This is fantastic. Please watch. Trump as a traumatized man. Elected by a society deeply in denial about its own trauma.

• The Psychology of Russiagate (Gabor Maté)

What’s interesting is that in the aftermath of the Mueller thunderbolt of no proof of collusion, there were articles about how people are disappointed about this finding. Now, disappointment means that you’re expecting something and you wanted something to happen, and it didn’t happen. So that means that some people wanted Mueller to find evidence of collusion, which means that emotionally they were invested in it. It wasn’t just that they wanted to know the truth. They actually wanted the truth to look a certain way. And wherever we want the truth to look a certain way, there’s some reason that has to do with their own emotional needs and not just with the concern for reality.

And in politics in general, we think that people make decisions on intellectual grounds based on facts and beliefs. Very often, actually, people’s dynamics are driven by emotional forces that they’re not even aware of in themselves. And I, really, as I observed this whole Russiagate phenomenon from the beginning, it really seemed to me that there was a lot of emotionality in it that had little to do with the actual facts of the case. There is no question that for a lot of people in this country, the election of Trump was a traumatic event. Now, when a trauma reaction happens, which is to say you’re hurt and you’re pained and you’re confused and you’re scared and you’re bewildered, there’s basically two things you can do about it.

One is you can own that I’m pained and I’m hurt and I’m bewildered and I’m really scared. And then try and look at what happened to bring me to that situation. Or you can instead of dealing with those emotions come up with some kind of explanation that makes me feel better about them. So that I’ve got this pain. I’ve got this bewilderment. I’ve got this fear. So what I’m looking at, what does it say about American society that a man like this could even run for office, let alone be elected? What does it say about American society that so many people are actually enrolled in believing that this man could be any kind of a savior? What does that say about the divisions and the conflicts and the contradictions and the genuine problems in this culture? And how do we address those issues?

You can look at that. Or you can say there must be a devil somewhere behind all this, and that devil is a foreign power, and his name is Putin, and his country is Russia. Now you’ve got a simple explanation that doesn’t invite you or necessitate that you explore your own pain and your own fear and your own trauma.

If the video does not show in your email, please go to the Automatic Earth site

Is it just me, or is this a really strange way to present old news as new? They really can’t find anything on the man? Didn’t he even write a book about this?

• Trump Tax Returns Show Over $1 Billion In Business Losses In A Decade (G.)

Donald Trump’s businesses lost a total of more than $1bn from 1985 to 1994, enabling him to avoid paying income taxes for eight of the 10 years, the New York Times reported on Tuesday. The newspaper, which said it obtained printouts from Trump’s official Internal Revenue Service tax transcripts, found that Trump’s core businesses, including casinos, hotels and apartment buildings, lost $1.17bn over a decade. Trump posted losses in excess of $250m in both 1990 and 1991, according to the records, which appeared to be more than double any other individual US taxpayer in an annual IRS sampling of high-income earners.

The New York Times report comes amid a fresh battle between Democrats in Congress and the Trump administration over the release of the president’s tax returns. On Monday, the US Treasury secretary, Steven Mnuchin, refused a request by the congressman Richard Neal, the Democratic chairman of the House ways and means committee, for Trump’s tax returns. Democrats want Trump’s tax data as part of their investigations of possible conflicts of interest posed by his continued ownership of extensive business interests, even as he serves as president. Responding to the New York Times’ revelations, Charles Harder, a lawyer for the president, said the tax information was “highly inaccurate”.

Yeah, well, if they try to keep Russigate going at this point in time, it’s not going to be easy.

• White House Orders Don McGahn Not To Comply With Congressional Subpoena (G.)

The White House has informed Congress that it has ordered the former counsel Don McGahn not to hand over documents subpoenaed by a congressional committee investigating the findings of the special counsel Robert Mueller. In a letter to the House judiciary committee chairman, Jerrold Nadler, the White House lawyer Pat Cipollone cited “significant Executive Branch confidentiality interests and executive privilege”. McGahn’s refusal is sure to set the Trump administration on course for another collision with the Democratic-led House over lawmakers’ pursuit of documents related to the Russia investigation.

