John French Sloan Spring rain 1912

Error? Powell obviously wants a strong dollar. And yes, that has consequences.

• The Everything Bubble Has Found Its Pin. The Pin’s Name is Jerome Powell. (PC)

The Powell Fed is playing with matches next to over $60 trillion in $USD-denominated debt. The $USD is the reserve currency of the world. As such it is the currency of choice if you are going to issue debt. As a result of this, entities around the globe, whether they be corporations or countries, will often choose to issue debt denominated in the $USD, even if the $USD is not a currency used in their economy. When you borrow money in the $USD… you are effectively SHORTING the $USD. You are betting/hopingthat the $USD will weaken, making your debt servicing/ future debt repayment, cheaper on a relative basis. In this environment, when the $USD strengthens, it becomes MORE DIFFICULT to service your debt.

This is true even for the US itself. The $20 trillion we owe in public debt is effectively one gigantic $20 trillion $USD short. Enter Jerome Powell. For whatever reason, the Powell Fed has decided to embark on the most aggressively hawkish monetary policy in Fed history. And the currency markets have taken note. The $USD is breaking out of downtrends in Every. Single. Currency. Pair. The day Jerome Powell became Fed chair is annotated buy the vertical blue line. Assuming Jerome Powell DOESN’T want to blow up the $60 trillion $USD-denominated debt bubble… the above chart SCREAMS “policy error.”

I’m not being dramatic here… the last time the $USD rallied like this against every major currency was in 2014. At that time the entire commodity complex imploded by over 60% and the Emerging Market came within a hair’s breadth of systemic collapse. Again, I’m not being dramatic here… within six months of the $USD’s rally in 2014, Brazil’s stock market was down nearly 70%. China’s was down nearly 50%. Emerging Markets across the board dropped over 30%. Oil fell from $105 to $30 and change. Etc. I don’t see any indication Powell is aware of this… which means… BUCKLE UP. THE EVERYTHING BUBBLE HAS FOUND ITS PIN. AND THE PIN’S NAME IS JEROME POWELL.

And Powell is very clear on “balance sheet normalization” too.

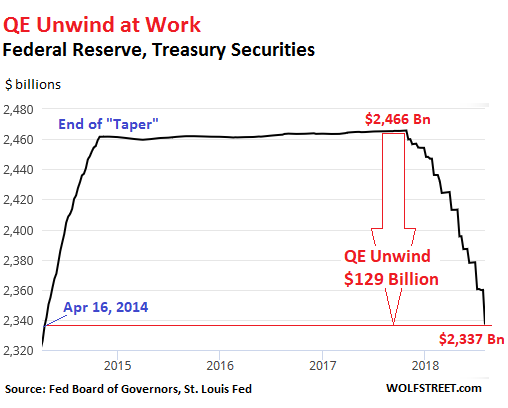

• The Fed Accelerates its QE Unwind (WS)

The Fed’s QE Unwind – “balance sheet normalization,” as it calls this – is accelerating toward cruising speed. The first 12 months of the QE unwind, which started in October 2017, are the ramp-up period – just like there was the “Taper” during the final 12 months of QE. The plan calls for shedding up to $420 billion in securities in 2018 and up to $600 billion a year in each of the following years until the balance sheet is sufficiently “normalized” – or until something big breaks. In July, the QE Unwind accelerated sharply. According to the plan, the Fed was supposed to shed up to $24 billion in Treasury Securities in July, up from $18 billion a month in the prior three months. And? The Fed released its weekly balance sheet Thursday afternoon. Over the four weeks ending August 1, the balance of Treasury securities fell by $23.5 billion to $2,337 billion, the lowest since April 16, 2014.

Since the beginning of the QE-Unwind, the Fed has shed $129 billion in Treasuries. The step-pattern in the chart is a result of how the Fed sheds Treasury securities. It doesn’t sell them outright but allows them to “roll off” when they mature. Treasuries only mature mid-month or at the end of the month. Hence the stair-steps. In mid-July, no Treasuries matured. But on July 31, $28.4 billion matured. The Fed replaced about $4 billion of them with new Treasury securities directly via its arrangement with the Treasury Department that cuts out Walls Street (its “primary dealers”) with which the Fed normally does business. Those $4 billion in securities, to use the jargon, were “rolled over.” But it did not replace about $24 billion of maturing Treasuries. They “rolled off.”

