Marc Riboud Painting the Eiffel Tower 1953

Oh well, we’ll just bail out the banks then.

• The US Isn’t Prepared for the Next Recession (Atlantic)

Maybe it will start with a failed initial public offering, followed by the revelation of widespread fraud in Silicon Valley. Perhaps energy prices will spike, sapping the finances of anyone who drives a car to work. Maybe a foreign crisis will cause a credit crunch, or President Trump will spark a global trade war. A recession might seem like a distant concern, with the latest data showing that the current, extraordinarily economic long expansion just keeps humming along. But one will hit eventually, for some reason or another—that’s how economies work. And when it does, the country won’t be ready. The average middle-class household has largely recovered from the Great Recession, which began nearly 10 years ago, in December 2007.

The growing economy has started to boost earnings across the income spectrum, and higher housing prices have done the same for net worth. The amount of debt that households owe is falling, too. Yet millions of people remain in perilous financial shape, with little to buffer them in the event of a layoff. Roughly half of respondents to a Federal Reserve survey conducted in 2015 said that they could not come up with $400 in an emergency, with a third saying they could not cover three months of expenses, even if they sold assets, dipped into retirement accounts, and asked friends and family for help. Outsize wealth and income continue to accumulate at the very top of the scale, and the finances of millions of American families remain fragile. Americans are no worse off than they were when the last recession hit, in other words, but a decade of growth has not made them more secure, either.

He really said it: “Torsten Slok, chief international economist at Deutsche Bank in New York: “The world economy has never been in better shape”

• The New Fed Chair Will Watch an Economy Fraught With Risks (BBG)

Jerome Powell, said to be President Donald Trump’s pick to be the next Federal Reserve chairman, is set to take the reins of the world’s most important central bank at a time when the U.S. economy is on a roll. Growth is accelerating, inflation is tame and unemployment is the lowest in 16 years. Such a backdrop should initially enable a new Fed chairman to keep gradually raising interest rates from historic lows with the aim of stretching out what is already the third-longest U.S. upswing. Expansions don’t die of old age. Rather, they typically are brought down by the bursting of asset bubbles, shocks like natural disasters or political upheaval, or errors by central banks. Faster rate hikes could cool the stock market but risk holding inflation below the central bank’s target, possibly tipping the economy into a recession.

Tightening too slowly could stoke asset values even further. Powell, and Trump by association, will own the outcome. Powell has the added dilemma that his Fed would confront any slump in growth with little in its policy arsenal. There is barely room to cut rates deeply, and the backup plan – quantitative easing – is now the subject of Republican lawmaker ire. “Powell has been dealt some cards in this poker game that aren’t helpful for carrying out monetary policy,” said Torsten Slok, chief international economist at Deutsche Bank in New York. “The world economy has never been in better shape, but it is a very unthankful job to be a central banker these days.”

“What lies around the corner is an immense fiscal catastrophe. That’s the inexorable result of the current cacophony of can-kicking in the Imperial City.”

• The Can Kickers’ Cacophony (Stockman)

[..] if by some miracle the Donald survives the Mueller assault, the GOP retains it majority in the bi-elections and the Republican party finally gets some serious fiscal gumption, it would still not be able to impact the deficit much before 2022. Yet by then, the baseline level of red ink by CBO’s lights will be $1.02 trillion per year or nearly $1.2 trillion with the tax cut add-on permitted under this year’s budget resolution. Nor can that dire prospect be mitigated by attacking the 25% part of the budget left over for so-called discretionary or appropriated programs. That’s because upwards of $10 trillion of the $13.6 trillion baseline in this category is accounted for by national security, veterans, homeland security, border control and public infrastructure – all of which Trump and much of the Congressional GOP want to increase.

In short, the GOP is now in the midst of kicking the fiscal can right straight into a terminal crisis. Indeed, they have as much as admitted that in the implicit numbers in their phony FY 2018 budget resolution, which really wasn’t a budget plan at all, but merely a de facto amendment to the Senate rules to circumvent the normal 60-vote rule on the tax bill. Stated differently, none of the $5 trillion in deficit cuts in the GOP’s budget resolution are real because none of them are subject to reconciliation. So the true fact of the case is that the GOP majorities on Capitol Hill have just passed a budget resolution which incorporates CBO’s baseline deficit of $10.1 trillion over the next decade and adds $1.5 trillion more.