In a subpoena, Congress had requested documents from McGahn pertaining to 36 matters, including discrete episodes in the Russia affair ranging from the resignation of the former national security adviser Michael Flynn to the 9 June 2016 Trump Tower meeting. Cipollone said McGahn “does not have the legal right to disclose these documents to third persons”. In a follow-up letter to Congress, a lawyer for McGahn said he intended to follow the White House direction. “Where co-equal branches of government are making contradictory demands on Mr McGahn concerning the same set of documents,” the letter reads, “the appropriate response for Mr McGahn is to maintain the status quo unless and until the committee and the executive branch can reach an accommodation.”

“Using leverage ratios alone, “45%, not just of the BBB but the entire corporate bond market would be junk right now..”

• ‘Bond King’ Gundlach: US National Debt ‘Totally Out Of Control’ (CNBC)

U.S. debt has climbed to an alarming level, according to DoubleLine CEO Jeffrey Gundlach. “People are starting to realize that the deficit and debt are totally out of control,” Gundlach said on CNBC’s “Halftime Report” Tuesday. Gundlach said the “main reason” the yield curve between 3-year and 5-year Treasury notes is steepening is the ballooning deficit. Last year, U.S. national debt increased by more than 6% of GDP, he said. An even bigger deficit could mean trouble in a recession, said Gundlach, whose DoubleLine has $130 billion in assets under management. Gundlach — sometimes known as the “bond king” — also flagged trouble in the corporate bond market, which got “dragged down” in the “economic mess that we’re in.”

“The corporate bond market is so much worse today than it was in 2006,” he said. Among Gundlach’s concerns: a corporate bond market that has tripled in size, and a BBB-rated bond market that is now bigger than the junk-bond market. Using leverage ratios alone, “45%, not just of the BBB but the entire corporate bond market would be junk right now,” he said, citing figures from Morgan Stanley. A recession or downturn could “spark” a wave of downgrades from investment grade bonds into junk bonds, he said. “The economy is in such bad shape to withstand a downturn again,” Gundlach said. “The national debt is exploding while we’re having some of the best GDP year over year that we’ve had in recent years.”

Jubilee.

• The State of the American Debt Slaves, Q1 2019 (WS)

