Giovanni Bellini St. Francis in ecstasy 1480

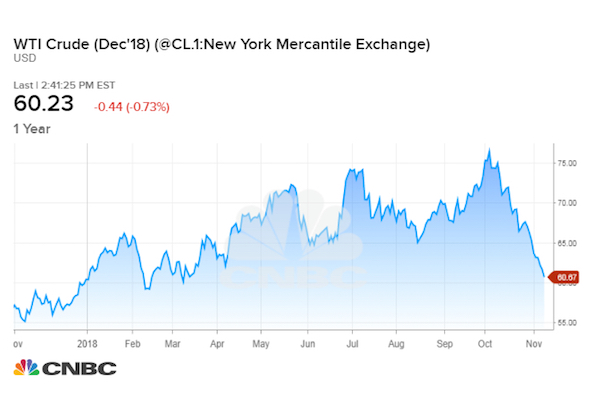

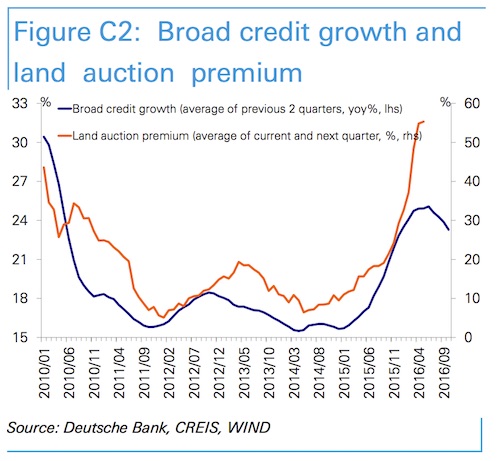

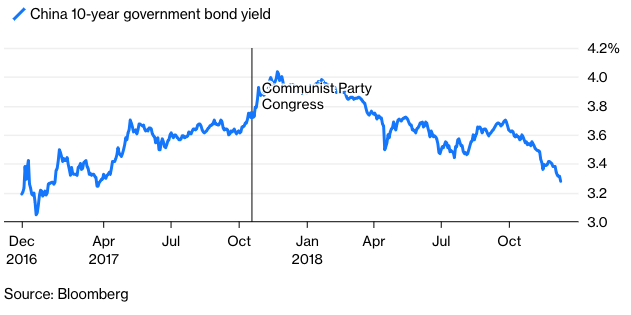

“China is an aging, leveraged country, with excess industrial capacity.”

Will China be 2019’s big story? Is the PBOC even more powerless than the Fed?

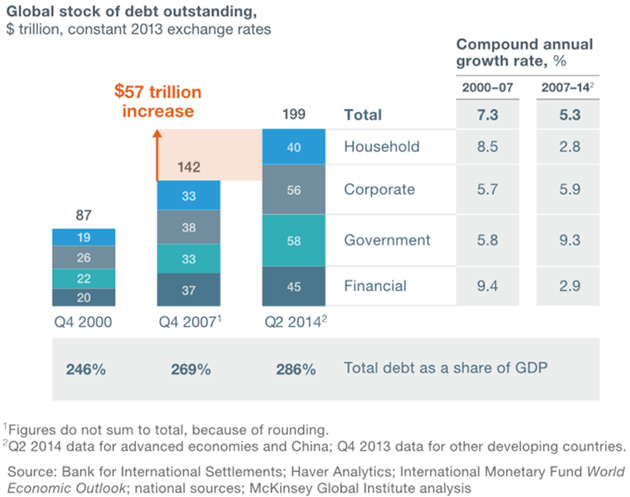

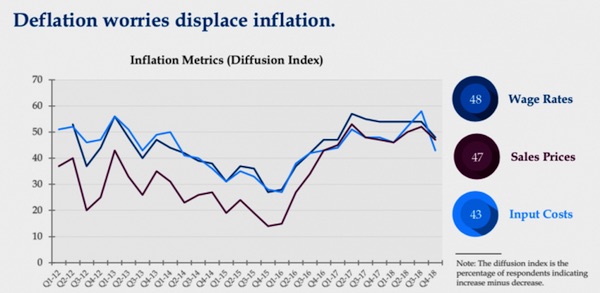

• Deflation Risk Rises as China’s Economy Keeps Faltering (ET)

