Edgar Degas Two laundresses 1876

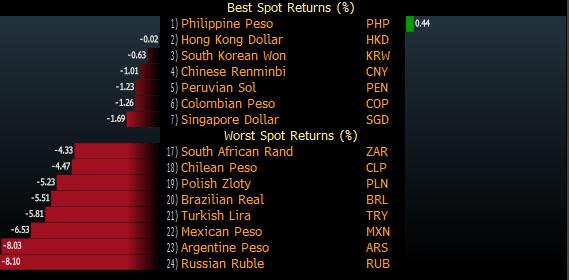

As the dollar keeps rising.

• Fed Chair Powell To Emerging Markets: You Are On Your Own (ZH)

Over the weekend, when commenting on the ongoing rout in emerging markets, Bloomberg published an article titled “Rattled Emerging Markets Say: It’s Over to You, Central Bankers.” Well, overnight the most important central banker of all, Fed Chair Jay Powell responded to these pleas to “do something”, and it wasn’t what EMs – or those used to being bailed out by the Fed – wanted to hear. As Powell explained, speaking at a conference sponsored by the IMF and Swiss National Bank in Zurich, the Fed’s gradual push towards higher interest rates shouldn’t be blamed for any roiling of emerging market economies – which are well placed to navigate the tightening of U.S. monetary policy. In other words, with the Fed’s monetary policy painfully transparent, Powell’s message to EM’s was simple: “you’re on your own.”

Arguing that the Fed’s decision-making isn’t the major determinant of flows of capital into developing economies (which, of course, it is especially as the Fed gradually reverses the biggest monetary experiment in history) Powell said the influence of the Fed on global financial conditions should not be overstated, despite Bernanke taking the blame five years ago for the so-called taper tantrum. “There is good reason to think that the normalization of monetary policy in advanced economies should continue to prove manageable for EMEs,” Powell said, adding that “markets should not be surprised by our actions if the economy evolves in line with expectations.”

[..] Meanwhile, as the Fed refuses to change course, other policy makers have been forced to step in to counter the sharp, sudden capital outflows, with Argentina’s central bank abruptly raising rates three times, to 40% to halt a sell-off in the peso. Russia has also put the brakes on further monetary easing. Turkey, which is a unique basket case in that Erdogan is expressly prohibiting the central bank from doing the one thing it should to ease the ongoing panic, i.e., raise rates, is seeking to bring down its current account deficit. Overnight, we learned that Indonesia was burning reserves to prop up its currency.

Meanwhile, also overnight, JPM CEO Jamie Dimon said it’s possible U.S. growth and inflation prove fast enough to prompt the Fed to raise interest rates more than many anticipate, and it would be wise to prepare for benchmark yields to climb to 4%. Such a scenario would be a disaster for EMs: “A sustained move higher would pressure local currencies and lure away foreign investors. The IMF warned last month that risks to global financial stability have increased over the past six months.” “Central banks may have to respond with interest rate hikes if the sell-off intensifies,” said Chua Hak Bin, a senior economist at Maybank Kim Eng Research in Singapore. Those most vulnerable include Ukraine, China, Argentina, South Africa and Turkey according to the Institute for International Finance.

IMF demand: austerity. Back to the hoovervilles.

• Argentina Seeks IMF Aid ‘To Avoid Crisis’ (BBC)

Argentina is to start talks about a financing deal with the International Monetary Fund (IMF) on Wednesday amid reports it is seeking $30bn (£22bn). Finance minister Nicolas Dujovne is due to fly to the IMF’s Washington offices. After recent turmoil that saw interest rates hit 40%, President Mauricio Macri said IMF aid would “strengthen growth” and help avoid crises of the past. The talks come 17 years after Argentina defaulted on its debts and 12 years since it severed ties with IMF. Mr Macri said in an address to the nation on Tuesday: “Just a few minutes ago I spoke with (IMF) director Christine Lagarde, and she confirmed we would start working on an agreement.”

“This will allow us to strengthen our program of growth and development, giving us greater support to face this new global scenario and avoid crises like the ones we have had in our history,” he said. Local media and Bloomberg reported that Argentina was seeking $30bn, although the government declined to comment. The peso has lost a quarter of its value in the past year amid President Macri’s pro-market reforms. Last week the central bank raised interest rates from 33.25% to 40%. Many people still blame IMF austerity requirements for policies that led to a financial and economic meltdown in 2001 to 2002 that left millions of middle class Argentines in poverty. Argentina eventually defaulted on its debts. And although its last IMF loan was paid down in 2006, the country severed ties with the Washington-based body.