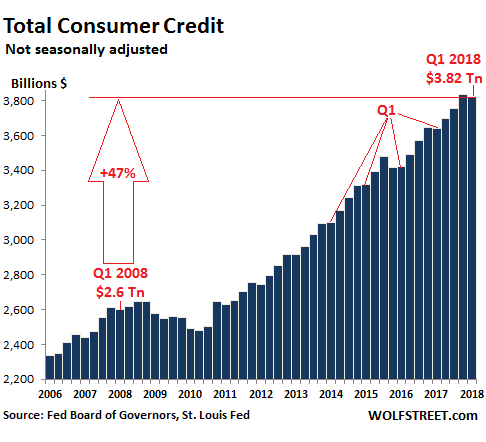

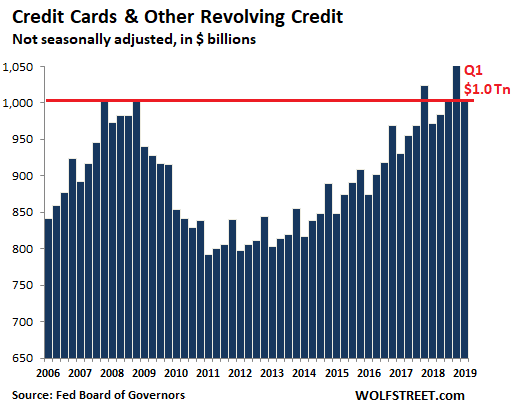

Consumer debt – or consumer “credit” more euphemistically – includes auto loans, student loans, credit-card debt, and personal loans, but it excludes housing related debt, such as mortgages and HELOCs. Growing consumer debt helps prop up the US economy because it means that consumers – they’re called “consumers” not “people” for a reason – spend money they don’t have. There is always a reckoning in the future, but to heck with the future, and so here we go. Credit card debt and other revolving credit, such as personal lines of credit, in Q1 rose 3.4% compared to Q1 last year, to $1.0 trillion (not seasonally adjusted), according to the Federal Reserve Tuesday afternoon. This was a record for a first quarter, when consumers cut back while they try to dig themselves out from under their shopping season debts. But it wasn’t good enough. Credit card balances in Q1 were flat with Q4 2008, despite a decade of inflation, population growth, and economic growth. Our debt slaves are lackadaisical:

The thing is, over the same period, nominal GDP rose 5.1%. And in terms of GDP, credit card debts actually fell, which explains the soft-ish retail data in the first quarter. In a very un-American way, consumers were again lackadaisical in charging up their credit cards to the max. Credit cards are a key element in the banking industry’s profits. At commercial banks, the average interest rate on credit-card plans is 15.1% and the average assessed interest rate is 16.9%, on $1 trillion in outstanding credit balances. This amounts to around $150 billion to $169 billion a year in interest income! These banks rely on consumers to spend money they don’t have. So why don’t they consume with sufficient energy? That’s a baffling question for economists.

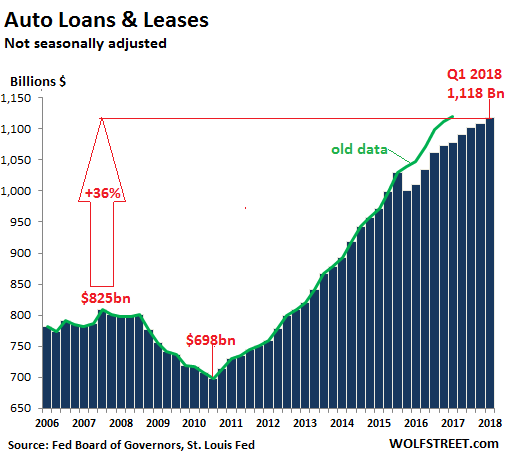

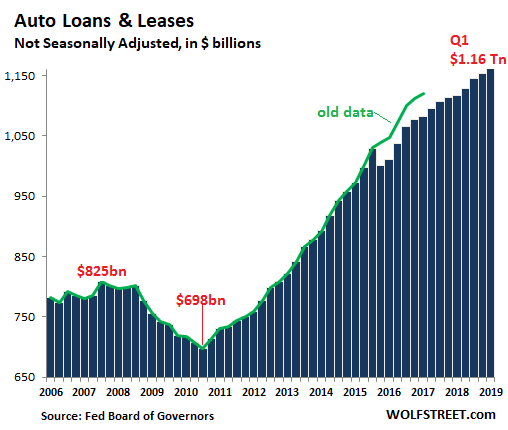

Total auto loans and leases outstanding for new and used vehicles in Q1 rose by $44.5 billion from a year ago, or by 4.0%, to a record of $1.16 trillion, despite new-vehicle sales that declined in Q1 by 3.2%, though there was some strength in used vehicles sales. The increase in borrowing was due to higher transaction prices of new and used vehicles, the rising average loan-to-value ratio, and the lengthening average duration of loans:

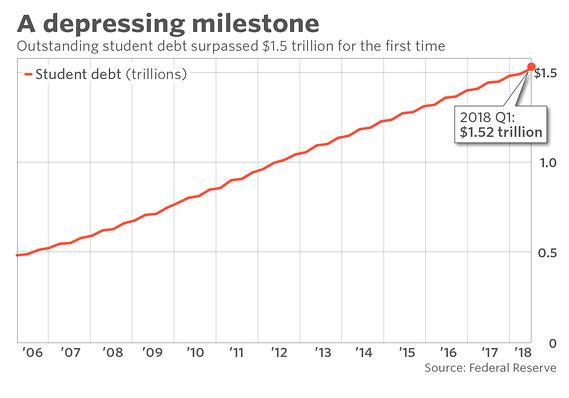

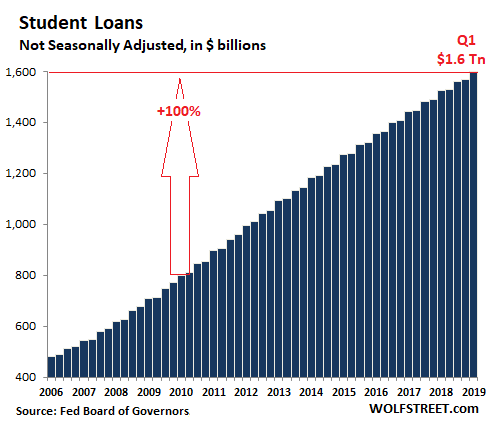

Student loans rose by 4.9% year-over-year in Q1, or by $74 billion, to a new record of $1.6 trillion (not seasonally adjusted). It has doubled since the beginning of 2010. Confusingly, enrollment in higher-education, based on the latest data available from the National Center for Education Statistics fell by 7% between 2010 and 2016. In other words, fewer students are enrolled, but all combined they borrow more as tuition continues to rise, and as the entire industry feeds on those government-guaranteed student loans. This ranges from device makers, such as Apple, text-book publishers, concert-ticket sellers, and commercial real estate investors specializing in student housing. Every dime a student borrows is spent, and it props up Corporate America, the university financial complex (UFI, my term), and the US economy overall – with heck to pay later:

The Fed is the only thing dominating markets. Not China.

• Stocks Could Drop 10-20% If China And US ‘Dig In’ On Trade War – Siegel (CNBC)

Stocks could drop significantly if the United States and China dig in during trade talks, Wharton finance professor Jeremy Siegel told CNBC on Tuesday. Tensions between the U.S. and China are high as U.S. Trade Representative Robert Lighthizer said Monday that new tariffs on 25% of goods will go through on Friday. Siegel said this causes major risk to the downside. “If both sides dig in this market could go down 10% to 20%,” Siegel said on “Squawk Alley. ” “It’s a question of what happens on Friday. If it does happen on Friday, what is the retaliation of the Chinese? And that’s totally dominating the market for the next two or three weeks.”

Siegel said the market built in about a 90% chance that trade negotiations with China would be resolved. Since Trump’s tweets on Sunday threatening to raise tariffs the market, the market now projects no more than a 70% chance of a resolution, he said. This change is what is shocking the market downward, he said. The Dow Jones Industrial Average, S&P 500 and the Nasdaq Composite all closed down more than 1.6% on Tuesday. Investors are waiting to see how the trade talks with China go this week but Trump will be watching the market, Siegel said. “The strongest thing that Donald Trump has going for him in next year’s election is the economy and the stock market. He cannot afford that to falter,” said Siegel.

Why is Reuters still polling economists?

• China Says April Trade Surplus $13.84 Billion, Far Below Expectations (CNBC)

China posted a big miss in its overall trade surplus for April, as exports unexpectedly fell and imports surprisingly rose. The numbers came on Wednesday as the trade impasse between the U.S. and China continues to drag on. Customs data on Wednesday showed that trade surplus for April came in at $13.84 billion. That was far lower than the $35 billion economists polled by Reuters had expected, and below the $32.65 billion posted in March. Dollar-denominated exports also missed expectations in April, falling 2.7% from a year ago, according to data from the China’s General Administration of Customs. Economists polled by Reuters expected an increase of 2.3% from a year earlier.