Just about every economic measure is trending down in China, and not surprisingly, deflation fears are mounting. The China Beige Book (CBB) fourth-quarter preview, released Dec. 27, reported that sales volumes, output, domestic and export orders, investment, and hiring all fell on a year-over-year and quarter-over-quarter basis. A much-weaker 2019 appears to be in the offing for China, but it’s not solely due to trade tensions with the United States. The domestic economy was already on weak footing and the CBB argues that government support is unlikely. The CBB is a research service that speaks to thousands of companies and bankers on the ground in China every quarter. It contends that deflation is the bigger threat compared to inflation.

“Because of China’s structural problems, deflation has very clearly emerged as the bigger threat in a slowing economy than inflation. Consumer demand has weakened, and you see that reflected in retail and services prices,” said Shehzad Qazi, CBB managing director, in an interview. While lower prices look good for consumers, policy-makers don’t like deflation for a number of reasons. With prices falling, companies produce less, often lay off workers, and reduce investment, leading to a vicious circle of sorts. While the trade war hurts export-sensitive regions, local orders have now weakened for two straight quarters. Hiring fell for the first time since early 2016. Worse still, the fall was concentrated in services and retail, two sectors being counted upon to pick up the slack left by manufacturing’s woes.

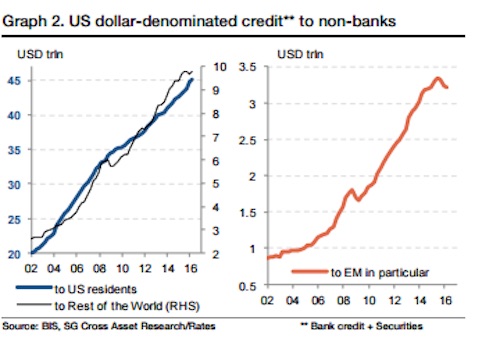

Also, debt—of which China has plenty—becomes more problematic under deflation, as its value adjusted for inflation rises. And it’s an issue for central bankers, who typically target 2 percent inflation for price stability. Rate cuts to spur the economy and inflation are less effective, since the real interest rates are higher when accounting for deflation. “China is an aging, leveraged country, with excess industrial capacity. Appearances by inflation should be cheered,” according to the CBB Q4 preview. “They are also rare.”

No effort needed.

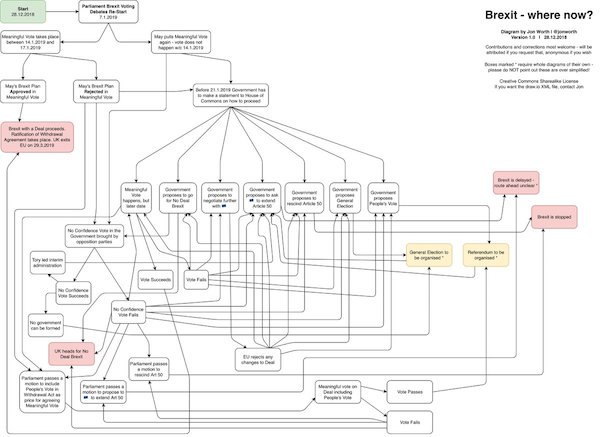

• Juncker: The EU Isn’t Trying To Keep Britain In The Union (R.)

The European Union is not trying to keep Britain in and wants to start discussing future ties the moment the U.K. parliament approves Brexit, partly to focus on its own unity ahead of May elections, the head of the bloc’s executive said. “It is being insinuated that our aim is to keep the United Kingdom in the EU by all possible means. That is not our intention. All we want is clarity about our future relations. And we respect the result of the referendum.” Jean-Claude Juncker, the head of the European Commission, told German newspaper Welt am Sonntag in an interview. Juncker said the EU was ready to start negotiating a new deal with Britain right after the British parliament approves the divorce deal. A vote is now due in the week starting Jan. 14.

