then just moves to another market, requiring another sector shutdown.”

“..in principle there’s nothing wrong with paying a bank a reasonable fee to safeguard your money. But that’s not what banks do.”

• Negative Interest Rates Have Come To America (Black)

Negative interest rates are particularly prominent in Europe. Starting back in 2014, the European Central Bank (ECB) slashed its main interest rate to below zero. One bizarre effect of this policy is that some banks have passed on these negative interest rates to their retail depositors. This trend has persisted across Europe, Japan, and many other parts of the world. Yet at least Americans were able to breathe a sigh of relief that negative interest rates hadn’t crossed the Atlantic. Well, that’s not entirely true. Recently I was reading through Bank of America’s most recent annual report; it’s filled with some shocking facts about the -real- level of wealth in the Land of the Free… which I’ll tell you more about next week. But here’s one of the things that caught my eye: Bank of America has $592.4 billion in deposits from retail customers, i.e. regular folks who bank at BOA.

And according to its annual report, BOA paid its retail depositors an average interest rate of 0.04% last year. Seriously. That’s a tiny, laughable amount of interest. But hey, at least it’s positive. That 0.04% average rate means the bank paid its retail depositors a total of $236 million in interest. Yet at the same time, Bank of America charged those very same retail depositors $4.1 BILLION in fees. So in total, small depositors forked over a net sum of $3.8+ billion to Bank of America last year for the privilege of holding their money at the bank. Based on the bank’s total consumer deposits of $592.4 billion, it’s as if the bank had charged its customers a negative interest rate of 0.64%. What’s the point? It’s one thing to pay fees to a bank that will safeguard your capital and act in the most conservative way possible.

People pay fees to storage companies to safeguard their wine collections, baseball card collections, all sorts of stuff. We even pay fees for safety deposit boxes to store important documents. So in principle there’s nothing wrong with paying a bank a reasonable fee to safeguard your money. But that’s not what banks do.

It’s time for competition.

• Adults Take Over at Uber, Cost Cutting Starts (WS)

[..] now the adults have taken over at Uber. And money has become an objective. A 14-member executive committee is running the show since there’s no CEO, no CFO, no number two behind the CFO, and no COO. A gaggle of other executives and managers left or were shoved out in the wake of scandals, chaos, and lawsuits. And the adults have decided to bring the expenses down. One of the steps is to unload Uptown Station. According to the San Francisco Business Times: The possible sale of Uptown Station means Uber can move the asset and development costs off its books, which could put it in a better financial position. That was a key motivator for exploring the sale, spokesperson MoMo Zhou told the Business Times. Uber was looking “to strengthen our financial position so we can better serve riders and drivers in the long term,” she said.

So they’re starting to concentrate their efforts and prioritize their spending where it matters: riders and drivers. In March already, Uber had decided to scale down its move to Uptown Station. Instead of migrating 2,500 to 3,000 employees into the building, it said it would move just a few hundred, and lease out the remaining space. Uber has booming sales – in Q2, “adjusted net revenue” soared by 118% year-over-year to $1.75 billion – but it also has booming expenses and losses, and sooner or later something has to give. In 2016, it booked an “adjusted” loss of $3.2 billion (not including interest, tax, employee stock compensation expenses, and other items). In the first two quarters of 2017, it booked an “adjusted” loss of $1.4 billion: $4.6 billion in “adjusted” losses in six quarters. It has $6.6 billion in cash. At this pace, it’ll be gone quickly.

Uber is now trying to cut its losses and reach profitability, a “person with knowledge of the matter” told the Business Times. And given the chaos surrounding Uber, it might be a better idea to concentrate employees in one place rather than scattering them all over the landscape. This comes after the adults have also decided to shut down Uber’s subprime auto leasing program that was started two years ago. “Xchange Leasing” put their badly paid drivers with subprime credit into new vehicles they couldn’t afford. The leases allowed drivers to put “unlimited miles” on their cars without consequences and return the cars after 30 days with two weeks’ notice. No one in the car business would ever offer this kind of lease. But the folks at Uber simply didn’t need to do the math. Uber invested $600 million in this program. Now the adults found out they’re losing $9,000 per car. With 40,000 cars in the fleet, it adds up in a hurry. So they decided to shut down that program.