“US sanctions will target critical sectors of Iran’s economy. German companies doing business in Iran should wind down operations immediately,” tweeted the US ambassador in Berlin, Richard Grenell.

• Europe On Collision Course With US Over Iran Deal (AFP)

Donald Trump’s decision to pull out of the landmark 2015 deal curbing Iran’s nuclear programme is a bitter pill to swallow for European leaders and risks a creating a major transatlantic rift. French President Emmanuel Macron, who has spent the past year cultivating the closest ties with Trump among EU leaders, made saving the Iran deal one of his priorities during his state visit to Washington last month. German Chancellor Angela Merkel had also travelled to the US in late April and she worked closely with Macron and British Prime Minister Theresa May right up to the last minute.

In a joint statement issued shortly after Trump walked away from 2015 accord, they said they noted the decision with “regret and concern” but they said they would continue to uphold their commitments. “Our governments remain committed to ensuring the agreement is upheld, and will work with all the remaining parties to the deal to ensure this remains the case,” they said. They noted that this included the “economic benefits to the Iranian people that are linked to the agreement,” which means European firms would in theory continue to invest and operate there. This would appear to set the three countries, all signatories along with Russia, China and the EU, on a direct collision course with Washington.

European leaders have clashed with the White House already on issues ranging from climate change to trade and Trump’s decision to move the US embassy in Israel to Jerusalem. Trump’s hawkish National Security Advisor John Bolton said that European firms would have a “wind down” period to cancel any investments made in Iran under the terms of the accord. “US sanctions will target critical sectors of Iran’s economy. German companies doing business in Iran should wind down operations immediately,” tweeted the US ambassador in Berlin, Richard Grenell. Under the 2015 deal, Iran was meant to benefit from increased trade and contracts with foreign firms in exchange for accepting curbs on its nuclear activity and stringent monitoring.

Airbus? But it’s European. Oh: “All the deals are dependent on U.S. licenses because of the heavy use of American parts in commercial planes.”

• Mnuchin: Revoking Boeing, Airbus Licenses To Sell Jets To Iran (R.)

Licenses for Boeing Co and Airbus to sell passenger jets to Iran will be revoked, U.S. Treasury Secretary Steven Mnuchin said on Tuesday after President Donald Trump pulled the United States out of the 2015 Iran nuclear agreement. Trump said he would reimpose U.S. economic sanctions on Iran, which were lifted under the agreement he had harshly criticized. The pact, worked out by the United States, five other world powers and Iran, lifted sanctions in exchange for Tehran limiting its nuclear program. It was designed to prevent Iran from obtaining a nuclear bomb. IranAir had ordered 200 passenger aircraft – 100 from Airbus SE, 80 from Boeing and 20 from Franco-Italian turboprop maker ATR.

All the deals are dependent on U.S. licenses because of the heavy use of American parts in commercial planes. Boeing agreed in December 2016 to sell 80 aircraft, worth $17 billion at list prices, to IranAir under an agreement between Tehran and major world powers to reopen trade in exchange for curbs on Iran’s nuclear activities. The U.S. Treasury Department, which controls licensing of exports, said the United States would no longer allow the export of commercial passenger aircraft, parts and services to Iran after a 90-day period. “The Boeing and (Airbus) licenses will be revoked,” Mnuchin told reporters at the Treasury. “Under the original deal, there were waivers for commercial aircraft, parts and services and the existing licenses will be revoked.”

Are they going to say they were well treated?

• Pompeo, In North Korea, To Return With Detained Americans (R.)

U.S. Secretary of State Mike Pompeo is expected to return from North Korea with three American detainees, as well as details of an upcoming summit between leader Kim Jong Un and U.S. President Donald Trump, a South Korean official said on Wednesday. Pompeo arrived in Pyongyang on Wednesday from Japan and headed to the Koryo Hotel in the North Korean capital for meetings, a U.S. media pool report said. Trump earlier broke the news of Pompeo’s second visit to North Korea in less than six weeks and said the two countries had agreed on a date and location for the summit, although he stopped short of providing details. An official at South Korea’s presidential Blue House said Pompeo was expected to finalize the date of the summit and secure the release of the three American detainees.