He also said Britain should get its act together. “And then tell us what it is you want,” he said. “I am working on the assumption that it will leave, because that is what the people of the United Kingdom have decided,” he added, refusing to be drawn into whether Britain would hold a second Brexit vote. “That is for the British to decide.” [..] He said he felt EU citizens were increasingly growing apart, another problem to tackle ahead of Europe-wide parliamentary elections in May. “We have to ensure that these rifts do not become too deep,” Juncker said. “We must not imply that the populists are right … they are just loud and do not have any specific proposals to offer on solving the challenges of our time.”

They want more delays.

• UK Trade Minister Says ’50-50′ Chance Brexit May Be Stopped (R.)

Britain’s trade minister Liam Fox said there is a “50-50” chance that Brexit may be stopped if parliament rejects the government’s divorce deal with the European Union next month. “If we were not to vote for that, I’m not sure I would give it (Brexit) much more than 50-50,” Fox, a leading supporter of leaving the EU, told the Sunday Times newspaper. With three months left until the United Kingdom is due to leave the EU on March 29, May’s Brexit deal is floundering, opening up a range of possibilities from a Brexit without a trade deal to calling Brexit off. Earlier this month, May pulled a planned vote on her deal after admitting parliament would reject it. Lawmakers are set to vote on the deal in the week starting Jan. 14.

But a delay of a few months?! What good will that do?

• Cross-Party Move Aims To Delay Hard Brexit (G.)

Senior Tory and Labour MPs are planning to force the government to delay Brexit by several months to avoid a no-deal outcome if Theresa May fails to get her deal through parliament in January, the Observer has been told. Cross-party talks have been under way for several weeks to ensure the 29 March date is put back – probably until July at the latest – if the government does not push for a delay itself. It is also understood that cabinet ministers have discussed the option of a delay with senior backbench MPs in both the main parties and that Downing Street is considering scenarios in which a delay might have to be requested from Brussels.

One senior Tory backbencher said: “I have had these discussions with ministers. They will not say so in public but of course the option of a delay has to be looked at in detail now. If we are determined to avoid a no deal, and the prime minister’s deal fails, we will have to ask to stop the clock, and that will give time for us to decide to go whatever way we decide thereafter.” The Conservative MP and former attorney general Dominic Grieve said he believed that even if May got her deal through, there would probably be insufficient time to push all the necessary legislation through parliament to allow Brexit to happen smoothly and that a delay might well be necessary. But if her deal were voted down, the need to take up the option of a delay would become a “certainty”.

He said: “I think that if she does not get her deal passed, a delay would be inevitable to give more time to avoid a no deal, and also there is the possibility that there would be a referendum, so this would allow for that.” Labour’s Brexit spokesman Keir Starmer said that parliament would need to discuss all options, including a possible delay, if and when May failed to get her blueprint through the Commons. “If the prime minister’s deal is voted down in early January, then we will be just nine weeks away from the date we are due to leave the EU,” Starmer said. “If the deal is rejected, parliament will need to have a very serious debate about how to protect the economy from a no-deal scenario and at this stage nothing should be ruled out.”

Brexit options. Click to enlarge

“..if you think about the poems that English schoolkids will know, they’re all about defeats or retreats or disasters…”

• Brexit Is Full Of Hysterical Self-Pity – Fintan O’Toole (G.)

In your book, you criticise the way parallels have been made between Brexit and the 100 years war. What is the main problem? A single word: vassalage. What on earth is this word doing in political discourse in the 21st century? I was struck by its re-emergence. It comes originally from Jacob Rees-Mogg and Boris Johnson, this mad idea that somehow the 100 years war shows the English capacity to throw off feudal vassalage. It’s a ludicrous misunderstanding of history. The war was more like Charles Taylor in Sierre Leone – a hideous crime against humanity. To go back to that as the only thing you have to express what English freedom might mean in the 21st century shows how demented it is.