In turn, that computes out to a $32.2 trillion public debt by 2027 or 135% of GDP. And that assumes Rosy Scenario economics, too. Namely, that there will be no recession for 207 months thru 2027 – a feat that is double the longest unbroken economic expansion in recorded history. In this context, the Donald tweeted yesterday a giant tax cut is just around the corner: “The Republican House members are working hard (and late) toward the Massive Tax Cuts that they know you deserve. These will be biggest ever!” No they won’t be! What lies around the corner is an immense fiscal catastrophe. That’s the inexorable result of the current cacophony of can-kicking in the Imperial City. And as we shall address tomorrow, there is no chance that Jerome Powell or any other busload of central bankers can save the day. The monetary can has been kicked way too long, as well.

Question is how bad will the fall be?

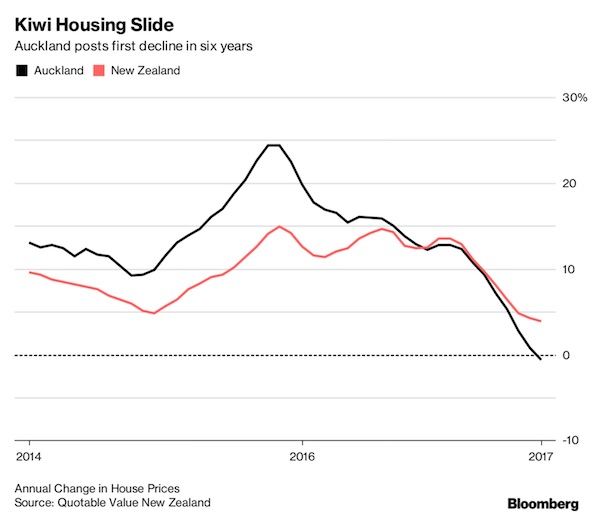

• New Zealand’s Housing Boom Has Come to an End (BBG)

House prices in New Zealand’s largest city posted their first annual decline in six years in October, bringing an end to the nation’s property boom. Prices in the Auckland region fell 0.6% from a year earlier, helping to slow the rate of growth nationwide to 3.9%, a five-year low, property research agency Quotable Value said Thursday. Auckland’s average house price has soared 90% in the last 10 years to more than NZ$1 million ($690,000), underpinning a 56% climb in the national average to NZ$647,000. The new Labour-led government this week announced it will ban foreigners from buying existing homes as it seeks to make housing more affordable for first-time buyers, a central pledge in its election campaign.

Labour also plans to build 100,000 dwellings over the next 10 years to address a shortage, and it will change tax structures to make housing less attractive to investors, who have stoked the property boom. “There appears to be a trend of slowing in the rate of growth, with the frenzy induced by high numbers of investors in the market subsiding and a return to more normal levels of activity in housing markets around the country,” QV spokeswoman Andrea Rush said in a statement. While the surge in prices since 2012 is largely due to a supply shortage amid record immigration, investors played a key role. That prompted the central bank to last year tighten lending restrictions on them, which has helped take the heat out of the market.

Outside Auckland, which is home to a third of New Zealand’s 4.8 million people, price growth has slowed dramatically in cities that saw double-digit gains in 2016. Hamilton prices rose just 1.1% in the year to October, the QV report shows, down from a peak of 31.5% in July last year. In capital city Wellington, where supply is constrained, values rose 10% in the year. In Christchurch, which is over-supplied, prices fell 1.6%.

People bought far more than they can afford.