Sears is toast.

• Sears Revenues to Hit Zero in 3 Years. But Bankruptcy First (WS)

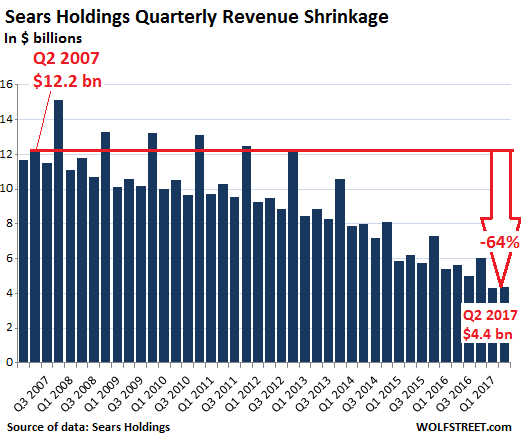

In its fiscal year 2017, it already closed about 180 stores and expects to shutter an additional 150 stores in the third quarter. Those closings had been announced previously. But in its earnings release, it announced the closing of 28 more Kmart stores “later this year.” Liquidation sales will begin as early as August 31, it said. The rest of the plunge was caused by same-store sales (sales at stores open longer than one year) which dropped 11.5%. “Softness in store traffic” the company called it. But the trend is falling off a cliff: In Q2 2016, same-store sales had dropped “only” 5.2%. Now they’re plunging at more than double that rate. Despite the ceaseless corporate rhetoric of operational improvements, this baby is going down the tubes at an ever faster speed. How does that $4.37 billion in revenues stack up? They’re down by nearly two-thirds from Q2 2007. This is what the accelerating revenue shrinkage looks like:

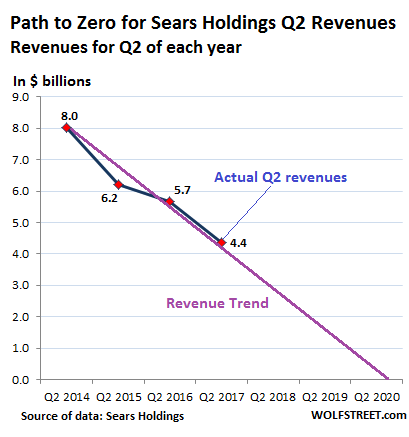

[..] Over the past three years, the momentum of the revenue decline has accelerated sharply. Q2 revenues have plummeted from $8.0 billion in 2014 to $4.37 billion in 2017. A decline of $3.6 billion, or 45% in three years. This chart shows Q2 revenues from 2014 to 2017, with the trend line (purple) extended until it hits zero. This is the same track that Q1 revenues are on. As I’d postulated three months ago, at this rate, revenues of the once largest retailer in the US will be zero in three years, or by 2020. Zero is the inevitable result of a hedge-fund strategy of asset-stripping and cost-cutting at a retailer that had already been struggling before the takeover, and that now finds itself embroiled without effective online strategy in the American brick-and-mortar retail meltdown. But revenues won’t drop to zero. Sears won’t last that long.

But who actually has the required $275,000? And what happens to those who don’t have it?

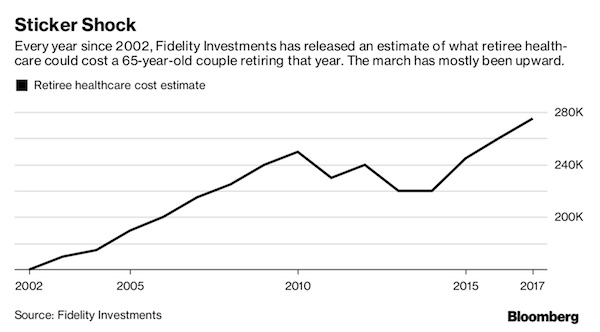

• Health-Care Costs Could Eat Up Your Retirement Savings (BBG)