You also write about the long English tradition of clinging romantically to heroic defeat. What do you ascribe this to? George Orwell wrote about this in the early 1940s. He said that it was extraordinary that if you think about the poems that English schoolkids will know, they’re all about defeats or retreats or disasters. It’s Scott of the Antarctic, it’s the Charge of the Light Brigade, it’s Gordon of Khartoum. That tradition of heroic failure was great when you were ruling the world as it was a way of saying we’re not really a nasty imperial power. But in a post-imperial age you get a farcical version. Because originally the thing that characterised heroic failure in the English imagination was not self-pity, but Brexit is full of hysterical self-pity.

You describe a false caricature of Germany, put about by Brexiters, of an expansionist nation. You also say that the EU, and especially Germany, had a need to severely punish debtor countries. Is Germany the glue that holds the EU together or a controlling villain? There’s no doubt that Germany is the major power in Europe, and that’s one of the things going on with Brexit. It’s this idea that this country we defeated twice in the 20th century is now seen as the dominant power. That leads to fantasies that Britain really lost the war and we’re being taken over insidiously by the Germans. The real problem with the Germans isn’t that they’re trying to take over Europe. It’s that they’ve promulgated a very heavy austerity that is deeply ingrained in the German mentality. The irony is, it’s exactly the policy that the Tory Brexiters themselves were pursuing.

Not quite UBI.

• Italian Parliament Passes Budget After EU Standoff (BBC)

Italy’s parliament has approved a revised budget for 2019, amid opposition complaints that it was dictated by the EU. The country’s populist government had originally vowed to push through costly campaign promises including a universal basic income. But in October, the European Commission raised concerns about the impact of such spending on Italy’s debt levels. Rome was told to revise its budget, or face fines and disciplinary action. Under a deal struck with the Commission last week, Italy lowered its planned budget deficit from 2.4% of GDP to 2.04% – less of a reduction than European officials had hoped for. The value of its concessions is understood to be a little more than €10bn. The deadline for passing the budget was 31 December, after which the government would have been forced to continue with the 2018 budget on a monthly basis.

[..] Italy’s coalition government, made up of the anti-establishment Five Star Movement and right-wing League, has pledged the following:

• A new income support scheme known as the “citizens’ wage” will pay €780 a month to 1.7 million of Italy’s poorest families. The measure is forecast to cost €7.1bn.

• The retirement age will be cut from the current 67 to 62, for workers who have paid into the pension system for 38 years.

• More than a million self-employed workers earning under €65,000 a year will see their taxes cut to 15%.

Watch for New Year’s Eve.

• Yellow Vests Target French Media Companies And Set Cars Alight (Ind.)

Protesters in France have marched on the headquarters of various French media organisations, with groups taking to the streets in small groups in Paris and across the country. Now in its seventh week, the gilet jaunes (yellow vest) protests have shrunk somewhat but hundreds of demonstrators, some chanting “fake news” and “journalists – collaborationists”, and others hurling stones, descended on the offices of TV network BFM and the state-run France Televisions. Police in riot gear intervened, leading to skirmishes, with officers eventually using tear gas to disperse those on the streets and making a number of arrests. Despite a lower turnout than at previous protests demonstrators still caused havoc, with some setting fire to a number of cars in central Paris leaving streets choked by fumes.

Damn foreigners!

• Cyber Attack Disrupts Printing Of Major US Newspapers (R.)

A cyber-attack has caused printing and delivery disruptions to major US newspapers, including the Los Angeles Times, the Chicago Tribune and the Baltimore Sun. The attack on Saturday appeared to originate outside the United States, the Los Angeles Times reported. It led to distribution delays in the Saturday edition of the Times, the Tribune, the Sun and other newspapers that share a production platform in Los Angeles. Tribune Publishing, which owns the Chicago Tribune and the Sun, as well as the New York Daily News and Orlando Sentinel, said it first detected the malware on Friday.