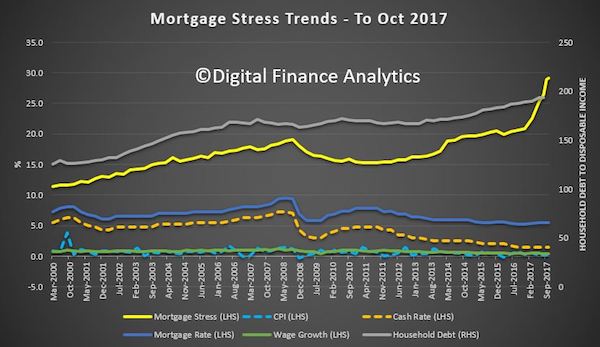

• Australia Mortgage Stress Is Rapidly Increasing (DFA)

Digital Finance Analytics has released the October 2017 Mortgage Stress and Default Analysis update. Across Australia, more than 910,000 households are estimated to be now in mortgage stress (last month 905,000) and more than 21,000 of these in severe stress, up by 3,000 from last month. This equates to 29.2% of households. We see continued default pressure building in Western Australia, as well as among more affluent household, beyond the traditional mortgage belts across the country. We estimate that more than 52,000 households risk 30-day default in the next 12 months, up 3,000 from last month. We expect bank portfolio losses to be around 2.8 basis points ahead, though with losses in WA rising to 4.9 basis points.

Risks in the system continue to rise, and while recent strengthening of lending standards will help protect new borrowers, there are many households currently holding loans which would not now be approved. As continued pressure from low wage growth and rising costs bites, those with larger mortgages are having more difficulty balancing the family budget. These stressed households are less likely to spend at the shops, which will act as a further drag anchor on future growth, one reason why retail spending is muted. The number of households impacted are economically significant, especially as household debt continues to climb to new record levels. Mortgage lending is still growing at three times income. This is not sustainable.

This time is different: “healthy re-balancing”

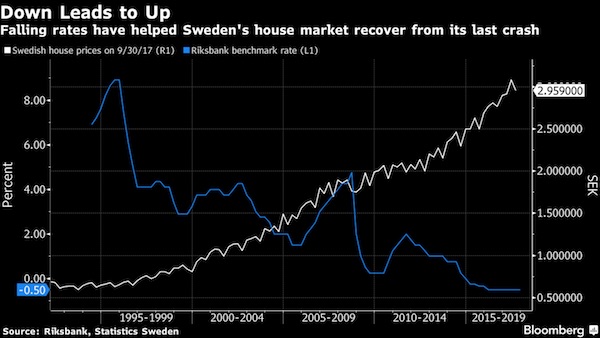

• Scandinavia Property Markets Are Up 70% But Experts Say There’s No Bubble (BBG)

Scandinavia’s red-hot property markets may be showing signs of cooling, but rumors of a bursting bubble are greatly exaggerated. That’s the consensus among local economists, who point to strong fundamentals and persistently low interest rates as evidence that the downturn is a “healthy re-balancing” rather than a harbinger of an imminent collapse. “If you ask me what is the main risk to the macro scenario, I’d say it’s probably house prices,” said Erik Bruce, senior economist at Nordea Bank in Oslo. “But I find it hard to see them dropping significantly with interest rates at this level, unemployment falling and optimism coming back.” Average house prices have shot up around 70% in both Sweden and Norway over the past decade (in Copenhagen they’ve nearly doubled since 2012, the year Danish rates first turned negative).

After years of warnings about excessive debt and overheating from financial regulators and central bankers, they’re now slowing in both Stockholm and Oslo. The adjustment in Norway’s capital city comes as the government there has tightened lending standards in order to reduce speculative buying. “These measures have worked,” said Bruce, noting that prices in Oslo are down 7-8% from their peak. In Stockholm, it’s more about supply and demand. The number of apartments up for sale in the Swedish capital hit a nine-year high in October, but real estate agents say they are having problems unloading properties as buyers and sellers drift apart on price. “New trends often start in Stockholm,” said Nordea’s Sweden-based economist Torbjorn Isaksson, so we expect “house prices at the national level to level out, going forward.”

Should be glad to see all those bankers go.

• City Could Lose 10,000 Jobs On Day One Of Brexit – Bank Of England (G.)