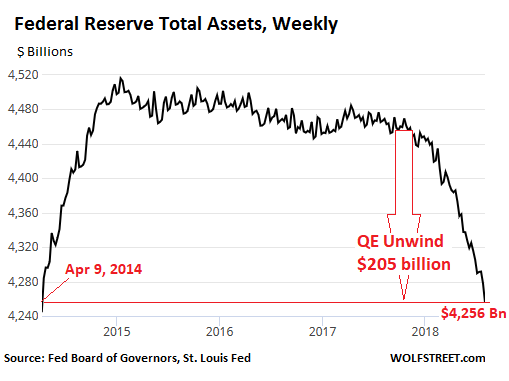

Total assets on the Fed’s balance sheet for the four weeks ending August 1 dropped by $34.1 billion. This brought the drop since October, when the QE unwind began, to $205 billion. At $4,256 billion, total assets are now at the lowest level since April 9, 2014, during the middle of the “taper.” It took the Fed about six years to pile on these securities, and now it’s going to take years to shed them:

Trend is towards lower paid jobs.

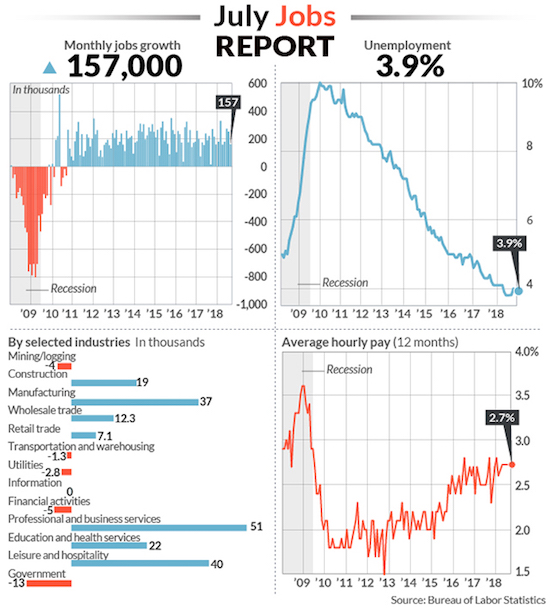

• US Gains Only 157,000 Jobs In July As Unemployment Falls To 3.9% (MW)

The U.S. posted another solid spurt in hiring in July, showing that companies are still able to find enough workers to meet the growing needs of a rapidly expanding U.S. economy. Some 157,000 new jobs were created last month despite widespread complaints among businesses about a shortage of skilled labor, the Labor Department said Friday. The increase in hiring fell below the 195,000 MarketWatch forecast, but job gains in May and June was stronger than previously reported. The smaller gain in employment was also a result of governments cutting jobs in education during the summer break and the closure of Toys R Us. Otherwise hiring may have topped 200,000.

Unemployment, meanwhile, slipped below 4% again, to 3.9%, as more people found work.The jobless rate is at a nearly two-decade low. Far-flung complaints about how hard it is to find good workers still aren’t inducing companies to jack up salaries and wages, however. Hourly pay rose 7 cents in July to $25.07, but the 12-month rate of wage gains was unchanged at 2.7%. And even those increases have been largely eaten up by rising inflation. Wages usually rise 3% to 4% a year when the labor market is as tight as it is now.

Much more interesting than the jobs report. 75 million gig workers? And they’re all counted as ’employed’?

• US Government Has No Idea How Many Gig Workers There Are (MW)

The BLS does not have an explicit definition for a gig worker, or a formal way of tracking them. It comes closest in a survey called the Contingent Worker Supplement, which studies “contingent workers” in temporary working arrangements that they don’t expect to last more than a year. But prior to last month, the BLS had not released the Contingent Worker Supplement since 2005 due in large part to a lack of funding. The most recent report found that 5.9 million people or 3.8% of all workers are contingent workers. “It’s not that the BLS doesn’t care about secondary work, they do,” said Demetra Nightingale at the Urban Institute, a think tank. But without adequate funding it is difficult for the BLS to study those workers, she said.

These workers come in many forms. They include side hustlers with regular jobs and freelancers who take on extra clients on their off-hours, according to Freelancing in America, a 2017 survey conducted in part by Freelancers Union. That survey estimated that 57.3 million Americans are freelancing, or 36% of the workforce. Other estimates say the gig economy is even larger than that. The Federal Reserve has a very broad definition of people working in the gig economy. The Fed says gig workers could be anyone from a babysitter to an Uber driver. According to that definition, there are as many as 75 million gig workers.

My first thought when reading this: he’s trying to get himself fired. Brexit Britain doesn’t need some Canadian opinion.

• Mark Carney Says Risk Of A No-Deal Brexit Is ‘Uncomfortably High’ (G.)

Mark Carney has warned that the possibility of a no-deal Brexit is “uncomfortably high” and will lead to higher prices, as Theresa May prepares to meet the French president, Emmanuel Macron, for talks. The Bank of England governor said both the UK and EU should “do all things to avoid” a no-deal scenario. He added that the banks had done the “stockpiling” and the country’s financial system was in a position to be able to withstand a shock that could result from the UK leaving the EU without an agreement. His remarks led to sterling falling sharply to just under $1.30. Carney told BBC Radio 4’s Today programme: “I think the possibility of a no-deal is uncomfortably high at this point.” Asked if no deal would be a disaster, he said: “It is highly undesirable. Parties should do all things to avoid it.”