While Trump said it would be a “great thing” if the American detainees were freed, Pompeo told reporters en route to Pyongyang he had not received such a commitment but hoped North Korea would “do the right thing”. “We’ll talk about it again today,” he said. “I think it’d be a great gesture if they would choose to do so.” The pending U.S.-North Korea summit has sparked a flurry of diplomacy, with Japan, South Korea and China holding a high-level meeting on Wednesday. Chinese Premier Li Keqiang said concerned parties should seize the opportunity to promote denuclearization of the Korean peninsula, the official Xinhua news agency reported.

More Nomi.

• Central Banks Rigged The Cost Of Money And The State Of The Markets (Prins)

Nomi Prins: The word “collusion” has come to be associated with Russia, Trump and the US election. My book is about something entirely different, much more global: the collusion (or coordination) that the US central bank (the Federal Reserve) forged with other major countries to fabricate an abundance of money in the wake of the 2008 financial crisis to support the US financial system at first, and banks and select companies and markets worldwide, as well, since. The Fed conjured up this money to provide liquidity for Wall Street banks. The policy was then exported to the major central banks who acted as a lender and supplier of last resort to the world.

Some of the most notable central banks include the European Central Bank (ECB), the Bank of Japan and the Bank of England. Collusion is about these powerful institutions’ relationships with each other. The book dives into how central banks rigged the cost of money and the state of the markets, and ultimately created more inequality and instability as a result. They did all of this in order to subsidize private banks at the expense of people everywhere. The book reveals the people in charge of these strategies, their elite gatherings and public and private communications. It uncovers how their policies rerouted economies, geopolitics, trade wars and elections.

How do central banks relate to the world’s markets? Central banks have several functions from an official standpoint. The first is to regulate the smooth and orderly operation of private banks or public banks within a particular country or region (the ECB is responsible for many countries in Europe). The other function they are tasked with is setting interest rates (the cost of borrowing money) so that there’s adequate economic balance between full employment and a select inflation rate. The idea is that if the cost of money is cheap enough, private banks will lend to the general population and businesses. The ultimate goal is that the money can be used to expand enterprise, hire people and develop a strong economic posture.

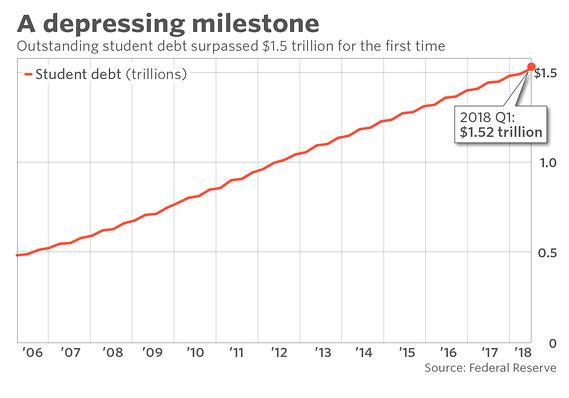

What cannot be repaid will not be.

• US Student Debt Just Hit $1.5 Trillion (MW)

America’s student loan problem just surpassed a depressing milestone. Outstanding student debt reached $1.521 trillion in the first quarter of 2018, according to the Federal Reserve, hitting $1.5 trillion for the first time. Though the marker is somewhat arbitrary, it offers a reminder of how quickly student debt has grown—jumping from about $600 billion 10 years ago to more than $1.5 trillion today—and that the factors fueling the increase aren’t likely to disappear any time soon. “People pay attention to milestones,” said Mark Kantrowitz, a financial aid expert. When student debt surpassed $1 trillion in 2012, “it definitely caused a shift in coverage of student loans in the news media,” he said.

In theory, that helps raise awareness of the issue for student advocates, lawmakers and, in particular, borrowers when considering what college to attend. But Kantrowitz added, “What’s more important is the impact on individual borrowers.” And they are feeling it. College graduates leave school with about $37,000 in debt on average, according to Kantrowitz’s data, a sum that can be bearable for many, given that the average starting salary for a new college graduate last year hovered around $50,000. But a large share—as many as one in six college graduates, Kantrowitz estimates—will leave school with debt that exceeds their income. That will make it challenging for those borrowers to pay off their loans on a standard 10-year repayment plan, he said.