However, April imports unexpectedly rose by 4% from a year ago, compared to a decline of 3.6% that economists predicted. Imports in March fell 7.6%. China’s trade surplus with the U.S., meanwhile, rose to $21.01 billion in April from $20.5 billion in March, the data showed. U.S. and Chinese officials have met several times in a bid to hammer out a trade deal, but Washington said this week that tariffs on Chinese products will increase on Friday, fueling fears that negotiations could be derailed. The outlook for Chinese exports will remain challenging even if a trade deal is reached with the U.S. soon, said Julian Evans-Pritchard, senior China economist at Capital Economics.

In other news: the sky is blue. What I like here is they state everyone is better off because of the single market. I don’t even want to see their ‘proof’ for that.

• Germany, Wealthy Regions Are Biggest Winners Of EU Single Market (R.)

The European Union’s industrial heartlands, its urban regions and Germany are the biggest beneficiaries of the bloc’s single market, according to a study that highlights the economic and social inequalities plaguing the bloc. The single market seeks to guarantee free movement of goods, capital, services and labor across the 28-nation EU. A report by the Bertelsmann Foundation found that Germany, Europe’s largest economy, benefited most in absolute terms from the single market, earning an extra 86 billion euros ($96 billion) a year because of it. It found that each German was on average 1,046 euros richer as a result of single market membership, while on average EU citizens were only 840 euros richer. “Not everyone profits equally from the single market, but everyone does gain,” said Aart De Geus, president of the Germany-based foundation.

The inequalities highlighted in the report are shaping EU politics ahead of this month’s European Parliament elections, in which some have called for a continent-wide minimum wage, while Italy, wrestling with low growth, has demanded the right to break European fiscal rules to finance tax cuts. Wealthy, advanced economies near the EU’s economic core such as Austria and the Netherlands are also far richer as a result of being members, the report showed, while poorer southern and eastern European countries benefit far less. “For countries like the Netherlands or Austria, the internal market is gold, since they have competitive sectors but are reliant on exports because they have small domestic markets,” said Dominic Ponattu, one of the study’s authors.

Call me crazy, but isn’t this happening a little too often?

• Hackers Steal $41 Million Worth Of Bitcoin From Binance Crypto Exchange (R.)

Hackers stole bitcoin worth $41 million from Binance, one of the world’s largest cryptocurrency exchanges, the company said on Wednesday, the latest in a string of thefts from cryptocurrency exchanges around the world. The 7,000 bitcoin were withdrawn by hackers using a variety of techniques, “including phishing, viruses and other attacks”, according to a post on Binance’s website by chief executive officer Zhao Changpeng. The post said user funds would not be affected because the company would use its secure asset fund for users to cover the loss.

Bitcoin’s price dropped by as much as 4.2 percent in early Asian trading as news of the hack broke, although it later recovered some of its losses. Zhao said on Twitter other crypto exchanges, including Coinbase, had blocked deposits from addresses linked to the hack. Last year, $950 million of cryptocurrencies was stolen from cryptocurrency exchanges and infrastructure services such as wallets, up nearly 260 percent from the previous year, research from U.S.-based cyber security firm CiptherTrace showed. Exchanges in Japan and South Korea accounted for 58 percent of the thefts last year, the research found.

It ain’t easy being green.

• A War Is Brewing Over Lithium Mining At The Edge Of Death Valley (LA Times)

A small Cessna soared high above the Mojave Desert recently, its engine growling in the choppy morning air. As the aircraft skirted the mountains on the edge of Death Valley National Park, a clutch of passengers and environmentalists peered intently at a broiling salt flat thousands of feet below. The desolate beauty of the Panamint Valley has long drawn all manner of naturalists, adventurers and social outcasts — including Charles Manson — off-road vehicle riders and top gun fighter pilots who blast overhead in simulated dogfights. Now this prehistoric lake bed is shaping up to be an unlikely battleground between environmentalists and battery technologists who believe the area might hold the key to a carbon-free future.