Pushed on what no deal would mean, he said “disruption to trade as we know it”, before adding: “As a consequence of that, a disruption to the level of economic activity, higher prices for a period of time. “Our job at the Bank of England is to make sure those issues don’t happen in the financial system, so that people will have things to worry about in a no-deal Brexit, which is still a relatively unlikely possibility but it is a possibility, but what we don’t want to have is people worrying about their money in the bank, whether or not they can get a loan from the bank – whether for a mortgage or for a business idea – and we have put the banks through the wringer well in advance of this to make sure they have the capital.”

An already completely gutted society. More to come. Local councils are being cut to the bone.

• The Conservatives Are In Crisis Over Austerity, Not Just Brexit (NS)

The Conservative party is engaged in the bloodiest incarnation yet of its 30-year Europe war. After Theresa May’s Chequers deal succeeded in alienating almost everyone, Remainers are backing a “people’s vote”, while Leavers are embracing no deal. There is no obvious means by which the parliamentary deadlock can be broken. But the Brexit crisis is masking another one: over austerity. The Leave vote in 2016 and the loss of the Tories’ majority in 2017 were symptoms of voter discontent over spending cuts (a new study published this week suggested that austerity may have directly caused Brexit). As the New Statesman’s Crumbling Britain series has charted, eight years of austerity have enfeebled the public realm.

Rough sleeping, which fell by three-quarters under the last Labour government, has risen by 169 per cent since 2010. The NHS has been forced to cancel operations and even urgent surgery as it struggles to meet ever greater demand. Relative child poverty has increased for three consecutive years and now stands at 4.1 million, or 30 per cent of children. Nearly 1,000 Sure Start children’s centres and 478 libraries are estimated to have closed since 2010. Potholed roads and uncollected bins are evidence of the scale of austerity borne by councils (real-terms funding for local authorities has been cut by 49 per cent since David Cameron took office as prime minister). Northamptonshire Council, a Conservative flagship, has declared itself effectively bankrupt – and others may follow.

The Guardian is up to some strange things.

• US Secret Service And The Guardian Face Off Over ‘Russian Spy’ (RT)

US Secret Service has scolded the Guardian for “irresponsible and inaccurate” reporting on an alleged Russian spy at the US embassy in Moscow. Unfazed, the newspaper continued to spin the story calling it the ‘tip of the iceberg.’ The British newspaper, never one to pass up a good Russia scare story, published a fresh one on Friday, citing multiple intelligence analysts to reinforce the idea that its own anonymously-sourced revelations of a suspected spy with high-level security clearance having been embedded for a decade in the US embassy in Moscow,”could be just the tip of the iceberg.” The Secret Service, meanwhile, has been issuing repeated rebuttals to the Guardian’s reporting.

The security officials were quite emphatic in bashing the article as “wrought with irresponsible and inaccurate reporting based on the claims of “anonymous sources’.” In its press release on Thursday, the Secret Service specifically points out that before the publication came out, it had provided the Guardian with background to the story “clearly refuting unfounded information” in its statement to the editor. The Guardian did mention the agency’s response, bundling it in the middle of its article, while citing its unnamed “intelligence source” profusely, claiming that the Russian woman, the suspected mole, “had access to the most damaging database, which is the US Secret Service official mail system.”

This allegedly included “schedules of the president – current and past, vice-president and their spouses, including Hillary Clinton.” According to the Secret Service, the allegations that a mysterious foreign ‘femme fatale’ could have access to such sensitive information, are unfounded. “FSNs [Foreign Service Nationals] working under the direction of the U.S. Secret Service have never been provided or placed in a position to obtain, secret or classified information as erroneously reported.”

You break it, you bought it.

• Russia Seeks US Help To Rebuild Syria (R.)

Russia has used a closely guarded communications channel with America’s top general to propose the two former Cold War foes cooperate to rebuild Syria and repatriate refugees to the war-torn country, according to a U.S. government memo. The proposal was sent in a July 19 letter by Valery Gerasimov, the chief of the Russian military’s General Staff, to U.S. Marine General Joseph Dunford, chairman of the Joint Chiefs of Staff, according to the memo which was seen by Reuters. The Russian plan, which has not been previously reported, has received an icy reception in Washington. The memo said the U.S. policy was only to support such efforts if there were a political solution to end Syria’s seven-year-old civil war, including steps like U.N.-supervised elections.