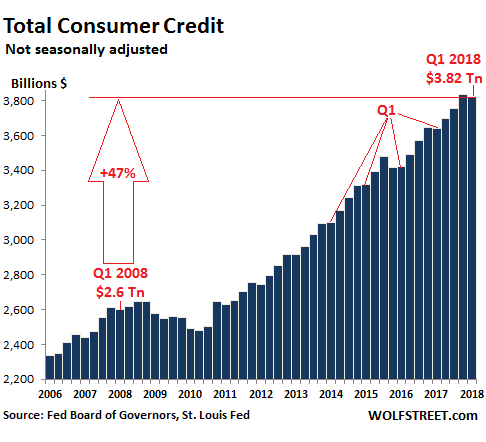

Now let’s throw in some rate hikes, see what happens.

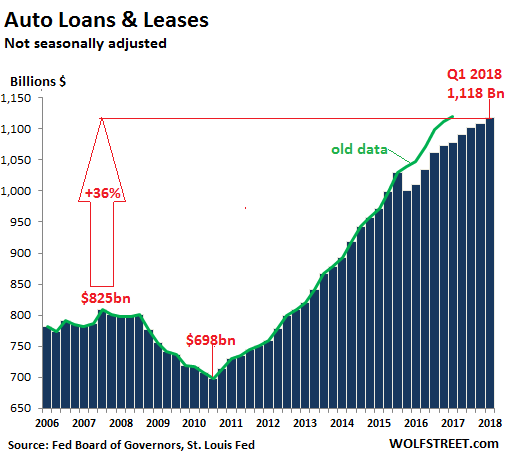

• The State of the American Debt Slaves, Q1 2018 (WS)

Total consumer credit rose 5.1% in the first quarter, compared to a year earlier, or by $184 billion, to $3.824 trillion (not seasonally adjusted), according to the Federal Reserve. This includes credit-card debt, auto loans, and student loans, but not mortgage-related debt. That 5.1% year-over-year increase isn’t setting any records – in 2011, year-over-year increases ran over 11%. But it does show that Americans are dealing with the economy and their joys and woes the American way: by piling on debt faster than the overall economy is growing. The chart below shows the progression of consumer debt since 2006. In line with seasonal patterns for first quarters, consumer credit (not seasonally adjusted) edged down from Q4, as the spending binge of the holiday shopping season turned into hangover, an annual American ritual:

Note how the dip after the Financial Crisis – when consumers deleveraged mostly by defaulting on those debts – didn’t last long. Over the 10 years since Q1 2008, consumer debt has now surged 47%. Over the same period, the consumer price index has increased 16.9%: Auto loans and leases for new and used vehicles rose by 3.8% from a year ago, or by $41 billion, to $1.118 trillion. It was one of the smaller increases since the Great Recession: The peak year-over-year jumps occurred at the peak of the new vehicle sales boom in the US in Q3 2015 ($87 billion or 9%). However, the still standing records were set in Q1 and Q2 2001 near the end of the recession, with each quarter adding around $93 billion, or 16%, year-over-year.

It really makes no difference; the EU will say no anyway to all plans acceptable to the UK.

• UK PM May Suffers Upper House Defeat Over Plans To Leave EU Single Market (R.)

Britain’s upper house of parliament on Tuesday inflicted another embarrassing defeat on Prime Minister Theresa May’s government on Tuesday, challenging her plan to leave the European Union’s single market after Brexit. May, who has struggled to unite the government behind her vision of Brexit, has said Britain will also leave the European Union’s single market and customs union after it quits the bloc next March. That stance has widened divisions not only within her own Conservative Party but also across both houses of parliament, which like Britons at large, remain deeply split over the best way to leave the EU after more than four decades of membership.

By a vote of 245 to 218, the unelected upper chamber, the House of Lords, supported an amendment to her Brexit blueprint, the EU withdrawal bill, requiring ministers to negotiate continued membership of the European Economic Area, meaning that it would remain in the single market. “The time has come over Brexit, really, for economic reality and common sense to prevail over political dogma and wishful thinking,” said Peter Mandelson, a member of the House of Lords from the main opposition Labour Party, who backed the amendment.

His comments drew criticism from pro-Brexit peers, including Conservative member Michael Forsyth who described the amendment as part of an attempt by “a number of people in this house who wish to reverse the decision of the British people”. Those proposing the amendment deny the charge. This is the 13th time in recent weeks that the government has been defeated in the House of Lords on the draft legislation that will formally terminate Britain’s EU membership.

Must have been the weather.

• UK Retailers Suffer Sharpest Sales Drop For 22 Years In April (G.)