Recently, the Australia-based firm Battery Mineral Resources Ltd. asked the federal government for permission to drill four exploratory wells to see if the hot, salty brine beneath the valley floor contains economically viable concentrations of lithium. The soft, silvery-white metal is a key component of rechargeable lithium-ion batteries and is crucial to the production of electric and hybrid vehicles. The drilling request has generated strong opposition from the Center for Biological Diversity, the Sierra Club and the Defenders of Wildlife, who say the drilling project would be an initial step toward the creation of a full-scale lithium mining operation. They say lithium extraction would bring industrial sprawl, large and unsightly drying ponds and threaten a fragile ecosystem that supports Nelson’s bighorn sheep, desert tortoises and the Panamint alligator lizard, among other species.

Why go into allegations that have no proven substance? There is no point in that which supports Assange. Tons of sympathy for Caitlin, but I really think this should be about Julian, not about her.

• People Who Publicly Fret About Assange Rape Allegations Are Lying (CJ)

As a survivor of multiple sexual assaults, I have found it unspeakably infuriating the way this same patriarchal imperialist system which has allowed rape culture to thrive throughout the entirety of its existence has suddenly become deeply, deeply concerned about plot hole-riddled and completely unproven allegations against a man who just so happens to have published humiliating truths about that very same imperialist system. This same warmongering power structure which has never given a shit about women beyond our ability to fly a stealth bomber and squeeze new recruits out of our vaginas suddenly has the full force of its propaganda machine whipping liberals into a hysteria about allegations of acts that aren’t even illegal in the nations those liberals live in. Acts that these liberals have never even thought about pushing to make laws against in their own governments.

Do you know how you can be absolutely certain that anyone you see on social media rending their garments about Assange’s Swedish allegations is completely full of shit? Because no matter how hard you search through their post history, you will never, ever find any similarly enthusiastic push to ban the actions that Assange is accused of in their own government. In their own land, where their own daughters and sons will be impacted. They focus solely on shaky allegations against a target of the CIA and the Pentagon which are alleged to have happened in Sweden, a nation with very different sexual consent laws than the nations of these English-speaking concern trolls.

"Julian Assange is bent not broken"@wikileaks editor @khrafnsson pays tribute to Assange's resilience after visiting him in HM Prison Belmarsh. pic.twitter.com/43J1yKh4fv

— RT UK (@RTUKnews) May 7, 2019

Good headline.

• Humanity Is About to Kill 1 Million Species in a Murder-Suicide (NYMag)

Human beings are more prosperous and numerous than we’ve ever been, while the Earth’s other species are dying off faster than at any time in human history. These two conditions are related. But if the second one persists long enough, we will be following our fellow organisms into the dustbin of geological history. This is the primary takeaway from a new United Nations report on our planet’s rapidly diminishing biodiversity. Humanity is reshaping the natural world at such scale and rapidity, an estimated 1 million plant and animal species are now at risk of extinction, according to the U.N. assessment.

Climate change is a major driver of all this death, but burning fossil fuels is far from our species’ only method of mass ecocide. We are also harvesting fish populations faster than they can reproduce themselves, annually dumping upward of 300 million tons of heavy metals and toxic sludge into the oceans, introducing devastating diseases and invasive species into vulnerable environments as we send people and goods hurtling across the globe, and simply taking up too much space — about 75 percent of the Earth’s land, and 85 percent of its wetlands, have been severely altered or destroyed by human development.

All this plunder has worked out fairly well for us, thus far. But all of our prosperity depends upon the natural world reproducing itself. As the New York Times notes, the U.N. has previously estimated that nature provides the economies of the Americas with $24 trillion worth of non-monetized benefits each year: “The Amazon rain forest absorbs immense quantities of carbon dioxide and helps slow the pace of global warming. Wetlands purify drinking water. Coral reefs sustain tourism and fisheries in the Caribbean. Exotic tropical plants form the basis of a variety of medicines. But as these natural landscapes wither and become less biologically rich, the services they can provide to humans have been dwindling.”

There is no man or woman who can’t be touched

But you who come between them will be judged

-Leonard Cohen