The proposal illustrates how Russia, having helped turn the tide of the war in favor of President Bashar al-Assad, is now pressing Washington and others to aid the reconstruction of areas under his control. Such an effort would likely further cement Assad’s hold on power. “The proposal argues that the Syrian regime lacks the equipment, fuel, other material, and funding needed to rebuild the country in order to accept refugee returns,” according to the memo, which specified that the proposal related to Syrian government-held areas of the country. The United States in 2011 adopted a policy that Assad must leave power but then watched as his forces, backed by Iran and then Russia, clawed back territory and secure Assad’s position. The United States has drawn a line on reconstruction assistance, saying it should be tied to a process that includes U.N.-supervised elections and a political transition in Syria. It blames Assad for Syria’s devastation.

But what can Sabraw do?

• Judge Calls US Efforts To Reunite Deported Parents ‘Unacceptable’ (R.)

A federal judge on Friday described as “unacceptable” the U.S. government’s progress in reuniting immigrant children in the United States with deported parents and ordered the government to appoint a person to take charge of its efforts. “This is going to be a significant undertaking and it’s clear there has to be one person in charge,” said U.S. District Judge Dana Sabraw at a hearing in San Diego. Sabraw in June ordered the government to begin reuniting some 2,500 children that officials separated from their parents after they crossed the U.S.-Mexican border. The families were separated as part of a “zero tolerance” U.S. government policy toward illegal immigration that began in early May.

Many of them had crossed the border illegally, while others had sought asylum. About 1,900 children have since been reconnected with their parents or a sponsor. On Thursday, the government proposed that non-profit groups should take the lead in locating as many as 500 parents deported or removed from the United States without their children. At Friday’s hearing, Sabraw said it was it was “100 percent the responsibility of the administration” to reunite those families. Sabraw also noted that as few as 12 of the 500 parents in question have been located. “That is just unacceptable at this point,” he said. “The reality is that for every parent who is not located there will be a permanently orphaned child.”

The government’s lawyer, Scott Stewart, said that the agencies involved would consider appointing a point person or persons. Stewart said the government had proposed a plan with non-profit groups in a prominent role because it believed that was the quickest way to locate parents.

Different judge. Legal opinions are sorely need in the US.

• US Court Orders Trump Administration To Fully Reinstate DACA Program (R.)

A federal judge on Friday ruled that the Trump administration must fully restore a program that protects from deportation some young immigrants who were brought to the United States illegally as children, including accepting new applications for the program. U.S. District Judge John Bates in Washington, D.C., said he would stay Friday’s order, however, until August 23 to give the administration time to decide whether to appeal. Bates first issued a ruling in April ordering the federal government to continue the Deferred Action for Childhood Arrivals, or DACA, program, including taking applications. He stayed that ruling for 90 days to give the government time to better explain why the program should be ended.

On Friday Bates, who was appointed by former President George W. Bush, a Republican, said he would not revise his previous ruling because the arguments of President Donald Trump’s administration did not override his concerns. Under DACA, roughly 700,000 young adults, often referred to as “Dreamers”, were protected from deportation and given work permits for two-year periods, after which they must re-apply to the program.

Better put this before a judge as well. But no surprise that Monsanto is powerful stateside.

• Trump Administration Lifts GMO Crop Ban For US Wildlife Refuges (R.)

The Trump administration has rescinded an Obama-era ban on the use of pesticides linked to declining bee populations and the cultivation of genetically modified crops in dozens of national wildlife refuges where farming is permitted. Environmentalists, who had sued to bring about the 2-year-old ban, said on Friday that lifting the restriction poses a grave threat to pollinating insects and other sensitive creatures relying on toxic-free habitats afforded by wildlife refuges. “Industrial agriculture has no place on refuges dedicated to wildlife conservation and protection of some of the most vital and vulnerable species,” said Jenny Keating, federal lands policy analyst for the group Defenders of Wildlife.

Limited agricultural activity is authorized on some refuges by law, including cooperative agreements in which farmers are permitted to grow certain crops to produce more food or improve habitat for the wildlife there. The rollback, spelled out in a U.S. Fish and Wildlife Service memo, ends a policy that had prohibited farmers on refuges from planting biotech crops – such as soybeans and corn – engineered to resist insect pests and weed-controlling herbicides. That policy also had barred the use on wildlife refuges of neonicotinoid pesticides, or neonics, in conjunction with GMO crops. Neonics are a class of insecticides tied by research to declining populations of wild bees and other pollinating insects around the world.

Rather than continuing to impose a blanket ban on GMO crops and neonics on refuges, Fish and Wildlife Service Deputy Director Greg Sheehan said in Thursday’s memo that decisions about their use would be made on a case-by-case basis.

Home › Forums › Debt Rattle August 4 2018