Britain’s retailers suffered the sharpest drop in business in more than two decades last month as bad weather, the squeeze on household budgets and the timing of Easter led to a hefty cut in consumer spending. In the latest evidence of the slowdown in the economy since the turn of the year, the latest health check from the British Retail Consortium (BRC) and KPMG found that sales were down by 3.1% in April, the biggest decline since the survey was launched in 1995. Spending on non-food items has been particularly hard hit over the last three months, and retailers are braced for tough trading conditions to continue for the rest of the year even though wages have now started to rise more quickly than prices.

Retailers have been hit hard by a combination of problems on top of the squeeze on spending, including higher labour costs as a result of increases in the minimum wage, the shift to online shopping and rapidly changing spending patterns. Toys R Us and the electricals retailer Maplin collapsed in February and a number of retailers, including House of Fraser, New Look, Carpetright and Poundworld, are all pursuing agreements with their landlords to cut their rents and close stores. The industry had been expecting that year-on-year comparisons would look poor for April, but the BRC’s chief executive, Helen Dickinson, said the problem ran deeper.

Pickers and packers.

• Sharp Drop In UK Retail Job Vacancies As High Street Crisis Deepens (Ind.)

Wages rose in April amid strong demand for candidates, but the number of retail vacancies dropped sharply as the crisis on the high street worsened, a recruitment industry survey has found. Growth of overall job vacancies picked up to a three-month high in April, the Recruitment and Employment Confederation said. Demand for permanent staff increased in the “vast majority” of job categories during the month, with the notable exception of retail, the REC said. The study of 400 recruitment consultancies found that engineering and IT saw the steepest increases in vacancies. REC director of policy Tom Hadley said the high-profile struggles of many retailers indicated it was a good time for staff to consider how they could transfer their skills into other roles, such as in the technology sector or as pickers and packers in distribution centres. “Helping people make career transitions will become increasingly important in this fast-changing business and employment landscape,” he said.

Smart.

“..In New York in 2017, 86% of fifth-degree marijuana arrests were of people of color, while only 9% of those arrested were white..”

• Cynthia Nixon: Marijuana Industry Could Be ‘A Form Of Reparations’ (Hill)

New York gubernatorial candidate and actress Cynthia Nixon on Saturday expanded on her calls for marijuana legalization, saying that the industry could provide a form of “reparations” for communities of color. Nixon, who expressed her support for legalizing marijuana earlier this year, told Forbes that she views marijuana as a racial justice issue. “We’re incarcerating people of color in such staggering numbers,” she said. She expressed support for what is known as an “equity” program, which would prioritize giving marijuana business licenses to people who have received marijuana convictions in the past. “Now that cannabis is exploding as an industry, we have to make sure that those communities that have been harmed and devastated by marijuana arrests get the first shot at this industry,” she told Forbes.

“We [must] prioritize them in terms of licenses. It’s a form of reparations.” In New York in 2017, 86% of fifth-degree marijuana arrests were of people of color, while only 9% of those arrested were white, despite data showing that black and white people are about equally likely to use marijuana. “Arresting people — particularly people of color — for cannabis is the crown jewel in the racist war on drugs and we must pluck it down,” she said. “We must expunge people’s records; we must get people out of prison.” “The use of marijuana has been effectively legal for white people for a really long time,” she told Forbes. “It’s time that we legalize it for everybody else.”

Everything keeps going down. It’s guaranteed.

• Record Drop In Greek Savings Last Year (K.)

Household savings shrank by 32.5 billion euros in total in the period from 2011 to 2017, as families increasingly resorted to dipping into their deposits after finding that disposable incomes are no longer enough to cover their outgoings. Last year the drop in savings reached an historic high of 8.3 billion euros in current prices, according to an analysis by Eurobank. In addition, households have resorted to liquidating assets such as properties, deposits, shares and bonds, among other investments. Notably consumption shrank by almost a quarter from 2008 to 2017, falling from 163.3 billion euros to 123.3 billion last year, which was the sixth in a row with negative savings for Greek households; this means that disposable income was less than consumption.

Eurobank data showed that the wealth of the country’s households has been in constant decline since 2011, falling at an average rate of 6.6 billion euros per year, which is transformed from various forms of savings into consumption. The report by Eurobank’s analysis department highlighted that the economic recession, the stagnation in investments and the major fiscal adjustment Greece experienced from 2009 to 2017 have compressed households’ saving capacity, both in terms of incomes and their obligations to the state through taxes and social security contributions.