The west coast editions of the Wall Street Journal and New York Times were also hit, as they are printed on the shared production platform, the Los Angeles Times said. A Tribune Publishing spokeswoman, Marisa Kollias, said the virus affected back-office systems used to publish and produce “newspapers across our properties”. “There is no evidence that customer credit card information or personally identifiable information has been compromised,” Kollias said. Most San Diego Union-Tribune subscribers were without a newspaper on Saturday as the virus infected the company’s business systems and hobbled its ability to publish, the paper’s editor and publisher, Jeff Light, wrote on its website.

“..when Mattis and Dunford sang the praises of the “rules-based, international democratic order” that has “kept the peace for 70 years,” Trump simply shook his head in disbelief.”

• Trump Scores, Breaks Generals’ 50-Year War Record (Porter)

The relationship between Trump and his national security team has been tense since the beginning of his administration. By mid-summer 2017, Defense Secretary James Mattis and Chairman of the Joint Chiefs General Joseph Dunford had become so alarmed at Trump’s negative responses to their briefings justifying global U.S. military deployments that they decided to do a formal briefing in “the tank,” used by the Joint Chiefs for meetings at the Pentagon. But when Mattis and Dunford sang the praises of the “rules-based, international democratic order” that has “kept the peace for 70 years,” Trump simply shook his head in disbelief.

By the end of that year, however, Mattis, Dunford, and Secretary of State Mike Pompeo believed they’d succeeded in getting Trump to use U.S. troops not only to defeat Islamic State but to “stabilize” the entire northeast sector of Syria and balance Russian and Iranian-sponsored forces. Yet they ignored warning signs of Trump’s continuing displeasure with their vision of a more or less permanent American military presence in Syria. In a March rally in Ohio ostensibly about health care reform, Trump suddenly blurted out, “We’re coming out of Syria, like, very soon. Let the other people take care of it now. Very soon—very soon we’re coming out.”

Then in early April 2018, Trump’s impatience with his advisors on Syria boiled over into a major confrontation at a National Security Council meeting, where he ordered them unequivocally to accept a fundamentally different Syria deployment policy. Trump opened the meeting with his public stance that the United States must end its intervention in Syria and the Middle East more broadly. He argued repeatedly that the U.S. had gotten “nothing” for its efforts, according to an account published by the Associated Press based on interviews with administration officials who had been briefed on the meeting. When Dunford asked him to state exactly what he wanted, Trump answered that he favored an immediate withdrawal of U.S. forces and an end to the “stabilization” program in Syria.

Mattis responded that an immediate withdrawal from Syria was impossible to carry out responsibly, would risk the return of Islamic State, and would play into the hands of Russia, Iran, and Turkey, whose interests ran counter to those of the United States. Trump reportedly then relented and said they have could five or six months to destroy the Islamic State. But he also made it clear that he did not want them to come back to him in October and say that they had been unable to defeat ISIS and had to remain in Syria. When his advisors reiterated that they didn’t think America could withdraw responsibly, Trump told them to “just get it done.”

New Knowledge. Defenders of freedom. Geez…

• Firm That Warned US Of Russian Bots Ran An Army Of Fake Russian Bots (RT)

The co-founders of cybersecurity firm New Knowledge warned Americans in November to “remain vigilant” in the face of “Russian efforts” to meddle in US elections. This month, they have been exposed for doing just that themselves. Ryan Fox and Jonathan Morgan, who run the New Knowledge cybersecurity company which claims to “monitor disinformation” online, penned a foreboding op-ed in the New York Times on November 6, about “the Russians” and their nefarious efforts to influence American elections. At the time, it struck me that Fox and Morgan’s reasoning seemed a little far-fetched. For example, one of the pieces of evidence presented to prove that Russia had targeted American elections was that lots of people had posted links to RT’s content online.