The Bank of England has warned that 10,000 jobs could leave the City on “day one” after the UK leaves the EU. Sam Woods, a deputy governor of the Bank, also admitted that forecasts of 75,000 job losses over the long-term were “plausible” at an appearance before peers on the Lords EU financial affairs sub-committee on Wednesday. Woods runs the regulatory arm of the Bank and based his estimate of 10,000 jobs on responses he received from 400 banks and financial firms required to provide him with their contingency plans for a hard Brexit. He has been reviewing the plans since July and said some were being put in place – with banks reserving school places and hiring office space – but that this process would get under way “in earnest” in the first quarter of 2018.

The estimate of 75,000 job losses was made by consultancy Oliver Wyman, and based on the assumption that the UK would be left to rely on World Trade Organisation rules with no transition period after March 2019, when the UK leaves the EU. Under this scenario, £10bn of tax revenue might also be lost, it said. The 75,000 estimate includes the knock-on effect of fewer City jobs to other parts of the economy. Woods said this was not a Bank of England estimate, but described it as being within a plausible range of job losses that would happen in the long term if the UK left the EU without a trade deal. He said the actual number was a “moving feast” and that the initial impact of about 10,000 roles amounted to 2% of the total employed in bank and insurance jobs, or less than 1% of financial services jobs.

If ‘only’ a 30% child poverty rate is presented as a triumph, your society is a very dismal failure.

• Child Poverty In Britain Set To Soar To New Record (G.)

The number of children living in poverty will soar to a record 5.2 million over the next five years as government welfare cuts bite deepest on households with young families, a leading UK thinktank has said. New research from the Institute for Fiscal Studies predicts an increase of more than a million in the number of children living in poverty, more than reversing all the progress made over the past 20 years. The IFS said freezing benefits, the introduction of universal credit and less generous tax credits would mean a surge in child poverty and that the steepest increases would be in the most deprived parts of the country. “Across all regions, relative child poverty is projected to increase markedly,” the IFS said. “The smallest increases are in the south, but even there relative child poverty is projected to rise by at least four percentage points.

The northern regions, the Midlands, Wales and Northern Ireland are projected to see increases of at least eight percentage points.” The report’s findings, which also predict a widening of the gap between rich and poor and four more years of weak income growth, pose a direct challenge to Theresa May, who arrived in Downing Street pledging to help those “just about managing”. May has slightly softened the impact of the £12bn of welfare cuts announced by the then chancellor George Osborne after the 2015 general election, but the IFS said the impact on poor families would still be severe. By 2021-22, the IFS expects 37% of children to be living in relative poverty – defined as a household where the income is less than 60% of the UK median – after housing costs have been taken into account.

The thinktank said this was the highest percentage since modern records began in 1961. Tackling child poverty was a priority for Labour when it took office in 1997 and over the next 13 years the rate fell from 34% to just under 30%. Since then, the relative child poverty rate has remained unchanged but, according to the IFS, is now set to increase by seven percentage points to 37% over the next five years.

What doesn’t kill you makes you stronger.

• The Limits of Russian Sanctions (HBlatt)

For Russia’s economy, the end of 2014 was something of a perfect storm, Elvira Nabiullina, the country’s central bank chief, remembers. In addition to sanctions imposed by the West, Russia had to deal with a collapse in oil prices. “The effect of the oil price was larger than that of the sanctions,” she said in an interview. “Now the economy has gotten used to both factors. The economy is growing again.” That may not be what European and American leaders would like to hear. After all, the whole point of economic sanctions is to convince political leaders like Russian President Vladimir Putin to change course. Sanctions were imposed on Russia in the aftermath of its annexation of Crimea from Ukraine.

The numbers bear out Ms. Nabiullina’s argument. Russia’s economy grew at a 2.5% annual rate in the second quarter of this year, nearly a five-year high and the third straight quarter of growth for Russia after nearly two years in a recession. Overall the IMF sees the economy growing 1.8% this year. Ms. Nabiullina’s remarks could give fodder to both sides of the Atlantic: Critics of sanctions, which include a number of German politicians and companies that have close business ties to Russia, would point out that there’s little point in continuing something that is having little effect. Supporters would say this is an argument for making sanctions even tougher – something the United States is considering imposing unilaterally by targeting energy firms, over the stiff opposition of German and European politicians who fear their own economies will be caught in the crossfire.