The figures reveal that Greek households’ net annual savings amounted to 11.4 billion euros in 2009, or 7% of their gross disposable income, while last year the balance was negative by 8.3 billion, or 6.7% of households’ gross disposable income. Shrinking private consumption has had a direct impact on investments: In 2009 investments had amounted to 18.3% of GDP and were 31.8% funded by domestic consumption and the rest from borrowing. In 2017 the investment rate slipped to 11.6% of GDP, with domestic consumption accounting for 91.1%.

Delusional or lying to our faces?

• Debt Repayment Feasible if Greece ‘Implements Reforms’ – Regling (AMNA)

“If the government in Athens implements all the remaining reforms decisively, Greece can successfully emerge from the ESM program in August 2018,” Klaus Regling, president of the European Stability Mechanism, has said. The ESM chief spoke at en event held in Aachen, Germany on the occasion of the awarding of the 60th International Charlemagne Prize to French President Emmanuel Macron. Regling expressed confidence that Greece could repay its loans, provided the maturity times are sufficiently extended and the obligations do not exceed 15-20% of the country’s economic performance. The ESM chief said that if the latest report on Greece’s bailout program is positive, there will be a final disbursement from the ESM, and then decisions will be made on possible further debt relief.

He argued that there was absolutely no alternative to the establishment of the rescue mechanism, without which, as he said, Greece, Portugal and Ireland would have probably come out of Economic and Monetary Union under “chaotic conditions,” while at the same time other countries such as Germany, would have problems. Regling also stressed that ESM interest rates are clearly below the level that countries would have to pay in the markets, and that is why they save a lot of money. In the case of Greece, “we estimate that ESM loans lead to savings of almost €10 billion [$11.8 billion] each year for the Greek budget”, he said and stressed that this is happening costing nothing to the European taxpayer.

“These savings are an expression of the solidarity shown by the member states of the euro zone,” he said, and referred to “great efforts” that Greece is making to fulfill the strict reform conditions. “Overall, Greece now has impressive adaptation efforts behind it. The budget deficit at the start of the 2009 crisis was above 15% of GDP. For two years, the country has been generating a budget surplus. Such a success is only possible with profound reforms,” Regling noted and said that if Greece implements all reforms, eurozone finance ministers would give Greece further debt relief, namely longer repayment times.

Finally, explaining the reasons why Greece remains in a program while the other countries have completed their own, referred to the country as a “special case” for three reasons: “Firstly, the Greek economy has had problems that are deeper rooted than for other countries in a program. Secondly, the country suffered from a much weaker public administration than the other eurozone member states. “And thirdly, the Greek government in the first half of 2015 went in the wrong direction with then finance minister (Yanis Varoufakis): major reforms were revoked and an effort was made to stop the agreed reform program. “As a result, the Greek economy had fallen into a recession. Grexit suddenly became a realistic scenario. The Bank of Greece estimates that this wrong move cost Greece €86 billion.”

How we think.

• British Diplomats: Saving The Rainforest Could Hurt Fighter Jet Sales (UE)

British government officials warned a proposed EU ban on palm oil in biofuels could harm UK defence sales to Malaysia, specifically Typhoon fighter jets, according to government emails obtained by Unearthed. The correspondence reveals that the British high commission in Kuala Lumpur even expected Malaysian Prime Minister Najib Razak to lobby Theresa May personally on the issue at last month’s Commonwealth Heads of Government meeting. In the event, Razak did not attend the meeting in London, a Number 10 spokeswoman told Unearthed. Correspondence between the Ministry of Defence, the Department for Environment, Food and Rural Affairs and the British high commission reveals British officials were concerned that EU moves to ban palm oil in biofuels could result in Malaysian trade reprisals against the UK.

MEPs voted in January to phase out the use of palm oil in biofuels, citing environmental concerns. The move sparked a furious response from the governments of Indonesia and Malaysia, which produce most of the world’s palm oil. The debate over palm oil is playing a significant role in the run-up to Malaysia’s general election, which will be held tomorrow. On the morning of 5 February, an official at the British high commission in Malaysia sent an email warning that the EU decision was “a big issue for Malaysia and, if not handled correctly, has the potential to impact on bilateral trade, particularly defence sales (Typhoon)”.

Home › Forums › Debt Rattle May 9 2018