Hardly a smoking gun worthy of a Times oped. Morgan and Fox, intrepid cyber sleuths that they are, claimed in the article they had detected more “overall activity” from ongoing Russian influence campaigns than social media companies like Facebook and Twitter had yet revealed — or that other researchers had been able to identify. The New Knowledge guys even authored a Senate Intelligence Committee report on Russia’s alleged efforts to mess with American democracy. They called it a “propaganda war against American citizens.” Impressive stuff. They must be really good at their job, right? This week, however, we learned that New Knowledge was running its own disinformation campaign (or “propaganda war against Americans,” you could say), complete with fake Russian bots designed to discredit Republican candidate Roy Moore as a Russia-preferred candidate when he was running for the US senate in Alabama in 2017.

The scheme was exposed by the New York Times — the paper that just over a month earlier published that aforementioned oped, in which Fox and Morgan pontificated about Russian interference online. New Knowledge created a mini-army of fake Russian bots and fake Facebook groups. The accounts, which had Russian names, were made to follow Moore. An internal company memo boasted that New Knowledge had “orchestrated an elaborate ‘false flag’ operation that planted the idea that the Moore campaign was amplified on social media by a Russian botnet.”

How popular do you think it would be if we pay people to not kill off orangutans? Lions, hippos?

• EU’s Palm Oil Policy Triggers Condemnation From Producing Countries (CNBC)

The European Union is phasing out the use of palm oil in transport fuel, triggering criticism of trade protectionism and threats of retaliation from major producersIndonesia and Malaysia. The European move comes after years of activist campaigns about the vegetable oil associated with rampant deforestation and labor abuses, highlighting how consumer concerns about sustainability are increasingly influencing businesses. According to Eyes on the Forest, a coalition of environmental non-governmental organizations co-founded by the World Wildlife Fund, the large Indonesian island of Sumatra lost 56 percent of its 25 million hectares (250,000 square kilometers, or bigger than the size of the U.K.) of natural forests over 31 years.

The palm oil industry, with its national epicenter on that island, is thought to be one of the biggest drivers of that loss, the coalition said. France and Norway have become the first few countries to start curbing use of palm oil in the last month, driving fears in major Southeast Asian producing countries, where the cash crop has powered economic growth. Indonesia and Malaysia together produce over 80 percent of the world’s palm oil. More broadly, the EU agreed in June to phase out the use of palm oil in transport fuel from 2030 as part of a broader plan to increase the share of renewables in the bloc’s energy production. The EU is one of the world’s top consumers of palm oil, which is used in a wide range of products from baked goods to detergents.

All of a sudden the UK creates a frenzy over refugees in the Channel.

• People-Smugglers Use Social Media To Lure Migrants To Their Deaths – UN (Ind.)

Tech companies are failing to crack down on people-smugglers using their platforms to lure migrants “to their deaths” with promise of safe passage to Europe, the UN has warned. Companies such as Facebook and WhatsApp are “enabling criminal activity” by traffickers who entrap victims who are unaware of the dangers they face, according to the UN’s migration agency. The warning comes amid a surge in migrants attempting to reach the UK by crossing the Channel in small boats, with almost 100 people intercepted by both British and French authorities while attempting to reach the UK from France since Christmas Day. [..]

Leonard Doyle, spokesperson for the International Organisation for Migration (IOM), said migrants were being “lured to Calais” over the internet as smugglers operate via social networks “without any real oversight” from the companies controlling them. He said that while tech firms had taken measures to curb other exploitative activities such as child pornography, efforts to prevent people-smuggling has been “microscopic” compared with the damage it causes. [..] Charities on the ground in northern France meanwhile cautioned that irregular migration was not the result of social media but of the persecution faced by migrants in their home countries. But they said failure by European governments to inform refugees of their right to seek asylum and how to do so had enabled criminal gangs to “fill the void”, often through online social networks.

Mr Doyle told The Independent: “People like to point fingers over the migration crisis, but a big part of it must be that the guy or the girl in the village with nothing but a cracked smartphone can actually meet a smuggler in a heartbeat. “This person will often have no prior knowledge, no sense that this is a trap, no sense that this is going to end up in their prostitution, their slavery, their murder, their drowning. “But the tech companies that have done so much to bring technology to its current place are not investing in civic communication to help counter-balance the nonsense people get from social media.