Ms. Nabiullina of course is no politician. Her job as central bank chief is to steer the Russian economy. But she did say that she believes sanctions are here to stay. “Our forecasts for continued economic development are built on the assumption that they will remain in place.” Even if the Russian economy has adapted, it would be wrong to say that sanctions have had no effect at all. Ms. Nabiullina said that foreign direct investment in Russia has fallen since December 2014 as the economy fell into a downward spiral, though she said some foreign investors are starting to return to the country’s bond markets. “That shows Russia’s macro-economic stability.”

Inflation also remains a mixed bag in the country. Ms. Nabiullina noted that inflation has fallen to below 3% – better even than her own medium-target of keeping price increases at 4% or below – but she said Russians have yet to be convinced that prices will remain stable. Interest rates, which were cut slightly on Friday to 8.25%, are being held high in Russia because consumer and business decisions are being driven more by inflation expectations than by actual inflation. “The population is accustomed to high inflation and doesn’t yet believe that it can stay low for a long period,” she said. “That is why our monetary policy remains strict.”

Will Spain make the mistake of parading them as criminals in public?

• Spanish Court To Question Catalonia Separatists – Except Puigdemont (AFP)

Spain is set for another day of drama in the Catalonia crisis on Thursday with a judge in Madrid to question the deposed leaders of the region’s separatist government. Notable by his likely absence, however, will be the dismissed Catalan president Carles Puigdemont, who is in Brussels and refusing to come, according to his lawyer. “He will not go to Madrid and I have suggested that he be questioned here in Belgium,” Paul Bekaert told Spain’s TV3 television on Wednesday. The hearing at the national court in Madrid, which deals with major criminal cases, is to start at 9am and to continue on Friday. The judge wants to question Puigdemont and 13 others over their efforts to spearhead Catalonia’s independence drive, which has plunged Spain into its biggest crisis in decades.

[..] On Monday, Spain’s chief prosecutor said he was seeking charges of rebellion – punishable by up to 30 years in prison – sedition and misuse of public funds against the 14. The speaker of the Catalan parliament, Carme Forcadell, and five parliamentary deputies will also be questioned over the same alleged offences, but by a judge at the supreme court. It was unclear how many of them will show up. Puigdemont, 54, has dismissed the accusations as politically motivated and on Tuesday said he would remain in Brussels until he had guarantees that any proceedings would be impartial. In a statement, he said there was a concerted effort to divide his government.

Some will go before a national audience “to denounce the drive of Spanish justice to pursue political ideas”, while others “will stay in Brussels to decry this political process to the international community”, he wrote. Puigdemont has retained the support of many in Catalonia. Maria Angels Selgas, a 60-year-old sales manager in Barcelona, said that for her, Puigdemont was still the Catalan president. “If they humiliate him then they humiliate also the more than 2 million Catalans who voted ‘yes’ in the referendum,” she said.

Time to close them down. There’s too much toxicity involved, we can’t afford it.

• Monsanto, BASF Weed Killers Strain US States With Damage Complaints (R.)

U.S. farmers have overwhelmed state governments with thousands of complaints about crop damage linked to new versions of weed killers, threatening future sales by manufacturers Monsanto and BASF. Monsanto is banking on weed killers using a chemical known as dicamba – and seeds engineered to resist it – to dominate soybean production in the United States, the world’s second-largest exporter. The United States has faced a weed-killer crisis this year caused by the new formulations of dicamba-based herbicides, which farmers and weed experts say have harmed crops because they evaporate and drift away from where they are applied. Monsanto and BASF say the herbicides are safe when properly applied. They need to convince regulators after the flood of complaints to state agriculture departments.

The U.S. Environmental Protection Agency (EPA) last year approved use of the weed killers on dicamba-resistant crops during the summer growing season. Previously, farmers used dicamba to kill weeds before they planted seeds, and not while the crops were growing. However, the EPA approved such use only until Nov. 9, 2018, because “extraordinary precautions” are needed to prevent dicamba products from tainting vulnerable crops, a spokesman told Reuters in a statement last week. The agency wanted to be able to step in if there were problems, he said. Next year, the EPA will determine whether to extend its approval by reviewing damage complaints and consulting with state and industry experts. States are separately considering new restrictions on usage for 2018.