In a perfect world, the largest expenses in retirement would be for fun things like travel and entertainment. In the real world, retiree health-care costs can take an unconscionably big bite out of savings. A 65-year-old couple retiring this year will need $275,000 to cover health-care costs throughout retirement, Fidelity Investments said in its annual cost estimate, out this morning. That stunning number is about 6% higher than it was last year. Costs would be about half that amount for a single person, though women would pay a bit more than men since they live longer. You might think that number looks high. At 65, you’re eligible for Medicare, after all. But monthly Medicare premiums for Part B (which covers doctor’s visits, surgeries, and more) and Part D (drug coverage) make up 35% of Fidelity’s estimate.

The other 65% is the cost-sharing, in and out of Medicare, in co-payments and deductibles, as well as out-of-pocket payments for prescription drugs. And that doesn’t include dental care—or nursing-home and long-term care costs. Retirees can buy supplemental, or Medigap, insurance to cover some of the things Medicare doesn’t, but those premiums would lead back to the same basic estimate, said Adam Stavisky, senior vice president for Fidelity Benefits Consulting. The 6% jump in Fidelity’s estimate mirrors the average annual 5.5% inflation rate for medical care that HealthView Services, which makes health-care cost projection software, estimates for the next decade. A recent report from the company drilled into which health-care costs will grow the fastest.

It estimates a long-term inflation rate of 7.2% for Medigap premiums and 8% for Medicare Part D. For out-of-pocket costs, the company estimates inflation rates of 3.7% for prescription drugs, 5% in dental, hearing, and vision services, 3% for hospitals, and 3.4% for doctor’s visits and tests. Cost-of-living-adjustments on Social Security payments, meanwhile, are expected to grow by 2.6%, according to the HealthView Services report.

“One day they will build a statue in my honor in Greece in a show of gratitude..”

• Schaeuble Defends Tough Line On Greek Reforms (K.)

As Prime Minister Alexis Tsipras prepares to present a positive narrative at next month’s Thessaloniki International Fair about how the country is turning a corner ahead of the next review by international creditors in the fall, German Finance Minister Wolfgang Schaeuble has reportedly suggested that Athens should be grateful to him for his tough stance on economic reform and austerity. “One day they will build a statue in my honor in Greece in a show of gratitude for the pressure that I imposed in order for necessary reforms to be carried out,” the outspoken minister was quoted as saying by German newspaper Handelsblatt. According to the same newspaper, Schaeuble aims to turn the European Stability Mechanism into a European version of the IMF, one of Greece’s creditors.

The concept is that of a European monetary fund that would help eurozone states in financial crisis but subject to strict terms, such as those that underpinned the IMF’s support to Greece and other countries in recent years. Other ideas, such as the possibility of introducing growth-inducing measures in such countries, were reportedly rejected by Schaeuble. French President Emmanuel Macron meanwhile has suggested that the eurozone should have its own central budget which it could tap if necessary to support member-states in financial difficulty. He is also said to back the idea of a eurozone finance minister, another idea opposed by Berlin. Macron is due in Athens in the first week of September for an official visit that government sources hope will bolster Tsipras’s positive narrative while there are also signs that French firms might confirm their interest in investing in the Thessaloniki Port Authority.

When you’re bled dry of your young and their energy, you’re not going to recover.

• Minister: Young Greeks Fleeing A ‘Debt Colony’ (K.)

In comments to Skai TV on Friday, Deputy Education Minister Costas Zouraris said he understood why large numbers of young Greeks are abandoning the country for better employment opportunities abroad, noting that Greece is “a debt colony” that is “slightly worse” than India. “For now, it’s understandable that kids are saying they want to leave,” Zouraris told Skai. “Let’s hope they return because we are, as you know, bankrupt and a debt colony.” He added that the Greek state has invested about 1 million euros in its top graduates who are now leaving the country. “We are now giving this as a gift to foreign countries for a few years,” he said.

Home › Forums › Debt Rattle August 26 2017

Tagged: Healthcare financing