Major soybean-growing states, including Arkansas, Missouri and Illinois, each received roughly four years’ worth of complaints about possible pesticide damage to crops this year due to dicamba use, state regulators said. Now agriculture officials face long backlogs of cases to investigate, which are driving up costs for lab tests and overtime. Several states had to reassign employees to handle the load. “We don’t have the staff to be able to handle 400 investigations in a year plus do all the other required work,” said Paul Bailey, director of the Plant Industries division of the Missouri Department of Agriculture. In Missouri, farmers filed about 310 complaints over suspected dicamba damage, on top of the roughly 80 complaints about pesticides the state receives in a typical year, he said. Nationwide, states launched 2,708 investigations into dicamba-related plant injury by Oct. 15, according to data compiled by the University of Missouri.

Where’s Mutti Merkel?

• Greece Concerned Over 200% Spike In Refugee, Migrant Arrivals (K.)

Migration Policy Minister Yiannis Mouzalas on Wednesday conceded that the migration problem is becoming more difficult to manage as the number of people arriving on the shores of Greek islands from Turkey since August is up 200% compared to the same period last year. Describing the spike as a “special phase” in the migration problem, Mouzalas added that while the average arrival rate in July was 87 people per day, it shot up to 156 per day in August, while in the months of September and October it rose even further, to 214 per day. With around 4,000 people arriving on the islands in October alone, Mouzalas described the situation at the congested camps on Lesvos as “very bad” and on Chios as “bad.” Nonetheless, he said that Greece continues to view the joint declaration of the EU and Turkey in March to stem the flow of migrants into Europe as valid.

Greece, he said, has intensified diplomatic efforts to ensure the implementation of the agreement which he described as “decisive for the future of Greece.” Referring to the scant number of returns of migrants to Turkey from Greece, Mouzalas said, “We would like to see more returns because that will restore the order of things.” He attributed the low number of returns to Turkey – 1,360 people since the deal was activated – to the way asylum applications are examined in Greece. “We are the only country that has four levels of examination of asylum applications,” he said, while admitting that some of the migrants whose applications have been rejected find illegal means to leave the islands and travel to the mainland.

Cruise ships.

• Greece Mulls Emergency Housing Measures After Migrant Spike (AP)

Greece’s government is considering emergency measures to house migrants and refugees confined to Greek islands over the winter months following a roughly four-fold increase in the number of daily arrivals from Turkey. Migration Minister Yannis Mouzalas said Wednesday that average arrivals had jumped since mid-August from about 50 per day to more than 200. He added the government could use ferries or military ships to provide additional housing space over the winter if alternatives provided by local municipalities were exhausted. Under a 2016 deal between Turkey and the EU migrants and refugees reaching Greek islands from the Turkish mainland are not allow to travel to the Greek mainland before their asylum claims are examined. Mouzalas said the agreement was not under threat but that the rise in migrant arrivals was “concerning.”

Right in front of Parliament.

• Refugees In Greece Demand Transfer To Germany, Start Hunger Strike (R.)

A group of mainly Syrian women and children who have been stranded in Greece pitched tents opposite parliament in Athens on Wednesday in a protest against delays in reuniting with relatives in Germany. Some of the refugees, who say they have been in Greece for over a year, said they had begun a hunger strike. “Our family ties our stronger than your illegal agreements,” read a banner held up by one woman, referring to deals on refugees between European Union nations. Greek media have reported that Greece and Germany informally agreed in May to slow down refugee reunification, stranding families in Greece for months after they fled Syria’s civil war. Greece denies this.

“What we’ve managed to do on family reunification is to have an increase of about 27% this year compared with last year, even though we’re accused of cutting back family reunification and doing deals to cut back family reunification,” Migration Minister Yannis Mouzalas told reporters. Mouzalas said Greece had assurances from Germany that refugees whose applications have been accepted will eventually go to Germany even if there are delays. He denied that refugees had to pay for their flights. Applications for asylum, reunification and relocation to other European countries can take months to be processed.

Home › Forums › Debt Rattle November 2 2017